Step 4 : Make a list of invoices and payment requests. After a certain period of time, CSCNT will make a list for each type of card to submit to the bank for payment

Figure 2.3: Card payment process

Issuing bank

Cardholder

(ten)

(9)

(7)

(8)

Processing Center

(1) (2)

(5) (6)

Bank payment

Facility that accepts card

(3)

(4)

Source: Card payment process at Viet A Commercial Joint Stock Bank

Units and individuals go to the issuing bank to apply for a card (deposit or borrow). The issuing bank provides the card to the user and informs the correspondent bank and the card payment receiving facility

(1) The cardholder buys goods and services and delivers the card to a card-accepting establishment, withdrawing money at an ATM.

(2) CSCNT provides goods and services to customers

(3) Within 10 days, the card-accepting establishment submits the receipt to the paying bank to claim the money.

(4) When receiving invoices and statements, the bank must check the validity of the information on the invoice. If there are no problems, the bank proceeds to debit its account and credit the merchant's account

card. This entry must be made on the day of receipt of invoices and documents from the card-accepting establishment, the paying bank shall pay the card-accepting establishment or the correspondent bank.

(5) The payment bank aggregates and sends payment data to the Data Processing Center (TTXL)

(6) The processing center will conduct data selection and classification for clearing among member banks. Then credit to NHTT.

(7) The processing center sends the clearing data to the credit bank

(8) Small bank debit processing center

(9) The issuing bank sends the statement to the cardholder.

(10) The cardholder pays the debt to the SMALL Bank

2.6 Development of card services at commercial banks

2.6.1 Perspectives on card service development:

Concept of development according to Marxism-Leninism:

In the dialectic, the concept of development refers to the movement process that tends to go from low to high, from less perfect to more perfect. Thus, the concept of development is not identical with the concept of movement in general; it is not a simple increase or decrease in quantity or a repetitive cyclical change in the old substance but a qualitative change towards the perfection of things. Development is also the process of arising and resolving inherent objective contradictions of things; is the unifying process between negating negative factors and inheriting and enhancing positive factors from old things in new forms of things.

Concept of Card Service Development:

The development of card services in commercial banks is also the process of moving in the direction of going from low to high, from less perfect to more complete, reflected in the following aspects: increasing the number of cards issued, as well as card payments are increasing day by day. In addition, it is also about increasing utilities and accompanying services in terms of quantity and quality and controlling risks that may arise to help products become more and more perfect, bringing convenience and safety to customers. most secure for customers, satisfying the growing needs of people and society, and able to compete well with other banks in the same card business.

Developing card services of commercial banks, including contents such as: increasing the number of customers using the bank's cards, increasing the conveniences associated with card payment, card services are increasingly satisfying. better respond to customers' needs, on that basis, increase the bank's income from fees, from the use of cardholder's account balance, thereby ensuring the realization of the bank's goals quickly. fastest and most effective.

Objectives of card service development:

From the above concept, we have the main goals in the bank's card business as follows:

- Development of card service scale.

- Increase income from card services

- Expanding market share of card service business.

- Developing card service quality.

- Streamline card service structure.

- Risk control in card services

2.6.2 Criteria for evaluating the development of card services in the Bank

2.6.2.1 In terms of quantity:

Scale development: can use criteria such as diversity of card products, growth rate of card numbers, card sales, ATM network, POS and number of active cards over the years. .

- Diversity of card products:

This is an indicator that reflects the development of card services not only in terms of utility, but also the degree to which the needs of customers are becoming increasingly diversified. The better the customer's demand, the more and more cards are used, which increases the bank's market share. Thus, it can be said that increasing the diversity of card products will directly affect the number of cards issued by the bank, thereby helping the bank's card services to develop more and more.

