TÀI LIỆU THAM KHẢO

1. Aaker, D.A. (1991), “Managing Brand Equity”, The free press.

2. Aaker, D.A. (1994), Measuring Brand Equity across Products and Markets,

California Management Review, Vol.38, Issue 3, pp.102 – 210.

3. Ahmad Jamal, Kamal Naser (2002) "Customer satisfaction and retail banking: an assessment of some of the key antecedents of customer satisfaction in retail banking", International Journal of Bank Marketing, Vol. 20 Issue: 4, pp.146-160.

4. Ahmad Jamal (2007), “Retail banking and customer behaviour: a study of self concept, satisfaction and technology usage”, The International Review of Retail, Distribution and Consumer Research, Vol.14. Issue 3, pp.357 – 379.

5. Amine, A. (1998), “Consumers true brand loyalty: The central role of commitment”, Journal of Strategic Marketing, pp.305 – 319.

6. Andrea Pérez, Ignacio Rodríguez del Bosque, (2015) "Customer responses to the CSR of banking companies", Journal of Product & Brand Management, Vol.24, Issue: 5, pp.481-493.

7. Andreas Leverin and Veronica Liljander (2006), “Does relationship marketing improve customer relationship satisfaction and loyalty?”, International Journal of Bank Marketing, Vol,24, Issue 4, pp.232-251.

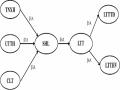

Có thể bạn quan tâm!

-

Kết Quả Tổng Hợp Hồi Quy Nhằm Kiểm Định Giả Thuyết H6 Với Lòng Trung Thành Thái Độ

Kết Quả Tổng Hợp Hồi Quy Nhằm Kiểm Định Giả Thuyết H6 Với Lòng Trung Thành Thái Độ -

Sự Khác Biệt Giữa Các Chỉ Tiêu Tương Thích Giữa Mô Hình Khả Biến Với Bất Biến Từng Phần Theo Giới Tính Của Khách Hàng

Sự Khác Biệt Giữa Các Chỉ Tiêu Tương Thích Giữa Mô Hình Khả Biến Với Bất Biến Từng Phần Theo Giới Tính Của Khách Hàng -

Ảnh Hưởng Của Sự Hài Lòng Đến Lòng Trung Thành Thương Hiệu

Ảnh Hưởng Của Sự Hài Lòng Đến Lòng Trung Thành Thương Hiệu -

Phỏng Vấn Chuyên Gia Ngân Hàng Và Chuyên Gia Marketing

Phỏng Vấn Chuyên Gia Ngân Hàng Và Chuyên Gia Marketing -

Quý Vị Đã Gửi Tiền Tiết Kiệm Tại Ngân Hàng Thương Mại Trong Thời Gian Bao Lâu?

Quý Vị Đã Gửi Tiền Tiết Kiệm Tại Ngân Hàng Thương Mại Trong Thời Gian Bao Lâu? -

Quý Vị Cho Biết Ý Kiến Về Sự Hài Lòng Của Quý Vị Đối Với Ngân Hàng X?

Quý Vị Cho Biết Ý Kiến Về Sự Hài Lòng Của Quý Vị Đối Với Ngân Hàng X?

Xem toàn bộ 229 trang tài liệu này.

8. Andreasen, W., & Lindestad, B. (1998), “Customer loyalty and complex services: the impact of corporate image on quality, customer satisfaction and loyalty for customers with varying degrees of service expertise”, Internaltional Journal of Service Industry Management, pp.7-23.

9. Angur et al. (1999), “Service quality in the banking industry: an assessment in a developing economy”, International Journal of Bank Marketing, Vol.17, Issue 3, pp.116‐123.

10. Arun K. Jain, Christian Pinson, Naresh K. Malhotra, (1987) "Customer Loyalty as a Construct in the Marketing of Banking Services", International Journal of Bank Marketing, Vol.5, Issue3, pp.49-72.

11. Avkiran, N.K. (1994), “Developing an instrument to measure customer service quality in branch banking”, International Journal of Bank Marketing, Vol.12, Issue 6, pp.10‐18.

