Size (1) | Liq (2) | Cap (3) | Size Liq (4) | Size Cap (5) | Liq Cap (6) | Size Liq Cap (7) | |

Cap(1) | -0.3090 | -0.2690 | -0.0538 | -0.4210 | |||

Cap(1)*Rate | 0.0120 | 0.1940* | 0.0216 | 0.2110** | |||

Cap(1)*Rate(1) | -0.0022 | -0.0345 | 0.0122 | -0.0390 | |||

Const | 8,5000*** | -0.3100 | -0.1750 | 8.2970*** | 8.0420*** | -1.0520 | 8.5170*** |

Hansen test (p-value) | 0.7060 | 0.4630 | 0.7200 | 0.9930 | 0.9970 | 0.9940 | 1,000 yen |

AR(1) test (p-value) | 0.0000 | 0.0010 | 0.0000 | 0.0000 | 0.0000 | 0.0010 | 0.0000 |

AR(2) test (p-value) | 0.6830 | 0.2060 | 0.2200 | 0.5200 | 0.4970 | 0.3440 | 0.6240 |

No. of observations | 265 | 265 | 265 | 265 | 265 | 265 | 265 |

Maybe you are interested!

-

Bank lending channel and monetary policy transmission in Vietnam - 1

Bank lending channel and monetary policy transmission in Vietnam - 1 -

Bank lending channel and monetary policy transmission in Vietnam - 2

Bank lending channel and monetary policy transmission in Vietnam - 2 -

The Asymmetric Effect Of Monetary Policy On The Supply Of Bank Credit

The Asymmetric Effect Of Monetary Policy On The Supply Of Bank Credit -

Macroeconomic Impact Of Bank Lending Channel

Macroeconomic Impact Of Bank Lending Channel -

Bank lending channel and monetary policy transmission in Vietnam - 6

Bank lending channel and monetary policy transmission in Vietnam - 6 -

Bank lending channel and monetary policy transmission in Vietnam - 7

Bank lending channel and monetary policy transmission in Vietnam - 7

Table 4.1. Estimations of Equation (4.1) Using Bank Data (continued)

38

Note: *, **, *** correspond to the significance level of 10%, 5% and 1%, respectively.

Results of Hansen test and Arellano - Bond test:

As described in Chapter 3, the SGMM estimates of equation (4.1) are considered appropriate and reliable only when two conditions are satisfied.

First, the instrumental variables must be relevant and valid, that is, the variables used as the instrumental variables must be correlated with the endogenous regressors while at the same time being orthogonal to the residuals (Baum et al., 2003). In most of the estimators, we use the second lag of the variables specified as instrumental in the differential equation and the first lag of the difference as the instrumental variable in the base equation. The fit of the instrumental variables is assessed by Hansen's test (1982) with the hypothesis H0 that the instrumental variables are appropriate . The probability values (p-values) of Hansen's test in Table 4.1 are greater than 0.1 in all estimates, showing that the null hypothesis H 0 is not rejected, implying that the instrumental variables used are fit and valid in all model estimates (columns 1 – 7).

Second, there is no quadratic autocorrelation in the first difference residuals. Arellano-Bond test (1991) on autocorrelation in residuals with hypothesis H0 that there is no autocorrelation and is applied to the differential balance. The results of the AR(1) and AR(2) progress tests in Table 4.1 show that the first order autocorrelation appears in the residuals, while the second order autocorrelation does not (p-value of the AR(1 test) ) is less than 0.1 in all estimators, while the p-value of the AR(2) test is greater than 0.1 in all estimators). As discussed in Chapter 3, the presence of first order autocorrelation does not lead to inconsistency of the estimates, however the presence of second order autocorrelation does (Benkovskis, 2008). . Therefore, the AR(2) test results are more important than the AR(1) test results. The acceptance of the null hypothesis H0 in the Arellano–Bond test for AR( 2 ) implies that no there exists quadratic autocorrelation in the first-difference residuals in all model estimates (column 1 - column 7).