- Number of cards issued and card usage

The goal of the bank is not only to increase the number of customers using the card and paying by card, but also how to let the cards issued by the bank be used as the "main" cards of the customers. . As the financial market in general and the bank card market in particular grow, the competition between banks is increasingly fierce. Therefore, in order to attract customers, banks often have policies to promote advertising so that the number of cards the bank holds as much as possible. The higher the number of cards issued, the more proof that the bank's card services can meet the needs of customers. At the same time, the more cards are issued, the higher the bank's income and vice versa. Therefore, the increase in the number of cards, the increase in customers,

- Number of active cards out of total number of cards issued

The number of cards issued does not mean that many cards are circulating in people's lives. Inactive cards or "non-active" cards can be understood as cards that have been issued but have no withdrawal and deposit transactions for a long time after opening an account or in an account with only a balance. enough at a minimum to maintain the card. Cards that do not work cause waste of resources of the bank, cost of marketing, issuance and management costs of card business for the bank. Therefore, the ratio of active cards is one of the criteria to evaluate the performance of banks' card business.

- Deposit balance on customer's card account:

Deposit balance on the card account is the amount that the cardholder deposits at the bank to ensure the payment of goods and services. The bank can use it for business activities and guarantee payment for this amount. This can be considered as a source of business capital that banks can take advantage of without paying interest. The larger the balance of the current account, the more the bank is able to expand its business activities and bring in higher income for the bank. Cardholders with large deposit balances are also financially capable cardholders, reaching these customers is the bank's success. Therefore, the deposit balance on the card account (absolute or average number per card) is also one of the criteria showing the development of the bank's card service.

Income from card service provision:

After all, banks provide card services with the purpose of increasing income, increasing the number of services to reduce risks and improve competitiveness for banks. Income from card business can be listed according to the following sources:

– Domestic card: Revenue from issuance fee, card maintenance fee, etc. Revenue from using balance on current account, collection of loan interest from consumer credit…

- International card:

+ Debit card has revenue from related fees, balance on checking account, fee from Interchange - a percentage calculated on cardholder's transaction volume and fee paid by Visa/MasterCard to issuing bank onion.

+ Credit card: Issuance fee, annual fee, ..., collection of loan interest from consumer credit, Interchange fee - is a percentage calculated on the cardholder's transaction volume, fee paid by Visa/MasterCard issue goods.

Revenue from POS: Collecting from the point of sale a percentage of the payment revenue, paying part of the payment to the international card organization, the rest is collected from the bank.

Revenue from ATM: This is the source of revenue if applying transaction fees on ATMs: withdrawal fees, transfer fees, withdrawal fees from customers with ATM cards of other banks in the alliance, etc.

2.6.2.2 In terms of quality:

Diversity of benefits of card services:

One of the important criteria to evaluate the development of card services cannot fail to mention the conveniences that the bank's card services bring. From simple cards to withdraw money, today cards are also used for payments, transfers, online purchases, payment of electricity and water bills,

… and many other utilities that make the card really a modern means of payment, so if the bank's card service offers more utilities, it will clearly have strengths in attracting customers and contributing to the overall development of this service.

Development of information technology: to make card use faster, more convenient and safer

Professional qualifications of bank staff: to give correct and complete advice and provide the most useful and relevant information to customers.

Streamline the structure of card services: from the actual survey and business efficiency assessment from card services, the bank selects a list of potential services that bring the most benefits to the bank and meets the needs of customers. meet customer needs.

Risk control: Risks in card service business are inevitable, especially when high-tech crimes are growing. The most common is operational risk; and the indicators to measure the risk control of the bank are: the rate of inquiries and complaints of customers and merchants towards the bank, the rate of online payment of goods and services, etc.

2.6.3 Factors affecting the development of card services of commercial banks

There are many factors affecting the development of card services at commercial banks, each factor has many influences on card payment activities, but in general, the factors can be divided into two groups:

2.6.3.1 Group of objective factors

First: People's intellectual level and consumption habits:

Consumption via card is a modern way of consumption, it will be easier to penetrate and develop with highly educated communities and vice versa. Likewise, consumption habits also significantly affect the development of card services. A market where people still only have the habit of spending cash will not be a good environment for card service development. Only when payments are made mainly through the banking system will bank cards have the opportunity to expand and develop. For Vietnam, this is really a huge difficulty because currently cash consumption accounts for about 70-75% of the total solvency of the whole society.

