56. Grant, R. M. (1987), ‘Multinationality and Performance among British Manufacturing Companies’, Journal of International Business Studies, Fall 1987, pp. 79-89.

57. Hasegawa, T. (1993), ‘Commercial Banking in the United States: Japanese Commercial Banks' Presence’, Journal of Asian Economics, 4(2).

58. Hejazi, W. a. (2005), Degree of internationalization and performance: An analysis of Canadian banks, Bank of Canada.

59. Hollensen, S. (2008), Essential of global marketing, Harlow: Prentice Hall, Pearson Education.

60. IMF (1993), Balance of Payment Mannual, 5th Edition.

61. Itter, M. a. (1994), ‘Shareholder benefits from corporate internatioal diversification: evidence from US international accquisitions’, Journal of International Business Studies, 25.

62. Johanson, J. and Wiedersheim-Paul, F. (1975) The Internationalization of the Firm-Four Swedish Cases. Journal of Management Studies.

63. Jones, G. (1993), ‘British multinational banking strategies over time’, In H. C.-

G. Cox, The growth of global business. Routledge: London.

64. Jones, G. R./Hill, C. W. L. (1988), ‘Transaction Cost Analysis of Strategy- Structure Choice’, Strategic Management Journal, 9, 2, pp. 159-172.

65. Katrishen, F. a. (1998), ‘Economies of scale in services: A study of multinational insurers’, Journal of International Business Studies, 305–324.

66. Kindleberger, C. P. (1969), American Business Abroad: Six Lectures on Direct Investment, New Haven and London.

67. Kobrin, S. J. (1991), ‘An empirical analysis of the determinants of global integration’, Strategic managment journal.

68. Khoury, S. a. (2000), ‘Foreign banks in the United States: Entry strategies and operations’, Thunderbird International Business Review.

69. Lensink, R. a. (2004), ‘The short-term effects of foreign bank entry on domestic bank behaviour: Does economic development matter?, Journal of Banking and Finance, 553-568.

70. Li, J. a. (1992), ‘The globalization of service multinationals in the Triad regions: Japan, Western Europe and North America’, Journal of International Business Studies, 23(4), 675-696.

71. Lu, J. W./Beamish, P. W. (2001), ‘The Internationalization and Performance of SMEs’, Strategic Management Journal, 22, pp. 565-586.

72. Lu, J. W./Beamish, P. W. (2004), ‘International Diversification and Firm Performance: The S-Curve Hypothesis’, Academy of Management Journal, 47, 4, pp. 598-609.

73. Magee, S. L. (1981), ‘The Appropriability Theory of the Multinational Corporation’, Annals of the American Academy of Political and Social Science, 458, Technology Transfer: New Issues, New Analysis, pp. 123-135.

74. Markides and Itter (1994), ‘Shareholder benefits from corporate internatioal diversification: evidence from US international accquisitions’, Journal of International Business Studies, 25 (2).

75. Mathur, I./Hanagan, K. (1983), ‘Are Multinational Corporations Superior Investment Vehicles for Achieving International Diversification?’, Journal of International Business Studies, 14, 3, pp. 135-146.

76. Meier, A. (1997): Das Konzept der transnationalen Organisation – Kritische Reflexion eines prominenten Konzeptes zur Führung international tätiger Unternehmen.

77. Merrett (2002), ‘The internationalization of Australian banks’, Journal of international financial Markets, Institutions & Money.

78. Mizruchi and Gerald (2003), The globalization of american banking, University of Michigan, Michigan.

79. Molyneux, P. a. (1996), Foreign banks, profits and commercial credit extension in the United States, Federal Reserve Bank of New York.

80. Morck, R./Yeung, B. (1991), ‘Why Investors Value Multinational’, The Journal of Business, 64, 2, pp. 165-187.

81. Mulder, A. &. (2008), The (Un)Profitability of Bank Internationalization.

82. Mutinelli and Piscitello (2001), ‘Foreign direct investment in the banking sector: the case of ialian banks in the ‘90s’, Journal of Banking and Finance, 10.

83. Nohria, N./Ghoshal, S. (1994): Differentiated Fit and Shared Values: Alternatives for Managing Headquarters-Subsidiary Relations, Strategic Management Journal.

84. Nguyễn Hải Đăng (2013), Đầu tư của các doanh nghiệp Việt Nam ra nước ngoài trong quá trình hội nhập kinh tế quốc tế, luận án tiến sĩ Trường Đại học kinh tế thuộc Đại học Quốc gia, Hà Nội.

