have a large impact on our results, if it does not change significantly over time. However, it should be ensured that the unusual variation in the composition of the banking sector over the analysis period does not undermine the interpretation of our results. To examine the potential effects of banks entering and leaving the industry during the sample period, as well as data collection and disclosure limitations (making the data table disproportionate) on the parameter estimates of the model, we perform the selection bias test.

Verbeek and Nijman (1992) considered three ways of testing for selection bias: the LM test, the Quasi–Hausman test, and the variable addition test. The first two tests require the use of computer algorithms. On the other hand, the extra-variable test is simpler and easier to apply, works reasonably well in practice, and it shows quite high reliability. Therefore, this test will be used in our study. We create three variables to test for selection bias due to the entry and exit of the banks in the sample during the analysis period, as well as due to disclosure and data collection limitations. The first variable (D1) represents the number of years banks are present in the sample. The second variable is a dummy variable that takes on the value one if the bank is absent for at least one year during the sample period and we call it the absent dummy variable (D2). enter the industry (D3). The hypothesis H0 of the additional test is that all the added variables are not statistically significant . This selection bias test will answer the question whether the parameter estimates in our model are biased by any non-randomness in the selection of banks in the sample.

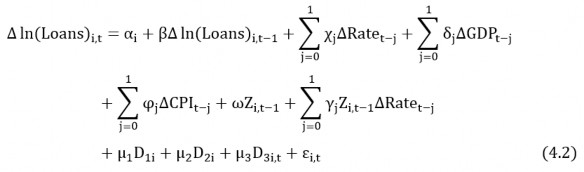

To perform the test, we re-estimate the regressions for each bank feature by adding the three variables D1, D2, D3 described above:

The results of the estimated coefficients for each additional variable are presented in Table .

4.3 8 . It is worth noting here that the estimated coefficients of the two variables D1, D2 are not statistically significant regardless of the banking characteristics used. Meanwhile, the variable D3 is eliminated by the computer algorithm due to collinearity in all cases.

Table 4.3. Selection bias tests

Size | Liq | Cap | |

D1 | 0.0546 | 0.0760 | 0.0246 |

D2 | 0.2010 | 0.2820 | 0.2050 |

D3 | - | - | - |

Maybe you are interested!

-

Bank lending channel and monetary policy transmission in Vietnam - 2

Bank lending channel and monetary policy transmission in Vietnam - 2 -

The Asymmetric Effect Of Monetary Policy On The Supply Of Bank Credit

The Asymmetric Effect Of Monetary Policy On The Supply Of Bank Credit -

Bank lending channel and monetary policy transmission in Vietnam - 4

Bank lending channel and monetary policy transmission in Vietnam - 4 -

Bank lending channel and monetary policy transmission in Vietnam - 6

Bank lending channel and monetary policy transmission in Vietnam - 6 -

Bank lending channel and monetary policy transmission in Vietnam - 7

Bank lending channel and monetary policy transmission in Vietnam - 7 -

Bank lending channel and monetary policy transmission in Vietnam - 8

Bank lending channel and monetary policy transmission in Vietnam - 8

Note: *, **, *** correspond to the significance level of 10%, 5% and 1%, respectively.

Therefore, these results show that it seems that sampling bias is not an important problem in model estimation. Combined with the SGMM model tests described above, these findings suggest that the conclusions drawn from our estimates are reliable.

8 Detailed results of the estimates are presented in Annex B.8 – Annex B.10.

4.2. Macroeconomic impact of bank lending channel

Ashcraft (2006) argues that evidence for differential responses of credit supply to changes in monetary policythrough banks does not necessarily imply the existence of a true bank lending channel. In assessing the importance of the bank lending channel, we also need to examine whether changes in the supply of credit across banks lead to changes in the overall credit supply. If the contraction in lending by small, illiquid, and low-capital banks is offset by large, liquid, and high-capitalization banks, overall bank credit will not change. changes and thus weakens the importance of the bank lending channel. In addition, we need to examine the second stage in the monetary policy transmission of the bank lending channel, that is, whether changes in bank credit lead to changes in economic activity. overall reality or not.

