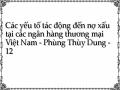

2011 | 0.66% | 0.66% | 0.94 | 8.66 | 0.93% | 25.24% | 18.13% | 6.24% | 20,695.50 | |

CTG | 2012 | 0.75% | 0.73% | 0.93 | 8.70 | 1.36% | 13.61% | 6.81% | 5.25% | 20,876.14 |

CTG | 2013 | 1.47% | 0.57% | 0.96 | 8.76 | 1.23% | 12.88% | 6.04% | 5.42% | 21,009.38 |

CTG | 2014 | 1.00% | 0.66% | 0.92 | 8.82 | 1.01% | 16.90% | 1.84% | 5.98% | 21,206.67 |

CTG | 2015 | 1.12% | 0.58% | 0.93 | 8.89 | 0.87% | 22.33% | 0.60% | 6.68% | 21,967.33 |

CTG | 2016 | 0.92% | 0.72% | 0.94 | 8.98 | 0.73% | 23.03% | 4.74% | 6.21% | 22,379.67 |

CTG | 2017 | 1,02% | 0,76% | 0.94 | 9,04 | 0,72% | 19,44% | 3,53% | 6,81% | 22,717.29 |

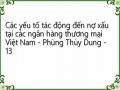

STB | 2007 | 0.72% | 0.27% | 0.89 | 7.81 | 1.90% | 145.78% | 12.60% | 7.13% | 16,077.58 |

STB | 2008 | 0.23% | 0.37% | 0.89 | 7.84 | 2.16% | -1.04% | 19.89% | 5.66% | 16,538.79 |

STB | 2009 | 0.60% | 0.50% | 0.90 | 8.02 | 1.40% | 70.41% | 6.52% | 5.40% | 17,862.83 |

STB | 2010 | 0.64% | 0.54% | 0.90 | 8.18 | 1.61% | 38.27% | 11.75% | 6.42% | 19,172.96 |

STB | 2011 | 0.54% | 0.57% | 0.90 | 8.15 | 1.25% | -2.36% | 18.13% | 6.24% | 20,695.50 |

STB | 2012 | 0.58% | 0.95% | 0.91 | 8.18 | 1.41% | 19.61% | 6.81% | 5.25% | 20,876.14 |

STB | 2013 | 2.05% | 0.82% | 0.90 | 8.20 | 0.66% | 11.95% | 6.04% | 5.42% | 21,009.38 |

STB | 2014 | 1.48% | 0.69% | 0.91 | 8.28 | 1.35% | 15.51% | 1.84% | 5.98% | 21,206.67 |

STB | 2015 | 1.19% | 0.77% | 0.92 | 8.47 | 1.21% | 47.43% | 0.60% | 6.68% | 21,967.33 |

STB | 2016 | 5.87% | 0.73% | 0.93 | 8.52 | 0.22% | 6.95% | 4.74% | 6.21% | 22,379.67 |

STB | 2017 | 7,00% | 0,75% | 0.94 | 8,57 | 0,03% | 12,10% | 3,53% | 6,81% | 22,717.29 |

EIB | 2007 | 0.85% | 0.22% | 0.81 | 7.53 | 1.41% | 80.77% | 12.60% | 7.13% | 16,077.58 |

EIB | 2008 | 0.88% | 0.78% | 0.73 | 7.68 | 1.37% | 15.07% | 19.89% | 5.66% | 16,538.79 |

EIB | 2009 | 4.71% | 0.58% | 0.80 | 7.82 | 1.47% | 80.77% | 6.52% | 5.40% | 17,862.83 |

EIB | 2010 | 1.83% | 0.48% | 0.90 | 8.12 | 1.73% | 62.44% | 11.75% | 6.42% | 19,172.96 |

EIB | 2011 | 1.42% | 0.34% | 0.91 | 8.26 | 1.38% | 19.76% | 18.13% | 6.24% | 20,695.50 |

EIB | 2012 | 1.61% | 0.36% | 0.91 | 8.23 | 1.66% | 0.35% | 6.81% | 5.25% | 20,876.14 |

EIB | 2013 | 1.32% | 0.42% | 0.91 | 8.23 | 1.24% | 11.25% | 6.04% | 5.42% | 21,009.38 |

EIB | 2014 | 1.98% | 0.63% | 0.91 | 8.21 | 0.38% | 4.55% | 1.84% | 5.98% | 21,206.67 |

EIB | 2015 | 2.46% | 0.70% | 0.89 | 8.10 | 0.03% | -2.74% | 0.60% | 6.68% | 21,967.33 |

EIB | 2016 | 1.86% | 0.83% | 0.90 | 8.11 | 0.03% | 2.51% | 4.74% | 6.21% | 22,379.67 |

EIB | 2017 | 2,95% | 0,71% | 0.90 | 8,17 | 0,24% | 16,61% | 3,53% | 6,81% | 22,717.29 |

Có thể bạn quan tâm!

