The more banks diversify interest rates suitable for each type of customer, each loan term and attractive customer policies, the more they can attract customers and fulfill their goal of expanding lending activities. But if the unsuitable interest rate is too high or too low, there is no preferential interest rate, it will not attract many customers and thus will limit the Bank’s lending activities.

Organization of the bank: the scientific organizational structure will ensure the close and smooth coordination among officers, employees, departments in the bank, among the bank branches in the whole system as well as with other relevant agencies to ensure the bank’s smooth, unified and effective operation, thereby facilitating timely response to customers’ requirements.

Credit information: is the basis for the project appraisal process, the basis for the appraisal staff’s analysis and evaluation process. In addition to the information provided by customers, the ability to access and actively collect other information sources and the ability to process and use information of the bank plays an important role in ensuring the results. Customer reviews are accurate.

Quality of personnel: including professional qualifications, communication ability, foreign language proficiency, computer skills, enthusiasm in the work of staff, marketing… If the customer communicates with the bank’s staff If they feel secure about the professional qualifications of the staff, they will definitely come to that bank.

– Appraisal: is the most important step in the process of deciding to lend to customers. In the appraisal process, it is required that the appraiser must have expertise, be able to judge the market and strictly follow the credit process to avoid causing risks to the bank in the process of lending capital.

1.1.2. Factors on the business side

Besides the factor on the bank’s side, a very important factor affecting the ability to access credit capital for customers is the customers themselves. This factor includes many factors, specifically:

– Assets to secure loans of customers: One of the most important factors affecting credit access is the availability of collateral. Usually, banks see two roles of collateral (Special Assets). Firstly, the supplementary repayment source helps the bank to minimize losses once customers are no longer able to fulfill their debt repayment obligations. Secondly, it helps to improve the customer’s willingness to repay, and prevents moral hazard from the customer because if the customer fails to pay the debt, it will mean the loss of special assets. But there is another role of the special asset which is also very effective in helping the bank evaluate and ‘screen out’ good customers, which is based on the goodwill of customers about whether they want to voluntarily give special assets. loan or not. Firm age: is often seen as a signal of the viability and quality of a firm’s management, as well as the accumulation of reputational capital (Diamond, 1991; Oliner and Rudebusch, 1992). Furthermore, misinformation is relatively smaller for established firms because of their longer track records (Petersen and Rajan, 1994; Cressy, 1996). Older companies have more access to credit than startups.

Maybe you are interested!

-

Factors affecting the ability to access bank credit of enterprises listed on the stock market - 1

Factors affecting the ability to access bank credit of enterprises listed on the stock market - 1 -

Current Status Of Listed Companies On Vietnam Stock Market

Current Status Of Listed Companies On Vietnam Stock Market -

Factors affecting the ability to access bank credit of enterprises listed on the stock market - 4

Factors affecting the ability to access bank credit of enterprises listed on the stock market - 4 -

Factors affecting the ability to access bank credit of enterprises listed on the stock market - 5

Factors affecting the ability to access bank credit of enterprises listed on the stock market - 5 -

Factors affecting the ability to access bank credit of enterprises listed on the stock market - 6

Factors affecting the ability to access bank credit of enterprises listed on the stock market - 6

Firm size: Small firms have more difficulty in credit markets because of the relatively high probability of failure (Jensen and McGuckin, 1997), and the fixed costs of borrowing for small firms are higher. (Symeonidis, 1996), and correspondingly higher monitoring costs (Boocock and Woods, 1997). In addition, smaller companies may have relatively lower collateral so their liability in the event of a breakdown is less so they can do more risky business.

The firm’s set of investment opportunities (represented by profitability, revenue growth, and fixed asset growth): can also affect credit allocation (Hubbard, 1998). The more investment opportunities, the higher the access to credit and vice versa.

– Cash Flow: Drakos & N. Giannakopoulos (2011) argues that higher cash flow reflects higher liquidity which is a good signal for banks to lend because of their ability to meet higher interest payments.

