De Nicolò, G., Dell’Ariccia, G., Laeven, L., & Valencia, F. (2010). Monetary policy and bank risk taking. Available at SSRN 1654582.

Dell’Ariccia, G., Igan, D., & Laeven, L. (2008). Credit booms and lending standards: Evidence from the subprime mortgage market. International Monetary Fund.

Dell’Ariccia, G., Igan, D., & Laeven, L. U. (2012). Credit booms and lending standards: Evidence from the subprime mortgage market. Journal of Money, Credit and Banking, 44(2–3), 367–384.

Dell’Ariccia, G., Laeven, L., Marquez, R., 2011. Monetary policy, leverage and bank risk-taking. Working Paper.

DellʼAriccia, G., Laeven, L., & Marquez, R. (2014). Real interest rates, leverage, and bank risk-taking. Journal of Economic Theory, 149, 65–99.

Demirgüç-Kunt, A., & Detragiache, E. (1998). The determinants of banking crises in developing and developed countries. Staff Papers, 45(1), 81–109.

Demsetz, R.S., Strahan, P.E., 1997. Diversification, size, and risk at US bank holding companies. Journal of Money, Credit, and Banking 29, 300–313.

DeYoung, R., Peng, E. Y., & Yan, M. (2013b). Executive Compensation and Business Policy Choices at U.S. Commercial Banks. Journal of Financial and Quantitative Analysis, 48(1), 165–196.

Diamond, D. W., & Dybvig, P. H. (1983). Bank runs, deposit insurance, and liquidity. Journal of political economy, 91(3), 401–419.

Dieppe, A., & McAdam, P. (2006). Monetary policy under a liquidity trap: Simulation evidence for the euro area. Journal of the Japanese and International Economies, 20(3), 338–363.

Có thể bạn quan tâm!

-

Thảo Luận Kết Quả Hồi Quy Gmm Mô Hình Tác Động Mức Độ Chấp Nhận Rủi Ro Đến Tính Ổn Định Tài Chính.

Thảo Luận Kết Quả Hồi Quy Gmm Mô Hình Tác Động Mức Độ Chấp Nhận Rủi Ro Đến Tính Ổn Định Tài Chính. -

Hàm Ý Chính Sách Đối Với Ngân Hàng Nhà Nước.

Hàm Ý Chính Sách Đối Với Ngân Hàng Nhà Nước. -

Tác động của chính sách tiền tệ đến tính ổn định tài chính của các ngân hàng thương mại Việt Nam thông qua mức độ chấp nhận rủi ro - 21

Tác động của chính sách tiền tệ đến tính ổn định tài chính của các ngân hàng thương mại Việt Nam thông qua mức độ chấp nhận rủi ro - 21 -

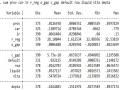

Ma Trận Hệ Số Tương Quan Mô Hình Tác Động Của Chính Sách Tiền Tệ, Prov Đến Car

Ma Trận Hệ Số Tương Quan Mô Hình Tác Động Của Chính Sách Tiền Tệ, Prov Đến Car -

Tác động của chính sách tiền tệ đến tính ổn định tài chính của các ngân hàng thương mại Việt Nam thông qua mức độ chấp nhận rủi ro - 24

Tác động của chính sách tiền tệ đến tính ổn định tài chính của các ngân hàng thương mại Việt Nam thông qua mức độ chấp nhận rủi ro - 24 -

Tác động của chính sách tiền tệ đến tính ổn định tài chính của các ngân hàng thương mại Việt Nam thông qua mức độ chấp nhận rủi ro - 25

Tác động của chính sách tiền tệ đến tính ổn định tài chính của các ngân hàng thương mại Việt Nam thông qua mức độ chấp nhận rủi ro - 25

Xem toàn bộ 203 trang tài liệu này.

Drakos, A. A., & Kouretas, G. P. (2015). The conduct of monetary policy in the Eurozone before and after the financial crisis. Economic Modelling, 48, 83– 92.

Drew Fudenberg, and Jean Tirole, “A Theory of Income and Dividend Smoothing Based on Incumbency Rents”, Journal of Political Economy, vol.103, n.1, February 1995, pp. 75 – 93.

Eisenbach, T. M., & Yorulmazer, T. (2014). Factors that Affect Bank Stability. Trong Liberty Street Economics (Số p.h 20140226; Liberty Street Economics). Federal Reserve Bank of New York.

El Sood, H. A. (2012). Loan loss provisioning and income smoothing in US banks pre and post the financial crisis. International Review of Financial Analysis, 25, 64-72.

