Training can be carried out periodically at the training center of the Head Office for new recruits and professional staff, or the branch trains itself internally if conditions permit. Practical experience shows that no analytical methods and tools can completely replace the skills and experience of a team of credit analysts.

Raise awareness of the Bank’s Board of Directors and operational staff about the role of credit socialization tools in risk prevention and effective loan portfolio establishment. Apply enterprise credit socialization tools in combination with other measures such as safety assets and risk provisioning.

Conclusion of the research issues of Chapter III:

In this chapter, the topic introduced in detail the SBV’s guidance on the credit society of corporate customers as a basis for the proposed model of amendments and supplements.

Since then, the thesis has tried to build a credit scoring model for corporate customers based on the model analysis being applied at LienVietPostBank , towards completing the feasibility of debt classification based on the qualitative method. Article 7 of Decision 493/2005/QD-NHNN dated 22/04/2005. The thesis references the progress of Altman’s model of predicting the possibility of corporate bankruptcy, the credit socialization model of domestic commercial banks as a basis for proposing amendments and supplements, contributing to perfecting the credit system of corporate customers. by LienVietPostBank.

Re-examining the revised and supplemented model in this chapter has also proven the accuracy, reasonableness and usefulness of this proposed model for LienVietPostBank. However, in order for the revised and supplemented model to be effective, LienVietPostBank needs to complete the credit society model according to the attached solutions of the topic.

CONCLUDE

The topic “Improving Credit Rating System for Corporate Customers at Lien Viet Post Commercial Joint Stock Bank ” has solved the following problems:

Systematize and perfect the theories of credit risk management through the credit system of commercial banks, in which mainly the credit system of corporate customers .

The thesis has analyzed and evaluated the current status of the corporate customer credit system applied at LienVietPostBank, thereby showing the achievements as well as the remaining limitations that need to be amended and supplemented in accordance with the current requirements. rapidly changing business environment conditions today. By comparing with the corporate credit scoring models of international credit rating organizations and domestic banks, combined with professional practical experience, and learn to study the models of the credit rating agencies. economy in the world, from which the thesis proposes additional amendments to improve the internal credit system of corporate customers of LienVietPostBank.

The topic also added recommendations on necessary support measures for LienVietPostBank’s corporate credit rating system to be effective.

In general, the enterprise credit society model proposed by the topic has met the requirements of credit risk management under the Basel II Treaty and Article 7 of Decision 493/2005/QD-NHNN dated April 22, 2005 on classifying debts, setting up and using provisions to deal with credit risks.

However, due to the limitation of implementation time, limited access to bank data and industry statistical data, this topic needs to be further studied in depth to be able to put into operation. used in practice. The direction of future research and development of this topic is to build multivariable models based on the results of this topic, update the database by industry groups, along with the analysis of financial statements. of the business is mainly based on cash flow and applies the Z-score model that reflects the bankruptcy risk of the business announced by Professor Altman, which is being applied by many countries.

The issue of perfecting credit society in general and standardizing the scoring model of internal credit society of corporate customers in particular have been paid much attention by commercial banks in order to contribute to reducing risks in business and improving the quality of work. credit of each bank itself, this is an advantage to help this topic continue to research and develop in the future.

REFERENCES

Vietnamese

Annual Report Vietnam Credit Index (2010), Report of the Vietnam Chamber of Commerce & Industry (VCCI).

Lam Minh Chanh (2007), Using Z-score to estimate Credit Score, www.saga.vn.

Nguyen Dang Don (2010), Modern Commercial Banking Administration, Statistical Publishing House.

Tran Huy Hoang (2007), Commercial Banking Administration, Statistical Publishing House.

Nguyen Thanh Huyen (2008), Credit Rating at Vietcombank.

State Bank of Vietnam, Report on the performance of business credit analysis and rating in 2007.

Tran Dac Sinh (2002), Credit norms in Vietnam, Lao Dong Publishing House.

Le Tat Thanh, Building a model to forecast the credit rating of Vietnamese enterprises in the manufacturing industry, Credit rating of the consumer durables industry, www.rating.com.vn

Internal documents on credit activities of LienVietPostBank.

Internal documents on Vietcombank’s credit rating.

Internal document on credit rating of Vietinbank.

Internal document on ACB’s credit rating.

Documents: Law on Credit Institutions 2010, Law on Enterprises, Law on State Bank 2010, system of other sub-law documents related to commercial banks’ operations.

General information from websites: www.sbv.gov.vn/wps/portal/vn, www.en.wikipedia.org/, www.rating.com.vn/, www.cicb.vn/, www. cic.vn, www.crv.com.vn, www.thesaigontimes.vn

English

Altman (2003), The use of Credit scoring Models and the Importance of a Credit Culture, New York University, USA.

Standard & Poor’s (2008), Corporate Ratings Criteria, Standard & Poor’s

Ciaran Walsh (2006), Key management ratios.

Nassim Nicholas Taleb (2007), The Black swan – The impact of the highly improbable.

Standard & Poor’s (2009), Vietnam Ratings Direct.