To examine these two problems, we apply the same method used by Ashcraft (2006) for the US and Matousek and Sarantis (2009) for Central and Eastern European countries. Ashcraft (2006) aggregated banking data at the state level and then studied the response of state bank credit to changes in the credit market share of banking corporations (including banks). affiliates and subsidiaries), as well as the response of state output growth to changes in state credit growth. The author's hypothesis is that member banks can protect their credit market share from a monetary tightening, thereby attenuating the adverse reaction of state credit growth and allowing bank credit to increase. the overall stock remains unchanged.

In the case of Vietnam, we still use data at the bank level. Since we are using three banking characteristics, we calculate the credit market share of the largest, most liquid, and most capitalized banks in Vietnam. According to Matousek and Sarantis (2009), the credit market share of large, liquid, and high-capitalized banks is calculated by including banks with medium size, average liquidity ratio , and the 90th percentile median capitalization, respectively, 9. We then use the same estimation method used in Section 4.1 to estimate an extended version of equation (4.1), which now includes the interaction quantity of the changes. changes in interest rates with the credit market share of large, liquid, and highly capitalized banks (similar to Matousek and Sarantis, 2009) 10 . As in the previous section, we estimate separate equations for each bank feature. Hypothesis H 0 here is that the sum of the interaction coefficients of changes in interest rates with the credit market share of large, liquid, and high-capitalization banks is zero .

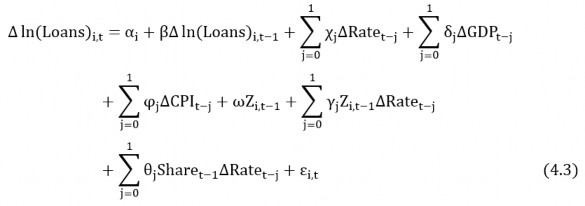

To study the second problem, we follow Matousek and Sarantis (2009) and Ashcraft (2006) in estimating a new equation: growth regression

9 The same definition is used by Gambacorta (2005).

10 Ashcraft (2006) adopted a similar approach, with regressions including lagged variables for inflation and aggregate output growth, and using state aggregate data of banking characteristics row.

national output in terms of bank credit growth and a similar set of variables as above.

The results are presented in Table 4.4. Similar to Matousek and Sarantis (2009) and Ashcraft (2006), we talk only about the coefficients (and their t-values) that are of interest in testing the respective hypotheses .

Table 4.4. Macroeconomic effects of the bank lending channel

Size | Liq | Cap | |

a. Response of bank credit to credit market share | |||

first θ j Share t−1 ∆Rate t−j j=0 | 0.0077** | -0.0332*** | -0.2838*** |

(-0.07) | (-4.82) | (-5.40) | |

b. Elasticity of output growth to bank credit growth | |||

ln(Loans) i,t | 0.2130*** | 0.0065 | 0.0082 |

(2.93) | (1.00) | (0.71) | |

Note: *, **, *** correspond to the significance level of 10%, 5% and 1%, respectively. The numbers in brackets below the coefficients are t-values.

The sum of the interaction coefficients of changes in interest rates and credit market shares (and their respective t-values) in row 1 is statistically significant at the 5% level (for the size characteristic). banks) and 1% (for liquidity characteristics

11 Detailed results of the estimates are presented in Annex B.11 – Annex B.16.

and bank capitalization). This shows that the credit market share of large, liquid, and high-capitalized banks have an impact on the response of bank credit to changes in interest rates.

However, the negative sign of the interaction coefficients in the case of liquidity characteristics and bank capitalization is considered, which suggests that an increase in the credit market share of the well-liquid banks , and high capitalization does not offset the negative response of overall bank credit growth to changes in monetary policy. This is consistent with the results reported by Matousek and Sarantis (2009) for the countries of Central and Eastern Europe, but is in contrast to what was found by Ashcraft (2006) in the US, author Authors have found that the negative response of state credit growth to changes in the federal funds rate is attenuated by the credit market share of member banks. It is worth noting here that the findings of Ashcraft (2006) are consistent with our research results when the bank size feature is used in the model. The positive sign of the interaction coefficient between the credit market share of large banks and changes in interest rates suggests that the contraction in lending by small banks can be offset by large banks. , which results in unchanged overall bank credit, and thus, weakens the importance of the bank lending channel.

