The maximum total score multiplied by the weight of the group of non-financial information indicators that cause financial difficulties for enterprises is one hundred points.

Step 5: Determine the final total score to rank the business by multiplying the scores of the above steps (the score has multiplied the weights of the financial indicators, the forecast criteria and the non-financial information indicators of the enterprise). enterprises in Steps 2, 3, 4) with the respective weights of each group, then add them together to get the final total score as shown in Table 3.6. The basis of the highest proportion of non-financial indicators is to support the limitations of quantitative methods when calculating financial indicators. However, the weight of the non-financial criteria group compared to the total weight of the other two groups is not too different to maintain balance, not too biased and subjective when ranking.

Table 3.6: Summary score of enterprise credit society according to the proposed amendment of the topic

| TT | Targets | Unweighted score (maximum) | Proportion | Weighted Points (maximum) |

| first | Financial indicators | 100 | 30% | 30 |

| 2 | Forecast indicators | 50 | 30% | 15 |

| 3 | Non-financial indicators | 100 | 55% | 55 |

| total score | 100% | 100 |

Maybe you are interested!

-

Second Case Study: The Enterprise Is Classified As Bbb And Has Incurred Overdue Debt

Second Case Study: The Enterprise Is Classified As Bbb And Has Incurred Overdue Debt -

Objectives Of Improving The Credit Rating System Of Lienvietpostbank’S Corporate Customers

Objectives Of Improving The Credit Rating System Of Lienvietpostbank’S Corporate Customers -

Completing the credit rating system of corporate customers at Lien Viet Post Commercial Joint Stock Bank - 9

Completing the credit rating system of corporate customers at Lien Viet Post Commercial Joint Stock Bank - 9 -

Completing the credit rating system of corporate customers at Lien Viet Post Commercial Joint Stock Bank - 11

Completing the credit rating system of corporate customers at Lien Viet Post Commercial Joint Stock Bank - 11 -

Completing the credit rating system of corporate customers at Lien Viet Post Commercial Joint Stock Bank - 12

Completing the credit rating system of corporate customers at Lien Viet Post Commercial Joint Stock Bank - 12 -

Completing the credit rating system of corporate customers at Lien Viet Post Commercial Joint Stock Bank - 13

Completing the credit rating system of corporate customers at Lien Viet Post Commercial Joint Stock Bank - 13

(Source: proposal of the topic)

Thus, the maximum score achieved by the enterprise after this step is 100 points, based on this final score, the enterprise credit rating according to nine ratings as presented in Table 2.5 (Page 38) has been detailed. in Chapter II of this thesis.

The credit scoring model proposed by the subject is not too complicated, but it still ensures that the rating is not too high, which makes it subjective when making credit decisions, and also ensures that it is not too low to cause banks to give up business opportunities. when turning down a good customer.

After implementing the credit policy, corporate customers will continue to be graded on their bank debt repayment status according to three levels: Good (Always repay on time, or new customers), Medium (Have had past due debts in the past). However, there are no past due debts, ie customers are in the probationary period) and bad (Overdue debts) as shown in Table 3.7 to serve the loan classification according to Article 7 of Decision 493. /2005/QD-NHNN.

Table 3.7: Evaluation of the debt repayment situation of enterprises according to the proposed amendment of the topic

| Status of loan principal and interest payment | Evaluate |

| Always pay your debt on time, or new customers | Good |

| Have had past due debts, are in the trial period | medium |

| Having past due debt | Bad |

(Source: proposal of the topic)

Loan classification for corporate customers is calculated according to the results of the two-way matrix between the credit rating and the debt repayment situation, detailed as in Table 3.8, including five levels: Qualified debt, outstanding debt , subprime debt, doubtful debt, and potentially forfeit debt.

Table 3.8: Business loan classification matrix according to the proposed amendment of the topic

Credit insurance level / Debt repayment situation | Good | medium | Bad |

| AAA AA A BBB | Eligible debt | Debt notes | Subprime debt |

| BB | Debt notes | Debt notes | Subprime debt |

| REMOVE | Debt notes | Subprime debt | Doubtful debt |

| CCC | Subprime debt | Doubtful debt | Irrecoverable debts |

| Old CC | Doubtful debt | Irrecoverable debts | Irrecoverable debts |

(Source: proposal of the topic)

Verifying credit rating model of corporate customers of LienVietPostBank after adjustment

Using the data and information of the subjects presented in Chapter II of this topic, combined with the modified and supplemented model presented in this Chapter to conduct verification.

