The effective development of banking services is also the foundation for Navibank’s sustainable development in the future.

CONCLUDE

In the context of increasingly fierce competition, each bank must make comprehensive efforts in all its activities to survive and develop, in which the development of banking services is extremely important.

Therefore, managers must set out a strategy to develop modern services and utilities to compete more effectively. Service development not only helps the bank improve its competitiveness, but also diversify services for customers to choose from, and at the same time bring more conveniences to customers, boosting the bank’s business performance.

However, in order to develop banking services with high efficiency, banks need to develop a specific roadmap and prepare the necessary factors for this development.

On the basis of understanding the factors affecting the development of services, understanding the business activities of Nam Viet Bank in general and the current situation of banking service provision in particular, the author stated: Navibank’s business mainly focuses on traditional services, the services provided are poor, service quality is still limited, the proportion of income from service activities is not high, modern banking services are only Just started implementing…

These lead to problems and affect the development of banking services of Navibank. Through the research, the author proposes a number of solutions that are long-term and consistent with the service development orientation of the State Bank in order to create conditions for Navibank to develop sustainably in the future.

REFERENCES

1. Annual report from 2009 to 2012 of Navibank

2. Doan Thi Thu Suong, 2011. Development of banking services in Vietnamese commercial banks. Master thesis. University of Economics Ho Chi Minh City.

3. Hoang Trong and Chu Nguyen Mong Ngoc, 2008. Applied statistics. Statistical publisher

4. Nguyen Dang Don et al., 2007. Commercial banking operations. Statistical publisher.

5. Nguyen Dang Don, 2005. Credit and banking operations. Statistical publisher.

6. Nguyen Minh Kieu, 2006. Banking operations. Statistical publisher

7. Circular 03/2008/TT – NHNN dated 11/08/2008

8. Tran Huy Hoang, 2007. Commercial Bank Management. Social Labor Publishing House.

9. Tran Kim Ngoc Tram, 2011. Solutions for developing banking services at Ho Chi Minh City Housing Development Joint Stock Commercial Bank. Master thesis. University of Economics Ho Chi Minh City.

10. Tran Thi Thuy Linh, 2011. Developing products and services at Joint Stock Commercial Bank for Industry and Trade of Vietnam. Master thesis. University of Economics Ho Chi Minh City.

APPENDIX 1: QUESTIONS

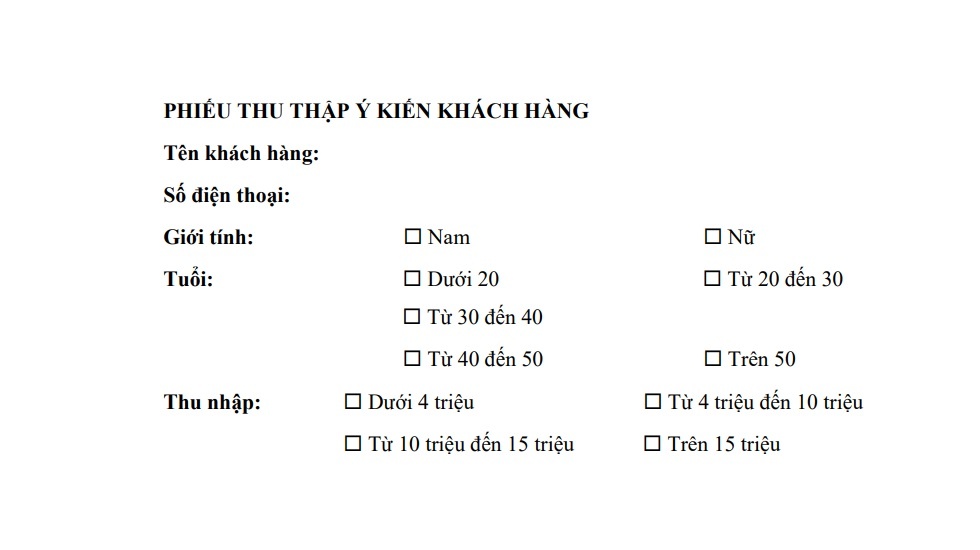

CUSTOMER COMMENTS COLLECTION FORM

Customer name:

Phone number:

| Sex: | Female | male |

| The age: | Under 20 | From 20 to 30 |

| From 30 to 40 | ||

| From 40 to 50 | Over 50 | |

| Income: | Under 4 million | From 4 million to 10 million VND |

| From 10 million to 15 million VND | Over 15 million won |

Maybe you are interested!

-

Solutions For Developing Banking Services Of Nam Viet Commercial Joint Stock Bank.

Solutions For Developing Banking Services Of Nam Viet Commercial Joint Stock Bank. -

Improving The Capacity And Role Of The State Bank In Managing Monetary Policy And Stabilizing The Economy

Improving The Capacity And Role Of The State Bank In Managing Monetary Policy And Stabilizing The Economy -

Developing banking services at Nam Viet Commercial Joint Stock Bank - 11

Developing banking services at Nam Viet Commercial Joint Stock Bank - 11

I. GENERAL INFORMATION

Time you use Navibank banking services:

| < 1 year | 1 year – less than 2 years |

| 2 years – less than 3 years | 3 years |

Banking services you are using at Navibank (You can choose many different options)

| a. Mobilization capital | |

| Deposit payment | Certificates of deposit Short-term |

| Saved money | Debentures |

| b.Credit | |

| Loan for home repair, home purchase | Study abroad loan |

| Loans for production, life | Savings book mortgage loan |

| Other loans | |

| c.Payment of treasury | |

| Domestic money transfers | Pay the bill telephone |

| Cash collection and payment | |

| d. Forex service | |

| Transfer money overseas | Receive money from Western Union |

| e. Money business | |

| Transactions now (Spot) | |

| f. Current bank great | |

| Internet Banking | Mobile Banking |

| Phone Banking | Vntopup |

| Online payment line | Navicard |

Do you have any transactions with any banks other than Navibank? If yes, please specify the name of the bank

| Yes | No |

Bank: ……………………………………………………………

Would you recommend Navibank banking services to others?

