Navi

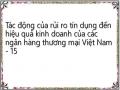

2008 | 0.017 | 0.005 | 0.597 | 0.562 | 0.076 | 14.688 | 0.044 | 0.016 | 5.66 | 23.12 | 2.40 | 16977 | 13.46 | |

KLB | 2009 | 0.012 | 0.006 | 0.464 | 0.851 | 0.045 | 15.828 | 0.085 | 0.019 | 5.40 | 7.05 | 2.60 | 17941 | 10.37 |

KLB | 2010 | 0.011 | 0.009 | 0.383 | 0.745 | -0.052 | 16.351 | 0.090 | 0.019 | 6.42 | 8.86 | 2.60 | 18932 | 11.5 |

KLB | 2011 | 0.028 | 0.011 | 0.387 | 0.806 | 0.041 | 16.697 | 0.118 | 0.026 | 6.24 | 18.68 | 2.00 | 20828 | 13 |

KLB | 2012 | 0.029 | 0.015 | 0.512 | 0.815 | 0.027 | 16.738 | 0.102 | 0.019 | 5.25 | 9.09 | 1.80 | 20828 | 11.5 |

KLB | 2013 | 0.025 | 0.010 | 0.553 | 0.837 | 0.027 | 16.878 | 0.091 | 0.016 | 5.42 | 6.59 | 2.00 | 21036 | 8.48 |

KLB | 2014 | 0.020 | 0.010 | 0.655 | 0.854 | 0.010 | 16.956 | 0.051 | 0.008 | 5.98 | 4.09 | 1.86 | 21246 | 7.62 |

KLB | 2015 | 0.011 | 0.008 | 0.673 | 0.867 | 0.031 | 17.047 | 0.049 | 0.007 | 6.68 | 0.63 | 2.31 | 22381 | 6.5 |

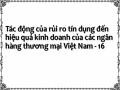

ABB | 2005 | 0.002 | 0.723 | 13.429 | 0.044 | 0.012 | 7.55 | 8.28 | 2.10 | 15916 | 8.4 | |||

ABB | 2006 | 0.013 | 0.219 | 0.618 | 0.373 | 14.951 | 0.084 | 0.031 | 6.98 | 7.39 | 2.30 | 16054 | 8.4 | |

ABB | 2007 | 0.015 | 0.008 | 0.347 | 0.856 | 0.231 | 16.659 | 0.088 | 0.016 | 7.13 | 8.30 | 2.30 | 16114 | 8.8 |

ABB | 2008 | 0.042 | 0.012 | 0.732 | 0.707 | 0.196 | 16.418 | 0.015 | 0.003 | 5.66 | 23.12 | 2.40 | 16977 | 13.46 |

ABB | 2009 | 0.015 | 0.011 | 0.418 | 0.831 | 0.179 | 17.093 | 0.074 | 0.016 | 5.40 | 7.05 | 2.60 | 17941 | 10.37 |

ABB | 2010 | 0.012 | 0.011 | 0.438 | 0.878 | 0.101 | 17.453 | 0.109 | 0.015 | 6.42 | 8.86 | 2.60 | 18932 | 11.5 |

ABB | 2011 | 0.028 | 0.016 | 0.471 | 0.886 | -0.019 | 17.542 | 0.066 | 0.008 | 6.24 | 18.68 | 2.00 | 20828 | 13 |

ABB | 2012 | 0.023 | 0.022 | 0.612 | 0.894 | 0.047 | 17.648 | 0.083 | 0.009 | 5.25 | 9.09 | 1.80 | 20828 | 11.5 |

ABB | 2013 | 0.067 | 0.028 | 0.669 | 0.900 | 0.212 | 17.870 | 0.026 | 0.003 | 5.42 | 6.59 | 2.00 | 21036 | 8.48 |

ABB | 2014 | 0.040 | 0.018 | 0.656 | 0.915 | 0.119 | 18.027 | 0.020 | 0.002 | 5.98 | 4.09 | 1.86 | 21246 | 7.62 |