Thus, the results of Hansen test and Arellano - Bond test for AR(2) show that all SGMM estimates presented in Table 4.1 are robust and efficient.

Fixed effects across banks:

Our model takes into account fixed effects across banks, as measured by the intercept α i . Block coefficient of each other bank This difference may be due to the different characteristics of each bank or the difference in management policies and operations of the bank. The results in Table 4.1 show that the intercepts of the estimates are positive and statistically significant at the 1% level in the case of the scale feature considered (column 1, column 4, column 5 and column 7). This shows that the fixed effect across banks has a positive influence on bank credit growth. However, this effect is unstable because the sign of the intercept becomes negative and insignificant in the case where each liquidity and capitalization feature is included in the model, or even both are considered. at the same time (column 2, column 3 and column 6).

Bank credit growth:

To study the impact of last year's credit growth on this year's credit growth, we use the first lagged variable of the dependent variable as an independent variable in the research model. The results in Table 4.1 show that the estimated coefficient of ln(loans) i,t - 1 is positive and statistically significant at 1% in all estimates. of the model. This shows that bank credit growth in the previous year will create inertia for next year's bank credit growth (Altunbas et al., 2009). However, one thing to note is that in the estimates with the appearance of bank size characteristics (column 1, column 4, column 5 and column 7), the estimated coefficient is only about 0.55, implying that that when credit in the previous year increases by 1%, it will help credit in the following year increase by 0.55%, other things being held constant. Meanwhile, this coefficient is close to 0.9 in the remaining estimates, showing that when credit increased by 1% in the previous year, it will help credit in the following year to increase by 0.9%, other factors remaining unchanged. This shows that bank size characteristics seem to have a significant impact on the response of bank credit growth, which we will discuss in future chapters.

next analysis.

The direct impact of monetary policy on bank credit growth:

Looking at the parameter estimates of the model (4.1) in Table 4.1, it is worth noting that the presence of a significant response of bank credit growth to the monetary policy situation is measured by interest rates. short-term yield. Specifically, short-term interest rates have a negative impact on credit growth with a significance level of 1% in the estimates with the presence of bank size characteristics (column 1, column 4, column 5 and column 7) , with coefficients ranging from -0.1170 in column 5 to -0.1290 in column 7. Meanwhile, the first-order lag of short-term interest rates also has a negative impact on credit growth with a significance level of 1% in remaining estimates (column 2, column 3 and column 6), with coefficients ranging from -0.1140 in column 2 to -0.1220 in column 6.

Impact of credit demand on bank credit growth:

To study the effects of credit demand on bank credit growth, macro factors such as real output growth and price growth have been considered in model (4.1) as representative indicators. represent the credit needs of the economy. The estimated results in Table 4.1 show the positive reaction between credit growth to changes in prices in most cases, the regression coefficients of CPI variable are positive and statistically significant at 1. % (column 1, column 4, column 5 and column 7), 5% (column 3) and 10% (column 2). At the same time, the first-order lag of the CPI variable is also positive and statistically significant at 1% in some cases (column 2, column 3 and column 6). This implies that price growth will increase the credit demand of the economy, leading to an increase in credit supply.

However, the impact of real output growth on credit growth in the long run is not clear, although the regression coefficients are statistically significant in most of the estimates, only output growth is statistically significant. real quantity at the present time has a positive effect on credit growth as initially expected with the significance level

mean 1% (column 2, column 3 and column 6) and 5% (column 1 and column 4), while the first-order lag of real output growth has a negative effect on credit growth with significant significance. 1% (column 1 – column 7), implying that last year's real output growth will slow down credit growth in the current year. This can be explained by the rapid economic growth in recent years, leading to an increase in annual credit demand, therefore, commercial banks rely on credit demand in the past years. In order to plan supply levels in the current year, it may lead to the cost of underestimating credit demand and reducing credit growth in the current year (Benkovskis, 2008).