| Yes | No |

Are you ready to come to Navibank when there is a need in the near future?

| Yes | No |

II. CUSTOMER SATISFACTION SURVEY ON NAVIBANK’S BANKING SERVICES

Please indicate your level of agreement with the statements in the following table:

(Circle the appropriate box, please do not leave it blank)

| Number | ELEMENT | Totally agree | Agree | Normal | Disagree | Totally disagree |

| A | Trust | |||||

| 1 | Navibank always fulfills its commitments to you about banking services | |||||

| 2 | Can Navibank’s banking services meet your needs? | |||||

| 3 | Navibank does the right service right the first time | |||||

| 4 | Navibank keeps information well for customers | |||||

| 5 | Navibank did not make any mistakes | |||||

| B | Feedback | |||||

| 6 | Navibank staff give advice to you | |||||

| 7 | Navibank staff perform services for you quickly | |||||

| 8 | Navibank staff are always ready to help you | |||||

| 9 | Navibank staff always respond to your requests | |||||

| C | Guarantee | |||||

| 10 | Navibank employees create trust in you | |||||

| 11 | Do you feel safe when choosing Navibank banking service? | |||||

| 12 | You are always welcomed warmly and thoughtfully | |||||

| 13 | Navibank staff has enough professional knowledge to answer your questions | |||||

| D | Sympathy | |||||

| 14 | Navibank calls or sends greeting cards to you on birthdays, holidays, Tet… | |||||

| 15 | Navibank is very interested in your interests | |||||

| 16 | Navibank staff clearly understand your needs | |||||

| 17 | There are often sweepstakes or gifts for you | |||||

| E | The tangible | |||||

| 18 | Very modern equipment | |||||

| 19 | Nice facilities | |||||

| 20 | Neat and polite Navibank staff uniforms | |||||

| 21 | Convenient parking for customers | |||||

| 22 | Wide trading network | |||||

| F | Satisfaction | |||||

| 23 | Reasonable transaction fees | |||||

| 24 | Attractive interest rates | |||||

| 25 | In general, you are completely satisfied when dealing with Navibank |

III. OTHER COMMENTS (Besides the above, do you have any other comments, please specify them below to help Navibank improve customer satisfaction)

Thank you very much for your valuable comments

ANNEX 2: RELIABILITY ANALYSIS

Appendix 2.1: Cronbach Alpha Reliability Analysis of the 1st Trust component

Reliability Statistics

| Cronbach’s Alpha | N of Items |

| .716 | 5 |

Item-Total Statistics

| Scale Mean if Item Deleted | Scale Variance if Item Deleted | Corrected Item-Total Correlation | Cronbach’s Alpha if Item Deleted | |

| TT1 | 12.90 | 3.930 | .478 | .666 |

| TT2 | 13.06 | 4.093 | .494 | .663 |

| TT3 | 13.06 | 3.608 | .643 | .600 |

| TT4 | 12.85 | 3.559 | .516 | .651 |

| TT5 | 13.19 | 4.383 | .274 | .746 |

Appendix 2.2: Cronbach Alpha reliability analysis of the 2nd Trust component

Reliability Statistics

| Cronbach’s Alpha | N of Items |

| .746 | 4 |

Item-Total Statistics

| Scale Mean if Item Deleted | Scale Variance if Item Deleted | Corrected Item-Total Correlation | Cronbach’s Alpha if Item Deleted | |

| TT1 | 9.83 | 2.715 | .526 | .695 |

| TT2 | 9.98 | 2.903 | .522 | .699 |

| TT3 | 9.98 | 2.769 | .516 | .700 |

| TT4 | 9.77 | 2.311 | .606 | .649 |

Appendix 2.3: Cronbach Alpha reliability analysis of the Response component

Reliability Statistics

| Cronbach’s Alpha | N of Items |

| .775 | 4 |

Item-Total Statistics

| Scale Mean if Item Deleted | Scale Variance if Item Deleted | Corrected Item-Total Correlation | Cronbach’s Alpha if Item Deleted | |

| PH1 | 9.72 | 2.968 | .562 | .730 |

| PH2 | 9.76 | 2.766 | .551 | .743 |

| PH3 | 9.74 | 2.848 | .683 | .667 |

| PH4 | 9.86 | 3.349 | .544 | .742 |

Appendix 2.4: Cronbach Alpha reliability analysis of the Assurance component

Reliability Statistics

| Cronbach’s Alpha | N of Items |

| . 750 | 4 |

Item-Total Statistics

| Scale Mean if Item Deleted | Scale Variance if Item Deleted | Corrected Item-Total Correlation | Cronbach’s Alpha if Item Deleted | |

| DB1 | 9.49 | 2.760 | .511 | .713 |

| DB2 | 9.45 | 2.746 | .562 | .683 |

| DB3 | 9.36 | 2.850 | .504 | .715 |

| DB4 | 9.54 | 2.771 | .610 | .659 |

Appendix 2.5: Cronbach Alpha reliability analysis of the Sympathy component

Reliability Statistics

| Cronbach’s Alpha | N of Items |

| . 697 | 4 |

Item-Total Statistics

| Scale Mean if Item Deleted | Scale Variance if Item Deleted | Corrected Item-Total Correlation | Cronbach’s Alpha if Item Deleted | |

| CT1 | 9.56 | 2.478 | .629 | .531 |

| CT2 | 9.17 | 2.893 | .497 | .623 |

| CT3 | 9.23 | 3.026 | .320 | .740 |

| CT4 | 9.54 | 2.977 | .512 | .618 |

Appendix 2.6: Cronbach Alpha reliability analysis of the Tangible component

Reliability Statistics

| Cronbach’s Alpha | N of Items |

| . 783 | 5 |

Item-Total Statistics

| Scale Mean if Item Deleted | Scale Variance if Item Deleted | Corrected Item-Total Correlation | Cronbach’s Alpha if Item Deleted | |

| HH1 | 11.00 | 4.012 | .544 | .747 |

| HH2 | 10.98 | 4.266 | .421 | .786 |

| HH3 | 10.91 | 3.998 | .493 | .764 |

| HH4 | 11.01 | 3.685 | .678 | .701 |

| HH5 | 11.02 | 3.727 | .669 | .705 |

Appendix 2.7: Cronbach Alpha reliability analysis of Satisfaction component.

