The average total assets of Navibank in 2012 reached VND 22,337 billion (an increase of VND 66 billion compared to 2011), the ratio of pre-tax profit to total assets on average was 0.02%.

Table 2.2: Profit margin

| Number | Targets | 2009 | 2010 | 2011 | 2012 |

| 1 | Profit before tax/average total assets | 1,06% | 1,27% | 1,00% | 0,02% |

| 2 | Profit before tax/average equity | 19,88% | 18,99% | 7,26% | 0,10% |

Maybe you are interested!

-

Developing banking services at Nam Viet Commercial Joint Stock Bank - 2

Developing banking services at Nam Viet Commercial Joint Stock Bank - 2 -

Policies, Management Mechanisms, Management Capacity Of The Central Bank

Policies, Management Mechanisms, Management Capacity Of The Central Bank -

Experience Of International Banks In Developing Banking Services And Lessons Learned For Vietnamese Commercial Banks.

Experience Of International Banks In Developing Banking Services And Lessons Learned For Vietnamese Commercial Banks. -

Evaluate The Level Of Development Of Banking Services Through Swot Analysis At Navibank.

Evaluate The Level Of Development Of Banking Services Through Swot Analysis At Navibank. -

Survey On Customer Satisfaction About Banking Services Of Nam Viet Commercial Joint Stock Bank.

Survey On Customer Satisfaction About Banking Services Of Nam Viet Commercial Joint Stock Bank. -

Evaluation Of The Scale By Cronbach Alpha Reliability Coefficient:

Evaluation Of The Scale By Cronbach Alpha Reliability Coefficient:

“Source: Navibank’s 2012 Annual Report”

2.1.4.2 About solvency

In 2012, Navibank always maintained liquidity at a reasonable level and fully met the safety ratios and limits prescribed by the State Bank. Navibank’s liquidity as of December 31, 2012 is reflected in the following criteria:

Table 2.3: Ability to pay

| Number | Targets | 31/12/2012 | Current regulations |

| 1 | Next day affordability ratio | 16,60% | ≥ 15,00% |

| 2 | Ratio of short-term capital for medium and long-term loans | 18,45% | ≤ 30,00% |

| 3 | Rate of capital contribution to buy shares | 24,19% | ≤ 40,00% |

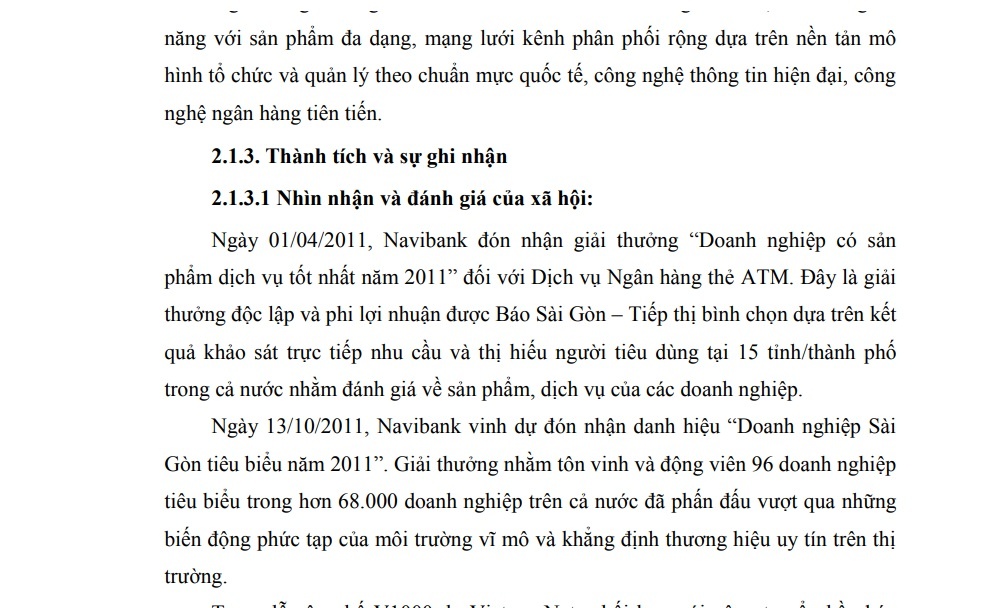

2.1.4.3 Total assets

Navibank’s total assets as of December 31, 2012 reached VND 21,585,214 million, a decrease of VND 910,833 million (- 4.05%) compared to 2011. Total assets decreased during the year mainly due to business limitations. business on the interbank market of the State Bank. Navibank’s profitable assets as of December 31, 2012 reached VND 16,798,774 million.

