Another type is a student card that can be deposited/withdrawn. This is considered as a new breakthrough in the Vietnamese card market and has very high practical significance.

This affiliate card fully integrates the features of the DongA Multi-Purpose Payment Card, and applies magnetic card technology to student management such as: Management of access to the library, access to the computer room, payment. tuition fees, student scholarships via card, ..

and a number of other applications suitable for the most preeminent features of current magnetic card technology.

c. ATM card Bank for Agriculture and Rural Development of Vietnam – Agribank .

Card business development is an objective necessity of the global linkage trend; diversifying services and modernizing banking technology for banks in the process of integration into the region and the world, including Vietnam Bank for Agriculture and Rural Development.

NHNo has an extensive branch network with more than 2,000 branches and nearly 30,000 bank staff. In addition, NHNo has established agency relationships with 850 banks in 90 countries. This is a favorable condition to meet the needs of domestic and international card users.

Compared with other banks, Bank for Agriculture and Rural Development of Vietnam entered the Vietnamese card market later and is a “later”.

After 4 years of participating in the card market, the bank has issued more than 1.5 million cards, accounting for 17% of the card market share among nearly 40 banks participating in card activities in Vietnam. This bank has a relatively wide acceptance network, including 1,200 ATMs and thousands of POS terminals, successfully deploying pay-by-phone service with those two other mobile networks. are Vinaphone and Viettel Mobile.

7.What do people understand about this product.

The utility of a bank card is to use it to pay for goods and services instead of using cash, but over 70% of customer transactions on ATMs today are only for withdrawing money. Banks are currently implementing payment for services and goods by card such as paying insurance premiums, electricity bills, landline phone charges, and mobile phone charges.

However, customers using bank cards to pay for these services are only about 30% of the total transactions.

+ Those who like it, those who don’t.

The transfer of salary through the account helps many people when they have a need to withdraw to spend and get used to banking services. However, when the salary is transferred to the account, it takes about 1-3 days to have cash in hand, so when there is a need to spend right after the company pays the salary, it is really inconvenient for those who receive the salary through the bank. card.

+ Not used to shopping with cards.

Along with the development of the ATM system, banks are also racing to install card machines in shopping malls, restaurants, and hotels. However, although the number of points of acceptance (POS) has increased rapidly in recent times. Recently, payment sales through this system are still very sluggish.

Data from Vietcombank in Ho Chi Minh City shows that in the past year, the revenue of withdrawing money from ATMs is up to 1,000 billion VND/month, while the payment through card-accepting points is only about 5 billion VND/month. One of the reasons why most consumers are not interested in using cards in daily payments is that the points of installation of POS machines are uneven, where there are no places. This leads to the mentality of many people that the most secure thing when going out on the street is still having a wallet (face) in the pocket.

One of the reasons people do not pay by card is because the utility of bank cards is not high.

8. Problems still exist.

From the above situation, a number of observations can be drawn.

Firstly, commercial banks only pay attention to the number of cards and card size. In order to compete to attract customers, many commercial banks offer no cards to customers, that is, no card issuance fees, but the cost of producing card blanks and other related costs is at least 30,000 VND/card. However, card service quality is not properly concerned. Even issuing free cards to customers but they use it or not, commercial banks do not need to know.

Second, the level and quality of card services of Vietnamese commercial banks are lagging behind the requirements of reality and lagging behind regional and international standards. Through the process of propaganda, promotion, persuasion of customers, etc., now a large number of businesses, agencies, organizations and officials, workers, and even students have realized the utility of card service, they willing to accept this service. But the real utility of the ATM card service is not guaranteed by commercial banks. Banks are now also having to calculate the cost of investing in ATMs, POS machines (card machines). With a local investment, banks have to spend a lot of money, because the price of each ATM is about 20,000-30,000 USD, the price of POS machine is about 800-900 USD. Meanwhile, if banks cooperate, the number of card acceptance points will increase exponentially.Because the points accepting payment of bank cards are still limited, the inadequacy when choosing a method of paying for goods and services by bank card has made withdrawal from ATMs popular.

Third, the type of ATM machine, card service technology of commercial banks imported or purchased from different banks, from different countries, different generations of machines, so there is a problem when connecting. , prolonged and inadequate quality that the customer is the first to bear. Not to mention many cards, but the machine is too few.

On average, there are 1,750 people crammed together to use an ATM, a very small percentage, not to mention that the distribution of the ATM system is uneven in localities as well as in areas within the same area. local.

Fourth, there has not been a synchronous organization of stages in card services. That is, not paying attention to professional training for operators, maintenance, maintenance and other services related to ATM services.

