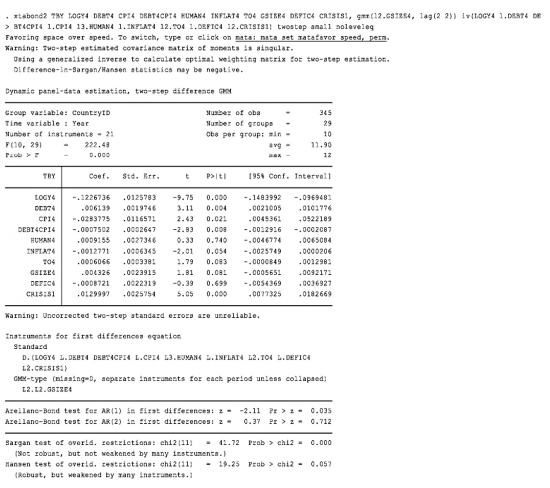

5b2. Kết quả phân tích tác động của nợ công, tham nhũng đến TTKT bằng DGMM

đối với nhóm thu nhập trung bình cao

. xtabond2 TBY LOGY4 DEBT4 CPI4 DEBT4CPI4 HUMAN4 INFLAT4 TO4 GSIZE4 DEFIC4 CRISIS1, gmm(l2.GSIZE4, lag(2 2)) iv(LOGY4 l.DEBT4 DE

> BT4CPI4 l.CPI4 l3.HUMAN4 l.INFLAT4 l2.TO4 l.DEFIC4 l2.CRISIS1) twostep small noleveleq Favoring space over speed. To switch, type or click on mata: mata set matafavor speed, perm. Warning: Two-step estimated covariance matrix of moments is singular.

Using a generalized inverse to calculate optimal weighting matrix for two-step estimation. Difference-in-Sargan/Hansen statistics may be negative.

Dynamic panel-data estimation, two-step difference GMM

Number of obs = | 345 | |

Time variable : Year | Number of groups = | 29 |

Number of instruments = 21 | Obs per group: min = | 10 |

F(10, 29) = 222.48 | avg = | 11.90 |

Prob > F = 0.000 | max = | 12 |

Có thể bạn quan tâm!

-

Nghiên cứu tác động của nợ công, tham nhũng đến tăng trưởng kinh tế tại các quốc gia trên thế giới - 30

Nghiên cứu tác động của nợ công, tham nhũng đến tăng trưởng kinh tế tại các quốc gia trên thế giới - 30 -

Kết Quả Phân Tích Tác Động Của Nợ Công, Tham Nhũng Đến Tăng Trưởng Kinh

Kết Quả Phân Tích Tác Động Của Nợ Công, Tham Nhũng Đến Tăng Trưởng Kinh -

Nghiên cứu tác động của nợ công, tham nhũng đến tăng trưởng kinh tế tại các quốc gia trên thế giới - 32

Nghiên cứu tác động của nợ công, tham nhũng đến tăng trưởng kinh tế tại các quốc gia trên thế giới - 32

Xem toàn bộ 264 trang tài liệu này.

Coef. | Std. Err. | t | P>|t| | [95% Conf. | Interval] | |

LOGY4 | -.1226736 | .0125783 | -9.75 | 0.000 | -.1483992 | -.0969481 |

DEBT4 | .006139 | .0019746 | 3.11 | 0.004 | .0021005 | .0101776 |

CPI4 | .0283775 | .0116571 | 2.43 | 0.021 | .0045361 | .0522189 |

DEBT4CPI4 | -.0007502 | .0002647 | -2.83 | 0.008 | -.0012916 | -.0002087 |

HUMAN4 | .0009155 | .0027346 | 0.33 | 0.740 | -.0046774 | .0065084 |

INFLAT4 | -.0012771 | .0006345 | -2.01 | 0.054 | -.0025749 | .0000206 |

TO4 | .0006066 | .0003381 | 1.79 | 0.083 | -.0000849 | .0012981 |

GSIZE4 | .004326 | .0023915 | 1.81 | 0.081 | -.0005651 | .0092171 |

DEFIC4 | -.0008721 | .0022319 | -0.39 | 0.699 | -.0054369 | .0036927 |

CRISIS1 | .0129997 | .0025754 | 5.05 | 0.000 | .0077325 | .0182669 |

Warning: Uncorrected two-step standard errors are unreliable.

