DANH MỤC TÀI LIỆU THAM KHẢO

Danh mục tài liệu Tiếng Việt

1. Huỳnh Thế Nguyễn và Nguyễn Quyết, 2013. Mối quan hệ giữa tỷ giá hối đoái, lãi suất và giá cổ phiếu tại Thành phố Hồ Chí Minh. Tạp chí phát triển và hội nhập, số 11 (21), trang 37-41.

2. Nguyễn Thị Ngọc Trang, 2007. Quản trị rủi ro tài chính. Nhà xuất bản thống kê.

3. Nguyễn Thị Ngọc Trang và Nguyễn Hữu Tuấn, 2014. Minh bạch chính sách tiền tệ và truyền dẫn lãi suất bán lẻ ở Việt Nam. Tạp chí phát triển và hội nhập, số 15 (25).

4. Trần Ngọc Thơ và cộng sự, 2005. Tài chính doanh nghiệp hiện đại. Thành phố Hồ Chí Minh: Nhà xuất bản thống kê.

5. Trương Đông Lộc, 2014. Các nhân tố ảnh hưởng đến sự thay đổi giá của cổ phiếu: các bằng chứng từ Sở giao dịch chứng khoán Thành phố Hồ Chí Minh. Tạp chí khoa học trường Đại học Cần Thơ, số 33 (2014), trang 72 – 78.

Danh mục tài liệu tiếng Anh

1. Akaike, H., (1974). A new look at statistical model identification, IEEE Transactions on Automatic Control, AC-19:716-723.

2. Bach, B., Ando, A., 1957. The redistribution of effects of inflation. The Review of Economics and Statistics, 3:1–13.

3. Bollerslev, T., 1986. Generalized autoregressive conditional heteroskedasticity.

Journal of Econometrics, 31:307–327.

4. Booth, J., Officer, D.T., 1985. Expectations, interest rates, and commercial bank stocks. Journal of Financial Research, 8:51–58.

5. Chamberlain, S., Howe, J., Popper, H., 1997. The exchange rate exposure of US and Japanese banking institutions. Journal of Banking & Finance, 21:871–892.

6. Chance, D.M., Lane, W.R., 1980. A re-examination of interest rate sensitivity in the common stocks of financial institutions. Journal of Financial Research, 3:49– 55.

7. Choi, J.J., Elyasiani, E., Kopecky, K., 1992. The sensitivity of bank stock returns to market, interest, and exchange rate risks. Journal of Banking & Finance, 16:983–1004.

8. Christian C. P. Wolff, H.A. Benink, 2000. Survey Data and the Interest Rate Sensitivity of US Bank Stock Returns. Economic Notes, 29:201-213.

9. Dickey, D.A. and Fuller, W.A., 1981. Distribution of the estimators for autoregressive time series with a unit root. Econometrica, 49:1057- 1072.

10. Dinenis E. & S. K. Staikouras, 1998. Interest rate changes and common stock returns of financial institutions: evidence from the UK. The European Journal of Finance, 4:113-127

11. Elyasiani, E., Mansur, I., 1998. Sensitivity of bank stock returns distribution to changes in the level of volatility of interest rate: a GARCH-M model. Journal of Banking & Finance, 22:535–563.

12. Elyasiani, E., Mansur, I., 2003. International spillover of risk and return among major banking institutions: a bivariate GARCH model. Journal of Accounting, Auditing, and Finance, 23:303–330.

13. Engle, R.F., 1982. Autoregressive conditional heteroscedasticity with estimates of the variance of United Kingdom inflations. Econometrica, 50:987-1007.

14. Engle, R.F., Ng, V., Rothschild, M., 1990. Asset pricing with a factor-ARCH covariance structure: empirical estimates for treasury bills. Journal of Econometrics, 45:213–238.

15. Fama, Eugene F., and Kenneth R. Frech, 1992. “The cross – section of Expected Stock Returns”. Journal of Finance, 47:427 – 465.

16. Fama, Eugene F., and Kenneth R. Frech, 1993. “Common Risk Factors in the Returns on Stock and Bonds”. Journal of Financial Economics, 33:3-56

17. Flannery, M., James, C., 1984. The effect of interest rate changes on the common stock returns of financial institutions. The Journal of Finance, 39:1141–1153.

18. Flannery, M.J., Hameed, A.S., Harjes, R.H., 1997. Asset pricing, time-varying risk premia and interest rate risk. Journal of Banking & Finance, 21:315–335.

19. French, K., Ruback, R., Schwart, G., 1983. Effects of nominal contracting on stock returns. Journal of Political Economy, 70–96.

20. Gilkenson, J., Smith, S., 1992. The convexity trap: pitfalls in financing mortgage portfolios and related securities. Economic Review. Federal Reserve Bank of Atlanta, 4–27.

21. Grammatikos, T., Saunders, A., Swary, I., 1986. Returns and risks of US bank foreign currency activities. The Journal of Finance, 4: 671–683.

22. Hahm, J.H., 2004. Interest rate and exchange rate exposures of banking institutions in pre-crisis Korea. Applied Economics, 36:1409–1419.