12. Bahareh Moradi Aliabadi et al. (2013), “Design and explain the factors affecting customer loyalty in online banking”, International Research Journal of Applied and Basic Sciences, Vol 4, Issue 9, pp. 2782-2791.

13. Bamberg, Ajzen, & Schmidt (2003), “Choice of Travel Mode in the Theory of Planned Behavior: The Roles of Past Behavior, Habit, and Reasoned Action”, Basic and Applied Social Psychology, Vol.25, Issue 3, pp.175-187.

14. Bandyopadhyay, S., Gupta K., Dube, L. (2005), “Does brand loyalty influence double jeopardy? A theoretical and empirical study”, Journal of Product and Brand Management, Vol.14, Issue 7, pp.414-423.

15. Barroso, C. and Picón, A. (2012), “Multi-dimensional analysis of perceived switching costs”, Industrial Marketing Management , Vol.41, Issue 3, pp.531-543.

16. Beerli, A., Martin, J.D. and Quintana (2004), “A Model of Customer Loyalty in the Retail Banking Market”, European Journal of Marketing, Vol.38, pp.253-275.

17. Belén Ruiz, Juan A. García, Antonio J. Revilla (2015), “Antecedents and consequences of bank reputation: a comparison of the United Kingdom and Spain”, International Marketing Review, Vol.33, Issue: 6, pp.781-805.

18. Benjamin Osayawe Ehigie (2006), “Correlates of customer loyalty to their bank: a case study in Nigeria”, International Journal of Bank Marketing, Vol.24, Issue 7, pp.494-508.

19. Bennett, R. & Rundle-Thiele, S. (2005), “The brand loyalty life cycle: Implications for marketers”, Brand Management, Vol.2, Issue 4, pp.250 – 263.

20. Bentler, P. M. (1990), “Comparative fit indexes in structural models”, Psychological Bulletin, Vol.107, Issue 2, pp.238-246.

21. Berens et al. (2005), “Corporate associations and consumer product responses: the moderating role of corporate brand dominance”, Journal of Marketing, Vol.69, pp. 35‐48.

22. Berens et al. (2007), “The CSR‐quality trade‐off: when can corporate social responsibility and corporate ability compensate each other?”, Journal of Business Ethics, Vol. 74, pp. 233‐52.

23. Berry, L.L. and Parasuraman, A. (1991), “Marketing Services: Competing Through Quality”, The Free Press, New York

24. Bhattacharya, C.B. & Sen, S. (2003), “Consumer‐company identification: a framework for understanding consumers' relationships with companies”, Journal of Marketing, Vol.67, pp.68‐76.

25. Binks, M. and Ennew, C. (1996), “The Impact of Service Quality and Service Characteristics on Customer Retention: Small Business and Their Banks in The UK”, British Journal of Management, Vol.7, pp.219-230.

26. Bloemer, J.M.M. & Kasper, J.D.P. (1995), “The complex relationship between consumer satisfaction and brand loyalty”, Journal of Economic Psychology, Vol.16, pp.311-329.

27. Bloemer, J.M.M. & Lemmink, J.A.G. (1992), “The importance of customer satisfaction in explaining brand and dealer loyalty”, Journal of Marketing Management, Vol.8, Issue 5/6, pp.351‐64.

28. Bộ Kế hoạch và Đầu tư (2016), “Năm 2015, tăng trưởng tín dụng Hà Nội tăng 19,5%”, Tạp chí Kinh tế và Dự báo, truy cập ngày 02/03/2017 từ http://kinhtevadubao.vn/chi-tiet/101-5183-nam-2015-tang-truong-tin-dung-ha-noi-tang-195.html

29. Brandoyapadhyay, S. and Martel, M (2007), “Does attitudinal influence behavioral loyalty? A theoretical and empirical study”, Journal of Retailing and Comsumer Services, pp. 35 – 44.

30. Burnham, T.A. et al. (2003), “Consumer switching costs: a typology, antecedents, and consequences”, Journal of the Academy of Marketing Science , 31(2), pp. 109-126.

