3.2.2 Proposal to amend and supplement LienVietPostBank’s corporate credit rating scoring model

The sequence of steps to score the corporate credit score according to the proposed amendment and supplement model of the topic includes:

Step 1: Classify enterprises according to the criteria of size and main business lines. Compared with the past, the credit society model proposed by this topic will not distinguish enterprises by type of ownership, but will instead be differentiated according to the criteria of whether enterprises have shares or not because of the efficiency of use. capital is fundamentally different between these two business objects.

First of all, an enterprise is defined as a large, medium and small sized enterprise by giving points on the criteria of equity, average number of employees, net revenue, total assets as presented in Table I.1 of Appendix I. Due to the limitation of implementation time and database by industry, the thesis is only classified according to normal enterprise size, not using a set of assets. financial and non-financial indicators for very small-sized enterprises.

After classifying by size, the business line will be determined based on the comparison of the business line of the enterprise that has the largest proportion or accounts for 50% of revenue or more compared to the table of branches presented. presented in Table I.2 of Appendix I by five groups of agriculture, forestry and fishery; Light industry; Trade in Services; Capital construction investment; Heavy industry.

Step 2: On the basis of industry and size, use Tables IV.1, IV.2, IV.3, IV.4, IV.5 of Appendix IV corresponding to the main business lines of the enterprise. for financial scoring.

The financial indicators are evaluated according to the guidance of the State Bank to be consistent across the country, moreover, the calculation data of the State Bank which is regressed on a large scale from many different sources will be close to the actual situation of the financial institutions. industry group than the data of each commercial bank, when there is a change, the State Bank will consider adjusting and the commercial banks will update accordingly.

Compared with the set of financial indicators guided by the State Bank, the scoring of financial indicators in the corporate credit society according to the proposed amendment of the topic still uses the number of eleven indicators. Accordingly, the topic proposes to add the indicator of working capital turnover to the set of financial indicators according to the guidance of the State Bank, replacing the indicator of the average collection period with the indicator of the turnover of receivables calculated by the data. According to the industry of these two additional indicators, LienVietPostBank is more updated than the data of the State Bank. In addition, the topic also proposes to remove the indicator of Overdue debt/Total bank balance from the scoring section of financial indicators and will include the score in the section of non-financial information indicators to avoid confusion. duplicate.

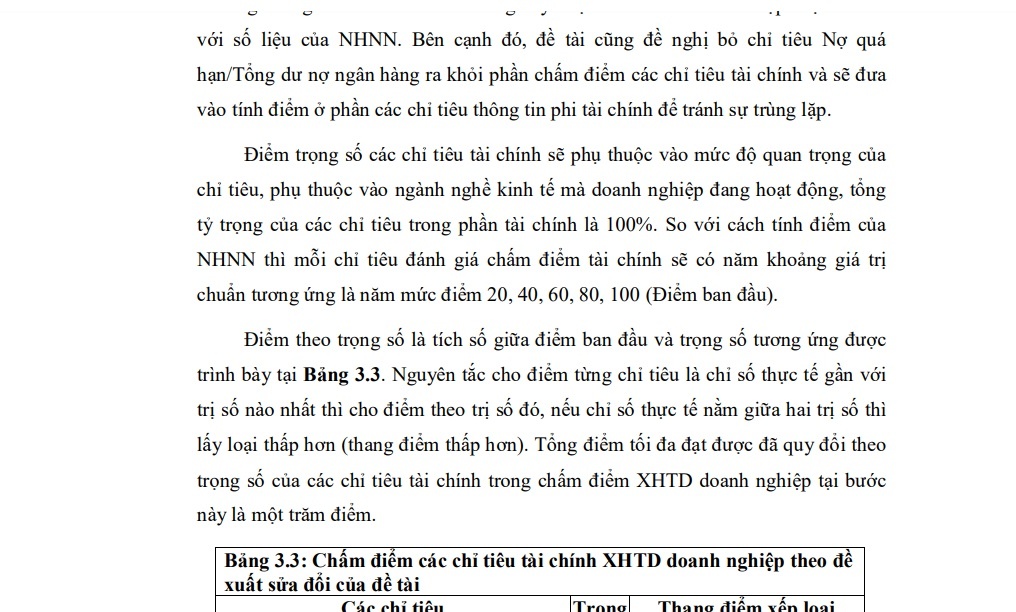

The weighting of financial indicators will depend on the importance of the indicator, depending on the economic sector in which the enterprise is operating, the total weight of the indicators in the financial section is 100%. Compared with the SBV’s scoring method, each financial scoring indicator will have five standard ranges, respectively, at five levels of 20, 40, 60, 80, 100 (initial score).

The weighted score is the product of the original score and the corresponding weight shown in Table 3.3. The principle for scoring each indicator is that the actual index that is closest to the value is given a score according to that value, if the actual index is between two values, the lower category (lower scale). The total maximum score achieved, converted according to the weight of the financial indicators in the corporate credit scoring at this step is one hundred points.

Table 3.3: Scoring of financial indicators of corporate credit according to the proposed amendment of the topic

| Targets | Weight | Rating scale | ||||

| Bar target group clause | ||||||

| first. Short-term solvency | 14% | 100 | 80 | 60 | 40 | 20 |

| 2. The ability to pay quickly | 8% | 100 | 80 | 60 | 40 | 20 |

| Operational target group | ||||||

| 3. Inventory turnover | 8% | 100 | 80 | 60 | 40 | 20 |

| 4. Working capital turnover | 8% | 100 | 80 | 60 | 40 | 20 |

| 5. Accounts Receivables Turnover | 8% | 100 | 80 | 60 | 40 | 20 |

| 6. Efficient use of assets | 4% | 100 | 80 | 60 | 40 | 20 |

| Debt balance group | ||||||

| 7. Liabilities/Total Assets | 15% | 100 | 80 | 60 | 40 | 20 |

| 8. Liabilities/Equity | 15% | 100 | 80 | 60 | 40 | 20 |

| Income target group | ||||||

| 9. Profit before tax/Revenue | 8% | 100 | 80 | 60 | 40 | 20 |

| 10.Benefits Profit before tax/Total assets | 6% | 100 | 80 | 60 | 40 | 20 |

| 11.Benefits Profit before tax/Equity | 6% | 100 | 80 | 60 | 40 | 20 |

Maybe you are interested!

-

Scoring Model Of Corporate Credit Society At Lienvietpostbank’S Branch

Scoring Model Of Corporate Credit Society At Lienvietpostbank’S Branch -

Second Case Study: The Enterprise Is Classified As Bbb And Has Incurred Overdue Debt

Second Case Study: The Enterprise Is Classified As Bbb And Has Incurred Overdue Debt -

Objectives Of Improving The Credit Rating System Of Lienvietpostbank’S Corporate Customers

Objectives Of Improving The Credit Rating System Of Lienvietpostbank’S Corporate Customers -

Completing the credit rating system of corporate customers at Lien Viet Post Commercial Joint Stock Bank - 10

Completing the credit rating system of corporate customers at Lien Viet Post Commercial Joint Stock Bank - 10 -

Completing the credit rating system of corporate customers at Lien Viet Post Commercial Joint Stock Bank - 11

Completing the credit rating system of corporate customers at Lien Viet Post Commercial Joint Stock Bank - 11 -

Completing the credit rating system of corporate customers at Lien Viet Post Commercial Joint Stock Bank - 12

Completing the credit rating system of corporate customers at Lien Viet Post Commercial Joint Stock Bank - 12

(Source: proposal of the topic)

Step 3: Scoring indicators for predicting financial difficulties of enterprises based on the following criteria: Altman’s Z-score statistical function predicts the risk of default of enterprises, bank debt repayment customers holding from 25% of the charter capital (share capital) of the enterprise as presented in Table 3.4. The basis of adding a group of indicators to forecast the risk of financial difficulties of enterprises is that this group of indicators reflects relatively accurately the prospects and short-term financial capacity of enterprises, contributing to limits for the shortcomings that the financial and non-financial indicators are using. The total maximum score multiplied by the weight of the group of indicators predicting the risk of financial difficulties of the enterprise is fifty points.

How to calculate the Z-score is detailed in Section 1.2.2 Chapter I (Page 16 of the topic), if the equitized enterprise belongs to the manufacturing industry, the Z-index = 1.2X1 + 1 should be used. ,4X2 + 3.3X3 + 0.64X4 + 0.999X5, if the enterprise has not been equitized in the manufacturing industry, then Z’ = 0.717X1 + 0.847X2 + 3.107X3 + 0.42X4 + 0.998X5. If the enterprise is not in the manufacturing industry, use the Z-index” = 6.56X1 + 3.26X2 + 6.72X3 + 1.05X4.

Table 3.4: Scoring indicators for predicting financial difficulties, credit society of enterprises according to the proposed amendment of the topic

| Targets | Initial score | Weight | |||||

| 1 | Risk broken muscle in debt (Z-score) | Region an full | Region scene newspaper | Region danger dangerous | 40% | ||

| 2 | Love return image in debt bank of the object hold 25% capital charter of the business Karma | No yes/Always pay debt correct term | Pay debt right term, yes sign brand no is fine determined about pay | Ever yes family term in debt, or muscle structure again debt loan, presently at no Yes debt too term | In progress yes in debt too term | ten% | . |

In the scoring model of the indicators for predicting difficulties of enterprises according to the revised proposal of the topic, the focus will be on the default risk index by giving a weighted score of 40%. The remaining indicator is the bank debt repayment status of the subjects holding more than 25% of the charter capital (share capital) of the enterprise with the target weight of 10%.

Step 4: Scoring non-financial information indicators that have a direct impact on the likelihood of an enterprise’s financial difficulties based on four groups of criteria: Management level and internal environment, Factors outside the enterprise, Relationship with credit institutions, Operational characteristics of the enterprise as presented in Table 3.5 (Page 59).

Compared with thirty-two non-financial criteria in the corporate customer credit model currently applied at LienVietPostBank, the proposed model uses a set of thirty-three evaluation criteria. In particular, the model proposed by the topic changes the weights of four indicators to reduce duplication when calculating scores, including: Number of times of debt restructuring, Delay in interest payment, Number of times of incapacitated commitments. /delayed payment in the past 12 months at credit institutions; The enterprise’s debt repayment history with Lien Viet Post Bank; Trends in net cash flows; Source of debt repayment of enterprises according to the assessment of the GE. In addition, the model proposed by the topic has also added five new indicators to more accurately reflect the enterprise’s ability to cope with business risks and financial difficulties: assessed quarterly revenue compared to the same period last year; Coverage of the property subject to loss; The separation of duties and powers in the business leadership; Medium and long-term principal repayment capacity; Diversify industries and business fields. In addition, the quality of financial statements is also revised and weighted to better distinguish audited and unaudited financial statements.

Table 3.5: Scoring of non-financial information indicators of corporate credit according to the proposed amendment of the topic

| Targets | Initial score | Weight | |||||

| 100 | 80 | 60 | 40 | 20 | |||

| 1 | Management qualifications and internal environment | 20% | |||||

| 1.1 | Calendar judicial history of the person standing head DN/Owner DN | Physical private calendar France good, not yet ever have money judgment, criminal record | Is already used to have suspect question, type complaint no main awake | Is already used to have money judgment, money NS | Presently at in progress is for statue doubt question France the law or in progress suffer France law access element | 2% | |

| 1.2 | Education level question of people stand head DN/Owner DN | Above University | Grand learn | High class | central grant | Below Middle grant or are not yes pine believe | 2% |

| 1.3 | Experience, power force regulator onion and substance quantity management of the Owner DN/Ban receive religion | Much business experiment, yes submit degree, thing onion business Karma good, set machine leadership is fine determined | Scripture test, matter quantity manager reason in level pretty, the set machine receive religion is fine determined | Yes lack of experience test, matter quantity manager business management live average jar, set machine receive religion unstable determined | Team five receive religion short business test and manager bad reason | 5% | |

| 1.4 | Uy trust, relationship of the Business owner above market, with agencies contact Mandarin | Yes reputation on love school, termite Mandarin system very good with muscles Mandarin contact Mandarin, can end used for NS develop business Karma | Normal relationship | Bad relationship | 4% | ||

| 1.5 | Environment check internal control the set, organization structure position of DN | NS process check internal control the set and rules submit active dynamic okay set set up, update Japan and check tra usually through, play NS effective high in reality economic. Organization structure position good | NS rules submit check control internal Okay set create but are not access Japan, check tra usually often. Muscle structure organization good | NS rules submit check control internal exist at but yet Okay real presently all face in real economic. Muscle structure organization still limited processing most determined | NS rules submit check control internal exist at but are not okay main wake chemical good Okay write Copy. Muscle structure organization still many term processing | Are not yes lip school check control internal the set. Muscle structure organization not yet complete good | 2% |

| 1.6 | Environment core internal of the business | Very good | Good | Rather | central jar | Least | 3% |

| 1.7 | Range look at battle comb business of the business Karma | Yes vision and strategy terrible clear business clear and have count feasible high in real economy | Yes vision and battle comb business business, Tuy course count ability exam 1 number school suitable still limit | Are not yes pine news do guest goods are from deny bow grant because physical do tell honey | Are not yes war comb tool can give ever period paragraph | 2% | |

| 2 | External factors enterprise | ten% |

| Targets | Initial score | Weight | |||||

| 100 | 80 | 60 | 40 | 20 | |||

| 2.1 | Exhibition hope development develop branch | In progress in stage paragraph or developed hope play develop high | Similarity for play develop, Yes develop hope | Fine determined | Yes sign failure quit or are failure withdraw | 2% | |

| 2.2 | Photo benefit from the policy of Home water, Main government, Main right geography direction | Yes policy tell household/advice encourage/favor treat and business Karma until use effective main book | Yes main book tell household/advice encourage/advantage treat but business Karma yet end use brand fruit main book | Are not yes main books private or are not bear Photo enjoy much from main books (if Yes) | Term regime play develop | 3% | |

| 2.3 | Source stability input materials | Very stable | Relatively stable or There are fluctuations but little impact on business activities and profits of enterprises | Unstable, influence big to business, profit | 2% | ||

| 2.4 | Product capabilities of Enterprises are replaced by “substitute products” according to the assessment of GMOs | Very difficult, market No replacement products within the next 1 year | Relatively difficult | Normal | Relatively easy | Very easy, on the market There are many alternative products for consumers to choose from | first% |

| 2.5 | Possibility to enter the market market (in the same industry/business field) of new enterprises as assessed by the CBA | Very difficult | Difficult, requires capital investment and large, highly qualified labor | Normal | Relatively easy | Very easy | first% |

| Targets | Initial score | Weight | |||||

| 100 | 80 | 60 | 40 | 20 | |||

| 2.6 | Dependency of business activities under natural conditions | Very few dependencies | Have dependencies, influence trivial | Depends a lot | Completely dependent | first% | |

| 3 | Relations with CIs | ||||||

| 3.1 | Debt situation too term/total residual current debt in of enterprises at NS Credit institutions | 0% | Below 3% | Are from 3% to below 5% | Are from 5% to below ten% | 10% | 4% |

| 3.2 | Number Debt restructuring, late payment interest, The number of times the Orange ending ability/slow bar math in 12 months via at the Credit institutions | 0 time | first time | 2 time | 3 time | Above 3 times | 4% |

| 3.3 | Debt repayment history of enterprises with Lien Viet Bank | Always pay your debt on time | Ever had a debt transfer? overdue/restructuring repayment period or in the total outstanding balance currently owed out of date | 4% | |||

| 3.4 | Using the loan in the wrong category the purpose of borrowing capital at Lien Viet Bank | Never used capital wrong goal | Have used capital wrong goal | 3% |

| Targets | Initial score | Weight | |||||

| 100 | 80 | 60 | 40 | 20 | |||

| 3.5 | Billion balance weight money send comments Troops/Remnants debt jar .’s army DN at Ngan row Lien Viet (in 12 months via) | 20% | Are from 10% come under 20% | Are from 5% to below ten% | Are from 2% to below 5% | <2% | 4% |

| 3.6 | Number medium amount jar the delivery Translate with Ngan row Lien Viet | > 6 | 5 – 6 | 3 – 4 | < 2 | 5% | |