APPENDIX I STANDARDS FOR CHARACTERISTICS OF LIENVIETPOSTBANK’S CORPORATE CREDIT SOCIAL

Table I.1: Scoring of business size of LienVietPostBank

| Category Criteria | AGRICULTURE, FORESTRY AND FISHERY | TRADE IN SERVICES | HEAVY INDUSTRY | LIGHT INDUSTRY | INVESTMENT OF CONSTRUCTION | Point |

| Net revenue (unit: billion VND/year) | > 250 150 – 250 100 – 149 75 – 99 50 – 74 30 – 49 10 – 29 < 10 | > 100 80 – 100 60 – 79 40 – 59 25 – 39 15 – 24 5 – 14 < 5 | > 500 400 – 500 330 – 399 250 – 329 170 – 249 100 – 169 50 – 99 < 50 | > 400 350 – 400 300 – 349 220 – 299 150 – 219 80 – 149 20 – 79 < 20 | > 330 280 – 330 230 – 280 180 – 230 130 – 180 80 – 130 30 – 80 30 | 35 30 25.5 21 16.5 12.5 8.5 4.5 |

| Equity (unit: billion VND) | > 70 50 – 70 40 – 49 30 – 39 20 – 29 10 – 19 5 – 9 < 5 | > 40 30 – 40 20 – 29 15 – 19 10 – 14 5 – 9 1 – 4 < 1 | > 400 340 – 400 260 – 339 180 – 259 100 – 179 50 – 99 10 – 49 < 10 | > 200 150 – 200 100 – 149 75 – 99 50 – 74 30 – 49 5 – 29 < 5 | > 100 85 – 100 70 – 85 55 – 70 40 – 55 25 – 40 10 – 25 10 | 30 26 22 18.5 14.5 11 7.5 4 |

| Total assets (unit: billion VND) | > 200 120 – 200 80 – 119 60 – 79 40 – 59 25 – 39 10 – 24 < 10 | > 80 65 – 80 50 – 64 35 – 49 25 – 34 15 – 24 3 – 14 < 3 | > 1500 1200 – 1500 1000 – 1199 750 – 999 500 – 749 250 – 499 50 – 249 < 50 | > 400 300 – 400 200 – 299 150 – 199 100 – 149 60 – 99 10 – 59 < 10 | > 400 340 – 400 280 – 339 220 – 279 160 – 219 100 – 159 40 – 99 < 40 | 20 17.5 15 12.5 10 7.5 5 2.5 |

| Number of employees (average number of people/year) | > 500 400 – 500 300 – 399 200 – 299 150 – 199 100 – 149 50 – 99 < 50 | > 250 200 – 250 160 – 199 120 – 159 80 – 119 50 – 79 20 – 49 < 20 | > 700 600 – 700 500 – 599 400 – 499 300 – 399 200 – 299 100 – 199 < 100 | > 500 420 – 500 350 – 419 270 – 349 200 – 269 120 – 199 50 – 119 < 50 | > 1000 850 – 1000 710 – 849 570 – 709 430 – 569 290 – 429 150 – 289 < 150 | 15 13 11 9 7 5.5 4 2.5 |

| Large Medium Small Scale | Total score 86.5 36.5 – 86.4 < 36.5 |

Maybe you are interested!

-

Objectives Of Improving The Credit Rating System Of Lienvietpostbank’S Corporate Customers

Objectives Of Improving The Credit Rating System Of Lienvietpostbank’S Corporate Customers -

Completing the credit rating system of corporate customers at Lien Viet Post Commercial Joint Stock Bank - 9

Completing the credit rating system of corporate customers at Lien Viet Post Commercial Joint Stock Bank - 9 -

Completing the credit rating system of corporate customers at Lien Viet Post Commercial Joint Stock Bank - 10

Completing the credit rating system of corporate customers at Lien Viet Post Commercial Joint Stock Bank - 10 -

Completing the credit rating system of corporate customers at Lien Viet Post Commercial Joint Stock Bank - 12

Completing the credit rating system of corporate customers at Lien Viet Post Commercial Joint Stock Bank - 12 -

Completing the credit rating system of corporate customers at Lien Viet Post Commercial Joint Stock Bank - 13

Completing the credit rating system of corporate customers at Lien Viet Post Commercial Joint Stock Bank - 13 -

Completing the credit rating system of corporate customers at Lien Viet Post Commercial Joint Stock Bank - 14

Completing the credit rating system of corporate customers at Lien Viet Post Commercial Joint Stock Bank - 14

(Source: Lien Viet Post Commercial Joint Stock Bank)

APPENDIX I

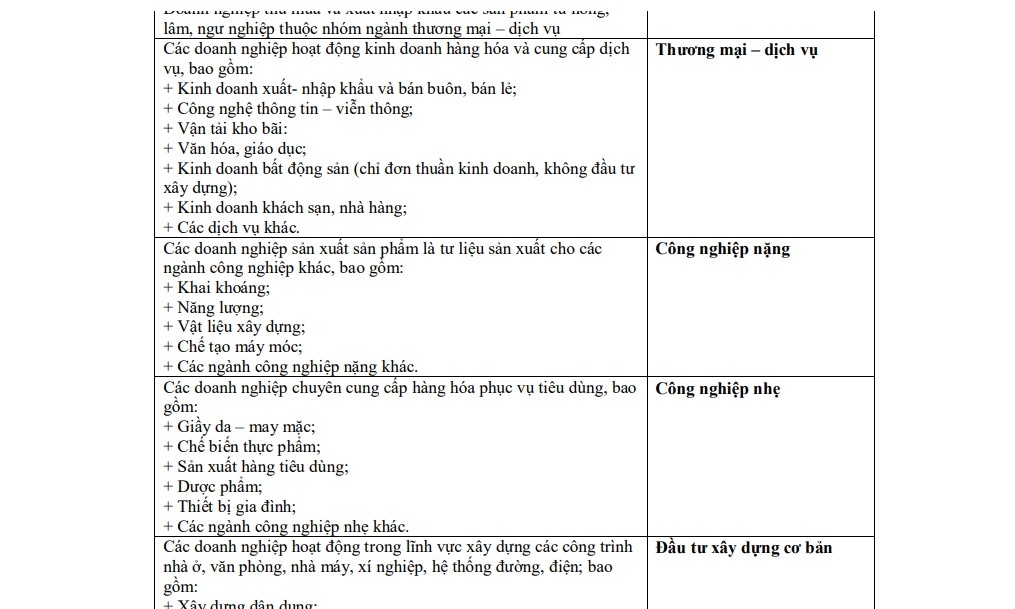

Table I.2: Identifying enterprises by field and business lines of LienVietPostBank

| Products and main areas of business activities | Classification by industry group |

| Enterprises exploiting and catching products from agriculture, forestry and fishery, including: + Cultivation and animal husbandry; + Afforestation, logging and other forest products; + Exploitation and aquaculture. Enterprises processing products from agriculture, forestry and fishery belong to the group of light industries. Enterprises that purchase and import and export products from agriculture, forestry and fishery in the group of trade – service industries | Agriculture, Forestry and fishery |

| Enterprises engaged in goods trading and service provision, including: + Import-export business and wholesale and retail; + Information technology – telecommunications; + Transportation and storage: + Culture, education; + Real estate business (just doing business, not investing in construction); + Hotel and restaurant business; + Other services. | Trade in Services |

| Enterprises produce products that are means of production for other industries, including: + Mining; + Energy; + Building materials; + Manufacturing machinery; + Other heavy industries. | Heavy industry |

| Enterprises specializing in providing consumer goods, including: + Leather shoes – apparel; + Food processing; + Production of consumer goods; + Pharmaceuticals; + Household appliances; + Other light industries. | Light industry |

| Enterprises operating in the field of construction of houses, offices, factories, factories, road systems, electricity; including: + Civil construction; + Industrial construction; + Construction of traffic system; + Real estate business from construction projects. | Capital construction investment |

(Source: Lien Viet Post Commercial Joint Stock Bank)

APPENDIX I

Table I.3: Scoreboard of financial indicators of enterprises in the Agriculture, Forestry and Fisheries sector according to LienVietPostBank

| STT | Targets | Proportion (%) | Enterprise size | ||||||||||||||

| Big | Fit | Small | |||||||||||||||

| 100 | 80 | 60 | 40 | 20 | 100 | 80 | 60 | 40 | 20 | 100 | 80 | 60 | 40 | 20 | |||

| ≥ | ≥ | ≥ | ≥ | < | ≥ | ≥ | ≥ | ≥ | < | ≥ | ≥ | ≥ | ≥ | < | |||

| first | Short-term solvency (times) | 15 | 1.8 | 1.4 | 1.0 | 0.6 | 0.6 | 1.9 | 1.5 | 1.1 | 0.8 | 0.8 | 2.0 | 1.6 | 1.3 | 1.0 | 1.0 |

| 2 | Ability to pay quickly (times) | 15 | 1.0 | 0.7 | 0.5 | 0.3 | 0.3 | 1.2 | 1.0 | 0.7 | 0.4 | 0.4 | 1.3 | 1.1 | 0.8 | 0.5 | 0.5 |

| 3 | Revenue growth rate (%) | 6 | 25 | 20 | 15 | ten | ten | 25 | 20 | 15 | ten | ten | 25 | 20 | 15 | ten | ten |

| 4 | Profit growth rate (%) | 6 | 25 | 20 | 15 | ten | ten | 25 | 20 | 15 | ten | ten | 25 | 20 | 15 | ten | ten |

| 5 | Net profit margin (%) | 7 | 3.0 | 2.5 | 2.0 | 1.5 | 1.5 | 4.0 | 3.5 | 3.0 | 2.5 | 2.5 | 5.0 | 4.5 | 4.0 | 3.5 | 3.5 |

| 6 | ROA (%) | 4 | 5.5 | 5.0 | 4.5 | 4.0 | 4.0 | 6.0 | 5.5 | 5.0 | 4.5 | 4.5 | 6.5 | 6.0 | 5.5 | 5.0 | 5.0 |

| 7 | ROE (%) | 4 | 11.0 | 10.0 | 9.0 | 8.0 | 8.0 | 13.0 | 11.6 | 10.3 | 9.0 | 9.0 | 15.0 | 13.3 | 11.6 | 10.0 | 10.0 |

| 8 | Self-financing coefficient (%) | 15 | 50 | 45 | 35 | 30 | 30 | 55 | 50 | 45 | 40 | 40 | 60 | 55 | 50 | 45 | 45 |

| 9 | Accounts Receivable Turnover (times) | 8 | 5.0 | 4.0 | 3.0 | 2.0 | 2.0 | 6.0 | 5.0 | 4.0 | 3.0 | 3.0 | 7.0 | 6.0 | 5.0 | 4.0 | 4.0 |

