Cash Department – Vault

Directly perform operations on management of vaults and professional funds. Directly performing fund operations (receiving, spending, exporting, importing); develop treasury transactions; closely coordinate with Customer Service Department to perform cash collection and payment at the counter, convenient and safe service for customers with one-stop transactions. Propose and advise the Director on measures and strictly implement the management process of warehouses and funds; apply measures and take full responsibility for the safety of the vault and currency, and the safety of assets of the Bank and customers.

– Transaction offices (Dong Ha Education Department and Vinh Linh Education Department Nam Dong Ha Education Department)

Directly perform operations according to the authorized scope to ensure compliance with the provisions of law and professional processes…

– Integrated planning Department

Directly manage capital balance to ensure large structures and manage safety factors according to regulations…; advising and assisting the Managing Director of capital resources; be responsible for proposing policies, measures and solutions to develop capital sources to meet the branch’s credit development requirements and measures to reduce capital costs to contribute to improving profits; propose measures to improve the efficiency of capital use; Directly conduct monetary business with customers according to regulations…

– Customer Service Department

Directly performing transaction tasks with customers, performing marketing of banking products and services to customers; Receive feedback from customers about services, absorb and suggest improvement instructions. Directly performing, processing, operating and accounting transactions for customers.

Take full responsibility for the accuracy and correctness of transactions, ensure safety of capital and assets of the Bank and customers; properly perform the business process, according to the authority and fully implement internal control measures before completing a transaction with the customer…

– Computing team

Directly manage and administer the system of decentralized access and control at the Branch, organize the operation of the computer equipment system and software programs applied at the Branch in accordance with regulations and procedures of the Branch. BIDV .

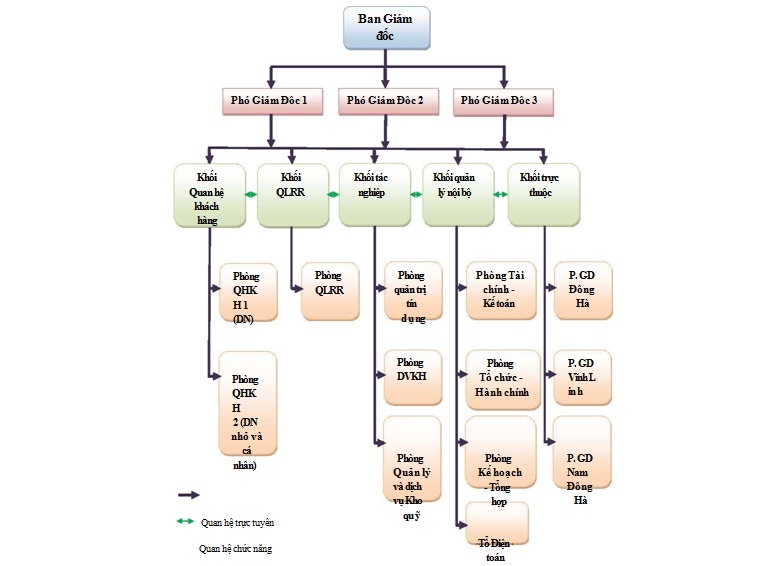

Figure 2.1: Organizational chart of operational apparatus at BIDV – Quang Tri

(Source: Administration Department of BIDV – Quang Tri)

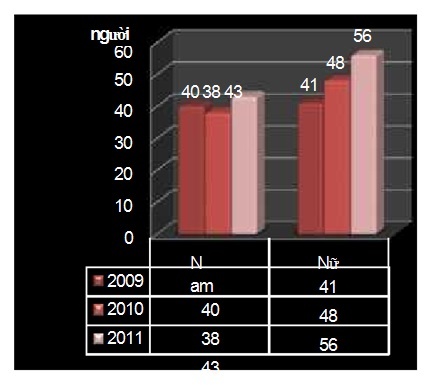

2.1.4. Labor situation During the period 2009 – 2011, the labor situation of Bank for Investment and Development of Vietnam – Quang Tri Branch was constantly increasing in quantity and quality.

