Regarding the ability to create low house prices, many new construction technology experts have affirmed that there are many solutions that can reduce construction and material costs by 50%. New technologies such as C-Deck hollow floor technology, Top-base method to reinforce soft ground, lightweight concrete wall technology, 3D panel technology, staggered steel frame technology, using heat-resistant foam concrete … Besides, the experts also confirmed that the construction cost for a 14-storey apartment building is 7 million VND/m2, and the 8-storey apartment building is 5.4 million VND/m2. Applying new technology in the social housing project in Binh Duong makes the construction cost only about 3 million VND/m2. It is important that previous high-end housing projects do not need to think about technological change because high prices are still welcomed by speculators.

In addition to factors of construction technology and construction materials, factors such as management costs, distribution mechanisms, capital mobilization costs are also factors that increase real estate prices significantly. Compared with other countries, the management technology of real estate enterprises in our country is very backward, unprofessional, the professional capacity of the managers is still low, the management apparatus is cumbersome and inefficient. The selling mechanism also creates relatively high indirect costs. The previous housing projects used the delivery mechanism with many intermediate levels. Currently, Vietnamese law still requires the distribution of goods through exchanges. Up to now, if you want to reduce real estate prices, it is necessary to create a mechanism for project investors to sell goods directly to consumers with absolute transparency in information.Real estate trading floors continue to operate towards the ability to bring benefits to both project investors and consumers, so investors should not be forced to sell on real estate exchanges. The cost of capital is also an important factor that increases real estate prices. Recently, the Ministry of Construction has started operating many types of real estate funds such as real estate trusts, housing savings funds, etc.

towards the ability to create medium and long-term loans for real estate investment. On the other hand, it is necessary to create a mechanism to reduce risks in mobilizing contributed capital from people wishing to buy houses in the future. Real estate securitization is a capital mobilization mechanism that needs to be considered for development.

It can be imagined that the picture of the difficult real estate market in 2013 is still present, it is necessary to do well with 2 problems: “settling the inventory of real estate associated with solving bad debts” and “opportunities for development”. low-cost housing segment warms up the market. The low-priced real estate segment has begun to warm up and will be strongly welcomed by consumers. Many investors have started focusing on this area. It can be seen that this is the only way to reheat the real estate market, increasing the supply of apartments suitable for large demand with low solvency. When the market warms up, confidence will increase. This will be an opportunity to deal with a large amount of inventory of real estate products.

The economic situation in 2013 is forecasted to face many challenges when bad debts increase, aggregate demand declines… Therefore, at least until mid-2013, the Government’s economic stabilization policies will begin to begin. shown to be effective. Once the economy shows positive signs and people’s income increases again, consumer and investment confidence will be strengthened, cash flow will start to return, although the real estate market cannot accelerate again. .

The developments of the real estate market in 2012 show that, entering 2013, the market still has many shortcomings that need to be handled. Two of them are “resolving the inventory of real estate associated with resolving bad debts” and “opportunities to develop the low-priced housing segment to warm up the market”. This picture has been sketched more and more clearly, especially in the first quarter of 2013. In fact, in order to solve the above two problems, in recent times, all levels and sectors have cooperated and participated strongly with high determination.

However, up to this point, there are not many concrete and practical policies, mainly just proposing solutions and new manifestations of the market. It can be imagined that the picture of the difficult real estate market in 2013 is still present, it is necessary to do well with 2 problems: “settling the inventory of real estate associated with solving bad debts” and “opportunities for development”. low-cost housing segment warms up the market”. With determination and agreement, these two key issues will be basically solved in 2013 on the basis of an overall task of restructuring the real estate market. Therefore, the opportunity to develop the real estate market is still ahead.

Besides, the real estate market is still facing a number of shortcomings in the old Land Law, such as the short term of use and the fickle land policy making it difficult for investors to have a long-term plan. Land policy has many loopholes, making corruption in the land sector very “hot”. These inadequacies will be revised and supplemented in the direction of stability for at least 20 years, which will be an important driving force to help the market recover and develop more sustainably.