| ten | Inventory Turnover (times) | 8 | 4.0 | 3.1 | 2.3 | 1.5 | 1.5 | 4.5 | 3.6 | 2.8 | 2.0 | 2.0 | 5.0 | 4.1 | 3.3 | 2.5 | 2.5 |

| 11 | Working capital turnover (times) | 8 | 2.8 | 2.2 | 1.6 | 1.0 | 1.0 | 3.2 | 2.5 | 1.9 | 1.3 | 1.3 | 3.5 | 2.8 | 2.1 | 1.5 | 1.5 |

| twelfth | Efficient use of assets (times) | 4 | 1.8 | 1.6 | 1.3 | 1.0 | 1.0 | 2.0 | 1.7 | 1.4 | 1.0 | 1.0 | 2.2 | 1.8 | 1.4 | 1.0 | 1.0 |

(Source: Lien Viet Post Commercial Joint Stock Bank)

Table I.4: Scoreboard of financial indicators of enterprises in the Trade – Service sector according to LienVietPostBank

| STT | Targets | Proportion (%) | Enterprise size | ||||||||||||||

| Big | Fit | Small | |||||||||||||||

| 100 | 80 | 60 | 40 | 20 | 100 | 80 | 60 | 40 | 20 | 100 | 80 | 60 | 40 | 20 | |||

| ≥ | ≥ | ≥ | ≥ | < | ≥ | ≥ | ≥ | ≥ | < | ≥ | ≥ | ≥ | ≥ | < | |||

| first | Short-term solvency (times) | 15 | 2.2 | 1.7 | 1.2 | 0.8 | 0.8 | 2.4 | 1.9 | 1.4 | 1.0 | 1.0 | 2.7 | 2.2 | 1.7 | 1.2 | 1.2 |

| 2 | Ability to pay quickly (times) | 15 | 1.4 | 1.1 | 0.8 | 0.5 | 0.5 | 1.5 | 1.2 | 0.9 | 0.6 | 0.6 | 1.6 | 1.3 | 1.0 | 0.7 | 0.7 |

| 3 | Revenue growth rate (%) | 6 | 35 | 30 | 25 | 20 | 20 | 35 | 30 | 25 | 20 | 20 | 35 | 30 | 25 | 20 | 20 |

| 4 | Profit growth rate (%) | 6 | 35 | 30 | 25 | 20 | 20 | 35 | 30 | 25 | 20 | 20 | 35 | 30 | 25 | 20 | 20 |

| 5 | Net profit margin (%) | 7 | 7.0 | 6.5 | 6.0 | 5.5 | 5.5 | 7.5 | 7.0 | 6.5 | 6.0 | 6.0 | 8.0 | 7.5 | 7.0 | 6.5 | 6.5 |

| 6 | ROA (%) | 4 | 6.5 | 6.0 | 5.5 | 5.0 | 5.0 | 7.0 | 6.5 | 6.0 | 5.5 | 5.5 | 7.5 | 7.0 | 6.5 | 6.0 | 6.0 |

| 7 | ROE (%) | 4 | 17.0 | 14.6 | 12.3 | 10.0 | 10.0 | 16.0 | 14.0 | 12.0 | 10.0 | 10.0 | 15.0 | 13.3 | 11.6 | 10.0 | 10.0 |

| 8 | Self-financing coefficient (%) | 15 | 60 | 55 | 50 | 45 | 45 | 65 | 60 | 55 | 50 | 50 | 65 | 60 | 55 | 50 | 50 |

| 9 | Accounts Receivable Turnover (times) | 8 | 6.0 | 5.5 | 5.0 | 4.5 | 4.5 | 7.0 | 6.5 | 6.0 | 5.5 | 5.5 | 7.5 | 7.0 | 6.5 | 6.0 | 6.0 |

| ten | Inventory Turnover (times) | 8 | 7.0 | 6.5 | 6.0 | 5.5 | 5.5 | 8.0 | 7.5 | 7.0 | 6.5 | 6.5 | 9.0 | 8.5 | 8.0 | 7.5 | 7.5 |

| 11 | Working capital turnover (times) | 8 | 5.0 | 4.3 | 3.6 | 3.0 | 3.0 | 5.0 | 4.3 | 3.6 | 3.0 | 3.0 | 5.0 | 4.3 | 3.6 | 3.0 | 3.0 |

| twelfth | Efficient use of assets (times) | 4 | 2.0 | 1.6 | 1.3 | 1.0 | 1.0 | 3.0 | 2.3 | 1.7 | 1.1 | 1.1 | 4.0 | 3.0 | 2.1 | 1.2 | 1.2 |

(Source: Lien Viet Post Commercial Joint Stock Bank)

