(0.40472) | (0.33256) | (0.34215) | (0.29087) | (0.05178) | (0.17590) | |

[ 1.37754] | [-1.65514] | [ 0.37638] | [ 0.65742] | [ 15.2202] | [ 0.16276] | |

D(CPI(-1)) | -0.171390 | 0.169476 | 0.489859 | 0.462164 | -0.033267 | 0.851564 |

(0.19006) | (0.15618) | (0.16068) | (0.13660) | (0.02432) | (0.08261) | |

[-0.90175] | [ 1.08516] | [ 3.04870] | [ 3.38341] | [-1.36808] | [ 10.3088] | |

D(CPI(-2)) | 0.092818 | -0.055464 | 0.070870 | 0.028341 | -0.031036 | -0.222257 |

(0.23648) | (0.19432) | (0.19992) | (0.16996) | (0.03025) | (0.10278) | |

[ 0.39250] | [-0.28543] | [ 0.35450] | [ 0.16675] | [-1.02580] | [-2.16249] | |

D(CPI(-3)) | 0.116061 | 0.010183 | -0.172560 | 0.145237 | 0.035716 | 0.102879 |

(0.18344) | (0.15073) | (0.15508) | (0.13184) | (0.02347) | (0.07973) | |

[ 0.63270] | [ 0.06756] | [-1.11273] | [ 1.10165] | [ 1.52183] | [ 1.29041] | |

C | 0.007305 | -0.002878 | -0.002714 | -0.001680 | 0.001052 | -0.000114 |

(0.00231) | (0.00190) | (0.00195) | (0.00166) | (0.00030) | (0.00100) | |

[ 3.16352] | [-1.51674] | [-1.39024] | [-1.01249] | [ 3.56218] | [-0.11337] | |

R-squared | 0.665655 | 0.383243 | 0.375786 | 0.561835 | 0.986421 | 0.811420 |

Adj. R-squared | 0.618894 | 0.296984 | 0.288484 | 0.500553 | 0.984522 | 0.785045 |

Sum sq. resids | 0.007123 | 0.004809 | 0.005090 | 0.003679 | 0.000117 | 0.001345 |

S.E. equation | 0.007058 | 0.005799 | 0.005966 | 0.005072 | 0.000903 | 0.003067 |

F-statistic | 14.23512 | 4.442904 | 4.304411 | 9.168046 | 519.4130 | 30.76491 |

Log likelihood | 590.9308 | 623.1356 | 618.4754 | 645.1036 | 928.1470 | 727.5888 |

Akaike AIC | -6.950376 | -7.343117 | -7.286285 | -7.611019 | -11.06277 | -8.616936 |

Schwarz SC | -6.553442 | -6.946183 | -6.889351 | -7.214085 | -10.66583 | -8.220002 |

Mean dependent | 0.020043 | -0.000122 | -1.83E-05 | -8.84E-05 | 0.009018 | 0.006779 |

S.D. dependent | 0.011432 | 0.006916 | 0.007073 | 0.007177 | 0.007258 | 0.006616 |

Có thể bạn quan tâm!

-

Phân tích kênh tín dụng ngân hàng trong cơ chế truyền dẫn tiền tệ ở Việt Nam: Tiếp cận bằng mô hình VECM - 14

Phân tích kênh tín dụng ngân hàng trong cơ chế truyền dẫn tiền tệ ở Việt Nam: Tiếp cận bằng mô hình VECM - 14 -

Phân tích kênh tín dụng ngân hàng trong cơ chế truyền dẫn tiền tệ ở Việt Nam: Tiếp cận bằng mô hình VECM - 15

Phân tích kênh tín dụng ngân hàng trong cơ chế truyền dẫn tiền tệ ở Việt Nam: Tiếp cận bằng mô hình VECM - 15 -

Phân tích kênh tín dụng ngân hàng trong cơ chế truyền dẫn tiền tệ ở Việt Nam: Tiếp cận bằng mô hình VECM - 16

Phân tích kênh tín dụng ngân hàng trong cơ chế truyền dẫn tiền tệ ở Việt Nam: Tiếp cận bằng mô hình VECM - 16

Xem toàn bộ 138 trang tài liệu này.