Benkovskis (2008) argues that it is problematic to use price changes (changes in CPI or GDP deflator) and real GDP growth to account for the impact of the macroeconomic environment on credit demand. subject. The main limitation of these variables is the implicit assumption that the elasticity of credit demand for GDP growth and inflation is uniform across banks. In practice, however, banks face different credit needs because the components of their credit portfolios belong to different sectors. To overcome this problem, Benkovskis (2008) and Worms (2003) used the same bank-specific real income and price variables as the weighted average of price and real income. industry (the author uses 11 production sectors according to the NACE classification and the household sector). Prices and real earnings by industry are weighted by the industry's share of a bank's credit portfolio. Unfortunately, the annual consolidated financial statements of Vietnamese commercial banks do not have statistics on credits by economic sector. Therefore, in this study, we use changes in CPI and real GDP growth to represent the macroeconomic factors (credit demand) that affect the supply of bank credit. , assuming that the demand for credit in each period is the same across banks.

However, even if that does not happen, the correlation between credit growth and real output growth is not very clear. Figure 4.1

shows that CPI inflation fluctuates in the same direction as Vietnam's bank credit growth during the period 2001 - 2011, while GDP growth hardly changes significantly compared to bank credit growth. This implies that the credit demand factors affecting credit supply mainly come from CPI inflation rather than from real output growth.

Credit growth, output growth, inflation (%)

60

50

40

30

20

ten

0

2001 2002 2003 2004 2005 2006

2007

GDP

2008 2009 2010 2011

Credit growth

CPI

Figure 4.1. Credit growth, GDP, CPI of Vietnam in the period 2001 - 2011

Source: General Statistics Office, State Bank

The impact of bank characteristics on bank credit growth:

To study the impact of bank characteristics on credit growth, size, liquidity, and bank capitalization characteristics are considered in our estimates, respectively. Looking at the cases where each bank characteristic is included in the model in Table 4.1, we find that the regression coefficient of the variable bank size is positive at the 1% significance level (column 1) exactly as in the previous period. This initial expectation confirms the hypothesis that large banks can better utilize the advantages of size to develop their credit operations than small banks (Kashyap and Stein, 1995). When two or three characteristics of the same bank

When included in the model, the coefficient of bank size is still positive at the 1% (column 4) and 5% (column 5 and 7) significance levels. This shows that the larger the banks, the higher the credit growth they report.

Meanwhile, bank liquidity does not seem to have a significant impact on credit growth as the regression coefficients of liquidity variable are almost not statistically significant in all our estimates, and positive only as expected when used alone or when combined with capitalization characteristics (columns 2 and 6), but negative in the rest (columns 4 and 7) . The negative sign of the estimated coefficients may be because the total capital mobilized by the bank is mainly short-term sources, so if the bank lends a lot, it will tend to finance the assets. less liquidity and bank liquidity will decrease. On the other hand, because Vietnam's financial market has not yet developed strongly, Commercial banks mainly use mobilized capital to provide credit rather than invest in liquid assets such as securities and other financial assets, therefore, banks have a large amount of liquid assets. Low rates usually have higher credit growth rates. Similar results were found by Matousek and Sarantis (2009) in the Baltic countries.

One thing worth noting when considering the impact of capitalization on bank credit growth is that the regression coefficients of the bank capitalization variable are negative and not statistically significant in all our estimates. whether it stands alone or in combination with other features (see column 3, column 5, column 6 and column 7 in Table 4.1). The negative sign of the regression coefficients shows that banks with lower capitalization will have more incentives to lend to individual customers to improve their reputation. Interestingly, such a negative relationship is not only found in Vietnam, but also reported by Matousek and Sarantis (2009) in their study of bank lending channels in the Baltic countries.

Figure 4.2 shows that the average size of banks fluctuated in line with the average credit growth of banks during the study period. Meanwhile, the liquidity ratios and average capitalization of banks seem to

There is no correlation with average credit growth, even, the average capitalization rate of banks since 2008 has also tended to decrease, showing a negative relationship between average capitalization and growth. average credit growth of banks. At this point, we can conclude that the size characteristic has an impact on bank credit growth, specifically, the larger the banks, the higher the credit growth reported, while the , liquidity characteristics and bank capitalization do not seem to have a significant impact on bank credit growth.