2.4 Current status of bad debt in real estate lending at Joint Stock Commercial Bank for Investment and Development of Vietnam and at BIDV Quang Trung branch

2.4.1 Business performance at Joint Stock Commercial Bank for Investment and Development of Vietnam BIDV – Quang Trung branch

According to the 2012 consolidated financial statements of the Joint Stock Commercial Bank for Investment and Development of Vietnam ( BIDV ), total assets increased by 19.3%, capital mobilization increased by 26.1% compared to 2011 while debt ratio bad debt at the end of 2012 was at 2.9%, only bad debt in real estate loans accounted for 1.3%. Accordingly, in 2012, the bank’s total assets increased by 19.3% compared to 2011, to VND 492,201 billion and ranked second in the industry, just behind the Bank for Agriculture and Rural Development (Agribank). ).

The bank’s capital mobilization also increased strongly in the past year, with an increase of 26.1% compared to 2011 and 30% higher than the plan, reaching more than 360,000 billion. This mobilization increase also far exceeds that of the whole industry (approximately 16%).

Although there were many fluctuations in the domestic and international economic situation in 2012, affecting the financial situation of customers as well as the bank’s business activities, BIDV’s credit quality was still under control. . In 2012, qualified outstanding loans (debts of group 1) increased in both absolute numbers and proportions of BIDV’s total outstanding loans. BIDV’s bad debt ratio after the audit was at 2.9%. In the period 2010 – 2012, the bad debt ratio of the banking sector continued to be controlled at less than 3%. To get the above positive results, credit quality management and bad debt handling continued to be promoted and focused. BIDV focuses on credit relations with customers with healthy financial situation, and at the same time makes efforts to control the arising of bad debts, and find ways to reduce existing bad debts in the context of the economy facing difficulties. difficult.

In order to improve credit quality, BIDV continuously improves and perfects risk management tools according to international practices. After 06 years of implementing debt classification according to Article 7 of Decision 493/2005/QD-NHNN, BIDV is conducting research, editing and perfecting the internal credit rating system to meet new requirements, and at the same time building up credit portfolio management tool and set of early warning signs of credit risk.

In the period 2010 – 2012, following the direction of the Head Office well, BIDV Quang Trung had relatively good business results compared to other branches of BIDV. In terms of credit growth, although BIDV achieved a credit growth rate of 16.5% in 2012, the branch still had a significantly higher growth rate of approximately 18%. If excluding outstanding loans by ADB and outstanding loans for businesses, individuals investing abroad, and non-residents, the actual growth will reach 17.1%.

Regarding debt quality, BIDV Quang Trung said that it has implemented synchronous measures to control bad debts including reviewing and classifying customers; closely monitor structural debt; and drastically handle the risk of off-balance sheet transfer, contributing to a healthy balance sheet, in addition to the exemption and reduction of interest for customers who are willing to pay debts, so the branch’s bad debt by the end of 2012 only at 0.015% . Compared to BIDV’s total bad debt of 2.9%, BIDV Quang Trung’s bad debt only accounts for a very small part, proving that the branch’s credit quality and credit risk management capacity are quite good.

However, in general, group 2 debt because these debts are transferred to group 3, group 4 and group 5 debts, which are very high-risk debts. In 2011, compared to the total outstanding loans up to the above time (excluding ODA loans and entrusted loans), the above debt groups accounted for 2.84%. This is the total group of sub-standard, doubtful and potentially losing debts of BIDV as of December 31, 2011 according to the published separate financial statements. In which, the sub-standard debt is nearly 4,970 billion dong, the doubtful debt is 406 billion dong and the debt that is likely to lose capital is 2,348.9 billion dong. Meanwhile, in 2012, because the economy still did not have significant signs of improvement, the bad debt ratio decreased insignificantly to about 2.9%.

Credit is a key activity that generates most of the profit in banking activities. Therefore, in its operation orientation, BIDV Vietnam in general and Quang Trung branch in particular always focuses on credit activities. However, credit development requires both quantitative and qualitative development.

In the context that the economy has just experienced the financial and economic crisis of 2008-2010, the past few years have been particularly difficult times for the banking industry as well as BIDV Quang Trung. Thanks to the effective implementation of capital use policy and customer policy, BIDV Quang Trung still achieved encouraging results. As of June 30, 2013, the branch’s outstanding loans reached VND 3,590,000 billion.

