3.2 Current status of card service development at VietABank

3.2.1 Card products of VietABank

3.2.1.1 International credit cards:

VietABank - Visa international credit card is issued by VietABank for customers to use to pay for goods and services or withdraw cash with the feature "spend first, pay later"

3.2.1.2 Domestic debit card:

First: Advance Card:

Advance Card is a domestic debit card product with Advance brand of VietABank, capable of making online and offline payments with high security. Advance Card product is a card product for both offline payment and success. online math. The chip part of the Advance Card is used to pay for goods and services offline and withdraw cash at card-accepting points; part of the word used to withdraw cash automatically and perform some other services at an ATM

Second: Thang long card:

Celebrating the 1000th anniversary of Thang Long, VietABank launched the Thang Long card product line with the VietABank brand with many features and utilities on the e-banking platform and developed product lines for high-end customers. This is an effective investment solution for customers.

Third: Co-branded cards: Yeah1 Passport Card, Vinh Today Passport Card, EZMart Card, E-Banking Card...have similar features to Advance cards.

Fourth: Education card:

This is a card that integrates the bank's domestic debit card with the technology and student management system of universities, colleges, high schools...

3.2.2 Card services of VietABank

- Withdraw cash at ATMs in the system and other banks in the banknet system.

- Transfer money within the same system via ATM.

- Transfer via card to other banks participating in the Smarlink system via ATM and ebanking.

- Pay at POS machines located in restaurants, hotels, supermarkets, domestic and foreign entertainment and entertainment centers, ...

- Pay online at online shops, online games, ...

- Automatic bill payment such as electricity, water, phone, air tickets, ...

- Query, account information statement.

- Deposit electronic money.

- Enjoy interest rate without term on the balance of money in the card. In particular, customers also enjoy a 15-day demand interest rate for the amount spent and paid.

- Receive salary via card.

- Accumulate bonus points, discounts, ...

- Grant card usage limit

3.2.3 Solutions VAB has implemented

card service

- Grow the number of debit cards

- Expanding merchants

- Strengthening business promotion of debit card services

- Strengthen the training to improve the qualifications of translation staff

- Implement risk control measures

3.2.4 The current situation of card service development at VietABank compared to the development target

3.2.4.1 Card strategic goals set out in 2015 at VietABank

![]() About the scale

About the scale

Card products: Issue more Visa Prepaid cards, Master credit cards.

Number of newly issued cards: 22,681 cards

Number of active cards at the end of the year: 92,650 cards

Balance on card account: 180 billion VND.

Cash withdrawal transactions by card:

Quantity: 4 million transactions

Amount: 10,000 billion VND

Sales of non-cash transactions via card

Quantity: 4 million transactions

Amount: 10,000 billion VND

Ratio of cash withdrawal and non-cash payment to total card usage: 50%.

Planned revenue: 5 billion VND.

Estimated cost: 3 billion VND.

Expected pre-tax income: 2 billion VND

Number of ATMs and POS: no additional investment.

![]() About quality:

About quality:

Connecting electricity and water bill payment services with PAYOO partners in central regions. Add 24/7 instant inter-bank money transfer service, transfer, open and finalize your passbook online on Internet Banking.

Develop reporting programs on risk management. Chapter Exploitation

programs and software in use.

3.2.4.2 Evaluation of card service development scale at VietABank

![]() Diversity of card products

Diversity of card products

Viet A Commercial Joint Stock Bank launched the Advance Card product, a type of card that applies 2 technology of magnetic card and chip card, issued Visa credit cards, Visa Prepaid prepaid cards and deployed more related cards. company, school, co-branded card, .... However, because it is still in the implementation phase of the card's utilities, the number of customers using the card is still not much compared to other banks such as Sacombank, Dong A Bank, ACB, Vietcombank... Particularly for credit card products. Master application has not yet been implemented as planned because it has not yet met the requirements of the system and is still in the testing phase.

![]() Number of cards issued, number of active cards and card usage

Number of cards issued, number of active cards and card usage

Thanks to promotional activities, preferential policies for customers..., ATM card service at Viet A Commercial Joint Stock Bank has been gradually expanded and more and more customers know about the bank's ATM service.

By the end of December 31, 2015, the bank had issued 109,660 cards to the market, in 2015 alone, 21,774 cards were issued, reaching 99.6% of the plan with the total balance on the account as of December 31, 2015. reached VND 143 billion, achieving 79.4% of the plan.

From 2011 - 2015 The total number of ATM withdrawal transactions was 18,141,888 transactions with a total amount of VND 35,749 billion, of which VAB card withdrawal at VAB machine was VND 14,514 billion. In 2015 alone, the number of cash withdrawal transactions was 3,751,833 times, equivalent to a total amount of VND 8,149 billion.

