Agribank has always focused on investing in innovation and applying banking technology to effectively serve business administration and develop a network of advanced banking services. Agribank is the first bank to complete the Project on Modernizing the Customer Accounting and Payment System (IPCAS 6 ) sponsored by the World Bank. With the completed IPCAS system, Agribank is capable of providing products and services

modern banking services, with high safety and accuracy, to all customers at home and abroad. Currently, Agribank has millions of customers who are production households and tens of thousands of customers who are businesses.

Agribank is one of the banks with the largest correspondent banking relationship in Vietnam with over 1,000 correspondent banks in nearly 100 countries and territories.

Agribank is the leading bank in receiving and implementing foreign projects. In the context of complicated economic developments, Agribank is still supported by international organizations such as the World Bank (WB), Asian Development Bank (ADB), French Development Agency (AFD), Investment Bank, etc. Europe (EIB)… trusts and entrusts the implementation of over 123 projects with a total capital of over 5.8 billion USD. Agribank is constantly approaching and attracting new projects: Financing contract with the European Investment Bank (EIB) phase II; Rural Finance Project III (WB); etc..

As the largest commercial bank - financial institution in Vietnam, Agribank has been making constant efforts to achieve many encouraging achievements, making great contributions to the cause of industrialization and modernization. and economic development of the country.

(Source: Agribank)

6 IPCAS: Interbank Payment and Customer Accounting Sytem

2.1.2. Current status of Agribank's credit activities

As of December 31, 2013, the total outstanding loans of Agribank reached VND 530,600 billion, reaching the credit growth target in 2013. In which, outstanding loans for agriculture and rural areas reached VND 378,985 billion. VND, accounting for 71.4% of the total loan balance.

Maybe you are interested!

-

Completing the credit rating system of Bank for Agriculture and Rural Development of Vietnam - 1

Completing the credit rating system of Bank for Agriculture and Rural Development of Vietnam - 1 -

Completing the credit rating system of Bank for Agriculture and Rural Development of Vietnam - 2

Completing the credit rating system of Bank for Agriculture and Rural Development of Vietnam - 2 -

Compare Agribank's Rating System With Other Commercial Banks In Vietnam

Compare Agribank's Rating System With Other Commercial Banks In Vietnam -

The Ranking Criteria, The Proportion Of The Set Of Criteria For Individual Customers

The Ranking Criteria, The Proportion Of The Set Of Criteria For Individual Customers -

Separation Of Duties Between The Grading Department And The Crediting Department

Separation Of Duties Between The Grading Department And The Crediting Department

In order to achieve the credit growth target, Agribank has directed and organized the synchronous implementation of 5 groups of solutions: (i) Flexible management of lending interest rates and capital adjustment fees in line with the regulations of the State Bank; (ii) Shifting credit structure towards timely meeting capital for agriculture, rural areas, supporting industries, lending for export;

(iii) Deploying credit programs and credit packages; (iv) Implement drastic solutions to remove difficulties for customers; (v) gradually build and perfect credit mechanisms and regulations…

60%

50%

Agribank

Banking system

40%

![]()

30%

20%

ten%

0%

2007 2008 2009 2010 2011 2012 2013

(Source: SBV and Agribank)

Figure 2.1: Growth chart of outstanding loans of Agribank and the banking system

year by year.

7.0%

6.0%

5.0%

![]()

Agribank

Banking system

4.0%

3.0%

2.0%

1.0%

0.0%

2007 2008 2009 2010 2011 2012 2013

(Source: SBV and Agribank)

Figure 2.2: Chart of bad debts of Agribank and the banking system over the years

After a period of high credit growth and the establishment of a series of branches in the period 2005-2009 to increase market share, Agribank in particular and commercial banks in general had to face the problem of bad debt as a result. high. The impact of the economic recession, the freezing of the real estate market, etc. made bad debts increase, long backlog and difficult to handle. The State Bank of Vietnam had to come up with many solutions to remove difficulties for customers, speed up the handling of bad debts to free up capital, and ensure stable operation of commercial banks.

