Oates, W. E. (1972). Fiscal federalism. Books.

OECD, 2008, OECD Benchmark Definition of Foreign Direct Investment, ISBN 978-92-64- 04573-6

OECD, 2015. OECD/G20 Base Erosion and ProTit Shing Project: Addressing the Tax Challenges of the Digital Economy, 2015 Final Report. s.l., s.n.

Ourvashi Bissoon. Can better institutions attract more Foreign Direct Investment (FDI)? Evidence from Developing countries Ourvashi Bissoon, International Conference On Applied Economics – ICOAE 2011

Pan-Long Tsai, 1994, Determinants of foreign direct investment and its impact on economic growth.

Journal of economic development, 19(1): 137-163,199.

Pesaran, M. Hashem. (2004). General Diagnostic Tests for cross Section Dependence in Panels. CESifo Working Papers No. 1233. Munich: CESifo, pp. 255–60.

Razin, A., Rubinstein, Y., & Sadka, E. (2005). Corporate taxation and bilateral FDI with threshold barriers.

Rendon-Garza, J. R. (2006). Global Corporate Tax Competition for Export Oriented Foreign Direct Investment.

Reynolds, Hayley, and Ludvig Wier. Estimating profit shifting in South Africa using firm-level tax returns. No. 2016/128. WIDER Working Paper, 2016.

Ricardo, D. (1891). Principles of political economy and taxation. G. Bell and sons.

Rock, M. T. (2009),"Corruption and democracy", Journal of Development Studies, 45(1), 55-75.

Rugman, A. M., & Verbeke, A. (2002). Edith Penrose's contribution to the resource‐based view of strategic management. Strategic management journal, 23(8), 769-780.

Sabir, S., Rafique, A., & Abbas, K. (2019). Institutions and FDI: evidence from developed and developing countries. Financial Innovation, 5(1), 1-20.

Sasana, H., & Fathoni, S. (2019). Determinant of Foreign Direct Investment Inflows in Asean Countries. JEJAK: Jurnal Ekonomi dan Kebijakan, 12(2), 253-266.

Sato, T. (2012). Empirical analysis of corporate tax and foreign direct investment. Public Policy Review, 8(1), 1-20.

Schneider, F. and Frey, B. (1985) “Economic and political determinants of foreign direct investment” , World Development, vol. 13,no. 2, pp. 161-175.

Scholes, Myron, and Mark A. Wolfson. (1990). “The Effects of Changes in Tax Law on Corporate Reorganization Activity”. Journal of Business 63, S141-S164.

Shahmoradi, B., & Baghbanyan, M. (2011). Determinants of foreign direct investment in developing countries: A panel data analysis. Asian Economic and Financial Review, 1(2), 49.

Shang-Jin, W. (1997), How Taxing is Corruption on International Investors? NBER Working Paper No.

6030

Shang-Jin, W. , 1997. How taxing is corruption on international investors?. How taxing is corruption on international investors? NBER Working.

Stotsky, J. (1995). Taxation of the financial sector. Tax Policy Handbook, 242.

Tax Justice Network (2007). Identifying Tax Havens and Offshore Financial Centres. Briefing Tax Justice Network (2015a). Narrative Report on United Kingdom. p. 1, http://www.

Tax Justice Network (2015b). Narrative Report on Netherlands. p. 1, http://www.

Tiebout, Charles M. (1956). A Pure Theory of Local Ex- penditures. J. Polit. Econ., Oct. 1956, 64(5), pp. 416-24.

Tørsløv, T. R., Wier, L. S., & Zucman, G. (2018). The missing profits of nations (No. w24701). National Bureau of Economic Research.

Ture, N. B. (1963). Tax reform: Depreciation problems. The American Economic Review, 53(2), 334- 353.

UNCTAD (2012a). Investment Country Profiles: South Africa. Tables 12, 15, February, http:// www.unctad.org/en/ /PublicationsLibrary/webdiaeia2012d4_engl.