85. Nguyễn Hữu Huy Nhựt (2010), Chiến lược đầu tư trực tiếp ra nước ngoài của Việt Nam trong tiến trình hội nhập kinh tế quốc tế, Luận án tiến sỹ, Trường đại học kinh tế Tp. Hồ Chí Minh.

86. Nguyễn Văn An (2009), ‘Đầu tư công nghiệp của doanh nghiệp Việt Nam vào Lào: thực trạng và những vấn đề đặt ra’, Tạp chí Nhà quản lý, (70) trang 39-41

87. Nguyễn Văn An (2012), Nghiên cứu phát triển đầu tư trực tiếp của các doanh nghiệp Việt Nam vào lĩnh vực công nghiệp ở CHDCND Lào, Luận án tiến sỹ, Trường Đại học Kinh tế Quốc dân

88. OECD (1996), Benchmark Definition of Foreign Direct Investment, 3rd Edition

89. Pecchioli (1983), The Internationalisation of Banking, OECD, Paris.

90. Pecchioli, R.M. (1983), ‘The Internationalisation of Banking’, The Policy Issues. Paris: OECD, Organisation for Economic Co-operation and Development.

91. Peek, J. R. (1999), ‘The poor performance of foreign bank subsidiaries: Were the problems acquired or created?’, Journal of Banking and Finance, 579-604.

92. Porter, M. (1986a), Competition in global industries: A conceptual framework,

M. E.

93. Porter, M. (1985), Competitive advantage, New York: The Free Press.

94. Porter, M. (1986), The Competitive Advantage of Nations, New York.

95. Porter, M. (1986b): Changing Patterns of International Competition,

California Management Review, 28, 2, pp. 9-40.

96. Rahman, I. a. (2011), What motivates Malaysian banks to go international? A case of Islamic banking products. Paper Presented at 8th International Conference on Islamic Economics and Finance,. Doha, Qata: Qatar National Convention Center.

97. Ramaswamy, K. a. (1996), ‘Measuring the degree of internationalization of a firm: a comment’, Journal of International Business Studies.

98. Ramaswamy, Kroeck and Renforth (1996), ‘Measuring the degree of internationalization of a firm: a comment’, Journal of International Business Studies, 26(1).

99. Robinson, S. (1972), Multinational banking (3rd ed.), Leiden: A.W. Sijthoff.

100. Rugman, A. (1976), ‘Risk reduction by international diversification’, Journal of International Business Studies, 75–80.

101. Rugman, A. M. (1975a), ‘Foreign Operations and the Stability of U.S. Corporate Earnings: Risk Reduction by International Diversification’, The Journal of Finance, 30, 1, pp. 233-234.

102. Rugman, A. M. (1975b), ‘Discussion: Corporate International Diversification and Market Assigned Measures of Risk and Diversification’, The Journal of Financial and Quantitative Analysis, 10, 4, pp. 651-652.

103. Rugman, A. M. (1980), ‘A New Theory of the Multinational Enterprise: Internationalization versus Internalization’, Columbia Journal of World Business, Spring 1980, pp. 23-29.

104. Rugman, A. M. (1983), ‘The Comparative Performance of U.S. and European Multinational Enterprises’, Management International Review, 23, pp. 4-14.

105. Rugman, A. M. (1986), ‘New Theories of the Multinational Enterprise: An Assessment of Internalization Theory’, Bulletin of Economic Research, 38, 2, pp. 101-118.

106. Rugman, A. M./ Hodgetts, R. (2001), ‘The End of Global Strategy’, European Management Journal, 19, 4, pp. 333-343.

107. Ruigrok, W./ Wagner, H. (2003a), ‘Internationalization and Firm Performance: Meta Analytic Review and Future Directions, Paper presented at the external seminar series at the Tjalling C’, Koopmans Institute, Utrecht School of Economics, December 2003

108. Ruigrok, W./ Wagner, H. (2003b), ‘Internationalization and Performance: An Organizational Learning Perspective’, Management International Review, 43, 1, pp. 63-83

109. Siddharthan, N. S./Lall, S. (1982), ‘The Recent Growth of the Largest US Multinationals’, Oxford Bulletin of Economics and Statistics, 44, 1, pp. 1-13.

