Mihov (1998), this can help identify different monetary regimes throughout the sample period. This task will be left to future research.

5.3. Some recommendations and policy suggestions

This study has demonstrated that commercial banks have an important role in the transmission of monetary policyIn Vietnam, there exists an asymmetric response of bank credit to changes in monetary policy across banks with different characteristics. In particular, large and high-cap banks are less sensitive to currency shocks than small and low-cap banks. Therefore, based on this result, we suggest that the State Bank of Vietnam, in the process of managing and implementing monetary policy, should pay attention to the absorption capacity and reaction of different commercial banks. Specifically, the State Bank needs to classify commercial banks by size and capitalization to apply the most appropriate monetary policy tools. All commercial banks should not be equated, as this makes it difficult for small and low-capitalized banks to respond to currency shocks.

We also find that overall banking credit activity seems to be dominated by a small number of large banks, mainly with state capital contribution, while this group of banks They appear to be quite indifferent to currency shocks due to certain advantages in terms of scale and prestige. The reason that state-owned commercial banks have such a high credit market share is thanks to the support from the state in terms of investment capital, as well as opportunities to access key national economic projects. . A relatively deep level of state involvement in the banking sector, coupled with a high concentration of credit markets, are factors that may undermine the importance of the bank lending channel.in the transmission mechanism of monetary policy in Vietnam. Therefore, we suggest that the State should limit its participation in the banking sector, delegate the management and operation rights of commercial banks to the State Bank, and create a healthy competitive environment between the two banks. commercial banks by public bidding for business projects

major economic projects, national key economic projects. In addition, it is necessary to promote equitization activities in state-owned commercial banks, creating opportunities for strategic private investors to participate.

Another conclusion drawn from the study is that bank credit seems to be the main source of capital for the economy and makes a significant contribution to the growth of national output. Therefore, we propose a number of measures to help improve the operational efficiency of commercial banks as follows:

- Firstly, the State Bank needs to build a clear and transparent legal framework, manage the macro economy in a stable manner, in order to create a favorable business environment for commercial banks. .

- Second, the State Bank should apply Basel II standards and a number of Basel III criteria to the entire banking system in order to match the macroeconomic developments and the actual situation in Vietnam with the aim of The objective is to increase the size and quality of the banks' equity capital, helping them to cope with risks, especially abnormal losses.

- Third, the State Bank should develop and perfect an effective financial supervision model to enhance operational capacity and reduce risks to the commercial banking system.

Fourth, the State Bank can raise the ownership ceiling for foreign investors to make the most of the financial strength and governance capacity of domestic banks.

For commercial banks, in order to improve business performance, we suggest that commercial banks should focus on sustainable credit growth, perform well the project appraisal before when making disbursement decisions, in order to limit the increasing bad debt situation. In addition, banks also need to strengthen internal inspection and audit to ensure a transparent financial situation, which will help banks, especially small banks, to reduce the problem of irregularities. asymmetric information, increasing access to non-deposit financial sources on capital markets.

The research results also show that credit growth is highly dependent on bank size characteristics. Therefore, in order to develop their credit activities, commercial banks should also focus on expanding their scale by raising equity capital to ensure flexibility and hedging ability in shocks. macroeconomic. In fact, large and high-capitalized banks will be more flexible in their response to monetary policy shocks, therefore, the capital increase of commercial banks is absolutely necessary. However, it should be noted that the capital increase must be accompanied by a corresponding growth in size, which means that the capital resources need to be used effectively to leverage the business. capital raising is really meaningful. Banks should prioritize raising capital from stable and long-term sources,

LIST OF REFERENCES

List of documents in Vietnamese

Chu Khanh Lan, 2013. Empirical research on monetary policy transmission through credit channels in Vietnam. Banking Magazine , No. 5, pp. 17-23.

World Bank, 2014. Vietnam Financial Sector Assessment Report . June 2014.

Nguyen Khac Quoc Bao and Nguyen Huu Huy Nhut, 2013. Empirical evidence of asymmetric interest rate pass-through in Vietnam. Economic Development Magazine , No. 274, pp. 11-22.