-

Hạn Chế Của Luận Văn Và Đề Xuất Hướng Nghiên Cứu Tiếp Theo

Hạn Chế Của Luận Văn Và Đề Xuất Hướng Nghiên Cứu Tiếp Theo -

Kiểm Định Hiện Tượng Phương Sai Thay Đổi Breusch-Pagan / Cook-Weisberg Test For Heteroskedasticity

Kiểm Định Hiện Tượng Phương Sai Thay Đổi Breusch-Pagan / Cook-Weisberg Test For Heteroskedasticity -

Các yếu tố tác động đến nợ xấu tại các ngân hàng thương mại Việt Nam - Phùng Thùy Dung - 14

Các yếu tố tác động đến nợ xấu tại các ngân hàng thương mại Việt Nam - Phùng Thùy Dung - 14 -

Các yếu tố tác động đến nợ xấu tại các ngân hàng thương mại Việt Nam - Phùng Thùy Dung - 16

Các yếu tố tác động đến nợ xấu tại các ngân hàng thương mại Việt Nam - Phùng Thùy Dung - 16

Xem toàn bộ 133 trang tài liệu này.

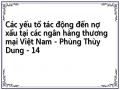

2007 | 0.19% | 0.16% | 0.93 | 7.93 | 1.13% | 86.96% | 12.60% | 7.13% | 16,077.58 | |