These differences in banking behavior may well reflect the differences in the development and structure of the banking industry in Vietnam compared with the US and the countries of Central and Eastern Europe. In Vietnam, the credit market of large-scale banks accounts for a relatively large proportion of the total credit of the economy, while the credits of banks with good liquidity and market capitalization are relatively large. high is insignificant (see Table 4.5 for credit market share of large, liquid, and high-capitalization banks during 2005

– 2014 in Vietnam).

Table 4.5. Credit market share of Vietnamese commercial banks

Five | Credit market share of large-scale banks (%) | Credit market share of banks with high liquidity (%) | Credit market share of banks with high capitalization (%) |

2005 | 69.26 | 1.71 | 0.20 |

2006 | 65.08 | 2.14 | 0.27 |

2007 | 56.28 | 3.38 | 0.42 |

2008 | 56.90 | 3.41 | 0.48 |

2009 | 52.67 | 4.50 | 0.68 |

2010 | 50.43 | 5.54 | 0.73 |

2011 | 49.64 | 5.56 | 0.76 |

2012 | 49.20 | 5.08 | 0.90 |

two thousand and thirteen | 48.88 | 5.10 | 0.98 |

2014 | 36.79 | 6.49 | 1.23 |

Source: Calculations from financial statements of Vietnamese commercial banks

This shows that it seems that bank credit activities in Vietnam are dominated by the behavior of a large group of banks rather than by the behavior of all banks in the whole system. This conclusion is consistent with the current characteristics of Vietnam's banking industry, when there is a fairly deep state involvement in the banking sector, creating a relatively high degree of concentration of the credit market. Although only 5 banks have capital contribution from the state 12, but the total assets of this group of banks account for nearly 35% of the total assets of the industry and the credit market share accounted for more than 51% (in 2011). State-owned commercial banks hold a high credit market share thanks to their wide networks covering key economic provinces. Lending to key economic projects of the state or having close relationships with economic groups are the factors that determine the difference in credit market share. Joint-stock commercial banks do not have such advantages, so credit is concentrated

12 Including: Agribank (100%), Vietinbank (60.3%), BIDV (95.8%), MHB (91%), VCB (77.1%) as of June 30, 2013.

focus on individual customers, small and medium enterprises, so accelerating the expansion of credit market share will be very difficult. The high degree of concentration indicates the dominance of state-owned commercial banks and is a factor that could undermine the importance of the bank lending channel in Vietnam, as these banks have the ability to receiving additional capital from the state as well as taking advantage of the advantages of scale, prestige and brand, it is less sensitive to currency shocks.

The second row in Table 4.4 shows the elasticity (or sensitivity) of national output growth to overall bank credit growth. It is interesting to find that this elasticity is positive and statistically significant at 1% when the bank size trait is used in the model, the result is still positive when we use it with the bank size trait. other banks such as liquidity and capitalization, although not statistically significant in either case. This result supports the second stage in the monetary policy transmission of the bank lending channel; Firms in Vietnam are unlikely to be able to replace bank credit with other sources of financing, which implies that banks' different responses to changes in monetary policy will affect affect real economic activity. Our findings are in agreement with those found by Matousek and Sarantis (2009) in the countries of Central and Eastern Europe, but are in contrast with those reported by Ashcraft (2006) in the US, author The authors found that the elasticity (or sensitivity) of state output growth to state credit growth is negative and not statistically significant for the US economy. This makes sense as the dynamic and liquid financial markets in the United States allow businesses to replace bank credit with other sources of financing, while the financial markets are less developed. in Vietnam has prevented businesses in Vietnam from doing the same. but in contrast to the reports of Ashcraft (2006) in the US, the author found that the elasticity (or sensitivity) of state output growth to state credit growth is negative and not statistically significant for the US economy. This makes sense as the dynamic and liquid financial markets in the United States allow businesses to replace bank credit with other sources of financing, while the financial markets are less developed. in Vietnam has prevented businesses in Vietnam from doing the same. but in contrast to the reports of Ashcraft (2006) in the US, the author found that the elasticity (or sensitivity) of state output growth to state credit growth is negative and not statistically significant for the US economy. This makes sense as the dynamic and liquid financial markets in the United States allow businesses to replace bank credit with other sources of financing, while the financial markets are less developed. in Vietnam has prevented businesses in Vietnam from doing the same.