31. Camelis, C. (2009), “L'influence de l'expérience sur l'image de la marque de service", Vie & sciences de l'entreprise, 1 (2), pp.57-74.

32. Carroll, A.B. (1979), “A three‐dimensional conceptual model of corporate performance”, Academy of Management Review, Vol.4, Issue 4, pp. 497‐505.

33. Carroll, A.B. (1999), “Corporate social responsibility: evolution of a definitional construct”, Business and Society, Vol, 38, Issue 3, pp.268‐295.

34. Caruana, A. (2002), “Service loyalty: The effects of service quality and the mediating role of customer satisfaction”, European Journal of Marketing, pp.811-828.

35. Cathy J. Cobb-Walgren, Cynthia A. Ruble & Naveen Donthu (1995), “Brand equity, brand preference, and purchase intent”, Journal of Advertising, vol.24, issue 3, pp.24-40.

36. Cengiz Erol, Radi El‐Bdour (1989) "Attitudes, Behaviour, and Patronage Factors of Bank Customers towards Islamic Banks", International Journal of Bank Marketing, Vol.7 Issue 6, pp.31-37.

37. Chaudhuri Kalneman, Daniel (1986), “Rational Choice and the Framing of Decisions”, The Journal of Business, Vol.59, Issue 4, pp. S251-S278.

38. Chaudhuri Kalneman (1999), “The Effects of Brand Attitudes and Brand Loyalty on Brand Performance”, European Advances in Consumer Research.

39. Clement Sudhahar, J. et al (2006), “Service Loyalty Measurement Scale: A Reliability Assessment”, American Journal of Applied Sciences, Vol.3, Issue 4, pp. 1814-1818.

40. Cổng thông tin điện tử Bộ Thư Pháp (2010), Luật các tổ chức tín dụng.

41. Cổng thông tin điện tử Ngân hàng nhà nước (2016), Thống kê tổng phương tiện thanh toán.

42. Cronin, J. Jr & Taylor, S.A. (1992), “Measuring service quality: a reexamination and extension”, Journal of Marketing, Vol.56, Issue 3, pp. 55‐68.

43. Crosby, L.A. & Stevens, N. (1987), “Effects of relationship marketing on relationship satisfaction, retention and prices in the life insurance industry”, Journal of Marketing Research, Vol.24, Issue 4, pp. 404-411.

44. Cunningham, R.M (1956), “Brand Loyalty – What, Where, How much”, Havard Business Review, Vol.34, Issue 1, pp. 116-128.

45. Dahlia El-Manstrly (2016), “Enhancing customer loyalty: critical switching cost factors”, Journal of Service Management, 27(2), pp.144-169.

46. Deborah Goldring (2015), "Reputation orientation: Improving marketing performance through corporate reputation building", Marketing Intelligence & Planning, Vol.33, Issue 5, pp.784-803.

47. Dick, A.S. and Basu, K. (1994), “Customer Loyalty: Toward an Integrated Conceptual Framework”, Journal of Academy of Marketing Science, Vol.22, Issue 2, pp.99-103.

48. Dwayne D. Gremler, Kevin P. Gwinner, Stephen W. Brown (2001), “Creating positive oral communication through the relationship between clients and employees”, Journal of Public Service Management Business, Vol.12, Issue 1, pp.44-59,

49. Ehrenberg, A.S. (1988), “Repeat buying theory and applications”, Oxford University Press, pp. 438-440.

50. Evanschitzky, H.; Iyer, G.R.; Plabmann, H. (2006), “The relative strength of affective commitment in securing loyalty in service relationships”, Journal of Business Research, Vol.59, Issue 12, pp. 1207-1213.

51. ey.com (2010), Understanding customer behavior in retail banking, access December 22, 2018 words: https://www.ey.com/Publication/vwLUAssets/Understanding_customer_behavio r_in_retail_banking_-

_February_2010/$FILE/EY_Understanding_customer_behavior_in_retail_banki ng_-_February_2010.pdf

52. Fecikova, I. (2004), “An index method for measurement of customer satisfaction”, The TQM Magazine, Vol.16, Issue 1, pp. 57-66.

