3. Ali Saleh, A. and Khalil, MN. (2013), ‘Customers Adoption of Internet Banking Service: An Empirical Examination of the Theory of Planned Behavior in Yemen’, International Journal of Business and Commerce, số 2, tập 5, tr.44-58.

4. Braja Podder (2005) – ‘Factors Influencing the Adoption and Usage os Internet Banking: A New Zealand Perspective’.

5. Bollen, (1989), KA. Structural equations with latent variables. New York.

6. Cheng, Davis, Andy (2006), ‘Adoption of Internet banking: an empirical study in Hong Kong’, Decis Support Syst, tập 42, số.3, tr.1558-72.

7. Davis F., Bagozzi R., Warshaw P (1992), Extrinsic and intrinsic motivation to use computers in the workplace, Journal of applied social psychology, tr. 1111-1132.

8. Davis, F. D. (1989). “Perceived Usefulness, Perceived Ease of Use, and User Acceptance of Information Technology,” MIS Quarterly (13:3), pp. 319-339.

9. Fishbein, M., and Ajzen, I. (19750 ‘Belief, Attitude, Intentions and Behavior: An Introduction to Theory and Research’.

10. Hair, J.F., Black, W.C., Babin, B.J., Anerson, R.E. & Tatham, R.L. (1998), Multivariate data analysis, 5 (3), 207-219.

11. Honei, Nasim, Z. (2009), ‘Internet banking: An Empirical study of odoption rates among midwest community bank’, Journal of Buisiness and Economics Reseach, tập7, số11, tr.51-72.

12. Howcroft, B., Hamilton, R. And Hewer, P. (2002), ‘Consumer attitude and the usage and adoption of home-based banking in the United Kingdom’, International Journal of Bank Marketing, tập 20, số 3, tr. 111-121.

13. Joseph và cộng sự (2003), ‘Sample size affects the generality of the research results’, Journal of Modelling in Management.

14. Karen, F., William, W., L., and Daniel, E. (2000), ‘Internet Banking: Developments and Prospects’, Office of the Comptroller of the Currency, Economic and Policy Analysis Working, tr.9.

15. Karen, F., William,W., L., and Daniel, E. (2001), ‘Internet banking in the US: landscape, prospects, industry implication’, Impact of new technology on individuals.

16. Kotler và Armstrong (2006). Principals of Marketing - 12 Edition, Prentice Hall, 2006.

17. Malhotra (2010), ‘An analysis of Internet banking offerings and its determinants in India’, Internet Research, Tập 20, số 1, tr. 87-106.

18. Maitlo GM, Kazi ZH, Khaskheley A, Shaikh FM (2014) “Factors that influence the adoption of online banking services in Hyderabad”, International Journal of Economics and Management Sciences.

19. Pew (2003), Convenience is King, Pew Internet and American life project, truy cập:www.pewinternet.org/Report.

20. Pooja, Balwinder, S. (2010), ‘The Impact of Internet Banking on Bank Performance and Risk: The Indian Experience’, Eurasian Journal of Business and Economics, tập 2, số 4, tr. 43-62.

21. Rprrajapakse, (2017) “E-banking: a review of status, implementation, challenges and opportunities “.Department of finance, University of Sri jayewardenepura, shri lanka.

22. S. Arunkumar (2008), ‘A study on attitude and intention towards Internet banking with reference to Malaysian consumers in klang valley region’, The International Journal of Applied Management and Technology, tập 6, số 1.

23. Seif Obeid AL-SHBIEL and Muhannad Akram AHMAD (2016), ‘A Theoretical Discussion of Electronic Banking in Jordan by Integrating Technology Acceptance Model and Theory of Planned Behavior’.

24. Seok-Jae., Ok and Ji-Hyun., Shon (2006), ‘The Determinant of Internet Banking Usage Behavior in Korea: A Comparison of Two Theoretical Models’.

25. Taylor S., Todd P (1995), Understanding information technology usage: A test of competing models, Information system research, tr. 144-176.

26. Thompson và cộng sự (1991), Use the model to predict computer usage, trang 91-93

27. Thulani, D., Tofara, C., and Langton, R. (2009), ‘Adoption and use of internet banking in Zimbabwe: An exploratory study’, Journal of Internet Banking and Commerce, Tập 14, Số 1, tr.1-13.