ACB | 2008 | 0.08% | 0.22% | 0.93 | 8.02 | 2.06% | 9.50% | 19.89% | 5.66% | 16,538.79 |

ACB | 2009 | 0.89% | 0.30% | 0.94 | 8.23 | 2.10% | 79.02% | 6.52% | 5.40% | 17,862.83 |

ACB | 2010 | 0.41% | 0.35% | 0.94 | 8.31 | 1.31% | 39.83% | 11.75% | 6.42% | 19,172.96 |

ACB | 2011 | 0.34% | 0.35% | 0.96 | 8.45 | 1.14% | 17.91% | 18.13% | 6.24% | 20,695.50 |

ACB | 2012 | 0.59% | 0.85% | 0.93 | 8.25 | 1.14% | 0.01% | 6.81% | 5.25% | 20,876.14 |

ACB | 2013 | 2.50% | 0.93% | 0.92 | 8.22 | 0.44% | 4.26% | 6.04% | 5.42% | 21,009.38 |

ACB | 2014 | 3.03% | 0.88% | 0.93 | 8.25 | 0.50% | 7.05% | 1.84% | 5.98% | 21,206.67 |

ACB | 2015 | 2.21% | 0.76% | 0.94 | 8.30 | 0.53% | 17.96% | 0.60% | 6.68% | 21,967.33 |

ACB | 2016 | 2.15% | 0.77% | 0.94 | 8.37 | 0.51% | 20.73% | 4.74% | 6.21% | 22,379.67 |

ACB | 2017 | 1,64% | 0,65% | 0.94 | 8,45 | 0,57% | 21,49% | 3,53% | 6,81% | 22,717.29 |

SHB | 2007 | 1.37% | 0.07% | 0.82 | 7.09 | 0.53% | 748.61% | 12.60% | 7.13% | 16,077.58 |

SHB | 2008 | 0.50% | 0.21% | 0.98 | 7.09 | 1.03% | 48.85% | 19.89% | 5.66% | 16,538.79 |

SHB | 2009 | 1.89% | 0.46% | 0.91 | 7.44 | 1.57% | 103.97% | 6.52% | 5.40% | 17,862.83 |

SHB | 2010 | 2.82% | 0.53% | 0.92 | 7.71 | 1.16% | 89.76% | 11.75% | 6.42% | 19,172.96 |

SHB | 2011 | 1.41% | 0.50% | 0.92 | 7.85 | 0.97% | 19.52% | 18.13% | 6.24% | 20,695.50 |

SHB | 2012 | 2.26% | 1.07% | 0.92 | 8.07 | 1.06% | 97.66% | 6.81% | 5.25% | 20,876.14 |

SHB | 2013 | 8.81% | 0.83% | 0.93 | 8.16 | 1.45% | 34.37% | 6.04% | 5.42% | 21,009.38 |

SHB | 2014 | 5.66% | 0.62% | 0.94 | 8.23 | 0.59% | 36.06% | 1.84% | 5.98% | 21,206.67 |

SHB | 2015 | 2.02% | 0.69% | 0.95 | 8.31 | 0.47% | 26.26% | 0.60% | 6.68% | 21,967.33 |

SHB | 2016 | 1.72% | 0.77% | 0.94 | 8.37 | 0.39% | 22.18% | 4.74% | 6.21% | 22,379.67 |

SHB | 2017 | 1,90% | 1,00% | 0.95 | 8,46 | 0,39% | 23,48% | 3,53% | 6,81% | 22,717.29 |

NCB | 2007 | 1.04% | 0.06% | 0.94 | 7.00 | 1.85% | 1131.72 % | 12.60% | 7.13% | 16,077.58 |

NCB | 2008 | 0.16% | 0.20% | 0.90 | 7.04 | 0.75% | 25.46% | 19.89% | 5.66% | 16,538.79 |

NCB | 2009 | 2.91% | 0.51% | 0.94 | 7.27 | 0.52% | 81.93% | 6.52% | 5.40% | 17,862.83 |

NCB | 2010 | 2.45% | 0.53% | 0.92 | 7.71 | 0.76% | 144.74% | 11.75% | 6.42% | 19,172.96 |

NCB | 2011 | 1.40% | 0.50% | 0.92 | 7.85 | 0.97% | 19.64% | 18.13% | 6.24% | 20,695.50 |

NCB | 2012 | 2.23% | 1.01% | 0.85 | 7.33 | 1.06% | -55.81% | 6.81% | 5.25% | 20,876.14 |

NCB | 2013 | 5.64% | 0.72% | 0.89 | 7.46 | 0.01% | 4.58% | 6.04% | 5.42% | 21,009.38 |

2014 | 6.07% | 0.53% | 0.91 | 7.57 | 0.06% | 22.04% | 1.84% | 5.98% | 21,206.67 | |

NCB | 2015 | 2.55% | 0.43% | 0.93 | 7.68 | 0.02% | 24.24% | 0.60% | 6.68% | 21,967.33 |

NCB | 2016 | 2.15% | 0.42% | 0.95 | 7.84 | 0.01% | 24.08% | 4.74% | 6.21% | 22,379.67 |

NCB | 2017 | 1,48% | 0,50% | 0.96 | 7,86 | 0,02% | 26,66% | 3,53% | 6,81% | 22,717.29 |

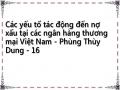

MBB | 2007 | 2.78% | 0.49% | 0.88 | 7.47 | 1.61% | 93.57% | 12.60% | 7.13% | 16,077.58 |

MBB | 2008 | 1.53% | 0.56% | 0.89 | 7.65 | 1.66% | 35.55% | 19.89% | 5.66% | 16,538.79 |

MBB | 2009 | 1.83% | 0.65% | 0.89 | 7.84 | 1.59% | 87.97% | 6.52% | 5.40% | 17,862.83 |

MBB | 2010 | 1.68% | 0.67% | 0.91 | 8.04 | 2.88% | 64.92% | 11.75% | 6.42% | 19,172.96 |

MBB | 2011 | 1.26% | 0.79% | 0.93 | 8.14 | 1.56% | 21.00% | 18.13% | 6.24% | 20,695.50 |

MBB | 2012 | 0.79% | 0.75% | 0.92 | 8.24 | 1.53% | 26.14% | 6.81% | 5.25% | 20,876.14 |

MBB | 2013 | 1.84% | 0.98% | 0.91 | 8.26 | 1.31% | 17.81% | 6.04% | 5.42% | 21,009.38 |

MBB | 2014 | 2.44% | 1.23% | 0.91 | 8.30 | 1.27% | 14.62% | 1.84% | 5.98% | 21,206.67 |

MBB | 2015 | 2.73% | 0.89% | 0.90 | 8.34 | 1.25% | 20.66% | 0.60% | 6.68% | 21,967.33 |

MBB | 2016 | 1.61% | 0.80% | 0.90 | 8.41 | 1.14% | 24.22% | 4.74% | 6.21% | 22,379.67 |

MBB | 2017 | 1,32% | 0,68% | 0.91 | 8,50 | 1,13% | 22,19% | 3,53% | 6,81% | 22,717.29 |

ABB | 2007 | 3.10% | 0.34% | 0.86 | 7.23 | 1.87% | 506.42% | 12.60% | 7.13% | 16,077.58 |

ABB | 2008 | 1.51% | 0.60% | 0.71 | 7.13 | 0.94% | -4.65% | 19.89% | 5.66% | 16,538.79 |

ABB | 2009 | 2.07% | 0.54% | 0.83 | 7.42 | 0.37% | 97.02% | 6.52% | 5.40% | 17,862.83 |

ABB | 2010 | 2.21% | 0.56% | 0.88 | 7.58 | 1.18% | 54.29% | 11.75% | 6.42% | 19,172.96 |

ABB | 2011 | 2.36% | 0.77% | 0.89 | 7.62 | 1.26% | 0.19% | 18.13% | 6.24% | 20,695.50 |

ABB | 2012 | 2.58% | 0.90% | 0.89 | 7.66 | 0.74% | -5.82% | 6.81% | 5.25% | 20,876.14 |

ABB | 2013 | 2.84% | 1.13% | 0.90 | 7.76 | 0.87% | 26.08% | 6.04% | 5.42% | 21,009.38 |

ABB | 2014 | 6.74% | 0.70% | 0.92 | 7.83 | 0.24% | 9.82% | 1.84% | 5.98% | 21,206.67 |

ABB | 2015 | 3.97% | 0.60% | 0.91 | 7.81 | 0.17% | 19.05% | 0.60% | 6.68% | 21,967.33 |

ABB | 2016 | 2.12% | 0.79% | 0.92 | 7.87 | 0.14% | 26.83% | 4.74% | 6.21% | 22,379.67 |

ABB | 2017 | 2,54% | 0,90% | 0.93 | 7,93 | 0,33% | 22,17% | 3,53% | 6,81% | 22,717.29 |

SeaBank | 2007 | 0.23% | 0.18% | 0.87 | 7.42 | 0.97% | 227.81% | 12.60% | 7.13% | 16,077.58 |