110. Slager, A. (2006), Internationalization of Banks: Strategic Patterns and Performance, Vienna: The European money and finance forum.

111. Smith, R. a. (1997), Global Banking, New York: Oxford University Press.

112. Staehle, W. H. (1991): Redundanz, Slack, und lose Kopplung in Organisationen

– Eine Verschwendung von Ressourcen?, Managementforschung 1, Berlin – New York.

113. Stevens, J. L. (1990), ‘Tobin's q and the Structure-Performance Relationship: Comment’, The American Economic Review, 80, 3, pp. 618-623.

114. Sullivan, D. (1994a), ‘The “Threshold of Internationalization:” Replication, Extension, and Reinterpretation’, Management International Review, 34, 2, pp. 165-186.

115. Sullivan, D. (1994b), ‘Measuring the Degree of Internationalization of a Firm’,

Journal of International Business Studies, 25, 2, pp. 325-342.

116. Sullivan, David, (1994), ‘Measuring the degree of internationalization of a firm’, Journal of International Business Studies, 2.

117. Teece, D. J. (1981), ‘The Multinational Enterprise: Market Failure and Market Power Considerations’, Sloan Management Review, 22, 3, pp. 3-17.

118. Teece, D. J. (1986), ‘Transactions Cost Economics and the Multinational Enterprise’, Journal of Economic Behavior and Organization, 7, pp. 21-45.

119. Tschoegl, A. (2001), The international expansion of Singapore's largest banks,

The Wharton Financial Institutions Center, University of Pennsylvania.

120. Thịnh, Đ. T. (2006), Thúc đẩy doanh nghiệp Việt Nam Đầu Tư trực tiếp ra nước ngoài, Nhà xuất bản Tài chính.

121. Thomas, D. E./Eden, L. (2004), ‘What is the Shape of the Multinationality- Performance Relationship?’, The Multinational Business Review, 12, 1, pp. 89-110.

122. Tripe, D. (2003), ‘The international expansion of Australian banks. In M. O. Lonnborg’, Money and finance in transition’ Huddinge, Sweden.

123. Trivedi, A. (2012), ‘International and multinational banking’, In A. A. Trivedi,

International banking operation, Macmillan Publisher India.

124. UNCTAD (2012), World Investment Report 2012: Towards a new generation of investment policies.

125. Van Tulder, R. D. (2001), The World’s Largest Firms and Internationalization,

Rotterdam: Rotterdam School of Management/Erasmus University Rotterdam.

126. Van Tulder, Rob, Douglas van den Berghe, and Allan Muller, (2001), The World’s Largest Firms and Internationalization, Rotterdam School of Management/Erasmus University Rotterdam, Rotterdam.

127. Van Tulder, Rob, Douglas van den Berghe, and Allan Muller, (2001), The World’s Largest Firms and Internationalization, Rotterdam School of Management/Erasmus University Rotterdam, Rotterdam.

128. Van Wensveen, D. v. (2000), ‘Wat waardeert de belegger?’, Economisch Statistische Berichten, 900-903.

129. Vernon, R. (1966), ‘International Investment and International Trade in the Product Cycle’, The Quarterly Journal of Economics, 80, 2, pp. 190-207.

130. Vernon, R. (1979), ‘The Product Cycle Hypothesis in an New International Environment’, Oxford Bulletin of Economics and Statistics, 41, pp. 255-267.

PHỤ LỤC 1. DANH MỤC CÁC NGÂN HÀNG THƯƠNG MẠI VIỆT NAM CÓ HOẠT ĐỘNG ĐẦU TƯ TRỰC TIẾP RA NƯỚC NGOÀI

Tên ngân hàng | Viết tắt | |

1 | Ngân hàng nông nghiệp và phát triển nông thôn Việt Nam | Agribank |

2 | NHTMCP Đầu tư và Phát triển Việt Nam | BIDV |

3 | NHTMCP Quân đội Việt Nam | MBBank |

4 | NHTMCP Sài gòn Thương tín | Sacombank |

5 | NHTMCP Sài gòn Hà nội | SHB |

6 | NHTMCP Ngoại thương Việt Nam | VCB |

7 | NHTMCP Công thương Việt Nam | CTG |

Có thể bạn quan tâm!