Reliability Statistics

| Cronbach’s Alpha | N of Items |

| . 723 | 3 |

Item-Total Statistics

| Scale Mean if Item Deleted | Scale Variance if Item Deleted | Corrected Item-Total Correlation | Cronbach’s Alpha if Item Deleted | |

| HL1 | 6.17 | 1.406 | .588 | .581 |

| HL2 | 6.28 | 1.499 | .500 | .687 |

| HL3 | 6.43 | 1.410 | .545 | .634 |

APPENDIX 3: DISCOVERING FACTOR ANALYSIS Appendix

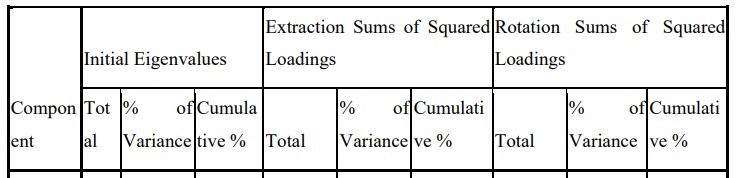

3.1: First exploratory factor analysis

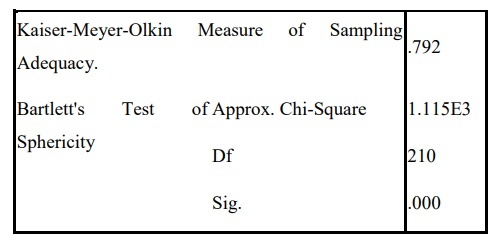

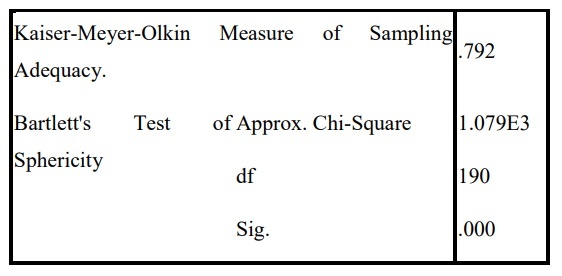

KMO and Bartlett’s Test

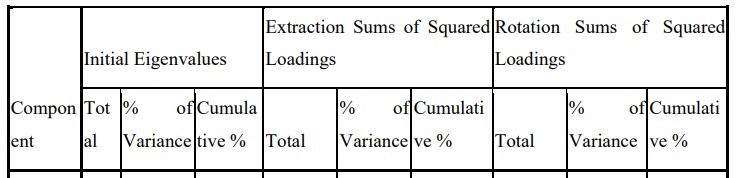

Total Variance Explained

| 1 | 5.096 | 24.266 | 24.266 | 5.096 | 24.266 | 24.266 | 2.716 | 12.934 | 12.934 |

| 2 | 2.385 | 11.356 | 35.622 | 2.385 | 11.356 | 35.622 | 2.612 | 12.436 | 25.369 |

| 3 | 1.815 | 8.645 | 44.267 | 1.815 | 8.645 | 44.267 | 2.509 | 11.948 | 37.317 |

| 4 | 1.654 | 7.877 | 52.145 | 1.654 | 7.877 | 52.145 | 2.175 | 10.359 | 47.676 |

| 5 | 1.286 | 6.125 | 58.270 | 1.286 | 6.125 | 58.270 | 2.132 | 10.152 | 57.828 |

| 6 | 1.009 | 4.804 | 63.074 | 1.009 | 4.804 | 63.074 | 1.102 | 5.246 | 63.074 |

| 7 | .901 | 4.293 | 67.367 | ||||||

| 8 | .800 | 3.808 | 71.175 | ||||||

| 9 | .733 | 3.492 | 74.666 | ||||||

| 10 | .656 | 3.126 | 77.792 | ||||||

| 11 | .602 | 2.868 | 80.660 | ||||||

| 12 | .564 | 2.687 | 83.347 | ||||||

| 13 | .529 | 2.521 | 85.868 | ||||||

| 14 | .489 | 2.329 | 88.197 | ||||||

| 15 | .462 | 2.200 | 90.397 | ||||||

| 16 | .438 | 2.084 | 92.481 | ||||||

| 17 | .390 | 1.858 | 94.339 | ||||||

| 18 | .369 | 1.757 | 96.096 | ||||||

| 19 | .321 | 1.530 | 97.626 | ||||||

| 20 | .281 | 1.336 | 98.962 | ||||||

| 21 | .218 | 1.038 | 100.000 |

Extraction Method: Principal

Component Analysis.

Rotated Component Matrixa

| Component | ||||||

| 1 | 2 | 3 | 4 | 5 | 6 | |

| HH4 | .852 | |||||

| HH5 | .829 | |||||

| HH1 | .727 | |||||

| HH3 | .591 | |||||

| HH2 | .545 | |||||

| DB4 | .790 | |||||

| DB2 | .691 | |||||

| DB1 | .681 | |||||

| DB3 | .678 | |||||

| PH3 | .822 | |||||

| PH2 | .788 | |||||

| PH4 | .688 | |||||

| PH1 | .674 | |||||

| CT4 | .818 | |||||

| CT1 | .811 | |||||

| CT2 | .672 | |||||

| TT2 | .798 | |||||

| TT3 | .745 | |||||

| TT4 | .656 | |||||

| TT1 | .532 | |||||

| CT3 |

Extraction Method: Principal Component Analysis. Rotation Method: Varimax with Kaiser Normalization. a. Rotation converged in 6 iterations.