Figure 2.1: Growth in Total Assets

“Source: Navibank’s Annual Report”

Details of profitable asset items are as follows:

Table 2.4: Profitable asset items (December 31, 2012)

| Number | Items | Value (million VND) | Proportion (%) |

| 1 | Deposits and loans Credit institutions | 372.161 | 2,22% |

| 2 | Loans to customers | 12.885.655 | 76,71% |

| 3 | Investment securities | 2.510.202 | 14,94% |

| 4 | contribute money, investment for longterm | 703.515 | 4,19% |

| 5 | Other assets | 327.240 | 1,95% |

“Source: Navibank’s 2012 Annual Report”

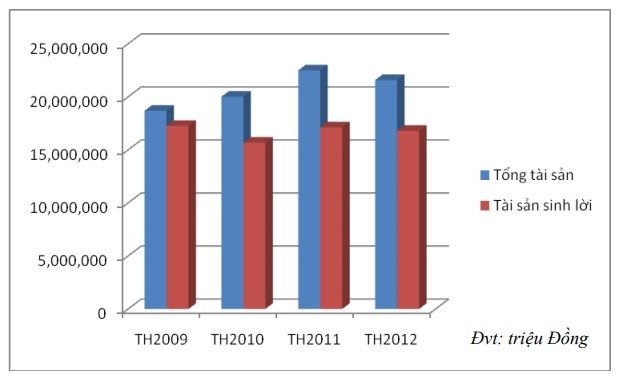

2.1.4.4 Capital raising activities

Capital mobilization growth: As of December 31, 2012, Navibank’s total mobilized capital reached VND 17,174,191 million. In which, capital mobilized from individuals and economic organizations reached VND 17,078,559 million, an increase of VND 1,996,579 million (13.24%) compared to 2011. Capital mobilization increased mainly from individual customers. (up 2,656,702 million VND, equivalent to 21.11% compared to 2011)

Figure 2.2: Growth of capital mobilization from individuals and economic organizations

“Source: Navibank’s Annual Report”

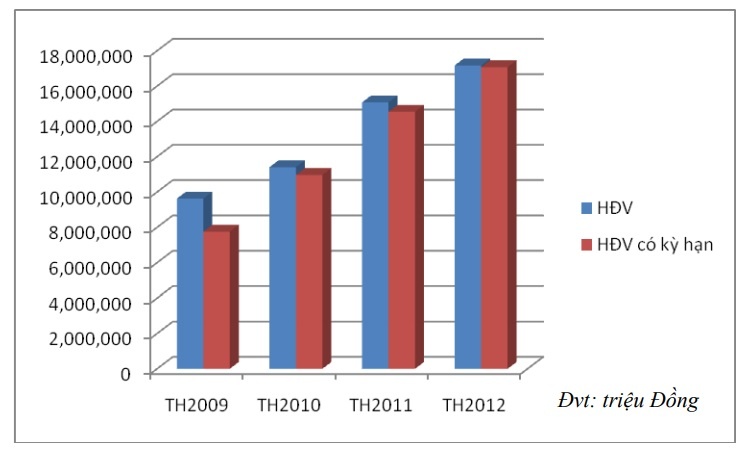

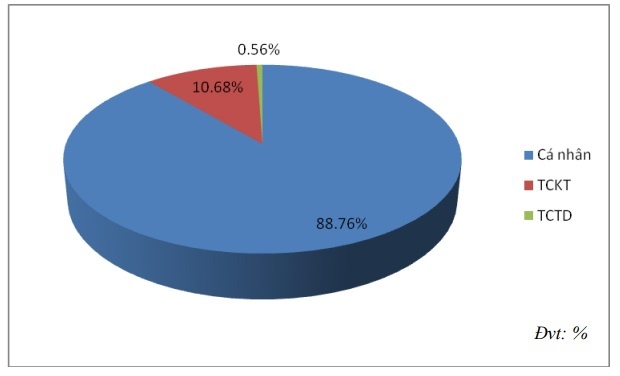

Capital mobilization structure: The main source of mobilized capital is VND (90.84%) and individual customers (88.76%).