In terms of number: The number of employees grew by 6% in 2010 corresponding to 5 employees. In particular, the branch opened more Nam Dong Ha transaction office to develop business activities, expand branch scale and better serve customers, so the number of employees in 2011 increased to 99 employees and increased. 15% compared to 2010.

Figure 2.1: Labor situation at BIDV Quang Tri classified by gender (2009 – 2011)

Table 2.3: Labor situation at BIDV Quang Tri, classified by qualifications (2009 – 2011)

2009 2010 2011 2010/2009 2011/2010

| Items | SL | % | SL | % | SL | % | +/- | % | +/- | % |

| University, above university | 55 | 67.9 | 63 | 73.3 | 80 | 80.8 | 8 | 14.55 | 17 | 26.98 |

| College, high school | 14 | 17.3 | 13 | 15.1 | 11 | 11.1 | -first | -7.14 | -2 | -15.38 |

| General Labor | twelfth | 14.8 | ten | 11.6 | 8 | 8.1 | -2 | -16.67 | -2 | -20.00 |

| Total number of employees | 81 | 100.0 | eighty six | 100.0 | 99 | 100.0 | 5 | 6.17 | 13 | 15.12 |

Maybe you are interested!

-

The main solution to improve the quality of short-term loans for small and medium-sized enterprises at Bank for Investment and Development - 1

The main solution to improve the quality of short-term loans for small and medium-sized enterprises at Bank for Investment and Development - 1 -

The main solution to improve the quality of short-term loans for small and medium-sized enterprises at Bank for Investment and Development - 2

The main solution to improve the quality of short-term loans for small and medium-sized enterprises at Bank for Investment and Development - 2 -

Chapter 2: Assessment Of Quality Of Short-Term Living Activities For Small And Small Enterprises At Bank For Investment And Development Of Vietnam – Quang Tri Branch

Chapter 2: Assessment Of Quality Of Short-Term Living Activities For Small And Small Enterprises At Bank For Investment And Development Of Vietnam – Quang Tri Branch -

Analysis Of Total Loan Profit On Average Total Outstanding Balance

Analysis Of Total Loan Profit On Average Total Outstanding Balance -

The main solution to improve the quality of short-term loans for small and medium-sized enterprises at Bank for Investment and Development - 6

The main solution to improve the quality of short-term loans for small and medium-sized enterprises at Bank for Investment and Development - 6 -

The main solution to improve the quality of short-term loans for small and medium-sized enterprises at Bank for Investment and Development - 7

The main solution to improve the quality of short-term loans for small and medium-sized enterprises at Bank for Investment and Development - 7

(Source: Administration Department at BIDV Quang Tri)

In terms of quality: In general, in the total number of employees, the proportion of female employees is higher than that of male workers and has increased over the years. From 51% in 2009 up to 57% in 2011 this is due to the branch’s characteristics of having a high transaction density with customers, so it requires careful and friendly female staff… In terms of qualifications, in in 2011 the number of employees with university and postgraduate degrees accounted for the majority and tended to increase over the years and accounted for over 80% compared to the number of employees across the branch and the proportion of highly qualified employees college, intermediate level only 11%.

This shows that the Branch has focused on creating conditions for staff to go to school to improve their professional skills, as well as enhance the quality of input recruitment.

2.1.5. Credit process for corporate customers at Bank for Investment and Development – Quang Tri Branch

Step 1: Marketing to customers and making credit proposal reports.

Step 2: Assess the risk.

Step 3: Approve credit grant.

Step 4: Carry out the procedures after approval.

Step 5: Disbursement/Issuance of guarantee.

Step 6: Monitoring and Controlling.

Step 7: Adjust loans.

Step 8: Collect debt, interest, fees.

Step 9: Handling and recovering overdue debts.

Step 10: Liquidate the credit contract.

(The specific business loan process is in APPENDIX 3)

– Evaluation of the credit process for corporate customers at Bank for Investment and Development of Vietnam – Quang Tri Branch:

BIDV’s business credit process clearly stipulates each step from receiving documents to liquidating credit contracts. In each stage, the exact tasks and functions of each department as well as the individual are specified, and the process is changed to suit each stage of the economy’s development. However, the credit process for corporate customers has not been clearly defined for each activity such as short-term loans or for SME or large enterprises. This will cause limitations when making short-term loans to SMEs. It will increase unnecessary procedures for short-term loans or some unnecessary documents for SMEs, thereby prolonging the disbursement time, affecting the Bank’s operations as well as SMEs.

