DISSERTATION:

Promotional communication solution for Success card of Bank for Agriculture and Rural Development of Vietnam in Da Nang city

PREFACE

Research problem:

Most commercial banks have two main business services, which are Wholesale Banking and Retail Banking. Both of these services are very important for the growth and development of a commercial bank. If the wholesale banking service can bring a large amount of operating revenue and income, the retail banking service can bring a stable and sustainable source of income. In addition, these two services also complement each other for development.

Retail Banking is known as a direct bridge connecting customers with the Bank. The card itself is a retail bank, since its inception, it has marked the explosion of retail banking services. And is known as an effective non-cash payment method, with outstanding features such as fast, convenient, efficient, cost-saving. Cards have really created a revolution in Banking technology.

Research purposes:

“Application of technology and development of goods and services” – That is the second biggest goal that the business development project in the urban environment that Bank for Agriculture and Rural Development aims at. The expansion of service business, the development of retail banking, and the modernization of banking operations are assigned the main “responsibility” to branches in urban areas by the Bank for Agriculture and Rural Development. .

Maybe you are interested!

-

Promotional communication solution for Success card of Bank for Agriculture and Rural Development - 2

Promotional communication solution for Success card of Bank for Agriculture and Rural Development - 2 -

Brief History Of Formation And Development Of Hai Chau Bank For Agriculture And Rural Development .

Brief History Of Formation And Development Of Hai Chau Bank For Agriculture And Rural Development . -

Functions And Tasks Of Hai Chau Bank For Agriculture And Rural Development.

Functions And Tasks Of Hai Chau Bank For Agriculture And Rural Development. -

The Position Of Bank For Agriculture And Rural Development Of Vietnam In The Market Compared To Competitors.

The Position Of Bank For Agriculture And Rural Development Of Vietnam In The Market Compared To Competitors. -

Promotional communication solution for Success card of Bank for Agriculture and Rural Development - 6

Promotional communication solution for Success card of Bank for Agriculture and Rural Development - 6 -

Promotional communication solution for Success card of Bank for Agriculture and Rural Development - 7

Promotional communication solution for Success card of Bank for Agriculture and Rural Development - 7

Implemented IT projects have supported the transaction process, increasing the competitiveness of the Bank for Agriculture and Rural Development in the city. Prominent in the application of new technology by the Bank for Agriculture and Rural Development in urban areas in recent years is the promotion of non-cash payments through payment cards. Up to now, the number of ATMs installed and put into use in urban areas is 1,268, accounting for 68% of the total number of machines of the Bank for Agriculture and Rural Development currently in operation. Most ATMs are installed at branch offices, large industrial parks, tourist areas, many main streets, many professional universities. In 5 big cities alone, 80% of the total domestic debit cards of the entire system of Bank for Agriculture and Rural Development of Vietnam have been issued.

After 10 years of not granting establishment licenses to any banks, in November 2007, the State Bank of Vietnam (SBV) approved in principle the project of establishing joint stock banks FPT, Bao Viet, Lien Viet and Petroleum Finance. At the end of December 2007, the Council to appraise the license application dossiers of the State Bank of Vietnam met again to review the application documents for the establishment of 5 other joint stock commercial banks.

Under today’s great competitive pressure, banks have been racing each other every inch. As a leading bank in the industry, Bank for Agriculture and Rural Development is also not out of fear of losing market share to other corporations.

In terms of card services, Vietnam Bank for Agriculture and Rural Development is still behind other banks such as Foreign Trade Bank (Vietcombank), Dong A Joint Stock Bank (Dongabank), etc. town.

In order to contribute to the development and increase of the number of domestic debit cards (Success card), and at the same time increase the prestige of the Bank for Agriculture and Rural Development of Vietnam in the future. After learning about the activities and card services of the Bank for Agriculture and Rural Development for a while, I would like to choose the topic: “Solution to promote communication for the Success card of the Agricultural Bank and Rural Development Bank. Rural Development in Vietnam in Da Nang City” as the topic of graduation thesis.

Objectives and tasks of the project

Objective: The thesis is carried out to systematize the theory of promotional communication in a reasonable order. Applying theoretical basis to analyze business activities and reality of promotional activities for ATM card products at Bank for Agriculture and Rural Development of Vietnam. On the basis of reasoning and grasping the business situation as well as the outstanding limitations to offer solutions to overcome and develop in accordance with the business situation of the Bank for Agriculture and Rural Development. Vietnamese villages in the current period.

Tasks: To study the theory of content related to promotional communication. Collect and analyze primary and secondary data to understand the current state of business operations and promotional communication at Bank for Agriculture and Rural Development of Vietnam. Build the bases to come up with solutions for the topic.