Figure 2.3: Capital mobilization structure by currency

“Source: Navibank’s 2012 Annual Report”

Figure 2.4: Structure of capital mobilization by customers

“Source: Navibank’s 2012 Annual Report”

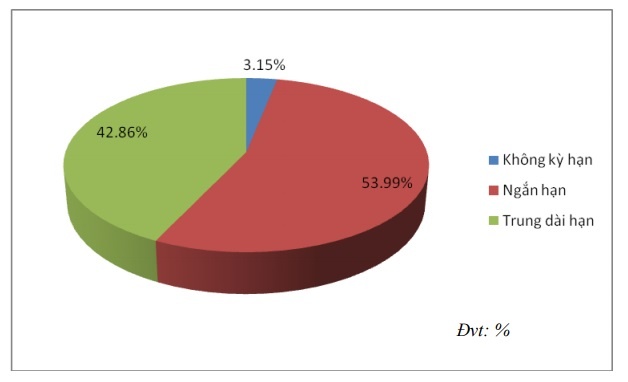

Figure 2.5: Capital mobilization structure by term.

“Source: Navibank’s 2012 Annual Report”

2.1.4.5 Credit activities

The difficult economic situation, large inventories have made a series of Vietnamese enterprises on the verge of bankruptcy, production has shrunk, banks’ bad debts are increasing, both businesses and banks are cautious. important in borrowing and lending. Faced with that situation, Navibank temporarily put aside the growth target of credit balance and focused resources on reviewing and re-evaluating all existing debts to control and improve debt quality.

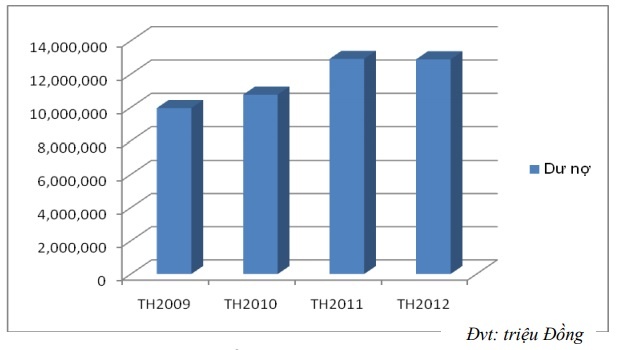

Credit balance growth: As of December 31, 2012, the Bank’s total credit balance reached VND 12,885,655 million.

Figure 2.6: Credit balance growth.

“Source: Navibank’s Annual Report”

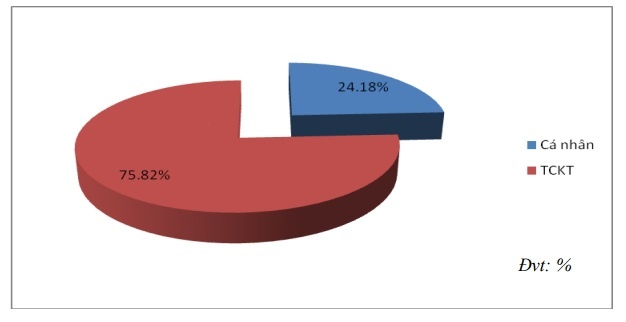

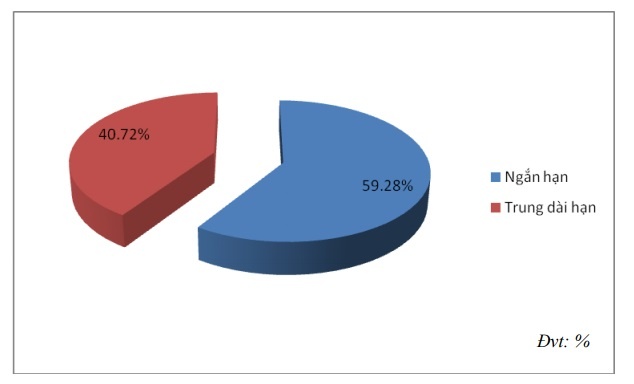

Structure of credit balance: Short-term credit balance accounts for 59.28% of total outstanding loans and mainly focuses on customers of economic organizations (accounting for 75.82%).

Figure 2.7: Loan structure by type of customer

“Source: Navibank 2013 Annual Report”

Figure 2.8: Loan structure by term

“Source: Navibank’s 2012 Annual Report”

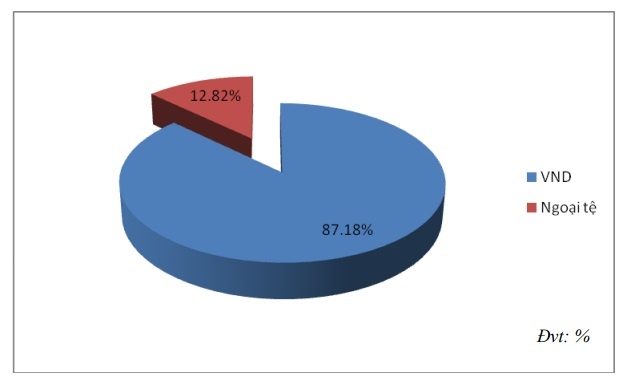

Figure 2.9: Loan structure by currency.