Nguyen Khac Quoc Bao, Truong Trung Tai and Nguyen Huu Tuan, 2013. Research on the impact of monetary policy on Vietnam's economy . Science research topic. University of Economics Ho Chi Minh City.

Nguyen Phuc Canh, Nguyen Quoc Anh and Nguyen Hong Quan, 2013. Banking characteristics affect the transmission of monetary policy through the bank credit channel in Vietnam . Science research topic. University of Economics Ho Chi Minh City.

Prime Minister, 2006. Decree No. 141/2006/ND-CP promulgating the list of legal capital levels of credit institutions . Hanoi, November 22, 2006.

Prime Minister, 2011. Decree No. 10/2011/ND-CP on amending and supplementing a number of articles of Decree No. 141/2006/ND-CP dated November 22, 2006 on promulgating the list of levels legal capital of the credit institution . Hanoi, January 26, 2011.

Tram Thi Xuan Huong, Vo Xuan Vinh and Nguyen Phuc Canh, 2014. Transmission of monetary policy through the bank interest rate channel in Vietnam before and after the crisis. Economic Development Magazine , No. 283, pp. 42-67.

Tran Ngoc Tho, 2013. The transmission mechanism of monetary policy in Vietnam . Science research topic. University of Economics Ho Chi Minh City.

VPBank Securities, 2014. Vietnam Banking Industry Report . January 2014.

List of documents in English

Altunbas, Y., Fazylov, O., Molyneux, P., 2002. Evidence on the bank lending channel in Europe. Journal of Banking & Finance , 26:2093–2110.

Altunbas, Y., Gambacorta, L., Marques-Ibanez, D., 2009. Securitisation and the bank lending channel. European Economic Review , coming soon.

Arellano, M., Bond, S., 1991. Some tests of specification for panel data: Monte Carlo evidence and an application to employment equations. The Review of Economic Studies , 58: 277–297.

Ashcraft, AB, 2006. New evidence on the lending channel. Journal of Money, Credit and Banking , 38: 751–775.

Baum, CF, Schaffer, ME, Stillman, S., 2003. Instrumental variables and GMM: Estimation and testing. The Stata Journal , 3: 1–31.

Bean, C., Larsen, J., Nikolov, K., 2003. Financial frictions and the monetary transmission mechanism: Theory, evidence and policy implications. In: I. Angeloni, AK Kashyap and B. Mojon, eds. 2003. Monetary policy transmission in the Euro Area . Cambridge University Press, pp. 107–130.

Benkovskis, K., 2008. Is there a bank lending channel of monetary policy in Latvia?

Evidence from bank level data . Working Paper, Latvijas Banka, January.

Bernanke, BS, Blinder, A., 1988. Credit, money and aggregate demand. American Economic Review , 78: 435–439.

Bernanke, BS, Blinder, A., 1992. The Federal funds rate and the channels of monetary transmission. American Economic Review , 82: 901–921.

Bernanke, BS, Gertler, M., 1995. Inside the black box: The credit channel of monetary policy transmission. Journal of Economic Perspectives , 9:27–48.

Bernanke, BS, Mihov, I., 1998. Measuring monetary policy. The Quarterly Journal of Economics , 113: 869–902.

Blundell, R., Bond, S., 1998. Initial conditions and moment restrictions in dynamic panel data models. Journal of Econometrics , 87: 115–143.

Cecchetti, SG, 1999. Legal structure, financial structure, and the monetary policy transmission mechanism . Economic Policy Review No. 2, Federal Reserve Bank of New York, July.

De Bondt, GJ, 1999. Credit channels in Europe: Cross-country investigation . Research Memorandum WO&E No. 569, De Nederlandsche Bank, February.

De Haas, R., Naaborg, I., 2005. Internal capital markets in multinational banks: Implications for European transition countries . Working Paper No. 51, De Nederlandsche Bank, August.

Disyatat, P., Vongsinsirikul, P., 2003. Monetary policy and the transmission mechanism in Thailand. Journal of Asian Economics , 14:389–418.

