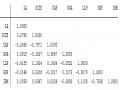

Tên ngân hàng | Tổng tài sàn | Vốn huy động | Vốn cho vay | Vốn tự có | |

2014 | HDBank | 99,524 | 90,325 | 41,508 | 9,198 |

2015 | HDBank | 106,485 | 96,644 | 55,853 | 9,841 |

2010 | KienLongBank | 12,627 | 9,402 | 6,946 | 3,224 |

2011 | KienLongBank | 17,849 | 14,393 | 8,309 | 3,456 |

2012 | KienLongBank | 18,580 | 15,136 | 9,541 | 3,444 |

2013 | KienLongBank | 21,372 | 17,896 | 12,003 | 3,475 |

2014 | KienLongBank | 23,103 | 19,739 | 13,389 | 3,364 |

2015 | KienLongBank | 25,322 | 21,948 | 16,080 | 3,373 |

2010 | LienVietBank | 34,984 | 30,878 | 9,755 | 4,106 |

2011 | LienVietBank | 56,132 | 49,538 | 12,639 | 6,594 |

2012 | LienVietBank | 66,412 | 59,021 | 22,588 | 7,391 |

2013 | LienVietBank | 79,594 | 72,322 | 28,954 | 7,271 |

2014 | LienVietBank | 100,801 | 93,410 | 40,815 | 7,391 |

2015 | LienVietBank | 107,587 | 99,986 | 55,470 | 7,600 |

2010 | MBBank | 109,623 | 99,882 | 48,058 | 9,741 |

2011 | MBBank | 138,831 | 128,533 | 57,952 | 10,297 |

2012 | MBBank | 175,609 | 162,080 | 73,165 | 13,529 |

2013 | MBBank | 180,381 | 164,673 | 85,972 | 15,707 |

2014 | MBBank | 200,489 | 183,340 | 98,106 | 17,148 |

2015 | MBBank | 221,041 | 197,858 | 119,372 | 23,183 |

2010 | MaritimeBank | 115,336 | 109,008 | 31,521 | 6,327 |

2011 | MaritimeBank | 114,374 | 104,875 | 37,388 | 9,499 |

2012 | MaritimeBank | 109,923, | 100,833 | 28,193 | 9,090 |

2013 | MaritimeBank | 107,114 | 97,702 | 26,676 | 9,412 |

2014 | MaritimeBank | 104,368 | 94,923 | 22,966 | 9,445 |

2015 | MaritimeBank | 104,311 | 90,695 | 27,490 | 13,616 |

2010 | NamABank | 14,508 | 12,333 | 5,247 | 2,174 |

2011 | NamABank | 18,890 | 15,737 | 6,891 | 3,152 |

2012 | NamABank | 16,008 | 12,731 | 6,778 | 3,276 |

2013 | NamABank | 28,781 | 25,523 | 11,493 | 3,258 |

2014 | NamABank | 37,293 | 33,961 | 16,474 | 3,331 |

2015 | NamABank | 35,469 | 32,055 | 20,671 | 3,414 |

2010 | NVB | 20,016 | 17,994 | 10,638 | 2,022 |

2011 | NVB | 22,496 | 19,280 | 12,755 | 3,216 |

2012 | NVB | 21,585 | 18,400 | 12,667 | 3,184 |

2013 | NVB | 29,074 | 25,870 | 13,266 | 3,203 |

2014 | NVB | 36,837 | 33,625 | 16,445 | 3,211 |

Có thể bạn quan tâm!

-

Tỷ Suất Roa Trung Bình Qua Các Năm

Tỷ Suất Roa Trung Bình Qua Các Năm -

Kiến Nghị Đối Với Yếu Tố “Rủi Ro Tín Dụng Ngân Hàng”

Kiến Nghị Đối Với Yếu Tố “Rủi Ro Tín Dụng Ngân Hàng” -

Hạn Chế Của Đề Tài Và Hướng Nghiên Cứu Tiếp Theo

Hạn Chế Của Đề Tài Và Hướng Nghiên Cứu Tiếp Theo -

Các yếu tố tác động đến tỷ lệ thanh khoản tại các ngân hàng thương mại tại Việt Nam - 13

Các yếu tố tác động đến tỷ lệ thanh khoản tại các ngân hàng thương mại tại Việt Nam - 13

Xem toàn bộ 104 trang tài liệu này.