Determinant resid covariance (dof

adj.) 7.95E-30

Determinant resid covariance 3.50E-30

Log likelihood 4160.624

Akaike information criterion -49.05639

Schwarz criterion -46.44797

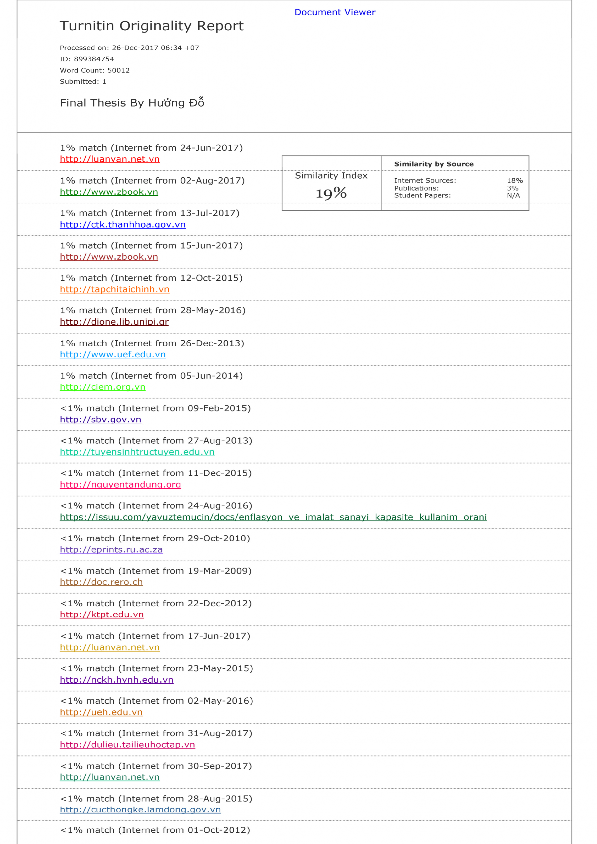

Vector Error Correction Estimates Sample (adjusted): 2001M05 2014M12

Included observations: 164 after adjustments Standard errors in ( ) & t-statistics in [ ]

Cointegration Restrictions: A(6,1)=0, A(6,2)=0

Convergence achieved after 10 iterations. Not all cointegrating vectors are identified LR test for binding restrictions (rank = 2):

6.005905 | ||

Probability | 0.049640 | |

Cointegrating Eq: | CointEq1 | CointEq2 |

CREDIT(-1) | -8.219948 | 21.24754 |

RR(-1) | 7.600480 | 67.22768 |

RC(-1) | -76.88855 | 6.902883 |

RL(-1) | 130.0561 | -35.83274 |

IPI_TC(-1) | 2.829759 | -25.18924 |

CPI(-1) | 20.30846 | -30.36689 |

C | 1.632628 | -51.41316 |

D(CREDIT) | D(RR) | D(RC) | D(RL) | D(IPI_TC) | D(CPI) | |

CointEq1 | -0.000209 | -0.000747 | -0.000600 | -0.002672 | -7.30E-05 | 0.000000 |