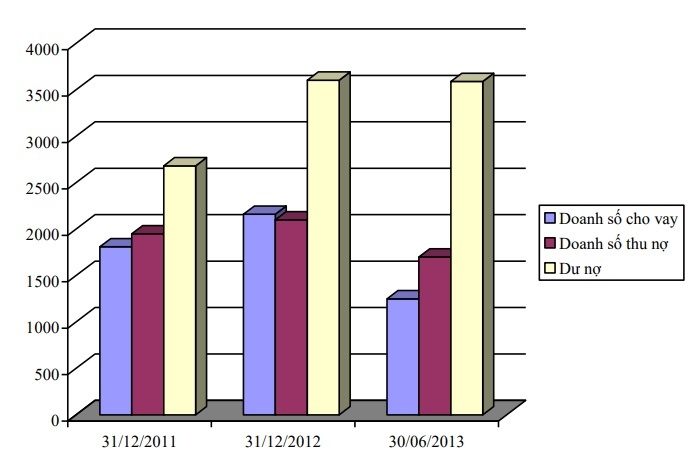

BIDV Quang Trung’s loan sales in 2012 had a relatively strong increase from 1,810 billion VND in 2011 to 2,160 billion VND in 2012, equivalent to an increase of 19.34% (Source: BIDV Quang Trung’s annual summary report). The reason for this sharp increase is the government’s stimulus package during the financial and monetary crisis with the policy of lowering interest rates to help small and medium enterprises. have more opportunities to access capital. But entering the second quarter of 2013 with the support package ended, banks fell into a fierce competition for interest rates to mobilize capital, so the loan sales in 2013 dropped to VND 1,250 billion, which is a decrease. 72.80% compared to 2012 and 44.80% compared to 2011.

Figure 2.2 Credit situation of BIDV Quang Trung

Unit: billion dong

(Source: BIDV Quang Trung’s annual summary report)

Along with the change in loan sales is the change in debt collection over the years with the same change. However, from the end of 2011 to 2012, the world economy as well as in Vietnam has gradually recovered and developed rapidly, businesses have started to do business effectively and fulfill their debt repayment obligations with banks in 2013 as well as overdue debts in the previous year. That explains why in 2013 with a modest loan turnover of VND 1,250 billion, debt collection revenue was at VND 1,700 billion with a difference of VND 450 billion. In early 2011, facing high inflation, monetary tightening caused many difficulties for the economy in general and the banking system in particular. Banks have to increase lending rates, making less businesses borrow capital, hindering the business of banks.Also because of high interest rates, the debtor’s ability to repay debts is reduced, debt recovery becomes more and more difficult, bad debts increase rapidly, especially bad debts in real estate lending. increase the risk of banks. Therefore, banks are cautious in lending capital.

By 2012, the State Bank of Vietnam will make flexible and prudent adjustments to monetary policy, interest rates and exchange rates to ensure that it contributes to the harmonious realization of the following objectives: preventing economic decline, macroeconomic stability and reasonable economic growth; curb inflation; exchange rate stability. It can be said that 2012 is a challenging year with the management of monetary policy in the context of the impact of the financial crisis and the global recession, the domestic economy is somewhat declining. However, the State Bank has successfully adjusted monetary policy and made an important contribution to the 2012 socio-economic targets approved by the National Assembly.

Entering 2013 with the prosperity of the domestic and regional economy. In Vietnam, economic growth was positive in 2013, it is noteworthy that industrial production recovered impressively, growing by nearly 14%, but the quality of growth was still low. Increasing inflationary pressure causes instability in the economy which is caused by the resonance of factors such as natural disasters, rising world commodity prices, devaluation of the dong and a sharp increase in money supply. In 2013, BIDV Quang Trung focused on credit quality rather than credit balance growth, in addition to ensuring safe operation and solvency for the bank.

2.4.2 Situation of bad debt in real estate lending at BIDV Quang Trung

Bad debt in the field of real estate lending is now an inevitable thing in commercial banks when the domestic market and the whole world have not yet escaped the economic crisis. But commercial banks are trying to improve to limit overdue debt. Over the years, with many efforts, BIDV Quang Trung has achieved many outstanding achievements. 2011 and 2012 were extremely difficult years for the Vietnamese economy in general and the banking system in particular.

BIDV Quang Trung is a level 1 branch of BIDV Vietnam, so it is quite easy to make loans for large loan packages. BIDV Quang Trung is a unit with relatively good business results in the whole system of BIDV Vietnam. If considering the period from 2011 to the end of the second quarter of 2013, the ratio of bad debt to total outstanding loans of the branch is only about 0.02%. In the period 2010 – 2013, the general situation of the Vietnamese economy is that bad debt in real estate lending is becoming a difficult problem for banks. And the number of bad debts in real estate loans of 0.02% (according to the annual report of the Branch) also accounts for 40 – 50% of the total bad debt.