53. Feldwick, P. J. (1996), “Do we really need ‘brand equity’?”, Journal of Brand Management, Vol.4, Issue 1, pp 9–28.

54. Folks, V.S. and Kamins, M.A. (1999), “Effects of information about firms' ethical and unethical actions on consumers' attitudes”, Journal of Consumer Psychology, Vol.8, Issue 3, pp. 243‐59.

55. Fombrun, C. and Shanley, M. (1990), “What's in a name? Reputation building and corporate strategy”, Academy of Management Journal, Vol.33, Issue 2, pp. 233‐248.

56. Getty, J.M & Thompson, K.N. (1994), “The relationship between quality, satisfaction, and recommending behavior in lodging decisions”, Journal of Hospitality & Leisure Marketing, Vol.2, Issue 3, pp.3-22.

57. Golrou Abdollahi (2008), Creating a model for customer loyalty in banking industry of Iran, Master Thesis.

58. Gremler, D. D. and Gwinner, K.P. (2000), “Customer-employee rapport in service relationships”, Journal of service research, Vol.3 , pp.82-104.

59. Gremler, D.D. & Brown, S.W. (1999), “The loyalty ripple effect: Appreciating the full value of customers”, International Journal of Service Industry Management, Vol.10, Issue 3, pp.271-293.

60. Hair, J.F. Jr., Anderson, R.E., Tatham, R.L., & Black, W.C. (1998), Multivariate Data Analysis, (5th Edition). Upper Saddle River, NJ: Prentice Hall.

61. Hayes, Andrew F. (2013), “Introduction to Mediation, Moderation, and Conditional Process Analysis: A Regression Based Approach”, The Guilford Press, New York.

62. Herbig, P., Milewicz, J. and Golden, J. (1994), “A model of reputation building and destruction”, Journal of Business Research, Vol. 31, pp. 23‐31.

63. Hồ Chí Dũng (2013), Nghiên cứu sự trung thành thương hiệu của người tiêu dùng Việt Nam trong nhóm hàng tiêu dùng nhanh, Luận án Tiến sĩ, ĐH Kinh Tế Quốc Dân

64. Hoàng Trọng và Chu nguyễn Mộng Ngọc (2008), Phân tích dữ liệu nghiên cứu với SPSS, Trường ĐH Kinh tế TP.HCM, NXB Hồng Đức.

65. Hoq, M.Z. and Amin, M, (2010), “The role of customer satisfaction to enhance customer loyalty”, African Journal of Business Management, Vol.4, Isse 12, pp. 2385-2392.

66. Icek Ajzen (1991), "From intentions to actions: A theory of planned behavior",

Psychological Review, pp.59-74.

67. Ivanauskiene, N. and Auruskeviciene, V. (2009), “Loyalty programs challenges in retail banking industry”, Economics & Management, pp. 407 – 412.

68. J.W. Prinsloo (2000), “The saving behaviour of the South African economy”,

South African Reserve Bank, Vol.14.

69. Jagdish N. Sheth và C. Whan Park (1974), “A theory of multidimensional brand loyalty”, Advances in Consumer Research, Vol.1, pp 449-459.

70. Javalgi, R.G. & Moberg, C.R. (1997), “Service loyalty: implications for service providers”, Journal of Services Marketing, Vol.11, Issue 3, pp. 165‐79.

71. Jones, M.A. , Reynolds, K.E. , Mothersbaugh, D.L. and Beatty, S.E. (2007), “The positive and negative effects of switching costs on relational outcomes”, Journal of Business Research, Vol.9, Issue 4, pp. 335-355.

72. Jones, T. , Taylor, S.F. and Bansal, H.S. (2008), “Commitment to a friend, a service provider, or a company – are they distinctions worth making?”, Journal of the Academy of Marketing Science, Vol.36, Issue 4, pp. 473-487.