SeaBank | 2008 | 0.24% | 0.35% | 0.81 | 7.35 | 1.14% | -31.29% | 19.89% | 5.66% | 16,538.79 |

2009 | 2.14% | 0.53% | 0.82 | 7.49 | 1.43% | 26.89% | 6.52% | 5.40% | 17,862.83 | |

SeaBank | 2010 | 1.88% | 0.59% | 0.90 | 7.74 | 1.50% | 113.09% | 11.75% | 6.42% | 19,172.96 |

SeaBank | 2011 | 2.14% | 0.32% | 0.95 | 8.00 | 1.14% | -4.25% | 18.13% | 6.24% | 20,695.50 |

SeaBank | 2012 | 2.75% | 0.62% | 0.93 | 7.88 | 0.12% | -15.00% | 6.81% | 5.25% | 20,876.14 |

SeaBank | 2013 | 2.98% | 0.63% | 0.93 | 7.90 | 0.07% | 25.36% | 6.04% | 5.42% | 21,009.38 |

SeaBank | 2014 | 2.84% | 0.62% | 0.93 | 7.90 | 0.19% | 53.22% | 1.84% | 5.98% | 21,206.67 |

SeaBank | 2015 | 2.86% | 0.43% | 0.93 | 7.93 | 0.11% | 33.49% | 0.60% | 6.68% | 21,967.33 |

SeaBank | 2016 | 1.60% | 0.53% | 0.94 | 8.01 | 0.11% | 37.81% | 4.74% | 6.21% | 22,379.67 |

SeaBank | 2017 | 1,83% | 0,48% | 0.95 | 8,10 | 0,11% | 19,56% | 3,53% | 6,81% | 22,717.29 |

