DANH MỤC TÀI LIỆU THAM KHẢO

1. Abba Ya’u, Natrah Saad (2019), ‘Fairness Perceptions and Voluntary Tax Compliance in Nigeria: The Moderating Role of Trust’, Global Business Management Review, 11 (1) 54-76.

2. Abdul Hamid, S. (2014), Tax Compliance Behaviour of Tax Agents: A Comparative Study of Malaysia and New Zealand, Unpublished Doctoral Thesis, University of Canterbury, New Zealand

3. Adellia, T. and Islami, Imas N. (2020), ‘Tax Awareness as Moderator Towards Tax Knowledge, Subejctive Norms, Personal Norms, and Tax Compliance’, Jurnal Ilmiah Akuntansi Fakultas Ekonomi, 6(1), 1-18.

4. Ajzen Icek và Martin Fishbein (1975), Belief, attitude, intention and behavior: An introduction to theory and research, Reading, MA: Addison- Wesley.

5. Ajzen, I. (1985), From intentions to actions: A theory of planned behavior, Berlin: Heidelber, New York: Springer-Verlag.

6. Ajzen, I. (1991), ‘The Theory of Planned Behavior’, Organizational Behavior and Human Decision Processes, 50: 179-211

7. Alan Lewis, Sonia Carrera, John Cullis, Philip Jones (2009), ‘Individual, cognitive and cultural differences in tax compliance: UK and Italy compared’, Journal of Economic Psychology, 30 (2009) 431–445

Có thể bạn quan tâm!

-

Mô Hình Các Yếu Tố Ảnh Hưởng Đến Hành Vi Tuân Thủ Thuế Tự Nguyện Của Hộ Kdct Trong Các Làng Nghề Ở Việt Nam

Mô Hình Các Yếu Tố Ảnh Hưởng Đến Hành Vi Tuân Thủ Thuế Tự Nguyện Của Hộ Kdct Trong Các Làng Nghề Ở Việt Nam -

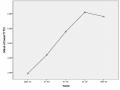

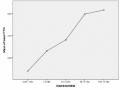

Mối Quan Hệ Giữa Số Năm Hoạt Động Kinh Doanh Và Ttt Tự Nguyện

Mối Quan Hệ Giữa Số Năm Hoạt Động Kinh Doanh Và Ttt Tự Nguyện -

Một Số Khuyến Nghị Nhằm Thúc Đẩy Tuân Thủ Thuế Ở Hộ Kinh Doanh Cá Thể Trong Các Làng Nghề Ở Việt Nam

Một Số Khuyến Nghị Nhằm Thúc Đẩy Tuân Thủ Thuế Ở Hộ Kinh Doanh Cá Thể Trong Các Làng Nghề Ở Việt Nam -

Tổng Cục Thuế (2021), Báo Cáo Tổng Kết Công Tác Thuế Năm 2020 Và Nhiệm Vụ, Giải Pháp Thực Hiện Công Tác Thuế Năm 2021.

Tổng Cục Thuế (2021), Báo Cáo Tổng Kết Công Tác Thuế Năm 2020 Và Nhiệm Vụ, Giải Pháp Thực Hiện Công Tác Thuế Năm 2021. -

Tổng Quan Về Lý Thuyết Nền Tảng Và Các Yếu Tố Ảnh Hưởng Đến Hành Vi Tuân Thủ Thuế

Tổng Quan Về Lý Thuyết Nền Tảng Và Các Yếu Tố Ảnh Hưởng Đến Hành Vi Tuân Thủ Thuế -

Bảng Tổng Hợp Các Yếu Tố Ảnh Hưởng Đến Hành Vi Tuân Thủ Thuế Từ Kết Quả Tổng Quan Nghiên Cứu

Bảng Tổng Hợp Các Yếu Tố Ảnh Hưởng Đến Hành Vi Tuân Thủ Thuế Từ Kết Quả Tổng Quan Nghiên Cứu

Xem toàn bộ 256 trang tài liệu này.

8. Alabede, J. O., Ariffin, Z. Z., & Idris, K. M. (2011b), ‘Individual taxpayers’ attitude and compliance behaviour in Nigeria: The moderating role of financial condition and risk preference’, Journal of Accounting and Taxation, 3(5), 91–104.

9. Alasfour, F., Samy, M. and Bampton, R. (2016), ‘The Determinants of Tax Morale and Tax Compliance: Evidence from Jordan’, Advances in Taxation, Emerald Group Publishing Limited, Bingley, pp. 125-171.

