The Bank’s main activities during this period are to serve businesses and individuals related to the field of Agriculture – Forestry – Fisheries – Seafood (not participating in export).

• In 1991, Agriculture Bank was renamed Bank for Agriculture and Rural Development (SBV) of Vietnam under the decision of the Governor of the State Bank of Vietnam. The branch was also renamed to Bank for Agriculture and Rural Development of Quang Nam Province, Da Nang.

• On April 20, 1991, the Bank of Agriculture and Rural Development of Vietnam established the Transaction Office III of the State Bank of Vietnam in Da Nang City according to Decision No. 66 of the Governor of the State Bank of Vietnam. At this time, in the province, there are 14 branches, cities, districts, towns directly under the State Bank of Agriculture and Rural Development of QNDN province with different functions and tasks.

The branch of the State Bank of Vietnam in Da Nang city (and later called the branch of the State Bank of Vietnam in Hai Chau district) with the task of doing business in the area of Da Nang city and surrounding areas, the main field of activity is agriculture. Karma.

Transaction Office III – SBV in Da Nang with the task of inspecting the observance of guidelines and policies of the State Bank and the State Bank of Vietnam in 11 central provinces, organizing capital regulation in the region.

– On October 19, 1992, the State Bank of Vietnam decided to merge the branch of the State Bank of Vietnam in QNDN into the Transaction Office III – the State Bank of Vietnam into the Transaction Office III – the State Bank of Vietnam in Da Nang according to the decision No. 267/QD – Board of Directors.

– On October 15, 1996, the State Bank issued a decision to establish the State Bank of Vietnam on the basis of the former State Bank of Vietnam. Therefore, the transaction office – the State Bank of Vietnam in Da Nang changed to the Transaction Office of the State Bank of Vietnam in Da Nang.

– Implement the government’s policy on administrative boundaries of QNDN province, Da city and Quang Nam province. On December 16, 1996, the Bank of Agriculture and Rural Development of Vietnam decided to separate the Transaction Office III – the Bank of Agriculture and Rural Development of Vietnam in Da Nang and the branch of the Bank of Agriculture and Rural Development in Quang Nam province according to Decision No. 515/QD of the General Director of the Bank of Agriculture and Rural Development. Vietnam.

– On March 26, 1999, Bank of Agriculture and Rural Development of Vietnam separated a branch of the Bank of Agriculture and Rural Development of Hai Chau District from Transaction Office III and upgraded it to a branch of the Bank of Agriculture and Rural Development of Da Nang city according to Decision No. 208/QD/HĐQT – 02.

– On October 26, 2001 Transaction Office III – Bank of Agriculture and Rural Development of Vietnam in Da Nang merged with branch of Bank of Agriculture and Rural Development of Da Nang city to become branch of Bank of Agriculture and Rural Development of Da Nang city under Decision 424/QD/HDQT – TCCB of the Chairman of the Board of Directors of the Bank of Agriculture and Rural Development of Vietnam. At the same time, the branch of the State Bank of Agriculture and Rural Development of Da Nang city was formerly a branch of the State Bank of Agriculture and Rural Development of Hai Chau district.

– On September 12, 2007, the Chairman of the Board of Directors of the Bank of Agriculture and Rural Development of Vietnam issued Decision 954/QD/HĐQT – TCCB on the opening of Hai Chau branch of the Bank of Agriculture and Rural Development, which is dependent on the Bank of Agriculture and Rural Development of Vietnam (level 1). .

1. Functions and tasks of Hai Chau Bank for Agriculture and Rural Development.

1.1. Function.

– Directly doing business in the locality in domestic and foreign currency, services as decentralized by the State Bank of Vietnam.

– Organize business operation and internal inspection and audit under the direction of the State Bank of Vietnam.

– Balancing and regulating business capital, distributing income according to regulations of the State Bank of Vietnam.

– Making investments in the form of joint ventures, buying shares in other investment forms with enterprises and economic organizations when permitted by the Agriculture Bank.

– Implement staff organization, training, emulation and commendation as authorized by the Agriculture Bank.

– Perform other assigned tasks.

1.2. Mission:

Hai Chau State Bank for Agriculture and Rural Development is an organization dealing in currency, credit and other services. The regular operation of the bank is to receive deposits from customers, repay and use that money to lend to production and service business households, to domestic and foreign enterprises in the city. street, perform discount operations and act as a means of payment.

In addition to the above activities, it also organizes non-cash payment through payment tools such as payment authorization, collection authorization, etc. to customers quickly, accurately and timely in order to contribute to the regulation of circulation. monetary communication, local economic development.

– Mobilizing capital: receiving demand deposits, term deposits, savings deposits in Vietnam dong or foreign currencies, issuing bonds.