Tên ngân hàng | Tổng tài sàn | Vốn huy động | Vốn cho vay | Vốn tự có | |

2015 | NVB | 48,230 | 45,012 | 20,222 | 3,217 |

2010 | OCB | 19,689 | 16,549 | 11,479 | 3,139 |

2011 | OCB | 25,429 | 21,677 | 13,671 | 3,751 |

2012 | OCB | 27,424 | 23,604 | 16,927 | 3,819 |

2013 | OCB | 32,795 | 28,830 | 19,973 | 3,964 |

2014 | OCB | 39,094 | 35,077 | 21,159 | 4,017 |

2015 | OCB | 49,447 | 45,221 | 27,452 | 4,225 |

2010 | PGBank | 16,378 | 14,204 | 10,781 | 2,173 |

2011 | PGBank | 17,582 | 14,991 | 11,928 | 2,590 |

2012 | PGBank | 19,250 | 16,056 | 13,469 | 3,194 |

2013 | PGBank | 24,875 | 21,666 | 13,679 | 3,209 |

2014 | PGBank | 25,779 | 22,439 | 14,334 | 3,339 |

2015 | PGBank | 24,681 | 21,308 | 15,704 | 3,372 |

2010 | SeABank | 55,241 | 49,498 | 21,403 | 5,743 |

2011 | SeABank | 101,092 | 95,555 | 19,312 | 5,536 |

2012 | SeABank | 75,066 | 69,484 | 16,230 | 5,582 |

2013 | SeABank | 79,864 | 74,138 | 20,422 | 5,726 |

2014 | SeABank | 80,183 | 74,501 | 31,568 | 5,682 |

2015 | SeABank | 84,756 | 78,987 | 42,439 | 5,768 |

2010 | SGB | 16,812 | 13,286 | 10,309 | 3,525 |

2011 | SGB | 15,365 | 12,060 | 10,945 | 3,304 |

2012 | SGB | 14,852 | 11,313 | 10,751 | 3,539 |

2013 | SGB | 14,684 | 11,184 | 10,568 | 3,500 |

2014 | SGB | 15,823 | 12,337 | 11,139 | 3,485 |

2015 | SGB | 17,748 | 14,357 | 11,520 | 3,390 |

2010 | SHB | 51,032 | 46,849 | 24,103 | 4,183 |

2011 | SHB | 70,989 | 65,158 | 28,806 | 5,830 |

2012 | SHB | 116,537 | 107,028 | 55,689 | 9,508 |

2013 | SHB | 143,625 | 133,267 | 75,322 | 10,358 |

2014 | SHB | 169,035 | 158,552 | 103,048 | 10,482 |

2015 | SHB | 204,704 | 193,446 | 130,005 | 11,257 |

2010 | Techcombank | 150,291 | 140,902 | 52,316 | 9,389 |

2011 | Techcombank | 180,531 | 168,015 | 62,562 | 12,515 |

2012 | Techcombank | 179,933 | 166,644 | 67,136 | 13,289 |

2013 | Techcombank | 158,896 | 144,976 | 69,088 | 13,920 |

2014 | Techcombank | 175,901 | 160,915 | 79,347 | 14,986 |

2015 | Techcombank | 191,993 | 175,536 | 110,461 | 16,457 |

Tên ngân hàng | Tổng tài sàn | Vốn huy động | Vốn cho vay | Vốn tự có | |

2010 | VCB | 307,621 | 286,764 | 171,241 | 20,856 |

2011 | VCB | 366,722 | 337,940 | 204,089 | 28,781 |

2012 | VCB | 414,488 | 372,789 | 235,889 | 41,698 |

2013 | VCB | 468,994 | 426,458 | 267,863 | 42,535 |

2014 | VCB | 576,995 | 533,523 | 316,253 | 43,471 |

2015 | VCB | 674,394 | 629,222 | 378,541 | 45,172 |

2010 | VIB | 93,826 | 87,233 | 41,257 | 6,593 |

2011 | VIB | 96,949 | 88,789 | 42,809 | 8,160 |

2012 | VIB | 65,023 | 56,587 | 33,313 | 8,435 |

2013 | VIB | 76,874 | 68,892 | 34,313 | 7,982 |

2014 | VIB | 80,660 | 72,160 | 37,289 | 8,500 |

2015 | VIB | 84,308 | 75,698 | 47,024 | 8,610 |

2010 | VietABank | 24,082 | 20,687 | 13,091 | 3,395 |

2011 | VietABank | 22,513 | 18,937 | 11,388 | 3,576 |

2012 | VietABank | 24,608 | 21,075 | 12,693 | 3,533 |

2013 | VietABank | 27,032 | 23,444 | 14,195 | 3,588 |

2014 | VietABank | 35,590 | 31,954 | 15,633 | 3,635 |

2015 | VietABank | 41,878 | 37,958 | 20,039 | 3,919 |

2010 | VPBank | 59,807 | 54,602 | 25,094 | 5,204 |

2011 | VPBank | 82,817 | 76,821 | 28,869 | 5,996 |

2012 | VPBank | 102,576 | 95,939 | 36,523 | 6,637 |

2013 | VPBank | 121,264 | 113,537 | 51,869 | 7,726 |

2014 | VPBank | 163,241 | 154,261 | 77,255 | 8,980 |

2015 | VPBank | 193,876 | 180,487 | 115,062 | 13,388 |

PHỤ LUC 03:

CÁC CHỈ TIÊU ĐÁNH GIÁ TÍNH THANH KHOẢN CỦA NGÂN HÀNG

Tên ngân hàng | CAR | H1 | H2 | |

2010 | ABBank | 12.24% | 13.94% | 12.24% |

2011 | ABBank | 11.37% | 12.83% | 11.37% |

2012 | ABBank | 10.65% | 11.92% | 10.65% |

2013 | ABBank | 9.97% | 11.07% | 9.97% |

2014 | ABBank | 8.47% | 9.26% | 8.47% |

2015 | ABBank | 8.99% | 9.88% | 8.99% |

2010 | ACB | 5.55% | 5.87% | 5.55% |

2011 | ACB | 4.26% | 4.44% | 4.26% |

2012 | ACB | 7.16% | 7.71% | 7.16% |

2013 | ACB | 7.51% | 8.11% | 7.51% |

2014 | ACB | 6.90% | 7.41% | 6.90% |

2015 | ACB | 6.35% | 6.78% | 6.35% |

2010 | BIDV | 6.65% | 7.13% | 6.65% |

2011 | BIDV | 6.06% | 6.45% | 6.06% |

2012 | BIDV | 5.51% | 5.83% | 5.51% |

2013 | BIDV | 5.89% | 6.26% | 5.89% |

2014 | BIDV | 5.17% | 5.45% | 5.17% |

2015 | BIDV | 4.98% | 5.24% | 4.98% |

2010 | Vietinbank | 5.00% | 5.26% | 5.00% |

2011 | Vietinbank | 6.23% | 6.64% | 6.23% |

2012 | Vietinbank | 6.72% | 7.20% | 6.72% |

2013 | Vietinbank | 9.42% | 10.40% | 9.42% |

2014 | Vietinbank | 8.36% | 9.12% | 8.36% |

2015 | Vietinbank | 7.20% | 7.76% | 7.20% |

2010 | Eximbank | 10.30% | 11.49% | 10.30% |

2011 | Eximbank | 8.88% | 9.75% | 8.88% |

2012 | Eximbank | 9.29% | 10.24% | 9.29% |

2013 | Eximbank | 8.64% | 9.46% | 8.64% |

2014 | Eximbank | 8.73% | 9.57% | 8.73% |

2015 | Eximbank | 10.53% | 11.77% | 10.53% |

Tên ngân hàng | CAR | H1 | H2 | |

2010 | HDBank | 6.86% | 7.36% | 6.86% |

2011 | HDBank | 7.88% | 8.55% | 7.88% |

2012 | HDBank | 10.22% | 11.38% | 10.22% |

2013 | HDBank | 9.97% | 11.08% | 9.97% |

2014 | HDBank | 9.24% | 10.18% | 9.24% |

2015 | HDBank | 9.24% | 10.18% | 9.24% |

2010 | KienLongBank | 25.54% | 34.30% | 25.54% |

2011 | KienLongBank | 19.36% | 24.01% | 19.36% |

2012 | KienLongBank | 18.54% | 22.76% | 18.54% |

2013 | KienLongBank | 16.26% | 19.42% | 16.26% |

2014 | KienLongBank | 14.56% | 17.04% | 14.56% |

2015 | KienLongBank | 13.32% | 15.37% | 13.32% |

2010 | LienVietBank | 11.74% | 13.30% | 11.74% |