The ratio of the economy's credit to Vietnam's GDP

3,500,000 160%

3,000,000 won

140%

2,500,000 120%

2,000,000 won

100%

1,500,000 won

1,000,000 won

500,000 won

80%

60%

40%

20%

0

0%

2007 2008

2009

Total credit

2010

2011

2012

GDP

Credit-to-GDP ratio

Figure 4.5. Credit to GDP ratio of Vietnam in the period 2007 - 2012

Source: Vietnam Key Indicator, ADB (2013)

Figure 4.5 shows the important role of bank credit in economic growth in Vietnam. In general, credit growth has always been accompanied by Vietnam's economic growth during the 2007-2012 period, the credit-to-GDP ratio has always been high (over 100%) and reached 135.8% in 2010. This result is supported by the underdevelopment of Vietnam's stock market in recent years, which is seen as a second alternative to bank credit. Vietnam's stock market is characterized by a large number of listed companies but low average capitalization. Two exchanges HOSE (operating since 2000) and HNX (operating since 2005) currently have about 700 listed companies, an unusually large number for nascent capital markets and income levels like Vietnam, but total market capitalization was only about 20% of GDP in 2011. The fact is that despite a large number of companies listed companies, but the relatively low market capitalization indicates that most listed companies are small in size. With such an underdeveloped stock market, there has been a high degree of banking dependence of institutions and individuals in the economy.

At this point, we can conclude about the important role of bank credit as the main source of capital for the Vietnamese economy, contributing positively to the development of national output. High bank dependence has supported the second phase of the monetary policy transmission of the bank lending channel, implying that changes in bank credit will lead to positive changes in the banking sector. overall real economic activity.

In summary, after synthesizing research results on the impact of monetary policy on the supply of bank credit and the impact of the supply of bank credit on the real economy, we find that the bank lending channel Commodities play an important role in the transmission mechanism of monetary policy in Vietnam. Monetary policy not only has a direct impact on the supply of bank credit, but also has an indirect effect through bank-specific characteristics, specifically, small-sized and low-capitalized banks will respond to more responsive to monetary tightening shocks than large-cap and large-cap banks. However, the results also show that the credit market share of large banks has a significant impact on the overall supply of bank credit. Given the high concentration of credit market shares in large banks as in Vietnam today, this could undermine the importance of the bank lending channel, as credit activities of banks are less important. Large banks can completely offset the negative reaction of small banks to monetary tightening shocks. However, when studying the second stage of monetary policy transmission through the bank lending channel, we find that changes in the overall supply of bank credit still have a positive impact on In the real economy, since Vietnam's stock market is currently underdeveloped, the availability of alternative finance sources to bank credit is still low, leading to a high degree of banking dependence of financial institutions. organizations and individuals in the economy,

