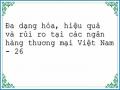

standard errors | Number of | obs | = | 278 | ||||

Method: Pooled OLS | Number of | groups | = | 25 | ||||

Group variable (i): bank | F( 5, | 24) | = | 5.04 | ||||

maximum lag: 2 | Prob > F | = | 0.0027 | |||||

R-squared | = | 0.0212 | ||||||

Root MSE | = | 0.1608 | ||||||

------------------------------------------------------------------------------- | ||||||||

Sta_inef | | | | Coef. | Drisc/Kraay Std. Err. | t | P>|t| | [95% Conf. Interval] | ||

--------------+---------------------------------------------------------------- | ||||||||

foc_asse | | | -.126128 | .072281 | -1.74 | 0.094 | -.2753088 | .0230527 | |

mar_shar | | | .0908937 | .0979169 | 0.93 | 0.363 | -.1111968 | .2929843 | |

exp_asse | | | .3658119 | .8309938 | 0.44 | 0.664 | -1.349275 | 2.080899 | |

cos_inco | | | .0006663 | .0014779 | 0.45 | 0.656 | -.002384 | .0037166 | |

nlo_asse | | | -.0011254 | .0004821 | -2.33 | 0.028 | -.0021204 | -.0001304 | |

_cons | | | .1109086 | .0754644 | 1.47 | 0.155 | -.0448422 | .2666594 | |

Có thể bạn quan tâm!

-

Đa dạng hóa, hiệu quả và rủi ro tại các ngân hàng thương mại Việt Nam - 26

Đa dạng hóa, hiệu quả và rủi ro tại các ngân hàng thương mại Việt Nam - 26 -

Đa dạng hóa, hiệu quả và rủi ro tại các ngân hàng thương mại Việt Nam - 27

Đa dạng hóa, hiệu quả và rủi ro tại các ngân hàng thương mại Việt Nam - 27 -

Đa dạng hóa, hiệu quả và rủi ro tại các ngân hàng thương mại Việt Nam - 28

Đa dạng hóa, hiệu quả và rủi ro tại các ngân hàng thương mại Việt Nam - 28 -

Đa dạng hóa, hiệu quả và rủi ro tại các ngân hàng thương mại Việt Nam - 30

Đa dạng hóa, hiệu quả và rủi ro tại các ngân hàng thương mại Việt Nam - 30 -

Đa dạng hóa, hiệu quả và rủi ro tại các ngân hàng thương mại Việt Nam - 31

Đa dạng hóa, hiệu quả và rủi ro tại các ngân hàng thương mại Việt Nam - 31 -

Đa dạng hóa, hiệu quả và rủi ro tại các ngân hàng thương mại Việt Nam - 32

Đa dạng hóa, hiệu quả và rủi ro tại các ngân hàng thương mại Việt Nam - 32

Xem toàn bộ 261 trang tài liệu này.

-------------------------------------------------------------------------------

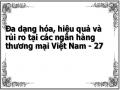

standard errors | Number of | obs = | 278 | ||||

Method: Pooled OLS | Number of | groups = | 25 | ||||

Group variable (i): bank | F( 5, | 24) = | 2.20 | ||||

maximum lag: 2 | Prob > F | = | 0.0873 | ||||

R-squared | = | 0.0267 | |||||

Root MSE | = | 0.1603 | |||||

------------------------------------------------------------------------------- | |||||||

Sta_inef | | | | Coef. | Drisc/Kraay Std. Err. | t | P>|t| | [95% Conf. Interval] | |