UNCTAD (2012b). Investment Country Profiles: South Africa. Tables 12, 15, February, http:// www.unctad.org/en/ /PublicationsLibrary/webdiaeia2012d4_engl

UNCTAD (2013a). Investment Country Profiles: India, 2 March, http:// www.unctad.org/en/

/PublicationsLibrary/webdiaeia2012d4_engl

UNCTAD (2013b). Investment Country Profiles: India. Table 6, 2 March, http:// www.unctad.org/en/

/PublicationsLibrary/webdiaeia2012d4_engl

UNCTAD (2014). World Investment Report 2014. UNCTAD (2015). Annex to WIR15, Chapter V UNCTAD (2015). World Investment Report 2015.

UNCTAD (2016a). Global Investment Trends Monitor. No. 22. 20 January. UNCTAD (2016b). World Investment Report 2016. unctad.org/en/PublicationsLibrary/webdiaeia2012d4_engl.

Urbain, J. P., & Westerlund, J. (2006). Spurious regression in nonstationary panels with cross-unit cointegration. (METEOR Research Memorandum; No. 057). Maastricht: METEOR, Maastricht University School of Business and Economics.

Vijayakumar, N., Sridharan, P., & Rao, K. C. S. (2010). Determinants of FDI in BRICS Countries: A panel analysis. International Journal of Business Science & Applied Management (IJBSAM), 5(3), 1-13.

Wang, Z. Q. a. N. J. S., (1995. The determinants of foreign direct investment in transforming economies: Empirical evidence from Hungary and China‖, Review of World Economics, Vol. 131(2), 359- 382.

Wang, Z. Q., & Swain, N. J. (1995). The determinants of foreign direct investment in transforming economies: Empirical evidence from Hungary and China. Weltwirtschaftliches Archiv, 131(2), 359-382.

Wanniski, J. (1978). Taxes, revenues, and the Laffer curve. The Public Interest, 50, 3.

Wei, Sang Jin, 2000. How taxing is corruption on international investors?. Review of economics and statistics, 82(1), 1-11.

Westerlund, J. (2007). Testing for error correction in panel data. Oxford Bulletin of Economics and Statistics, 69(6), 709–748.

Westerlund, J., 2007. Testing for error correction in panel data. Oxford Bulletin of Economics and Statistics 69, 709-748

White, Michelle J. (1975) Firm Location in a Zoned Metropolitan Area, in EDWIN S. MILLS AND WAL- LACE E. OATES, 1975a, pp. 175-201

Wijeweera, A., Dollery, B., & Clark, D. (2007). Corporate tax rates and foreign direct investment in the United States. Applied Economics, 39(1), 109-117.

Wilson, F. H., Disse-Nicodeme, S., Choate, K. A., Ishikawa, K., Nelson-Williams, C., Desitter, I., ... & Lifton, R. P. (2001). Human hypertension caused by mutations in WNK kinases. Science, 293(5532), 1107-1112.

Wilson, J. D. (1986). A theory of interregional tax competition. Journal of urban Economics, 19(3), 296-315.

Wilson, J. D. (1999). Theories of tax competition. National tax journal, 269-304.

Wong, M. F., Fai, C. K., Yee, Y. C., & Cheng, L. S. (2019). Macroeconomic policy and exchange rate impacts on the foreign direct investment in ASEAN economies. International Journal of Economic Policy in Emerging Economies, 12(1), 1-10.

World Bank (2012). Draining Development: Controlling Flows of Illicit Funds from Developing World Bank (2015). World Bank Data, http://worldbank.org/indicator.

Xaypanya, P., P. Rangkakulnuwat, and S. W. Paweenawat. 2015. “The Determinants of Foreign Direct Investment in ASEAN. The First Differencing Panel Data Analysis.” International Journal of Social Economics 42 (3): 239–250. doi:10.1108/IJSE-10-2013-0238.

Yang, J. Y. Y., Groenewold, N., & Tcha, M. (2000). The determinants of foreign direct investment in Australia. Economic Record, 76(232), 45-54.

Zucman, G. (2014). Taxing across borders: Tracking personal wealth and corporate profits. Journal of economic perspectives, 28(4), 121-48.