Credit growth, size, liquidity and capitalization

20

18

16

14

twelfth

ten

8

6

4

2

0

0.45

0.4

0.35

0.3

0.25

0.2

0.15

0.1

0.05

0

2005 2006 2007 2008 2009 2010 2011 2012 2013

Credit growth

Liquidity Scale

2014

Capitalization

Figure 4.2. Credit growth, size, liquidity and bank capitalization

Source: Calculations from financial statements of Vietnamese commercial banks

Distributive effects of monetary policy on bank credit growth:

To evaluate the distributional effects of monetary policy on bank credit growth, in order to find empirical evidences on the existence of a bank lending channel in monetary policy transmission in Vietnam, We need to check the coefficients of the interaction quantity between the bank features

commodity and monetary policy index. In the model using only bank size, we find its interaction with interest rates to be positive at 5% significance level (column 1). When adding other bank characteristics to the model, bank size remains positive at the 5% significance level across all estimates (column 4, column 5 and column 7). The positive sign of the coefficients of the interaction between bank size and short-term interest rates supports our hypothesis that the lending activities of small banks are more sensitive to changes in short-term interest rates. in monetary policy. Because small banks are more prone to information asymmetry problems than large banks. This will make small banks more sensitive to monetary policy shocks, because unlike large banks can easily increase non-deposit funds in response to currency shocks (Kashyap and Stein, 1995, 2000; Kishan and Opiela, 2000). It is noteworthy that our findings on the important role of bank size are in sharp contrast to those found in the countries of Western Europe (see Ehrmann et al., 2003; Altunbas et al., 2002; Gambacorta, 2005). On the other hand, they are consistent with reports by Pruteanu (2004) for the Czech Republic, Horváth et al (2006) for Hungary, and Wróbel and Pawlowska (2002) for Poland. The conflicting results on the role of bank size in bank lending behavior between the countries of Western Europe and Vietnam can be attributed to the small proportion of banks (compared to the number of large banks) in Vietnam is higher than other countries in Western Europe.

The fact that large banks in Vietnam are less affected by changes in monetary policy than small banks suggests the existence of economies of scale and the problem of inequality. information worthiness in today's capital markets. Before a monetary tightening, banks will find it more difficult to mobilize capital from deposits (due to rising costs), then, large banks are less likely to face asymmetric problems through Therefore, they will have easier access to non-deposit capital sources at a lower cost than small banks. Therefore, the credit capacity of large banks will be less constrained than that of small banks in the face of a tightening monetary shock.

The estimation results in Table 4.1 show that bank liquidity does not seem to play an important role in discriminating the response of banks to changes in monetary policy. Its interaction with short-term interest rates is not statistically significant when liquidity is used as the only feature in the model, and even when combined with other banking features, the system This number is still not statistically significant. It is worth noting that the interaction coefficient of liquidity and short-term interest rate is only positive as initially expected when all three banking characteristics are included in the model (column 7), and negative in most cases. remaining cases (column 2, column 4 and column 6). The negative sign of the coefficient of interaction suggests that monetary policy has no less impact on banks with good liquidity.

The contrast in the role of liquidity in bank lending behavior in Vietnam can be explained by the weakness of Vietnam's financial market in recent years, financial products have not been able to attract attention. interest of commercial banks. In general, commercial banks use most of their capital to provide credit rather than invest in liquid assets such as stocks and bonds. On the other hand, because the financial market is still illiquid, commercial banks mainly invest in securities with the aim of earning profit, therefore, securities with long maturities usually account for one billion in the very long term. large in the investment portfolio of commercial banks. This shows that Vietnamese commercial banks do not seem to be interested in using liquid assets as a risk prevention tool.

Figure 4.3 shows the asset structure of Vietnamese commercial banks during the research period, in general, banks use their capital in lending activities (accounting for about 60% - 65% of total capital). bank assets). The ratio of liquid assets to total assets has remained stable throughout the research period, showing that the liquidity factor does not seem to have an impact on the response of bank credit to currency shocks.