El-Ansary, Osama and Hafez, Hassan, Determinants of Capital Adequacy Ratio: An Empirical Study on Egyptian Banks (December 27, 2015). Corporate Ownership & Control / Volume 13, Issue 1, 2015, Available at SSRN: https://ssrn.com/abstract=2708603

Floro, D. (2010). Loan loss provisioning and business cycle: Does capital matter? Evidence from Philippines banks. BIS Working Paper: Bank for International Settlements.

Fofack, H. 2005. Non-performing Loans in Sub-Saharan Africa: Causal Analysis and Macroeconomic Implications. World Bank Policy Research Working Paper No. 3769.

Gambacorta, L., 2009. Monetary policy and the risk-taking channel. BIS Q. Rev. 4, 43–51.

García-Herrero, A.; Gavilá, S.; Santabárbara, D. What Explains the Low Profitability of Chinese Banks? J. Bank. Financ. 2009, 33, 2080–2092.

García-Suaza, A. F., Gómez-González, J. E., Pabón, A. M., & Tenjo-Galarza, F. (2012). The cyclical behavior of bank capital buffers in an emerging economy: Size does matter. Economic Modelling, 29(5), 1612–1617.

Geraats, P. M. (2002). Central bank transparency. The economic journal, 112(483), F532–F565.

Greenspan, A. (2005). Risk transfer and financial stability. Federal Reserve Bank of Chicago Proceedings, 968.

Gropp, R., and Heider, F., 2009, “The Determinants of Bank Capital Structure”, European Central Bank Working Paper Series n° 1096, September.

Hanifan, F. and Umanto. 2017. The impact of macroeconomic and bank-specific factors toward non-performing loan: evidence from Indonesian public banks. Banks and Bank Systems, 12(1), 67-74, doi:10.21511/bbs.12(1).2017.08

Hasan, Iftekhar & Wall, Larry D., 2003. "Determinants of the loan loss allowance: some cross-country comparisons," Research Discussion Papers 33/2003, Bank of Finland.

Hasni Abdullah, Ismail Ahmad, Imbarine Bujang, 2014. Loan Loss Provisions And Macroeconomic Factors: The Case Of Malaysian Commercial Banks. International Business Management 9(4):377-383.

Hassan K (1992). An empirical analysis of bank standby letters of credit risk. Rev.

Fin. Econ., 2 (1): 31-44.

Hung, L. V., & Pfau, W. D. (2009). VAR analysis of the monetary transmission mechanism in Vietnam. Applied Econometrics and International Development, 9(1), 165–179.

Ibish Mazreku & Fisnik Morina & Valdrin Misiri & Jonathan V. Spiteri & Simon Grima, 2018. "Determinants of the Level of Non-Performing Loans in Commercial Banks of Transition Countries," European Research Studies Journal, vol. 0(3), pages 3-13.

Imbierowicz, B., & Rauch, C. (2014). The relationship between liquidity risk and credit risk in banks. Journal of Banking & Finance, 40, 242–256.

Ioannidou, V., Ongena, S., & Peydró, J. L. (2009). Monetary policy and subprime lending: A tall tale of low federal funds rates, hazardous loans and reduced loan spreads. European banking centre discussion paper, 45.

Issing, O. (2004). Inflation targeting: A view from the ECB. Federal Reserve Bank of St. Louis Review, 86(4), 169–179.

Jahn, N., & Kick, T. (2012). Determinants of banking system stability: A macro- prudential analysis. Finance Center Münster, University of Münster.

Jean Louis, R., & Balli, F. (2013). Low-inflation-targeting monetary policy and differential unemployment rate: Is monetary policy to be blamed for the financial crisis? Evidence from major OECD countries. Economic Modelling, 30(C), 546–564.

Jiménez, G., Ongena, S., Peydró, J.-L., & Saurina, J. (2012). Credit supply and monetary policy: Identifying the bank balance-sheet channel with loan applications. American Economic Review, 102(5), 2301–26.

Jiménez, G., Ongena, S., Peydró, J.L., Saurina, J., 2014. Hazardous times for monetary policy: what do twenty-three million bank loans say about the effects of monetary policy on credit risk-taking. Econometrica 82 (2), 463– 505.

Jiménez, G., Saurina, J. 2005. Credit cycles, credit risk, and prudential regulation. Working paper 0531 Banco de Espađa. International Journal of Central Banking 2(2), 1-34.

Jin‐li hu., yang li., yung‐ho chiu., 2004. Ownership and nonperforming loans: evidence from taiwan's banks. The developing economies 42(3):405 - 420

Jokipii, T., & Monnin, P. (2013). The impact of banking sector stability on the real economy. Journal of International Money and Finance, 32, 1–16.