Ehrmann, M., Gambacorta, L., Martínez-Pagés, J., Sevestre, P., Worms, A., 2003. Financial systems and the role of banks in monetary policy transmission in the Euro Area. In: I. Angeloni, AK Kashyap and B. Mojon, eds. 2003. Monetary Policy in the Euro Area . Cambridge University Press, pp. 235–269.

Ehrmann, M., Worms, A., 2004. Bank networks and monetary policy transmission.

Journal of the European Economic Association , 2: 1148-1171.

Favero, CA, Giavazzi, F., Flabbi, L., 1999. The transmission mechanism of monetary policy in Europe: Evidence form banks' balance sheets . Working Paper No. 7231, National Bureau of Economic Research.

Gambacorta, L., 2005. Inside the bank lending channel. European Economic Review , 49: 1737–1759.

Gunji, H., Yuan, Y., 2010. Bank profitable and the bank lending channel: Evidence from China. Journal of Asian Economics , 21: 129–141.

Hansen, LP, 1982. Large sample properties of generalized method of moments estimators. Econometrica , 50: 1029–1054.

Havrylchyk, O., Jurzyk, E., 2005. Does the bank lending channel work in a transition economy? A case of Poland . Mimeo, European University Viadrina.

Hernando, I., Martínez-Pages, J., 2003. Is there a bank-lending channel of monetary policy in Spain? In: I. Angeloni, AK Kashyap and B. Mojon, eds. 2003.

Monetary policy transmission in the Euro Area . Cambridge University Press, pp. 284–296.

Horváth, C., Krekó, J., Naszódi, A., 2006. Is there a bank lending channel in Hungary? Evidence form bank panel data . Working Paper No. 7, MNB.

Hosono, K., 2006. The transmission mechanism of monetary policy in Japan: Evidence from banks' balance sheets. Journal of The Japanese and International Economies , 20: 380–405.

Juks, R., 2004. The importance of the bank-lending channel in Estonia: Evidence from micro-economic data . Working Paper No. 6, Eesti Pank, November.

Kakes, J., Sturm, J., 2002. Monetary policy and bank lending: Evidence from German banking groups. Journal of Banking & Finance , 26:2077–2092.

Kashyap, AK, Stein, JC, 1993. Monetary policy and bank lending . Working Paper No. 4317, NBER, April.

Kashyap, AK, Stein, JC, 1995. The impact of monetary policy on bank balance sheets. Carnegie–Rochester Conference Series on Public Policy , 42:151–195. Kashyap, AK, Stein, JC, 2000. What do a million observations on banks say about the transmission of monetary policy? American Economic Review , 90: 407–428.

Kashyap, AK, Stein, JC, Wilcox, DW, 1993. Monetary policy and credit conditions: Evidence from the composition of external finance. The American Economic Review , 83: 78–98.

Keynes JM, 1936. The general theory of employment, interest and money . 1st ed.

Macmillan Cambridge University Press.

Kierzenkowski, R., 2005. The multi-regime bank lending channel and the effectiveness of the Polish monetary policy transmission during transition. Journal of Comparative Economics , 33: 1–24.

Kishan, RP, Opiela, TP, 2000. Bank size, bank capital, and the bank lending channel. Journal of Money, Credit and Banking , 32: 121–141.

Kishan, RP, Opiela, TP, 2006. Bank capital and loan asymmetry in the transmission of monetary policy. Journal of Banking & Finance , 30: 259–285.

Kohler, M., Hommel, J., Grote, M., 2005. The role of banks in the transmission of monetary policy in the Baltics . Discussion Paper No 10, Zentrum für Europäische Wirtschaftsforschung.

Le Viet Hung, Wade Pfau, 2008. VAR analysis of the monetary transmission mechanism in Vietnam. Applied Econometrics and International Development , 9: 165–179.

Loupias, C., Savignac, F., Sevestre, P., 2003. Is there a bank-lending channel in France? Evidence from bank panel data. In: I. Angeloni, AK Kashyap and B. Mojon, eds. 2003. Monetary policy transmission in the Euro Area . Cambridge University Press, pp. 297–308.