Appendix 3.2: Second exploratory factor analysis

KMO and Bartlett’s Test

Total Variance Explained

| 1 | 4.990 | 24.948 | 24.948 | 4.990 | 24.948 | 24.948 | 2.757 | 13.783 | 13.783 |

| 2 | 2.385 | 11.924 | 36.871 | 2.385 | 11.924 | 36.871 | 2.485 | 12.425 | 26.209 |

| 3 | 1.766 | 8.828 | 45.699 | 1.766 | 8.828 | 45.699 | 2.468 | 12.342 | 38.551 |

| 4 | 1.611 | 8.056 | 53.756 | 1.611 | 8.056 | 53.756 | 2.254 | 11.268 | 49.819 |

| 5 | 1.278 | 6.392 | 60.148 | 1.278 | 6.392 | 60.148 | 2.066 | 10.329 | 60.148 |

| 6 | .987 | 4.933 | 65.081 | ||||||

| 7 | .824 | 4.122 | 69.203 | ||||||

| 8 | .774 | 3.868 | 73.071 | ||||||

| 9 | .657 | 3.284 | 76.355 | ||||||

| 10 | .604 | 3.019 | 79.374 | ||||||

| 11 | .569 | 2.847 | 82.221 | ||||||

| 12 | .529 | 2.647 | 84.869 | ||||||

| 13 | .489 | 2.446 | 87.314 | ||||||

| 14 | .468 | 2.338 | 89.653 | ||||||

| 15 | .453 | 2.265 | 91.917 | ||||||

| 16 | .402 | 2.011 | 93.928 | ||||||

| 17 | .387 | 1.937 | 95.865 | ||||||

| 18 | .325 | 1.624 | 97.489 | ||||||

| 19 | .284 | 1.420 | 98.909 | ||||||

| 20 | .218 | 1.091 | 100.000 |

Extraction Method: Principal

Component Analysis.

Rotated Component Matrixa

| Component | |||||

| 1 | 2 | 3 | 4 | 5 | |

| HH4 | .829 | ||||

| HH5 | .811 | ||||

| HH1 | .723 | ||||

| HH3 | .625 | ||||

| HH2 | .607 | ||||

| DB4 | .788 | ||||

| DB2 | .683 | ||||

| DB1 | .675 | ||||

| DB3 | .675 | ||||

| PH3 | .831 | ||||

| PH2 | .772 | ||||

| PH4 | .722 | ||||

| PH1 | .661 | ||||

| TT2 | .774 | ||||

| TT4 | .732 | ||||

| TT3 | .728 | ||||

| TT1 | .622 | ||||

| CT4 | .831 | ||||

| CT1 | .801 | ||||

| CT2 | .690 |

Extraction Method: Principal Component Analysis. Rotation Method: Varimax with Kaiser Normalization. a. Rotation converged in 5 iterations.

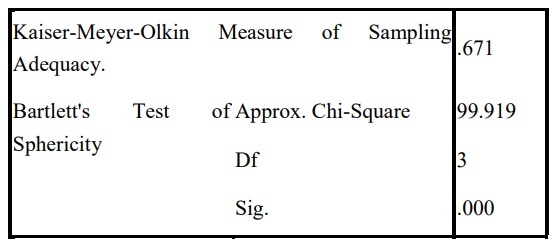

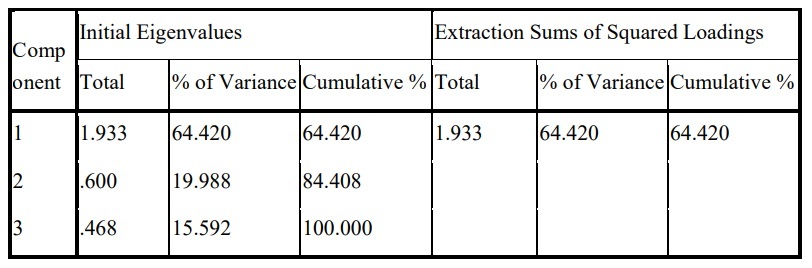

Appendix 3.3: Factor analysis to explore the satisfaction component

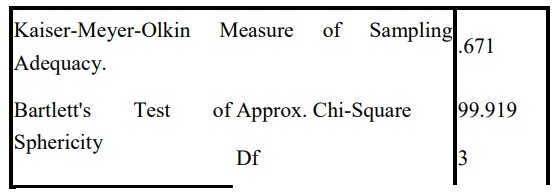

KMO and Bartlett’s Test

Total Variance Explained

KMO and Bartlett’s Test

Extraction Method: Principal Component Analysis.

Component Matrixa

| Component | |

| 1 | |

| HL1 | .834 |

| HL3 | .805 |

| HL2 | .768 |

Extraction Method: Principal Component Analysis. a. 1 components extracted.