ABB | 2015 | 0.024 | 0.012 | 0.604 | 0.910 | 0.165 | 17.980 | 0.016 | 0.001 | 6.68 | 0.63 | 2.31 | 22381 | 6.5 |

OCB | 2005 | 0.005 | 0.897 | 15.207 | 0.153 | 0.015 | 7.55 | 8.28 | 2.10 | 15916 | 8.4 | |||

OCB | 2006 | 0.005 | 0.219 | 0.871 | 0.259 | 15.678 | 0.166 | 0.020 | 6.98 | 7.39 | 2.30 | 16054 | 8.4 | |

OCB | 2007 | 0.014 | 0.005 | 0.380 | 0.859 | 0.108 | 16.280 | 0.136 | 0.019 | 7.13 | 8.30 | 2.30 | 16114 | 8.8 |

OCB | 2008 | 0.029 | 0.008 | 0.640 | 0.842 | 0.197 | 16.128 | 0.040 | 0.006 | 5.66 | 23.12 | 2.40 | 16977 | 13.46 |

OCB | 2009 | 0.026 | 0.010 | 0.421 | 0.816 | 0.116 | 16.356 | 0.105 | 0.018 | 5.40 | 7.05 | 2.60 | 17941 | 10.37 |

OCB | 2010 | 0.021 | 0.009 | 0.401 | 0.841 | 0.105 | 16.796 | 0.111 | 0.019 | 6.42 | 8.86 | 2.60 | 18932 | 11.5 |

OCB | 2011 | 0.028 | 0.013 | 0.470 | 0.852 | 0.003 | 17.051 | 0.088 | 0.013 | 6.24 | 18.68 | 2.00 | 20828 | 13 |

OCB | 2012 | 0.028 | 0.018 | 0.479 | 0.861 | -0.111 | 17.127 | 0.061 | 0.009 | 5.25 | 9.09 | 1.80 | 20828 | 11.5 |

OCB | 2013 | 0.029 | 0.010 | 0.496 | 0.879 | -0.023 | 17.306 | 0.062 | 0.008 | 5.42 | 6.59 | 2.00 | 21036 | 8.48 |

OCB | 2014 | 0.029 | 0.014 | 0.528 | 0.897 | 0.130 | 17.482 | 0.055 | 0.006 | 5.98 | 4.09 | 1.86 | 21246 | 7.62 |

OCB | 2015 | 0.019 | 0.009 | 0.558 | 0.915 | 0.068 | 17.716 | 0.051 | 0.005 | 6.68 | 0.63 | 2.31 | 22381 | 6.5 |

PGB | 2005 | 7.55 | 8.28 | 2.10 | 15916 | 8.4 | ||||||||

PGB | 2006 | 0.001 | 0.271 | 0.820 | -0.083 | 13.986 | 0.059 | 0.011 | 6.98 | 7.39 | 2.30 | 16054 | 8.4 | |

PGB | 2007 | 0.001 | 0.002 | 0.281 | 0.884 | 0.134 | 15.359 | 0.108 | 0.014 | 7.13 | 8.30 | 2.30 | 16114 | 8.8 |

PGB | 2008 | 0.014 | 0.007 | 0.487 | 0.834 | 0.339 | 15.638 | 0.084 | 0.012 | 5.66 | 23.12 | 2.40 | 16977 | 13.46 |

PGB | 2009 | 0.012 | 0.008 | 0.366 | 0.895 | 0.319 | 16.159 | 0.165 | 0.021 | 5.40 | 7.05 | 2.60 | 17941 | 10.37 |

PGB | 2010 | 0.014 | 0.010 | 0.425 | 0.867 | 0.222 | 16.611 | 0.134 | 0.016 | 6.42 | 8.86 | 2.60 | 18932 | 11.5 |

PGB | 2011 | 0.021 | 0.015 | 0.388 | 0.853 | 0.063 | 16.682 | 0.187 | 0.026 | 6.24 | 18.68 | 2.00 | 20828 | 13 |

PGB | 2012 | 0.084 | 0.023 | 0.500 | 0.834 | 0.120 | 16.773 | 0.083 | 0.013 | 5.25 | 9.09 | 1.80 | 20828 | 11.5 |