Matousek, R., Sarantis, N., 2009. The bank lending channel and monetary transmission in Central and Eastern European countries. Journal of Comparative Economics , 37: 321–334.

Mishkin, FS, 1996. The channels of monetary transmission: Lessons for monetary policy . Working Paper No. 5464, NBER, May.

Nickell, SJ, 1981. Biases in Dynamic Models with Fixed Effects. Econometrica , 49: 1417–1426.

Peek, J., Rosengren, E., 1995. The capital crunch: Neither a borrower nor a lender be.

Journal of Money, Credit and Banking , 27: 626–638.

Pruteanu, A., 2004. The role of banks in the Czech monetary policy transmission mechanism . Working Paper No. 3, Czech National Bank.

Roodman, D., 2009. How to do xtabond2: An introduction to difference and system GMM in Stata. The Stata Journal , 9:86–136.

Stein, JC, 1998. An adverse selection model of bank asset and liability management with implications for the transmission of monetary policy. RAND Journal of Economics , 29: 466–486.

Van den Heuvel, SJ, 2002. Does bank capital matter for monetary transmission?

Economic Policy Review, Federal Reserve Bank of New York, May, 260–266.

Verbeek, M., Nijman, T., 1992. Testing for selectivity bias in panel data models.

International Economic Review , 33: 681–703.

Worms, A., 2003. The reaction of bank lending to monetary policy measures in Germany. In: I. Angeloni, AK Kashyap and B. Mojon, eds. 2003. Monetary Policy Transmission in the Euro Area . Cambridge University Press, pp. 270–283.

Wróbel, E., Pawlowska, M., 2002. Monetary transmission in Poland: Some evidence on interest rate and credit channels . Materials and Studies No. 24, National Bank of Poland.

APPENDIX

APPENDIX A. CHARACTERISTICS OF VIETNAM'S BANKING INDUSTRY

A.1. The importance of the banking industry to the Vietnamese financial system

A.2. Structure of Vietnam's banking industry APPENDIX B. ESTIMATE RESULTS

B.1. Model estimation results (4.1) using scale characteristics

B.2. Model estimation results (4.1) using liquidity characteristics

B.3. Model estimation results (4.1) using capitalization characteristics

B.4. Model estimation results (4.1) using size and liquidity characteristics

B.5. Model estimation results (4.1) using size and capitalization characteristics

B.6. Model estimation results (4.1) using liquidity and capitalization characteristics

B.7. Model estimation results (4.1) using the characteristics of size, liquidity and capitalization

B.8. Model estimation results (4.2) using scale characteristics

B.9. Model estimation results (4.2) using liquidity characteristics

B.10. Model estimation results (4.2) using capitalization characteristics

B.11. Model estimation results (4.3) using scale characteristics

B.12. Model estimation results (4.3) using liquidity characteristics

B.13. Model estimation results (4.3) using capitalization characteristics

B.14. Model estimation results (4.4) using scale characteristics

B.15. Model estimation results (4.4) using liquidity characteristics

B.16. Model estimation results (4.4) using capitalization characteristics APPENDIX C. RESEARCH DATA

C.1. List of banks in the research sample

C.2. Bank balance sheet figures

C.3. Macroeconomic data

APPENDIX A. CHARACTERISTICS OF VIETNAM'S BANKING INDUSTRY

A.1. The importance of the banking sector to Vietnam's financial system In general, for a low-middle-income country, Vietnam's financial system is large, with total assets amounting to 185% of GDP in 2018. 2011. In which, the banking industry plays an important role in the Vietnamese economy and dominates other types of financial intermediaries (see Table A.1). The development of the banking industry has been extremely dynamic throughout the years, with the ratio of total assets

Banks to GDP increased from 150% in 2007 to more than 170% in 2011.

Table A.1. Structure of Vietnam's financial system

December 2007 | December 2011 | |||

Financial institutions | Total assets (billion VND) | GDP Ratio (%) | Total assets (billion VND) | GDP Ratio (%) |

Commercial Bank | 1733.3 | 151.5 | 4750.5 | 170.9 |

Financial company | 69 | 6 | 159.5 | 5.7 |

Financial leasing companies | 14.1 | 1.2 | 24 | 0.9 |

Securities Company | 54.9 | 4.8 | 81 | 2.9 |

Insurance company | 56.3 | 4.9 | 107 | 3.8 |

Investment funds | 15.4 | 1.3 | 10.3 | 0.4 |

total | 1943 | 169.7 | 5132.3 | 184.6 |

Maybe you are interested!

-

The Asymmetric Effect Of Monetary Policy On The Supply Of Bank Credit

The Asymmetric Effect Of Monetary Policy On The Supply Of Bank Credit -

Bank lending channel and monetary policy transmission in Vietnam - 4

Bank lending channel and monetary policy transmission in Vietnam - 4 -

Macroeconomic Impact Of Bank Lending Channel

Macroeconomic Impact Of Bank Lending Channel -

Bank lending channel and monetary policy transmission in Vietnam - 7

Bank lending channel and monetary policy transmission in Vietnam - 7 -

Bank lending channel and monetary policy transmission in Vietnam - 8

Bank lending channel and monetary policy transmission in Vietnam - 8

Source: State agencies, IMF, ADB, Bloomberg

Meanwhile, other types of financial intermediaries are less important and their growth is not so impressive. Although finance companies, leasing companies, securities companies, and insurance companies have seen a significant increase in assets, their relative size has decreased somewhat. Overall, the total assets of non-banking financial institutions accounted for only about 18% of GDP in 2007, and fell to 14% of GDP in 2011.

Along with the rapid growth in the size of the banking industry compared to the overall Vietnamese economy, credit growth has also changed significantly. In 2005, the credit-to-GDP ratio was only 71.22%, however, after 5 years of growth

In 2010, Vietnam's credit-to-GDP ratio peaked at 135.79%, an increase of 1.9 times compared to 2005.

Table A.2. The ratio of the economy's credit to Vietnam's GDP

Five | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 |

Credit-to-GDP ratio (%) | 71.22 | 75.38 | 96.19 | 94.53 | 123.01 | 135.79 | 120.86 | 115.40 |

Source: Trading Economics – World Bank

The credit-to-GDP ratio in Vietnam in 2012 reached 115.40%. This ratio is nonetheless still lower than the average of developing countries in the region, showing that Vietnam's banking sector still has a lot of potential for development. However, the growth rate will be more modest than before.

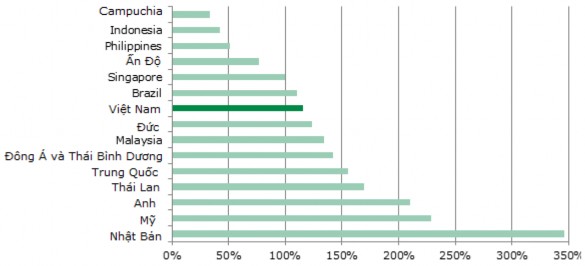

Figure A.1. Compare the ratio of credit to GDP in 2012

Source: WDI

Compared to bank credit markets, the bond and equity markets are considerably weaker in Vietnam. The size of the domestic bond market is still modest and is dominated by government bonds (see Table A.3). The total value of current bonds is about 15% of GDP, with nearly 90% being government bonds (including treasury bonds, government-guaranteed bonds and a small amount of bonds issued by local governments). . The corporate bond market has grown over the past few years, but is still in its infancy.

Table A.3. Vietnam capital market in 2011

Targets | Total value (billion VND) | Share in GDP (%) |

Outstanding Government Bonds | 353.6 | 12.7 |

Outstanding balance of bills | 2.1 | 0.1 |

Outstanding corporate bonds | 35.5 | 1.3 |

Issued by a financial company | 21.6 | 0.8 |

Issued by a non-financial company | 10.8 | 0.4 |

Market capitalization | 533.7 | 19.2 |

Source: State agencies, IMF, ADB, Bloomberg

The stock market is characterized by a large number of listed companies but low average capitalization. The two exchanges HOSE (operating since 2000) and HNX (operating since 2005) currently have around 700 listed companies, an unusually large number for nascent capital markets and income levels like Vietnam. Total market capitalization was around 20% of GDP in 2011, which is quite close to the forecast for Vietnam but much lower than other East Asian markets. The fact that despite a large number of listed companies, the relatively small market capitalization shows that most listed companies are small in size.