-

Về Mối Quan Hệ Giữa Mức Độ Ofdi Và Kết Quả, Hiệu Quả Hoạt Động Kinh Doanh

Về Mối Quan Hệ Giữa Mức Độ Ofdi Và Kết Quả, Hiệu Quả Hoạt Động Kinh Doanh -

Về Vai Trò Của Các Yếu Tố Điều Tiết Trong Mối Quan Hệ Giữa Mức Độ

Về Vai Trò Của Các Yếu Tố Điều Tiết Trong Mối Quan Hệ Giữa Mức Độ -

Accenture (2001), ‘Globalization In Financial Services’, Accenture’S Financial Services Global Thought Leadership.

Accenture (2001), ‘Globalization In Financial Services’, Accenture’S Financial Services Global Thought Leadership. -

Tác động hoạt động đầu tư trực tiếp ra nước ngoài đến hiệu quả hoạt động tại các NHTM Việt Nam - 23

Tác động hoạt động đầu tư trực tiếp ra nước ngoài đến hiệu quả hoạt động tại các NHTM Việt Nam - 23 -

Tác động hoạt động đầu tư trực tiếp ra nước ngoài đến hiệu quả hoạt động tại các NHTM Việt Nam - 24

Tác động hoạt động đầu tư trực tiếp ra nước ngoài đến hiệu quả hoạt động tại các NHTM Việt Nam - 24

Xem toàn bộ 193 trang tài liệu này.

PHỤ LỤC 2. THỐNG KÊ MÔ TẢ ĐẦU RA – ĐẦU VÀO TRONG MÔ HÌNH TÍNH HIỆU QUẢ HOẠT ĐỘNG

Mean | Std. Dev. | Min | Max | ||

CPQL | overall | 2,193,437 | 1,613,853 | 41,102 | 7,167,277 |

between | 1,309,484 | 541,986 | 4,339,729 | ||

within | 1,063,089 | -676,754 | 6,330,721 | ||

VSCH | overall | 31,900,000 | 19,900,000 | 688,072 | 89,600,000 |

between | 15,200,000 | 10,400,000 | 47,800,000 | ||

within | 14,000,000 | -2,478,804 | 76,700,000 | ||

TSCD | overall | 4,799,214 | 3,144,847 | 121,410 | 11,400,000 |

between | 2,342,911 | 1,524,807 | 7,114,295 | ||

within | 2,273,840 | -790,258 | 9,136,908 | ||

TNSDP | overall | 3,743,645 | 2,715,938 | 121,976 | 15,200,000 |

between | 1,913,984 | 879,858 | 5,677,490 | ||

within | 2,055,854 | -1,342,348 | 13,300,000 | ||

DNTDR | overall | 348,000,000 | 289,000,000 | 5,859,178 | 1,140,000,000 |

between | 222,000,000 | 113,000,000 | 637,000,000 | ||

within | 203,000,000 | -43,700,000 | 935,000,000 | ||

NV | overall | 479,000,000 | 363,000,000 | 11,300,000 | 1,410,000,000 |

between | 275,000,000 | 162,000,000 | 809,000,000 | ||

within | 259,000,000 | -14,500,000 | 1,170,000,000 | ||

TSSLK | overall | 158,000,000 | 99,200,000 | 6,965,757 | 486,000,000 |

between | 73,900,000 | 58,000,000 | 246,000,000 | ||

within | 71,700,000 | -749,352 | 397,000,000 |

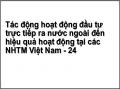

Biểu đồ diễn biến từng đầu vào của các NHTM có OFDI giai đoạn từ quý 2/2009 – quý 2/2020

Nguồn: tính toán của tác giả

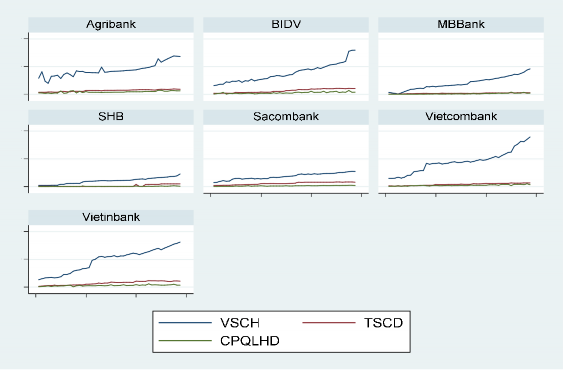

Biểu đồ diễn biến từng đầu ra của các NHTM có OFDI giai đoạn từ quý 2/2009 – quý 2/2020

Nguồn: tính toán của tác giả