Ibrahim, M. H., & Alagidede, P. (2018). Nonlinearities in financial developmenteconomic growth nexus: Evidence from subSaharan Africa. Research in International Business and Finance, 46, 95104.

IMF. (2022). Global Financial Stability Report—Shockwaves from the War in Ukraine Test the Financial System’s Resilience. Washington, DC.

Ireland, P. N. (1994). Money and Growth: An Alternative Approach. American Economic Review, 4765.

Jung, W. S. (1986). Financial Development and Economic Growth: International Evidence. Economic Development and Cultural Change, 34, 333346.

Kar, M., Nazlıoglu, S., & Agir, H., (2011). Financial development and economic growth nexus in the MENA countries: bootstrap panel Granger causality analysis. Economic Modelling, 28, 685693.

Khan, M.S., & Senhadji, A.S. (2003). Financial Development and Economic Growth: A Review and New Evidence. Journal of African Economies, 12(2), 89110.

Khandelwal, P., Cabezon, E., Mirzayev, S., & AlFarah, R. (2022). Macroprudential Policies to Enhance Financial Stability in the Caucasus and Central Asia. IMF Departmental Paper 2022/006. International Monetary Fund, Washington, DC.

King, R. G., & Levine, R. (1993). Finance and growth: Schumpeter might be right. The Quarterly Journal of Economics, 108(3), 717–737.

Kónya, L. (2006). Exports and growth: Granger causality analysis on OECD countries with a panel data approach. Economic Modelling, 23(6), 978–992.

Có thể bạn quan tâm!

-

Kết Quả Kiểm Định Nhân Quả Dumitrescuhurlin Với Sự Phụ Thuộc Chéo Tại Các Thang Thời Gian Khác Nhau

Kết Quả Kiểm Định Nhân Quả Dumitrescuhurlin Với Sự Phụ Thuộc Chéo Tại Các Thang Thời Gian Khác Nhau -

Hạn Chế Và Hướng Nghiên Cứu Trong Tương Lai

Hạn Chế Và Hướng Nghiên Cứu Trong Tương Lai -

Phát triển tài chính, cấu trúc tài chính và tăng trưởng kinh tế - 20

Phát triển tài chính, cấu trúc tài chính và tăng trưởng kinh tế - 20 -

Tổng Hợp Các Bằng Chứng Thực Nghiệm Có Liên Quan Đến Pttc Và Ttkt

Tổng Hợp Các Bằng Chứng Thực Nghiệm Có Liên Quan Đến Pttc Và Ttkt -

Kết Quả Phần Trăm Phương Sai Chỉ Số Pttc Được Giải Thích Bởi Các Thành Phần Pca

Kết Quả Phần Trăm Phương Sai Chỉ Số Pttc Được Giải Thích Bởi Các Thành Phần Pca -

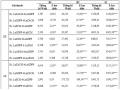

Kết Quả Kiểm Định Nghiệm Đơn Vị Dữ Liệu Bảng (Cips) Các Biến Trong Mô Hình Pttc Và Ttkt

Kết Quả Kiểm Định Nghiệm Đơn Vị Dữ Liệu Bảng (Cips) Các Biến Trong Mô Hình Pttc Và Ttkt

Xem toàn bộ 328 trang tài liệu này.

Kowarik, A., & Templ, M. (2016). Imputation with R package VIM. Journal of Statistical Software, 74(7), 116.

Kripfganz, D., & Schneider, D., C. (2018). Ardl: Estimatiing autogregressive distributed lag and equilibrium correction models. Proceedings of the 2018 London Stata Coference.

Kumar, K., & Paramanik, R. N. (2020). Nexus between Indian economic growth and financial development: A nonlinear ARDL approach. The Journal of Asian Finance, Economics, and Business, 7(6), 109–116.

Kuznets, S. (1959). Six Lectures on Economic Growth. New York: Free Press.

Law, S. H., & Singh, N. (2014). Does too much finance harm economic growth?

Journal of Banking and Finance, 41, 36–44.

Lee, B. S. (2012). Bankbased and Marketbased financial systems: Timeseries evidence. PacificBasin Finance Journal, 20(2), 173–197.

Levine, R. (2002). Bankbased or marketbased financial systems: which is better?

Journal of Financial Intermediation, 11(4), 398–428.

Levine, R. (2004). Denying foreign bank entry: Implications for bank interest margins. In: Ahumada, L.A., Fuentes, J.R. (Eds.), Bank Market Structure and Monetary Policy. Banco Central de Chile, Santiago, Chile, 271–292.

Levine, R. (2005). Finance and growth: Theory and evidence. In P. Aghion & S. N. Durlauf, Handbook of economic growth (pp. 865–934). Amsterdam: Elsevier.

Levine, R., (1997). Financial development and economic growth: views and agenda.

Journal of Economic Literature, 35(2), 688–726.

Levine, R., Loayza, N., & Beck, T. (2000). Financial intermediation and growth: Causality and causes. Journal of Monetary Economics, 46(1), 31–77.

Lin, J. Y., & Monga, C. (2010). The growth report and new structural economics.