The total number of non-cash transactions was 8,705,280 transactions with a total amount of VND 43,552 billion. In which, in 2015, there were 1,741,056 transactions with a total amount of 8,710 billion VND

Along with the development of card issuance, the number of bank transactions and the balance on deposit accounts also increased slightly, from an average of 7.3 million VND/card in 2011 to 7.5 million VND/card in 2011. 2015. This is also an important signal in card activities at VAB.

General criteria on cards

Table 3.4: General criteria for cards 2011-2015

STT | Targets | Quantity ( dish) / Value (billion VND) |

first | Number of active domestic cards | 70,200 |

2 | Number of active international cards | 34 |

3 | Number of ATMs in operation | 45 |

4 | Number of ATM cash withdrawal transactions | 18,141,888 |

5 | Value of cash withdrawal via ATM | 35.749 |

6 | Number of cashless transactions | 8,705,280 |

7 | Non-cash transaction value | 43.552 |

Maybe you are interested!

-

Developing card services at Viet A Commercial Joint Stock Bank - 1

Developing card services at Viet A Commercial Joint Stock Bank - 1 -

Developing card services at Viet A Commercial Joint Stock Bank - 2

Developing card services at Viet A Commercial Joint Stock Bank - 2 -

Criteria For Evaluating The Development Of Card Services In The Bank

Criteria For Evaluating The Development Of Card Services In The Bank -

General Assessment Of The Development Of Card Services Of Vietabank

General Assessment Of The Development Of Card Services Of Vietabank -

Card Service Development Solutions Organized By Vietabank

Card Service Development Solutions Organized By Vietabank -

Developing card services at Viet A Commercial Joint Stock Bank - 7

Developing card services at Viet A Commercial Joint Stock Bank - 7

Source of Circular 21 Report of State Bank

Table 3.5: Issued card data and card payment means

Five Targets | 2011 | 2012 | two thousand and thirteen | 2014 | 2015 |

Number of cards issued (cards) | 11,298 | 5,342 | 10,251 | 14,940 | 21,774 |

Number of ATMs (machines) | 45 | 45 | 45 | 45 | 45 |

Number of POS machines (machines) | 1,700 | 1,700 | 1,700 | 1,700 | 1,700 |

Source of Circular 21 Report of State Bank

Figure 3.4: Card issuance growth chart 2011-2015

![]() Income from card service business:

Income from card service business:

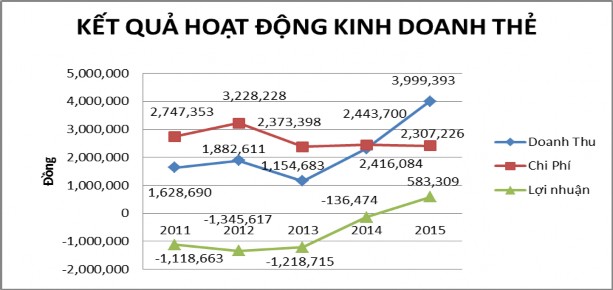

Table 3.7: Card business results 2011-2015

Unit: thousand dong

Five Targets | 2011 | 2012 | two thousand and thirteen | 2014 | 2015 |

Turnover | 1,628,690 | 1,882,611 | 1,154.683 | 2,307,226 | 3,999,393 |

Expense | 2,747,353 | 3,228,228 | 2,373,398 | 2,443,700 | 2,416,084 |

Profit | (1,118,663) | (1,345,617) | (1,218,715) | (136,474) | 583,309 |

Source: Report on card business results at Viet A Commercial Joint Stock Bank

Figure 3.4: Chart of card business performance 2011-2015

Viet A Bank started preparing for the issuance of credit card products from June 2011, the first time of official implementation in the first months of 2012, leading to high costs in 2011 and a sudden increase. in 2012 due to having to pay the costs of joining a visa organization such as the cost of guarantee to join the Visa Organization, the fee to pay the Visa card organization in payment and use of the card, the system setup fee... and other fees. other relevant.

In 2013, the revenue decreased significantly because the Card Center stopped working at home, including electricity, cable TV and internet bills. This is one of the services that brought in relatively high revenue for the Card Center during the period from 2008 to 2012. In addition, at this time, the Bank is still waiving annual fees and card transaction fees, so revenue was significantly reduced. However, the cost has also decreased significantly because the issuance of credit card products has gradually stabilized and is gradually bringing in revenue for the Bank.

In 2014, revenue and expenses were almost equal, the Bank is gradually reducing costs and increasing revenue from card activities to bring profit in this activity.

By 2015, VietABank had initially made a profit from card activities, although it was not high, but this proved that the card industry was stabilizing and gradually developing. However, revenue in 2015 only reached 79.88% of the plan, expenses reached 80.54% and revenue only reached 29.17% of the set plan.

