Banks lending to businesses will promote production and business, and there will be many goods. Banks lend to consumers to satisfy the demand for goods.

Thus, the lending activities of banks have contributed to regulating the supply and demand of goods and services for the economy.

Promoting the process of money circulation and stabilizing prices Lending activities have directly participated in the process of goods circulation and money circulation, facilitating the development of the economy, especially important economic sectors. points in each stage of economic development.

Lending activities are always under the direct control of the Government’s economic development policy, thus contributing to speeding up the cash flow process in the market economy, minimizing congestion. depositing capital in the production and business process, speeding up the turnover of capital.

The Bank creates capital mainly from mobilizing idle money in the economy through attractive flexible interest rate policy, then invests in the economy, in key projects in the government. national development policy set out by the Government. Besides, it is still guaranteed not to negatively affect the price situation and national currency circulation.

On the contrary, the State uses other measures, such as issuing paper money to create capital for investment in the economy, which will cause an imbalance in circulation, in the goods-monetary relationship, causing an imbalance in circulation. inflation… As a result, it negatively affects the process of industrialization and modernization of the country.

Contributing to the expansion and development of foreign economic relations and international exchanges Today, the economic development of each country is always associated with domestic economic relations with the world economy. The former self-sufficient “closed” economy has now given way to a developed “open” economy, expanding economic relations with countries around the world.

A country called developed must have a stable political economy, position in the international market, and a large amount of capital in which foreign currency reserves are very important.

Lending activities have become one of the means of connecting the economies of countries with each other by international lending activities such as loans between governments, between organizations and individuals with the Government, between individuals and individuals… The growing development in foreign trade and the increasing number of members participating in the activities make the need for financial activities more and more necessary.

Maybe you are interested!

-

Solutions to promote the efficiency of lending activities for individual customers at Military Commercial Joint Stock Bank - 1

Solutions to promote the efficiency of lending activities for individual customers at Military Commercial Joint Stock Bank - 1 -

Solutions to promote the efficiency of lending activities for individual customers at Military Commercial Joint Stock Bank - 2

Solutions to promote the efficiency of lending activities for individual customers at Military Commercial Joint Stock Bank - 2 -

The Necessity Of Promoting The Efficiency Of Lending Activities For Individual Customers

The Necessity Of Promoting The Efficiency Of Lending Activities For Individual Customers -

Factors Affecting The Improvement Of The Efficiency Of Lending Activities For Individual Customers

Factors Affecting The Improvement Of The Efficiency Of Lending Activities For Individual Customers -

Business Performance Of Military Commercial Joint Stock Bank

Business Performance Of Military Commercial Joint Stock Bank

Therefore, the financial facilitation is an effective competitive tool besides other competitive factors such as price, quality of products and services, etc., which is beyond the scope of a single competition. countries to the world, has the effect of promoting international production, forming a regional and world market economy, creating a new development in cooperation and competition between countries. water together.

As such, payment methods will also be more diversified through SWIFT network payment, LC payment… each payment method requires a suitable loan form and ensures its safe and efficient operation. . The efficiency of foreign trade lending activities is the basis for creating trust for customers in commerce, facilitating the circulation of goods, winning in the payment competition will lead to victory in all competitions. other foreign trade activities.

1.2. Lending activities for individual customers

1.2.1. The concept of lending activities for individual customers

Lending to individual customers (Science and Technology) is a form of loan where a bank temporarily transfers the right to use capital to an individual or household customer for consumption and small business activities. of such individuals and households with certain conditions agreed upon in the contract on the principle of full repayment of both principal and interest.

In the past, banks were less interested in individual customers, because loans were often very small, making debt collection quite difficult. Although lending to HCN is quite new in Vietnam, it has great potential for development. The big advantage is the large market size with a population of about 90 million people. Most of them have young age, income, modern lifestyle and big shopping demand. Lending activities for HCN are mainly to help finance students’ studies or to buy cars, houses, household equipment, building materials for repair and modernization of houses, cover hospital fees, investment in household production and business and other personal expenses. Therefore, banks are increasingly focusing on this customer.

1.2.2. Features of lending activities for individual customers

The object of science and technology of this activity includes individuals and households that need to borrow capital to use for the purposes of living, consuming, or serving the production and business of that individual or household. Unlike businesses and economic organizations, HCNs often have a large number, the demand for loans is very diverse, but usually the borrowing needs of each HCN are irregular and greatly influenced by the environment. economic, cultural and social schools.

Depending on the purpose of the loan and the form of lending, the loans of Science and Technology have terms: short-term, medium-term or long-term.

Normally, the size of each loan of HCN is usually smaller than that of enterprises or financial institutions. However, the number of loans of science and technology in commercial banks is often large. In commercial banks operating in the direction of semi-banks, the number of loans of science and technology is very large and therefore the total size of HCN loans usually accounts for a large proportion of the total outstanding loans of the bank.