2011 | LienVietBank | 11.75% | 13.31% | 11.75% |

2012 | LienVietBank | 11.13% | 12.52% | 11.13% |

2013 | LienVietBank | 9.14% | 10.05% | 9.14% |

2014 | LienVietBank | 7.33% | 7.91% | 7.33% |

2015 | LienVietBank | 7.06% | 7.60% | 7.06% |

2010 | MBBank | 8.89% | 9.75% | 8.89% |

2011 | MBBank | 7.42% | 8.01% | 7.42% |

2012 | MBBank | 7.70% | 8.35% | 7.70% |

2013 | MBBank | 8.71% | 9.54% | 8.71% |

2014 | MBBank | 8.55% | 9.35% | 8.55% |

2015 | MBBank | 10.49% | 11.72% | 10.49% |

2010 | MaritimeBank | 5.49% | 5.80% | 5.49% |

2011 | MaritimeBank | 8.31% | 9.06% | 8.31% |

2012 | MaritimeBank | 8.27% | 9.01% | 8.27% |

2013 | MaritimeBank | 8.79% | 9.63% | 8.79% |

2014 | MaritimeBank | 9.05% | 9.95% | 9.05% |

2015 | MaritimeBank | 13.05% | 15.01% | 13.05% |

2010 | NamABank | 14.99% | 17.63% | 14.99% |

2011 | NamABank | 16.69% | 20.03% | 16.69% |

2012 | NamABank | 20.47% | 25.74% | 20.47% |

Tên ngân hàng | CAR | H1 | H2 | |

2013 | NamABank | 11.32% | 12.77% | 11.32% |

2014 | NamABank | 8.93% | 9.81% | 8.93% |

2015 | NamABank | 9.63% | 10.65% | 9.63% |

2010 | NVB | 10.10% | 11.24% | 10.10% |

2011 | NVB | 14.30% | 16.68% | 14.30% |

2012 | NVB | 14.76% | 17.31% | 14.76% |

2013 | NVB | 11.02% | 12.38% | 11.02% |

2014 | NVB | 8.72% | 9.55% | 8.72% |

2015 | NVB | 6.67% | 7.15% | 6.67% |

2010 | OCB | 15.95% | 18.97% | 15.95% |

2011 | OCB | 14.75% | 17.31% | 14.75% |

2012 | OCB | 13.93% | 16.18% | 13.93% |

2013 | OCB | 12.09% | 13.75% | 12.09% |

2014 | OCB | 10.28% | 11.45% | 10.28% |

2015 | OCB | 8.55% | 9.34% | 8.55% |

2010 | PGBank | 13.27% | 15.30% | 13.27% |

2011 | PGBank | 14.74% | 17.28% | 14.74% |

2012 | PGBank | 16.59% | 19.89% | 16.59% |

2013 | PGBank | 12.90% | 14.81% | 12.90% |

2014 | PGBank | 12.95% | 14.88% | 12.95% |

2015 | PGBank | 13.66% | 15.83% | 13.66% |

2010 | SeABank | 10.40% | 11.60% | 10.40% |

2011 | SeABank | 5.48% | 5.79% | 5.48% |

2012 | SeABank | 7.44% | 8.03% | 7.44% |