Kaminsky, G. L., & Reinhart, C. M. (1999). The twin crises: The causes of banking and balance-of-payments problems. American economic review, 89(3), 473– 500.

Kanagaretnam, K., Lobo, G. J., & Yang, D.-H. (2005). Determinants of signaling by banks through loan loss provisions. Journal of Business Research, 58(3), 312- 320.

Keeley, M. C. (1990). Deposit insurance, risk, and market power in banking. The American economic review, 1183–1200.

Kim, D., & Santomero, A. M. (1988). Risk in banking and capital regulation. The journal of finance, 43(5), 1219–1233.

Kleff, V., and Weber, M., 2008, “How Do Banks Determine Capital? Evidence from Germany”, German Economic Review, 9(8), 354-372.

Koehn, M., & Santomero, A. M. (1980). Regulation of bank capital and portfolio risk. The journal of finance, 35(5), 1235–1244.

Koopman SJ, Lucas A 2004, ‘Business and default cycles for credit risk’, Journal of Applied Econometrics, 20:2: 311- 323.

Labonte, M., & Makinen, G. E. (2008). Monetary policy and the Federal Reserve: Current policy and conditions.

Laeven, L. and Majnoni, G. (2003), “Loan loss provisioning and economic slowdowns: too much, too late?”, Journal of Financial Intermediation, Vol. 12 No.2, pp. 178-197.

Laeven, L., & Levine, R. (2009). Bank governance, regulation and risk taking.

Journal of financial economics, 93(2), 259–275.

Lai, A. (2002). Modelling financial instability: A survey of the literature. Bank of Canada.

Leventis, S., Dimitropoulos, P. E. and Anandarajan, A (2011), “Loan loss provisions, earnings management and capital management under IFRS: The case of EU commercial banks”, Journal of Financial Services Research, Vol. 40 No. (1-2), pp. 103-122.

Loayza, N., & Schmidt-Hebbel, K. (2002). Monetary policy functions and transmission mechanisms: An overview. Serieson Central Banking, Analysis, and Economic Policies, no. 4.

Longstaff, F. A., & Schwartz, E. S. (1995). A simple approach to valuing risky fixed and floating rate debt. The Journal of Finance, 50(3), 789–819.

Lown, C., & Morgan, D. P. (2006). The credit cycle and the business cycle: New findings using the Loan officer opinion survey. Journal of Money, Credit and Banking, 1575–1597.

Ma, C. K. 1988. Loan loss reserves and income smoothing: The experience in the

U.S. banking industry. Journal of Business Finance and Accounting 15:487- 497.

Maddaloni, A., & Peydró, J.-L. (2011a). Bank risk-taking, securitization, supervision, and low interest rates: Evidence from the Euro-area and the US lending standards. the review of financial studies, 24(6), 2121–2165.

Menon, R. (2015). Ravi Menon: Macroeconomic stability and financial stability - uncomfortable bedfellows?

Merton, R. C. (1974). On the pricing of corporate debt: The risk structure of interest rates. The Journal of finance, 29(2), 449–470.

Mili, M., Sahut, J.M., Trimeche, H., Teulon, F., 2017. Determinants of the capital adequacy ratio of foreign banks’ subsidiaries: The role of interbank market and regulation. Research in International Business and Finance 42, 442-453.

Mishkin Frederic, S. (2004). The economics of money, banking, and financial markets. Mishkin Frederic–Addison Wesley Longman.

Mishkin, F. S. (1995). Symposium on the monetary transmission mechanism.

Journal of Economic perspectives, 9(4), 3–10.

Mishkin, F. S. (1996). The channels of monetary transmission: Lessons for monetary policy. National Bureau of Economic Research.

Mishkin, F. S. (1999). Financial consolidation: Dangers and opportunities. Journal of Banking & Finance, 23(2–4), 675–691.

Mishkin, F. S. (2001). Financial policies and the prevention of financial crises in emerging market economies. The World Bank.

Mishkin, F. S., Giuliodori, M., & Matthews, K. (2013). The Economics of Money, Banking and Financial Monetary. Pearson.

Mishkin, Frederic S., Monetary Policy Strategy: Lessons from the Crisis (February 2011). NBER Working Paper No. w16755, Available at SSRN: https://ssrn.com/abstract=1754908

Montes, G. C., & Peixoto, G. B. T. (2014). Risk-taking channel, bank lending channel and the “paradox of credibility”: Evidence from Brazil. Economic Modelling, 39, 82–94.

Montes, G.C., Peixoto, G., 2014. Risk-taking channel, bank lending channel and the paradox of credibility. Econ. Model. 39, 82–94.