Through two charts, we can see that the growth rate of outstanding loans of the banking system from 2009 to now has slowed down. The growth rate of outstanding loans of Agribank was lower than the whole industry, but the bad debt ratio was higher, especially from 2011 to 2012, the bad debt was approximately 6%, nearly double the prescribed safe level (3%). In which, the bad debt ratio of Agribank is mainly concentrated in two big cities: Hanoi and Ho Chi Minh City, accounting for 72% of Agribank's total bad debt (as of December 31, 2013).

In fact, the bad debt of the Vietnamese banking system has been hidden and accumulated since previous years, combined with macroeconomic instability such as: Real estate market

property, the stock market froze; the gold market is full of risks... along with the recession of the domestic and world economy has revealed the weaknesses of the banking system, leading to high and difficult to control bad debts. According to international credit rating agencies, Vietnam's bad debt situation is much worse than announced by the State Bank, the actual bad debt ratio is at double digits.

Compared to other banks, Agribank is affected more deeply and heavily. Despite being a big man and elder brother, Agribank is always a latecomer, slow to change before the fluctuations of the economy. So, the problem of bad debt increased significantly of Agribank in the period 2011 - 2013 (from the time Agribank applied the credit rating system to2011) was due to a problem with Agribank's internal credit rating system, leading to an increase in bad debt? Although there are no statistics and analysis on this issue due to certain limitations in accessing the records of customers with bad debt. But with information related to large, high-risk loans that have been cleared and inspected by the State Bank and the Government Inspector, it shows that these loans have not been implemented properly and fully. , loan operations according to regulations. In particular, the human factor is the factor that causes the biggest risk and loss to Agribank's credit activities.

Faced with that pressure, Agribank has set the task of restructuring itself comprehensively from the leadership apparatus, operating mechanism to the credit process, inspection and control, risk management... The reform Those strong initial results have achieved some positive results, the bad debt that peaked in 2011 has cooled down, Agribank's operations have become safer and more effective according to the evaluation criteria of banking activities.

Fitch Ratings has upgraded Agribank's long-term debt issuer rating (IDR) and government support ceiling (SRF) from B to B+. 7 . Along with that, Agribank's short-term debt issuance outlook is maintained at B and the supported possibility rating remains at 4. Fitch assesses, Bank for Agriculture and Rural Development of Vietnam ( Agribank) is currently the bank with the largest assets in Vietnam and has the advantage of a brand name. This is one reason why Fitch has upgraded its credit rating with Agribank.

2.2. Agribank's credit granting process

Subjects participating in the credit granting process in the Agribank system:

An appraiser is a person who is assigned the task of receiving loan documents, performing loan appraisal or re-appraisal.

- Loan controller is the person assigned to control the content of the appraisal report (re-appraisal), control the report on the proposal for disbursement, control the report on the proposal for debt restructuring.

- Loan approver is the person who is entitled to decide to lend to a customer, an investment project, the total amount of loan decision to a customer and related persons according to regulations of the Members' Council. The person approving the loan is the Director (Deputy Director) of the Transaction Office, the Director (Deputy Director) of the Branch, the General Director (Deputy General Director), the Members' Council.

- A loan manager is a person who is assigned the task of drafting credit contracts, loan security contracts, proposing loan disbursements, checking and monitoring loans, monitoring and urging recovery and handling. loan amount.

7 Agribank source: http://agribank.com.vn/31/820/tin-tuc/hoat-dong-agribank/2014/11/8197/fitch-nang-xep-hang-tin-nhiem-agribank--07 -11-2014-.aspx

The credit granting process of the Bank for Agriculture and Rural Development of Vietnam is divided into 6 stages:

Stage 1: Credit appraisal and approval

This phase includes the following steps:

- Receiving requests from customers: the loan appraiser receives and guides customers on loan conditions and documents.

- Appraisal and credit granting decision: after receiving all documents from the customer, the loan appraiser will conduct an assessment of civil legal capacity and civil act capacity in accordance with the law; Loan purpose; customers' financial capacity and capacity; feasibility and effectiveness of investment projects, production, business and service plans; loan guarantee; assess the customer's relationship with the bank and the bank's benefits… The loan appraiser must prepare a loan appraisal report detailing the results of the appraisal process, making a loan proposal or do not lend.