Proportion of the bank's asset portfolio

Loans to customers Liquid assets Fixed assets and other assets

33.1

38.0

37.4

37.1

34.5

36.8

37.4

33.6

32.4

35.4

64.2

58.8

59.1

58.2

60.2

56.9

54.7

58.9

60.0

57.6

2005 2006 2007 2008 2009 2010 2011 2012 2013 2014

Figure 4.3. Proportion of Vietnam's bank asset portfolio in the period 2005 - 2014

Source: Calculations from financial statements of Vietnamese commercial banks

Finally, the interaction quantity of bank capitalization and short-term interest rates is positive and not statistically significant when capitalization is used as the sole feature in the model (column 3), or when combined. with liquidity characteristics (column 6). However, when the size feature is present, the interaction coefficient of capitalization and short-term interest rates becomes positive and significant at 10% (column 5) and 5% (column 7). The positive sign of the coefficient of interaction is in line with initial expectations, implying that banks with weak capital will reduce their credit supply more than well-capitalized banks after a monetary tightening. currencies, due to their limited access to non-deposit funds (Peek and Rosengren, 1995; Kishan et al.

Opiela, 2000, 2006). Overall, the evidence suggests that capitalization is not as important in discriminating bank responses to changes in monetary policy as it is for size because the interaction quantity of capitalization and short-term interest rates are only statistically significant when the bank size characteristics are present in the model. This is consistent with the results reported by Ehrmann et al. (2003) for Western European countries, but not with Altunbas et al (2002) and Gambacorta (2005), who found a role importance of capitalization.

Gambacorta (2005) argues that the capital-to-asset ratio widely used to calculate the capitalization of a bank can be an imprecise measure due to the capital constraints that banks face when complying with the requirements. according to Basel standards. According to Gambacorta (2005), the capitalization index should be calculated as the amount of capital a bank holds in excess of the minimum required to meet the respective country-specific regulatory safety standards. In Vietnam, the State Bank of Vietnam stipulates the legal capital level applied to state-owned commercial banks and joint-stock commercial banks to be 3,000 billion dong and 1,000 billion dong respectively in 2008; and by 2010, the State Bank shall apply the legal capital of 3,000 billion dong for both of the above subjects (according to Decree No. 141/2006/ND-CP). However, the process of increasing capital according to the regulations of commercial banks has encountered many difficulties. partly due to the weak performance of the stock market, partly due to the increase in the issuance of shares by a series of banks that wanted to raise capital at the same time. This makes the capital level of most banks not significantly superior to the regulation during the study period, even some banks could not meet the prescribed capital level. Therefore, it is almost impossible to determine the exact amount of bank capital that is superior to the regulation in Vietnam. Furthermore, Matousek and Sarantis (2009) have applied the above calculation method in the countries of Central and Eastern Europe, the results show that Gambacorta (2005) calculation does not make any difference compared with the calculation method. Traditionally, the sign and significance of the coefficients of interaction of interest rate changes with capitalization, remain essentially unchanged. Hence the outcome of capitalization is unlikely to be

related to capitalization measures, we therefore do not re-examine the results for the capitalization index as defined by Gambacorta (2005).

The weak capitalization evidence could be due to the fact that the capital growth rate of banks is not commensurate with the growth rate of total bank assets, which depends on business performance such as deposits. capital, loans, investments, etc. of banks. In general, banks with high capitalization will not necessarily be able to hedge against currency shocks, which may be small, newly established, newly merged or restructured banks, due to capital sources are low, so they are under pressure to increase their charter capital to reach the legal capital level as prescribed (see Table 4.2), while the business performance of these banks is less developed, the growth rate is low. of total assets is slower. The pressure to increase charter capital according to such regulations has led to a higher capital growth rate than asset growth, creating a relatively high level of capitalization in these banks. Therefore, our finding on the role of capitalization in discriminating the response of bank credit to changes in monetary policy is only meaningful in the presence of bank size, implies that only high-capitalization banks, accompanied by a corresponding growth in size, are able to hedge against monetary policy shocks.