VIETCAP | 2007 | 0.04% | 0.10% | 0.63 | 6.31 | 1.52% | 101.76% | 12.60% | 7.13% | 16,077.58 |

VIETCAP | 2008 | 0.44% | 0.10% | 0.69 | 6.52 | 3.16% | 23.30% | 19.89% | 5.66% | 16,538.79 |

VIETCAP | 2009 | 1.24% | 0.54% | 0.07 | 6.52 | 0.15% | 78.60% | 6.52% | 5.40% | 17,862.83 |

VIETCAP | 2010 | 3.48% | 0.45% | 0.75 | 6.92 | 1.64% | 58.23% | 11.75% | 6.42% | 19,172.96 |

VIETCAP | 2011 | 4.07% | 0.28% | 0.81 | 7.23 | 0.69% | 19.59% | 18.13% | 6.24% | 20,695.50 |

VIETCAP | 2012 | 2.70% | 0.35% | 0.84 | 7.32 | 1.59% | 77.66% | 6.81% | 5.25% | 20,876.14 |

VIETCAP | 2013 | 1.90% | 0.54% | 0.86 | 7.36 | 1.00% | 28.93% | 6.04% | 5.42% | 21,009.38 |

VIETCAP | 2014 | 4.11% | 0.54% | 0.87 | 7.41 | 0.45% | 29.46% | 1.84% | 5.98% | 21,206.67 |

VIETCAP | 2015 | 4.25% | 0.42% | 0.89 | 7.46 | 0.63% | 22.12% | 0.60% | 6.68% | 21,967.33 |

VIETCAP | 2016 | 4.33% | 0.36% | 0.84 | 7.52 | 0.18% | 12.78% | 4.74% | 6.21% | 22,379.67 |

VIETCAP | 2017 | 3,94% | 0,62% | 0.92 | 7,60 | 0,13% | 39,92% | 3,53% | 6,81% | 22,717.29 |

EAB | 2007 | 0.98% | 0.23% | 0.88 | 7.44 | 1.55% | 123.62% | 12.60% | 7.13% | 16,077.58 |

EAB | 2008 | 0.44% | 0.77% | 0.90 | 7.54 | 1.21% | 43.19% | 19.89% | 5.66% | 16,538.79 |

EAB | 2009 | 2.55% | 0.81% | 0.90 | 7.63 | 1.55% | 34.35% | 6.52% | 5.40% | 17,862.83 |

EAB | 2010 | 1.33% | 0.80% | 0.90 | 7.75 | 1.38% | 11.54% | 11.75% | 6.42% | 19,172.96 |

EAB | 2011 | 1.60% | 1.01% | 0.91 | 7.82 | 1.18% | 14.83% | 18.13% | 6.24% | 20,695.50 |

EAB | 2012 | 1.69% | 1.29% | 0.91 | 7.84 | 1.44% | 15.11% | 6.81% | 5.25% | 20,876.14 |

EAB | 2013 | 3.95% | 1.20% | 0.92 | 7.87 | 0.83% | 4.74% | 6.04% | 5.42% | 21,009.38 |

EAB | 2014 | 3.99% | 1.09% | 0.94 | 7.94 | 0.44% | -2.26% | 1.84% | 5.98% | 21,206.67 |

EAB | 2015 | 3.76% | 1.14% | 0.96 | 7.96 | 0.03% | 8.80% | 0.60% | 6.68% | 21,967.33 |

2016 | 4.55% | 1.09% | 0.93 | 7.99 | 0.22% | -2.26% | 4.74% | 6.21% | 22,379.67 | |

EAB | 2017 | 22,717.29 | ||||||||

MSB | 2007 | 3.76% | 0.20% | 0.89 | 7.24 | 0.93% | 126.02% | 12.60% | 7.13% | 16,077.58 |

MSB | 2008 | 2.08% | 0.26% | 0.94 | 7.51 | 0.98% | 71.72% | 19.89% | 5.66% | 16,538.79 |

MSB | 2009 | 2.78% | 0.27% | 0.94 | 7.81 | 0.97% | 112.95% | 6.52% | 5.40% | 17,862.83 |

MSB | 2010 | 3.42% | 0.27% | 0.95 | 8.06 | 1.21% | 33.34% | 11.75% | 6.42% | 19,172.96 |

MSB | 2011 | 2.65% | 0.32% | 0.92 | 8.06 | 1.00% | 18.61% | 18.13% | 6.24% | 20,695.50 |

MSB | 2012 | 2.42% | 0.68% | 0.92 | 8.04 | 0.70% | -23.33% | 6.81% | 5.25% | 20,876.14 |

MSB | 2013 | 2.30% | 0.68% | 0.91 | 8.03 | 0.21% | -5.30% | 6.04% | 5.42% | 21,009.38 |

MSB | 2014 | 2.21% | 0.51% | 0.88 | 8.03 | 0.31% | -14.23% | 1.84% | 5.98% | 21,206.67 |

MSB | 2015 | 2.02% | 0.58% | 0.87 | 8.02 | 0.13% | 19.49% | 0.60% | 6.68% | 21,967.33 |

MSB | 2016 | 1.95% | 0.49% | 0.85 | 7.97 | 0.11% | 25.02% | 4.74% | 6.21% | 22,379.67 |

MSB | 2017 | 1,33% | 0,38% | 0.88 | 8,05 | 0,15% | 3,11% | 3,53% | 6,81% | 22,717.29 |

KLB | 2007 | 0.68% | 0.33% | 0.71 | 6.34 | 2.20% | 124.50% | 12.60% | 7.13% | 16,077.58 |

KLB | 2008 | 1.22% | 0.39% | 0.64 | 6.47 | 2.45% | 62.41% | 19.89% | 5.66% | 16,538.79 |

KLB | 2009 | 1.61% | 0.39% | 0.85 | 6.87 | 1.27% | 122.03% | 6.52% | 5.40% | 17,862.83 |

KLB | 2010 | 1.17% | 0.49% | 0.74 | 7.10 | 1.22% | 43.78% | 11.75% | 6.42% | 19,172.96 |

KLB | 2011 | 1.11% | 0.53% | 0.81 | 7.25 | 1.55% | 19.91% | 18.13% | 6.24% | 20,695.50 |

KLB | 2012 | 2.77% | 0.76% | 0.81 | 7.27 | 2.21% | 15.23% | 6.81% | 5.25% | 20,876.14 |

KLB | 2013 | 2.93% | 0.59% | 0.84 | 7.33 | 1.89% | 25.25% | 6.04% | 5.42% | 21,009.38 |

KLB | 2014 | 2.47% | 0.59% | 0.85 | 7.36 | 1.47% | 11.53% | 1.84% | 5.98% | 21,206.67 |

KLB | 2015 | 1.95% | 0.54% | 0.87 | 7.40 | 0.76% | 19.90% | 0.60% | 6.68% | 21,967.33 |

KLB | 2016 | 1.13% | 0.56% | 0.89 | 7.48 | 0.65% | 21.88% | 4.74% | 6.21% | 22,379.67 |

KLB | 2017 | 1,06% | 0,59% | 0.90 | 7,57 | 0,40% | 24,89% | 3,53% | 6,81% | 22,717.29 |

TECHCOM | 2007 | 0.66% | 0.00% | 0.91 | 7.60 | 1.48% | 135.58% | 12.60% | 7.13% | 16,077.58 |

TECHCOM | 2008 | 1.41% | 0.55% | 0.92 | 7.97 | 1.29% | 105.47% | 19.89% | 5.66% | 16,538.79 |

TECHCOM | 2009 | 1.65% | 0.41% | 0.94 | 8.18 | 1.84% | 25.74% | 6.52% | 5.40% | 17,862.83 |

TECHCOM | 2010 | 2.00% | 0.41% | 0.94 | 8.18 | 1.38% | 0.00% | 11.75% | 6.42% | 19,172.96 |

2011 | 2.31% | 0.49% | 0.93 | 8.26 | 1.38% | 19.88% | 18.13% | 6.24% | 20,695.50 | |