- The loan controller controls the legality, validity and completeness of the loan application, controls the content of the appraiser's appraisal report and recommends lending or not lending or requesting a report. Learn more about the loan.

- The person approving the loan, based on the loan file, appraisal report and relevant documents, decides to lend or not to lend. The approval authority belongs to the Director (Deputy Director) of the Transaction Office, the Director (Deputy Director) of the Branch, the General Director (Deputy General Director), the Members' Council.

- After agreeing to grant credit, the Bank and the customer will negotiate the terms of the loan term, payment method, interest rate, fee, loan guarantee terms and other issues.

Stage 2: Completing the profile

After the loan is approved, the Bank and the customer complete the legal procedures related to the loan such as signing the contracts, notarizing the mortgage contract and registering the secured transaction according to the regulations. provisions of law.

Stage 3: Disbursement

After completing the application procedures, disbursement will be made according to the actual capital needs of the customer. Loan managers must closely monitor the disbursement process so that loan funds are used for the right purposes and effectively.

Stage 4: Supervision after credit granting

After disbursement, loan managers must regularly check and monitor the loan through data, signed terms, condition of collateral, solvency, and evaluate the effectiveness of the loan. use capital to ensure the repayment ability of customers or promptly catch signs affecting the ability to pay debts, collateral assets...

Stage 5: Dealing with problem debt

When realizing that a loan has problems related to using capital for improper purposes, repayment sources, collateral, etc., it must be closely monitored to take timely measures to support customers or try to recover debts. .

Stage 6: Dealing with bad debts

In the credit business, risk is inevitable. When a bad debt occurs, it must be handled to recover the debt and minimize possible losses. Handling measures in this period can be by legal measures such as lawsuits, property handling, debt trading or use of other measures such as debt restructuring, debt freezing, debt forgiveness, etc.

According to the credit process, customer credit scoring is done during the credit appraisal stage and this is one of the bases for credit approval decisions. Scoring is done on the IPCAS system and will also be used as a basis for debt classification if the loan is disbursed, thereby determining the level of risk provisioning and risk management. Scoring is based on the results of information collection from the customer and the credit officer will re-evaluate the information selected by the customer. The scoring is based on sets of criteria according to the type of borrowers classified into individuals, farmer households, business households, old/new customers, economic organizations, financial institutions/financial leasing, securities companies, commercial banks.

However, due to the limitations of the topic as presented, the thesis will only highlight and analyze the scoring process for individual and corporate customers, compared with other commercial banks.

2.3. Credit rating system of Agribank

2.3.1. Ranking method

Agribank's credit rating system is built with a combination of statistical methods and expert methods. The scoring of customers by assessing financial criteria and non-financial indicators by weight. Based on the scoring results to rank customers.

2.3.2. Rating object

- Customers are economic organizations: Customers of economic organizations are applied on the rating system including all types of businesses established under the law on enterprises, cooperatives, unions of cooperatives established. under the Law on Cooperatives and economic organizations established under the Investment Law, except for customers Financial Institutions.

- Customers are financial institutions: Financial institutions applied on the rating system include banks, financial companies, finance leasing companies, securities companies.

- Customers are individuals/households: Customers are Individuals, Farm households, Households

business.

Within the scope of the topic, the author is limited to analyzing two objects: Business

professional and personal. These are the two main subjects in Agribank's credit activities.

2.3.3. Working principle

Agribank's credit rating system operates on Agribank's system management software called IPCAS, on the mechanism of information exchange for scoring, customer ratings, debt classification and provisioning for credit risks. use.

The information that will link and support the grading includes: Personal information; History of transactions with the bank about deposits, payments and other services, past repayment of principal and interest, number of debt restructurings... This information will be stored on the system and automatically show results when conducting grading, reduce the amount of work as well as create accuracy in the grading process.

From the customer scoring results, the system will automatically determine the final debt classification results and make provision for risks, supporting decision making and implementing customer policies.