The topic of using the scoring model proposed in Section 3.2.2 (Page 55) Chapter III of this topic for credit socialization for Joint Stock Company B (Group of capital construction investment, medium-sized) has been approved. The review in Section 2.5.2 (Page 43) Chapter II of this topic shows that the total score of the enterprise in the financial indicators has been multiplied by 55.6 points as presented in Table 3.9. The baseline score is determined according to Table I.7 of Appendix I and Table 3.3 (Page 56).

Table 3.9: Scoring of the financial indicators of Joint Stock Company B by the revised model as proposed by the topic

| Targets | Unit | Value | Initial score | Weight | Weight score |

| Liquidity target group | |||||

| 1. Short-term solvency | Time | 1.06 | 40 | 14% | 5.6 |

| 2. Quick payment ability | Time | 0.86 | 80 | 8% | 6.4 |

| Activity target group | |||||

| 3. Inventory Turnover | Ring | 5.27 | 100 | 8% | 8 |

| 4. Working capital turnover | Ring | 1.23 | 60 | 8% | 4.8 |

| 5. Accounts receivable turnover | Ring | 1.94 | 20 | 8% | 1.6 |

| 6. Efficient use of assets | Time | 1.06 | 60 | 4% | 2.4 |

| Debt balance group | |||||

| 7. Liabilities/Total Assets | % | 86.98 | 20 | 15% | 3 |

| 8. Liabilities/Equity | % | 14.96 | 100 | 15% | 15 |

| Income target group | |||||

| 9. Profit before tax/Revenue | % | 1.79 | 20 | 8% | 1.6 |

| 10. Profit before tax/Total assets | % | 1.90 | 20 | 6% | 1.2 |

| 11. Profit before tax/Equity | % | 14.61 | 100 | 6% | 6 |

| Total weighted score | 55.6 |

(Source: Scoring according to the proposed model of the topic)

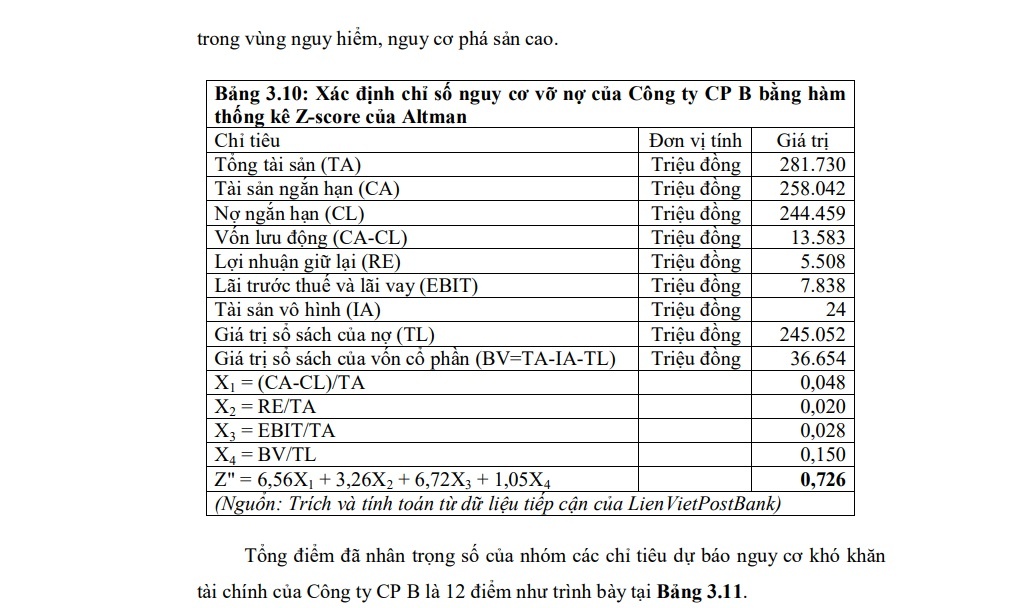

Joint Stock Company B is an equitized enterprise, not in the manufacturing industry, so the default risk index is determined as shown in Table 3.10. The calculation results show that the index Z” = 0.726 (Z” < 1.1), which means that the enterprise is in a dangerous area, with a high risk of bankruptcy.