--------------+---------------------------------------------------------------- | |||||||

div_inco | | | .1301989 | .0878881 | 1.48 | 0.152 | -.0511931 | .311591 |

mar_shar | | | -.0054291 | .0876363 | -0.06 | 0.951 | -.1863016 | .1754435 |

exp_asse | | | .2964569 | .9134288 | 0.32 | 0.748 | -1.588768 | 2.181681 |

cos_inco | | | .0008281 | .0015098 | 0.55 | 0.588 | -.002288 | .0039441 |

nlo_asse | | | -.0006211 | .0002458 | -2.53 | 0.019 | -.0011284 | -.0001138 |

_cons | | | -.0170176 | .0551949 | -0.31 | 0.761 | -.1309343 | .0968991 |

------------------------------------------------------------------------------- | |||||||

Phụ lục I3: Mô hình động đo lường tác động đa dạng hóa đến rủi ro các NHTM Việt Nam: Biến Loa_loss

Dynamic panel-data estimation, two-step difference GMM

------------------------------------------------------------------------------

Number of obs | = | 259 | |

Time variable : time | Number of groups | = | 25 |

Number of instruments = 23 | Obs per group: min | = | 0 |

F(6, 25) = 62.94 | avg | = | 10.36 |

Prob > F = 0.000 | max | = | 16 |

-------------------------------------------------------------------------------

loa_loss | Coef. Std. Err. t P>|t| [95% Conf. Interval]

--------------+----------------------------------------------------------------

loa_loss |

.0118853 | .1071802 | 0.11 | 0.913 | -.2088565 | .232627 | |

| | ||||||

foc_depo | | .0042449 | .0010941 | 3.88 | 0.001 | .0019916 | .0064982 |

mar_shar | | .0062359 | .0239596 | 0.26 | 0.797 | -.0431098 | .0555815 |

exp_asse | | .5484391 | .163646 | 3.35 | 0.003 | .2114038 | .8854745 |

cos_inco | | .000101 | .0000409 | 2.47 | 0.021 | .0000167 | .0001853 |

nlo_asse | | .0000431 | .000021 | 2.05 | 0.051 | -.0000863 | 1.58e-07 |

-------------------------------------------------------------------------------

Instruments for first differences equation

GMM-type (missing=0, separate instruments for each period unless collapsed) L(1/17).(L2.foc_depo ) collapsed

------------------------------------------------------------------------------

Arellano-Bond test for AR(1) in first differences: z = -2.20 Pr > z = 0.028 Arellano-Bond test for AR(2) in first differences: z = -0.74 Pr > z = 0.258

------------------------------------------------------------------------------

Sargan test of overid. restrictions: chi2(43) = 42.02 Prob > chi2 = 0.509 (Not robust, but not weakened by many instruments.)

Dynamic panel-data estimation, two-step difference GMM

------------------------------------------------------------------------------

Number of obs | = | 253 | |

Time variable : time | Number of groups | = | 25 |

Number of instruments = 21 | Obs per group: min | = | 0 |

F(6, 25) = 57.460 | avg | = | 10.12 |

Prob > F = 0.000 | max | = | 16 |

-------------------------------------------------------------------------------

loa_loss | Coef. Std. Err. t P>|t| [95% Conf. Interval]

--------------+----------------------------------------------------------------

loa_loss |

.0879035 | .0801181 | 1.10 | 0.283 | -.0771028 | .2529099 | |

| foc_loan | | .0088709 | .0035398 | 2.51 | 0.019 | .0015806 | .0161612 |

mar_shar | | .1054677 | .0413944 | 2.55 | 0.017 | .0202144 | .1907211 |

exp_asse | | .6686059 | .1047647 | 6.38 | 0.000 | .4528389 | .8843729 |

cos_inco | | .0000517 | .0000668 | 0.77 | 0.447 | -.0001893 | .000086 |

nlo_asse | | .0001136 | .0000205 | 5.54 | 0.000 | -.0001559 | -.0000714 |

-------------------------------------------------------------------------------

Instruments for first differences equation

GMM-type (missing=0, separate instruments for each period unless collapsed) L(1/17).(L2.foc_loan)

collapsed

------------------------------------------------------------------------------

Arellano-Bond test for AR(1) in first differences: z = -2.79 Pr > z = 0.005 Arellano-Bond test for AR(2) in first differences: z = -1.47 Pr > z = 0.143

------------------------------------------------------------------------------

Sargan test of overid. restrictions: chi2(27) = 17.22 Prob > chi2 = 0.926 (Not robust, but not weakened by many instruments.)