![]() Capital mobilization is shown by the balance on the card account:

Capital mobilization is shown by the balance on the card account:

Table 3.6: Card account balance at year-end

Five | 2011 | 2012 | two thousand and thirteen | 2014 | 2015 |

Account balance (billion VND) | 83 | 72 | 88 | 112 | 143 |

Source: Annual settlement report at Viet A Commercial Joint Stock Bank

Figure 3.3: Chart of Balance growth on card accounts 2011-2015

![]() Expand market share

Expand market share

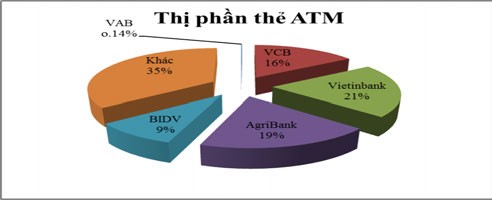

First: Market share of cards

Table 3.8: Card data on the market at the end of December 2015

Unit: thousand cards

Card | VAB | VCB | Vietinbank | AgriBank | BIDV | Other | Total |

2015 | 110 | 12,613 | 16.595 | 15,118 | 7.442 | 28,407 | 80,285 |

% | 0.14 | 15.71 | 20.67 | 18.83 | 9.27 | 35.38 | 100 |

Source: Card Association Report Quarter 4/2015

Figure 3.5: Chart of card market share at the end of 2015 Table 3.9: Proportion of VAB cards in the market from 2011-2015.

Five Targets | 2011 | 2012 | two thousand and thirteen | 2014 | 2015 |

Released by VAB (card) | 11,298 | 5,342 | 10,251 | 14,940 | 21,774 |

Total number of cards on the market (cards) | 42,000,000 won | 54,290,000 won | 66,200,000 won | 74,285,000 won | 80,285,000 won |

Ratio(%) | 0.027% | 0.010% | 0.015% | 0.020% | 0.027% |

Source: Card Association Report

Figure 3.6: Share of VAB cards in the market from 2011-2015

Viet A Bank is one of the banks with a small scale compared to other banks, so the card market share is still very small, compared to big banks like Vietcombank, Agribank, the number of VAB cards is not significant, although However, the Bank is still learning and improving to develop in a sustainable way.

Looking at the chart, Vietinbank is currently the leading bank in terms of number of ATM cards issued. With card issuance fees and ATM functions similar to other banks, Vietinbank's ATM card development speed is very fast. The basic reason is that Vietinbank completed the banking modernization program first, focusing on cross-selling products, meaning that when a customer opens an account, one more card is issued. Another important reason is that Vietinbank has developed into a card brand in the market... thus has a loyal customer base.

Besides Vietinbank, Agribank and Vietcombank are also two banks that hold a high market share for cards today. These are two banks that have built their own brands for many years and are one of the largest banks in Vietnam with a wide business network throughout the country, so they are favored by many customers when choosing.

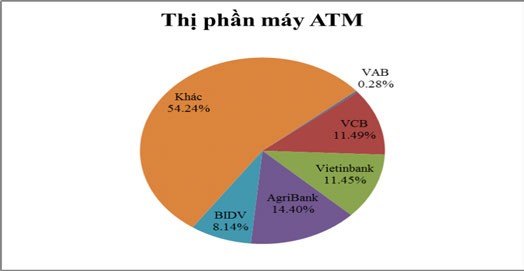

Second: Market share of ATMs

Table 3.10: Number of ATMs in the market 2015

VAB | VCB | Vietinbank | AgriBank | BIDV | Other | Total | |

ATM | 45 | 1.835 | 1.829 | 2,300 | 1,300 | 8,663 | 15,972 |

% | 0.28 | 11.49 | 11.45 | 14.40 | 8.14 | 54.24 | 100.00 |

(Source: Statistics of card association)

Figure 3.7: ATM market share in 2015

Table 3.11: VAB's share of ATMs in the market from 2011-2015

Five Targets | 2011 | 2012 | two thousand and thirteen | 2014 | 2015 |

Number of VAB's ATMs (machines) | 45 | 45 | 45 | 45 | 45 |

Number of ATMs in the market (machine) | 13,000 won | 14.269 | 15,300 | 15.652 | 15,972 |

Ratio(%) | 0.346% | 0.315% | 0.294% | 0.288 % | 0.282% |

Source: Card Association Statistics

Chart: 3.8: VAB's proportion of ATMs compared to the market.