Table 3.10: Determining the default risk index of JSC B by Altman’s Z-score statistical function

| Targets | Unit | Value |

| Total assets (TA) | Million dong | 281.730 |

| Current Assets (CA) | Million dong | 258.042 |

| Short-term debt (CL) | Million dong | 244.459 |

| Working Capital (CA-CL) | Million dong | 13.583 |

| Retained earnings (RE) | Million dong | 5.508 |

| Earnings before interest and taxes (EBIT) | Million dong | 7.838 |

| Intangible Assets (IA) | Million dong | 24 |

| Book value of debt (TL) | Million dong | 245.052 |

| Book value of equity (BV=TA-IA-TL) | Million dong | 36,654 |

| X1 = (CA-CL)/TA | 0.048 | |

| X2 = RE/TA | 0.020 | |

| X3 = EBIT/TA | 0.028 | |

| X4 = BV/TL | 0.150 | |

| Z” = 6.56X1 + 3.26X2 + 6.72X3 + 1.05X4 | 0.726 |

(Source: Extracted and calculated from LienVietPostBank’s outreach data)

The total score multiplied by the weight of the group of indicators predicting financial difficulties of JSC B is 12 points as shown in Table 3.11.

Table 3.11: Scoring indicators for forecasting financial difficulties of JSC B by the modified model proposed by the topic

| Targets | Evaluate | Initial score | Weight | Weight score |

| 1. Risk of default (Z-score) | Danger area | 20 | 40% | 8 |

| 2. Bank debt repayment of subjects holding 25% of the charter capital of the enterprise | Ever had debt extension, or loan restructuring, currently no past due debt | 40 | ten% | 4 |

| Total score by weight | twelfth |

The non-financial information indicators of JSC B are scored as shown in Table 3.12 with the total score multiplied by the weight of this group of indicators is 71.6 points.

Table 3.12: Scoring of non-financial information indicators of JSC B by the modified model proposed by the topic

| Targets | Evaluate | Initial score | Weight | Weight score | |

| first | Management qualifications and internal environment | 20% | |||

| 1.1 | Judicial history of the head of the business/business owner | Good criminal record, no criminal record, no criminal record | 100 | 2% | 2 |

| 1.2 | Education level of the head of the business/business owner | University | 80 | 2% | 1.6 |

| 1.3 | Experience, executive capacity and management quality of the business owner/leadership | Management experience and quality are quite good, the leadership apparatus is stable | 80 | 5% | 4 |

| 1.4 | Reputation and relationship of the business owner in the market, with relevant agencies | Normal relationship | 60 | 4% | 2.4 |

| 1.5 | Internal control environment, organizational structure of enterprises | Internal control processes are established but not regularly updated and checked. Good organizational structure | 80 | 2% | 1.6 |

| 1.6 | Internal HR environment of the enterprise | Good | 80 | 3% | 2.4 |

| 1.7 | Business strategic vision of the enterprise | Having a vision and business strategy, but the feasibility in some cases is still limited | 60 | 2% | 1.2 |

| 2 | Factors outside the business | ten% | |||

| 2.1 | Industry development prospects | Relatively developed and promising | 80 | 2% | 1.6 |

Table 3.12: Scoring of non-financial information indicators of JSC B by the modified model proposed by the topic

| Targets | Evaluate | Initial score | Weight | Weight score | |

| 2.2 | Influences from the policies of the State, Government, local authorities | Does not have its own policy or is not heavily influenced by the policy (if any) | 40 | 3% | 1.2 |

| 2.3 | Stability of input materials | Relatively stable or volatile but have little impact on business operations and profits | 60 | 2% | 1.2 |

| 2.4 | The possibility of the company’s products being replaced by “substitute products” according to the assessment of GMOs | Relatively difficult | 80 | first% | 0.8 |

| 2.5 | The ability of new businesses to enter the market (in the same industry/business field) as assessed by GE | Difficult, requiring large capital and labor investment, high level | 80 | first% | 0.8 |