28. Triandis (1977), “Interpersonal Behavior”, Scientific Research An Academic Publisher, tr.25-48

29. Venkatesh và Davis, (1996), A Model of the Antecedents of Perceived Ease of Use: Development and Test, University of Minnesota.

30. Venkatesh V., Morris M., Davis F. (2003) User acceptance of information technology: Toward a unified view, MIS quarterly:Management information systems, tr.425-478.

31. Vinayagamoorthy, K., (2006), ‘Role of reach of internet banking in India’.

32. Wadie, N. and Mohamed, Z. (2014), ‘Empirical analysis of internet banking adoption Tunisia’, Asian Economic and Financial Review, Tập 4, Số 12, tr.1812-1825.

33. Wang, Y-S., Wang, Y-M., Lin, H.H. and T-I. Tang (2003), ‘Determinants of user acceptance of Internet banking: an empirical study’, International Journal of Service Industry Management, Tập 14, số 5, tr.501-519.

34. Yiu, C., and Edgar G., K., (2007), ‘Factors affecting the adoption of Internet Banking in Hong Kong- implications for the banking sector’, International Journal of Information Management, Tập 27, số 3, tr.336-351

PHỤ LỤC 01

KẾT QUẢ PHÂN TÍCH SPSS

1. Đặc điểm của đối tượng nghiên cứu

Giới tính

Frequency | Percent | Valid Percent | Cumulative Percent | ||

Valid | Nam | 128 | 51.2 | 51.2 | 51.2 |

Nữ | 122 | 48.8 | 48.8 | 100.0 | |

Total | 250 | 100.0 | 100.0 |

Có thể bạn quan tâm!

-

B1. Kết Quả Phân Tích Thang Đo Lần 1 Cho Yếu Tố Tt

B1. Kết Quả Phân Tích Thang Đo Lần 1 Cho Yếu Tố Tt -

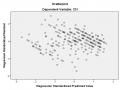

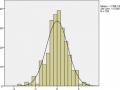

Đồ Thị Phân Tán Giữa Giá Trị Dự Đoán Và Phần Dư Từ Hồi Quy

Đồ Thị Phân Tán Giữa Giá Trị Dự Đoán Và Phần Dư Từ Hồi Quy -

Hạn Chế Của Đề Tài Và Hướng Nghiên Cứu Tiếp Theo

Hạn Chế Của Đề Tài Và Hướng Nghiên Cứu Tiếp Theo -

Các yếu tố ảnh hưởng đến việc chấp nhận sử dụng dịch vụ ngân hàng điện tử của khách hàng cá nhân tại Ngân hàng thương mại cổ phần An Bình chi nhánh Đồng Nai - 10

Các yếu tố ảnh hưởng đến việc chấp nhận sử dụng dịch vụ ngân hàng điện tử của khách hàng cá nhân tại Ngân hàng thương mại cổ phần An Bình chi nhánh Đồng Nai - 10 -

Các yếu tố ảnh hưởng đến việc chấp nhận sử dụng dịch vụ ngân hàng điện tử của khách hàng cá nhân tại Ngân hàng thương mại cổ phần An Bình chi nhánh Đồng Nai - 11

Các yếu tố ảnh hưởng đến việc chấp nhận sử dụng dịch vụ ngân hàng điện tử của khách hàng cá nhân tại Ngân hàng thương mại cổ phần An Bình chi nhánh Đồng Nai - 11

Xem toàn bộ 88 trang tài liệu này.