Washinton, DC: The World Bank.

Lin, J. Y., Sun, X., & Jiang, Y. (2009). Toward a theory of optimal financial structure.

Washington, DC: The World Bank.

Lin, J.Y., Sun, X., & Jiang, Y. (2013). Endowment, industrial structure and appropriate financial structure: A new structural economics perspective. Journal of Economic Policy Reform, 16(2), 1–14.

Lind J.T., & Mehlum H. (2010). With Or Without U? The Appropriate Test for a U Shaped Relationship. Oxford Bulletin of Economics and Statistics, 72(1), 109118.

Liu, G., & Zhang, C. (2020). Does financial structure matter for economic growth in China. China Economic Review, 61, 101194.

Loayza, N. V., & Ranciere, R. (2006). Financial Development, Financial Fragility, and Growth. Journal of Money, Credit and Banking, 38(4), 10511076.

Lown, C., Morgan, D., & Rohatgi, S. (2000). Listening to Loan Officers: The Impact of Commercial Credit Standards on Lending and Output. Federal Reserve Bank of New York Economic Policy Review, 6(2), 116.

Lucas, Robert E., Jr. (1988). On the Mechanics of Economic Development.

Journal of Monetary Economics, 22, 342.

Luintel, K. B., Khan, M., LeonGonzalez, R., & Li, G. (2016). Financial development, structure, and growth: New data, method, and results. Journal of International Financial Markets, Institutions, and Money, 43, 95–112.

Mallat, S. (1989). A theory for multiresolution signal decomposition: the wavelet representation. IEEE Transactions on Pattern Analysis and Machine Intelligence, 11, 67493.

McKinnon, R. I. (1973). Money and Capital in Economic Development, Washington: The Brookings Institution.

Morck, R., & Nakamura, M. (1999). Banks and corporate control in Japan. The Journal of Finance, 54(1), 319–339.

Naceur, S.B., & Ghazouani, S. (2007). Stock markets, banks and economic growth: Empirical evidence from the MENA region. Research in International Business and Finance, 21, 197315.

Narayan, P.K., & Narayan, S. (2013). The shortrun relationship between the financial system and economic growth: New evidence from regional panels. International Review of Financial Analysis, 29, 7078.

Ncanywa, T., & Mabusela, K. (2019). Can financial development influence economic growth: The subSaharan analysis? Journal of Economic and Financial Sciences, 12(1), 1–13.

Nili, M., & Rastad, M. (2007). Addressing the growth failure of the oil economies: The role of financial development. The Quarterly Review of Economics and Finance, 46, 726740.

Ocampo, J.A. (2022). Ensuring Global Financial Stability. in Ing, L.Y., & Rodrik, D. (eds.) New Normal, New Technology, New Financing, Jakarta: ERIA and IEA, 385.

OECD/JRC. (2008). Handbook on constructing composite indicators. Methodology and user guide. OECD Publisher, Paris.

Oima, D., & Ojwang, C. (2013). Marketbased and bankbased financial structure on economic growth in some selected Ecowas countries. International Journal of Education and Research, 1(2), 110.

Pagano, M. (1993). Financial markets and growth: an overview. European Economic Review, 37, 613622.

Panizza, U. (2014). Financial development and economic growth: Known knowns, known unknowns, and unknown unknowns. Revue d’économie Du Développement, 22(HS02), 35–65. https://www.cairn.info/revuedeconomiedudeveloppement 2014HS02page35.htm

Panizza, U (2018). Nonlinearities in the Relationship Between Finance and Growth.

Comparative Economic Studies, 60(1), 4453.

Patrick, H.T. (1966). Financial development and economic growth in underdeveloped countries. Economic Development and Cultural Change, 14(1), 174189.

Persyn, D., & Westerlund J. (2008). Errorcorrectionbased cointegration tests for panel data. Stata Journal, 8, 232241.

Pesaran, M. (2004). General diagnostic tests for crosssection dependence in panels.

Cambridge MA: NBER.

Pesaran, M. H. (2007). A simple panel unit root test in the presence of cross‐section dependence. Journal of Applied Econometrics, 22(2), 265–312.

Pesaran, M. H., & Smith, R. P. (1995). Estimating LongRun Relationships from Dynamic Heterogeneous Panels. Journal of Econometrics, 68(1), 79113.

Pesaran, M. H., Shin, Y., & Smith, R.P. (1999). Pooled Mean Group Estimation of Dynamic Heterogeneous Panels. Journal of the American Statistical Association, 94(446), 621634.

Rajan, R.G., & Zingales, L. (1998). Financial Dependence and Growth. The American Economic Review, 88(3), 559586.

Ramsey, J. B., & Lampart, C. (1998). The decomposition of economic relationship by time scale using wavelets: money and income. Macroeconomic Dynamics and Econometrics, 2, 4971.

Rebelo, S. (1991). LongRun Policy Analysis and LongRun Growth. The Journal of Political Economy, 99(3), 500521.

Ricardo, D. (1817). On the Principles of Political Economy and Taxation. London: John Murray, AlbemarleStreet.