Table 2.1 Statistics of outstanding loans of BIDV Quang Trung and BIDV Vietnam branches

Unit: million VND

| Time | December 31, 2011 | December 31, 2012 | June 30, 2013 | |||

| Object | BIDV Quang Trung | BIDV Vietnam | BIDV Quang Trung | BIDV Vietnam | BIDV Quang Trung | BIDV Vietnam |

| total loans | 2,682,050 | 274,304,000 won | 3,604,000 won | 337,627.458 | 3,590,000 won | 362,527,976 |

| Real estate loan balance | 296,560 | 114,232,400 | 367,900 | 144,007,200 | 330,000 won | 150,679,000 VND |

| Proportion of real estate loans/ Total outstanding loans | 11% | 40% | 10.2% | 40% | 9.2% | 42% |

Maybe you are interested!

-

The Need For Solutions To Limit Bad Debts In Real Estate Lending

The Need For Solutions To Limit Bad Debts In Real Estate Lending -

Organizational Structure, Management Apparatus Of Bidv Quang Trung Branch

Organizational Structure, Management Apparatus Of Bidv Quang Trung Branch -

Solutions to limit bad debt in real estate lending at Joint Stock Commercial Bank for Investment and Development - 6

Solutions to limit bad debt in real estate lending at Joint Stock Commercial Bank for Investment and Development - 6 -

Causes Of Bad Debt Risk In Real Estate Lending At Bidv Quang Trung

Causes Of Bad Debt Risk In Real Estate Lending At Bidv Quang Trung -

Impact Of Bad Debt In Real Estate Lending For Joint Stock Commercial Bank Bidv Vietnam – Quang Trung Branch

Impact Of Bad Debt In Real Estate Lending For Joint Stock Commercial Bank Bidv Vietnam – Quang Trung Branch -

Orientation On Limiting Bad Debt In Real Estate Lending At Bidv Vietnam – Quang Trung Branch

Orientation On Limiting Bad Debt In Real Estate Lending At Bidv Vietnam – Quang Trung Branch

(Source: P. Finance and Accounting)

Specifically, the table can see that the total outstanding balance of the branch as of December 31, 2012 increased by 34.4% compared to 2011 is 922 billion. The increase in total outstanding loans shows that the branch’s credit growth is relatively large and it seems that the situation of the real estate market in the period 2011 – 2012 has made the Branch tighten its “pockets” more closely with real estate investors. . That is shown by the data on the proportion of real estate loans / Total outstanding loans of the branch, in 2011, outstanding loans for real estate business accounted for 11% of total outstanding loans, by 2012, that proportion had decreased slightly. is 71,340 million VND although the total outstanding balance of the branch continues to increase to 3,604,000 billion VND. However, the cause of the above slight decrease was not due to a decrease in real estate loans, but because the growth rate of total outstanding loans was about 10% higher than the growth rate of real estate loans. By the end of the second quarter of 2013,The ratio of outstanding loans to real estate business/total outstanding loans has decreased significantly to 9%, down 1.2% compared to the end of 2012 But when compared with the “terrible” figures 40% of real estate loans /Total outstanding balance in 2011, 2012 and 42% in 2013 of the Head Office, this is still an acceptable number in this day and age. Outstanding loans for real estate business as of June 30, 2013 of BIDV Quang Trung reached VND 330,000 billion, down 37,900 billion compared to 2012. The proportion of outstanding loans for real estate business in total outstanding loans in 2012 was 10.2 % to the end of the second quarter of 2013 decreased to 9.2% while this rate in 2011 was 11.1%. According to statistics by the end of 2012, BIDV Quang Trung had bad debts in real estate lending, accounting for 0.02% of total outstanding loans. However,Since BIDV Quang Trung branch has been established for a long time, the branch has relatively good experience in handling and preventing credit risks. Of the total outstanding customer loans of BIDV Quang Trung, half are debts of businesses applying for loans to reinvest in production and business, the other half are granted to small and medium-sized construction investment projects in the locality. Hanoi City. This is the credit weakness of BIDV Quang Trung.