Table 4.2. Legal capital level for credit institutions in Vietnam

Credit institutions | Legal capital level | |

2008 | 2010 | |

State commercial banks | 3,000 billion VND | 3,000 billion VND |

Joint-stock commercial bank | 1,000 billion VND | 3,000 billion VND |

Joint-venture bank | 1,000 billion VND | 3,000 billion VND |

Foreign bank | 1,000 billion VND | 3,000 billion VND |

Foreign bank branch | 15 million USD | 15 million USD |

Source: State Bank

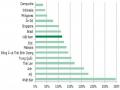

Figure 4.4 shows the relationship between capital sources and capitalization of Vietnamese commercial banks in 2011. After Decree No. 10/2011/ND-CP

The relationship between capital source and bank capitalization

35,000,000 VND

0.4

30,000,000 VND

0.35

25,000,000 0.3

0.25

20,000,000 won

0.2

15,000,000 VND

0.15

10,000,000 won

0.1

5,000,000 won

0.05

0

0

Capital

Level of capitalization

on the extension of the time limit for raising the legal capital of commercial banks to 3,000 billion dong, which expired on December 31, 2011. Banks with low capital such as PGBank, NamABank, MHB, NCB, VietCapitalBank, Saigonbank, etc., are under pressure to increase capital, so their capitalization is relatively higher than banks with large capital sources such as Agribank, Vietcombank, etc. VietinBank, BIDV , etc. Even, MDB has a relatively low capital (about 3,882 billion in 2011) but has the highest capitalization compared to banks in the sample (about 37.91%). This shows that bank capitalization does not seem to be an optimal indicator to assess the financial strength of banks in Vietnam.

Agribank

Vietcombank VietinBank

BIDV

Eximbank Sacombank Techcombank

ACB SCB MB

Maritime Bank

VIB

VPBank

SHB

DongABank SeABank ABBank OceanBank SouthernBank

MDB OCB

VietABank HDBank KienLongBank Saigonbank VietCapitalBank

NCB MHB

NamABank

PGBank

Figure 4.4. The relationship between capital source and bank capitalization in 2011

Source: Calculations from financial statements of Vietnamese commercial banks

Thus, here we can conclude that bank size and capitalization play an important role in discriminating the response of bank credit to changes in monetary policy (although the capitalization is still weak), while the role of liquidity is not important. This suggests that before a tightening monetary shock reduces the reserves and deposits of the banking system, large and highly capitalized banks are less prone to information asymmetry problems than other banks.

Small and low-capitalization banks will have more access to low-cost external sources of capital (non-deposit funds, such as debt and equity issuance) to offset the drop in deposits, thus not affecting their ability to extend credit. Meanwhile, small and low-cap banks cannot do the same and are forced to reduce credit supply in the face of tightening monetary shocks. This shows that monetary policy has a significant impact on credit supply through small and low-capitalized banks, implying that the bank lending channel is quite efficient in Vietnam, as well as confirming the role of banks. the importance of banks in the transmission of monetary policy in Vietnam.

The results in Table 4.1 also show that the coefficients of the interaction quantity between bank characteristics and the first-order lag of short-term interest rates are not statistically significant in all the random estimates. Discuss which bank characteristics are used (columns 1 – 7), which implies that the distributional effects of monetary policy on bank credit through bank characteristics only exist in current year. This finding reinforces the evidence on the important role of bank characteristics (size and capitalization) in accelerating monetary policy transmission in Vietnam.

Selection bias test:

An important issue that needs to be considered is the significant number of banks that joined and others left the banking industry during the study period, as well as disclosure and disclosure restrictions. data collection, which forced us to use an unbalanced panel. As Verbeek and Nijman (1992) have shown, unbalanced panel-based parameter estimates can lead to selection bias, either due to the selection of observations or to the correlation between the effects. random behavior in the model and in the selection process. Our research paper mainly deals with the macro behavior of the entire banks in Vietnam. Therefore, the composition of the banking industry will have no effect