Dynamic panel-data estimation, two-step difference GMM

------------------------------------------------------------------------------

Number of obs | = | 259 | |

Time variable : time | Number of groups | = | 25 |

Number of instruments = 23 | Obs per group: min | = | 0 |

F(6, 25) = 227.23 | avg | = | 10.36 |

Prob > F = 0.000 | max | = | 16 |

-------------------------------------------------------------------------------

loa_loss | Coef. Std. Err. t P>|t| [95% Conf. Interval]

--------------+----------------------------------------------------------------

loa_loss |

-.0132574 | .0670129 | -0.20 | 0.845 | -.151273 | .1247583 | |

| | ||||||

foc_asse | | .0064387 | .0015333 | 4.20 | 0.000 | .0032808 | .0095966 |

mar_shar | | -.0331528 | .0217332 | -1.53 | 0.140 | -.0779131 | .0116075 |

exp_asse | | .5954016 | .1053856 | 5.65 | 0.000 | .378356 | .8124473 |

cos_inco | | .0001443 | .0000323 | 4.47 | 0.000 | .0000778 | .0002108 |

nlo_asse | | -.0000393 | .0000294 | -1.34 | 0.193 | -.0000998 | .0000212 |

-------------------------------------------------------------------------------

Instruments for first differences equation

GMM-type (missing=0, separate instruments for each period unless collapsed) L(1/17).(L2.foc_asse ) collapsed

------------------------------------------------------------------------------

Arellano-Bond test for AR(1) in first differences: z = -2.99 Pr > z = 0.003 Arellano-Bond test for AR(2) in first differences: z = -4.11 Pr > z = 0.133

------------------------------------------------------------------------------

Sargan test of overid. restrictions: chi2(47) = 52.05 Prob > chi2 = 0.375 (Not robust, but not weakened by many instruments.)

Dynamic panel-data estimation, two-step difference GMM

------------------------------------------------------------------------------

Number of obs | = | 259 | |

Time variable : time | Number of groups | = | 25 |

Number of instruments = 22 | Obs per group: min | = | 0 |

F(6, 25) = 128.05 | avg | = | 10.36 |

Prob > F = 0.000 | max | = | 16 |

-------------------------------------------------------------------------------

loa_loss | Coef. Std. Err. t P>|t| [95% Conf. Interval]

--------------+----------------------------------------------------------------

loa_loss |

.1794719 | .0457002 | 3.93 | 0.001 | .0853506 | .2735932 | |

| div_inco | | .0061398 | .0015408 | 3.98 | 0.001 | .0029664 | .0093132 |

mar_shar | | -.0028764 | .0342891 | -0.08 | 0.934 | -.0734961 | .0677433 |

exp_asse | | .356518 | .1171249 | 3.04 | 0.005 | .1152948 | .5977412 |

cos_inco | | .0000853 | .000034 | 2.51 | 0.019 | .0000152 | .0001554 |

nlo_asse | | -9.77e-06 | .0000283 | -0.35 | 0.733 | -.000068 | .0000484 |

-------------------------------------------------------------------------------

Instruments for first differences equation

GMM-type (missing=0, separate instruments for each period unless collapsed) L(1/17).(L2.div_inco )

collapsed

------------------------------------------------------------------------------

Arellano-Bond test for AR(1) in first differences: z = -4.28 Pr > z = 0.000 Arellano-Bond test for AR(2) in first differences: z = -1.54 Pr > z = 0.123

------------------------------------------------------------------------------

Sargan test of overid. restrictions: chi2(34) = 22.12 Prob > chi2 = 0.942 (Not robust, but not weakened by many instruments.)