PGB | 2013 | 0.030 | 0.013 | 0.699 | 0.871 | 0.235 | 17.029 | 0.012 | 0.002 | 5.42 | 6.59 | 2.00 | 21036 | 8.48 |

PGB | 2014 | 0.025 | 0.012 | 0.638 | 0.870 | 0.126 | 17.065 | 0.040 | 0.005 | 5.98 | 4.09 | 1.86 | 21246 | 7.62 |

PGB | 2015 | 0.028 | 0.011 | 0.649 | 0.863 | 0.123 | 17.022 | 0.012 | 0.002 | 6.68 | 0.63 | 2.31 | 22381 | 6.5 |

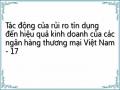

SCB | 2005 | 0.004 | 0.628 | 0.918 | 0.174 | 15.210 | 0.187 | 0.015 | 7.55 | 8.28 | 2.10 | 15916 | 8.4 | |

SCB | 2006 | 0.005 | 0.925 | 16.208 | 0.215 | 0.017 | 6.98 | 7.39 | 2.30 | 16054 | 8.4 | |||

SCB | 2007 | 0.003 | 0.004 | 0.399 | 0.897 | 0.354 | 17.073 | 0.149 | 0.014 | 7.13 | 8.30 | 2.30 | 16114 | 8.8 |

SCB | 2008 | 0.006 | 0.008 | 0.380 | 0.927 | 0.171 | 17.469 | 0.169 | 0.014 | 5.66 | 23.12 | 2.40 | 16977 | 13.46 |

SCB | 2009 | 0.013 | 0.011 | 0.427 | 0.916 | 0.219 | 17.814 | 0.085 | 0.007 | 5.40 | 7.05 | 2.60 | 17941 | 10.37 |

Có thể bạn quan tâm!

-

Hạn Chế Và Hướng Nghiên Cứu Tiếp Theo

Hạn Chế Và Hướng Nghiên Cứu Tiếp Theo -

Hasna Chaibi And Zied Ftiti, 2015. Credit Risk Determinants: Evidence From A Cross-Country Study. Research In International Business And Finance 33 (2015) 1–16.

Hasna Chaibi And Zied Ftiti, 2015. Credit Risk Determinants: Evidence From A Cross-Country Study. Research In International Business And Finance 33 (2015) 1–16. -

Tác động của rủi ro tín dụng đến hiệu quả kinh doanh của các ngân hàng thương mại Việt Nam - 17

Tác động của rủi ro tín dụng đến hiệu quả kinh doanh của các ngân hàng thương mại Việt Nam - 17 -

Tác động của rủi ro tín dụng đến hiệu quả kinh doanh của các ngân hàng thương mại Việt Nam - 19

Tác động của rủi ro tín dụng đến hiệu quả kinh doanh của các ngân hàng thương mại Việt Nam - 19 -

Tác động của rủi ro tín dụng đến hiệu quả kinh doanh của các ngân hàng thương mại Việt Nam - 20

Tác động của rủi ro tín dụng đến hiệu quả kinh doanh của các ngân hàng thương mại Việt Nam - 20 -

Tác động của rủi ro tín dụng đến hiệu quả kinh doanh của các ngân hàng thương mại Việt Nam - 21

Tác động của rủi ro tín dụng đến hiệu quả kinh doanh của các ngân hàng thương mại Việt Nam - 21

Xem toàn bộ 175 trang tài liệu này.