Instruments for first differences equation Standard

D.(LOGY4 L.DEBT4 DEBT4CPI4 L.CPI4 L3.HUMAN4 L.INFLAT4 L2.TO4 L.DEFIC4 L2.CRISIS1)

GMM-type (missing=0, separate instruments for each period unless collapsed) L2.L2.GSIZE4

Arellano-Bond test for AR(1) in first differences: z = -2.11 Pr > z = 0.035 Arellano-Bond test for AR(2) in first differences: z = 0.37 Pr > z = 0.712

Sargan test of overid. restrictions: chi2(11) = 41.72 Prob > chi2 = 0.000 (Not robust, but not weakened by many instruments.)

Hansen test of overid. restrictions: chi2(11) = 19.25 Prob > chi2 = 0.057 (Robust, but weakened by many instruments.)

5b3. Kết quả phân tích tác động của nợ công, tham nhũng đến TTKT bằng DGMM

đối với nhóm thu nhập trung bình thấp

. xtabond2 TBY LOGY4 DEBT4 CPI4 DEBT4CPI4 HUMAN4 INFLAT4 TO4 GSIZE4 DEFIC4 CRISIS1, gmm(l2.HUMAN4, lag(2 2)) iv(LOGY4 l2.DEBT4 D

> EBT4CPI4 l3.CPI4 l3.GSIZE4 l.INFLAT4 l2.TO4 l.DEFIC4 l2.CRISIS1) twostep small noleveleq Favoring space over speed. To switch, type or click on m ata: mata set matafavor speed, perm. Warning: Two-step estimated covariance matrix of moments is singular.

Using a generalized inverse to calculate optimal weighting matrix for two-step estimation. Difference-in-Sargan/Hansen statistics may be negative.

Dynamic panel-data estimation, two-step difference GMM

Number of obs = | 229 | |

Time variable : Year | Number of groups = | 21 |

Number of instruments = 21 | Obs per group: min = | 2 |

F(10, 21) = 223.33 | avg = | 10.90 |

Prob > F = 0.000 | max = | 12 |

Coef. | Std. Err. | t | P>|t| | [95% Conf. | Interval] | |

LOGY4 | -.2680687 | .0359336 | -7.46 | 0.000 | -.3427966 | -.1933408 |

DEBT4 | .0079411 | .0036402 | 2.18 | 0.041 | .0003709 | .0155112 |

CPI4 | .0267942 | .0227872 | 1.18 | 0.253 | -.0205943 | .0741827 |

DEBT4CPI4 | -.0010093 | .0004974 | -2.03 | 0.055 | -.0020436 | .000025 |

HUMAN4 | .033353 | .0062904 | 5.30 | 0.000 | .0202714 | .0464347 |

INFLAT4 | .0007767 | .000435 | 1.79 | 0.089 | -.0001279 | .0016812 |

TO4 | -.0002549 | .0004772 | -0.53 | 0.599 | -.0012474 | .0007376 |

GSIZE4 | -.0023768 | .0017785 | -1.34 | 0.196 | -.0060754 | .0013217 |

DEFIC4 | -.0019093 | .0013321 | -1.43 | 0.167 | -.0046795 | .000861 |

CRISIS1 | .0049152 | .0037203 | 1.32 | 0.201 | -.0028216 | .0126521 |

Warning: Uncorrected two-step standard errors are unreliable.

Instruments for first differences equation Standard

D.(LOGY4 L2.DEBT4 DEBT4CPI4 L3.CPI4 L3.GSIZE4 L.INFLAT4 L2.TO4 L.DEFIC4 L2.CRISIS1)

GMM-type (missing=0, separate instruments for each period unless collapsed) L2.L2.HUMAN4

Arellano-Bond test for AR(1) in first differences: z = 2.24 Pr > z = 0.025 Arellano-Bond test for AR(2) in first differences: z = 1.76 Pr > z = 0.078

Sargan test of overid. restrictions: chi2(11) = 23.88 Prob > chi2 = 0.013 (Not robust, but not weakened by many instruments.)

Hansen test of overid. restrictions: chi2(11) = 14.93 Prob > chi2 = 0.186 (Robust, but weakened by many instruments.)

Difference-in-Hansen tests of exogeneity of instrument subsets:

iv(LOGY4 L2.DEBT4 DEBT4CPI4 L3.CPI4 L3.GSIZE4 L.INFLAT4 L2.TO4 L.DEFIC4 L2.CRISIS1)

Hansen test excluding group: chi2(2) = 1.49 Prob > chi2 = 0.474 Difference (null H = exogenous): chi2(9) = 13.43 Prob > chi2 = 0.144