Fifth, Vietnamese commercial banks still only pay attention to credit activities. Because this business field brings 95%-97% of income for many commercial banks. Meanwhile, the ATM card service has not yet collected card issuance fees and has not yet collected fees for cash withdrawal at ATMs, which new commercial banks expect to temporarily use demand deposit balances with low interest rates. cardholder’s account to lend only.

For commercial banks, the balance on the card account is not much and often fluctuates, so the card business is of course a loss. Therefore, small and medium-sized commercial banks, like most joint-stock commercial banks , develop new card services with a “movement” nature, not for business efficiency purposes.

Even for state-owned commercial banks, perhaps only the Foreign Trade Bank is profitable in card business, while other state-owned commercial banks have to wait at least 2-3 years before they can. revenue to cover expenses, currently at a loss. Therefore, the quality of card services is not interested by commercial banks.

Especially, when a series of countries and territories in the region such as Malaysia, Taiwan, Japan, Singapore, China… are actively switching to EMV-standard smart cards with higher security. Card fraudsters are tending to move their activities to Vietnam, because the vast majority of Vietnamese people are using magnetic cards – cards that are easily counterfeited. Faced with this risk, many Vietnamese banks still seem to be “as calm as ever”. There have also been a number of lawsuits for losing money from ATM cards.

Maybe in some cases, the fault is on the customer’s side, but the solutions of many banks are often not “reasonable”. In most of these lawsuits, users lose because the bank is always “holding the handle”. The work of equipping customers with card security knowledge seems to be done in a loose way and lacks proper attention. According to the State Bank, as of November 2007, 30 banks with card payment services have issued more than 8.28 million cards with 130 different brands, of which domestic cards account for 93.87%. There are about 4,280 ATMs nationwide and 22,959 card payment machines. Currently, there are card alliances formed such as Smartlink Company (25 members), East Asia Card Alliance (5 members)… PART III: PROMOTION COMMUNICATION SOLUTIONS FOR SUCCESS CARD APPLICATION IN THE PERIOD 2008- 2009.

Through the process of analyzing and evaluating the current status of communication activities as well as the actual situation related to the bank’s business activities, the card product is currently entering the development stage. profit from this activity but the future is very promising. There are many substitute products on the market with high similarities, the competition environment is extremely fierce. Therefore, in this period, it is necessary to carry out promotional communication programs for card products in order to persuade to change awareness and remind consumers, to increase the rate of product preference among those who know it. So how to build these programs effectively is the solution that this topic focuses on implementing.

I.Determine target customers.

The demand for cards today is very great, most banks rely on relationships to promote the sale of ATM card services. On the other hand, due to the incomplete infrastructure, it causes a number of problems (such as: being swallowed a card while performing the correct withdrawal operations, ATM runs out of money, etc.), and the psychology of liking to use it. Cash makes consumers hesitant to buy or try card products. As such, there is still a large number of untapped consumers. With the advantage of being the leading bank in the industry and having more than 2,200 branches and transaction points distributed nationwide with nearly 30,000 employees, the bank’s target customers in the past few years. Currently, the subjects are often traveling, working in remote provinces, students, and couples.

I. Communication goals.

On the basis of the bank’s general business strategy, the communication objectives are:

– Build a unique image of the Success card that has a clear place in the mind of the target customer.

– Provide information about the superior features of the Success card, emphasizing the convenience of the card when away from home, saving time and money.

– Erase the idea of a rigid state-owned bank from everyone’s mind.

II. Promotional communication messages.

The more the message shows the ability to satisfy the desires of the consumer, the more persuasive it is. Therefore, the communication message of the Success card, in addition to showing its convenience, speed, savings and security, must also emphasize the role of this smart card, with the success of the Success card. in hand, customers can use it anytime, anywhere thanks to a nationwide network of branches and ATMs.