| 2.6 | The degree of dependence of the enterprise’s business activities on natural conditions | There is a dependency but the effect is not significant | 80 | first% | 0.8 |

| 3 | Relations with CIs | 24% | |||

| 3.1 | Overdue debts/total current outstanding loans of enterprises at credit institutions | 0% | 100 | 4% | 4 |

| 3.2 | Number of times of debt restructuring, Late payment of interest, Number of times of insolvency/late payment commitments in the past 12 months at credit institutions | 0 | 100 | 4% | 4 |

| 3.3 | Debt repayment history of enterprises with Lien Viet Bank | Always pay your debt on time | 100 | 4% | 4 |

| 3.4 | Using loan capital for wrong purposes when borrowing capital at Lien Viet Bank | Never used capital for the wrong purpose | 100 | 3% | 3 |

| 3.5 | Percentage of average deposit balance (in the last 12 months) / Average outstanding balance of enterprises at Lien Viet Bank (in the last 12 months) | <2% | 20 | 4% | 0.8 |

Table 3.12: Scoring of non-financial information indicators of JSC B by the modified model proposed by the topic

| Targets | Evaluate | Initial score | Weight | Weight score | |||||

| 3.6 | Average number of transactions with Lien Viet Bank | < 2 | 20 | 5% | first | ||||

| 4 | Operational characteristics of the business | forty six% | |||||||

| 4.1 | Position and competitiveness of enterprises in the market | Branded but commonly known, the position belongs to a stable development group. Be subject to competition but have a clear direction of development to improve its position. | 60 | 5% | 3 | ||||

| 4.2 | Scope of business activities (scope of product consumption) | Only within Vietnam or the surrounding border area | 80 | 4% | 3.2 | ||||

| 4.3 | Supplier relationship | Fully active and with multiple input options | 100 | 3% | 3 | ||||

| 4.4 | Relationship with output partners | The output market is huge. Enterprises are not dependent on a small number of output partners, fully actively developing sales | 100 | 5% | 5 | ||||

| 4.5 | Main substance | quantity | newspaper | fox | talent | Report truthfully, completely, with audit, sent on time | 100 | 5% | 5 |

| 4.6 | Applying modern management model (ISO) and advanced technological processes | Do not apply | 20 | 2% | 0.4 | ||||

| 4.7 | Achievements are widely recognized | Never received awards from organizations | 20 | 2% | 0.4 | ||||

| 4.8 | Net cash flow trends | Downtrend (positive period net cash flows) | 60 | 3% | 1.8 | ||||

| 4.9 | Quarterly revenue growth rate compared to the same period last year | < 20% | 80 | 2% | 1.6 | ||||

| 4.10 | Coverage of property that can be damaged | No insurance | 20 | 3% | 0.6 | ||||

| 4.11 | Separation of duties and powers in business leadership | There is a separation, but it is not complete and reasonable | 60 | 3% | 1.8 | ||||

| 4.12 | Medium and long-term debt repayment capacity | 1 time | 60 | 2% | 1.2 |

Table 3.12: Scoring of non-financial information indicators of JSC B by the modified model proposed by the topic

| Targets | Evaluate | Initial score | Weight | Weight score | |

| 4.13 | Diversify industries and business fields | No diversification | 60 | 2% | 1.2 |

| 4.14 | Sources of debt repayment of enterprises according to the assessment of the CBA | Reliable source of debt repayment, businesses are fully capable of paying debts on time | 100 | 5% | 5 |

| Total weighted score | 71.6 |

(Source: Grading according to the proposed model of the topic)

Thus, the total credit score of Joint Stock Company B is 59.6 points as Table 3.13, equivalent to the BB rating as presented in Table 2.5 (Page 38) Chapter II of the topic. With this credit society, Joint Stock Company B is assessed as Low effective operation, medium financial potential and management capacity, medium risk, may face difficulties when adverse economic conditions persist for a long time. , limit credit expansion, focus only on short-term credit and require adequate collateral. Comparing the credit performance of Joint Stock Company B with the fact that bad debt has occurred shows that it is completely consistent. If in 2010, enterprises were properly assessed according to their capacity and risk, then the bank’s credit policy towards Joint Stock Company B was tightened by limiting or reducing credit limits and required If the demand for assets is sufficient, if this is the case, it is difficult for enterprises to expand the scale of business activities in 2011.leading to many risks for enterprises in the year-end period. And so, the bank also better control the increase in bad debt.