(0.00054) | (0.00045) | (0.00042) | (0.00038) | (7.0E-05) | (0.00000) | |

[-0.38397] | [-1.65586] | [-1.41684] | [-6.99810] | [-1.04183] | [NA] | |

CointEq2 | 0.001884 | -0.001695 | -4.68E-05 | 0.000169 | 0.000214 | 0.000000 |

(0.00054) | (0.00045) | (0.00042) | (0.00038) | (7.0E-05) | (0.00000) | |

[ 3.47693] | [-3.76690] | [-0.11073] | [ 0.44428] | [ 3.06604] | [NA] | |

D(CREDIT(-1)) | 0.413378 | -0.027101 | -0.049538 | -0.073649 | -0.001308 | 0.049078 |

(0.08880) | (0.07317) | (0.07522) | (0.06385) | (0.01133) | (0.03891) | |

[ 4.65530] | [-0.37040] | [-0.65856] | [-1.15341] | [-0.11539] | [ 1.26142] | |

D(CREDIT(-2)) | 0.151309 | 0.192670 | -0.030007 | -0.086709 | -0.016052 | 0.004706 |

(0.09501) | (0.07828) | (0.08048) | (0.06832) | (0.01213) | (0.04163) | |

[ 1.59264] | [ 2.46120] | [-0.37285] | [-1.26921] | [-1.32363] | [ 0.11304] | |

D(CREDIT(-3)) | -0.074541 | -0.006470 | 0.056622 | -0.020388 | -0.015176 | 0.050881 |

(0.09291) | (0.07656) | (0.07871) | (0.06681) | (0.01186) | (0.04071) | |

[-0.80229] | [-0.08451] | [ 0.71941] | [-0.30517] | [-1.27963] | [ 1.24987] | |

D(RR(-1)) | 0.084625 | 0.111928 | -0.107927 | -0.050249 | -0.004667 | -0.002334 |

(0.09635) | (0.07939) | (0.08162) | (0.06929) | (0.01230) | (0.04222) | |

[ 0.87829] | [ 1.40981] | [-1.32228] | [-0.72525] | [-0.37947] | [-0.05529] | |

D(RR(-2)) | 0.016694 | 0.059274 | -0.087665 | -0.073427 | 0.004337 | 0.038805 |

(0.09443) | (0.07781) | (0.07999) | (0.06790) | (0.01205) | (0.04137) | |

[ 0.17679] | [ 0.76180] | [-1.09590] | [-1.08134] | [ 0.35983] | [ 0.93788] | |

D(RR(-3)) | -0.084234 | 0.091016 | 0.088391 | 0.080764 | -0.013405 | 0.027817 |

(0.08829) | (0.07275) | (0.07479) | (0.06349) | (0.01127) | (0.03868) | |

[-0.95406] | [ 1.25109] | [ 1.18182] | [ 1.27210] | [-1.18947] | [ 0.71908] | |

D(RC(-1)) | -0.289667 | -0.040651 | -0.171613 | 0.234767 | 0.006521 | 0.136149 |

(0.10769) | (0.08873) | (0.09123) | (0.07744) | (0.01375) | (0.04718) | |

[-2.68985] | [-0.45812] | [-1.88120] | [ 3.03167] | [ 0.47439] | [ 2.88547] | |

D(RC(-2)) | -0.112893 | -0.152166 | -0.255363 | -0.151735 | -0.008105 | -0.121031 |

(0.11219) | (0.09244) | (0.09504) | (0.08068) | (0.01432) | (0.04916) | |

[-1.00624] | [-1.64603] | [-2.68689] | [-1.88078] | [-0.56597] | [-2.46212] | |

D(RC(-3)) | -0.056901 | -0.057487 | -0.110062 | -0.062115 | -0.019244 | 0.007610 |

(0.11436) | (0.09423) | (0.09688) | (0.08224) | (0.01460) | (0.05011) | |

[-0.49756] | [-0.61006] | [-1.13609] | [-0.75533] | [-1.31829] | [ 0.15186] | |

D(RL(-1)) | -0.156173 | 0.376935 | 0.132740 | 0.133530 | 0.002525 | -0.030727 |

(0.10573) | (0.08712) | (0.08957) | (0.07603) | (0.01350) | (0.04633) | |

[-1.47705] | [ 4.32652] | [ 1.48200] | [ 1.75624] | [ 0.18710] | [-0.66327] | |

D(RL(-2)) | 0.041719 | 0.300675 | 0.318076 | 0.254842 | 0.024196 | 0.165354 |

(0.11381) | (0.09377) | (0.09641) | (0.08184) | (0.01453) | (0.04986) | |

[ 0.36658] | [ 3.20639] | [ 3.29930] | [ 3.11404] | [ 1.66564] | [ 3.31608] | |

D(RL(-3)) | 0.018343 | 0.048618 | 0.313435 | 0.014643 | -0.010302 | -0.233983 |

(0.11704) | (0.09644) | (0.09915) | (0.08416) | (0.01494) | (0.05128) | |

[ 0.15672] | [ 0.50413] | [ 3.16128] | [ 0.17398] | [-0.68957] | [-4.56266] | |

D(IPI_TC(-1)) | 0.612308 | -0.314218 | -0.008938 | 0.176698 | 2.342016 | 0.001044 |

(0.41306) | (0.34035) | (0.34991) | (0.29702) | (0.05272) | (0.18098) | |

[ 1.48239] | [-0.92322] | [-0.02555] | [ 0.59489] | [ 44.4202] | [ 0.00577] | |

D(IPI_TC(-2)) | -0.864746 | 0.700296 | -0.050641 | -0.240091 | -2.156990 | -0.030640 |

(0.70515) | (0.58103) | (0.59734) | (0.50707) | (0.09001) | (0.30896) | |

[-1.22633] | [ 1.20527] | [-0.08478] | [-0.47349] | [-23.9644] | [-0.09917] |

0.508788 | -0.512884 | 0.107333 | 0.148151 | 0.781568 | 0.014580 | |

(0.40333) | (0.33234) | (0.34167) | (0.29003) | (0.05148) | (0.17672) | |

[ 1.26147] | [-1.54326] | [ 0.31414] | [ 0.51081] | [ 15.1811] | [ 0.08250] | |

D(CPI(-1)) | -0.159905 | 0.157475 | 0.498141 | 0.464230 | -0.031541 | 0.859155 |

(0.18930) | (0.15598) | (0.16036) | (0.13613) | (0.02416) | (0.08294) | |

[-0.84469] | [ 1.00956] | [ 3.10632] | [ 3.41027] | [-1.30532] | [ 10.3582] | |

D(CPI(-2)) | 0.094149 | -0.054567 | 0.076158 | 0.031553 | -0.030392 | -0.219533 |

(0.23593) | (0.19441) | (0.19986) | (0.16966) | (0.03012) | (0.10338) | |

[ 0.39905] | [-0.28069] | [ 0.38105] | [ 0.18598] | [-1.00918] | [-2.12365] | |

D(CPI(-3)) | 0.117296 | 0.013960 | -0.161412 | 0.159160 | 0.036704 | 0.107738 |

(0.18354) | (0.15123) | (0.15548) | (0.13198) | (0.02343) | (0.08042) | |

[ 0.63908] | [ 0.09231] | [-1.03816] | [ 1.20593] | [ 1.56669] | [ 1.33972] | |

C | 0.007563 | -0.002818 | -0.002737 | -0.001619 | 0.001108 | -0.000239 |

(0.00232) | (0.00191) | (0.00197) | (0.00167) | (0.00030) | (0.00102) | |

[ 3.25489] | [-1.47196] | [-1.39040] | [-0.96893] | [ 3.73505] | [-0.23458] | |

R-squared | 0.667339 | 0.382948 | 0.376388 | 0.563557 | 0.986552 | 0.809307 |

Adj. R-squared | 0.620812 | 0.296647 | 0.289170 | 0.502517 | 0.984671 | 0.782637 |

Sum sq. resids | 0.007087 | 0.004812 | 0.005086 | 0.003664 | 0.000115 | 0.001360 |

S.E. equation | 0.007040 | 0.005801 | 0.005963 | 0.005062 | 0.000899 | 0.003084 |

F-statistic | 14.34332 | 4.437349 | 4.315471 | 9.232455 | 524.5301 | 30.34487 |

Log likelihood | 591.3447 | 623.0963 | 618.5545 | 645.4266 | 928.9401 | 726.6753 |

Akaike AIC | -6.955423 | -7.342638 | -7.287250 | -7.614959 | -11.07244 | -8.605796 |

Schwarz SC | -6.558488 | -6.945704 | -6.890316 | -7.218025 | -10.67551 | -8.208862 |

Mean dependent | 0.020043 | -0.000122 | -1.83E-05 | -8.84E-05 | 0.009018 | 0.006779 |

S.D. dependent | 0.011432 | 0.006916 | 0.007073 | 0.007177 | 0.007258 | 0.006616 |

Determinant resid covariance (dof

adj.) 7.95E-30

Determinant resid covariance 3.50E-30

Log likelihood 4163.017

Akaike information criterion -49.08557

Schwarz criterion -46.47715

Chuẩn đoán mô hình

VEC Residual Serial Correlation LM Tests

Null Hypothesis: no serial correlation at lag order h

Sample: 2001M01 2014M12

Lags | LM-Stat | Prob |

1 | 41.54673 | 0.2418 |

2 | 38.63354 | 0.3515 |

3 | 31.71519 | 0.6726 |

4 | 48.49292 | 0.0798 |

Included observations: 164

Probs from chi-square with 36 df. VEC Residual Normality Tests

Orthogonalization: Cholesky (Lutkepohl)