The above events have demonstrated the dominant role of the banking industry in Vietnam in the financial intermediation system, which leads to a high degree of banking dependence of domestic organizations and individuals.

A.2. Structure of Vietnam's banking industry

At the end of 2011, Vietnam had 97 commercial banks, including 5 state-owned commercial banks, 38 joint stock commercial banks, and 54 foreign banks1 (see Table A.4). The number of banks has hardly changed in recent years.

1 Includes joint venture banks, 100% foreign owned banks, and foreign bank branches in Vietnam.

Table A.4. Structure of Vietnam's commercial banking system in 2011

Financial institutions | Number of organizations | Total assets (billion VND) | Ratio of total assets (%) | GDP Ratio (%) |

Commercial Bank | 97 | 4750.5 | 85.9 | 170.9 |

Private ownership | 92 | 2838.2 | 51.3 | 102.1 |

Domestic | 38 | 2285.8 | 41.3 | 82.2 |

Foreign | 54 | 552.4 | ten | 19.9 |

State ownership | 5 | 1912.3 | 34.6 | 68.8 |

Source: State agencies, IMF, ADB, Bloomberg

Regarding the ownership structure, we receive controversial signals about the strength of the lending channel. Although the number of banks owned by foreign investors is relatively large, the proportion of assets of this group of banks in the whole industry is quite modest at 10%, and contributes only about 20 percent to GDP. %. Foreign banks often receive aid from the parent bank, so they are less sensitive to domestic currency shocks. Therefore, the inefficient operation of this group of banks does not weaken the potential bank lending channel of Vietnam. However, the level of state involvement in Vietnam's banking industry is relatively large. Although there are only 5 state-owned banks, the total assets of this group of banks are nearly equal to the total assets of 38 joint stock banks, accounting for nearly 35% of the total assets of the industry, and contributing 68%. into GDP.

In terms of market concentration, the Vietnamese banking market is both concentrated and scattered. In general, state-owned commercial banks dominate both deposit and credit market shares, accounting for 60% of the market share in 2007. However, in recent years, fierce competition in the banking industry has causing 15% of the market share of state-owned commercial banks to fall into the hands of commercial banks

share trade. The level of competition of small-sized banks is also relatively high.

Deposit market share (%)

State-owned commercial banks Joint-stock commercial banks

Foreign banks

Other

2007

2008

2009

2010

2011

The level of market concentration on capital mobilization of state-owned commercial banks has gradually decreased over the years, indicating a high level of competition among banks in capital mobilization. Historical factors of operating time and mobilization network have not been able to maximize the advantages to help state-owned commercial banks stabilize market share. The market share of state-owned commercial banks in raising capital has narrowed from 59.5% in 2007 to 43.6% in 2011 (see Figure A.2). However, the capital mobilization market share of 9 key joint stock commercial banks 2 has not significantly expanded compared to the decrease of state-owned commercial banks. This implies that smaller banks have also expanded their capital mobilization market share, and thus the level of competition for capital mobilization has become more and more intense. A low level of market concentration could support a potential bank lending channel.

8.8 | 8.1 | 7.5 | 6.6 | 7.6 | ||||||||||

30.4 | 33.1 | 40.8 | 46.7 | 47.1 | ||||||||||

59.5 | 57.1 | |||||||||||||

49.7 | ||||||||||||||

45.1 | 43.6 | |||||||||||||

Figure A.2. Deposit market share of Vietnamese banks in the period 2007–2011

Source: VNEconomy

2 Including TCB, ACB, MBB, EIB, STB, SCB, SHB, MSB, VPB (large scale with total assets over 100,000 billion VND).