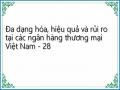

Phụ lục I4: Mô hình động đo lường tác động của đa dạng hóa đến rủi ro các NHTM Việt Nam: Biến Sta_inef

Dynamic panel-data estimation, two-step difference GMM

------------------------------------------------------------------------------

Number of obs | = | 192 | |

Time variable : time | Number of groups | = | 25 |

Number of instruments = 23 | Obs per group: min | = | 2 |

F(6, 25) = 28.520 | avg | = | 7.68 |

Prob > F = 0.000 | max | = | 14 |

----------------------------------------------------------------------------------

Sta_inef | Coef. Std. Err. t P>|t| [95% Conf. Interval]

-----------------+----------------------------------------------------------------

| | | .6226691 | 6.45e-08 | 9.7e+06 | 0.000 | .6226689 | .6226692 | |

| | |||||||

foc_depo | | | 9.27e-08 | 4.01e-08 | 2.31 | 0.029 | 1.02e-08 | 1.75e-07 |

mar_shar | | | -5.76e-07 | 4.72e-07 | -1.22 | 0.234 | -1.55e-06 | 3.97e-07 |

exp_asse | | | 4.44e-06 | 2.61e-06 | 1.70 | 0.101 | -9.31e-07 | 9.82e-06 |

cos_inco | | | 9.23e-10 | 2.66e-10 | 3.47 | 0.002 | -1.47e-09 | -3.75e-10 |

nlo_asse | | | -9.71e-10 | 7.84e-10 | -1.24 | 0.227 | -2.59e-09 | 6.44e-10 |

----------------------------------------------------------------------------------

Instruments for first differences equation

GMM-type (missing=0, separate instruments for each period unless collapsed) L(1/17).(L2.foc_depo)

collapsed

------------------------------------------------------------------------------

Arellano-Bond test for AR(1) in first differences: z = -3.29 Pr > z = 0.001 Arellano-Bond test for AR(2) in first differences: z = 1.35 Pr > z = 0.176

------------------------------------------------------------------------------

Sargan test of overid. restrictions: chi2(25) = 24.94 Prob > chi2 = 0.466 (Not robust, but not weakened by many instruments.)

Dynamic panel-data estimation, two-step difference GMM

------------------------------------------------------------------------------

Number of obs | = | 189 | |

Time variable : time | Number of groups | = | 25 |

Number of instruments = 24 | Obs per group: min | = | 2 |

F(6, 25) = 78.880 | avg | = | 7.56 |

Prob > F = 0.000 | max | = | 14 |

----------------------------------------------------------------------------------

Sta_inef | Coef. Std. Err. t P>|t| [95% Conf. Interval]

-----------------+----------------------------------------------------------------

Sta_inef |

.6226691 | 2.65e-09 | 2.3e+08 | 0.000 | .6226691 | .6226691 | |

foc_loan | | 1.21e-07 | 5.65e-08 | 2.15 | 0.042 | 5.03e-09 | 2.38e-07 |

mar_shar | | -1.09e-06 | 1.11e-06 | -0.98 | 0.337 | -3.37e-06 | 1.20e-06 |

exp_asse | | 7.07e-06 | 3.11e-06 | 2.28 | 0.032 | 6.70e-07 | .0000135 |

cos_inco | | -4.53e-12 | 7.75e-10 | -0.01 | 0.995 | -1.60e-09 | 1.59e-09 |

nlo_asse | | -2.05e-09 | 2.71e-09 | -0.76 | 0.457 | -7.63e-09 | 3.53e-09 |

----------------------------------------------------------------------------------

Instruments for first differences equation

GMM-type (missing=0, separate instruments for each period unless collapsed) L(1/17).(L2.foc_loan) collapsed

------------------------------------------------------------------------------

Arellano-Bond test for AR(1) in first differences: z = -3.14 Pr > z = 0.002 Arellano-Bond test for AR(2) in first differences: z = 1.47 Pr > z = 0.140

------------------------------------------------------------------------------

Sargan test of overid. restrictions: chi2(37) = 37.51 Prob > chi2 = 0.446 (Not robust, but not weakened by many instruments.)