TECHCOM | 2012 | 2.83% | 0.63% | 0.93 | 8.26 | 1.75% | 7.58% | 6.81% | 5.25% | 20,876.14 |

TECHCOM | 2013 | 2.70% | 0.75% | 0.91 | 8.20 | 0.43% | 1.21% | 6.04% | 5.42% | 21,009.38 |

TECHCOM | 2014 | 3.71% | 0.55% | 0.91 | 8.25 | 0.41% | 14.85% | 1.84% | 5.98% | 21,206.67 |

TECHCOM | 2015 | 2.41% | 0.61% | 0.91 | 8.28 | 0.62% | 41.38% | 0.60% | 6.68% | 21,967.33 |

TECHCOM | 2016 | 1.66% | 0.64% | 0.92 | 8.37 | 0.80% | 27.13% | 4.74% | 6.21% | 22,379.67 |

TECHCOM | 2017 | 1,58% | 0,70% | 0.90 | 8,43 | 1,34% | 12,78% | 3,53% | 6,81% | 22,717.29 |

NAMA | 2007 | 0.17% | 0.15% | 0.87 | 6.72 | 1.01% | 31.80% | 12.60% | 7.13% | 16,077.58 |

NAMA | 2008 | 1.76% | 0.34% | 0.78 | 6.77 | 1.43% | 38.94% | 19.89% | 5.66% | 16,538.79 |

NAMA | 2009 | 1.94% | 0.23% | 0.88 | 7.04 | 0.16% | 33.69% | 6.52% | 5.40% | 17,862.83 |

NAMA | 2010 | 2.04% | 0.37% | 0.85 | 7.16 | 0.51% | 5.77% | 11.75% | 6.42% | 19,172.96 |

NAMA | 2011 | 2.18% | 0.28% | 0.83 | 7.28 | 0.96% | 17.79% | 18.13% | 6.24% | 20,695.50 |

NAMA | 2012 | 2.84% | 0.43% | 0.80 | 7.20 | 1.26% | 9.65% | 6.81% | 5.25% | 20,876.14 |

NAMA | 2013 | 2.48% | 0.27% | 0.89 | 7.46 | 1.13% | 68.95% | 6.04% | 5.42% | 21,009.38 |

NAMA | 2014 | 1.48% | 0.40% | 0.91 | 7.57 | 0.47% | 37.09% | 1.84% | 5.98% | 21,206.67 |

NAMA | 2015 | 1.47% | 0.55% | 0.90 | 7.55 | 0.50% | 31.55% | 0.60% | 6.68% | 21,967.33 |

NAMA | 2016 | 0.91% | 0.91% | 0.92 | 7.63 | 0.55% | 15.21% | 4.74% | 6.21% | 22,379.67 |

NAMA | 2017 | 2,94% | 1,55% | 0.93 | 7,74 | 0,07% | 51,19% | 3,53% | 6,81% | 22,717.29 |

OCB | 2007 | 0.35% | 0.36% | 0.86 | 7.07 | 1.61% | 62.16% | 12.60% | 7.13% | 16,077.58 |

OCB | 2008 | 1.39% | 0.69% | 0.84 | 7.00 | 1.43% | 13.76% | 19.89% | 5.66% | 16,538.79 |

OCB | 2009 | 2.87% | 0.84% | 0.82 | 7.10 | 0.64% | 18.84% | 6.52% | 5.40% | 17,862.83 |

OCB | 2010 | 2.64% | 0.53% | 0.84 | 7.29 | 1.63% | 13.39% | 11.75% | 6.42% | 19,172.96 |

OCB | 2011 | 2.05% | 0.69% | 0.85 | 7.41 | 1.55% | 19.52% | 18.13% | 6.24% | 20,695.50 |

OCB | 2012 | 2.25% | 1.14% | 0.86 | 7.44 | 1.19% | 24.51% | 6.81% | 5.25% | 20,876.14 |

OCB | 2013 | 2.80% | 0.63% | 0.88 | 7.52 | 0.84% | 17.06% | 6.04% | 5.42% | 21,009.38 |

OCB | 2014 | 2.90% | 0.78% | 0.90 | 7.59 | 0.74% | 6.37% | 1.84% | 5.98% | 21,206.67 |

OCB | 2015 | 3.00% | 0.49% | 0.91 | 7.69 | 0.56% | 29.03% | 0.60% | 6.68% | 21,967.33 |

OCB | 2016 | 1.90% | 0.52% | 0.93 | 7.80 | 0.42% | 39.04% | 4.74% | 6.21% | 22,379.67 |

OCB | 2017 | 1,51% | 0,48% | 0.93 | 7,93 | 0,61% | 25,13% | 3,53% | 6,81% | 22,717.29 |

2007 | 0.77% | 0.62% | 0.86 | 7.01 | 1.91% | 51.76% | 12.60% | 7.13% | 16,077.58 | |