2.1.6. Short-term loan products for businesses at Bank for Investment and Development – Quang Tri Branch

– Ordinary short-term loan

Is a loan product to supplement working capital to serve production and business needs of enterprises.

– Business overdraft

As a loan product to supplement working capital, meeting the unexpected needs of enterprises to compensate for the temporary shortage of business capital, customers can spend more than the amount (surplus) on the deposit account. payment (Debit Account) opened at BIDV.

– Loans for construction and installation

Is a product to meet the needs of supplementing working capital for enterprises operating in the field of construction and installation for construction and installation of equipment for construction works, infrastructure, …

– Shipbuilding loan

Is a product to supplement working capital for shipbuilding enterprises (including sea-going ships, special-use ships, river ships, barges and other water transport equipment).

(Characteristics and benefits of BIDV’s short-term corporate loans are in APPENDIX4) Evaluation of loan products and services short-term enterprises:

BIDV’s short-term business loan products are now quite diverse and rich, in addition to the usual short-term loan products such as loan by item and loan by credit line. There are also new products. in line with market demand such as: shipbuilding loans, construction loans, corporate discounts, etc. It shows that BIDV has quite well grasped the demand for short-term loans for businesses to improve quality. business loans.

2.1.7. Number of Small and Medium Enterprises

Quang Tri Bank for Investment and Development has a leading reputation in the area, has a long tradition, has a lot of experience in the field of investment and development loans, especially in the field of investment loans for customers. SMEs.

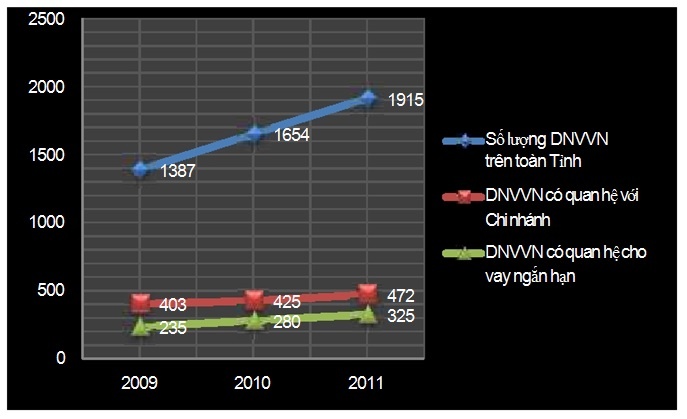

Figure 2.2 : Number of SMEs with short-term lending relationship with BIDV Quang Tri (2009 – 2011)

Table 2.4 : Percentage of SMEs with short-term lending relationships to SMEs related to BIDV Quang Tri (2009 – 2011)

| Items | 2009 | 2010 | 2011 |

| Proportion of SMEs to the whole of Tinh (%) | 29.1 | 25.7 | 24.6 |

| SMEs with short-term lending relationship / SMEs with branch relationships (%) | 58.3 | 65.9 | 68.9 |

Looking at the chart, we can see that the number of SMEs in the province has increased sharply over the years. In 2009, the number of SMEs having relations with the Branch was 403 enterprises, accounting for 29.1% of the whole province, this figure was 425 enterprises and 25.7% respectively in 2010 and 472 enterprises and 24.6% in 2011 respectively. . In absolute terms, the number of businesses having relations with the branch has increased over the years, however, the market share of credit customers of BIDV Quang Tri is on a decreasing trend. The reason is that there are more and more SMEs registered to establish and operate in the province, besides there is competition from other banks. On the other hand, the continuous high interest rates in 2011 made it difficult for businesses to borrow capital.