2013 | SeABank | 7.17% | 7.72% | 7.17% |

2014 | SeABank | 7.09% | 7.63% | 7.09% |

2015 | SeABank | 6.81% | 7.30% | 6.81% |

2010 | SGB | 20.97% | 26.54% | 20.97% |

2011 | SGB | 21.51% | 27.40% | 21.51% |

2012 | SGB | 23.83% | 31.29% | 23.83% |

2013 | SGB | 23.84% | 31.30% | 23.84% |

2014 | SGB | 22.03% | 28.25% | 22.03% |

2015 | SGB | 19.11% | 23.62% | 19.11% |

Tên ngân hàng | CAR | H1 | H2 | |

2010 | SHB | 8.20% | 8.93% | 8.20% |

2011 | SHB | 8.21% | 8.95% | 8.21% |

2012 | SHB | 8.16% | 8.88% | 8.16% |

2013 | SHB | 7.21% | 7.77% | 7.21% |

2014 | SHB | 6.20% | 6.61% | 6.20% |

2015 | SHB | 5.50% | 5.82% | 5.50% |

2010 | Techcombank | 6.25% | 6.66% | 6.25% |

2011 | Techcombank | 6.93% | 7.45% | 6.93% |

2012 | Techcombank | 7.39% | 7.97% | 7.39% |

2013 | Techcombank | 8.76% | 9.60% | 8.76% |

2014 | Techcombank | 8.52% | 9.31% | 8.52% |

2015 | Techcombank | 8.57% | 9.38% | 8.57% |

2010 | VCB | 6.78% | 7.27% | 6.78% |

2011 | VCB | 7.85% | 8.52% | 7.85% |

2012 | VCB | 10.06% | 11.19% | 10.06% |

2013 | VCB | 9.07% | 9.97% | 9.07% |

2014 | VCB | 7.53% | 8.15% | 7.53% |

2015 | VCB | 6.70% | 7.18% | 6.70% |

2010 | VIB | 7.03% | 7.56% | 7.03% |

2011 | VIB | 8.42% | 9.19% | 8.42% |

2012 | VIB | 12.97% | 14.91% | 12.97% |

2013 | VIB | 10.38% | 11.59% | 10.38% |

2014 | VIB | 10.54% | 11.78% | 10.54% |

2015 | VIB | 10.21% | 11.38% | 10.21% |

2010 | VietABank | 14.10% | 16.41% | 14.10% |

2011 | VietABank | 15.88% | 18.88% | 15.88% |

2012 | VietABank | 14.36% | 16.76% | 14.36% |

2013 | VietABank | 13.27% | 15.31% | 13.27% |

2014 | VietABank | 10.22% | 11.38% | 10.22% |

2015 | VietABank | 9.36% | 10.33% | 9.36% |

2010 | VPBank | 8.70% | 9.53% | 8.70% |

2011 | VPBank | 7.24% | 7.81% | 7.24% |

2012 | VPBank | 6.47% | 6.92% | 6.47% |

Tên ngân hàng | CAR | H1 | H2 | |

2013 | VPBank | 6.37% | 6.81% | 6.37% |

2014 | VPBank | 5.50% | 5.82% | 5.50% |

2015 | VPBank | 6.91% | 7.42% | 6.91% |