Table I.5: Scoreboard of financial indicators of enterprises in the heavy industry group according to LienVietPostBank

| STT | Targets | Proportion (%) | Enterprise size | ||||||||||||||

| Big | Fit | Small | |||||||||||||||

| 100 | 80 | 60 | 40 | 20 | 100 | 80 | 60 | 40 | 20 | 100 | 80 | 60 | 40 | 20 | |||

| ≥ | ≥ | ≥ | ≥ | < | ≥ | ≥ | ≥ | ≥ | < | ≥ | ≥ | ≥ | ≥ | < | |||

| first | Short-term solvency (times) | 15 | 2.0 | 1.5 | 1.0 | 0.5 | 0.5 | 2.2 | 1.6 | 1.2 | 0.8 | 0.8 | 2.4 | 1.9 | 1.4 | 1.0 | 1.0 |

| 2 | Ability to pay quickly (times) | 15 | 1.2 | 0.9 | 0.6 | 0.4 | 0.4 | 1.3 | 1.0 | 0.7 | 0.5 | 0.5 | 1.4 | 1.1 | 0.8 | 0.5 | 0.5 |

| 3 | Revenue growth rate (%) | 6 | 25 | 20 | 15 | ten | ten | 25 | 20 | 15 | ten | ten | 25 | 20 | 15 | ten | ten |

| 4 | Profit growth rate (%) | 6 | 25 | 20 | 15 | ten | ten | 25 | 20 | 15 | ten | ten | 25 | 20 | 15 | ten | ten |

| 5 | Net profit margin (%) | 7 | 5.5 | 5.0 | 4.5 | 4.0 | 4.0 | 6.0 | 5.5 | 5.0 | 4.5 | 4.5 | 6.5 | 6.0 | 5.5 | 5.0 | 5.0 |

| 6 | ROA (%) | 4 | 6.0 | 5.0 | 4.0 | 3.0 | 3.0 | 6.5 | 5.5 | 4.5 | 3.5 | 3.5 | 7.0 | 5.8 | 4.6 | 3.5 | 3.5 |

| 7 | ROE (%) | 4 | 12.0 | 10.6 | 9.3 | 8.0 | 8.0 | 13.0 | 11.6 | 10.3 | 9.0 | 9.0 | 14.0 | 12.6 | 11.3 | 10.0 | 10.0 |

| 8 | Self-financing coefficient (%) | 15 | 55 | 50 | 40 | 30 | 30 | 55 | 50 | 45 | 35 | 35 | 60 | 55 | 50 | 45 | 45 |

| 9 | Accounts Receivable Turnover (times) | 8 | 5.5 | 5.0 | 4.5 | 4.0 | 4.0 | 6.0 | 5.5 | 5.0 | 4.5 | 4.5 | 6.5 | 6.0 | 5.5 | 5.0 | 5.0 |

| ten | Inventory Turnover (times) | 8 | 4.5 | 4.0 | 3.5 | 2.5 | 2.5 | 5.0 | 4.5 | 4.0 | 3.5 | 3.5 | 5.5 | 5.0 | 4.5 | 4.0 | 4.0 |

| 11 | Working capital turnover (times) | 8 | 3.5 | 3.0 | 2.5 | 2.0 | 2.0 | 3.5 | 3.0 | 2.5 | 2.0 | 2.0 | 3.5 | 3.0 | 2.5 | 2.0 | 2.0 |

| twelfth | Efficient use of assets (times) | 4 | 1.8 | 1.5 | 1.2 | 1.0 | 1.0 | 1.8 | 1.5 | 1.2 | 1.0 | 1.0 | 1.8 | 1.5 | 1.2 | 1.0 | 1.0 |

Table I.6: Scoreboard of financial indicators of light industry enterprises according to LienVietPostBank

| STT | Targets | Proportion (%) | Enterprise size | ||||||||||||||

| Big | Fit | Small | |||||||||||||||

| 100 | 80 | 60 | 40 | 20 | 100 | 80 | 60 | 40 | 20 | 100 | 80 | 60 | 40 | 20 | |||

| ≥ | ≥ | ≥ | ≥ | < | ≥ | ≥ | ≥ | ≥ | < | ≥ | ≥ | ≥ | ≥ | < | |||

| first | Short-term solvency (times) | 15 | 2.1 | 1.6 | 1.1 | 0.6 | 0.6 | 2.3 | 1.8 | 1.3 | 0.9 | 0.9 | 2.5 | 2.0 | 1.5 | 1.1 | 1.1 |

| 2 | Ability to pay quickly (times) | 15 | 1.3 | 1.0 | 0.7 | 0.4 | 0.4 | 1.4 | 1.1 | 0.8 | 0.5 | 0.5 | 1.5 | 1.2 | 0.9 | 0.6 | 0.6 |

| 3 | Revenue growth rate (%) | 6 | 30 | 25 | 20 | 15 | 15 | 30 | 25 | 20 | 15 | 15 | 30 | 25 | 20 | 15 | 15 |

| 4 | Profit growth rate (%) | 6 | 30 | 25 | 20 | 15 | 15 | 30 | 25 | 20 | 15 | 15 | 30 | 25 | 20 | 15 | 15 |

| 5 | Net profit margin (%) | 7 | 6.0 | 5.5 | 5.0 | 4.5 | 4.5 | 6.5 | 6.0 | 5.5 | 5.0 | 5.0 | 6.5 | 6.0 | 5.5 | 5.0 | 5.0 |

| 6 | ROA (%) | 4 | 6.0 | 5.0 | 4.0 | 3.0 | 3.0 | 6.5 | 5.6 | 4.8 | 4.0 | 4.0 | 7.0 | 6.0 | 5.0 | 4.0 | 4.0 |

| 7 | ROE (%) | 4 | 12.0 | 11.0 | 10.0 | 9.0 | 9.0 | 13.0 | 12.0 | 11.0 | 10.0 | 10.0 | 14.0 | 13.0 | 12.0 | 11.0 | 11.0 |