Rioja, F., & Valev, N. (2004a). Does one size fit all? Are examination of the finance and growth relationship. Journal of Development Economics, 74(2), 429447.

Rioja, F., & Valev, N. (2004b). Finance and the sources of growth at various stages of economic development. Economic Inquiry, 42(1), 127–140.

Romer, P. M., (1986). Increasing returns and long run growth. Journal of Political Economy, 94(5), 1002–1037.

Roodman, D. (2009). How to do xtabond2: An introduction to difference and syste GMM in Stata. Stata Journal, 9(1).

Rousseau, P. L., & Wachtel, P. (2002). Inflation Thresholds and the FinanceGrowth Nexus. Journal of International Money and Finance, 21(6), 777–793.

Rousseau, P. L., & Wachtel, P. (2011). What is Happening to the Impact of Financial Deepening on Economic Growth? Economic Inquiry, 49(1), pp. 276–288.

Saldivia, M., Kristjanpoller, W., & Olson, J. E. (2020). Energy consumption and GDP revisited: A new panel data approach with wavelet decomposition. Applied Energy, 272, 115207.

Samargandi, N., Fidrmuc, J., & Ghosh, S. (2015). Is the Relationship Between Financial Development and Economic Growth Monotonic? Evidence from a Sample of MiddleIncome Countries. World Development, 68, 6681.

Samuelson, P. A., & Nordhaus, W. D. (2014). Economics. Boston: McGrawHill.

Santomero, A.M., & Seater, J.J. (2000). Is there an optimal size for the financial sector? Journal of Banking & Finance, 24(6), 945–965.

Schumpeter, J. A. (1911). The theory of economic development. Cambridge, MA: Harvard University Press.

Schumpeter, J. A., & Opie, R. (1934). The theory of economic development: An inquiry into profits, capital, credit, interest, and the business cycle. Cambridge, MA.: Harvard University Press.

Seven, Ü., & Yetkiner, H. (2017). Financial intermediation and economic growth: Does income matter? Economic Systems, 40(1), 39–58.

Shaw, E. S. (1973). Financial deepening in economic development. New York: Oxford University Press.

Shen, C. H., Lee, C. C., Chen, S.W., & Xie, Z. (2011). Roles Played by Financial Development in Economic Growth: Application of the Flexible Regression Model. Empirical Economics, 41(1), 103–125.

Shin, Y., Yu, B., & GreenwoodNimmo, M. (2014). Modeling asymmetric cointegration and dynamic multipliers in a nonlinear ARDL framework. New York: Springer.

Smith, A. (1776). An Inquiry into the Nature and Causes of the Wealth of Nations.

London: Methuen & Co.

Solow, R. (1956). A Contribution to the Theory of Economic Growth. Quarterly Journal of Economics, 70, 6594.

Stiglitz, J.E. (1985). Credit markets and the control of capital. Journal of Money, Credit, and Banking, 17(1), 133152.

Stulz, R. 2001. Does financial structure matter for economic growth? A corporate finance perspective. In: DermirgüçKunt, A. and R. Levine (eds.), Financial Structure and Economic Growth: A CrossCountry Comparison of Banks, Markets, and Development. Cambridge: MIT Press, 81140.

Svirydzenka, K. (2016). Introducing a New Broadbased Index of Financial Development. IMF Working Paper, WP/16/5, January 2016.

Swamy, V., & Dharani, M. (2020). Thresholds of financial development in the Euro area.

The World Economy, 43(6), 17301774.

Tang, D. (2006). The Effect of Financial Development on Economic Growth: Evidence from the APEC Countries, 1981–2000. Applied Economics, 38(16), 1889–1904.

Teodoru, I., & Akepanidtaworn, K. (2022). Managing Financial Sector Risks from the COVID19 Crisis in the Caucasus and Central Asia. IMF Departmental Paper 2022/005. International Monetary Fund, Washington, DC.

Trehan, R. (2013). Marketbased finance vs. bankbased finance. New York: PRLOG Press.

Trew, A. (2008). Efficiency, depth and growth: Quantitative implications of finance and growth theory. Journal of Macroeconomics, 30, 1550–1568.

Valickova, P., Havranek, T., & Horvath, R. (2015). Financial Development and Economic Growth: A MetaAnalysis. Journal of Economic Surveys, 29(3), 506526.

WESTERLUND, J. (2007),

“Testing for error correction in panel data”, Oxford Bulletin of Economics

and Statistics, Vol. 69 (6),

709–748.

Westerlund, J. (2007). Testing for error correction in panel data. Oxford Bulletin of Economics and Statistics, 69(6), 709748.

World Bank. (2012). Global Financial Development Report 2013: Rethinking the Role of the State in Finance. Washington, DC: World Bank.

Yilmazkuday, H. (2011). Thresholds in the FinanceGrowth Nexus: A CrossCountry Analysis. World Bank Economic Review, 25(2), 278–295.

Young, A. (1928). Increasing Returns and Economic Progress. The Economic Journal, 518542 (Presidential Address before Section F, British Association for the Advancement of Science).