KLB

2010 | 0.125 | 0.023 | 0.388 | 0.922 | 0.696 | 17.913 | 0.060 | 0.005 | 6.42 | 8.86 | 2.60 | 18932 | 11.5 | |

SCB | 2011 | 0.072 | 0.025 | 0.922 | 18.791 | 6.24 | 18.68 | 2.00 | 20828 | 13 | ||||

SCB | 2012 | 0.072 | 0.011 | 0.711 | 0.924 | 0.035 | 18.821 | 0.006 | 0.000 | 5.25 | 9.09 | 1.80 | 20828 | 11.5 |

SCB | 2013 | 0.016 | 0.007 | 0.707 | 0.928 | 0.224 | 19.014 | 0.003 | 0.000 | 5.42 | 6.59 | 2.00 | 21036 | 8.48 |

SCB | 2014 | 0.005 | 0.005 | 0.541 | 0.946 | 0.350 | 19.305 | 0.007 | 0.000 | 5.98 | 4.09 | 1.86 | 21246 | 7.62 |

SCB | 2015 | 0.005 | 0.007 | 0.523 | 0.951 | 0.100 | 19.557 | 0.006 | 0.000 | 6.68 | 0.63 | 2.31 | 22381 | 6.5 |

VietA | 2005 | 0.003 | 0.361 | 0.866 | 0.206 | 14.673 | 0.115 | 0.015 | 7.55 | 8.28 | 2.10 | 15916 | 8.4 | |

VietA | 2006 | 0.006 | 0.628 | 0.819 | 0.079 | 15.246 | 0.099 | 0.016 | 6.98 | 7.39 | 2.30 | 16054 | 8.4 | |

VietA | 2007 | 0.004 | 0.488 | 0.860 | 0.119 | 16.063 | 0.141 | 0.021 | 7.13 | 8.30 | 2.30 | 16114 | 8.8 | |

VietA | 2008 | 0.018 | 0.009 | 0.547 | 0.860 | 0.301 | 16.145 | 0.052 | 0.007 | 5.66 | 23.12 | 2.40 | 16977 | 13.46 |

VietA | 2009 | 0.013 | 0.010 | 0.387 | 0.892 | 0.365 | 16.577 | 0.133 | 0.016 | 5.40 | 7.05 | 2.60 | 17941 | 10.37 |

VietA | 2010 | 0.025 | 0.015 | 0.420 | 0.859 | 0.273 | 16.997 | 0.104 | 0.013 | 6.42 | 8.86 | 2.60 | 18932 | 11.5 |

VietA | 2011 | 0.026 | 0.016 | 0.505 | 0.841 | 0.242 | 16.930 | 0.071 | 0.011 | 6.24 | 18.68 | 2.00 | 20828 | 13 |

VietA | 2012 | 0.047 | 0.015 | 0.593 | 0.856 | 0.409 | 17.019 | 0.046 | 0.007 | 5.25 | 9.09 | 1.80 | 20828 | 11.5 |

VietA | 2013 | 0.029 | 0.013 | 0.645 | 0.867 | 0.122 | 17.113 | 0.017 | 0.002 | 5.42 | 6.59 | 2.00 | 21036 | 8.48 |

VietA | 2014 | 0.023 | 0.012 | 0.827 | 0.898 | 0.051 | 17.388 | 0.013 | 0.002 | 5.98 | 4.09 | 1.86 | 21246 | 7.62 |

VietA | 2015 | 0.023 | 0.011 | 0.501 | 0.906 | -0.259 | 17.550 | 0.022 | 0.002 | 6.68 | 0.63 | 2.31 | 22381 | 6.5 |