Object and scope of the study

Subjects: Focusing on research on promotional activities for ATM card products. Focusing on researching communication tools that are considered the most suitable for card product promotion activities in the current period (period 2008-2009)

Scope of the study: the topic goes into depth analysis to find out the tools that are considered the most suitable for ATM card products of the Bank for Agriculture and Rural Development of Vietnam in this period, combining tools to increase the effectiveness of the entire communication program.

The study mainly uses data collected from 2005-2007, the measures are applied for the period 2008-2009 and adjusted to suit the next period.

Research Methods

The topic is researched with the application of many methods, including theoretical, statistical, predictive and actual marketing research methods through direct interview research by questionnaire. Besides, the topic also uses SPSS processing techniques, charting techniques on Excel software.

Related theory used

Theory of marketing research,

Theory of promotional communication,

The theory of the operation of commercial banks,

Theory of consumer behavior…

Structure of the topic

In addition to the introduction and conclusion, the thesis consists of three parts:

PART I: Theoretical basis of Banking Marketing and promotional communication.

PART II: Analysis of business operations and the current status of the card market in general and the Success card of the Bank for Agriculture and Rural Development.

PART III: Solution for communication promotion for Success card of Bank for Agriculture and Rural Development applied in the period 2008-2009.

PART I: THEORETICAL BASIS

I. SOME GENERAL ISSUES ABOUT BANK MARKETING.

1. Concepts.

Banking marketing is a type of specialized marketing formed on the basis of applying the content, principles and techniques of modern marketing to banking activities, which can be understood as follows:

“Banking marketing is the whole process of organizing and managing a bank, from discovering the needs of selected customers and satisfying their needs with a system of policies and measures that are more effective with competitors in order to achieve the expected profit target”.

2 Features of Bank Marketing.

2.1 Bank marketing is a type of financial services marketing.

Intangibility: is the main feature that distinguishes banking products from other physical products, banking customers often face difficulties in making decisions about using products. They can only determine product quality during and after use. From this feature, in banking business must rely on trust. Therefore, banking marketing must create the image and reputation of the bank and strengthen the trust of customers by improving service quality and increasing the utility of products.

Inseparability: the process of providing and consuming products and services occurs simultaneously and with the participation of customers. The supply of banking products usually follows a certain process, no work in progress, no inventory. This feature requires marketing banks to have close coordination between departments in providing products and determining customer needs.

Unstable and difficult to determine: banking products and services are composed of many factors: staff qualifications, technology, time, customers… these factors are often volatile, because so it is difficult to determine exactly.

2.2 Banking marketing activities need to take special measures to control the situation in order to limit risks.

A bank is a business entity in the capital market. Commercial banks all trade in the right to use capital and provide banking services to the market in order to seek optimal profits. With these characteristics, the bank’s business is likely to face many risks. The types of risks that often occur for banks are: credit risk, interest rate risk, market risk, foreign exchange risk, etc.

2.3 Banking marketing activities are diverse and complex.

Banking technology is increasingly diversified by performing many complex and highly technical tasks. Commercial banks have relationships with many customers and with many different types of needs. Therefore, banking marketing activities are also very diverse and complex. It has to deal with the vertical and horizontal relationships that take place in the business process, governed by changing conditions, the business environment.

2.4 Banking marketing is constantly doing better and having more unique new products to satisfy the increasing needs of customers.

The characteristics of banking products are that there is no inventory, the production process takes place at the same time as the consumption process, with the simultaneous participation of 3 factors:

Customers – directly involved in the production and consumption of the bank’s products. Because they are the ones who propose needs, use and evaluate products. Their evaluation is not through sensory perception but satisfaction, satisfaction in utility, safety and effectiveness of the products they use. On the other hand, it is customers who have created conditions to develop new products, improve labor productivity, save costs and increase profits for the bank.

Bankers – play an important role because they directly provide products to customers. They are the ones who decide the quality of the products and create the image of the bank. In fact, the attitude and qualifications of bank staff have become an important factor for both customers’ choice of a bank.

Equipment – plays a fundamental role in banking business. The mechanical facilities, techniques, headquarters… they have created conditions to perform banking operations better. At the same time, they also create a superficial image of the outside that attracts attention and attracts customers.

2.5 Bank marketing must pay attention to legal factors to ensure effective business operations.

Commercial banks operate in a separate market different from other economic sectors. The operation of the bank must comply with the regulations on management of special goods – currency. Commercial banks are subject to the strict management of the State in the corridor of the law in general and of the Law on Banking in particular. Therefore, bank marketers must pay attention to legal factors to ensure effective business operations within the legal framework.

II THEORETICAL BASIS OF ADVERTISING COMMUNICATIONS.

Promotional communication is one of the important techniques of bank marketing activities because promotional communication is not only a tool of banking business but also a “bridge” for supply and demand, consumers to meet customers. selling, the customer meets the bank in the market.