Second: Card user's income:

People's income is higher, their needs are also growing, payment for them requires a higher, faster and safer utility. The use of the card very well meets this need. Moreover, the bank only provides services to people with a reasonable income, low-income people will not be eligible to use this service.

Third: Age

Older people often take less risks and use cards less. Meanwhile, people aged 18 to 45 easily accept opening an account because at this age, they are quite sensitive to changes in the banking system. new technology and dynamic in finding new uses for their lives.

Fourth: Legal environment:

Card service business in any country is conducted within a certain legal framework. Regulations and regulations on cards will have two sides: it can be in the direction of encouraging business and card use if there are reasonable regulations, but on the other hand, the regulations are too tight or too loose. looseness may bring negative effects to card issuance and payment.

Fifth: Technology environment:

Card payment activities are greatly influenced by the level of science and technology, especially information technology. For a country with advanced science and technology, its banks can provide card services with greater speed and safety. Therefore, it is always necessary to invest in upgrading technology and scientific research to improve service quality as well as security for banking operations.

Sixth: Competitive environment:

This is a decisive factor to the expansion and contraction of a market share

banks when participating in the card market. If there is only one bank providing card services in the market, that bank will have a monopoly advantage, but the fees can be very high and the market is difficult to become active. But as more banks enter the market, competition becomes increasingly fierce, which will contribute to the development of service diversification, reduction of card issuance and payment fees.

2.6.3.2 Group of subjective factors

1st: Capital and effective use of capital of the Bank

A bank with large capital will have an advantage over small banks that do not have this advantage in developing card services - which is a capital-intensive field. In addition to Capital, the effective use of capital is also very important, because the effective use of capital helps the Bank avoid rampant and wasteful investment but the profit is not high.

Second: Qualification of the staff doing card work:

Capable, dynamic and experienced staff is one of the important factors for the development of card service activities, business processing activities, risk management activities, and marketing activities. good, advanced technology, high-speed accurate transaction processing, but the officials who perform it are erroneous, negligent or irresponsible, lack of professional qualifications, card operations cannot develop and vice versa. again

Tuesday: Card Widget

With the feature of a new technology, the more utilities the Card has, the more interest it will attract customers to use. In addition to the usual functions with ATM cards such as withdrawing money, transferring money. Some cards now even extend their utility by allowing payment for goods. . . The benefits of the card are not only created by the issuing bank, but also depend a lot on whether the bank participates in card alliances or not, which allows a cardholder of this bank to also withdraw money and pay money through the machine of the

other bank.

card development:

Fourth: Development orientation of the bank and development policy

In the current trend of development and integration, the card is a product

products are paid special attention by banks. To develop this activity, the bank must first create a solid foundation related to cards such as capital policy making and investment technology for payment cards; human resource development policy for card officers; develop regulations and professional processes; set out mechanisms, principles as well as policies to promote card development... Besides, the bank must develop card development strategies such as card business strategy, increase card's utility; expanding the network of activities...etc to have a development orientation in the coming time.

Fifth: Procedures for card issuance and payment:

In the past, card issuance procedures often took a long time and many procedures. In order to improve competitiveness, banks have shortened the procedures and time of card issuance and payment for the convenience of customers but still ensuring strict confidentiality and safety.

card:

Sixth: Risk management activities in issuance and payment

Risk management in card issuance and payment is an activity

prevent, detect and promptly handle the risks that occur. Solving this problem means contributing to the improvement and development of card payment activities at commercial banks.

2.6.4 Experience in developing card services at Joint Stock Commercial Bank for Foreign Trade of Vietnam (VCB)

Currently, Joint Stock Commercial Bank for Foreign Trade is considered one of the most prestigious commercial banks in Vietnam, classified by the State as one of the special enterprises. In July 2014, The Banker Magazine announced ending

Results of ranking 1,000 leading banks in the world on Top 1000 World Banks special issue magazine issued in July 2014. In card payment, mainly international payment, with existing relationships with international payment organizations, Vietcombank has a great advantage when participating in the field of card payment.

General assessment of the current situation of card service development at VCB:

- Achievements : sales, profits, market share from card services have increased over the years, minimizing possible risks in card services.

Firstly : VCB card brand has a position in the financial industry

bank.

Second : the service fee policy for the card line is aimed at all customers

The number of customers tends to decrease.

Third , the quality of the bank's card services is increasing, better meeting the needs of customers.

- Limitations: Growth in card size is still limited and not really stable; Diversified services but not properly and sufficiently meeting the needs of customers; The card payment network is not yet wide; Marketing is not really professional; Risk control is limited.

The reasons for the above limitations are:

Internal causes: lack of and in-depth staff; the policy for accepting card-accepting units is not attractive; processing and tracing is still slow; the information technology system has not fully met the needs of modernization;

External causes: The habit of using cash in payment today is a major obstacle in developing the card service business in order to create a habit of non-cash payment. The intellectual level is not high, so the use of debit card services is still limited and causes many unnecessary risks. High-tech crime is increasing, causing increased pressure to control risks.

Cause from the State agency: there is no specific legal framework and sanctions for the use of cards and card services.

Solutions VCB has implemented to develop card services:

Appreciate Marketing and customer strategies to always improve the quality of their services. Customers are regularly updated with specific information and instructions on card payment processes. In addition, for each customer, Vietcombank can always offer appropriate preferential policies, with preferential policies for cardholders depending on the card limit that the cardholder uses. In addition, it is necessary to pay more attention to the care of agents and card-accepting establishments, to develop the number of cards, to strengthen the training to improve the qualifications of card service staff, to control measures to risk control.

Conclusion Chapter 2

With its features and utilities, the Reclining Card is more and more popular with customers. Besides the traditional functions, today the card is also integrated with new services as a form of competition between banks. Cards bring many benefits but also contain some risks, so card users, as well as card issuers and card payment banks, need to strictly follow the procedures on card issuance and transaction. need to follow up for timely and quick handling. In order to accelerate the development of card services, the Bank needs to attach importance to product promotion strategies, improve quality and offer suitable preferential policies for cardholders and card acceptors.

3 CHAPTER 3

SITUATION OF CARDS SERVICE DEVELOPMENT AT VIET A COMMERCIAL JOINT STOCK BANK

3.1 Overview of Viet A Commercial Joint Stock Bank

3.1.1 History of establishment and development of VietABank

In 1991, Ho Chi Minh City Jewelry Company – SJC established two credit institutions in two big cities:

- Da Nang Rural Commercial Joint Stock Bank in Da Nang city.

- Saigon Finance Joint Stock Company in Ho Chi Minh City (SFC)

Since their establishment, these two organizations have operated stably and effectively for 12 years. In 2003, in order to strengthen the strength and increase the competitiveness of each economic unit when Vietnam's economy integrates with the global market, with the permission of the State Bank of Vietnam, the Joint Stock Commercial Bank for Agriculture and Rural Development. Da Nang Village and Saigon Finance Joint Stock Company have merged to form a new legal entity called Viet A Commercial Joint Stock Bank (VAB) . On the basis of inheriting the activities of Saigon Joint Stock Finance Company and Da Nang Rural Commercial Joint Stock Bank, VAB officially operates under the model of an urban commercial joint stock bank.

As of December 31, 2014, the total assets of this bank are VND 26,564 billion. And after more than 12 years of operation, VietABank has become a fast-growing financial institution, with nearly 1,300 officers and employees, 85 transaction points across the country (including 1 Head Office, 17 branches and 67 transaction offices); has agency relationship with over 380 correspondent banks in 65 countries around the world and total charter capital is 3,098 billion VND.

3.1.2 Business performance 2011-2015

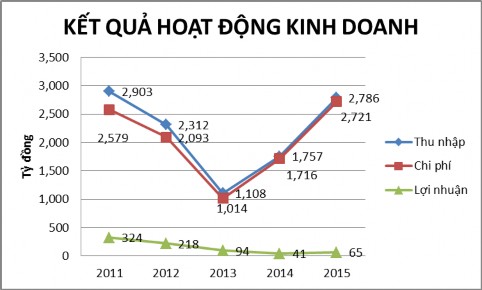

Table 3.1 Some indicators reflecting VAB's business performance 2011-2015

Unit: billion

Five Targets | 2011 | 2012 | two thousand and thirteen | 2014 | 2015 |

Authorized capital | 3.098 | 3.098 | 3.098 | 3.098 | 3.098 |

total assets | 22,513 | 24.609 | 27,071 | 26,564 | 28,470 |

Income | 2.903 | 2.312 | 1.108 | 1,757 | 2.786 |

Expense | 2,579 | 2.093 | 1.014 | 1,716 | 2.721 |

Profit | 32 | 4 218 | ninety four | 41 | 65 |

Maybe you are interested!

-

Developing card services at Viet A Commercial Joint Stock Bank - 1

Developing card services at Viet A Commercial Joint Stock Bank - 1 -

Developing card services at Viet A Commercial Joint Stock Bank - 2

Developing card services at Viet A Commercial Joint Stock Bank - 2 -

The Current Situation Of Card Service Development At Vietabank Compared To The Development Target

The Current Situation Of Card Service Development At Vietabank Compared To The Development Target -

General Assessment Of The Development Of Card Services Of Vietabank

General Assessment Of The Development Of Card Services Of Vietabank -

Card Service Development Solutions Organized By Vietabank

Card Service Development Solutions Organized By Vietabank

(Source: VAB Annual Report 2011-2015)

Figure 3.1: Asset growth chart of VietABank 2011-2014

Figure 3.1: Chart of Business Performance 2011-2015

From 2011-2015, charter capital remained unchanged, total assets increased by more than

4,000 billion VND. Entering a difficult period, in 2012, the total realized income was equivalent to 2,311 billion VND, down 591 billion VND, down 20.3% compared to the previous year.

2011. Total expenses reached 2,093 billion VND, down 486 billion VND, equivalent to 18.8%. Profit before tax reached 218 billion dong, down 105 billion dong, equivalent to 32.5% compared to 2011

In 2013, the total realized income reached 1,108 billion VND, down 1,203 billion VND, equivalent to 52%. Total cost is 1,014 billion dong, down 1,079 billion dong, equivalent to 51%. Profit before tax reached VND 94 billion, down VND 124 billion, equivalent to 56% compared to 2012

2014 was a year with many advantages as well as difficulties affecting the bank's operations, but with the proactive and active management, focusing on the implementation of product programs, and promptly expanding the banking sector. activities, gradually improving the quality of customer service. With the dedication and efforts of all staff, along with the timely direction of the Board of Directors, the Board of Directors, the business activities of VAB in 2014 have achieved effective results as planned. proposed by the General Meeting of Shareholders and the Board of Directors.

In 2014, the total realized income reached more than 1,756 billion VND, an increase of 648 billion VND compared to 2013 and the rate of increase was 58.5%. Total cost is 1,716 billion VND, up 69.2% over the previous year. Profit before tax is equivalent to 40 billion VND, down 53 billion VND, equivalent to 57% compared to 2013.

In 2015, the operation situation was more stable, but expenses were still very high, leading to a slight increase in income.

The years 2011-2015 were the years when the world economic situation in general and Vietnam in particular had many fluctuations, which significantly affected the operations of domestic banks. But with appropriate guidelines and policies, VietABank is gradually overcoming difficulties.