| 8 | Self-financing coefficient (%) | 15 | 50 | 45 | 40 | 35 | 35 | 50 | 47 | 44 | 40 | 40 | 50 | 47 | 42 | 37 | 37 |

| 9 | Accounts Receivable Turnover (times) | 8 | 6.0 | 5.5 | 4.0 | 4.5 | 4.5 | 7.0 | 6.5 | 6.0 | 5.5 | 5.5 | 7.5 | 7.0 | 6.5 | 6.0 | 6.0 |

| ten | Inventory Turnover (times) | 8 | 5.0 | 5.0 | 4.0 | 3.0 | 3.0 | 6.0 | 5.1 | 4.3 | 3.5 | 3.5 | 7.0 | 6.0 | 5.0 | 4.0 | 4.0 |

| 11 | Working capital turnover (times) | 8 | 4.0 | 3.3 | 2.6 | 2.0 | 2.0 | 4.0 | 3.3 | 2.6 | 2.0 | 2.0 | 4.0 | 3.3 | 2.6 | 2.0 | 2.0 |

| twelfth | Efficient use of assets (times) | 4 | 2.0 | 1.6 | 1.3 | 1.0 | 1.0 | 2.2 | 1.8 | 1.4 | 1.0 | 1.0 | 2.4 | 1.9 | 1.4 | 1.0 | 1.0 |

Table I.7: Scoreboard of financial indicators of enterprises in the construction investment sector according to LienVietPostBank

| STT | Targets | Proportion (%) | Enterprise size | ||||||||||||||

| Big | Fit | Small | |||||||||||||||

| 100 | 80 | 60 | 40 | 20 | 100 | 80 | 60 | 40 | 20 | 100 | 80 | 60 | 40 | 20 | |||

| ≥ | ≥ | ≥ | ≥ | < | ≥ | ≥ | ≥ | ≥ | < | ≥ | ≥ | ≥ | ≥ | < | |||

| first | Short-term solvency (times) | 15 | 1.9 | 1.4 | 0.9 | 0.5 | 0.5 | 2.1 | 1.6 | 1.1 | 0.6 | 0.6 | 2.3 | 1.7 | 1.2 | 0.7 | 0.7 |

| 2 | Ability to pay quickly (times) | 15 | 0.8 | 0.5 | 0.3 | 0.1 | 0.1 | 1.0 | 0.7 | 0.5 | 0.3 | 0.3 | 1.2 | 0.9 | 0.7 | 0.5 | 0.5 |

| 3 | Revenue growth rate (%) | 6 | 25 | 20 | 15 | ten | ten | 25 | 20 | 15 | ten | ten | 25 | 20 | 15 | ten | ten |

| 4 | Profit growth rate (%) | 6 | 25 | 20 | 15 | ten | ten | 25 | 20 | 15 | ten | ten | 25 | 20 | 15 | ten | ten |

| 5 | Net profit margin (%) | 7 | 7.5 | 7.0 | 6.0 | 5.0 | 5.0 | 8.5 | 7.5 | 6.5 | 5.5 | 5.5 | 9.0 | 7.5 | 6.5 | 5.5 | 5.5 |

| 6 | ROA (%) | 4 | 6.0 | 5.0 | 4.0 | 3.0 | 3.0 | 6.5 | 5.5 | 4.5 | 3.5 | 3.5 | 7.0 | 5.8 | 4.6 | 3.5 | 3.5 |

| 7 | ROE (%) | 4 | 15.0 | 12.0 | 10.0 | 8.0 | 8.0 | 17.0 | 14.0 | 11.0 | 9.0 | 9.0 | 18.0 | 15.0 | 12.0 | 10.0 | 10.0 |

| 8 | Self-financing coefficient (%) | 15 | 40 | 35 | 30 | 25 | 25 | 35 | thirty first | 28 | 25 | 25 | 35 | thirty first | 28 | 25 | 25 |

| 9 | Accounts Receivable Turnover (times) | 8 | 4.0 | 3.3 | 2.6 | 2.0 | 2.0 | 4.5 | 4.0 | 2.6 | 2.2 | 2.2 | 4.5 | 3.8 | 3.1 | 2.5 | 2.5 |

| ten | Inventory Turnover (times) | 8 | 3.0 | 2.5 | 2.0 | 1.5 | 1.5 | 3.5 | 3.0 | 2.5 | 2.0 | 2.0 | 4.0 | 3.5 | 3.0 | 2.5 | 2.5 |

| 11 | Working capital turnover (times) | 8 | 2.0 | 1.5 | 1.0 | 0.8 | 0.8 | 2.0 | 1.5 | 1.0 | 0.8 | 0.8 | 2.5 | 2.0 | 1.5 | 1.0 | 1.0 |

| twelfth | Efficient use of assets (times) | 4 | 1.2 | 1.0 | 0.8 | 0.6 | 0.6 | 1.6 | 1.3 | 1.0 | 0.7 | 0.7 | 1.6 | 1.3 | 1.0 | 0.7 | 0.7 |