Dynamic panel-data estimation, two-step difference GMM

------------------------------------------------------------------------- -----

Number of obs | = | 192 | |

Time variable : time | Number of groups | = | 25 |

Number of instruments = 22 | Obs per group: min | = | 2 |

F(8, 25) = 93.350 | avg | = | 7.68 |

Prob > F = 0.000 | max | = | 14 |

----------------------------------------------------------------------------------

Sta_inef | Coef. Std. Err. t P>|t| [95% Conf. Interval]

-----------------+----------------------------------------------------------------

.6226692 | 6.16e-09 | 1.0e+08 | 0.000 | .6226692 | .6226692 | |

| foc_asse | | 3.80E-08 | 1.90E-08 | 4.11 | 0.000 | 7.97e-10 | 2.40e-09 |

mar_shar | | 1.34e-07 | 4.64e-07 | 0.29 | 0.775 | -8.22e-07 | 1.09e-06 |

exp_asse | | -2.22e-06 | 1.80e-06 | -1.23 | 0.229 | -5.94e-06 | 1.49e-06 |

cos_inco | | -1.88e-10 | 5.44e-10 | -0.35 | 0.732 | -1.31e-09 | 9.33e-10 |

nlo_asse | | 8.06e-10 | 4.30e-10 | 1.88 | 0.072 | -7.88e-11 | 1.69e-09 |

----------------------------------------------------------------------------------

Instruments for first differences equation

GMM-type (missing=0, separate instruments for each period unless collapsed) L(1/17).(L2.foc_asse ) collapsed

------------------------------------------------------------------------------

Arellano-Bond test for AR(1) in first differences: z = -3.24 Pr > z = 0.001 Arellano-Bond test for AR(2) in first differences: z = 1.59 Pr > z = 0.104

------------------------------------------------------------------------------

Sargan test of overid. restrictions: chi2(71) = 54.17 Prob > chi2 = 0.931 (Not robust, but not weakened by many instruments.)

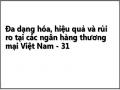

Dynamic panel-data estimation, two-step difference GMM

------------------------------------------------------------------------------

Number of obs | = | 192 | |

Time variable : time | Number of groups | = | 25 |

Number of instruments = 24 | Obs per group: min | = | 2 |

F(6, 25) = 45.860 | avg | = | 7.68 |

Prob > F = 0.000 | max | = | 14 |

----------------------------------------------------------------------------------

Sta_inef | Coef. Std. Err. t P>|t| [95% Conf. Interval]

-----------------+----------------------------------------------------------------

.6226691 | 5.84e-09 | 1.1e+08 | 0.000 | .6226691 | .6226692 | |

| | ||||||

div_inco | | 1.05E-07 | 4.60E-08 | 3.26 | 0.003 | 1.65e-09 | 7.32e-09 |

mar_shar | | -3.59e-08 | 5.37e-07 | -0.07 | 0.947 | -1.14e-06 | 1.07e-06 |

exp_asse | | 6.93e-07 | 3.79e-06 | 0.18 | 0.857 | -7.12e-06 | 8.50e-06 |

cos_inco | | 1.96e-10 | 9.04e-10 | 0.22 | 0.830 | -1.67e-09 | 2.06e-09 |

nlo_asse | | -3.09e-10 | 8.19e-10 | -0.38 | 0.709 | -2.00e-09 | 1.38e-09 |

----------------------------------------------------------------------------------

Instruments for first differences equation

GMM-type (missing=0, separate instruments for each period unless collapsed) L(1/17).(L2.div_inco) collapsed

------------------------------------------------------------------------------

Arellano-Bond test for AR(1) in first differences: z = -3.24 Pr > z = 0.000 Arellano-Bond test for AR(2) in first differences: z = 1.23 Pr > z = 0.212

------------------------------------------------------------------------------

Sargan test of overid. restrictions: chi2(45) = 41.72 Prob > chi2 = 0.612 (Not robust, but not weakened by many instruments.)

PHỤ LỤC J: CÁC MÔ HÌNH ĐO LƯỜNG TÁC ĐỘNG ĐỒNG THỜI CỦA ĐA DẠNG HÓA, HIỆU QUẢ HOẠT ĐỘNG KINH DOANH, RỦI RO TẠI CÁC NHTM VIỆT NAM

Phụ lục J1: các mô hình đo lường tác động đồng thời đa dạng hóa, hiệu quả hoạt động kinh doanh, rủi ro (Loa_loss) các NHTM Việt Nam: Biến ROA

Seemingly unrelated regression

--------------------------------------------------------------------------

Equation Obs Parms RMSE "R-sq" chi2 P

--------------------------------------------------------------------------

307 | 6 | .3921148 | 0.7379 | 1170.07 | 0.0000 | |

loa_loss | 307 | 6 | .0031353 | 0.6778 | 994.55 | 0.0000 |

foc_depo | 307 | 5 | .1444418 | 0.0343 | 22.38 | 0.0004 |

--------------------------------------------------------------------------

-------------------------------------------------------------------------------

| Coef. Std. Err. z P>|z| [95% Conf. Interval]

--------------+----------------------------------------------------------------

foc_depo |

.0510248 | .012933 | 3.95 | 0.000 | .0256766 | .076373 | |

loa_loss | | 6.223125 | 1.811681 | 3.44 | 0.001 | 2.672296 | 9.773954 |

ln_asse | | -.0023502 | .0021066 | -1.12 | 0.265 | -.006479 | .0017787 |

equ_asse | | -.122066 | .1621825 | -0.75 | 0.452 | -.4399378 | .1958059 |

dep_asse | | .1317953 | .0669706 | 1.97 | 0.049 | .0005353 | .2630554 |

_cons | | .4965967 | .0578046 | 8.59 | 0.000 | .3833018 | .6098916 |

-------------------------------------------------------------------------------

loa_loss |

-.0079927 | .0003155 | -25.33 | 0.000 | -.0086111 | -.0073744 | |

foc_depo | | .0031477 | .0011739 | 2.68 | 0.007 | .000847 | .0054485 |

mar_shar | | .0119355 | .0031219 | 3.82 | 0.000 | .0058166 | .0180545 |

exp_asse | | .3221071 | .0326884 | 9.85 | 0.000 | .2580389 | .3861752 |

cos_inco | | .0003288 | .0000191 | 17.18 | 0.000 | -.0003663 | .0002913 |

nlo_asse | | -.0000195 | .0000117 | -1.67 | 0.094 | -.0000424 | 3.36e-06 |

_cons | | .0241171 | .0015478 | 15.58 | 0.000 | .0210834 | .0271507 |

--------------+----------------------------------------------------------------

roa |

-90.02769 | 4.393049 | -20.49 | 0.000 | -98.63791 | -81.41747 | |

foc_depo | | .4338834 | .1575288 | 2.75 | 0.006 | .1251326 | .7426342 |

Ln_asse | | .0144124 | .0044272 | 3.26 | 0.001 | .0057353 | .0230894 |

tlo_asse | | .8987807 | .1709933 | 5.26 | 0.000 | .5636401 | 1.233921 |

mar_shar | | -.3073937 | .429218 | -0.72 | 0.474 | -1.148645 | .533858 |

equ_asse | | 2.17912 | .4701853 | 4.63 | 0.000 | 1.257574 | 3.100666 |

_cons | | 1.998174 | .1484106 | 13.46 | 0.000 | 1.707294 | 2.289053 |

--------------+----------------------------------------------------------------