CHAPTER 5 CONCLUSION

5.1. Main results of the study

This paper studies the existence of a bank lending channel in the monetary transmission mechanism in Vietnam in the period from 2005 to 2014. In contrast to the traditional interest rate channel, the bank lending channel focuses on the special role of banks in the monetary transmission mechanism. Two necessary conditions for the existence of a bank lending channel are the ability of monetary policy to affect the supply of bank credit and the dependence of borrowers on bank credit. The existence of a bank lending channel in the monetary transmission mechanism has a very important meaning for monetary policy: the transmission of monetary policy depends on the structure of the financial system. This means that structural changes in the financial sector can impact money transmission. More, Monetary policy can also have a distributive effect, as individual banks with different characteristics will have an asymmetrical response to a currency shock. An understanding of how banks respond to changes in monetary policy is therefore essential and very important for policymakers. Our study period spans from 2005 to 2014, which seems to be a sufficiently long period because it covers the entire cycle of monetary policy, i.e., periods of monetary tightening. and monetary easing. An understanding of how banks respond to changes in monetary policy is therefore essential and very important for policymakers. Our study period spans from 2005 to 2014, which seems to be a sufficiently long period because it covers the entire cycle of monetary policy, i.e., periods of monetary tightening. and monetary easing. An understanding of how banks respond to changes in monetary policy is therefore essential and very important for policymakers. Our study period spans from 2005 to 2014, which seems to be a sufficiently long period because it covers the entire cycle of monetary policy, i.e., periods of monetary tightening. and monetary easing.

To conduct an empirical study on the bank lending channel in Vietnam, we use panel data of 30 commercial banks and SGMM estimation method to estimate a dynamic panel data model of credit growth. not only take into account the monetary policy index and macroeconomic variables, but also take into account bank-specific characteristics, which represent the response of bank credit to monetary policy. directly (through the traditional interest rate channel, also known as the money channel) and with respect to banking characteristics (the lending channel). The main question is what role does the bank lending channel play in money transmission?

currency in Vietnam, and which banking characteristics play an important role in discriminating the asymmetric response of the bank credit supply to changes in monetary policy.

Our experimental results support the hypothesis that there is a bank lending channel in monetary policy transmission in Vietnam. In which, the characteristics of bank size and capitalization seem to play an important role in distinguishing the asymmetric response of bank credit to changes in monetary policy. The expected and statistically significant positive sign of the interaction coefficients of bank size and capitalization for short-term interest rates implies that small and low-cap banks are more sensitive to shocks. currency shock compared to large and high-capitalization banks, because small, low-capitalized banks are more prone to information asymmetry and capital adequacy barriers than large banks , high capitalization will face more difficulties in accessing non-deposit financial sources, therefore, credit capacity of these banks will be limited in the face of tightening monetary shocks. The evidence for the role of bank size is generally strong across all estimates. Meanwhile, the evidence on the role of bank capitalization seems to be weak, only statistically significant in the estimates with the presence of the size feature. What is remarkable in our results is that bank liquidity characteristics do not seem to play an important role in discriminating the asymmetric response of bank credit to changes in monetary policy. currency, when the interaction coefficient with short-term interest rates is negative and not statistically significant in most estimates. The evidence for the role of bank size is generally strong across all estimates. Meanwhile, the evidence on the role of bank capitalization seems to be weak, only statistically significant in the estimates with the presence of the size feature. What is remarkable in our results is that bank liquidity characteristics do not seem to play an important role in discriminating the asymmetric response of bank credit to changes in monetary policy. currency, when the interaction coefficient with short-term interest rates is negative and not statistically significant in most estimates. The evidence for the role of bank size is generally strong across all estimates. Meanwhile, the evidence on the role of bank capitalization seems to be weak, only statistically significant in the estimates with the presence of the size feature. What is remarkable in our results is that bank liquidity characteristics do not seem to play an important role in discriminating the asymmetric response of bank credit to changes in monetary policy. currency, when the interaction coefficient with short-term interest rates is negative and not statistically significant in most estimates.

In addition to the interaction quantities between bank characteristics and short-term interest rates, our research model also considers the fixed effects of banks, as well as the separate effects of credit growth. previous year, short-term interest rates, macroeconomic factors, and bank-specific characteristics on bank credit growth. Our results show that the fixed effect across banks seems to have a positive effect on credit growth.

bank when the sign of the intercepts is positive and statistically significant in the estimates with the presence of the bank size feature. We also find that last year's bank credit growth will create inertia for this year's bank credit growth when the signs of the coefficients of the lagged dependent variable are positive and statistically significant at all. cases. Meanwhile, short-term interest rates have a negative effect and are statistically significant in most estimates, implying the existence of a traditional interest rate channel in Vietnam. Macroeconomic variables representing credit demand have a positive and statistically significant effect as initially expected, except that the effect of output growth is not clear, indicating credit demand The main use comes from inflation. We also find some evidence on the role of bank characteristics in bank credit growth, in which, the coefficients of bank size feature are positive and statistically significant. In all estimates, large banks can take advantage of economies of scale to develop credit. However, liquidity characteristics and bank capitalization do not seem to have a significant impact on bank credit growth as the estimated coefficients are not statistically significant in all cases, regardless of What bank characteristics are we considered?