APPENDIX I

Table I.8: Scoreboard for assessment of target groups Management qualifications and internal environment according to LienVietPostBank

| Targets | Initial score | Weight | |||||

| 100 | 80 | 60 | 40 | 20 | |||

| first | Judicial history of the head of the business/business owner | Good criminal record, no criminal record, no criminal record | Ever had suspicions, unofficial complaints? | Ever had a criminal record? | Currently being the subject of legal suspicion or being prosecuted | 2% | |

| 2 | Education level of the head of the business/business owner | Graduate | University | College | Intermediate | Below Intermediate, no information | 2% |

| 3 | Experience, executive capacity and management quality of the business owner/leadership | Lots of experience, qualifications, good business management, stable leadership | Management experience and quality are quite good, the leadership apparatus is stable | Having little experience, medium quality of enterprise management, unstable leadership | Inexperienced leadership team and poor management | 5% | |

| 4 | Reputation and relationship of the business owner in the market, with relevant agencies | Prestigious in the market, very good relationship with relevant agencies, can be used for business development | Normal relationship | Bad relationship | 4% | ||

| 5 | Internal control environment, organizational structure of enterprises | Internal control processes and operational procedures are established, updated and checked regularly, promoting high efficiency in practice. Good organizational structure | Internal control processes are established but not regularly updated and checked. Good organizational structure | Internal control processes exist but have not been fully implemented in practice. The organizational structure also has certain limitations | Internal control processes exist but are not formalized or documented. The organizational structure has many limitations | There is no internal control environment. The organizational structure is not complete | 2% |

| 6 | Internal HR environment of enterprises | Very good | Good | Rather | medium | Least | 3% |

| 7 | Business strategic vision of the enterprise | Have a clear and highly feasible business vision and strategy in practice | Having a vision and business strategy, but the feasibility in some cases is still limited | There is no information because the customer refuses to provide it for security reasons | There is no specific strategy for each stage | 2% |

(Source: Lien Viet Post Commercial Joint Stock Bank)

Table I.9: Scoreboard for evaluation of criteria group External factors according to LienVietPostBank

| Targets | Initial score | Weight | ||||||

| 100 | 80 | 60 | 40 | 20 | ||||

| first | Industry development prospects | In progress or with high growth prospects | Relatively developed and promising | Stability | There are signs of recession or recession | 2% | ||

| 2 | Influences from policies of the State, Government, and local authorities | There are protection/encouragement/incentive policies and businesses make effective use of the policy | There are protection/encouragement/incentive policies, but enterprises have not taken advantage of the policies effectively | Does not have its own policy or is not heavily influenced by the policy (if any) | Limited development | 3% | ||

| 3 | Input source stability | of material | Very stable | Relatively stable or volatile but have little impact on business operations and profits | Unspecified, affecting business, profit | good picture big business profit | 2% | |

| 4 | The possibility of the company’s products being replaced by “substitute products” according to the assessment of GMOs | Very difficult, the market has no substitute products within the next 1 year | Relative difficulty | opposite to | Normal | Relatively easy | It’s very easy, there are many substitute products on the market for consumers to choose from | first% |

| 5 | The ability of new enterprises to enter the market (in the same industry/field) according to the assessment of GE | Very difficult | Difficult, requiring large capital and labor investment, high level | Normal | Relatively easy | Very easy | first% | |

| 6 | The degree of dependence of the enterprise’s business activities on natural conditions | Very few dependencies | There is a dependency but the effect is not significant | Depends a lot | Completely dependent | first% | ||

| (Source: Lien Viet Post Commercial Joint Stock Bank) |

Table I.10: Scorecard for the assessment of the relationship with credit institutions according to LienVietPostBank

| Targets | Initial score | Weight | |||||||

| 100 | 80 | 60 | 40 | 20 | |||||

| first | Overdue debts/total current outstanding loans of enterprises at credit institutions | 0% | Less than 3% | From 3% under 5% | come | From 5% to less than 10% | 10% | 4% | |

| 2 | Number of times of debt restructuring (including principal and interest) in the past 12 months at credit institutions | 0 times | 1 times | 2 times | 3 times | More than 3 times | 4% | ||

| 3 | Number of times of late payment of interest in the past 12 months at credit institutions | 0 times | 1-2 times | 3-4 times | 5-6 times | Over 6 times | 4% | ||

| 4 | Number of times of insolvency/late payment commitments (L/C, guarantee, other commitments) in the past 12 months at credit institutions | 0 times | 1 times | 2 times | More than 2 times | 3% | |||

| 5 | Credit relationship with Lien Viet Bank (%) | 80% | 50% | 30% | < 30% | 4% | |||

| 6 | Debt repayment history of enterprises with Lien Viet Bank | Always pay on time | in debt | Ever been transferred to overdue debt/rescheduled for repayment or have overdue debts in the total current balance | 4% | ||||

| 7 | Using loan capital for wrong purposes when borrowing capital at Lien Viet Bank | Never used the purpose capital | wrong history | Ever used capital for the wrong purpose? | 3% | ||||

| 8 | The situation of providing information at the request of Lien Viet Bank in the past 12 months | Always provide complete, accurate and timely information. Actively cooperate in providing ttin | The information provided meets the required level. Moderate cooperation | Incomplete or not on time | Do not cooperate or provide incorrect information | 2% | |||

| 9 | Ratio of average deposit balance (last 12 months)/Average outstanding balance of enterprises at LienVietPostBank (last 12 months) | 20% | From up to 20% | 10% below | From 5% to less than 10% | come | From 2% to less than 5% | <2% | 4% |

| ten | Average number of transactions with Lien Viet Bank | > 6 | 5 – 6 | 3 – 4 | < 2 | 3% |