1. Communication process.

1.1 Concepts.

Communication process is the process of conveying information of a business to consumers so that they know the features of products, services, programs of enterprises, benefits that businesses can bring to customers. through products or services. For this to be effective, businesses need a marketing communication system.

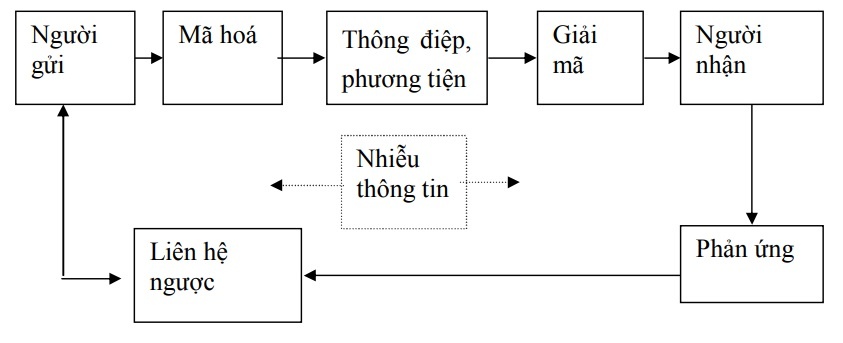

Figure 1.1: Marketing communication system

The marketing communication mix, also known as the promotion mix, includes the following five main tools:

Advertising: (Advertising) is any form of promotion of product or service ideas by a person (some organization that wants to advertise and pay for it).

Direct Marketing is the use of mail, telephone and other indirect communication tools to inform existing and potential customers or to ask for a response.

Sales Promotions Short-term rewards to encourage trial or purchase of a product or service.

Public relations includes various programs designed to promote or protect the image of a business or certain products and services.

Direct selling: (personal selling) is a form of direct communication with prospective customers for the purpose of selling.

Figure 1.2: Model of 5 communication tools

The communication process in marketing consists of nine elements that are divided into three main groups:

Figure 1.3: Elements in the communication process

The communication model says that in order for the sender to provide information to the receiver, there must be a process of encoding and forming a message for the ideas and information to be conveyed and expressed through the media. But whether the receiver correctly decodes that message no longer depends on the impact of the communication environment, the ability of the medium or the receiver’s cognitive level. For effective communication, there are a few principles that need to be met:

Transmitter (sender): the source must be reliable, objective, highly informative, appropriate to the recipient’s interests, circumstances and qualifications.

Encrypted message: easy to remember, headlines that attract attention or recall the product.

Communicating the message: it is necessary to choose the means to deliver the message that is suitable for the characteristics of the product, service and customer audience.

1.2. Factors affecting the structure of the promotional communication strategy.

In order to come up with a suitable promotional communication strategy, there is not too much difference in using the tools or setting the right communication goals, we need to analyze the factors affecting the strategy. company communications. These factors include product market type, chosen communication strategy, product life cycle stage.

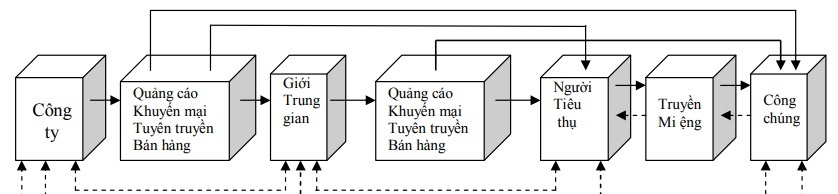

Product market type: Depending on the characteristics of each type of market, whether it is consumer goods or means of production, an appropriate communication system can be used.

Push Strategies: A company’s marketing efforts are directed at the consumer intermediaries to induce them to order, sell products, and market to end consumers.

Pull strategy: is a marketing method aimed at end consumers to push them to make a buying decision, thereby stimulating intermediaries to buy.

Product life cycle stage: each stage of the product life cycle will require a different level of communication tools to achieve its goals. The relationship between the product life cycle, communication goals, and communication tools can be represented on the following graph:

2. Content of promotional communication.

2.1. Identify the target audience.

The entire communication process will not be effective even if it costs a great deal if it is not correctly formatted in the first place. Therefore, this is the first and important step of a communication program. The target audience may include: potential customers, current users of the product, decision makers or influencers on purchasing choices. They can be individuals, organizations, intermediaries, etc. The target public will have an important influence on all future communicators’ decisions about decisions: what to say, how to say, to say. where and to whom.

Determining the target audience allows businesses to analyze the image of the company’s products in the minds of customers such as the level of awareness, understanding or preference of the product. From there, it is possible to define specific communication goals.

2.2. Define communication goals.

Media objectives refer to what the company seeks to accomplish in a communications program. It is often stated clearly in the message or what the communication outcome will be.