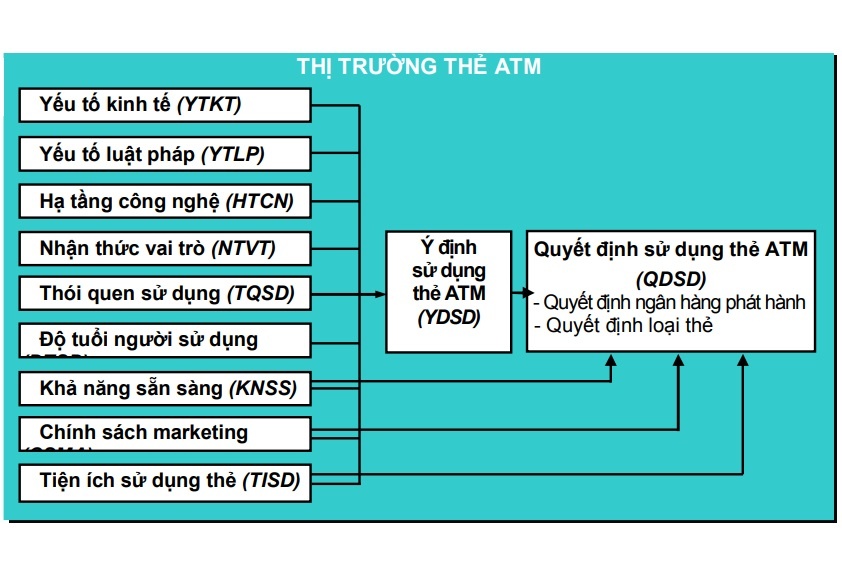

Figure 1.5: Model of factors affecting intention and decision to use ATM card

III. Budget for communication and promotion.

Promotional communication budgets are determined using a percentage of predicted revenue method combined with a goal and mission-based approach. Because to achieve the goal, it is necessary to spend a large enough budget, but if it is too large than the company’s ability, it will not be possible. For example, communication goals can bring short-term or long-term results, but we determine the budget according to the year’s planned revenue will not be reasonable but must be based on the accumulation of many years to achieve. long-term goals. The promotion budget of the Bank for Agriculture and Rural Development is limited to 0.55 0.75% of the previous year’s revenue, which is reasonable and feasible. The specific budget for each tool is: advertising 45%, Direct selling and promotion 15% each, PR activities 15%, the remaining 10% is for Direct Marketing.

IV. Communication tools.

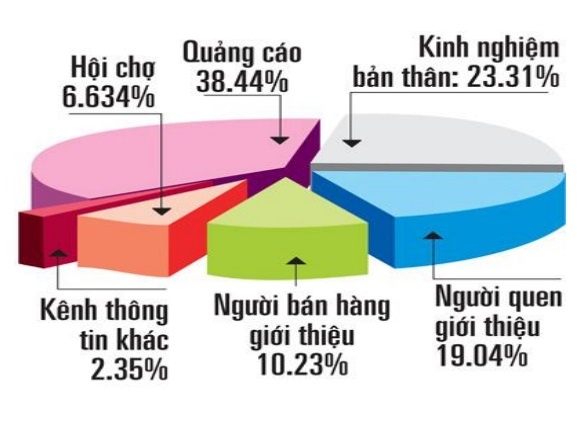

Figure 1.6: Information channels influence consumer decisions.

Source: http://www. sgtt.com. vn 1 Advertising.

1.1 Define advertising objectives

The advertising strategy includes the following objectives:

– Provide information about the utility of the card, indicating the role of the smart card in modern society.

– Create a public-friendly image.

– Convince the public to come to the Success card.

1.2 Advertising message

With the current situation when the card is a hot issue and there is a lot of unfavorable information for banks, the advertisements must quickly provide information to soothe and remind about the benefits brought to customers. goods when using the card.

Usually people watch TV or read newspapers for information and entertainment, but the information people are looking for is not advertising, on the contrary they are very allergic to advertising.. “Many studies have shown that that, usually, people really only pay attention in the first 5 seconds. If after that 5 seconds, the ad is not really attractive, they will switch to another channel.” Therefore, the advertisement must be attractive, attract the attention and curiosity of the viewers from the beginning, illustrate the product images, then emphasize the message and the bank’s name clearly. Create an advertising campaign “love.

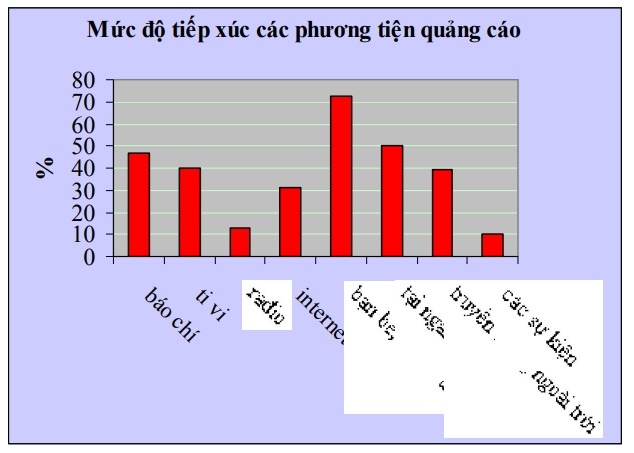

1.3 Selection of advertising media

The target audience of advertising is the potential end consumers or people who influence the buying decision. Therefore, advertising must appear on mediums with many people exposed. The level of media exposure is shown on the following chart:

Figure 1.7:. The level of media exposure is shown on the following chart:

So the suitable medium for advertising Success card products is television, newspapers, at banks and outdoor advertising.

a) Newspaper Although it is a classic type of advertising, advertising in newspapers is still applied by many businesses. Most studies show that 80% of consumers do not read the details when reading the newspaper, but only read the main and prominent information. Thus, advertising in newspapers-magazines must pay attention to the most prominent but complete information, including card name, issuing bank, main advantages and benefits that Success card brings to users. .