PHỤ LỤC

PHỤ LỤC 1: CÁC QUỐC GIA TRONG MẪU NGHIÊN CỨU

QG ĐANG PHÁT TRIỂN | STT | QG THIÊN ĐƯỜNG THUẾ | ||

1 | Armenia, Rep. of | 1 | Anguilla | |

2 | Bolivia | 2 | Antigua and Barbuda | |

3 | Botswana | 3 | Aruba, Kingdom of the Netherlands | |

4 | Bulgaria | 4 | Bahamas | |

5 | Cambodia | 5 | Bahrain | |

6 | Chile | 6 | Belize | |

7 | Costa Rica | 7 | Bermuda | |

8 | El Salvador | 8 | British Virgin Islands | |

9 | Georgia | 9 | Cayman Islands | |

10 | Ghana | 10 | Cook Islands | |

11 | Guatemala | 11 | Cyprus | |

12 | Honduras | 12 | Dominica | |

13 | Hungary | 13 | Gibraltar | |

14 | Kazakhstan, Rep. of | 14 | Grenada | |

15 | Kyrgyz Rep. of | 15 | Guernsey | |

16 | Latvia | 16 | Isle of Man | |

17 | Lithuania | 17 | Jersey | |

18 | Malaysia | 18 | Liberia | |

19 | Moldova, Rep. of | 19 | Liechtenstein | |

20 | Mongolia | 20 | Malta | |

21 | Montenegro | 21 | Marshall Islands, Rep. of the | |

22 | Morocco | 22 | Mauritius | |

23 | Paraguay | 23 | Monaco | |

24 | Philippines | 24 | Montserrat | |

25 | Romania | 25 | Nauru, Rep. of | |

26 | South Africa | 26 | Netherlands Antilles | |

27 | Tanzania, United Rep. of | 27 | Niue | |

28 | Thailand | 28 | Panama | |

29 | Turkey | 29 | Samoa | |

30 | Ukraine | 30 | San Marino, Rep. of | |

31 | Uruguay | 31 | Seychelles | |

32 | Vietnam | 32 | Turks and Caicos Islands | |

33 | United States Virgin Islands | |||

34 | Vanuatu | |||

Có thể bạn quan tâm!

-

Tổng Hợp Các Kết Quả Nghiên Cứu Về Tổn Thất Thuế Tndn Do Xói Mòn Cơ Sở Thuế Tndn

Tổng Hợp Các Kết Quả Nghiên Cứu Về Tổn Thất Thuế Tndn Do Xói Mòn Cơ Sở Thuế Tndn -

Hợp Tác Quốc Tế Về Thuế Chống Xói Mòn Cơ Sở Thuế

Hợp Tác Quốc Tế Về Thuế Chống Xói Mòn Cơ Sở Thuế -

Hạn Chế Của Đề Tài Và Hướng Nghiên Cứu Tiếp Theo

Hạn Chế Của Đề Tài Và Hướng Nghiên Cứu Tiếp Theo -

Thuế và đầu tư trực tiếp nước ngoài tại các quốc gia đang phát triển - 22

Thuế và đầu tư trực tiếp nước ngoài tại các quốc gia đang phát triển - 22 -

Thuế và đầu tư trực tiếp nước ngoài tại các quốc gia đang phát triển - 23

Thuế và đầu tư trực tiếp nước ngoài tại các quốc gia đang phát triển - 23

Xem toàn bộ 193 trang tài liệu này.