SCB

Nguồn: Tác giả thu thập từ BCTC và ADB

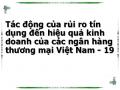

4. Tóm tắt kết quả nghiên cứu của Hasna Chaibi và Zied Ftiti (2015)

GMM Estimations | Kỳ vọng | ||

Pháp | Đức | ||

NPL(t-1) | 0.39*** | 0.36*** | + |

-3.95 | -3.56 | ||

Biến nội tại | |||

Dự phòng rủi ro tín dụng(LLP) | 160.9** | -58.2 | + |

-2.99 | (-1.12) | ||

Kém hiệu quả (EFF) | 0.0052** | -0.001 | +/- |

-3.83 | (-0.34) | ||

Đòn bẩy (LEV) | -6.282 | 10.22* | + |

(-086) | -2.38 | ||

Thu nhập ngoài lãi (NII) | - | -0.0003 | - |

(-1.41) | |||

Quy mô (SIZE) | 2.683** | 0.276* | + |

-2.49 | -1.99 | ||

Lợi nhuận (ROE) | -0.01* | -0.02' | -/+ |

(-220) | (-2.61) | ||

Biến kinh tế vĩ mô | |||

Lạm phát (INF) | -0.517 | -0.621*** | +/- |

(-1.62) | (—4.91) | ||

Tăng trưởng GDP (GGDP) | -0.491*** | -0.097* | - |

-3.59 | (—/.97) | ||

Lãi suất danh nghĩa (INR) | 2.061** | - | + |

-3.17 | |||

Tỷ lệ thất nghiệp (UNR) | 327* | 0.472*** | + |

-2.58 | -4.86 | ||

Tỷ giá hối đoái (EXR) | 0.571*** | -0.203* | +/- |

-3.63 | -2.61 | ||

Sargan test (p-value) | 0.5074 | 0.9696 | |

Serial correlation test (p-value) | 0.7245 | 0.3267 | |

Số quan sát | 199 | 78 |

Nguồn: Hasna Chaibi và Zied Ftiti (2015)

5. Kết quả nghiên cứu trên phần mềm STATA 13

. *** Mo hinh 1

.

. xtset donvi time

panel variable: donvi (strongly balanced) time variable: time, 2005 to 2015

delta: 1 unit

.

. sum npl llr eff lev nii size roe ggdp inf unr exr inr

Variable | Obs Mean Std. Dev. Min Max

-------------+--------------------------------------------------------

233 | .0224712 | .0158215 | .001 | .1246 | |

llr | | 271 | .0111496 | .0066228 | .0001286 | .0370178 |

eff | | 262 | .4879579 | .190311 | .0795316 | 2.0527 |

lev | | 276 | .8698281 | .1108404 | .0152707 | 1.129474 |

nii | | 264 | .1606875 | .2713953 | -2.003685 | .7855639 |

-------------+--------------------------------------------------------

276 | 17.34343 | 1.619804 | 11.88353 | 20.56153 | |

roe | | 275 | .114088 | .0747594 | .0007494 | .4449051 |

ggdp | | 286 | 6.246387 | .7420688 | 5.247367 | 7.547248 |

inf | | 286 | 9.280675 | 6.03656 | .63 | 23.11632 |

unr | | 286 | 2.206564 | .2625723 | 1.8 | 2.6 |

-------------+--------------------------------------------------------

286 18932.05 | 2319.773 | 15916 | 22380.54 | |

inr | | 286 9.820909 | 2.178888 | 6.5 | 13.46 |

.

. corr npl llr eff lev nii size roe ggdp inf unr exr inr (obs=230)

| npl llr eff lev nii size roe ggdp inf unr

exr

-------------+---------------------------------------------------------------------------------------------

npl | | | 1.0000 | |||||||||

llr | | | 0.5258 | 1.0000 | ||||||||

eff | | | 0.2015 | -0.0229 | 1.0000 | |||||||

lev | | | -0.0936 | 0.1457 | -0.2249 | 1.0000 | ||||||

nii | | | -0.0711 | -0.0030 | -0.5166 | 0.3357 | 1.0000 | |||||

size | | | 0.0029 | 0.4629 | -0.2154 | 0.5494 | 0.2359 | 1.0000 | ||||

roe | | | -0.2439 | -0.0531 | -0.5585 | 0.1936 | 0.3051 | 0.2812 | 1.0000 | |||

ggdp | | | -0.2795 | -0.2966 | -0.1968 | 0.0643 | -0.0057 | -0.0930 | 0.2636 | 1.0000 | ||