23. Hooy, C.W., Tan, H.B., Md Nassir, A., 2004. Risk sensitivity of bank stocks in Malaysia: Empirical evidence across the Asian financial crisis. Asian Economic Journal, 18:261–276.

24. Kessel, R., 1956. Inflation-caused wealth redistribution: a test of a hypothesis. The American Economic Review, 3:128–141.

25. Lloyd, W.P., Shick, R.A., 1977. A test of stone's two-index model of returns.

Journal of Financial and Quantitative Analysis, 12:363–376.

26. Lynge, M.J., Zumwalt, J.K., 1980. An empirical study of the interest rate sensitivity of commercial bank returns: a multi-index approach. Journal of Financial and Quantitative Analysis, 15:731–742.

27. Mansur, I., Elyasiani, E., 1995. Sensitivity of bank equity returns to the level and volatility of interest rates. Managerial Finance, 21:58–77.

28. Merton, R.C., 1973. An intertemporal capital asset pricing model. Econometrica, 41:867–887.

29. Ross, S., 1976. The Arbitrage theory of capital asset pricing. Journal of Economic Theory, 13:314-360.

30. Ryan, Suzame K., Worthington, Andrew C., 2004. Market, interest rate and foreign exchange rate risk in Australian banking: A GARCH-M approach. International Journal of Appiled Business and Economic Research, 2:81-103.

31. Saadet Kasman, Vardar, G., and Tunc, G., 2011. The impact of interest rate and exchange rate volatility on banks’ stock returns and volatility: Evidence from Turkey. Economic Modeling, 28:1328-1334.

32. Saunders, A., Yourougou, P., 1990. Are banks special? The separation of banking from commerce and interest rate risk. Journal of Economics and Business, 42:171– 182.

33. Scott, W.L., Peterson, R.L., 1986. Interest rate risk and equity values of hedged and unhedged financial intermediaries. Journal of Financial Research, 9:325–329.

34. Song, F., 1994. A two factor ARCH model for deposit-institution stock returns.

Journal of Money Credit and Banking, 26:323–340.

35. Stone, B., 1974. Systematic interest rate risk in a two index model of returns.

Journal of Financial and Quantitative Analysis, 9:709–721.

36. Sweeney, R., Warga, A., 1986. The pricing of interest rate risk: evidence from the stock market. The Journal of Finance, 41:393–410.

37. Wetmore, J.L., Brick, J.R., 1994. Commercial bank risk: market interest rate, foreign exchange. Journal of Financial Research, 17:585–596.

38. Yourougou, P., 1990. Interest rate and the pricing of depository financial intermediary common stock: empirical evidence. Journal of Banking & Finance, 14:803–820.