– Using independent auditors and applying international accounting standards: increasing the transparency of financial statements. Dharan (1993) points out that the auditor’s opinion is assumed to convey the firm’s risk characteristics to lenders.

The cost of external audits is expensive, so companies that choose to do so actually send a signal about the quality of a company’s performance to the lender. Therefore, it will increase the ability of enterprises to access bank credit.

– Type of business (limited liability company, joint stock company, partnership, private enterprise…): is a decisive factor to the potential of credit distribution. For example, private companies have unlimited liability, thus being able to adopt a more conservative investment strategy, as well as minimizing the possibility of bankruptcy, which reduces the risk of the lender.

– Credit level of the company: assessing the creditworthiness of customers is a difficult problem for banks when the basic requirements of this criterion are long-term relationships, reputation, brand, management capacity level of customers… Banks mainly rely on the history of customer relationships with the bank, while for new customers, the assessment is based on subjective opinions of credit officers. used when interacting with customers in addition to information obtained from the Credit Information Center of the State Bank (CIC). The higher the credit rating, the greater the ability to access bank credit and vice versa.

– Efficiency of loan capital: this is the plan to use the enterprise’s loan capital to generate profit to repay the bank’s debt. If the project is evaluated as good, the bank’s ability to lend to enterprises is high and vice versa.

– Industry heterogeneity: banks often classify industry to assess loan credit quality, so it also significantly affects bank lending decisions (Cole, 1998; Rajan and Zingales, 1998; Beck and Levine, 2002; Cowling and Mitchell, 2003).

– Maintaining a deposit account at the bank: represents the relationship with the bank that increases the ability to access bank credit.

– Owner’s gender: affects how much loan approval or interest rate (Cavaluzzo et al., 2002; Blancflower et al., 2003; Mijid and Bernasek, 2008)

– There are also a number of other factors affecting the ability to access bank credit such as: the company is a member of a business association, chamber of commerce, number of competitors….

1.1.3. Other factors

– Socio-economic environment: The socio-economic environment favorable for the development of bank credit is densely populated, high income, financial, commercial, tourism, educational center. training, science and technology, etc. to develop bank credit activities, thereby improving the credit access of enterprises.

– Political environment: Vietnam has a very stable political environment, which is a very favorable condition, creating peace of mind for domestic and foreign investors, creating peace of mind for people to invest. business. It is also a favorable environment for the bank to develop stably.

– Legal environment: Currently, our country also has significant reforms to create an equal and fair legal environment for all types of businesses to participate in business, step by step towards a uniform legal system. Ministry, review and amend administrative procedures to create favorable conditions and create an equal environment for businesses to access credit capital, land, new technology, information, market, training and other benefits. State incentives, encouraging enterprises to expand investment.

– Science and technology environment: Under the influence of science and technology, production methods develop, so people have conditions to expand production, so the need to access bank capital increases. With the development of science and technology, information technology has made great strides in developing the bank’s business activities, the bank has applied technology to its services, especially in banking activities. credit loans to customers.

– Natural environment: conditions of topography, geography where customers live or do business, facilities, technical infrastructure, roads, population density, weather , natural disasters, fires, epidemics… these factors, when occurring, greatly affect customers, thereby also affecting the bank’s ability to access credit capital, not only that, customers in The agricultural production sector is also affected by seasonal factors.

1.2. Some studies in the world

1.2.1. Research by Hongjiang Zhao, Wenxu Wu and Xuehua Chen (2006) “What Factors Affect Small and Medium-sized Enterprise’s Ability to Borrow from Bank: Evidence from Chengdu City, Capital of South-Western China’s Sichuan Province”

Hongjiang Zhao, Wenxu and Xuehua Chen (2006) conducted a study on “Factors affecting the bank lending capacity of small and medium enterprises (SMEs): evidence in Chengdu city, capital of Sichuan province. Southwest China”. The survey data covers the financial situation of small and medium-sized enterprises in 10 Chengdu city districts and 10 neighboring provinces. Research period from 2003 to 2004. The author uses multivariate regression model and logit model to analyze the factors affecting the ability of SMEs to borrow from banks. The variables included in the research model are as follows:

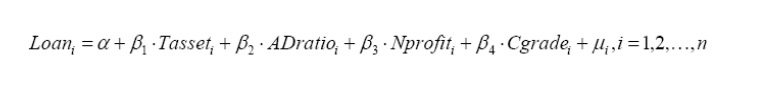

– Multivariate regression model:

+ Dependent variable (debt): includes long-term debt and short-term debt (Loan)

+ Independent variable (impact factor): total assets (Tasset), debt / total assets ratio

(Adratio), net profit (Nprofit), credit rating (Cgrade)

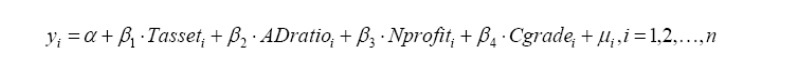

Logit model:

Dependent variable (y): y=1 if SME has debt, y=0 otherwise.

Independent variable (impact factor): total assets (Tasset), debt / total assets ratio

(Ad Ratio), net profit (Profit), credit rating (Grade)

The research results show that the ability to get a loan from the bank will increase if the enterprise has a lot of collateral, the size of the enterprise is large (expressed in total assets), and has a close relationship with the bank. Factors such as revenue, net profit, debt-to-total assets ratio, and credit rating do not affect SMEs’ ability to access bank credit.

1.2.2. Research by Yuko Nikaido, Jesim Pais, Mandira Sarma (2012) “Determinants of Access to Institutional Credit for Small Enterprises in India”

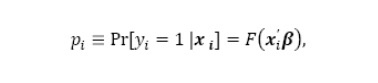

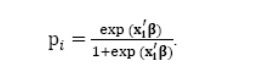

Yuko Nikaido, Jesim Pais, Mandira Sarma (2012) conducted a research on the topic “Factors affecting the accessibility to institutional credit of small businesses in India”. The number of surveyed enterprises is 2897 surveyed enterprises across India, according to the above criteria, the author selects an appropriate data for analysis. The survey was conducted over a period of 5 years. The research model used is a weighted logit regression model, which has the following form:

Where, F(.) is the logit distribution function, so:

Probability (p) occurs for the enterprise to receive institutional credit (y=1) with the condition x.

The independent variables are included in the model as follows: number of employees (representative of company size); land, house owner (collateral), firm output (capital requirement), diversified business lines (dummy variable), having an account with a credit institution (representing the relationship between the two). relationship with credit institutions), labor contract dummy variable, business registration location dummy variable (East, West, South, North India), education dummy variable of business owner, variable Assuming the business owner is female, the dummy variable is rural.

The research results show that the factors that increase the access to credit of small businesses in India include: high school education or higher, having a bank account. Factors that reduce small business access to credit include business diversity, rural areas, and business locations in East and South India. Factors such as company size, business output, fixed asset value, and gender of the owner do not affect the ability of small businesses to access credit.

1.2.3. Constantine’s research. Drakos and Nicholas Giannakopoulos (2011) “On the determinants of credit rationing: Firm-level evidence from transition countries”

Constantine. Drakos and Nicholas Giannakopoulos (2011) conducted a study on the topic “Factors affecting credit allocation: A case study in countries undergoing economic transition”. The research data covers 9500 enterprises in 26 transition economies: 15 economies in Central and Eastern Europe and 11 economies of the Commonwealth of Independent States.

Constantine. Drakos and Nicholas Giannakopoulos are particularly interested in surveying the following group of key drivers: (1) Establishing a company’s investment opportunities (represented by profitability, revenue growth, and asset growth) fixed), (2) company age, (3) company size, (4) gender of principal owners, (5) use of independent audit, (6) application of accounting standards internationally, (7) maintaining savings accounts (representing the relationship with the bank).