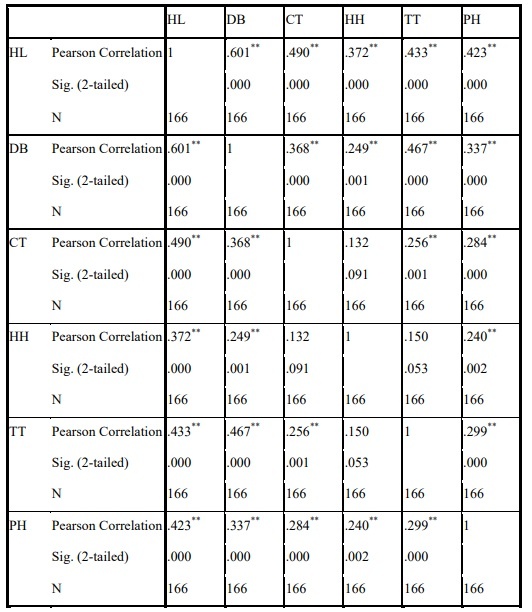

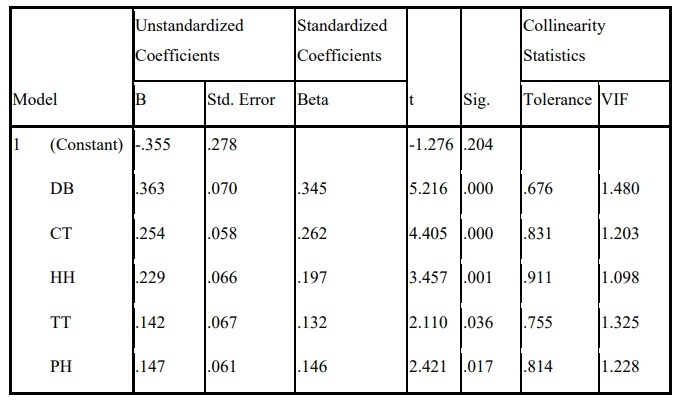

ANNEX 4: RESIDENTIAL AND CONCLUSION ANALYSIS

Correlations

Variables Entered/Removedb

| Model | Variables Entered | Variables Removed | Method |

| 1 | PH, HH, CT, TT, DBa | . | Enter |

a. All requested variables entered.

b. Dependent Variable:

HL Model Summary

| Model | R | R Square | Adjusted R Square | Std. Error of the Estimate |

| 1 | .727a | .528 | .513 | .39211 |

a. Predictors: (Constant), PH, HH, CT, TT, DB

ANOVAb

| Model | Sum of Squares | Df | Mean Square | F | Sig. |

| 1 Regression Residual Total | 27.500 24.600 52.100 | 5 160 165 | 5.500 .154 | 35.773 | .000a |

a. Predictors: (Constant), PH, HH, CT, TT,

DB

Variables Entered/Removedb

| Model | Variables Entered | Variables Removed | Method |

| 1 | PH, HH, CT, TT, DBa | . | Enter |

b. Dependent Variable: HL

Coefficientsa

a. Dependent Variable: HL

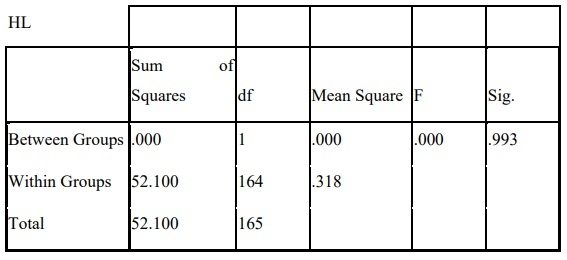

ANNEX 5: ANOVA ANALYSIS

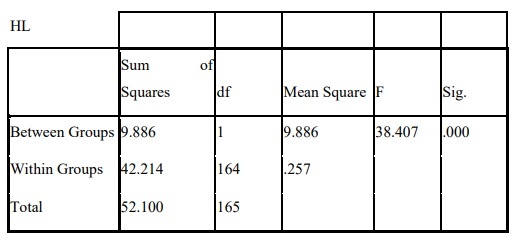

Appendix 5.1: Analysis of differences by sex.