Mpuga, P., 2002. “The 1998-99 banking crisis in Uganda: What was the role of the new capital requirements?”, Journal of Financial Regulation and Compliance, 10(3), 224- 242.

Ngugi, R.W. An Empirical Analysis of Interest Rate Spread in Kenya. 2001, RP No.

106. Available online: https://www.africaportal.org/publications/an-empirical- analysis-of-interest-rate-spread-in-kenya/ (accessed on 15 January 2019).

Octavia, M., Brown, R., 2010. Determinants of bank capital structure in developing countries: regulatory capital requirement versus the standard determinants of capital structure. Journal of Emerging Markets, 15, 1–50.

Ombunya, C.O., 2017. The Relationship Between Monetary Policy and Non Performing Loans in Deposit Taking Saving and Credit Cooperative Societies in Nairobi County, Kenya. University of Nairobi.

Osama El-Ansary, Ahmed A. El-Masry, Zainab Yousry, Determinants of Capital Adequacy Ratio (CAR) in MENA Region: Islamic vs. Conventional Banks, DOI: https://doi.org/10.5296/ijafr.v9i2.14696

Ozili P.K. (2015), “Loan loss provisioning, Income Smoothing, signalling, capital management and procyclicality. Does IFRS Matter? Empirical Evidence from Nigeria”, Mediterranean Journal of Social Science, Vol. 6 No. 2, pp. 224-232.

Ozili, Peterson K, 2018. "Bank Loan Loss Provisions, Investor Protection and the Macroeconomy," MPRA Paper 80281, University Library of Munich, Germany.

Pain, D. (2003), “The Provisioning Experience of the Major UK Banks: A Small Panel Investigation.” Bank of England, Working Paper 177.

Paligorova, T., & Santos, J. A. (2012). When is it less costly for risky firms to borrow? Evidence from the bank risk-taking channel of monetary policy. Bank of Canada Working Paper.

Paligorova, T., & Santos, J. A. (2017). Monetary policy and bank risk-taking: Evidence from the corporate loan market. Journal of Financial Intermediation, 30, 35–49.

Park, Y. C., & Song, C.-Y. (1998). The East Asian financial crisis: A year later. ponencia presentada a la Conference on the East Asian crisis. Institute of Development Studies, University of Sussex, Brighton, 13–14.

Perez, D, Salas-Fumas, V, and J, Saurina, 2006, ‘Earnings and capital management in alternative loan-loss provision regulatory regimes’, Banco de Espađa Working Papers: 0614.

Pham Thi Xuan Thoa and Nguyen Ngoc Anh (2017). The Determinants of Capital Adequacy Ratio: The Case of the Vietnamese Banking System in the Period

2011-2015. VNU Journal of Science: Economics and Business, Vol. 33, No. 2 (2017) 49-58

Pool, S., De Haan, L., and Jacobs, J. P. (2015), “Loan loss provisioning, bank credit and the real economy.” Journal of Macroeconomics, Vol. 45, pp. 124-136.

Quagliariello, Mario, 2008, Does macro economy affect bank stability? A review of empirical evidence’, Journal of Banking Regulation, Vol. 2, No.9 pp. 102-115. Quttainah, M. A., Song, L., and Wu, Q. (2013), “Do Islamic banks employ less earnings management?”, Journal of International Financial Management &

Accounting, Vol. 24 No.3, pp. 203-233.

Rajan, R.G., 2005. Has financial development made the world riskier? National Bureau of Economic Research working Paper Series, n. 11.728.

Rajan, RG 1994, ‘Why bank credit policy fluctuate: a theory and some evidence’, Quarterly Journal of Economics, 109 (2): 399-441.

Ranjan, R. and Dhal, S.C. 2003. Non-Performing Loans and Terms of Credit of Public Sector Banks in India: An Empirical Assessment. Reserve Bank of India Occasional Papers, 24(3).

Rime, B., 2001. Capital requirements and bank behavior: Empirical evidence for Switzerland. Journal of Banking and Finance 25, 789–805.

Rochet, J.-C. (1992). Capital requirements and the behaviour of commercial banks.

European Economic Review, 36(5), 1137–1170.

Ross, S. A. (1987). The interrelations of finance and economics: Theoretical perspectives. The American Economic Review, 77(2), 29–34.

Roy, A. D. (1952). Safety first and the holding of assets. Econometrica: Journal of the econometric society, 431–449.

Ruckes, M., 2004, “Bank competition and credit standards”, Review of Financial Studies, Vol. 17(4), 1073-1102.

Salas, V, and J, Saurina, 2002, ‘Credit risk in two institutional regimes: Spanish commercial and savings banks’, Journal of Financial Services Research, 22: 203 – 224.