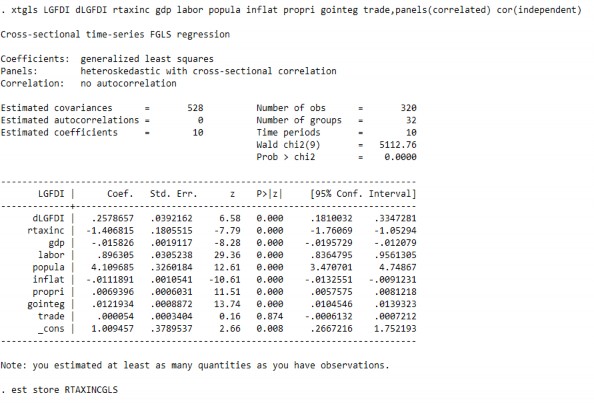

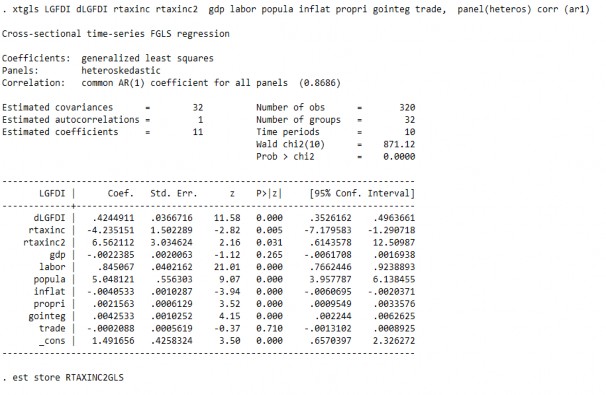

PHỤ LỤC 2: KẾT QUẢ STATA

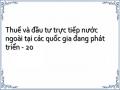

I. THỐNG KÊ MÔ TẢ CÁC BIẾN

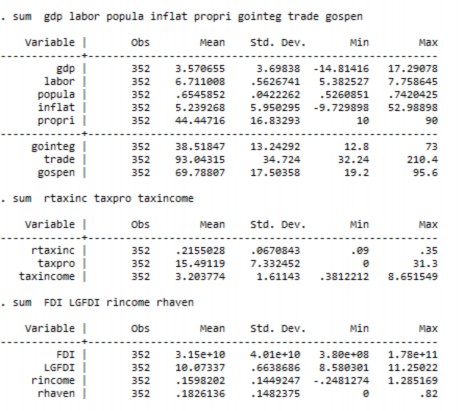

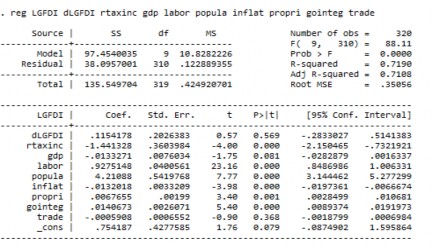

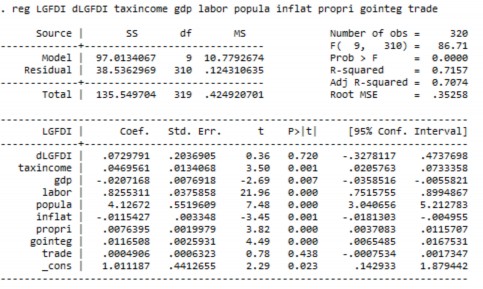

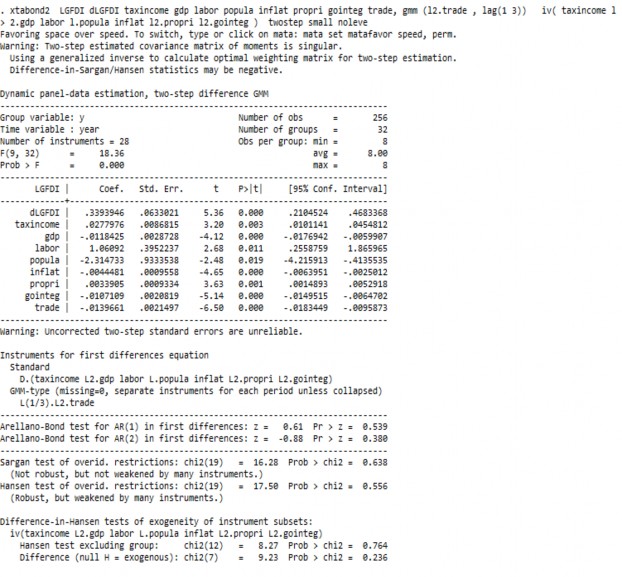

II. TÁC ĐỘNG CỦA CHÍNH SÁCH THUẾ TNDN ĐẾN FDI

1. MÔ HÌNH THUẾ SUẤT LUẬT ĐỊNH

2. MÔ HÌNH THUẾ SUẤT HIỆU QUẢ

3. MÔ HÌNH SỐ THU THUẾ TNDN

III. QUAN HỆ PHI TUYẾN GIỮA THUẾ SUẤT THUẾ TNDN VÀ FDI

1. MÔ HÌNH THUẾ SUẤT LUẬT ĐỊNH

1.1 PHƯƠNG PHÁP GLS