Test of Homogeneity of Variances

HL

| Levene Statistic | df1 | df2 | Sig. |

| .231 | 1 | 164 | .631 |

ANOVA

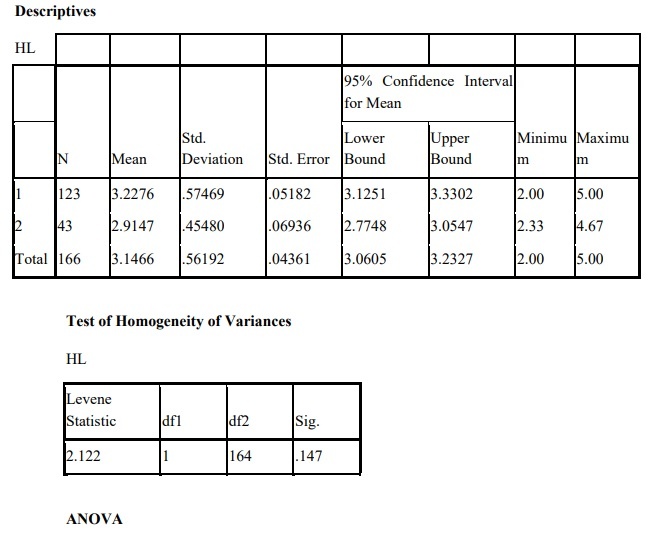

Appendix 5.2: Analysis of differences by age

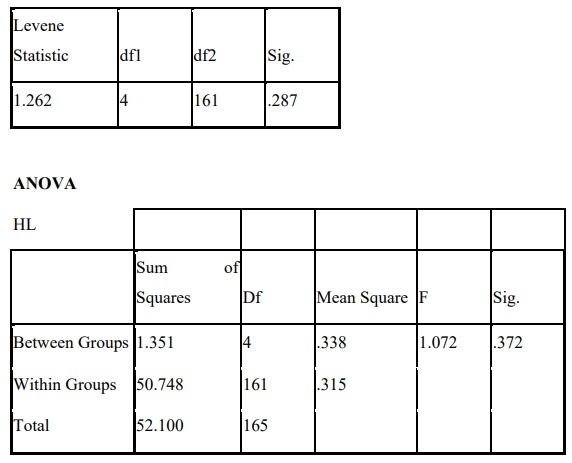

Test of Homogeneity of Variances

HL

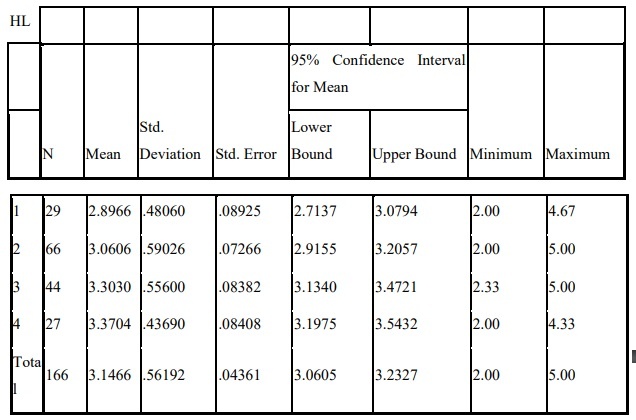

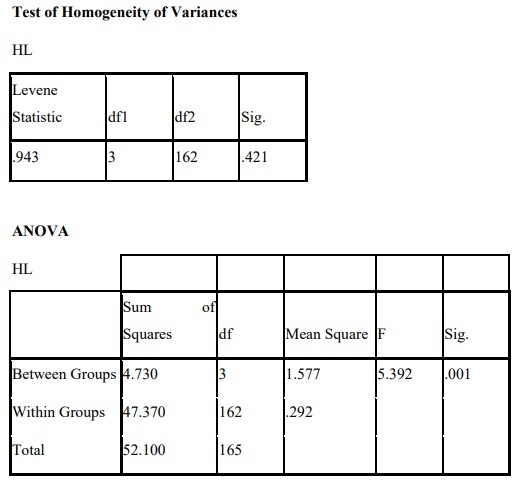

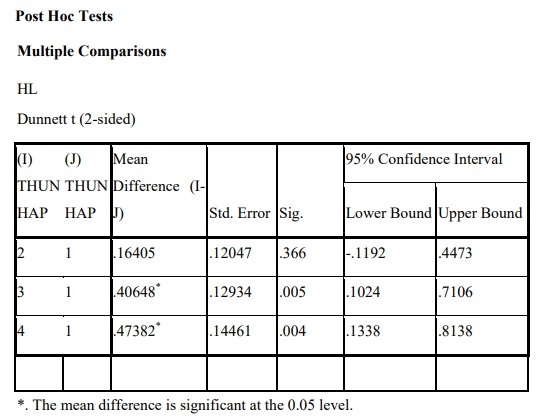

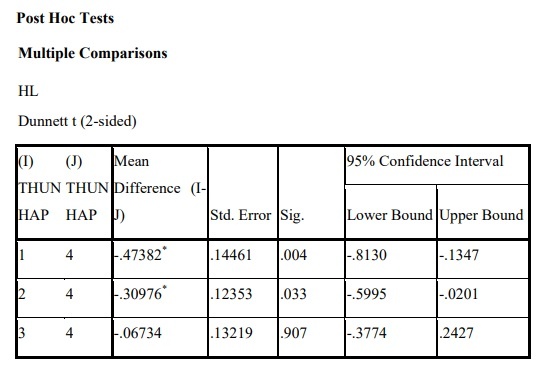

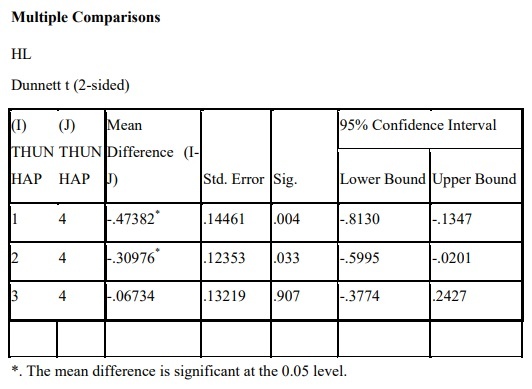

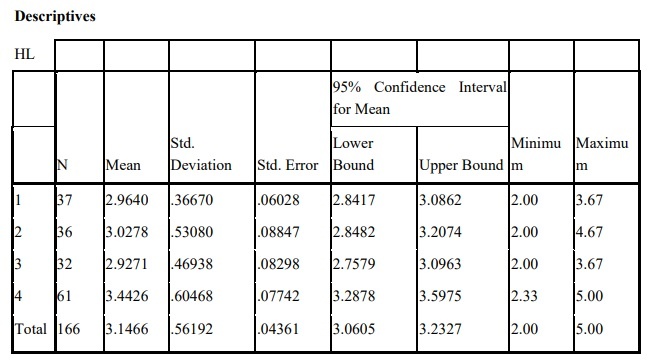

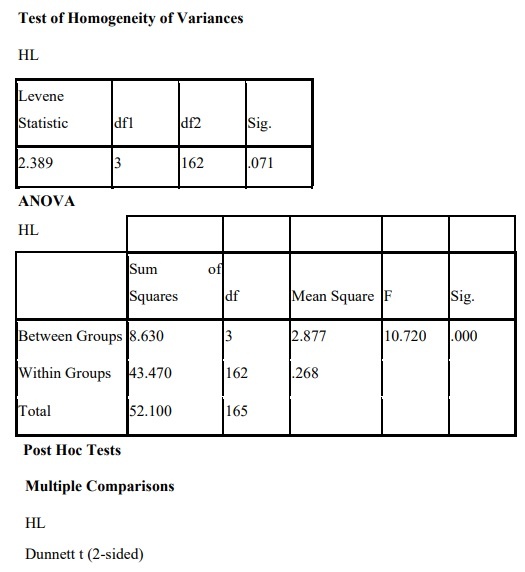

Appendix 5.3: Analysis of differences by income.