Null Hypothesis: residuals are multivariate normal Sample: 2001M01 2014M12

Included observations: 164

Skewness | Chi-sq | df | Prob. | |

1 | -1.084095 | 32.12381 | 1 | 0.0000 |

2 | 4.243055 | 492.0961 | 1 | 0.0000 |

3 | 2.691416 | 197.9951 | 1 | 0.0000 |

4 | -0.207595 | 1.177949 | 1 | 0.2778 |

5 | 0.188443 | 0.970623 | 1 | 0.3245 |

6 | 0.270557 | 2.000830 | 1 | 0.1572 |

Joint | 726.3643 | 6 | 0.0000 | |

Component | Kurtosis | Chi-sq | df | Prob. |

1 | 16.63236 | 1269.915 | 1 | 0.0000 |

2 | 35.40807 | 7176.935 | 1 | 0.0000 |

3 | 22.02076 | 2472.226 | 1 | 0.0000 |

4 | 11.45700 | 488.7261 | 1 | 0.0000 |

5 | 3.303418 | 0.629094 | 1 | 0.4277 |

6 | 7.973361 | 169.0179 | 1 | 0.0000 |

Joint | 11577.45 | 6 | 0.0000 | |

Component | Jarque-Bera | df | Prob. | |

1 | 1302.038 | 2 | 0.0000 | |

2 | 7669.031 | 2 | 0.0000 | |

3 | 2670.221 | 2 | 0.0000 | |

4 | 489.9041 | 2 | 0.0000 | |

5 | 1.599717 | 2 | 0.4494 | |

6 | 171.0187 | 2 | 0.0000 | |

Joint | 12303.81 | 12 | 0.0000 |

VEC Residual Heteroskedasticity Tests: No Cross Terms (only levels and squares) Sample: 2001M01 2014M12

Included observations: 164

Chi-sq | df | Prob. | |||

1260.858 | 840 | 0.0000 | |||

Individual components: | |||||

Dependent | R-squared | F(40,123) | Prob. | Chi-sq(40) | Prob. |

res1*res1 | 0.306832 | 1.361153 | 0.1025 | 50.32043 | 0.1270 |

res2*res2 | 0.159608 | 0.584009 | 0.9738 | 26.17578 | 0.9549 |

res3*res3 | 0.452481 | 2.541244 | 0.0000 | 74.20689 | 0.0008 |

res4*res4 | 0.421124 | 2.237020 | 0.0004 | 69.06436 | 0.0029 |

res5*res5 | 0.238609 | 0.963661 | 0.5395 | 39.13188 | 0.5092 |

res6*res6 | 0.671778 | 6.293670 | 0.0000 | 110.1717 | 0.0000 |

res2*res1 | 0.615700 | 4.926551 | 0.0000 | 100.9747 | 0.0000 |

res3*res1 | 0.562589 | 3.954999 | 0.0000 | 92.26457 | 0.0000 |

res3*res2 | 0.433595 | 2.353981 | 0.0002 | 71.10965 | 0.0018 |

res4*res1 | 0.415297 | 2.184083 | 0.0006 | 68.10875 | 0.0037 |

res4*res2 | 0.236127 | 0.950538 | 0.5603 | 38.72483 | 0.5276 |

res4*res3 | 0.438060 | 2.397114 | 0.0001 | 71.84184 | 0.0015 |

0.344729 | 1.617712 | 0.0240 | 56.53549 | 0.0432 | |

res5*res2 | 0.299962 | 1.317618 | 0.1280 | 49.19375 | 0.1511 |

res5*res3 | 0.332471 | 1.531541 | 0.0400 | 54.52523 | 0.0626 |

res5*res4 | 0.353913 | 1.684419 | 0.0159 | 58.04169 | 0.0324 |

res6*res1 | 0.491103 | 2.967475 | 0.0000 | 80.54082 | 0.0002 |

res6*res2 | 0.408981 | 2.127881 | 0.0009 | 67.07293 | 0.0047 |

res6*res3 | 0.517509 | 3.298175 | 0.0000 | 84.87147 | 0.0000 |

res6*res4 | 0.433081 | 2.349056 | 0.0002 | 71.02530 | 0.0018 |

res6*res5 | 0.608431 | 4.778030 | 0.0000 | 99.78275 | 0.0000 |