The advantage of this medium is that it is very flexible, timely covering the market and highly reliable, has enough space to present and express its information to customers. Therefore, this advertising medium will be used for short promotional campaigns, suitable for activities that require lengthy explanations and activities that urge immediate action. There should be articles about cards that focus on the benefits of using ATM cards, in addition to providing a vision for a bright future of the card market.

Select type of newspaper Thanh Nien newspaper: This is a newspaper that is interested and read by the public because of its rich content and beautiful presentation. The target audience is the vast majority of people, mainly young people and middle-aged people who are married.

Tuoi Tre Newspaper: This is also a newspaper with very attractive content. In particular, the Advertising page is presented very scientifically and the audience is usually young people, who always love to explore and find new things and at the same time are one of the subjects that the bank is looking for. towards. Despite having a wide coverage, the ability to reach customers is very low, so it is often used in combination with other media channels, the number of releases is about 470,000 copies/day.

(Source: http://quangcao.tuoitre.com.vn/ndquangcao/banggia/new/banggia.htm) Thus, for information about the advertising program, you should choose one of these two newspapers because in general These two papers have the same number of readers. In some large programs, advertising in both newspapers will be more effective.

There are also some popular online newspapers such as Tuoi Tre, Youth, Vnexpress, Vietnamnet, Dan Tri, 24H. Tuoi Tre and Thanh Nien are two large and reputable newspapers, and the electronic version is also very successful, with many readers.

VnExpress and VietnamNet do not have paper newspapers, but are the first and most famous electronic newspapers in Vietnam. Dan Tri and 24h just appeared recently, but it seems to be quite successful (based on the number of banners as dense as other sites).

(Source: http://sonnymotives.com/archives/cac-bao-dien-tu-viet-nam-co-vi-pham-banquyen-phan-1) … was also selected for this ad campaign.

Table 7: Newspaper advertising plan.

| Number | Type of newspaper | Type of advertising | Unit | Total | Unit price (million VND) | Cash (million VND) |

| 1 | Youth | Posts | Posts | 4 | 10 | 40 |

| News | believe | 4 | 2 | 8 | ||

| Logo(110x 150) | month | 6 | 0.5 | 3 | ||

| 2 | Youth | Online advertising homepage | week | 4 | 15 | 150 |

| Color photo page | time | 4 | 17 | 68 | ||

| 3 | Vnexpress | Posted by | Posts | 3 | 1.2 | 3.6 |

| News | believe | 3 | 0.5 | 1.5 | ||

| 4 | People | Posts | Posts | 2 | first | 2 |

| total | 276.1 |

Maybe you are interested!

-

Promotional communication solution for Success card of Bank for Agriculture and Rural Development - 1

Promotional communication solution for Success card of Bank for Agriculture and Rural Development - 1 -

Promotional communication solution for Success card of Bank for Agriculture and Rural Development - 2

Promotional communication solution for Success card of Bank for Agriculture and Rural Development - 2 -

Brief History Of Formation And Development Of Hai Chau Bank For Agriculture And Rural Development .

Brief History Of Formation And Development Of Hai Chau Bank For Agriculture And Rural Development . -

Functions And Tasks Of Hai Chau Bank For Agriculture And Rural Development.

Functions And Tasks Of Hai Chau Bank For Agriculture And Rural Development. -

The Position Of Bank For Agriculture And Rural Development Of Vietnam In The Market Compared To Competitors.

The Position Of Bank For Agriculture And Rural Development Of Vietnam In The Market Compared To Competitors. -

Promotional communication solution for Success card of Bank for Agriculture and Rural Development - 7

Promotional communication solution for Success card of Bank for Agriculture and Rural Development - 7

b) Television Select a TV channel.

Advertising on channels with nationwide coverage such as VTV1, VTV3, digital television stations… VTV1 is a general information channel with contents about hot domestic socio-economic and political information. and international.

The sports, entertainment and economic information channel of Vietnam Television VTV3 is the most popular channel today, serving the entertainment needs of the audience, creating new playgrounds such as Sunday at home, We are soldiers, Who Wants to Be a Millionaire, The Magic Hat, The Road to Olympia, Getting Rich Is Not Difficult….

