Huangi, G., 2006. The determinants off capitall structure: Evidencei from China.

China economic review, 17, 14-36.

Huang, R. & Ritter, J. R., 2019. Corporate cash shortfalls and financing decisions.

Available at SSRN 2589096.

Huang, S. G. & Song, F. M., 2004. The determinants of capital structure: Evidence from China. China Economic Quarterly-Beijing-, 3, 395-414.

Irvine, P. J. & Pontiff, J., 2009. Idiosyncratic return volatility, cash flows, and product market competition. The Review of Financial Studies, 22, 1149- 1177.

International Finance Corporation; World Bank (2012), “Doing business: doing business in a more transparent world”, Doing Business, World Bank, available at: https://openknowledge. worldbank.org/handle/10986/5907 License: CC BY 3.0 IG Jensen, M. C., 1986. Agency costs of free cash flow, corporate finance, and

takeovers. The American economic review, 76, 323-329.

Jensen, M. C. & Meckling, W. H., 1976. Theory of the firm: Managerial behavior, agency costs and ownership structure. Journal of financial economics, 3, 305-360.

Kale, J. R. et al., 1991. The effect of business risk on corporate capital structure: Theory and evidence. The journal of finance, 46, 1693-1715.

Kalelkar, R. & Khan, S., 2016. CEO financial background and audit pricing.

Accounting Horizons, 30, 325-339.

Kane, A. et al., 1985. Debt Policy and the Rate of Return Premium to Leverage. The Journal of Financial and Quantitative Analysis, 20, 479-499.

Karimli, T., 2018. The Impact of Cash Flow Volatility on Corporate Debt Decisions. Central Europeann University.

Kayhan, A. & Titman, S., 2007. Firms’ historiess and their capitall structuress.

Journal of financial Economics, 83, 1-321.

Keefe, M. O. C. & Yaghoubi, M., 2016. The influence off cashh flow volatility on capitall structurei and the use of debt of differentt maturities. Journal of Corporate Finance, 38, 18-36.

Kester, W. C., 1986. Capital and ownership structure: A comparison of United States and Japanese manufacturing corporations. Financial management, 5- 16.

Kim, W. S. & Sorensen, E. H., 1986. Evidence on the impact of the agency costs of debt on corporate debt policy. Journal of Financial and quantitative analysis, 21, 131-144.

Kovsted, J. et al., 2003. Financial sector reforms in Vietnam: Selected issues and problems.

Kraus, A. & Litzenberger, R. H., 1973. A state‐preference model of optimal financial leverage. The journal of finance, 28, 911-922.

Kumar, S. et al., 2017. Research on capital structure determinants: a review and future directions. International Journal of Managerial Finance.

Labrai, Ai., 1980. Publici Enterprise ini ani Underdevelopedi and Dependent Economy.

Public and Private Enterprise in ai Mixed Economy. Springer.

Le, T. P. V. & Tannous, Ki., 2016. Ownership structure andd capital structure: Ai study off Vietnamese listedi firms. Australian Economic Papers, 55, 319-344.

Leary, Mi. Ti. & Roberts, Mi. Ri., 2005. Do firms rebalance their capital structures?

The journal of finance, 60, 2575-2619.

Leary, M. T. & Roberts, M. R., 2014. Do peer firms affect corporate financial policy? The Journal of Finance, 69, 139-178.

Lee, H. & Moon, G., 2011. The long‐run equity performance of zero‐leverage firms. Managerial Finance.

Lee, H. et al., 2014. How do capital structure policiesi of emergiing markets differ fromi those off developedi economiesi? Survey evidence fromi Koreai.

Emerging Markets Finance and Trade, 50, 34-72.

Lemmon, M. L. et al., 2008. Backe to the beginning: persistence and the cross‐ section of corporate capitall structure. The journal of finance, 63, 1575-1608.

Levine, O. & Wu, Y., 2014. Asset volatility and financial policy: Evidencei froml corporate mergersi. Working Paper.

Malmendier, U. & Tate, G., 2015. Behavioral CEOs: The role of managerial overconfidence. Journal of Economic Perspectives, 29, 37-60.

Memon, Z. A. et al., 2018. The impact of cash flow volatility on firm leverage and debti maturity structure: evidence fromi China. China finance review international.

Merton, R. C., 1973. Theory of rational option pricing. The Bell Journal of economics and management science, 141-183.

Merton, R. C., 1974. On the pricing of corporate debt: The risk structure of interest rates. The Journal of finance, 29, 449-470.

Mileva, E., 2007. Using Arellano-Bond dynamic panel GMM estimator in Stata.