10. Allingham, M. G., & Sandmo, A. (1972), ‘Income tax evasion: A theoretical analysis’, Journal of Public Economics, 1, 323-338.

11. Alm, J. , McClelland, G.H. , Schulze, W.D. (1992), ‘Why do people pay taxes?’,

J. Public Econ, 48, 21–38.

12. Alm, J. (1991), ‘A perspective on the experimental analysis of taxpayer reporting’,

The Accounting Review, 66(3), 577– 593.

13. Alm, J., Cherry, T., Jones, M., & McKee, M. (2010), ‘Taxpayer information assistance services and tax compliance behavior’, Journal of Economic Psychology, 31(4), 577–586.

14. Alm, James, Erich Kirchler, Stephan Muehlbacher, Katharina Gangl, Eva Hofmann, Christoph Kogler, and Maria Pollai (2012), Rethinking the research paradigms for analysing tax compliance behaviour, In CESifo Forum. München: IfoInstitut-Leibniz-InstitutfürWirtschaftsforschung an der Universität München, vol. 13, pp. 33–40.

15. Alm, J. (2014), ‘Does an uncertain tax system encourage “aggressive tax planning”?’, Economic Analysis and Policy, 44(1), 30-38.

16. Alm, James, Michele Bernasconi, Susan Laury, Daniel J. Lee, and Sally Wallace (2016), ‘Culture, Compliance and Confidentiality: A Study of Taxpayer Behavior in the United States and Italy’, 36.Dept. of Economics Research Paper Series. https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2888276.

17. Alshira’h, A.F.; Alsqour, M.; Lutfi, A.; Alsyouf, A.; Alshirah, M (2020), ‘A Socio-Economic Model of Sales Tax Compliance’, Economies 2020, 8, 88. https://doi.org/10.3390/economies8040088

18. Andi Nurwanah, Sutrisno T., Rosidi Rosidi and Roekhudin Roekhudin (2018), ‘Determinants of tax compliance: theory of planned behavior and stakeholder theory perspective’, Problems and Perspectives in Management, 16(4), 395-407. https://doi:10.21511/ppm.16(4).2018.33

19. Andrighetto, G. , Zhang, N. , Ottone, S. , Ponzano, F. , D’Attoma, J. , Steinmo, S. (2016), ‘Are some countries more honest than others? evidence from a tax compliance experiment in Sweden and Italy’, Front. Psychol, 7

20. Andreas and Savitri, Enni (2015), ‘The Effect of Tax Socialization, Tax Knowledge, Expediency of Tax ID Number and Service Quality on Taxpayers Compliance with Taxpayers Awareness as Mediating Variables’ Procedia - Social and Behavioral Sciences, 211, 163–169

21. Arcos-Holzinger, Lilia and Nicholas Biddle (2016), Behavioural Insights of Tax Compliance: An Overview of Recent Conceptual and Empirical Approaches, Tax and Transfer Policy Institute Working Paper 79.

22. Azmi, A., Anna, C. and Perumal, A.K. (2008), ‘Tax fairness dimensions in an Asian context: the Malaysian perspective’, International Review of Business Research Papers, Vol. 4 No. 5, pp. 11-19.

23. Azmi, A., Sapiei, N. S., Mustapha, M. Z., & Abdullah, M. (2016), ‘SMEs’ tax compliance costs and IT adoption: the case of a value-added tax’, International Journal of Accounting Information Systems, 23, 1–13

24. Benk, S., Çakmak, A., & Budak, T. (2011), ‘An Investigation of Tax Compliance Intentions: A Theory of Planned Behaviour Approach’, European Journal of Economics, Finance and Administrative Sciences, 28.

160

25. Benk, S., Budak, T. and Cakmak, A.F. (2012), ‘Tax professionals’ perceptions of tax fairness: survey evidence in Turkey’, International Journal of Business and Social Science, Vol. 3 No. 2, pp. 112-117.

26. Bergman, M., & Nevarez, A. (2006), ‘Do audits enhance compliance? An empirical assessment of VAT enforcement’, National Tax Journal, 59(4), 817–832.

27. Bobek, D.D. and Hatfield, R.C. (2003), ‘An investigation of the theory of planned behavior and the role of moral obligation in tax compliance’, Behavioral Research in Accounting, Vol. 15, No. 1, pp. 13-38.

28. Bobek, D. D., Roberts, R. W., & Sweeney, J. T. (2007), ‘The Social Norms of Tax Compliance: Evidence from Australia, Singapore, and the United States’, Journal of Business Ethics, 74(1), 49–64.

29. Bobek, D. D., Hageman, A. M., & Kelliher, C. F. (2011), ‘The Social Norms of Tax Compliance: Scale Development, Social Desirability, and Presentation Effects’, Advances in Accounting Behavioral Research, 14, 37–66.

30. Bobek, D. D., Hageman, A. M., & Kelliher, C. F. (2013), ‘Analyzing the Role of Social Norms in Tax Compliance Behavior’, Journal of Business Ethics, 115, 451–468.

31. Bộ Tài chính (2021), Thông tư số 40/2021/TT-BTC Hướng dẫn thuế giá trị gia tăng, thuế thu nhập cá nhân và quản lý thuế đối với hộ kinh doanh, cá nhân kinh doanh

32. Bộ Nông nghiệp và Phát triển nông thôn (2021), Báo cáo về Sơ kết 02 năm thực hiện Nghị định số 52/2018/NĐ-CP của Chính phủ về phát triển ngành nghề nông thôn.

33. Brautigam, Deborah, Odd-Helge Fjeldstad and Mick Moore (eds.) 2008, Taxation andstatebuilding in developing countries. Capacity and consent, Cambridge University Press.

34. Braithwaite, V. (2003), Dancing with tax authorities: Motivational postures and non-compliant actions. In V. Braithwaite (Ed.), Taxing democracy: Understanding tax avoidance and evasion, Aldershot: Ashgate, pp. 15–39

35. Braithwaite, V. (2009). Defiance in taxation and governance: Resisting and dismissing authority in a democracy. Cheltenham: Edward Elgar.

36. Bùi Ngọc Toản (2017), ‘Các yếu tố ảnh hưởng đến hành vi tuân thủ thuế thu nhập của doanh nghiệp - Nghiên cứu thực nghiệm trên địa bàn thành phố Hồ Chí Minh’, Tạp chí khoa học, Tập 126, Số 5A, 2017, Tr. 77–88.

37. Casal, S., Kogler, C., Mittone, L., & Kirchler, E. (2016). Tax compliance depends on voice of taxpayers. Journal of Economic Psychology, 56, 141–150.

38. Carsamer, Emmanuel; Abbam, Anthony (2020), ‘Religion and tax compliance among SMEs in Ghana’, Journal of Financial Crime, ahead-of-print(ahead-of- print), –. https://doi:10.1108/jfc-01-2020-0007

39. Casagrande, A., Cagno, D. D., Pandimiglio, A., & Spallone, M. (2015), ‘The effect of competition on tax compliance The role of audit rules and shame’, Journal of behavioral and Experimental Economics, 59, 96–110.

161

40. Chan, C. W., Troutman, C. S., & O’Bryan, D. (2000), ‘An expanded model of taxpayer compliance: Empirical evidence from the United States and Hong Kong’, Journal of International Accounting, Auditing and Taxation, 9(2), 83-103.

41. Chau G, Leung P (2009), ‘A critical review of Fischer tax compliance model: a research synthesis’, J Acc Taxat, 1(2):34

42. Chen, C. W. (2010), ‘Impact of quality antecedents on taxpayer satisfaction with online tax-filing systems—An empirical study’, Information & Management, 47(5), 308–315. https://doi:10.1016/j.im.2010.06.005

43. Cummings, R. G., Martinez-Vazquez, J., McKee, M., & Torgler, B. (2009), ‘Tax morale affects tax compliance: Evidence from surveys and an art factual field experiment’, Journal of Economic Behavior & Organization, 70(3),447–457, https://doi:10.1016/j.jebo.2008.02.010

44. Choo, C. Y. L., Fonseca, M. A., & Myles, G. D. (2016), ‘Do students behave like real taxpayers in the lab? Evidence from a real effort tax compliance experiment’, Journal of Economic Behavior & Organization, 124, 102–114.

45. Clotfelter, C. T. (1983), ‘Tax evasion and tax rates: An analysis of individual returns’, The Review of Economics and Statistics, 65(3), 363–373. doi:10.2307/1924181

46. Cechovsky, N. (2018), ‘The importance of tax knowledge for tax compliance: A study on the tax literacy of vocational business students. In C. Nägele & B. E. Stalder (Eds.)’, Trends in vocational education and training research. Proceedings of the European Conference on Educational Research (ECER), Vocational Education and Training Network (VETNET) (pp. 113– 121). https://doi.org/10.5281/zenodo.1319646

47. Da Silva, F. P., Guerreiro, R., & Flores, E. (2019), ‘Voluntary versus enforced tax compliance: the slippery slope framework in the Brazilian context’, International Review of Economics, 66(2), 147–180.

48. Damayanti, T. (2012), ‘Changes on Indonesia Tax Culture, Is there a way? Studies through theory of planned behavior’, Journal of Arts, Science & Commerce, 4(1), 8-15

49. Damayanti, T.W., Subekti, I. and Baridwan, Z. (2015), ‘Trust and Uncertainty Orientation: An Efforts to Create Tax Compliance in Social Psychology Framework’, Procedia - Social and Behavioral Sciences, Elsevier B.V., Vol. 211 No. September, pp. 938–944.

50. Darmayasa, I. N., & Aneswari, Y. R. (2015), ‘The Ethical Practice of Tax Consultant Based on Local Culture’, Procedia - Social and Behavioral Sciences, 211, 142–148.

51. Deyganto (2018), ‘Factors Influencing Taxpayers’ Voluntary Compliance Attitude with Tax System Evidence from Gedeo Zone of Southern Ethiopia’, Universal Journal of Accounting and Finance, 6(3): 92-107.

162

52. Devos, Ken (2008), ‘Tax evasion behaviour and demographic factors: An exploratory study in Australia’, Revenue Law Journal, 18: 1–45.

53. Devos, K. (2012), ‘A Comparative Study of Compliant and Non-compliant Individual Taxpayers in Australia’, Journal of Business and Policy Research, 7(2), July issue, 180–196.

54. Devos, K. (2013), Factors influencing individual taxpayer compliance behavior,

Dordrect, Netherlands: Springer Science & Business Media

55. Devos, K., & Zackrisson, M. (2015), ‘Tax compliance and the public disclosure of tax information: An Australia/Norway comparison’, Journal of Tax research, 13(1), 108–129.

56. Doreen Musimenta, Stephen Korutaro Nkundabanyanga, Moses Muhwezi, Brenda Akankunda,Irene Nalukenge, (2017), ‘Tax compliance of small and medium enterprises: a developing country perspective’, eJournal of Financial Regulation and Compliance, Vol. 25 Issue: 2, pp.149-175, https://doi.org/10.1108/JFRC-08-2016-0065

57. Dubin, J., & Wilde, L. (1988), ‘An empirical analysis of federal income tax auditing andcompliance’, National Tax Journal, 41, 61-74.

58. Đặng Thị Bạch Vân (2014), ‘Xoay quanh vấn đề người nộp thuế và tuân thủ thuế’,

Tạp chí Phát triển và Hội nhập, Số 16 (26), Tr. 59-63.

59. Đỗ Đức Minh và Nguyễn Việt Cường (2010), Giáo trình Lý thuyết thuế, Học viện Tài chính.

60. Eichfelder, Sebastian; Kegels, Chantal (2014), ‘Compliance costs caused by agency action? Empirical evidence and implications for tax compliance’, Journal of Economic Psychology, 40, 200–219.

61. Eriksen, K., & Fallan, L. (1996), ‘Tax knowledge and attitudes towards taxation: A report on a quasi-experiment’, Journal of Economic Psychology, 17(3), 387– 402. https://doi:10.1016/0167-4870(96)00015-3.

62. Evans, C., Carlon, S., & Massey, D. (2005), ‘Record keeping practices and tax compliance of SMEs’, eJournal of Tax Research, 3(2), 288–334.

63. Fadjar O.P. Siahaan (2012), ‘The Influence of Tax Fairness and Communication on Voluntary Compliance: Trust as an Intervening Variable’, International Journal of Business and Social Science, Vol. 3 No. 21.

64. Fagbemi, T., Uadiale, O., & Noah, A. (2010), ‘The Ethics of Tax Evasion: Perpetual Evidence from Nigeria’, European Journal of Social Science, 17(3), 360-371.

65. Fjeldstad, O.-H., Kagoma, C., Mdee, E., Sjursen, I. H., & Somville, V. (2020), ‘The customer is king: Evidence on VAT compliance in Tanzania’, World Development, 128, 104841.

163

66. Feld, L., Dan Frey, B. (2002), ‘Tust Breeds Trust: How Taxpayer are Treated’,

Economics of Governance, 3, 87-99, http://dx.doi.org/10.1007/s101010100032

67. Fischer, C. M., Wartick, M., & Mark, M. (1992), ‘Detection Probability and Taxpayer Compliance: A Review of the Literature’, Journal of Accounting Literature, 11, 1-46.

68. Fehr, E., & Rockenbach, B. (2003), ‘Detrimental effects of sanctions on human altruism’, Nature, 422(6928), 137–140

69. Feinstein, J. (1991), An econometric analysis of income tax evasion and its detection, RANDJournal of Economics, 22(1), 14-35

70. Frey, B. S., & Torgler, B. (2007), ‘Tax morale and conditional cooperation’, Journal of Comparative Economics, 35(1), 136-159. doi: 10.1016/j.jce.2006.10.006

71. Gangl, K., Hofmann, E., & Kirchler, E. (2015), ‘Tax authorities’ interaction with taxpayers: A conception of compliance in social dilemmas by power and trust’, New Ideas in Psychology, 37, 13–23.

72. Gerbing, M. D. (1988), An empirical study of taxpayer perceptions of fairness (Unpublished doctoral dissertation), University of Texas, Austin, TX. http://doi:10.3168/jds.S00220302(88)79586-7

73. Gobena, L. B., & Van Dijke, M. (2016), ‘Power, justice, and trust: A moderated mediation analysis of tax compliance among Ethiopian business owners’, Journal of Economic Psychology, 52, 24–37.

74. Grabosky, P. and J. Braithwaite (1986), Of Manners Gentle: Enforcement strategies of Australian Business Regulatory Agencies, Melbourne: Oxford University Press.

75. Guerra, Alice; Harrington, Brooke (2018), ‘Attitude–behavior consistency in tax compliance: A cross-national comparison’, Journal of Economic Behavior & Organization, http://doi:10.1016/j.jebo.2018.10.013

76. Güzel, Sonnur Aktaş (2018), ‘The Effect of the Variables of Tax Justice Perception and Trust in Government on Tax Compliance: The Case of Turkey’, Journal of Behavioral and Experimental Economics, http://doi:10.1016/j.socec.2018.12.006

77. Groves, H. M. (1958), ‘Empirical studies of income tax compliance’, National Tax Journal, 6, 291301.

78. Hanno, D., & Violcttc, G. (1996), ‘An analysis of moral and social influences on tax behaviour’, Behaviour Research in Accounting, 8, 57-75.

79. Hassan, I., Naeem, A., & Gulzar, S. (2021), ‘Voluntary tax compliance behavior of individual taxpayers in Pakistan’, Financial Innovation, 7(1), https://doi:10.1186/s40854-021-00234-4

164

80. Harju, J., Matikka, T., & Rauhanen, T. (2019), ‘Compliance costs vs. tax incentives: Why do entrepreneurs respond to size-based regulations?’, Journal of Public Economics, 173, 139–164.

81. Hite, P.A. and Roberts, M.L. (1992), “An analysis of tax reform based on taxpayers perceptions of fairness and self-interest”, Advances in Taxation, Vol. 4, pp. 115-137

82. Jackson, B. R., & Milliron, C. V. (1986), ‘Tax compliance research: Findings, problems and prospects’, Journal of Accounting Literature, 125-165.

83. James, S., dan Alley, C. (2002), ‘Tax Compliance, Self-Assessment and Tax Administration’, Journal in Finance and Management in Public Services, 2(2), 27-42

84. James, S., Murphy, K., dan Reinhart, M (2005), ‘Taxpayer Beliefs and Views: Two New Surveys’, Australian Tax Forum, 20, 157-188.

85. James, S., & Edwards, A. (2008), ‘Developing tax policy in a complex and changing world’, Economic Analysis and Policy, 38(1), 35-53.

86. Jayawardane, D. (2015), ‘Psychological factors affect tax compliance-a review paper’, International Journal of Art and Commerce, 4(6), 131–141.

87. Jimenez, P., and Iyer, G.S. (2016), ‘Tax Compliance in a Social Setting: The Influence of Social Norms, Trust in Government, and Perceived Fairness on Taxpayer Compliance’, Advances in Accounting, 34, 17–26.

88. Kastlunger, B., Lozza, E., Kirchler, E., & Schabmann, A. (2013), ‘Powerful authorities and trusting citizens: The Slippery Slope Framework and tax compliance in Italy’, Journal of Economic Psychology, 34, 36–45

89. Khasawneh, A., Ibrahim Obeidat, M., & Abdullah AlMomani, M. (2008), ‘Income Tax Fairness and the Taxpayers‟ Compliance in Jordan’, Journal of Economic and Administrative Sciences, Vol. 24 No. 1, pp. 15–39

90. Kirchler, E. (2007), The economic psychology of tax behaviour, Cambridge, England: Cambridge University Press.

91. Kirchler, E., Hoelzl, E., & Wahl, I. (2008), ‘Enforced versus voluntary tax compliance: The “slippery slope” framework’, Journal of Economic Psychology, 29(2), 210–225.

92. Kirchler, E., Kogler, C., and Muehlbacher, S. (2014), ‘Cooperative Tax Compliance From Deterrence to Deference’, Current Directions in Psychological Science, 23(2), 87-92.

93. Kirchler, E., & Wahl, I. (2010), ‘Tax compliance inventory TAX-I: Designing an inventory for surveys of tax compliance’, Journal of Economic Psychology, 31(3), 331–346.

94. Kleven, H.J. , (2014), ‘How can Scandinavians tax so much’, J. Econ. Perspect. 28 (4), 77–98 .

165

95. Kleven, H.J. , Knudsen, M.B. , Kreiner, C.T. , Pedersen, S. , Saez, E. (2011), ‘Unwilling or unable to cheat? Evidence from a tax audit experiment in Denmark’, Econometrica, 79 (3), 651–692 .

96. Kogler, C., Batrancea, L., Nichita, A., Pantya, J., Belianin, A., & Kirchler, E. (2013), ‘Trust and power as determinants of tax compliance: Testing the assumptions of the slippery slope framework in Austria, Hungary, Romania and Russia’, Journal of Economic Psychology, 34, 169–180.

97. Kogler, C., Mittone, L. and Kirchler, E. (2016), ‘Delayed feedback on tax audits affects compliance and fairness perceptions’, Journal of Economic Behavior and Organization, Elsevier B.V., Vol. 124, pp. 81–87

98. Lê Xuân Trường (2016), Giáo trình Quản lý thuế, Học viện Tài chính, Nhà Xuất bản Tài chính, Hà Nội.

99. Lê Xuân Trường (2011), ‘Thúc đẩy tính tuân thủ thuế - Từ quan điểm cổ điển đến hiện đại và thực tiễn Việt Nam’, Kỷ yếu Nghiên cứu Khoa học, Học viện Tài chính

100. Lê Xuân Trường, Nguyễn Đình Chiến (2013), ‘Nhận diện các hành vi gian lận thuế’, Tạp chí Tài chính, số 09 (857), 2013.

101. Lê Xuân Trường (2014), ‘Hoàn thiện hành lang pháp lý cho hoạt động thanh tra, kiểm tra thuế ở Việt Nam’, Tạp chí Tài chính (10/2014).

102. Lê Kim Ngọc (2016), Hoàn thiện quản lý thuế đối với hộ kinh doanh cá thể trên địa bàn quận Hoàng Mai, thành phố Hà Nội, Luận văn Thạc sỹ Kinh tế, Đại học Kinh tế quốc dân.

103. Lê Xuân Quang (2012), Thuế, Nhà xuất bản Lao động – Xã hội

104. Lèng Minh Hoàng (2017), Nâng cao tính tuân thủ thuế của người nộp thuế ở Việt Nam, Luận án Tiến sĩ, Học viện Tài chính.

105. Lefebvre, Mathieu; Pestieau, Pierre; Riedl, Arno; Villeval, Marie Claire (2015), ‘Tax evasion and social information: an experiment in Belgium, France, and the Netherlands’, International Tax and Public Finance, 22(3), 401–425.

106. Lisi, G. (2014), ‘The interaction between trust and power: Effects on tax compliance and macroeconomic implications’, Journal of Behavioral and Experimental Economics, 53, 24–33.

107. Lidija Hauptman, Şevin Gürarda, Romana Korez-Vide (2015), ‘Exploring Voluntary Tax Compliance Factors in Slovenia: Implications for Tax Administration and Policymakers’, Lex localis - Journal of Local Self- Government, Vol 13 No 3 Mas’ud, A., Manaf, N. A. A., & Saad, N. (2014), ‘Do trust and power moderate each other in relation to tax compliance?’, Procedia- Social and Behavioral Sciences, 164, 49-54.

108. Mas’ud, A., Manaf, N. A. A., & Saad, N. (2019), ‘Trust and power as predictors to tax compliance: Global evidence’, Economics and Sociology, 12(2), 192-204. https://doi:10.14254/2071-789X.2019/12-2/11