Statistics:

Forecast values

Trials 10.000

Mean 20,52%

Median 20,56%

Mode ---

Standard Deviation 0,92%

Variance 0,01%

Skewness -0,2228

Kurtosis 3,06

Coeff. of Variability 0,0449

Minimum 16,66%

Maximum 23,58%

Range Width 6,92%

Mean Std. Error 0,01%

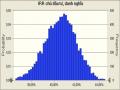

Forecast: IRR chủ đầu tư, danh nghĩa (cont'd)

Percentiles:

Forecast values

0% 16,66%

10% 19,31%

20% 19,76%

30% 20,07%

40% 20,33%

50% 20,56%

60% 20,79%

70% 21,03%

80% 21,30%

90% 21,67%

100% 23,58%

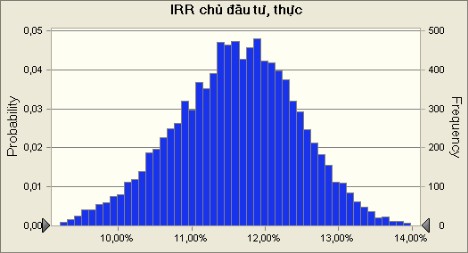

Forecast: IRR chủ đầu tư, thực

Summary:

Entire range is from 8,02% to 14,43% Base case is 11,63%

After 10.000 trials, the std. error of the mean is 0,01%

Statistics:

Forecast values

Trials 10.000

Mean 11,59%

Median 11,63%

Mode ---

Standard Deviation 0,85%

Variance 0,01%

Skewness -0,2228

Kurtosis 3,06

Coeff. of Variability 0,0736

Minimum 8,02%

Maximum 14,43%

Range Width 6,41%

Mean Std. Error 0,01%

Forecast: IRR chủ đầu tư, thực (cont'd)

Percentiles:

Forecast values

0% 8,02%

10% 10,47%

20% 10,88%

30% 11,18%

40% 11,42%

50% 11,63%

60% 11,85%

70% 12,06%

80% 12,31%

90% 12,66%

100% 14,43%

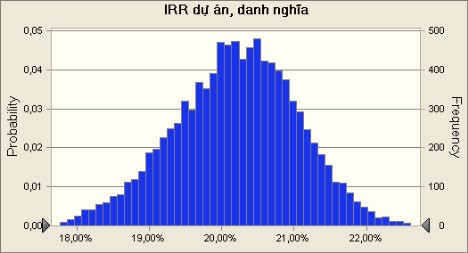

Forecast: IRR dự án, danh nghĩa

Summary:

Entire range is from 16,56% to 23,06% Base case is 20,23%

After 10.000 trials, the std. error of the mean is 0,01%

Statistics:

Forecast values

Trials 10.000

Mean 20,19%

Median 20,22%

Mode ---

Standard Deviation 0,87%

Variance 0,01%

Skewness -0,2227

Kurtosis 3,06

Coeff. of Variability 0,0429

Minimum 16,56%

Maximum 23,06%

Range Width 6,50%

Mean Std. Error 0,01%

Forecast: IRR dự án, danh nghĩa (cont'd)

Percentiles:

Forecast values

0% 16,56%

10% 19,05%

20% 19,47%

30% 19,77%

40% 20,01%

50% 20,22%

60% 20,44%

70% 20,66%

80% 20,92%

90% 21,27%

100% 23,06%

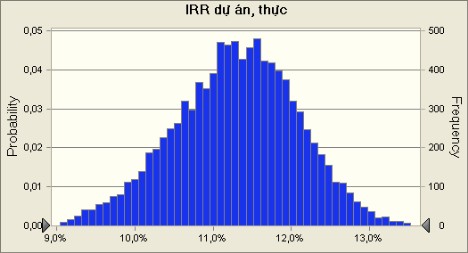

Forecast: IRR dự án, thực

Summary:

Entire range is from 7,9% to 13,9% Base case is 11,3%

After 10.000 trials, the std. error of the mean is 0,0%

Statistics:

Forecast values

Trials 10.000

Mean 11,3%

Median 11,3%

Mode ---

Standard Deviation 0,8%

Variance 0,0%

Skewness -0,2227

Kurtosis 3,06

Coeff. of Variability 0,0710

Minimum 7,9%

Maximum 13,9%

Range Width 6,0%

Mean Std. Error 0,0%

Forecast: IRR dự án, thực (cont'd)

Percentiles:

Forecast values

0% 7,9%

10% 10,2%

20% 10,6%

30% 10,9%

40% 11,1%

50% 11,3%

60% 11,5%

70% 11,7%

80% 12,0%

90% 12,3%

100% 13,9%

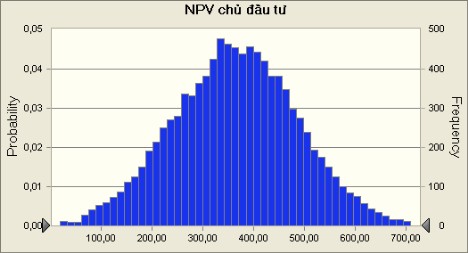

Forecast: NPV chủ đầu tư

Summary:

Entire range is from -83,87 to 822,65 Base case is 365,19

Forecast

After 10.000 trials, the std. error of the mean is 1,23

values | |

Trials | 10.000 |

Mean | 364,29 |

Median | 364,54 |

Mode | --- |

Standard Deviation | 123,29 |

Variance | 15201,58 |

Skewness | -0,0052 |

Kurtosis | 2,96 |

Coeff. of Variability | 0,3385 |

Minimum | -83,87 |

Maximum | 822,65 |

Range Width | 906,51 |

Mean Std. Error | 1,23 |

Có thể bạn quan tâm!