Ashcraft (2006) argues that if the contraction in lending by small, illiquid, and low-capital banks is offset by large, liquid, and high-capitalization banks, then bank credit overall banking will remain unchanged and thus weaken the importance of the bank lending channel. To test whether changes in the supply of credit across banks lead to changes in the overall credit supply, we add to the original credit growth equation the interactions between interest rates The short-term rates and credit market shares of large, liquid, high-capitalization banks are similar to those in Ashcraft (2006) and Matousek and Sarantis (2009). Our results show that the credit market share of high-capital and liquid banks does not reduce the negative reaction of overall bank credit growth to changes in government policy. currency book. However, the interaction coefficient

between short-term interest rates and the credit market share of large banks is positive and statistically significant, implying that a decrease in credit of small banks can be completely offset by credit. used by large banks, which may weaken the importance of the bank lending channel. This difference in lending behavior can be explained by the structural characteristics of Vietnam's commercial banking system, when the majority of the credit market share is concentrated in a small number of large banks (mainly the largest banks). mainly banks with state capital contribution), while these banks are quite indifferent to changes in monetary policy due to certain advantages in terms of size and prestige. credit.

We also investigate the macroeconomic effects caused by the bank lending channel by regressing a national output growth equation that takes into account the growth factor in bank credit (similar to Ashcraft, 2006). and Matousek and Sarantis, 2009). We find strong evidence for a link between aggregate credit supply and real economic activity, with the elasticity of national output growth to aggregate bank credit growth being positive in all cases. in all cases, although it is only statistically significant when we consider bank size characteristics. This shows that in Vietnam, the bank credit market is still the main source of capital for the economy, while other financial markets have not yet developed strongly.

In summary, from the collected results, we can conclude about the existence of a bank lending channel in the transmission of monetary policy in Vietnam as well as its positive role in economic development. macroeconomics. Size characteristics and bank capitalization play an important role in differentiating the asymmetric response of bank credit to monetary policy shocks. In particular, large and highly capitalized banks are less sensitive to changes in monetary policy due to certain advantages in terms of size and capital. However, it is worth noting that large-scale banks hold a large share of the credit market

has significant influence on the overall credit market, thus, the behavior of this group of banks could have a strong impact on overall bank credit and undermine the importance of the bank lending channel in the banking system. monetary policy transmission in Vietnam. Even so, with a high dependence on bank credit as in Vietnam today, changes in the overall supply of bank credit still have a positive impact on real economic activities.

5.2. Limitations of the study and future research directions

Our research paper could be extended in a number of useful ways. First, this study only stops at using aggregated bank credit data to examine the response of credit supply to currency shocks. Further studies can use disaggregated bank credit data to study the lending channel, disaggreating bank credit data can help us better understand how the lending channel works. bank. For example, a credit can be divided into a business credit and a household credit. These two types of credit can be further divided into short-term and long-term.

Second, this study is limited to using a sample of data over a 10-year period, including periods of monetary tightening and easing. Further studies can divide the sample into periods of monetary tightening and monetary expansion, as in Kishan and Opiela (2006) in the US. Such division of the sample into periods of monetary tightening and monetary expansion will allow us to analyze the asymmetric effects of monetary policy on bank lending behaviour. This may also allow us to study the multi-mode bank lending channel emphasized by Kierzenkowski (2005). But such an economic study requires a fairly long time series data to identify a large number of different policy regimes, with enough observations for each. Unfortunately such a long time series is not available in Vietnam. However, one way to deal with this problem is to try to construct an MCI (Monetary Condition Index) for the monetary policy situation as in Bernanke et al.