(Source: Lien Viet Post Commercial Joint Stock Bank)

Table I.11: Scoreboard for assessment of criteria group Operational characteristics of enterprises according to LienVietPostBank

| Targets | Initial score | Weight | ||||

| 100 | 80 | 60 | 40 | 20 | ||

| first | Position and ability | Branded | There are wounds | Creating | Enterprise | 5% |

| business competition | register in | but | rendering | small, hentai | ||

| industry in the market | or out | known | Photo. Products | action in crime | ||

| water, known | at the level | products/services | narrow micro, not yet | |||

| come widely and | normally, | take the market | interested | |||

| popular on | the location of | small part. | trademark, | |||

| market, location | broadcast group | Edge pressure | ability | |||

| belong to the lead group | stable development. | big picture | compete in | |||

| market leader | Bear the edge | edge ability | low | |||

| in terms of market share and | picture but | painting at level | ||||

| reputation. Coins | have direction | medium. | ||||

| play direction | well developed | |||||

| good development, close | clear to improve | |||||

| like no | good position. | |||||

| risk of being changed | ||||||

| good or bad? | ||||||

| position | ||||||

| 2 | Operation range | Nationwide and | Only in | In the range | In the range | 4% |

| of the business | there is activity | limit | microdomain | vi province/city | ||

| (range of product consumption | export (if | Vietnam | city | |||

| Products) | only export to | or both | ||||

| boundary range | limit | |||||

| Neighborhood then | border | |||||

| of level | vicinity | |||||

| below) | ||||||

| 3 | Relationship with home | Totally master | There are dependencies, | Depend | 3% | |

| provided | move and have | but still | much into the house | |||

| many ways | ability | provided | ||||

| first choice project | arrange if | |||||

| into the | there are fluctuations | |||||

| from supplier | ||||||

| grant | ||||||

| 4 | Relationship with | Top market | Relationship | Enterprise | 5% | |

| output effect | out very large. | normal, | only a few | |||

| Enterprise | both sides are equal | first partner | ||||

| unfazed | need to rely on | out, very teary | ||||

| belong to one | together to be together | belong to the | ||||

| handful of partners | develop | that partner. | ||||

| output, complete | ||||||

| fully active | ||||||

| sell development | ||||||

| row |

| 5 | Financial reporting quality | Report truthfully, completely, with audit, sent on time | Report truthfully, completely, sent on time but not independently audited | Average quality, basically reflects the financial situation of the business, but it is incomplete and not sent on time | Poor quality, there are reports but need to edit and update a lot to reflect reality | Very poor quality (dishonest, lacking) | 4% |

| 6 | Applying modern management model (ISO) and advanced technological processes | Has been applied for 01 year | Started/newly deployed for less than 1 year | Do not apply | 2% | ||

| 7 | Achievements are widely recognized | Regularly receive awards from prestigious organizations | Received awards but not often | Never received awards from organizations | 2% | ||

| 8 | Net cash flow trends | Uptrend (positive period net cash flow) | Downtrend (positive period net cash flows) | Uptrend (negative period net cash flow) | There is a downward trend (negative period net cash flows) or no information on the CBTD | 4% | |

| 9 | Sources of debt repayment of enterprises according to the assessment of the CBA | Reliable source of debt repayment, businesses are fully capable of paying debts on time | The source of debt repayment is not stable, businesses may ask to restructure the repayment period | The source of debt repayment is uncertain, enterprises have difficulty in finding sources of debt repayment | 6% |

(Source: Lien Viet Post Commercial Joint Stock Bank)

APPENDIX II

RESULTS OF Scoring Enterprise Credit Society of Joint Stock Company B BY LIENVIETPOSTBANK’S MODEL

| Table II.1: Scoring of financial indicators of B . JSC | |||||

| Targets | Unit | Value | Initial score | Weight | Weight score |

| Solvency | |||||

| 12. Short-term solvency | Time | 1.06 | 40 | 15% | 6 |

| 13. Ability to pay quickly | Time | 0.86 | 80 | 15% | twelfth |

| Growth | |||||

| 14. Revenue growth rate | % | 11.4 | 40 | 6% | 2.4 |

| 15. Profit growth rate | % | 15.73 | 60 | 6% | 3.6 |

| Profitability | |||||

| 16. Net profit margin | % | 1.61 | 20 | 7% | 1.4 |

| 17. ROA | % | 1.7 | 20 | 4% | 0.8 |

| 18. ROE | % | 13.08 | 60 | 4% | 2.4 |

| Self-funding ability | |||||

| 19. Self-financing coefficient | % | 13.02 | 20 | 15% | 3 |

| Performance Indicators | |||||

| 20. Accounts Receivable Turnover | Time | 1.94 | 20 | 8% | 1.6 |

| 21. Inventory Turnover | Time | 5.27 | 100 | 8% | 8 |

| 22. Working capital turnover | Time | 1.23 | 60 | 8% | 4.8 |

| 23. Effective use of assets | Time | 1.06 | 60 | 4% | 2.4 |

| Total weighted score | 48.4 | ||||

| (Source: Extracted from LienVietPostBank’s outreach data) |