-

Thiết Kế, Quy Hoạch Chi Tiết Dự Án Bình Hòa

Thiết Kế, Quy Hoạch Chi Tiết Dự Án Bình Hòa -

Chi Phí Vận Hành, Quản Lý Và Bảo Trì (Tỷ Đồng)

Chi Phí Vận Hành, Quản Lý Và Bảo Trì (Tỷ Đồng) -

Thẩm định dự án khu chung cư - văn phòng cho thuê Bình Hòa - 11

Thẩm định dự án khu chung cư - văn phòng cho thuê Bình Hòa - 11

Xem toàn bộ 96 trang tài liệu này.

Forecast: NPV chủ đầu tư (cont'd)

Percentiles:

Forecast values

0% -83,87

10% 204,04

20% 259,73

30% 300,63

40% 334,57

50% 364,53

60% 396,69

70% 429,18

80% 467,42

90% 521,28

100% 822,65

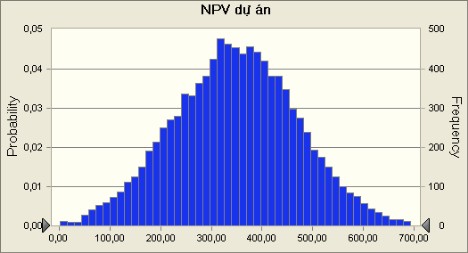

Forecast: NPV dự án

Summary:

Entire range is from -100,82 to 805,70 Base case is 348,24

After 10.000 trials, the std. error of the mean is 1,23

Forecast values | ||

Trials | 10.000 | |

Mean | 347,34 | |

Median | 347,58 | |

Mode | --- | |

Standard Deviation | 123,29 | |

Variance | 15201,58 | |

Skewness | -0,0052 | |

Kurtosis | 2,96 | |

Coeff. of Variability | 0,3550 | |

Minimum | -100,82 | |

Maximum | 805,70 | |

Range Width | 906,51 | |

Mean Std. Error | 1,23 | |

Forecast: NPV dự án (cont'd) | ||

Percentiles: | Forecast values | |

0% | -100,82 | |

10% | 187,09 | |

20% | 242,78 | |

30% | 283,68 | |

40% | 317,62 | |

50% | 347,58 | |

60% | 379,74 | |

70% | 412,23 | |

80% | 450,46 | |

90% | 504,33 | |

100% | 805,70 | |

End of Forecasts | ||

Assumptions | ||

Worksheet: [VBH.xls]PtTaichinhThuc_VoiLPhat | ||

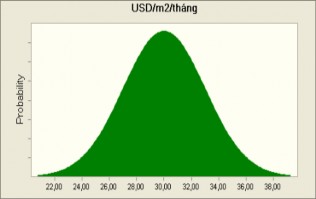

Assumption: USD/m2/tháng |

Bao cao Quy3/2009 cua CBRE

Normal distribution with parameters: Mean 30,00

Std. Dev. 3,00

End of Assumptions

85

Phụ lục 13. Ngân lưu kinh tế dự án (tỷ đồng)

2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | |

Ngân lưu vào | |||||||||||||||

Thu nhập tiềm năng | 0.0 | 90.3 | 231.5 | 556.1 | 377.0 | 240.0 | 83.3 | 95.9 | 100.3 | 105.0 | 109.8 | 114.9 | 120.2 | 125.9 | 131.9 |

Ngân lưu ra | |||||||||||||||

Tổng chi phí vận hành, quản lý, bảo trì | 0.0 | 0.0 | 0.0 | 0.0 | 52.0 | 14.6 | 8.5 | 7.4 | 7.5 | 7.5 | 7.6 | 7.7 | 7.9 | 8.0 | 8.1 |

Chi phí mua đất | 959.35 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

Ngân lưu hoạt động ròng | -959.35 | 81.1 | 499.7 | 479.3 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 |

Chi phí đầu tư | -965.0 | 9.3 | -268.2 | 76.8 | 325.1 | 225.4 | 74.8 | 88.6 | 92.8 | 97.4 | 102.2 | 107.1 | 112.4 | 117.9 | 123.8 |

Ngân lưu ròng dự án | -965.0 | 9.3 | -9.3 | 76.8 | 169.3 | 78.6 | 74.8 | 88.6 | 92.8 | 97.4 | 102.2 | 107.1 | 112.4 | 117.9 | 123.8 |

2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | 2032 | 2033 | 2034 | 2035 | 2036 | 2037 | 2038 | |

Ngân lưu vào | ||||||||||||||

Thu nhập tiềm năng | 138.1 | 144.6 | 151.5 | 158.7 | 166.4 | 174.4 | 182.7 | 191.6 | 200.8 | 210.6 | 220.8 | 231.5 | 242.8 | 254.6 |

Ngân lưu ra | ||||||||||||||

Tổng chi phí vận hành, quản lý, bảo trì | 8.2 | 8.3 | 8.5 | 8.6 | 8.8 | 8.9 | 9.1 | 9.3 | 9.5 | 9.7 | 9.9 | 10.1 | 10.3 | 10.6 |

Chi phí mua đất | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

Ngân lưu hoạt động ròng | 129.9 | 136.3 | 143.0 | 150.1 | 157.6 | 165.4 | 173.6 | 182.3 | 191.3 | 200.9 | 210.9 | 221.4 | 232.4 | 244.0 |

Chi phí đầu tư | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 |

Ngân lưu ròng dự án | 129.9 | 136.3 | 143.0 | 150.1 | 157.6 | 165.4 | 173.6 | 182.3 | 191.3 | 200.9 | 210.9 | 221.4 | 232.4 | 244.0 |