– Lending: Short-term, medium-term and long-term loans in Vietnam dong or foreign currencies to individuals and economic organizations of all sectors and business fields.

– Foreign exchange business: foreign currency trading, international payment and other foreign exchange services according to the foreign exchange management policies of the Government, the State Bank and the Agricultural Bank.

– Business services: cash collection and payment, automatic teller machine services, credit cards, receiving and storing discount valuable papers, receiving loan entrustment and other services approved by the Bank. State and Agricultural Bank allowed.

– Investment entrustment service at home and abroad.

– Contract performance guarantee.

– Import-export finance and international payment.

– Forex trading.

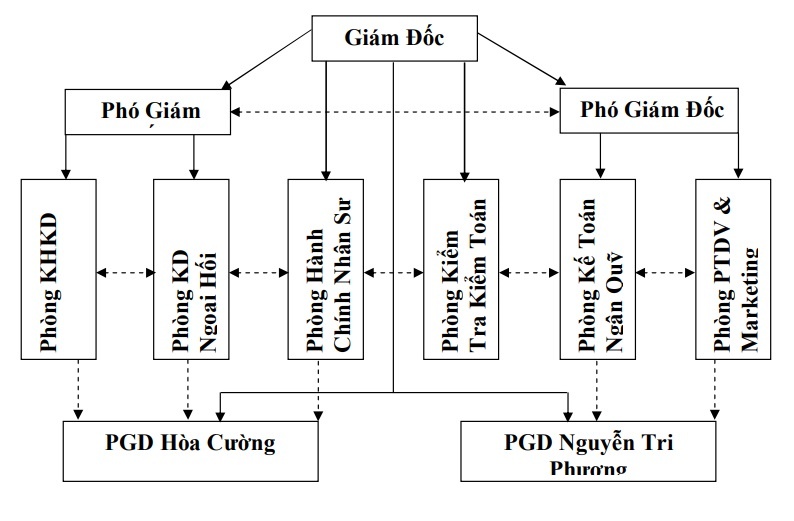

2. Organizational and management apparatus of Hai Chau State Bank of Agriculture and Rural Development.

2.1. Organizational chart:

Hai Chau Branch of the State Bank of Agriculture and Rural Development is a dependent accounting unit of the Bank of Agriculture and Rural Development of Vietnam, with a staff of 60 people. The Board of Directors consists of 3 people, there are 6 departments: Budget Accounting Department, Business Planning Department, Administration Department, Internal Audit Department, Service Development and Marketing Department and 2 online transaction offices. under: Nguyen Tri Phuong Transaction Office and Hoa Cuong Transaction Office.

Functional relations Figure 1.6: Organization chart at Hai Chau branch of 1 1" class="lazyload"> Online relationship > Functional relations Figure 1.6: Organization chart at Hai Chau branch of 1" class="lazyload">

Functional relations Figure 1.6: Organization chart at Hai Chau branch of 1 1" class="lazyload"> Online relationship > Functional relations Figure 1.6: Organization chart at Hai Chau branch of 1" class="lazyload">

_________> Online relationship

—————> Functional relations

Figure 1.6: Organization chart at Hai Chau branch of State Bank of Agriculture and Rural Development.

2.2. Functions of departments.

Functions of the Board of Directors:

– Director in charge of general and in charge of business planning, internal audit and personnel organization. Directing the departments and urging the units to try to complete their tasks.

– Deputy Director in charge of domestic and foreign currency credit and international payment.

– Deputy Director in charge of treasury accounting and Chairman of the Finance Council.

Duties of the rooms:

– Planning and Business Department: Planning to balance capital sources, monitoring the implementation of business plans, lending to economic sectors and performing guarantee operations.

– Foreign Exchange Business Department: International payment, foreign currency trading, import and export finance.

– Internal Audit Department: Supervising, inspecting and controlling all internal professional activities of Hai Chau Branch of State Bank of Agriculture and Rural Development.

– Treasury Accounting Department: Accounting and payment for all business activities and assets of the bank. Fund management: foreign currency, local currency, gold, silver, precious metals, preserving legal records of customers, preserving valuable papers and other papers related to collateral, pledge, real estate perform cash collection and payment transactions. In charge of the field of information technology for all professional activities of the Bank of Agriculture such as: network organization, application of management software, database storage, handling information technology problems. ..

– Administration and Human Resources Department: Manage personnel work, advise leaders on training, staff placement, implementation of salary, social insurance and health insurance according to regulations state regulations.

– Hoa Cuong Transaction Office: Has the function of mobilizing loans and other services, assigned the task of raising capital under the authorization of the Director in the form of savings, promissory notes, bonds, business investment direct business to production and business households in accordance with the charter, regime and industry as prescribed by law.