“Source: Navibank’s 2012 Annual Report”

Credit quality: As of December 31, 2012, the Bank’s bad debt balance was VND 726,707 million, accounting for 5.64% of total outstanding loans.

2.1.4.6 Business results

In addition to ensuring operational safety, Navibank also accompanies and shares difficulties with borrowers by adjusting interest rates on old loans to a reasonable level to help businesses overcome difficulties, maintain stabilize and gradually develop production and business activities. Therefore, in 2012, Navibank’s profit did not meet expectations and only reached VND 3,390,487,276.

2.2 Service activities

2.2.1 Card Service

In addition to using the card as a versatile “wallet”, the work of ensuring safety, security and accuracy in all transactions is always focused and completed by Navibank to bring customers high satisfaction. Best. In 2012, Navibank issued 14,494 more Navicard cards (including 12,394 Debit cards, 2,100 Credit cards), bringing the total number of Navicard cards issued in the market to 64,791 cards. Navibank’s card service revenue as of December 31, 2012 reached VND 4,882 million (an increase of VND 2,493 million compared to 2011); the number of units accepting cards reached 429, the number of points accepting cards reached 474, installed 222 POS and put into operation 34 ATMs.

2.2.2 Remittance Service

Preferential policies for customers using remittance services at Navibank continue to attract customers and achieve certain successes. As of December 31, 2012, Navibank’s remittance revenue reached about 4 million USD, almost equal to the previous year and contributed to the total service revenue of 308 million VND.

2.2.3 International payments

With the establishment of relationships with many domestic and foreign agents, including large reputable credit institutions in the world, the implementation of international payment transactions for Navibank has become faster. , effective with high safety and accuracy. As of December 31, 2012, Navibank’s revenue from international payment services contributed VND 7,615 million, accounting for 29.40% of total service revenue.

2.2.4 Guarantee

Navibank’s letter of guarantee has been approved by more and more partners, thereby demonstrating the increasingly enhanced reputation of Navibank in the financial market. With 17 years of operation experience, Navibank basically issues all kinds of guarantee letters: Bid guarantee, Contract performance guarantee, product quality guarantee, payment guarantee, refund guarantee. pay…

2.3 List of banking services being performed at Nam Viet Commercial Joint Stock Bank

2.3.1 Banking services on capital mobilization

2.3.1.1 Payment deposit:

It is a form of demand deposit for both individual and corporate customers. This service helps customers make non-cash payment transactions quickly, safely and accurately.

Payment deposits (VND, USD): providing customers with services of depositing, withdrawing cash, transferring money to pay for goods and services, etc. inside and outside Navibank system. Customers can enjoy free transaction for transactions other than the location where the account is opened for the withdrawal amount of less than 20 million VND. Minimum balance for individual customers is 50,000 VND, 10 USD, for corporate customers is 1,000,000 VND, 100 USD.

2.3.1.2 Term deposits:

It is a form of deposit for businesses that have temporarily idle money for a certain period of time.

Term deposits (VND, USD): diverse deposit periods from 1 week to 36 months, customers can choose the form of interest payment: at the end of the period or by agreement. Minimum deposit balance 1,000,000 VND, 100 USD.

2.3.1.3 Savings deposit:

A type of service for individual customers.

Term Savings (VND, USD): Term Savings (VND, USD): designed for individual customers who need to deposit money for safe and profitable purposes but cannot plan. the use of this deposit. Customers can pay off before the due date.

Term savings (VND, USD): : flexible time from 01 week to 60 months, interest is paid at the end of the period, monthly, quarterly, every 6 months. Principal paid at the end of the period. In particular, term savings pay interest at the end of the period, customers can withdraw 01 part of the principal during the deposit period and enjoy the interest rate without term, the remaining principal will continue to be maintained until maturity. Minimum balance is 1,000,000 VND and 100 USD.

Savings that accumulate value: this is a type of deposit where customers only need to deposit a fixed amount of money regularly weekly, monthly or quarterly within the agreed period with the bank to get a sum of money. large enough to fulfill future plans.