Descriptives

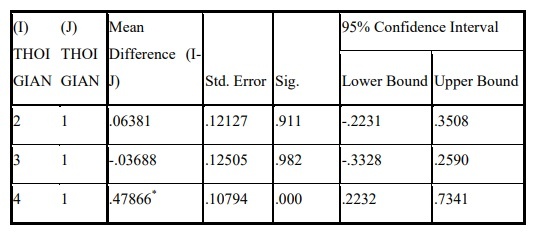

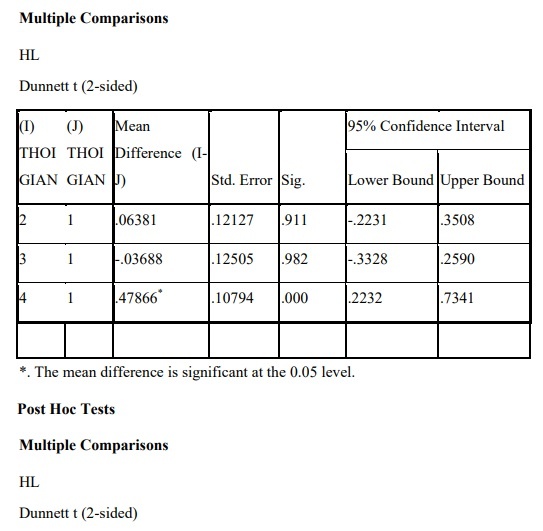

Appendix 5.4: Analysis of differences over time of use.

Appendix 5.5: Analysis of differences in service referrals

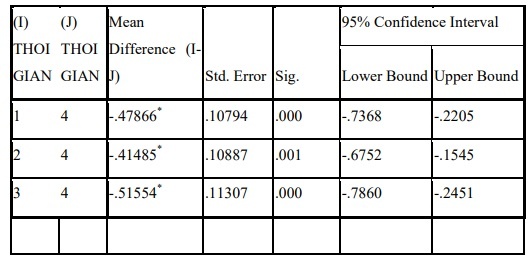

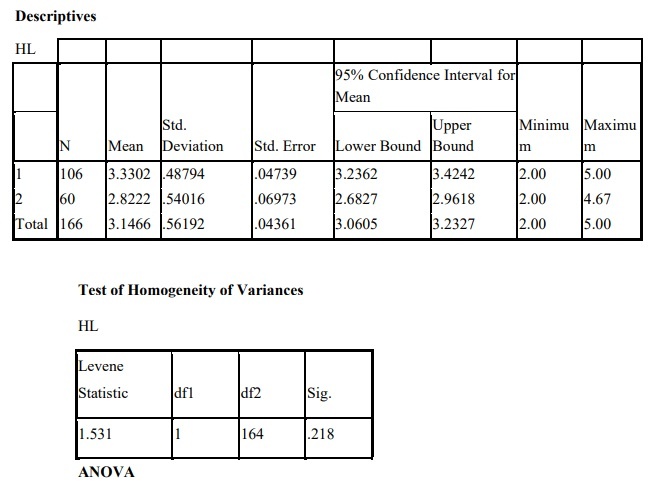

Appendix 5.6: Analysis of differences in future usage needs.