– Nguyen Tri Phuong Transaction Office: has the function of mobilizing loans and other services, assigned the task of raising capital under the authorization of the Director in the form of savings, promissory notes, bonds, investments. direct business to production and business households in accordance with the charter, regime and industry as prescribed by law.

3. Business performance of Hai Chau branch of Agriculture and Rural Development Bank in 2 years 2006-2007.

It can be said that in the two years 2006-2007, in general, Hai Chau branch of the State Bank of Agriculture and Rural Development has performed well the set targets and tasks, achieved higher growth steps than in previous years, and met the requirements in year, while creating the capacity to gradually solve the old problems and create momentum for future development. This is clearly demonstrated through the better implementation of the capacity to plan strategies and policies, identify appropriate directions, tasks and objectives, and have the right solutions. The guiding policies and guidelines are always issued in a timely, correct and realistic manner, which has the effect of promoting business activities, and the interest rate policy is applied flexibly. Good management of both business plan targets, provisioning and risk treatment…

3.1 Fundraising activities

Capital mobilization is an important activity because banks mobilize idle capital in the economy to supply to places where additional capital is needed for business activities and consumption… Besides, it also contributes to the implementation of capital mobilization activities. the monetary policies of the State Bank in all cases depend on the situation of each specific period.

Table 1: Status of capital sources.

Unit: Million VND

(Source: Report on capital mobilization in 2 years 2006,2007)

From the above table, we can see that the total mobilized capital in 2007 reached 320,464 million VND, an increase of 308,226 million VND compared to 2006 and 12,238 million VND with an increase rate of 4%. Specifically, this increase can be seen in the capital structure as follows:

| TARGETS | YEAR 2006 | 2007 | DIFFERENCE | |

| Level | Ratio (%) | |||

| 1. Source of capital | 308.226 | 320,464 | 12,238 | 4.0 |

| Deposits of credit institutions | 21,050 | 14.420 | -6,630 | -31.5 |

| Deposits of financial institutions | 104.477 | 118,642 | 14.165 | 13.6 |

| Residential | 182,699 | 187.402 | 4,703 | 2.6 |

Maybe you are interested!

-

Promotional communication solution for Success card of Bank for Agriculture and Rural Development - 1

Promotional communication solution for Success card of Bank for Agriculture and Rural Development - 1 -

Promotional communication solution for Success card of Bank for Agriculture and Rural Development - 2

Promotional communication solution for Success card of Bank for Agriculture and Rural Development - 2 -

Brief History Of Formation And Development Of Hai Chau Bank For Agriculture And Rural Development .

Brief History Of Formation And Development Of Hai Chau Bank For Agriculture And Rural Development . -

The Position Of Bank For Agriculture And Rural Development Of Vietnam In The Market Compared To Competitors.

The Position Of Bank For Agriculture And Rural Development Of Vietnam In The Market Compared To Competitors. -

Promotional communication solution for Success card of Bank for Agriculture and Rural Development - 6

Promotional communication solution for Success card of Bank for Agriculture and Rural Development - 6 -

Promotional communication solution for Success card of Bank for Agriculture and Rural Development - 7

Promotional communication solution for Success card of Bank for Agriculture and Rural Development - 7

Deposits with credit institutions: in 2007, deposits of credit institutions were VND 14,420 million, down from VND 21,050 million in 2006 and a decrease of 6,630 with a decrease rate of 31.5%. The result of this decrease is because the characteristics of this type of deposit are for banks to pay each other, so the amount of this deposit is not fixed but can change continuously as long as the credit institutions meet the payment needs. math with each other.

Deposits to financial institutions: From the table, we also see that deposits from financial institutions also contribute a significant part of the total capital, specifically in 2007 reaching 118,642 million VND, an increase compared to 2006, with an increase of 14,165 million VND. with a growth rate of 13.6%. The reason for this increase is that financial institutions in 2007 increased their business activities, so the demand for payment was expanding, so this deposit account was always high to meet their payment needs.

Residential deposits: this is the type of deposit that accounts for a high proportion of the total mobilized capital of the bank in recent years. Specifically, in 2007 it mobilized 187,402 million VND, in 2006 it mobilized 182,699 million VND, an increase of 4,703 million VND with an increase of 2.6%. The above results show that the income of people in this area is increasing, so they have excess cash to deposit in banks for safe and profitable purposes. Besides, it shows that the Bank has effectively exploited residential customers because these are potential customers.

Through the above analysis, it can be seen that this is the result of the process of attracting customers through the mass media, the policy of adjusting interest rates in time with the fluctuations of the domestic and international financial markets. flexibly, allowing customers to withdraw their deposits ahead of time to meet customers’ immediate spending needs, professional service attitude of bank staff…thereby creating trust customers to banks to attract a large number of customers in the economy with the trend of increasingly fierce competition between domestic and foreign banks, and in the market there are many types of investment that bring income. high benefit.