Tuổi

Frequency | Percent | Valid Percent | Cumulative Percent | ||

Valid | Dưới 26 tuổi | 39 | 15.6 | 15.6 | 15.6 |

Từ 26-35 tuổi | 86 | 34.4 | 34.4 | 50.0 | |

Từ 36 - 45 tuổi | 84 | 33.6 | 33.6 | 83.6 | |

Trên 45 tuổi | 41 | 16.4 | 16.4 | 100.0 | |

Total | 250 | 100.0 | 100.0 |

Trình độ học vấn

Frequency | Percent | Valid Percent | Cumulative Percent | ||

Valid | Dưới cao đẳng | 94 | 37.6 | 37.6 | 37.6 |

Cao đẳng, Đại học” | 130 | 52.0 | 52.0 | 89.6 | |

Trên Đại học | 26 | 10.4 | 10.4 | 100.0 | |

Total | 250 | 100.0 | 100.0 |

Thu nhập

Frequency | Percent | Valid Percent” | Cumulative Percent” | ||

Valid | < 5 triệu | 20 | 8.0 | 8.0 | 8.0 |

Từ 5-dưới 10 triệu | 108 | 43.2 | 43.2 | 51.2 | |

Từ 10-20 triệu | 75 | 30.0 | 30.0 | 81.2 | |

> 20 triệu | 47 | 18.8 | 18.8 | 100.0 | |

Total | 250 | 100.0 | 100.0 |

2. Đánh giá độ tin cậy của thang đo 2.1.Nhân tố TL

Reliability Statistics

N of Items | |

.877 | 5 |

Item-Total Statistics

Scale Mean if Item Deleted | Scale Variance if Item Deleted | Corrected Item- Total Correlation | Cronbach's Alpha if Item Deleted | |

TL1 | 13.6040 | 21.670 | .701 | .852 |

TL2 | 13.4800 | 21.488 | .703 | .851 |

TL3 | 13.3280 | 21.611 | .723 | .847 |

TL4 | 13.2480 | 21.641 | .736 | .844 |

TL5 | 13.1400 | 21.671 | .674 | .859 |

2.2.Nhân tố TT Lần 1:

Reliability Statistics

N of Items | |

.766 | 5 |

Item-Total Statistics

Scale Mean if Item Deleted | Scale Variance if Item Deleted | Corrected Item- Total Correlation | Cronbach's Alpha if Item Deleted | |

TT1 | 14.3600 | 13.870 | .674 | .673 |

TT2 | 14.4400 | 14.689 | .620 | .695 |

TT3 | 14.4400 | 14.472 | .638 | .688 |

TT4 | 14.8680 | 18.131 | .170 | .849 |

TT5 | 14.4200 | 14.020 | .663 | .677 |

Lần 2:

Reliability Statistics

N of Items | |

.849 | 4 |

Item-Total Statistics

Scale Mean if Item Deleted | Scale Variance if Item Deleted | Corrected Item- Total Correlation | Cronbach's Alpha if Item Deleted | |

TT1 | 11.0960 | 10.392 | .710 | .799 |

TT2 | 11.1760 | 11.174 | .645 | .826 |

TT3 | 11.1760 | 10.836 | .685 | .809 |

TT5 | 11.1560 | 10.445 | .710 | .798 |

2.3.Nhân tố KT

Reliability Statistics

N of Items | |

.867 | 5 |

Item-Total Statistics

Scale Mean if Item Deleted | Scale Variance if Item Deleted | Corrected Item- Total Correlation | Cronbach's Alpha if Item Deleted | |

KT1 | 12.7520 | 21.296 | .731 | .829 |

KT2 | 12.8000 | 21.261 | .648 | .852 |

KT3 | 12.7240 | 22.458 | .657 | .847 |

KT4 | 12.7560 | 22.225 | .686 | .840 |

KT5 | 12.9040 | 21.348 | .735 | .828 |

2.4.Nhân tố BM

Reliability Statistics

N of Items | |

.875 | 5 |

Item-Total Statistics

Scale Mean if Item Deleted | Scale Variance if Item Deleted | Corrected Item- Total Correlation | Cronbach's Alpha if Item Deleted | |

BM1 | 14.2720 | 16.930 | .747 | .837 |

BM2 | 14.1800 | 17.313 | .757 | .836 |

BM3 | 13.9880 | 17.265 | .683 | .853 |

BM4 | 14.0680 | 16.907 | .781 | .829 |

BM5 | 14.0360 | 17.818 | .569 | .882 |

2.5.Nhân tố RR

Reliability Statistics

N of Items | |

.813 | 4 |

Cronbach's Alpha

Item-Total Statistics

Scale Mean if Item Deleted | Scale Variance if Item Deleted | Corrected Item- Total Correlation | Cronbach's Alpha if Item Deleted | |