HTV7 Channel 7 of Ho Chi Minh City Television Station mainly serves the needs of economic information and entertainment. With attractive TV games such as “Together”, “Green Bamboo”, “Sing with the Star”, “Lucky Supermarket”, “Claim – lawsuit”, “Golden Dragon”, “Notes” fun music”, “Everyone wins”, “Pyramid”. Channel 7 also has news, music, and theater programs such as: “News”, “Late stage”, “Friend tunes”.

Disseminating guidelines and policies of the Party and State, the political – economic – social situation at home and abroad are the main contents of Channel 9 of Ho Chi Minh City Television. In addition, Channel 9 spends a fair amount of time on live TV sessions, revolving around social activities, sports, and music. Some outstanding programs of HTV9:

* News: News bulletins are conveyed news, important events of the day.

* Live TV: Political, social and sports programs, activities. * Theater and music Digital technology has officially brought Vietnamese people new achievements in the field of audio-visual with digital television programs. Up to now, the DTH service (digital satellite television of Vietnam Television has hundreds of thousands of subscribers). Meanwhile, the Seminar on experimental results of terrestrial digital television organized by the Ministry of Post and Telematics at the end of 2004 confirmed the superiority of digital television in general and terrestrial digital television in particular. Currently, VTC Digital Television has deployed to produce 5 program channels including: General Entertainment channel VTC1, Movie Channel VTC2, Sports channel VTC3, Fashion channel VTC4, Information Technology channel and TV channel. VTC5 communication.

Broadcast frequency on television will be more frequent than in newspapers, but it should not be too dense during the day. Advertising price in Vietnam is currently about 15-30 million VND for a color page in major newspapers or 30 seconds of advertising on major TV channels.

Table 8: Specific advertising plan on television and digital television.

| Channel | Playtime | Quantity (plays) | Unit price (million VND/30s) | Cash (million VND) | |||

| QUOTE | QII | QIII | QIV | ||||

| VTV3 | ten | 18 | ten | 6 | 44 | 30 | 1,320 |

| VTV1 | 6 | 14 | 8 | 6 | 34 | 20 | 680 |

| Local station | |||||||

| DVTV | 2 | ten | ten | 0 | 20 | 2.5 | 50 |

| HTV7 | 5 | 6 | 6 | 3 | 20 | 3.0 | 60 |

| Digital radio station VTC | 8 | 14 | ten | 4 | 36 | 2.8 | 100.8 |

| total | 2210.8 | ||||||

Table 9: Detailed schedule of advertising plans.

| Quarter I | Second quarter | Third quarter | Quarter IV | ||||||||||

| Month | first | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | ten | 11 | twelfth | |

| Channel | VTV3 | 3 | 3 | 4 | 6 | 6 | 8 | 5 | 3 | 2 | 2 | 2 | 2 |

| VTV1 | 2 | 2 | 2 | 4 | 5 | 5 | 3 | 3 | 2 | 2 | 2 | 2 | |

| DVTV | 0 | 0 | 2 | 4 | 3 | 3 | 4 | 3 | 3 | 0 | 0 | 0 | |

| HTV7 | first | first | 3 | 2 | 2 | 2 | 2 | 2 | 2 | 3 | 0 | 0 | |

| VTC | 2 | 2 | 4 | 4 | 5 | 5 | 4 | 3 | 3 | 2 | 2 | 0 | |

According to this advertising plan, most of the months of the year advertising will be broadcast. This will help the card image to reach the masses and not be blurred despite the advertisements of other banks. . However, the broadcast frequency usually focuses on the second and third quarters and gradually decreases in the first and fourth quarters because of the time of the second and third quarters; People have more free time because they have more holidays. This advertising plan will make it possible to convey information to the target public nationwide regularly and on average twice a week.

c) Outdoor advertising

There are many forms of outdoor advertising, but the most popular is still using billboards or billboards placed in public places, on the roofs and walls of buildings between city centers, highways, and tall buildings. floors, stations, … for effective advertising, advertising billboards should be placed at stops, highlights, and stops on traffic axes in the direction and vision of movement. For this type of advertising, colorful images and colors always catch people’s eyes. One form of outdoor advertising with a high exposure rate is on mobile vehicles with signs mounted on buses and trucks running on roads.

To make a billboard, businesses have to spend about 30,000-80,000 USD/year, which is about 450,000,000 – 1,200,000,000 VND/year. This type of advertising always has a larger demand than supply, due to the increasing demand while outdoor advertising companies have been “planned” in fixed areas.