2.3.4. Scoring process

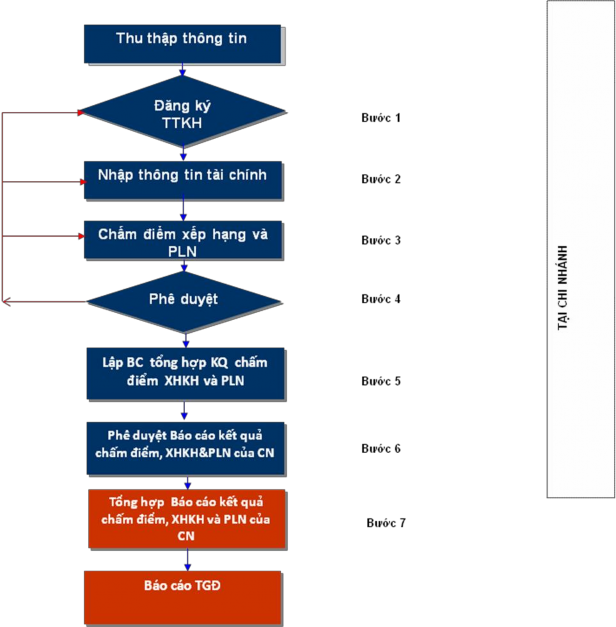

The customer scoring process at Agribank includes the following steps as shown in the diagram in Figure 2.3:

Source: Agribank

Figure 2.3: Agribank's customer scoring process

In the above customer scoring process, at the lending branch, steps from 1 to 6 will be performed to get the scoring results at the branch, while the 7th step will be compiled by the Bank's Headquarters for data. the entire Agribank system.

Agribank ranks customers into 10 classes with risks from low to high and these grades will correspond to 5 debt groups when applied to classify loans.

Table 2.1: Ranking and classification of debt of Agribank | ||

Points earned | Rating | Group debt |

90-100 | AAA | first |

80-<90 | AA | |

73-<80 | A | |

70-<73 | BBB | 2 |

63-<70 | BB | |

60-<63 | REMOVE | 3 |

56-<60 | CCC | |

53-<56 | CC | |

44-<53 | OLD | 4 |

< 44 | EASY | 5 |

Source: Agribank | ||

Currently, Agribank is applying scoring to all new customers at the time of applying for credit as a basis for making credit granting decisions and applying accompanying policies such as interest rate incentives, level of guarantee. Security of assets... Quarterly, all customers with outstanding loans will be graded as a basis for classifying debts and making provision for risks according to regulations.

2.3.4.1. Individual customers.

For individual customers, the basis for scoring is based on three criteria: personal identity, borrower's ability to repay and collateral. In which the criteria of identity and ability to repay debt are mandatory criteria with a ratio of 60:40 points. Also consider more criteria on assets to assess the risk level of the bank when deciding to grant credit.

The criteria on the borrower's identity is the most important and includes 12 sub-criteria such as age, education level, housing status, family structure, number of dependents... Purpose of identification the borrower's age will help assess the influence of age on the borrower such as risk of life, illness, years of experience in the profession....; and the determination of housing status will assess the stability of the borrower's own residence, if the borrower has a house of his own, it will have higher stability than someone who is renting or living in the same house. with parents… Thus, in addition to 10 criteria of identity similar to E&Y, Agribank scores 2 more criteria about the personal status of family members (only considering father, mother, spouse, etc.) the borrower's children) and the borrower's relationship with family members because these indicators may indirectly affect the working psychology and the borrower's ability to repay. This is the advantage of Agribank's credit system because it has been absorbed and supplemented to suit the reality in Vietnam.