Contrary to the decreasing trend for the proportion of SMEs in the province, the proportion of SMEs with short-term lending relationships compared to SMEs with relationships with branches has an increasing trend. This proves that the SME short-term lending business is operating more and more effectively. 2.1.8. Business results Bank for Investment and Development – Quang Tri Branch

Table 2.5: Business situation of BIDV Quang Tri (2009 – 2011)

Unit: Billion VND

| Items | 2009 | 2010 | 2011 | 2010/2009 | 2011/2010 | ||

| +/- | % | +/- | % | ||||

| I. Autumn | 115.71 | 146.81 | 175.58 | 31.1 | 26.88 | 28.77 | 19.60 |

| 1. Income from interest | 105.48 | 132.95 | 157.69 | 27.47 | 26.04 | 24.74 | 18.61 |

| 2. Non-interest income | 9.03 | 12.48 | 16.37 | 3.45 | 38.21 | 3.89 | 31.17 |

| 3. Extraordinary income | 1.2 | 1.38 | 1.52 | 0.18 | 15.00 | 0.14 | 10.14 |

| II. Cost | 90.85 | 114.56 | 136.36 | 23.71 | 26.10 | 21.8 | 19.03 |

| 1. Interest expense | 72.9 | 93.13 | 112.17 | 20.23 | 27.75 | 19.04 | 20.44 |

| 2. Non-interest expenses | 0.61 | 0.93 | 1.11 | 0.32 | 52.46 | 0.18 | 19.35 |

| 3. Operating costs | 17.34 | 20.5 | 23.08 | 3.16 | 18.22 | 2.58 | 12.59 |

| III. Profit | 24.86 | 32.25 | 39.22 | 7.39 | 29.73 | 6.97 | 21.61 |

(Source: Business Banking Department of BIDV Bank – Quang Tri Branch)

– Revenues: Interest income accounted for the largest proportion of over 90%1 of the Branch’s total revenues, showing that lending is one of the Branch’s main business activities. Interest income grew at a relatively high rate of 26.04% in 2010 but decreased to 18.61% in 2011. The high growth in 2010 was due to the proactive policy to prevent economic downturn in 6 years. In the first month of 2009 by the State Bank of Vietnam, besides that, the branch’s loans in 2010 were mainly short-term loans, so the profit generated in the year was large. The decline in 2011 was due to the fact that Vietnam’s inflation in 2010 also increased to double digits (11.8%) at the end of 2010 and the Vietnamese dong (VND) depreciated leading to tightening policy. monetary tightening to limit credit growth of commercial banks.

Along with the main activity of lending, the branch also focuses on service activities such as guarantee, import and export financing, financial consulting, card operations, etc. These activities have brought a significant source of income. reported to the Branch with VND 9.03 billion in 2009 and steadily increased at a rate of over 30%. From the above results, it shows the efforts in developing diversified products and services of BIDV in general, and BIDV Quang Tri Branch in particular. This will bring many benefits to customers and more broadly orient the development of advanced products and services to catch up with the development of the economy. Revenue from services will also contribute significantly to the growth of the branch’s revenue sources.

– About costs: Along with the increase in interest income, interest payment expenses also increase at a similar rate, which is understandable because mobilizing and lending are two closely related activities. together. However, interest expense increased more strongly than interest income, increasing by 20.23 billion dong, equivalent to 27.75% in 2010 and 19.04 billion dong, equivalent to 20.44% in 2011. The reason is that at the branch, the amount of savings deposits accounts for a large part and has a high growth rate, causing large interest payments. In addition, there are deposit insurance payments to reduce risk.

As for non-interest expenses, the strong growth in 2010 was due to the fact that the Branch focused its costs on technology such as equipping laptops for each room to quickly respond to business requirements and increase the number of ATMs. . In addition, there is an operating expense item whose growth rate has decreased over the years.

– In terms of profit: in 2010 total revenue increased by 31.1 billion VND, equivalent to 26.88% and total expenses increased by 23.71 billion VND, respectively 26.1% and in 2011 total revenue increased by 28.77 billion VND, respectively increased by 19.6% and total expenses increased. VND 21.8 billion, equivalent to an increase of 19.03%. The growth rate of total costs is close to the growth rate of total revenue. However, in terms of absolute numbers, the total revenue was larger, making the branch’s profit in 2010 reached 32.25 billion VND, an increase of 7.39 billion VND, equivalent to an increase of 29.73% and profit reached 39.22 billion VND, an increase of 6.97 billion VND respectively. increased by 21.61% in 2011. Despite the difficult business situation, with reasonable and correct business policies in cost management, the Branch achieved good profit growth.