PHỤ LỤC: KẾT QUẢ CHẠY MÔ HÌNH HỒI QUY

KẾT QUẢ CHẠY THỐNG KÊ MÔ TẢ VÀ KIỂM ĐỊNH ADF

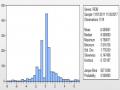

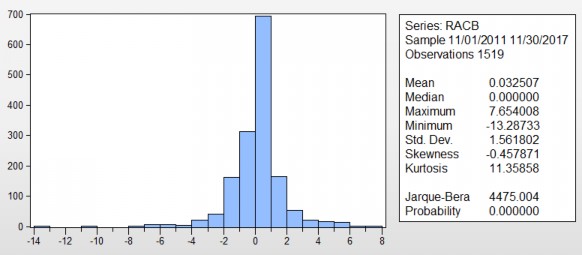

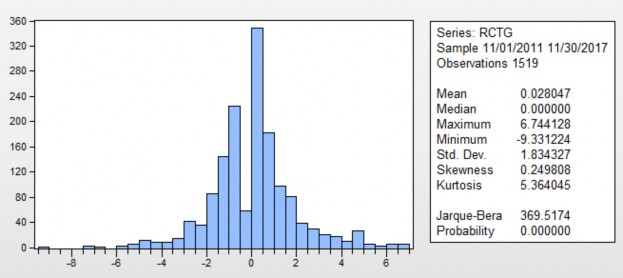

ACB

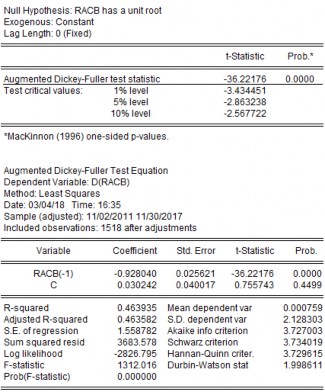

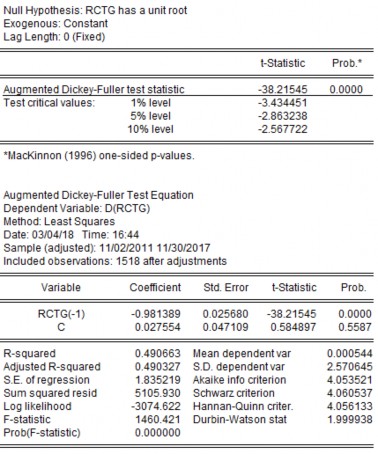

CTG

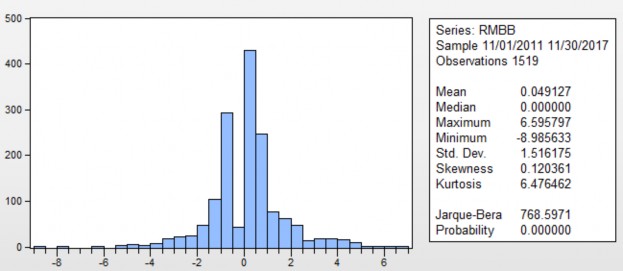

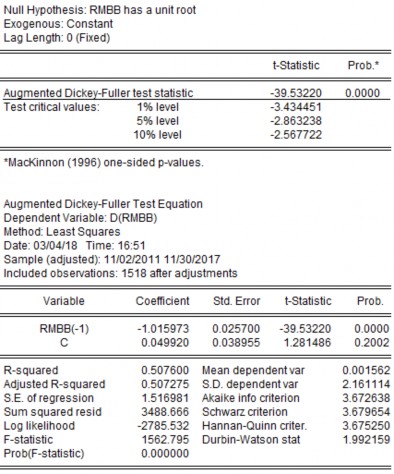

MBB

70 0

60 0

? 0 0

40 0

300

Mean | -0.003991 |

Median | 0.000000 |

Maximum | 9.531018 |

Minimum | -10.53605 |

Std. Dev. | 3.408486 |

Skewness | 0.057135 |

Kurtosis | 4.380374 |

Jarque-Bera | 121.4245 |

Probability | 0.000000 |

Có thể bạn quan tâm!

-

Thống Kê Mô Tả Và Kết Quả Kiểm Định Tính Dừng

Thống Kê Mô Tả Và Kết Quả Kiểm Định Tính Dừng -

Kết Quả Hồi Quy Tỷ Suất Sinh Lợi Theo Mô Hình Garch (1,1)

Kết Quả Hồi Quy Tỷ Suất Sinh Lợi Theo Mô Hình Garch (1,1) -

Kết Quả Ước Lượng Biến Động Tỷ Suất Sinh Lợi Theo Mô Hình Garch (1,1)

Kết Quả Ước Lượng Biến Động Tỷ Suất Sinh Lợi Theo Mô Hình Garch (1,1) -

Ảnh hưởng của biến động lãi suất và tỷ giá đến tỷ suất sinh lợi và biến động tỷ suất sinh lợi cổ phiếu tại ngân hàng thương mại Việt Nam - 10

Ảnh hưởng của biến động lãi suất và tỷ giá đến tỷ suất sinh lợi và biến động tỷ suất sinh lợi cổ phiếu tại ngân hàng thương mại Việt Nam - 10 -

Ảnh hưởng của biến động lãi suất và tỷ giá đến tỷ suất sinh lợi và biến động tỷ suất sinh lợi cổ phiếu tại ngân hàng thương mại Việt Nam - 11

Ảnh hưởng của biến động lãi suất và tỷ giá đến tỷ suất sinh lợi và biến động tỷ suất sinh lợi cổ phiếu tại ngân hàng thương mại Việt Nam - 11 -

Ảnh hưởng của biến động lãi suất và tỷ giá đến tỷ suất sinh lợi và biến động tỷ suất sinh lợi cổ phiếu tại ngân hàng thương mại Việt Nam - 12

Ảnh hưởng của biến động lãi suất và tỷ giá đến tỷ suất sinh lợi và biến động tỷ suất sinh lợi cổ phiếu tại ngân hàng thương mại Việt Nam - 12

Xem toàn bộ 96 trang tài liệu này.

t-Statistic | Prob ' | |

.éuomented DickeY-Fuller test statistic | -49.23271 | 0.0001 |

Test critical values: 1% level | -3.434451 | |

5% level | -2863238 | |

10 % level | -2.567722 |

-

-

-

-

Series. RNVB

Sample 11.!01.!2011 11.!30.!2017

Observations 1519

*klacKinn on (1996) one-s ided p-values.

.Augmented Dickey-Fuller Te st Equation Dependent Variab Ie: D(RNVB)

I lethod: Le ast Squares Date: 03/04/18 Time: 16:5 6

Sample (adjuste d): 11/02/2011 11/30/2017 Included observations: 1518 after adjustments

Coefficient | Std. Error t-Statistic | P rob. | |

RNVB(-1) | -1.230845 | 0.025001 -49.23271 | 0.0000 |

c | -0.005497 | 0.085179 -0.064533 | 0.9486 |

R-squared | 0.615215 | flean dependent var | 0.002518 |

.Pdjusted R-squared | 0.614961 | S.D. dependent var | 5.348281 |

S.E. of regression | 3.318690 | .4kaike info criterion | 5.238334 |

Sum squared resid | 16696.77 | Schwarz criterion | 5.245350 |

Log likelihood | -3973.895 | Hannan-Quinn criter. | 5.240946 |

F-statistic | 2423.860 | Durb in-'.Watson stat | 2.02 9732 |

Prob(F-statistic) | 0.000000 |