RR1 | 7.9520 | 12.696 | .631 | .766 |

RR2 | 7.8960 | 12.222 | .658 | .753 |

RR3 | 7.9120 | 12.546 | .626 | .768 |

RR4 | 8.0040 | 12.205 | .614 | .774 |

2.5.Nhân tố CN

Reliability Statistics

N of Items | |

.809 | 4 |

Item-Total Statistics

Scale Mean if Item Deleted | Scale Variance if Item Deleted | Corrected Item- Total Correlation | Cronbach's Alpha if Item Deleted | |

CN1 | 10.3920 | 9.171 | .669 | .740 |

CN2 | 10.2680 | 9.619 | .595 | .775 |

CN3 | 10.4920 | 9.319 | .612 | .767 |

CN4 | 10.4400 | 9.581 | .627 | .760 |

3. EFA

3.1. Biến độc lập

Kaiser-Meyer-Olkin Measure of Sampling Adequacy. | .881 | |

Bartlett's Test of Sphericity | Approx. Chi-Square | 2863.579 |

df | 253 | |

Sig. | .000 | |

Total Variance Explained

Initial Eigenvalues | Extraction Sums of Squared Loadings | Rotation Sums of Squared Loadings | |||||||

Total | % of Variance | Cumulative % | Total | % of Variance | Cumulative % | Total | % of Variance | Cumulative % | |

1 | 6.886 | 29.940 | 29.940 | 6.886 | 29.940 | 29.940 | 3.428 | 14.904 | 14.904 |

2.593 | 11.276 | 41.216 | 2.593 | 11.276 | 41.216 | 3.388 | 14.729 | 29.633 | |

3 | 2.432 | 10.575 | 51.791 | 2.432 | 10.575 | 51.791 | 3.372 | 14.663 | 44.295 |

4 | 2.152 | 9.359 | 61.150 | 2.152 | 9.359 | 61.150 | 2.831 | 12.307 | 56.602 |

5 | 1.442 | 6.268 | 67.418 | 1.442 | 6.268 | 67.418 | 2.488 | 10.816 | 67.418 |

6 | .694 | 3.018 | 70.436 | ||||||

7 | .635 | 2.760 | 73.196 | ||||||

8 | .593 | 2.579 | 75.775 | ||||||

9 | .577 | 2.507 | 78.282 | ||||||

10 | .525 | 2.284 | 80.566 | ||||||

11 | .480 | 2.085 | 82.651 | ||||||

12 | .456 | 1.984 | 84.636 | ||||||

13 | .443 | 1.924 | 86.560 | ||||||

14 | .405 | 1.760 | 88.320 | ||||||

15 | .381 | 1.657 | 89.977 | ||||||

16 | .364 | 1.581 | 91.559 | ||||||

17 | .346 | 1.503 | 93.062 | ||||||

18 | .324 | 1.411 | 94.472 | ||||||

19 | .290 | 1.262 | 95.734 | ||||||

20 | .279 | 1.212 | 96.947 | ||||||

21 | .246 | 1.068 | 98.014 | ||||||

22 | .231 | 1.006 | 99.020 | ||||||

23 | .225 | .980 | 100.000 |

2

Extraction Method: Principal Component Analysis.

Rotated Component Matrixa

Component | |||||

1 | 2 | 3 | 4 | 5 | |

BM2 | .843 | ||||

BM1 | .840 | ||||

BM4 | .838 | ||||

BM3 | .752 | ||||

BM5 | .662 | ||||

TL3 | .839 | ||||

TL1 | .797 | ||||

TL2 | .795 | ||||

TL4 | .780 | ||||

TL5 | .752 | ||||

KT1 | .813 | ||||

KT5 | .808 |

.783 | |||

KT2 | .771 | ||

KT3 | .736 | ||

TT1 | .829 | ||

TT5 | .815 | ||

TT3 | .806 | ||

TT2 | .787 | ||

RR2 | .780 | ||

RR3 | .766 | ||

RR4 | .764 | ||

RR1 | .639 |