inf | | | 0.0412 | -0.0481 | -0.1133 | -0.0865 | 0.0657 | -0.2027 | 0.1704 | -0.1668 | 1.0000 | |

unr | | | -0.2662 | -0.2741 | -0.2968 | 0.0527 | 0.2003 | -0.2107 | 0.2720 | 0.2537 | 0.0555 | |

1.0000 | exr | | | 0.2040 | 0.3535 | 0.2815 | 0.0940 | -0.2484 | 0.4105 | -0.4104 | -0.2862 | -0.3791 |

0.3007 | inr | | | 0.0969 | 0.0345 | -0.1699 | -0.0885 | 0.0428 | -0.1652 | 0.2070 | -0.3332 | 0.8866 |

------

1.0000

-0.5588

0.1313 -

| inr

-------------+---------

inr | 1.0000

.

. reg npl l.npl llr eff lev nii size roe ggdp inf unr exr inr

Source | SS df MS Number of obs = 204

-------------+------------------------------ F( 12, 191) = 13.11

Model | .020411414 12 .001700951 Prob > F = 0.0000

Residual | .0247762 191 .000129718 R-squared = 0.4517

-------------+------------------------------ Adj R-squared = 0.4173 Total | .045187613 203 .000222599 Root MSE = .01139

------------------------------------------------------------------------------

npl | Coef. Std. Err. t P>|t| [95% Conf. Interval]

-------------+----------------------------------------------------------------

| | |||||||

L1. | | | .1719398 | .0637995 | 2.69 | 0.008 | .0460976 | .2977819 |

| | |||||||

llr | | | 1.268895 | .1606624 | 7.90 | 0.000 | .9519946 | 1.585796 |

eff | | | .0100425 | .0076513 | 1.31 | 0.191 | -.0050494 | .0251344 |

lev | | | -.0028094 | .0089534 | -0.31 | 0.754 | -.0204697 | .0148509 |

nii | | | .0140145 | .0054503 | 2.57 | 0.011 | .003264 | .0247651 |

size | | | -.0033214 | .001013 | -3.28 | 0.001 | -.0053195 | -.0013234 |

roe | | | -.019222 | .0166014 | -1.16 | 0.248 | -.0519675 | .0135235 |

ggdp | | | .0001132 | .0018301 | 0.06 | 0.951 | -.0034965 | .0037229 |

inf | | | -.0002893 | .0003124 | -0.93 | 0.356 | -.0009056 | .0003269 |

unr | | | -.0045828 | .0041865 | -1.09 | 0.275 | -.0128405 | .0036749 |

exr | | | 8.57e-07 | 7.70e-07 | 1.11 | 0.267 | -6.61e-07 | 2.38e-06 |

inr | | | .0019409 | .0009374 | 2.07 | 0.040 | .0000918 | .0037899 |

_cons | | | .0347255 | .0280183 | 1.24 | 0.217 | -.0205396 | .0899905 |

------------------------------------------------------------------------------

.

. vif

Variable | VIF 1/VIF

-------------+----------------------

| | 7.28 | 0.137276 | |

inf | | | 6.72 | 0.148760 |

exr | | | 3.32 | 0.301063 |

roe | | | 2.54 | 0.392968 |

size | | | 2.52 | 0.396951 |

unr | | | 2.41 | 0.414942 |

eff | | | 1.98 | 0.504402 |

ggdp | | | 1.64 | 0.608486 |

llr | | | 1.51 | 0.661288 |

lev | | | 1.41 | 0.707721 |

npl | | | ||

L1. | | | 1.40 | 0.714563 |

nii | | | 1.37 | 0.731054 |

-------------+----------------------

Mean VIF | 2.84

.