Minton, B. A. & Schrand, C., 1999. The impact of cash flow volatility on discretionary investment and the costs of debt and equity financing. Journal of Financial Economics, 54, 423-460.

Mishkin, F. S., 2007. The economics of money, banking, and financial markets.

Pearson education

Modigliani, F. & Miller, M. H., 1958. The cost of capital, corporation finance and the theory of investment. The American economic review, 48, 261-297.

Myers, S. C., 1984. The capital structure puzzle. The journal of finance, 39, 574- 592.

Myers, S. C. & Majluf, N. S., 1984. Corporate financing and investment decisions when firms have informationthat investors do not have. National Bureau of Economic Research.

Nguyen, D. T. T. et al., 2014. Determinants of thei capital structure of listed Vietnamese companies. Journal of Southeast Asian Economies, 412-431.

Nguyen, T. D. K. & Ramachandrani, N., 2006. Capital structure ini small andi medium-sizedi enterprises: the case of Vietnami. ASEAN Economic bulletinl, 23, 192-211.

Nguyen, T. T. M., Evans, E., & Lu, M. (2017). Independent directors, ownership concentration and firm performance in listed companies: Evidence from Vietnam. Pacific Accounting Review.

O'Connor Keefe, M. & Tate, J., 2013. Is the relationship between investment and conditional cash flow volatility ambiguous, asymmetric or both? Accounting & Finance, 53, 913-947.

Okuda, H. & Nhung, L. T. P., 2012. Capital Structure and Investment Behavior of Listed Companies in Vietnam: An Estimation of the Influence of Government Ownership. International Journal of Business & Information, 7.

Pandey, I. M., 2001. Capital structure and the firm characterstics: evidence from an emerging market.

Petersen, M. A., 2009. Estimating standard errors in finance panel data sets: Comparing approaches. The Review of financial studies, 22, 435-480.

Pinkowitz, L. & Williamson, R., 2007. Whatl isi the marketi value of a dollar of corporate cashi? Journal of Applied Corporate Finance, 19, 74-81.

Rajani, R. G. & Zingales, L., 1995. What do we know about capital structure? Some evidence from international datai. The journal of Finance, 50, 1421-1460.

Roodmanl, D., 2006. How to Do xtabond2. North American Stata Users' Group Meetings 2006. Stata Users Group.

Roodman, D., 2009. How to do Xtabond2: An Introduction to Difference and System GMM in Stata. The Stata Journal, 9, 86-136.

Ross, S. et al., 2012. Corporate finance. McGraw-Hill Higher Education.

Ross, S. A., 1973. The economic theory of agency: The principal's problem. The American economic review, 63, 134-139.

Sacristani, E., 1980. Some considerations on the role of public enterprise. Baumol, William ed.

Salancik, G. R. & Pfeffer, J., 1978. A social information processing approach to job attitudes and task design. Administrative science quarterly, 224-253.

Santosuosso, P., 2015. How cash flow volatility affects debt financingi and accounts payable. International Journal of Economics andi Finance, 7, 138-145.

Sargan, J. D., 1958. The estimation of economic relationships using instrumental variables. Econometrica: Journal of the Econometric Society, 393-415.

Shailer, G. & Wang, K., 2015. Government ownershipi andii the cost ofi debt for Chinese listedi corporationsi. Emerging Markets Review, 22, 1-17.

Spence, M. & Zeckhauser, R., 1978. Insurance, information, and individual action.

Uncertainty in Economics. Elsevier.

Statman, M. & Tyebjee, T. T., 1985. Optimistic capital budgeting forecasts: An experiment. Financial Management, 27-33.

Stohsi, M. H. & Maueri, D. C., 1996. The determinantsi of corporate debt maturity structure. Journal of business, 279-312.

Stolll, H. R., 1969. Thei relationship betweeni puti andi call optioni prices. The Journal of Finance, 24, 801-824.

Strebulaev, I. A. & Yangi, B., 2013. Thei mysteryi of zero-leveragei firms. Journal of Financial Economics, 109, 1-23.

Tabachnick, B. G. et al., 2007. Using multivariate statistics. Pearson Boston, MA. Takiah, I. M. et al., 2012. The Moderating Effect of Ownership Structure on The

Relationship Between Free Cash Flow and Asset Utilization. Asian Academy of Management. Journal of Accounting and Finance, 8, 69-89.

Titman, S. & Wessels, R., 1988. The determinants of capital structure choice. The Journal of finance, 43, 1-19.

Thach, N. N. & Oanh, T. T. K., 2018. Effect of Macroeconomic Factors on Capital Structure of the Firms in Vietnam: Panel Vector Auto-regression Approach

(PVAR). International Conference of the Thailand Econometrics Society. Springer, 502-516.