2.2. Current status of short-term lending quality for SMEs at Bank for Investment and Development of Vietnam – Quang Tri Branch

2.2.1. Fund raising situation

Capital mobilization is an important and indispensable operation in parallel with credit operations in commercial banks. This is the operation that creates capital for most of the bank’s activities. Since this is the main source of mobilized capital, the more capital a commercial bank can attract, the more profitable it will be because of its strong capital. other profitable. Therefore, banks need to actively expand and improve service quality and diversify forms of capital mobilization to attract idle capital from residents as well as economic organizations in the province in order to create financial resources. credit capital to meet the capital needs of all economic sectors in a timely manner. Capital mobilization is carried out in many ways: payment deposits, personal deposits, savings deposits, issuance of valuable papers, etc.

Table 2.6: Fund mobilization of BIDV Quang Tri (2009 – 2011)

| Items | 2009 | 2010 | 2011 | 2010/2009 | 2011/2010 | ||

| +/- | % | +/- | % | ||||

| 1. Payment deposit | 242.04 | 279.78 | 314.64 | 37.74 | 15.59 | 34.86 | 12.46 |

| 2. Savings deposit | 429.56 | 560.09 | 750.85 | 130.5 | 30.39 | 190.8 | 34.06 |

| 3. Valuable papers | 8,908 | 10.72 | 12,539 | 1.812 | 20.34 | 1.819 | 16.97 |

| 680.51 | 850.59 | 1078.03 | 170.1 | 24.99 | 227.4 | 26.74 | |

| Mobilized capital | |||||||

(Source: Business Banking Department of BIDV Quang Tri Bank)

Among the types of deposits, payment deposits are for the purpose of ensuring the safety of assets, making payments in production and business activities, paying salaries to employees of the enterprise, and at the same time limiting expenses for payment organization, money preservation and money transportation… Currently, payment deposits at the branch are mainly economic organizations. From the table, we can see that, in absolute terms, the amount of payment deposits has increased over the years. However, the ratio of payment deposit structure to total mobilized capital and its growth rate in 2010 was 33% 2 and 15.59%, respectively, in 2011 it was 29% 3 and 12.46%, which is on a downward trend. gradually. The objective reason is that the economic situation in 2011 fluctuated strongly, with high risks, so it is possible that businesses will shrink and reduce production and business activities.

Another major reason is that the utilities from the branch’s payment products and services are still not strong enough to attract more individual customers in the area, so the effectiveness of this type of promotion has not yet been fully promoted. this move.

As mentioned above, the macroeconomic situation at the end of 2010 and 2011 was unstable: the stock market “hibernated”, the gold market, interest rates and exchange rates were “hot – cold” unstable, frozen real estate. This greatly affects the psychology of depositors. They need a safe and profitable place to deposit money, so the Bank savings solution is the most optimal. Specifically, in 2010, the growth rate of savings deposits was 30.39% compared to 2009 and in 2011 the growth rate was 34.06% compared to 2010. To achieve this, the branch must also use flexibly. forms of capital mobilization such as savings with tiered interest rates, savings with flexible principal withdrawals, floating interest rate savings.. with attractive interest rates and rewards, thus attracting many customers.

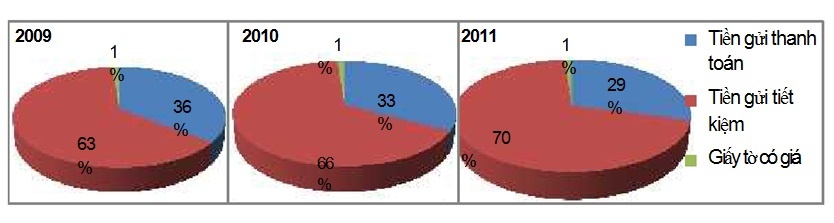

Figure 2.3: Structure of mobilized capital of BIDV Quang Tri (2009 – 2011)

2 33%=279.78/850.59

3 29%=314.64/1078.03

The capital source accounts for a small proportion of the total mobilized capital of the Branch, which is from the issuance of valuable papers. With a value of VND 8,908 billion in 2009, VND 10.72 billion in 2010 and VND 12,539 billion in 2011 and this capital always accounts for less than 2% of total mobilized capital. This shows that BIDV Quang Tri still has many limitations in mobilizing valuable papers.