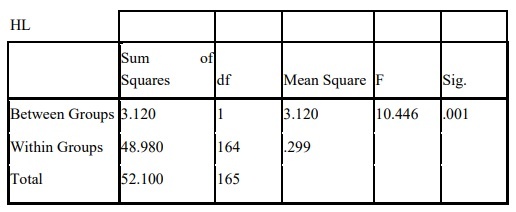

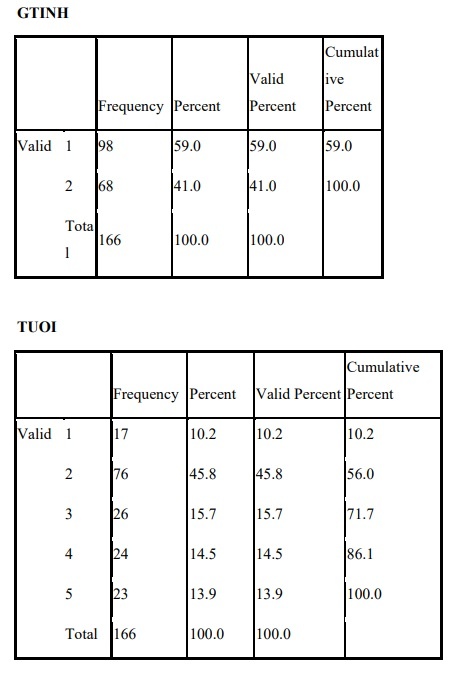

APPENDIX 6: DESCRIPTION STATISTICS

| N | Minimum | Maximum | Mean | Std. Deviation | |

| TT1 | 166 | 2 | 5 | 3.36 | .689 |

| TT2 | 166 | 1 | 5 | 3.20 | .618 |

| TT3 | 166 | 1 | 5 | 3.20 | .674 |

| TT4 | 166 | 2 | 5 | 3.42 | .787 |

| TT5 | 166 | 1 | 5 | 3.08 | .713 |

| PH1 | 166 | 2 | 5 | 3.31 | .736 |

| PH2 | 166 | 2 | 5 | 3.27 | .818 |

| PH3 | 166 | 2 | 5 | 3.28 | .695 |

| PH4 | 166 | 2 | 5 | 3.17 | .609 |

| DB1 | 166 | 1 | 5 | 3.13 | .740 |

| DB2 | 166 | 1 | 5 | 3.16 | .708 |

| DB3 | 166 | 2 | 5 | 3.25 | .711 |

| DB4 | 166 | 2 | 5 | 3.07 | .666 |

| CT1 | 166 | 2 | 5 | 2.94 | .768 |

| CT2 | 166 | 2 | 5 | 3.33 | .708 |

| CT3 | 166 | 2 | 5 | 3.27 | .812 |

| CT4 | 166 | 2 | 5 | 2.96 | .664 |

| HH1 | 166 | 1 | 5 | 2.73 | .646 |

| HH2 | 166 | 1 | 4 | 2.75 | .655 |

| HH3 | 166 | 1 | 5 | 2.82 | .690 |

| HH4 | 166 | 1 | 4 | 2.72 | .659 |

| HH5 | 166 | 2 | 5 | 2.71 | .652 |

| HL1 | 166 | 2 | 5 | 3.27 | .689 |

| HL2 | 166 | 2 | 5 | 3.16 | .699 |

| HL3 | 166 | 2 | 5 | 3.01 | .713 |

| Valid N (listwise) | 166 |

ANNEX 7: Summary of products and services of Nam Viet Bank and some other banks

| Sacombank | HSBC | ANZ | Navibank |

Banking service group on capital mobilization

Individual customers

| Current deposit – Daily term savings – Dong dong savings – Au Co account – Yield account – Traditional term savings – Daily installments – Advantageous medium-term savings – Deposit future – Versatile deposit – Housing savings | Current account – Security account – Term deposit – Online deposit account | -Online winning account -Term savings account -Multiple fortune account -Smart account | Paying deposit – Savings deposit – Savings deposit accumulating value |

Corporate customers

| -Date deposit -Payment deposit -Commodity transaction payment -MSmart deposit -Deposit for capital contribution to buy shares for foreign investors -Escrow deposit -mFree deposit – Regular term deposit – Hoa Viet payment deposit. | -Current account -Term deposit account -Safety account | -Corporate payment deposit account -Cash management account -Term deposit account | -Payment deposit -Term deposit – Margin deposit |

Credit banking service group

Individual customers

| -Studying loan -Loan to buy a house -Loan to buy a car -Borrow to prove financial capacity -Consumer loan – My Tin -Employee consumption loan -Consumer loan – Bao Tin -Small business loan market -Support loan Supporting women to start a business -Business loans -Securities loans -Consumer loans -Bao Toan -Pledge loans with valuable documents. | -Home loan -Real estate loan – home repair -Real estate mortgage loan – Study abroad -Real estate mortgage loan – other purposes -Car loan -Secured overdraft -Consumer loan | -Home loans – home construction – Home mortgage loans -Consumer loans -Short-term loans secured by deposits | Borrowing to buy a house, repair a house, build a house -Borrow to supplement capital for production and commerce -Borrow for study abroad -Loan for life -Loan for mortgage of savings book -Loan to buy a car |

Corporate customers

| Domestic and foreign guarantees – Loans for production and business – Loans for investment in assets/projects – Overdrafts secured by deposits – Loans for car dealerships – Financing for domestic production and business fish sauce in Phu Quoc -Sponsoring domestic trade -Sponsoring imports -Sponsoring coffee production and business | -Working capital financing -Bill discounting -Trade financing -Bond underwriting | -Working capital loans -Term loans -Finance leasing -Import and export financing -Trade finance -Guarantee | Loans to supplement working capital – Import and export financing – Loans for investment in factories, office warehouses, fixed assets – Loans for implementation of housing and residential land projects – Loans to businesses car business -Deposit account overdraft -Guarantee |

Banking service group on payment and treasury

Individual customers

| Money transfer – Gold custody service – IME, MoneyGram, Xpress Money, Coinstar remittance payment service – Check supply and issuance service – Safe deposit box rental service – Domestic fast gold transfer service – Payment service for Cambodian and Lao checks – Traveller’s check exchange service – Over the counter bill payment service – Real estate payment intermediary | Money transfer – Traveller’s check – Bill of exchange collection | Money transfer – Bill of exchange – Payplus service | Money transfer – Telephone fee collection – Asset storage service, valuable papers – Western union service – Collection and payment service – Foreign currency exchange |

Corporate customers

| Transfer money – Collection and payment – Set up counters at designated points | Money transfer – Receivables management solution – Liquidity management solution | Transfer money – Manage accounts receivable and payable – Liquidity management | Transfer money – Collection and payment |

Banking service group on foreign exchange

Individual customers

| Foreign currency futures trading – Foreign currency spot trading, gold – Foreign currency call options trading | Foreign currency spot trading | Foreign currency spot trading | Spot forex trading |

Corporate customers

| Swaps, spot, forward, foreign currency options | Transactions in spot and forward foreign exchange. – Structural products | Swaps, spot, forward, foreign currency options | Foreign currency spot trading – Forex futures trading – Foreign currency swaps |

E-banking service

Individual customers

| Mobile banking, Internet banking, Phone banking | Online banking – Mobile banking – Phone banking | E-banking service – 24/7 customer service center | Online payment – Mobile banking, Internet banking, Phone banking |

Corporate customers

| Mobile banking, Internet banking, Phone banking | Online banking service | Ngân hàng điện tử dành cho doanh nghiệp (eBiz) | Mobile banking, Internet banking, Phone banking |

Card banking service

Individual customers

| International credit card – International payment card – Prepaid card – Plus payment card – Family credit card | Credit card – International payment card | ANZ credit card – Global payment card | Domestic Debit Card – Domestic Credit Card – Payoo Link Card |

Other banking services group

Individual customers

| Financial plan – Education guarantee – Retirement guarantee – Investment-linked deposit | Travel insurance – Life insurance – Investment: bi-currency deposits, structured deposits, foreign investments | Security insurance – Investment: structural investment, dual currency investment |

Corporate customers

| Gold and foreign currency exchange investment and insurance services – Commodity derivative products – Structured products | Property insurance, personnel insurance, marine insurance – Bond issuance consulting | Market for debt instruments – Interest rate derivatives – Structured investment products |

“Source: Website of HSBC Bank, ANZ Bank, Sacombank, Navibank”

The above service summary shows that Navibank has only diversified in credit services, while other services are relatively poor compared to other banks. Especially in terms of card services, Navibank can only issue domestic debit and credit cards, while other banks already have international credit cards, international payment cards, prepaid cards…

For the group of payment and treasury services, especially international payment, Navibank has not developed strongly because it does not have the advantage of branches in many countries around the world like HSBC and ANZ.

In addition, Navibank has not yet deployed other banking services such as insurance, investment, financial consulting, etc.