In the past five years, the number of ATM cards has grown far outstripping the number of ATMs, resulting in the card/ATM posting ratio nearly doubling. Holidays and Tet are a busy and stressful period for banks to preparing cash to meet the needs of withdrawing money from ATMs but still not meeting the needs of the people. As of December 2015, on the Vietnamese market, there were 50 card issuers with over 80 million cards issued, more than 15,900 ATMs and nearly

176,000 POS/EDC have been installed and used. Calculated, each ATM is serving about 5000 ATM cards. Compared to 2012, according to statistics of the Vietnam Bank Card Association, the ratio of cards/ATMs in Vietnam was 2,800 cards/ATMs, in the same period, compared with neighboring countries like Thailand, this ratio is 532.

According to statistics from the Bank Card Association 5 years ago, by the end of 2009, the number of ATMs in the whole market was 9,723 ATMs, which means that more than two thirds of ATMs today have more than 5 years of use, so there is a risk of failure. will be higher. However, it is also necessary to sympathize with the banks because the investment and operating costs of ATMs are quite large, including the cost of buying machines, maintaining the system, providing funds, renting space to place the machines.. Solution. for this overload is developing a POS system. The function of payment for goods and cash advance at the counter of the POS machine is effectively meeting the increasing demand for card use of the people.

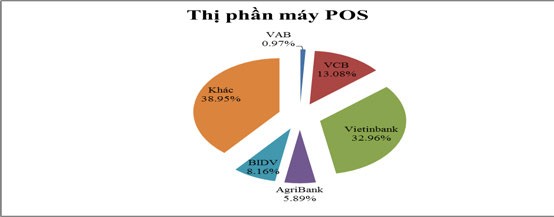

Third : Market share of POS machines (2011-2015)

Table 3.12: POS market share in the market in 2015

VAB | VCB | Vietinbank | AgriBank | BIDV | Other | Total | |

POS | 1,700 | 23,000 won | 57,950 | 10,350 | 14,344 | 68,483 | 175,827 |

% | 0.97 | 13.08 | 32.96 | 5.89 | 8.16 | 38.95 | 100.00 |

Source: Card association statistics

2015

Figure 3.9: Number of Pos machines on the market in 2015

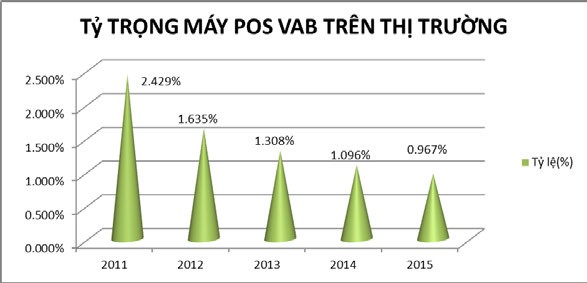

Table 3.13: Proportion of VAB's POS machines in the market from 2011-

Five Targets | 2011 | 2012 | two thousand and thirteen | 2014 | 2015 |

Number of POS machines (machines) | 1,700 | 1,700 | 1,700 | 1,700 | 1,700 |

Number of POS machines on the market (machines) | 70,000 won | 104,000 won | 130,000 won | 155,127 | 175,827 |

Ratio(%) | 2.429% | 1.635% | 1.308% | 1.096% | 0.967% |

Source: Card Association Statistics

Figure: 3.10: VAB's share of POS machines in the market from 2011-2015

The modern retail network in Vietnam is changing rapidly. According to the Ministry of Industry and Trade, by the end of 2013, Vietnam has about 700 supermarkets and 125 trade centers. And by 2020, the whole country will have about 1,200 -

1,300 supermarkets, 180 trade centers. According to statistics, in the period from January to the end of September 2014, about 12 new supermarkets/convenience stores were opened every month with many big names: Satrafoods, Coopfood, Guardian, Big C, Lotte, New Market... These retail systems are all equipped with card payment machines to bring convenience to consumers and have gradually created the card payment habit of a large number of cardholders.

A significant function of the card payment machine (POS) that has not been popularized in Vietnam is the cash advance function. With the retail network, we are not limited to supermarkets, commercial centers but also a network of gas stations, a network of post offices, a network of shops, a network of taxis, pharmacies, and cafes. ... places that often have a lot of cash. Therefore, the opportunity to provide cash advance services to cardholders via POS machines is huge. As long as each of these transaction points has cash available and accepts to participate in providing withdrawal services, the problem of overloading at ATM cards can be solved quickly without any additional investment costs in ATMs. The POS withdrawal process is simple and can spread quickly. Risks in the process, I believe, are completely monitored by many technical support measures: texting of balance fluctuations,

In terms of technology, the development of wireless POS technology (connected via GSM or 3G/Wifi) has made transactions more convenient. Even the mobile POS (mPOS) generation is just a device. Card readers can be attached to smart phones (smart phones) to make transactions easily.

According to statistics of the Bank Card Association, by the end of 2009, there were about 36,000 POS, by December 2015, the market had about 176,000 POS, an increase of nearly 5 times within 5 years. According to the goal of the state bank, to