SGB | 2008 | 0.42% | 0.64% | 0.87 | 7.05 | 1.67% | 7.51% | 19.89% | 5.66% | 16,538.79 |

SGB | 2009 | 0.69% | 1.02% | 0.84 | 7.08 | 1.44% | 22.81% | 6.52% | 5.40% | 17,862.83 |

SGB | 2010 | 1.78% | 0.87% | 0.79 | 7.23 | 1.74% | 7.55% | 11.75% | 6.42% | 19,172.96 |

SGB | 2011 | 1.91% | 1.54% | 0.78 | 7.19 | 4.73% | 6.95% | 18.13% | 6.24% | 20,695.50 |

SGB | 2012 | 4.75% | 0.74% | 0.76 | 7.17 | 1.98% | -2.88% | 6.81% | 5.25% | 20,876.14 |

SGB | 2013 | 2.93% | 0.69% | 0.76 | 7.17 | 2.00% | -1.76% | 6.04% | 5.42% | 21,009.38 |

SGB | 2014 | 2.24% | 0.59% | 0.78 | 7.20 | 1.18% | 5.27% | 1.84% | 5.98% | 21,206.67 |

SGB | 2015 | 2.08% | 0.52% | 0.81 | 7.25 | 1.14% | 3.38% | 0.60% | 6.68% | 21,967.33 |

SGB | 2016 | 1.88% | 0.54% | 0.82 | 7.28 | 0.24% | 7.94% | 4.74% | 6.21% | 22,379.67 |

SGB | 2017 | 2,63% | 0,55% | 0.84 | 7,33 | 0,73% | 12,54% | 3,53% | 6,81% | 22,717.29 |

VPB | 2007 | 0.58% | 0.23% | 0.88 | 7.26 | 1.12% | 164.10% | 12.60% | 7.13% | 16,077.58 |

VPB | 2008 | 0.49% | 0.87% | 0.87 | 7.27 | 1.25% | -2.88% | 19.89% | 5.66% | 16,538.79 |

VPB | 2009 | 3.40% | 0.47% | 0.91 | 7.44 | 0.77% | 22.54% | 6.52% | 5.40% | 17,862.83 |

VPB | 2010 | 1.63% | 0.38% | 0.91 | 7.78 | 1.07% | 60.14% | 11.75% | 6.42% | 19,172.96 |

VPB | 2011 | 1.20% | 0.38% | 0.93 | 7.92 | 0.84% | 15.24% | 18.13% | 6.24% | 20,695.50 |

VPB | 2012 | 1.82% | 0.37% | 0.94 | 8.01 | 0.97% | 26.45% | 6.81% | 5.25% | 20,876.14 |

VPB | 2013 | 2.72% | 0.50% | 0.94 | 8.08 | 0.63% | 42.19% | 6.04% | 5.42% | 21,009.38 |

VPB | 2014 | 2.81% | 0.69% | 0.94 | 8.21 | 0.84% | 49.37% | 1.84% | 5.98% | 21,206.67 |

VPB | 2015 | 2.54% | 0.90% | 0.93 | 8.29 | 0.77% | 49.03% | 0.60% | 6.68% | 21,967.33 |

VPB | 2016 | 2.69% | 0.91% | 0.92 | 8.36 | 1.24% | 23.86% | 4.74% | 6.21% | 22,379.67 |

VPB | 2017 | 2,91% | 1,13% | 0.89 | 8,44 | 1,72% | 26,26% | 3,53% | 6,81% | 22,717.29 |

TPB | 2009 | 0.12% | 0.20% | 0.85 | 7.03 | 2.79% | 1059.5% | 6.52% | 5.40% | 17,862.83 |

TPB | 2010 | 0.15% | 0.33% | 0.85 | 7.32 | 0.34% | 63.65% | 11.75% | 6.42% | 19,172.96 |

TPB | 2011 | 0.52% | 0.24% | 0.93 | 7.40 | 0.25% | -29.86% | 18.13% | 6.24% | 20,695.50 |

TPB | 2012 | 0.67% | 0.61% | 0.78 | 7.18 | -5.51% | 66.00% | 6.81% | 5.25% | 20,876.14 |

TPB | 2013 | 3.66% | 0.36% | 0.88 | 7.51 | 0.77% | 96.05% | 6.04% | 5.42% | 21,009.38 |

TPB | 2014 | 1.97% | 0.39% | 0.92 | 7.71 | 1.19% | 66.35% | 1.84% | 5.98% | 21,206.67 |

TPB | 2015 | 1.01% | 0.34% | 0.94 | 7.88 | 1.04% | 42.35% | 0.60% | 6.68% | 21,967.33 |

2016 | 0.66% | 0.39% | 0.95 | 8.02 | 0.74% | 65.16% | 4.74% | 6.21% | 22,379.67 | |