| 4 | Operational characteristics of the business | forty six% | |||||

| 4.1 | Taste position and possibility power competition of the business Karma on the market school | Love brand post Sign at inside/out water, okay know to wide cobble and spectrum variable on the market school, group guide market leader school about market part and Uy credit. Trend play good development, near the like are not at risk NS replaced nice taste reduction position | Yes love brand but Okay know come at degree information often, taste wisdom belonging to group play develop okay determined. Bear NS edge painting but Yes direction play develop clearly clear to improve good position. | In progress create build picture Photo. Products product/translation service occupy market section small. Pressure edge paintings big, ability power edge painting at central jar. | Business Karma small, Hentai moving in commit en narrow, yet Mandarin mind come love brand, ability power edge painting at short | 5% | |

| 4.2 | Pham active dynamic of business Karma (range pepper fertility Products) | Toan country and Yes activities export password (if only export luxurious border unicorn near tense belong level below) | Only in commit en Vietnamese Male or crime Because border unicorn near | In crime Because domain | In crime en province/city city | 4% |

| Targets | Initial score | Weight | |||||

| 100 | 80 | 60 | 40 | 20 | |||

| 4.3 | Relationship with supplier grant | Complete all owner dynamic and Yes many direction project choose select head into the | Yes dependent, although course still likely power thu arrange if yes variable dynamic are from supplier grant | Le belonging to much on home bow grant | 3% | ||

| 4.4 | Relationship with first partner out | Market school head out huge. Business career are not teary belong on one the handful of opposite to output effect, complete all owners dynamic play develop sell row | Termites Quan generation average often, two beside all need rely on together to together play develop | Business Karma only Yes 1 few opposite to first work out, very teary belong on NS partner there. | 5% | ||

| 4.5 | Matter newspaper volume fox finance | Newspaper middle fox real, full, Yes audit, to send on time | Newspaper fox central real, full enough, send correct term but are not okay check math poison create | Matter quantity central vase, counter muscle light copy love Figure talent main DN, although course short full and no to send right term | Matter quantity least, newspaper fox but need edit fix access Japan many for reflect correct real economy | 5% | |

| 4.6 | Apply tissue Figure management presently great (ISO) and process labour Artisan up | Is already deploy pressure use 01 year | Catch top/new develop declare pressure use below 01 year | Are not pressure use | 2% |

| Targets | Initial score | Weight | |||||

| 100 | 80 | 60 | 40 | 20 | |||

| 4.7 | Wall accumulated labour get wide cobble | Usually through receive Okay prizes bonus of NS organization Yes reputation | Ever receive Okay the prize bonus but no usually through | Not yet each take okay NS prize bonus of NS organization | 2% | ||

| 4.8 | Coins direction transfer money pure | Yes trend get a raise (save transfer money pure in period positive) | Yes coin direction reduce (save transfer money pure in period positive) | Yes coin direction increase (save transfer money pure in period minus) | Yes coin direction reduce (save transfer money pure in period minus) or rolling credit use no Yes information | 3% | |

| 4.9 | Increase speed chief business collect quarter price compared with the same period last year | ≥ 20% | < 20% | Are not increase chief | Fall reduce | 2% | |

| 4.10 | Level of protection dangerous of property Yes possible loss | > 90% | 50% – 90% | <50% | Are not yes tell dangerous | 3% | |

| 4.11 | Separation duty service, permission force in you leadership business Karma | Yes split full enough, spend weather, very reasonable | Yes feces Cup chi weather, are up to complete good job feces determined | Yes feces Cup but not yet full and reasonable | Not yet feces Cup | 3% | |

| 4.12 | Possibility debt repayment capacity origin medium and long term | ≥ 1.5 times | ≥ 1.3 times | ≥ 1 times | ≥ 0.5 times | < 0.5 times | 2% |

| 4.13 | Diversify branch profession, receive economic area business | Multi format around receive area core | Are not multi form chemistry | Multi form chemistry outside receive core area core | 2% | ||

| 4.14 | Debt repayment source of the DN according to fight price of GB | The source debt repayment worth trust, business career complete all ability ability to pay in debt on time | The source pay in debt no is fine determined, business Karma yes can will mention proposal structure again time pay in debt | The source pay in debt no sure sure, business Karma meet difficult towel in job find source pay in debt | 5% |

(Source: proposal of the topic)