Table 3.13: Summary score of corporate credit society of Joint Stock Company B by the modified model proposed by the topic

| STT | Targets | Scores are not weighted | Proportion | Points have been weighted |

| first | Financial indicators | 55.6 | 30% | 16.6 |

| 2 | Forecast indicators | twelfth | 30% | 3.6 |

| 3 | Non-financial indicators | 71.6 | 55% | 39.4 |

| total score | 100% | 59.6 |

(Source: Grading according to the proposed model of the topic)

On the basis of the credit rating of JSC B as above, with the assessment of the repayment status of banks at an average level, the enterprises’ loans are classified as “Debts to pay attention” according to the matrix combining the level of Credit society and assessment of loan repayment are as presented in Table 3.8 (Page 67).

Using the post-adjusted credit scoring model as described above to re-evaluate the credit capacity of JSC A (belonging to the group of light and medium-sized industries) reviewed in Section 2.5.1 (Page 40) Chapter II of this topic. The credit rating results of Joint Stock Company A achieved the final total score multiplied by 58.9 points, equivalent to the BB credit rating as detailed in Appendix V. This result is also completely consistent This is consistent with the assessment of the current situation of the business at the end of 2011. The ranking of loans of JSC A according to the matrix combining the level of credit and debt repayment situation gives the result “Debts needing attention. idea”. Judging by the actual situation with the current difficult economic conditions and low construction demand,The bank’s lending to JSC A medium and long term to implement the construction material factory project is likely to generate overdue debt and bad debt, leading to the possibility of not fully recovering the principal and bank loan interest.

Solutions to complete the CBA system at Lien Viet Post Commercial Joint Stock Bank

Assessing the credit risk of corporate customers or borrowers in general, based only on the credit scoring model, the results achieved may still be far from reality due to the continuous fluctuations of credit institutions. economic conditions and business environment. Almost no analytical method or a complex system can completely replace the experience as well as the professional judgment of the operational staff. Therefore, LienVietPostBank still needs to have a close coordination between human factors and technology in the credit society of corporate customers in order to effectively manage credit risk.

Through analyzing the outstanding achievements and limitations of the CBA model being used at LienVietPostBank, the topic proposes solutions to improve the CBA system at Lien Viet Post Commercial Joint Stock Bank as follows:

Amending and supplementing the enterprise credit society model in the direction of adding a group of indicators for predicting the risk of enterprise bankruptcy (mainly Altman’s Z-score function), adjusting the weights and adding in the criteria group financial and non-financial, supplementing the loan classification matrix, etc. to properly reflect the corporate credit society and the corresponding debt classification as proposed to amend the corporate credit model presented in Section 3.2 (Page 52) ) Chapter III.

Strengthening the actual inspection of customers’ business activities before and after lending. LienVietPostBank’s branches need to collect timely information about customers’ movements in order to adjust credit policies flexibly and reasonably.

Branches of LienVietPostBank need to urge and encourage businesses to comply with the law on accounting and auditing. The business credit scoring results of the model proposed by this topic are influenced by compliance with accounting standards and especially by international accounting standards because of the use of a failure risk prediction model. Debt is widely used in the world.

Building a complete information system of LienVietPostBank. Like other commercial banks, LienVietPostBank also faced difficulties in accessing information sources to serve the credit socialization. In order to have a separate database, serving the credit socialization, LienVietPostBank must establish a central information system. Branches are obliged to report periodically or upon unexpected request information on relevant business customers. contact at the branch to the storage center. When needing information, branches will ask the center to provide information. In addition, setting up a specialized software program to perform credit transactions also helps data to be entered accurately and synchronously throughout the system.

In the condition that the internal resources of the bank itself are not synchronized and inadequate, LienVietPostBank can take advantage of the experience, technology, and management level of auditing organizations and organizations. Leading credit society through consulting programs, supporting strategic partners to perfect its credit society system. It is necessary to establish an information exchange channel between banks on the basis of competition and cooperation in order to achieve the common goal of preventing and minimizing risks in credit activities.

Strengthen ethics training, improve professional qualifications and skills in analysis and assessment.