Because HCN loans are often small in size, the number of these loans is often very large, so banks often have to spend a lot of money in customer development, appraisal, approval and loan management. Therefore, the cost per dong for HCN loans is usually higher than that of corporate customers.

Interest rates of HCN loans are usually higher than other loans of commercial banks. The reason is that the costs of science and technology loans are large, and science and technology loans have a high level of risk.

HCN loans are usually the riskiest for the bank. This is because HCN’s financial situation often changes rapidly depending on their work status and health. In production and business activities, individuals and households often have poor management skills, lack of experience, outdated science and technology – and limited ability to compete in the market. Therefore, the bank will face many risks when the borrower is unemployed, has an accident or goes bankrupt… Therefore, loans with collateral or guaranteed by a third party will increase more reliability, and at the same time help the bank reduce risks than loans without special assets. In addition, banks may face currency risks when lending to customers in foreign currencies. Therefore, science and technology loans need to be monitored more strictly.

1.2.3. The role of individual customer lending activities

For individual customers

For consumer lending: This activity brings great benefits to consumers by satisfying their spending needs, satisfying their need to enjoy the best quality goods to improve their lives. living. The reality shows that there are many natural, essential and important needs in the life of each individual and household. For example, the demand for shopping, home repair, buying household appliances, etc. For production and business loans: This means that customers will have capital to expand their production and business activities or to carry out business activities. new business plans do not need to take a lot of time to borrow from relatives, acquaintances, etc., but sometimes they cannot borrow the necessary amount of capital. When customers go to the bank to borrow money,they will have a variety of products to choose from with the right loan values along with a repayment period that suits their income.

For the bank

Science and technology lending helps banks improve capital efficiency. Although there are still many risks due to the relatively high interest rates applied to HCN loans, this makes science and technology lending activities with a large profit margin .

Promoting the efficiency of science and technology lending activities helps the bank not only expand its lending customers, effectively utilize mobilized capital, but also diversify banking products and services. Normally, when lending to science and technology, banks are often forced to transfer money or use salary payments through bank accounts. Since then, the bank has increased its competitive strength and created attractive features for its services.

For economy

For science and technology customers with the purpose of consumer loans, this loan will help them have a more stable life, be more motivated to work and save. As for science and technology customers with the purpose of borrowing for production and business, this loan helps businesses of the customer to increase their production scale and develop their own business activities. This has made the whole process of production, exchange, distribution and consumption take place quickly and effectively, making the economy grow. Thus, promoting the efficiency of science and technology lending activities helps to fulfill the important role of commercial banks in the policy of economic renewal of the country, creating conditions to improve the people’s quality of life and contributing to promoting economic growth. economic growth.

1.2.4. Types of loans for individual customers

Based on the purpose of using loans, science and technology loans include two forms: for consumption and for production and business.

1.2.4.1. Consumer loans

Consumer loans are loans to meet the consumption needs of individuals and households. The demand for loans is rich because the borrowers are very diverse and the purpose of using the capital is also very flexible.

However, consumer loans often have higher risks than loans in production and business sectors, so the interest rates of consumer loans are often higher than lending rates in these areas.

The term of consumer loans is quite diverse, including short, medium and long term.

1.2.4.2. Loans for production and business

Production and business loans are loans for the purpose of supplementing capital for production, business, investment of individuals and households: supplementing working capital, purchasing machinery and equipment, investing in facilities. for production and business activities, securities investment and business… For the above two types of loans, the loan term can be short term (lending term less than 12 months), medium term (loan term). from 12 months to 60 months) and long-term (loan term from 60 months or more); Loan methods can be: one-time loan, installment loan, overdraft, especially for regular loan needs to supplement working capital in production and business activities, the limit loan method Credit is widely used.

Lending in installments: is a lending method where each time the customer and the bank carry out the procedures (the customer makes a loan plan, the bank approves, …) and signs a credit contract. Lending in installments is a form of loan in installments, when customers have a need to borrow for a specific purpose of using capital such as paying for goods and other production and business expenses.

Installment loan: When taking out a loan, the customer and the bank agree to determine the amount of loan interest to be paid plus the principal amount to be divided to repay over many terms during the loan period.

Loan under overdraft limit: A type of credit through which the bank allows customers to use more than the amount they have deposited with the bank on the current account with a certain amount and term. determined.

Lending by credit line: A lending method where the bank and the customer agree to determine a credit line to maintain for a certain period of time.

Credit limit is the maximum loan balance that is maintained for a certain period of time, agreed upon by the bank and the customer in the credit contract.

Loan safety measures are an important factor in the bank’s loan approval for customers, currently banks consider lending to customers based on two forms:

Secured loans: Loans secured by assets owned by the borrower or by a third party. Special assets for loans can be: deposit account balances, savings books, goods, machinery and equipment, real estate, etc.

Unsecured loans (unsecured loans): Loans that do not need to be secured, but based on the customer’s reputation. The bank chooses customers with good reputation and ability to repay loans to lend in this form.

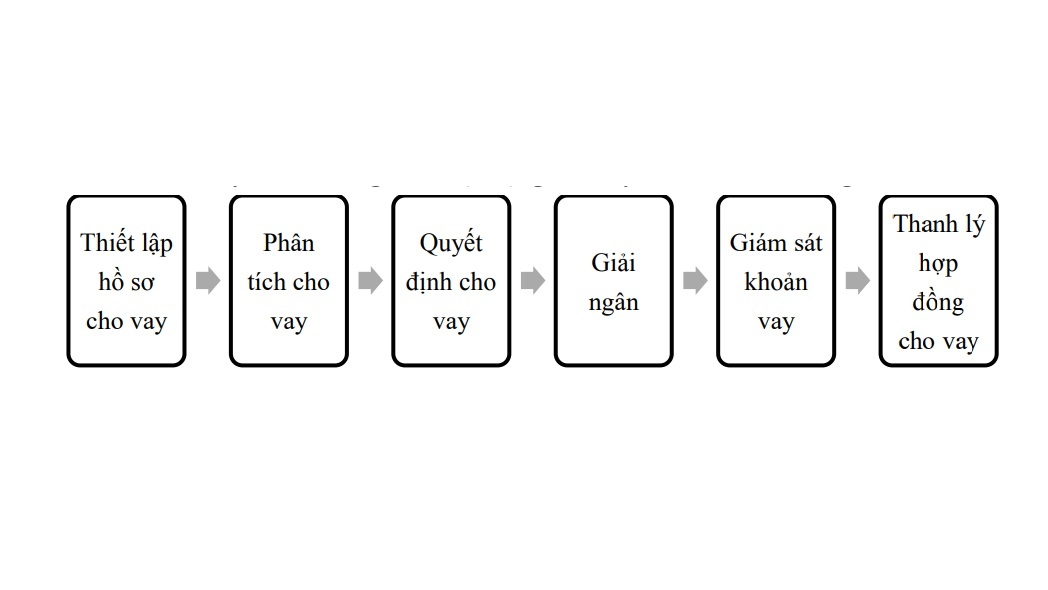

1.2.5. Loan operation process for individual customers

The lending process is a summary of the bank’s principles and regulations in lending, describing the bank’s job from receiving a customer’s loan application until deciding on a loan, disbursement, loan supervision, recovery and liquidation of loan contracts. The lending process serves as the basis for the division of powers and responsibilities for different departments in lending activities and is also the basis for the establishment of loan documents and procedures.

The lending process for science and technology includes the following six basic steps:

Diagram 1.1. General process of lending activities for individual customers

(Source: Commercial banking textbook – Thang Long University, 2009)

Step 1: Set up a loan profile

A bank’s loan record is a written document that represents the bank’s overall relationship with its borrower. The effectiveness of lending activities depends on the completeness and accuracy of loan documents. Making a loan application is the first basic step of the lending process, it is done right after the credit officer (CBTD) contacts the customer who needs a loan. Making a profile is an important step because it is the stage of collecting information as a basis for performing the following stages, especially the stage of analysis and decision-making.

Depending on the relationship between the customer and the bank, the type of credit required and the size of the credit, the credit bureau guides the customer to make a profile with different information and requirements. In general, a credit application file should collect from customers the following information:

Information on the legal capacity and behavioral capacity of the client; Information about the customer’s ability to use and return capital; Information about credit guarantees.

In order to collect the above basic information, banks often require customers to prepare and submit to the bank the following documents:

Credit application form;

Capital use plan;

Legal documents: establishment license, production and business registration license, decision on appointment of director, operation charter…;

Financial records: balance sheet, income statement, cash flow statement of the most recent period;

Dossier on production and business plans and debt repayment plans;

Documents on special assets: documents related to mortgaged, pledged, loan guarantee; Other documents required by the bank.

Step 2: Loan analysis

Loan analysis is the process of assessing customers on loan conditions and loan repayment, on which the bank will make lending decisions and monitor loans.

Loan analysis is the analysis of the current and future ability of the customer in terms of loan use, repayment and return of capital and interest. The purpose of loan analysis is to find situations that may cause risks to the bank and to suggest measures to limit and overcome those risks. In addition, loan analysis is also to check the authenticity of loan documents provided by customers, thereby making judgments about the customer’s ability to repay as a basis for deciding whether to lend or not. Possible sources of information include:

Explanatory documents on the loan such as production and business plans or plans, business licenses for import and export of zones, contracts for supply and consumption of products.

Accounting documents to assess the financial ability of customers.

Documents related to credit guarantee.