As the chart shows, the branch’s capital mobilization focuses on savings products, so the fluctuation of total capital is strongly influenced by the increasing trend of savings deposits. Total mobilized capital in 2009 reached 680.51 billion VND. In 2010, the economy showed more optimistic signs, capital mobilization achieved good results. Mobilized capital reached VND 850.59 billion, an increase of VND 170.1 billion, equivalent to 24.99% compared to 2009. By 2011, mobilized capital was at VND 1078.03 billion with a growth rate of 26.74% compared to 2010.

Thus, although in the period 2009-2012, the world economic situation in general and Vietnam in particular faced many difficulties. However, the branch’s capital has grown steadily over the years. This shows that the Branch is more and more proactive in mobilizing capital so that it can further improve the quality of capital use.

2.2.2. General analysis of short-term lending to SMEs

Through the data table, we can see that: In the structure of SME loan sales, short-term loans account for the main proportion. Specifically, in 2009, short-term loan sales accounted for 65.2%, 67.6% in 2010 and 66.6% in 2011.

During the period 2009 – 2011, Vietnam’s economy experienced many changes.

In 2009, this is the post-crisis period, SMEs have overcome the crisis and have shown their “health”, so since then the Branch has gradually increased lending. Entering 2010, the economy made more positive progress, the Branch increased short-term lending to SMEs with a rate of 52.26%4 compared to 2009 and at VND 1298.03 billion. 2011 was an unstable year and subject to many regulations of the State Bank in lending; Therefore, short-term loans to SMEs reached VND 1592.12 billion and increased by 22.66%5 compared to 2010.

This has shown that the Branch has been more cautious in times of uncertainty, strictly complied with regulations of the State Bank, strict risk assessment process, thereby minimizing risks for the Branch.

Table 2.7: SME lending situation (2009 – 2011)

Unit: Billion VND

| TT | Items | 2009 | 2010 | 2011 | |||

| Amount of money | Proportion % | Amount of money | Proportion % | Amount of money | Percentage % | ||

| first | Loan sales | 1307 | 1921.3 | 2389.67 | |||

| Short-term Long term | 852.53 454.47 | 65.2 34.8 | 1298.03 623.27 | 67.6 32.4 | 1592.12 797.55 | 66.6 33.4 | |

| 2 | Debt collection revenue | 1066.02 | 1672.37 | 2225.7 | |||

| Short-term Long term | 671.25 394.77 | 63.0 37.0 | 1134.34 538.03 | 67.83 32.17 | 1476.52 749.18 | 66.34 33.66 | |

| 3 | Odd debt | 678.45 | 927.38 | 1091.35 | |||

| Short-term Long term | 536.66 141.79 | 79.1 20.9 | 700.35 227.03 | 75.5 24.5 | 815.95 275.4 | 74.8 25.2 | |

| 4 | Overdue | 7.327 | 9.09 | 10.56 | |||

| Short term Long term | 4,766 2,561 | 65.0 35.0 | 5,827 3,263 | 64.1 35.9 | 6.401 4.159 | 60.6 39.4 | |

| 5 | Overdue rate | 1.08 | 0.98 | 0.97 | |||

| Short term Long term | 0.89 1.81 | 0.83 1.44 | 0.78 1.51 | ||||

Debt collection is an important step in the lending process, if you don’t do this well, it will be considered as an inefficient business operation. Just like short-term loan sales to SMEs, short-term debt collection SME also accounts for a large proportion of debt collection revenue. Debt collection is relatively positive, increasing from VND 671.25 billion in 2009 to VND 1134.34 billion in 2010 with an increase of 68.99 %6 and at VND 1476.52 billion in 2011 with a growth rate of 30.17%7 . Thus, the revenue of short-term debt collection SME has achieved positive results.

4 52.26%=(1298.03/852.53)-1

5 22.66%=(1592.12/1298.03)-1