TPB | 2017 | 0,71% | 0,54% | 0.95 | 8,09 | 0,53% | 35,97% | 3,53% | 6,81% | 22,717.29 |

PGB | 2007 | 0.09% | 0.08% | 0.88 | 6.67 | 1.06% | 139.16% | 12.60% | 7.13% | 16,077.58 |

PGB | 2008 | 1.10% | 0.29% | 0.83 | 6.79 | 0.87% | 23.35% | 19.89% | 5.66% | 16,538.79 |

PGB | 2009 | 1.40% | 0.45% | 0.90 | 7.02 | 1.06% | 164.96% | 6.52% | 5.40% | 17,862.83 |

PGB | 2010 | 1.23% | 0.64% | 0.87 | 7.21 | 1.68% | 73.71% | 11.75% | 6.42% | 19,172.96 |

PGB | 2011 | 1.42% | 1.05% | 0.85 | 7.25 | 1.34% | 11.26% | 18.13% | 6.24% | 20,695.50 |

PGB | 2012 | 2.06% | 1.65% | 0.83 | 7.28 | 2.54% | 13.83% | 6.81% | 5.25% | 20,876.14 |

PGB | 2013 | 8.44% | 0.75% | 0.87 | 7.40 | 1.25% | 0.58% | 6.04% | 5.42% | 21,009.38 |

PGB | 2014 | 2.98% | 0.67% | 0.87 | 7.41 | 0.15% | 4.62% | 1.84% | 5.98% | 21,206.67 |

PGB | 2015 | 2.48% | 0.72% | 0.86 | 7.39 | 0.51% | 9.48% | 0.60% | 6.68% | 21,967.33 |

PGB | 2016 | 2.75% | 0.71% | 0.86 | 7.39 | 0.17% | 10.40% | 4.74% | 6.21% | 22,379.67 |

PGB | 2017 | 2,47% | 0,78% | 0.88 | 7,47 | 0,49% | 22,17% | 3,53% | 6,81% | 22,717.29 |

HDB | 2007 | 0.29% | 0.26% | 0.95 | 7.14 | 1.69% | 232.86% | 12.60% | 7.13% | 16,077.58 |

HDB | 2008 | 0.31% | 0.42% | 0.83 | 6.98 | 0.88% | -30.71% | 19.89% | 5.66% | 16,538.79 |

HDB | 2009 | 1.93% | 0.33% | 0.91 | 7.28 | 0.63% | 33.28% | 6.52% | 5.40% | 17,862.83 |

HDB | 2010 | 1.10% | 0.25% | 0.93 | 7.54 | 1.02% | 42.49% | 11.75% | 6.42% | 19,172.96 |

HDB | 2011 | 0.83% | 0.31% | 0.92 | 7.65 | 0.78% | 18.07% | 18.13% | 6.24% | 20,695.50 |

HDB | 2012 | 2.11% | 0.37% | 0.90 | 7.72 | 0.95% | 52.72% | 6.81% | 5.25% | 20,876.14 |

HDB | 2013 | 2.35% | 0.81% | 0.90 | 7.94 | 0.62% | 108.20% | 6.04% | 5.42% | 21,009.38 |

HDB | 2014 | 3.53% | 0.49% | 0.91 | 8.00 | 0.25% | -4.63% | 1.84% | 5.98% | 21,206.67 |

HDB | 2015 | 2.27% | 0.66% | 0.91 | 8.03 | 0.48% | 34.69% | 0.60% | 6.68% | 21,967.33 |

HDB | 2016 | 1.05% | 0.61% | 0.93 | 8.18 | 0.59% | 45.38% | 4.74% | 6.21% | 22,379.67 |

HDB | 2017 | 1,46% | 0,61% | 0.92 | 8,28 | 0,61% | 27,09% | 3,53% | 6,81% | 22,717.29 |

VIB | 2007 | 1.50% | 0.34% | 0.94 | 7.59 | 0.88% | 82.20% | 12.60% | 7.13% | 16,077.58 |

VIB | 2008 | 1.24% | 0.54% | 0.93 | 7.54 | 0.79% | 18.10% | 19.89% | 5.66% | 16,538.79 |

VIB | 2009 | 1.84% | 0.44% | 0.95 | 7.75 | 0.49% | 38.33% | 6.52% | 5.40% | 17,862.83 |

VIB | 2010 | 1.28% | 0.50% | 0.93 | 7.97 | 0.82% | 52.56% | 11.75% | 6.42% | 19,172.96 |