Non-financial and financial information.

After reviewing the legality and validity of the above documents, commercial banks often conduct a thorough appraisal of their customers.

Legal capacity of customers Borrowers must have legal status, this is a prerequisite for banks to consider lending in order to determine their responsibility before the law for loan repayment.

For individuals, they must be those who have full legal and behavioral capacity and have a permanent residence in the same area as the lending bank. Banks do not accept loans to people such as those who are serving a sentence, banned from doing business by the court, or mentally ill.

Customer’s Reputation

This is a very important factor that banks need to evaluate. Most of the customer information is already known to the bank. For an old customer, the bank’s previous transactions with h will yield a large amount of information about the customer’s honesty, financial resources and capabilities, information about the seriousness of the implementation. debt repayment obligations, stability in production and business.

For new customers, much depends on referrals, on other customers who have a relationship with that customer, on status notices from other banks.

Analysis of customers’ financial situation Customers with strong financial capacity are an important basis for ensuring autonomy in business activities, ensuring competitiveness in the market and ensuring the ability to repay loans. future debt. This is also the most important basis for the bank to consider whether to lend or not? What is the loan amount? Evaluation of the management capacity of production and business of the leadership of the client unit The business activities of the client depend a lot on the qualifications and operating capacity of the leadership. When considering analysis, the bank needs to assess the professional capacity, financial capacity and reputation of the leader.

Appraisal of loan proposal project When receiving a loan application sent by a customer, especially a new customer who has a relationship with a bank, CBTD must thoroughly investigate and analyze the information provided by the customer. .

Loan guarantee appraisal

To ensure the safety of loan capital, customers are required to secure loans in the form of mortgages, property pledges or guarantees of a third party when taking out loans. Assets used as pledge or mortgage for bank loans must be appraised by credit officers for conditions of properties used for mortgage or pledge. In addition, the guarantor must also be assessed whether the guarantor is eligible to guarantee or not.

Step 3: Decide on a loan

The decision to lend or refuse a customer’s loan application is an extremely important step in the credit process because it greatly affects the following stages and affects the reputation and efficiency of credit operations. of the bank.

This is the most important step and also the most prone to mistakes. There are two basic types of mistakes that often occur in this stage: deciding to approve a loan for a bad customer, or to refuse to lend to a good customer. Both of these types of mistakes result in significant losses for the bank. The first type of mistake easily leads to damage due to overdue or irrecoverable debt, i.e. financial loss.

The second type of mistake can easily lead to reputational damage and loss of loan opportunities.

In order to limit mistakes, in the credit decision stage, banks often focus on two issues: collecting information and processing information fully and accurately as a basis for decision-making; empowering a credit committee or persons with analytical and judgmental competence.

Based on the decision of the appraisal council, the credit bureau is responsible for informing the customer about the decision to lend or refuse to lend to the customer. After making a credit decision, the result may be loan approval or denial, depending on the results of analysis and appraisal at the previous stage. If the loan is approved, CBTD will guide the customer to sign a credit contract and follow the next steps. If the bank refuses to borrow, the bank will give a written reply and explain the reason to the customer clearly.

Step 4: Disbursement

Disbursement is the next step after the credit contract is signed. Disbursement means that the bank distributes the loan to the customer on the basis of the credit level committed in the contract. Although it is the next step in the credit decision, disbursement is also an important step because it can help detect and correct in time if there are errors in the previous stages. The principle of disbursement is always to associate monetization with the movement of reciprocal goods or services to ensure the ability to recover debts later. However, disbursement must also comply with the principle of ensuring convenience, avoiding difficulties and troubles for customers.

Step 5: Monitor your loan

Loan monitoring is an important step to ensure that the loan amount is used for the right purposes, on schedule, whether the business process goes smoothly or not, there are signs of fraud or business loss. or not,… If the information reflects in a good direction, it proves that the loan is secured. On the contrary, if there are any negative signs, the bank has the right to recover the debt before maturity and stop disbursement. In addition, the bank can ask customers to add more special assets, reduce the loan amount when necessary to ensure credit safety. Loan monitoring helps banks prevent customers’ intentions to use loans, and promptly take measures to handle if there are negative signs to minimize risks to the bank.

Step 6: Liquidation of the loan contract

Loans when due or when the customer violates the contract, the bank will liquidate the contract. This section includes:

Debt collection: The bank collects debts from customers according to the terms committed in the loan contract. Depending on the nature of the loan and the situation of the business, the two parties can agree and choose one of the forms of debt collection.

If the enterprise is unable to repay the debt by the due date, the bank may consider extending the debt or switching to overdue debt to take appropriate handling measures to ensure debt recovery. In case the bank checks the use of the loan, if the customer uses it for the wrong purpose, the bank will recover the loan before the due date. If there is not enough money to collect the debt before the due date, the bank will switch to overdue debt.