Tranl, D. T. T., 2015. Determinants ofl capital structure: ani empirical study of Vietnamese listed firms.

Vo, X. V., 2017. Determinants off capital structure inn emerging markets: Evidence fromm Vietnam. Research in International Business and Finance, 40, 105- 113.

Wang, K. T. & Shailer, G., 2011. Government control andd performance criteriaa for Chinese listedd corporations. 24th Australasian Finance and Banking Conference.

Wang, Q. et al., 2008. Statel ownership, the institutional environmentt, and aiuditor choice: Evidence fromi China. Journal of accounting and economics, 46, 112-134.

Welch, I., 2011. Two common problems in capital structure research: The financial‐debt‐to‐asseti ratio and issuing activiity versus leverage changeis. International Review of Finance, 11, 1-17.

Yoo, S., 2005. Essays on corporate ownership and governance in an emerging market. Temple University.

Zhang, M. X., 2014. Who Bears Firm-Level Risk? Implications for cash flow volatility. Un.

Zou, H. & Xiao, J. Z., 2006. The financing behaviour of listed Chinese firms. The British Accounting Review, 38, 239-258.

PHỤ LỤC

Hồi quy với mẫu tổng thể

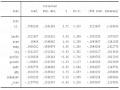

Kiểm tra tính vững với biến khủng hoảng

Coef. | Corrected Std. Err. | t | P>|t| | [95% Conf. | |

lata L1. | .723837 | .0608718 | 11.89 | 0.000 | |

lncfv | -.0161996 | .0054058 | -3.00 | ||

size | .0174753 | .0031349 | 5.5 | ||

tang | -.0249364 | .0146791 | |||

liq | -.0046604 | .003165 | |||

profit | -.0383436 | .08 | |||

growth | -.008614 | ||||

nsdt gdp | -.2404 . | ||||

induslev |

Có thể bạn quan tâm!

-

Tác Động Của Sở Hữu Nhà Nước Đến Mối Quan Hệ Giữa Bđdt Và Ctv

Tác Động Của Sở Hữu Nhà Nước Đến Mối Quan Hệ Giữa Bđdt Và Ctv -

Tác Động Của Bđdt Đến Việc Sử Dụng Nợ Dựa Trên Phân Vị Dòng Tiền

Tác Động Của Bđdt Đến Việc Sử Dụng Nợ Dựa Trên Phân Vị Dòng Tiền -

Một Số Gợi Ý Phát Triển Hướng Nghiên Cứu Trong Tương Lai

Một Số Gợi Ý Phát Triển Hướng Nghiên Cứu Trong Tương Lai -

Tác động của biến động dòng tiền đến cấu trúc vốn của các DNNY tại Việt Nam - 19

Tác động của biến động dòng tiền đến cấu trúc vốn của các DNNY tại Việt Nam - 19 -

Tác động của biến động dòng tiền đến cấu trúc vốn của các DNNY tại Việt Nam - 20

Tác động của biến động dòng tiền đến cấu trúc vốn của các DNNY tại Việt Nam - 20

Xem toàn bộ 167 trang tài liệu này.

cris

Coef. | Corrected Std. Err. | t | P>|t| | [95% Conf. | Interval] | |

fdc | ||||||

L1. | .7027448 | .06941 | 10.12 | 0.000 | .5664264 | .8390632 |

lncfv | -.0217918 | .011852 | -1.84 | 0.066 | -.0450687 | .0014851 |

size | .0230568 | .005239 | 4.40 | 0.000 | .0127677 | .033346 |

tang | .0630264 | .0192685 | 3.27 | 0.001 | .0251839 | .1008689 |

liq | -.0021391 | .0013674 | -1.56 | 0.118 | -.0048246 | .0005464 |

profit | -.2323171 | .186175 | -1.25 | 0.213 | -.5979572 | .1333231 |

growth | .0052845 | .0077517 | 0.68 | 0.496 | -.0099395 | .0205085 |

nsdt | -.1671591 | .2428468 | -0.69 | 0.492 | -.6441004 | .3097821 |

gdp | -.0011288 | .0050427 | -0.22 | 0.823 | -.0110323 | .0087748 |

induslev | .0101055 | .0424872 | 0.24 | 0.812 | -.0733376 | .0935486 |

crisis | -.0108988 | .0111913 | -0.97 | 0.331 | -.032878 | .0110804 |

_cons | -.5366904 | .1308096 | -4.10 | 0.000 | -.7935951 | -.2797857 |