The criteria for the borrower's ability to repay debt are based on four criteria: a stable monthly net income, the ratio between the source of debt repayment and the amount to be paid in the period (principal + interest) according to the debt repayment plan, the situation of repayment of principal and interest with Agribank, services used at Agribank currently. Compared with E&Y's 7 debt repayment indicators, Agribank has only built 4 indicators because it has combined the criteria for calculating principal repayment and interest payment into the ratio of principal and interest payment with Agribank. As for the indicator of Outstanding debt/Net Asset, this is a difficult criterion to determine, so Agribank did not include it for the sake of convenience in scoring. As for the indicator of solvency assessment, Agrbank did not include it in the credit society system because this is an important criterion, so it will be separated in the appraisal work. If there are sufficient grounds to evaluate the debt repayment ability of customers, depending on each stage of credit granting activities, banks will have different measures. If the bank is in the appraisal stage to decide to grant credit, the bank will only grant credit if it assesses that the customer has the ability to repay the loan. Also gave credit and rated

If there is a problem with the customer's debt repayment ability, the bank will extend the debt, decide to recover the debt or move to a higher debt group as prescribed.

Details of the criteria on the customer's identity, debt repayment ability, and assessment methods are referred to in the Appendix.

After scoring the personal criteria and ability to repay, customers will be rated based on the actual score received into 10 groups from AAA to D.

For individual customers, in addition to credit rating, Agribank also considers collateral to summarize risk levels and make credit granting decisions.

The scoring of collateral is based on 4 criteria: Type of collateral, Nature of ownership of collateral, Value of collateral/proposed loan portion to be secured by that property, trend of decreasing value of collateral in the last 12 months according to CBTD's assessment. Scoring results are divided into 3 groups:

Table 2.2: Scoreboard of collateral | ||

Point | Classification | Evaluate |

>= 22 | A | Strong |

12 - 21 | REMOVE | Medium |

< 12 | OLD | Short |

Source: Agribank | ||

The summary of risk ratings will be based on credit ratings and collateral ratings.

Table 2.3: Individual customer risk assessment matrix | ||||||||||

Rating rating | AA | AA | A | BBB | BB | REMOVE | CCC | CC | OLD | EASY |

Risk rating Evaluate Collateral | Low risk | Medium risk | High risk | |||||||

A (Strong) | Excellent | Good | Average/Rejected | |||||||

B (Average) | Good | Medium | Refuse | |||||||

C (Low) | Medium | Average/Rejected | ||||||||

No collateral | Medium | Loans according to the policy of the State or guaranteed by a political organization - society | Refuse | |||||||

Source: Agribank | ||||||||||

2.3.4.2. Corporate customers

For corporate customers, ranking criteria include financial and non-financial criteria. In which, financial indicators are based on quarterly financial statements, latest year's financial statements and information related to business activities of customers, while non-financial indicators are scored based on evaluation. of loan appraisal and management staff based on information collected from the customer's past credit relationship process, business environment, management level of business leaders...

The set of criteria for scoring corporate customers is built on the basis of 34 industries in 10 predefined groups of industries in accordance with the characteristics of Agribank's operations and credit structure.

Industry groups include:

For each industry, there is a set of criteria for scoring corporate customers.

- Each set of indicators includes 60 indicators: 14 financial indicators and 46 non-financial indicators.

- Scale of financial indicators (quarterly/yearly): 100

- Scale of non-financial indicators: 100

KHI's m-point | = | Score of financial indicators five | x | Weight of the financial part of the year | + | Score quarterly financial indicators | x | Weight of the financial quarter | + | Score of non-talented indicators main | x | Non-financial part weight H |

In which, the weight of the financial and non-financial parts depends on whether the customer's quarterly financial statements and annual financial statements are audited or not.

Table 2.4: Score weight in corporate customer scoring | ||||||||

Targets | Financial statements of the business | |||||||

First quarter | Second quarter | Third quarter | Quarter IV | |||||

Checked maths | Not check maths | Checked maths | Not check maths | Checked maths | Not check maths | Checked maths | Not check maths | |

Financial targets main year | 35% | 30% | 28% | 23% | 23% | 18% | 35% | 30% |

Financial targets Precious | 0% | 0% | ten% | ten% | 15% | 15% | 0% | 0% |

Targets nonfinancial | 65% | 65% | 62% | 62% | 62% | 62% | 65% | 65% |

(Source: Agribank) | ||||||||

The corporate customer scoring process also includes 8 steps, which detail each step: