The results of ANOVA analysis with significance level 0.993 > 0.05, so the hypothesis H0 “Equal mean” is accepted. Observational data are not qualified to confirm that there is a difference in satisfaction between Female and Male (Appendix 5.1).

Analysis of differences by age

This test shows whether the variance of customer satisfaction is equal or different across age groups. Sig of Levene statistic = 0.287 (>0.05). Therefore, the results of ANOVA analysis can be used.

Results of ANOVA analysis with significance level 0.372 > 0.05. Observational data are not sufficient to confirm that there is a difference in satisfaction across age groups (Annex 5.2).

Analyze the difference by income

The results of the income variance test:

Table 2.16: Income-based variance test

Test of Homogeneity of Variances

HL

| Levene Statistic | df1 | df2 | Sig. |

| .943 | 3 | 162 | .421 |

Maybe you are interested!

-

Evaluate The Level Of Development Of Banking Services Through Swot Analysis At Navibank.

Evaluate The Level Of Development Of Banking Services Through Swot Analysis At Navibank. -

Survey On Customer Satisfaction About Banking Services Of Nam Viet Commercial Joint Stock Bank.

Survey On Customer Satisfaction About Banking Services Of Nam Viet Commercial Joint Stock Bank. -

Evaluation Of The Scale By Cronbach Alpha Reliability Coefficient:

Evaluation Of The Scale By Cronbach Alpha Reliability Coefficient: -

Improving The Capacity And Role Of The State Bank In Managing Monetary Policy And Stabilizing The Economy

Improving The Capacity And Role Of The State Bank In Managing Monetary Policy And Stabilizing The Economy -

Developing banking services at Nam Viet Commercial Joint Stock Bank - 11

Developing banking services at Nam Viet Commercial Joint Stock Bank - 11 -

Developing banking services at Nam Viet Commercial Joint Stock Bank - 12

Developing banking services at Nam Viet Commercial Joint Stock Bank - 12

Table 2.17: ANOVA – income test

ANOVA

HL

| Sum of Squares | Df | Mean Square | F | Sig. | |

| Between Groups Within Groups Total | 4.730 47.370 52.100 | 3 162 165 | 1.577 .292 | 5.392 | .001 |

This test shows whether the variance of customer satisfaction is equal or different across income levels. Sig of Levene statistic = 0.421 (>0.05), so at 95% confidence level, hypothesis H0: “Equal variance” is accepted, and hypothesis H1: “Different variance” is rejected. Therefore, the results of ANOVA analysis can be used.

The results of ANOVA analysis with the significance level of 0.001 < 0.05, thus with the observational data are eligible to confirm that there is a difference in satisfaction between groups of customers with different incomes.

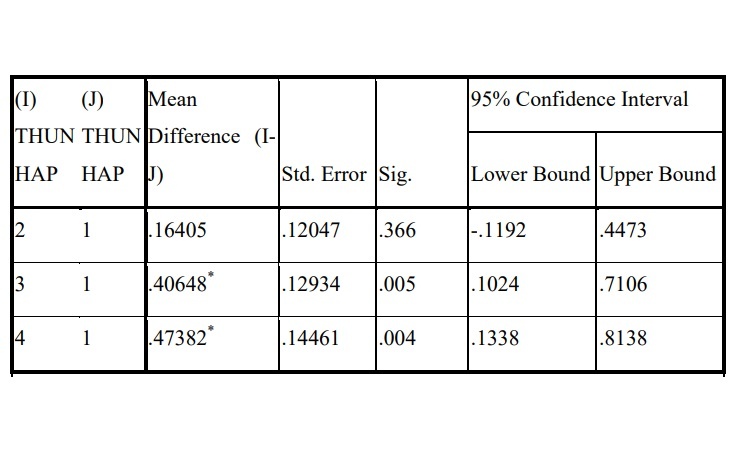

Table 2.18: Post Hoc Tests – income

Multiple Comparisons

HL

Dunnett t (2-sided)

Income (1=”under 4 million”, 2=”from 4 million to less than 10 million”, 3=”from 10 million to 15 million”, 4=”over 15 million”

*. The mean difference is significant at the 0.05 level.

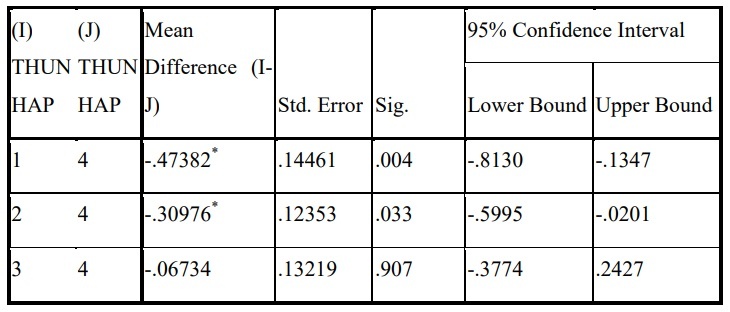

Multiple Comparisons

HL

Dunnett t (2-sided)

Post Hoc Tests results show that there is a difference in customer satisfaction between groups of customers with different incomes:

– Between the group of customers with incomes below 4 million and the group of customers with incomes from 10 million to 15 million and over 15 million

– Between the group of customers with income from 4 million to 10 million and the group of customers with income over 15 million

Thereby, it shows that the group of customers with income > 10 million tend to be more satisfied

Analysis of service time difference

This test shows whether the variance of customer satisfaction is equal or different in terms of time of using banking services. Sig of Levene statistic = 0.71 (>0.05), so at 95% confidence level, hypothesis H0: “Equal variances” is accepted, and hypothesis H1: “Different variances” is rejected. Therefore, the results of ANOVA analysis can be used.

The results of ANOVA analysis at the significance level of 0.000 < 0.05, thus, with observational data, it is sufficient to confirm that there is a difference in satisfaction between groups of customers with different service time.

Analysis of Post hoc Tests shows that there is a difference between the group of customers who have used the service for <3 years and >3 years. In which, the group of customers with usage time > 3 years tends to be more satisfied (Appendix 5.4).

Analyze the difference in recommending services to others

This test shows whether the variance of customer satisfaction is equal or different for the group of customers who recommend the service and do not recommend the service to others. Sig of Levene statistic = 0.218 (>0.05), so at 95% confidence level, hypothesis H0: “Equal variances” is accepted, and hypothesis H1: “Different variances” is rejected. Therefore, the results of ANOVA analysis can be used.

The results of ANOVA analysis with the significance level of 0.000 < 0.05, so with the observational data, it is enough to confirm that there is a difference in satisfaction between the group of customers who refer the service and do not refer the service to them. others.

Looking at the descriptive statistics table, we see that the group of customers who recommend the service tends to be more satisfied (Appendix 5.5).

Analyze the difference in whether or not there is a need in the future

This test shows whether the variance of customer satisfaction is equal or different for two groups of customers with or without future need. Sig of Levene statistic = 0.147 (>0.05) so at 95% confidence level, hypothesis H0: “Equal variances” is accepted, and hypothesis H1: “Different variances” is rejected. Therefore, the results of ANOVA analysis can be used.

The results of ANOVA analysis with significance level 0.001 < 0.05, thus, with observational data, it is sufficient to confirm that there is a difference in satisfaction between two groups of customers with or without future needs.

Looking at the descriptive statistics table, we see that the group of customers with future needs tends to be more satisfied (Appendix 5.6).

CONCLUSION CHAPTER 2

In Chapter 2, the thesis introduced the current status of banking service provision at Nam Viet Commercial Joint Stock Bank, assessed strengths, weaknesses, opportunities and threats through SWOT analysis, and at the same time stated reasons for the above problems. At the end of the chapter, the thesis has conducted a customer satisfaction survey, using descriptive statistics and regression analysis to find out the factors affecting customer satisfaction. However, the survey object is individual customers while the customer component includes corporate and individual customers, so the survey has not evaluated all of Navibank’s customers. But, the survey also helps the bank understand customer satisfaction and retail banking strategy, which will be more favorable in targeting future goals. From there, the thesis will find a solution to develop banking services at Nam Viet Commercial Joint Stock Bank.

CHAPTER 3: SOME SOLUTIONS FOR DEVELOPING BANKING SERVICES AT NAM VIET COMMERCIAL JOINT STOCK BANK

3.1 Navibank’s strategic objectives and orientation to 2015

2013 is considered to be another difficult year for the Vietnamese economy in general and the banking industry in particular when the global economy has not yet escaped the consequences of the financial crisis, key export markets of Vietnam has not been able to recover. With the goal of controlling inflation and keeping economic growth at a reasonable level, the State Bank is expected to maintain credit growth at about 12%, and at the same time focus strongly on bad debt settlement. of the entire banking system. In that context, in order to create a foundation for sustainable growth and maintain stability in operations, Navibank aims to comprehensively restructure its operations based on four core elements of a business: Strong finance and stable; Modern and humanized technology; Professional and unanimous human resources; Large and pervasive customer network. These four factors are likened to four foundation bricks, closely linked together to create a premise for Navibank to steadily develop, towards future goals.

By 2015, in order to affirm its position in the fiercely competitive environment, Navibank is determined to strive to become one of the top ten leading retail commercial banks in terms of service quality and efficiency according to specialized standards. competitive capacity. To accomplish that goal, Navibank strives to focus on the core factors of improving financial capacity, perfecting the information technology system and focusing on investing in human resources. Thereby, all activities of Navibank will gradually be standardized according to international standards.

– Mission: Serving customers with friendly, safe and effective products and services to bring benefits to customers and shareholders.

– Brand personality: Friendly – Safe – Effective

– Core values:

- For shareholders: as a joint stock company, Navibank is committed to constantly optimizing profits for shareholders on the basis of stable and sustainable business operations.

- For customers: as a provider of banking and financial services, Navibank is committed to always being the financial fulcrum to bring success to customers.

- For staff: as a large family, Navibank is committed to providing family members with competitive income, learning conditions and promotion opportunities.

- For the community: as an active member of the community, Navibank is committed to participating in social activities and charity programs to build a progressive civilized community.

– Target customers: individual customers, business customers with small, medium and micro scale.

– Main services and products: products related to capital mobilization, lending and other banking services for target customers.

– Target market: TP. Ho Chi Minh City, Hanoi, Hai Phong, Can Tho, Da Nang, industrial parks, high-tech parks.

– Development strategy: in order to carry out the strategic orientation until 2015, Navibank will focus its operations on the following three core strategies:

- Financial strategy: with the goal of building principles of allocation and rational use of available financial resources to successfully implement the selected business strategies. Navibank’s financial strategy will focus on solving charter capital issues; the minimum capital adequacy ratio must be maintained in order to both meet the requirements of current laws and ensure a reasonable level of profitability and liquidity; portfolio management; dividend policy.

- Technology strategy: Navibank considers the application of information technology as a key factor, supporting all management and R&D activities at Navibank. Aware of this importance, Navibank has invested in implementing the application of Corebanking system – Banking administration system – focusing on data management, automatic processing of business operations, and information retrieval. immediately to serve the administration and especially to add a series of new utilities to existing products, etc. In order to effectively serve the administration and management, Navibank determined an innovation strategy. The banking technology platform is as follows:

Continue researching and deploying applications of Corebanking system in all areas of Navibank’s activities such as domestic and international payment operations, currency business combined with perfecting the software system. other specialized management such as customer relationship management software, risk management software, ..

Improve the processing capacity of the network system, switching equipment,…; upgrade the security system, security, … to detect and prevent attacks from outside, ensuring high security features for banking technology services.

Building and fostering a team of professional IT staff with high professional qualifications, meeting the needs of operation management and mastering modern technology systems

Build backup data station

Human resource development strategy: Navibank will develop human resource development policies to maximize labor productivity and build a customer-oriented corporate culture and use that as a basis for training. The staff is dedicated to serving customers with dedication and professionalism. Although there are cultural differences in different areas of operation, all officers and employees of Navibank will share a common corporate culture, which is “Professional, disciplined and dedicated.” devoted to the development of customers, banks and society”

3.2 Solutions for developing banking services of Nam Viet Commercial Joint Stock Bank.

3.2.1 Group of specific solutions for each service segment

3.2.1.1 Solutions for capital mobilization services

Strengthen and focus on product diversification. First of all, it is necessary to increase demand deposits, increase the proportion of medium and long-term capital sources through serving and taking good care of major customers in relationship and at the same time attracting new customers with money sources. major in opening payment accounts at Navibank such as branches of the State Treasury, administrative and non-business units, hospitals, schools…; Cooperate with organizations providing services and public goods (electricity, water, salary payment…) to attract service fees.

Diversifying forms of capital mobilization, besides traditional products, Navibank must pay more attention to improving, researching and developing new products with reasonable interest rates and many utilities for customers. At the same time, it is necessary to create unique, quality, easy-to-remember, and easy-to-deploy products.

Promote marketing activities to attract deposit customers. There are constantly drawing programs to win prizes, give gifts on the occasion of Tet…

3.2.1.2 Solutions for credit services

Completing the professional process, strengthening the appraisal capacity by reviewing the process with a team of staff with professional expertise, legal knowledge and professional ethics. Regularly analyze and evaluate customers with loan needs in the area, actively looking for plans, projects, and good customers.