73. Jones, T. and Taylor, S.F. (2007), “The conceptual domain of service loyalty: How many dimensions?”, Journal of Services Marketing, Vol.21, Issue 1, pp.36-51.

74. JW Prinsloo Chris Baumann et al (2012), “Modeling customer satisfaction and loyalty: survey data versus data mining”, Journal of Services Marketing, Vol.26, Issue 3, pp. 148-157.

75. Kaplan, D.W. (2008), Structural Equation Modeling: Foundations and Extensions, Advanced Quantitative Techniques in the Social Sciences, 2nd Edition.

76. Karatepe, O.M et al. (2005), “Measuring service quality of banks: Scale development and validation”, Journal of Retailing and Consumer Services, Vol. 12, pp. 373–383.

77. Kasri, R. A. and Kassim, S.H. (2009), Empirical Determinants of Saving in the Islamic Banks: Evidence from Indonesia, Islamic Econ., Vol.22, Issue 2, pp: 181- 201.

78. Kassim, N. & Abdullah, N.A. (2010), “The effect of perceived service quality dimensions on customer satisfaction, trust, and loyalty in e‐commerce settings: a cross cultural analysis”, Asia Pacific Journal of Marketing and Logistics, Vol. 22, No. 3, pp. 351‐71.

79. Kassim, N. M. & Abdullah, N.A. (2006). “The influence of attraction on internet banking: an extension to the trust- relationship commitment model”, International Journal of Bank Marketing, Vol.24, Issue 6, pp. 424-442.

80. Kathleen Khirallah (2005), “Customer Loyalty in retail Banks: Time to move beyond”, Simple Programs or a Product Orientation, working paper, from http://www.towergroup.com

81. Kettinger, William J. and Choong C. Lee. (1995), “Perceived Service Quality and User Satisfaction with the Information Services Function”, Decision Sciences, pp.737-766.

82. Klemperer, P. (1995), “Competition when consumer have switching costs: an overview with applications to industrial organization, macroeconomics”, and international trade, Review of Economics Studies , Vol.62, Issue 4, pp. 515-539.

83. Kocoglu and Kirmaci (2012), “Customer relationship management and customer loyaty: a survey in the sector of banking”, International Journal of Business and Social Science, Vol.3, Issue 3, pp.282 – 291.

84. Kotler P. (1991), Marketing Management: Analysis, Planning, Implementation, and Control, 8th Edition.

85. Kuasirikun, N. and Sherer, M. (2004), “Corporate social accounting disclosure in Thailand, Accounting”, Auditing & Accountability Journal, Vol.17, Issue 4, pp. 629‐60.

86. Kumar & Reinartz (2006), “Managing Retailer Profitability-One Customer at a Time”, Journal of Retailing, Vol.82, Issue 4, pp. 277-294.

87. Kuo et al (2009), “Investigation of the Relationship between Perceived Value and Customer Satisfaction”, International Research Journal of Management Sciences, Vol.3, Issue 3, pp. 74-78.

88. Lê Chí Công (2014), Xây dựng lòng trung thành của du khách đối với du lịch biển Việt Nam, Luận án Tiến sĩ, ĐH Kinh Tế Quốc Dân.

89. Lê Thị Thu Hằng (2012), Nghiên cứu hành vi gửi tiền tiết kiệm ngân hàng của KHCN, Luận án Tiến sĩ, Học viện Khoa học xã hội.

90. Leonard L. Berry (2000), “Cultivating service brand equity”, Journal of the Academy of Marketing Science, Vol.28, Issue 1, pp.128–137.

91. Levesque, TJ and McDougall, G. (1996), “Determinants of customer satisfaction in retail banking”, International Journal of Bank Marketing, Vol.14, Issue 7, pp. 12 – 20.

92. Lewis, B.R. and Soureli, M. (2006), “The antecedents of consumer loyalty in retail banking”, Journal of Consumer Behavior, Vol. 5, pp. 15-31.

93. Liang, C.J et al. (2009), “The influence of customer perceptions on financial performance in financial services”, International Journal of Bank Marketing, Vol.27, Issue 2, pp. 129-149.