. reg npl l.npl llr eff lev nii size roe ggdp inf unr exr inr

Source | SS df MS Number of obs = 204

-------------+------------------------------ F( 12, 191) = 13.11

Model | .020411414 12 .001700951 Prob > F = 0.0000

Residual | .0247762 191 .000129718 R-squared = 0.4517

-------------+------------------------------ Adj R-squared = 0.4173 Total | .045187613 203 .000222599 Root MSE = .01139

------------------------------------------------------------------------------

npl | Coef. Std. Err. t P>|t| [95% Conf. Interval]

-------------+----------------------------------------------------------------

| | |||||||

L1. | | | .1719398 | .0637995 | 2.69 | 0.008 | .0460976 | .2977819 |

| | |||||||

llr | | | 1.268895 | .1606624 | 7.90 | 0.000 | .9519946 | 1.585796 |

eff | | | .0100425 | .0076513 | 1.31 | 0.191 | -.0050494 | .0251344 |

lev | | | -.0028094 | .0089534 | -0.31 | 0.754 | -.0204697 | .0148509 |

nii | | | .0140145 | .0054503 | 2.57 | 0.011 | .003264 | .0247651 |

size | | | -.0033214 | .001013 | -3.28 | 0.001 | -.0053195 | -.0013234 |

roe | | | -.019222 | .0166014 | -1.16 | 0.248 | -.0519675 | .0135235 |

ggdp | | | .0001132 | .0018301 | 0.06 | 0.951 | -.0034965 | .0037229 |

inf | | | -.0002893 | .0003124 | -0.93 | 0.356 | -.0009056 | .0003269 |

unr | | | -.0045828 | .0041865 | -1.09 | 0.275 | -.0128405 | .0036749 |

exr | | | 8.57e-07 | 7.70e-07 | 1.11 | 0.267 | -6.61e-07 | 2.38e-06 |

inr | | | .0019409 | .0009374 | 2.07 | 0.040 | .0000918 | .0037899 |

_cons | | | .0347255 | .0280183 | 1.24 | 0.217 | -.0205396 | .0899905 |

------------------------------------------------------------------------------

.

. vif

Variable | VIF 1/VIF

-------------+----------------------

7.28 | 0.137276 | |

inf | | 6.72 | 0.148760 |

exr | | 3.32 | 0.301063 |

roe | | 2.54 | 0.392968 |

0.396951 | ||

unr | | 2.41 | 0.414942 |

eff | | 1.98 | 0.504402 |

ggdp | | 1.64 | 0.608486 |

llr | | 1.51 | 0.661288 |

lev | | 1.41 | 0.707721 |

npl | | ||

L1. | | 1.40 | 0.714563 |

nii | | 1.37 | 0.731054 |

size |

-------------+----------------------

Mean VIF | 2.84

.

. imtest,white

White's test for Ho: homoskedasticity

against Ha: unrestricted heteroskedasticity

chi2(79) = 153.26

Prob > chi2 = 0.0000

Cameron & Trivedi's decomposition of IM-test

---------------------------------------------------

Source | chi2 df p

---------------------+-----------------------------

153.26 | 79 | 0.0000 | |

Skewness | | 29.58 | 12 | 0.0032 |

Kurtosis | | 1.47 | 1 | 0.2256 |

---------------------+----------------------------- Total | 184.32 92 0.0000

---------------------------------------------------

.

. est sto POOL1

.

. xtreg npl l.npl llr eff lev nii size roe ggdp inf unr exr inr,fe

Number of obs | = | 204 | |

Group variable: donvi | Number of groups | = | 26 |

5 | ||

between = 0.3793 | avg = | 7.8 |

overall = 0.4221 | max = | 10 |