Loan turnover ratio for science and technology:

This indicator measures the speed of loan turnover for science and technology. Fast or slow loan recovery time. This ratio increases, showing good loan management and high lending efficiency. Besides, it is necessary to consider an important factor that is the average outstanding loan for science and technology. When the average loan balance is low, it will make the capital turnover large, but it does not reflect the high quality of the loan because it shows the poor lending capacity of the bank.

Loan turnover of science and technology loans = Sales of science and technology loans / Average outstanding balance of science and technology loans

1.3.3. Factors affecting the improvement of the efficiency of lending activities for individual customers

1.3.3.1. The subjective factor

The operation of each commercial bank is greatly influenced by the socio-economic environment. A bank, no matter how hard it tries in its business activities, if the socio-economic environment is not stable, it will be difficult to succeed.

Improving the efficiency of science and technology lending is affected by the following factors:

Macroeconomic environment:

The operation of the bank is mainly based on mobilizing idle capital from all economic sectors in society to make loans to meet the capital needs of the economy. A developed and stable economic environment can create favorable conditions for credit activities. A healthy economic development environment, effective economic actors will promote the expansion of credit scale, and the efficiency of credit activities will also be improved. But when the economic environment has unexpected changes such as high inflation, real interest rates fall and if banks do not balance between capital and interest-sensitive assets, those credits may not be as effective as intended. Or fluctuations in exchange rates or fluctuations in the market make investors surprised,leading to a situation where cash inflows are not as planned, reducing the bank's ability to repay loans. A stable macroeconomic environment is a prerequisite for lending activities to enter a stable orbit, promote the efficiency of science and technology lending activities and minimize risks. Therefore, for banks, it is necessary to do well in forecasting and quickly adapt to fluctuations to ensure the effectiveness of science and technology lending activities.

Regulatory environment:

A commercial bank when operating must fully comply with the provisions of law of the state, as well as of the State Bank, so the legal environment has a great influence on the quality of credit activities of the bank. A complete, synchronous and stable legal system will make it easier for banks to build their business plans, timely prevent possible negative risks, contribute to promoting the effectiveness of science and technology lending.

Political and social environment:

A stable socio-political environment will be an important factor promoting investment activities and boldly expanding credit activities as well as customers willing to use credit for investment in production and business. This makes the bank more profitable. The impact of the socio-political environment on lending performance is infrequent, but when there are political upheavals, its impact on banks is enormous.

Although, the above objective factors do not have much and far-reaching influence on the subjects of science and technology, but they have a great impact on the activities of banks, leading to the effectiveness of science and technology lending activities.

1.3.3.2. The objective factors

Credit policy

Credit policy is the basic orientation for credit activities of banks.

Credit policy plays a key role in regulating activities such as capital mobilization and lending, interest rates, credit products and customer attraction. Therefore, it has a great influence on the success or failure of a bank. A correct credit policy will stimulate savings and investment, attract many customers, ensure the bank's profitability, and at the same time comply with the laws and policies of the Party and State. suggest. Any bank that wants to have good credit must have a clear credit policy suitable for their bank.

Interest rates and interest rate risk management

Interest rate is the most important factor affecting the efficiency of lending activities, input and output interest rates determine the bank's profitability. Interest rates also affect the decision of customers to use the bank's products or not.

The organization of credit activities of a bank depends on many factors such as the size of the bank, the bank's credit policy, the size and type of credit, and the credit process at that bank. In the credit operation process, credit bureaus will directly contact borrowers, receive loan applications, interview customers, collect information about customers and projects before making an official decision to submit to senior officials. than. The information about customers and projects, after being reviewed by functional departments of the bank, if deemed eligible, will make specific decisions on disbursement and debt collection later. In this process, if the stages are done well, it will help the bank choose good projects to grant credit, as well as create prestige in the hearts of customers.

Thus, the organization and implementation of credit activities can effectively support credit officers to carry out their work and it has an important influence on the quality of credit activities of commercial banks.

Quality of the staff

The decisive factor to improve or decrease the efficiency of on-lending activities is human resources because after all, the bank's decision to provide credit is a subjective decision. A bank with a good leadership team will offer reasonable policies and development methods in line with the development trend of the economy. A team of good credit officers will help the bank get loans with the highest quality. The staff of other departments and functions will help the bank expand its business activities and make a mark on the market.

Factors from customers

Due to the loss of business customers

This is the main cause of the bank's overdue debt. For loans for business purposes, the loan capital used effectively not only brings profits to customers but also serves as a premise for the repayment of both principal and interest. On the contrary, a business loss occurs, causing bad impacts and will affect the debt repayment ability to different degrees.

Customers' financial capacity is not healthy, using capital for wrong purposes Many customers use bank loans without the right plan and purpose when borrowing capital.

Due to the borrower's fraudulent intent

Failure to repay on time can also stem from the subjective intention of the borrower not to pay the debt, although capable but does not want to do it.

SUMMARY OF CHAPTER 1

The entire chapter 1 is the basic theory of lending in general, lending to individual customers in particular, and promoting the efficiency of lending to individual customers in commercial banks. From general issues about lending to individual customers to specific issues such as: concept, object, characteristics, role of lending for individual customers or processes. , loan classification for individual customers. In addition, Chapter 1 is also a theoretical basis, giving a way to study the current situation on the effectiveness of individual customer lending activities and solutions to promote the efficiency of individual customer lending activities at Commercial Banks. Military shares trade will be presented in the next chapter.

CHAPTER 2. SITUATION OF Lending ACTIVITIES FOR PERSONAL CUSTOMERS AT MILITARY JOINT STOCK COMMERCIAL BANK

2.1. Overview of Military Commercial Joint Stock Bank

2.1.1. The process of formation and development

Military Commercial Joint Stock Bank ( MBBank ) officially came into operation in 1994 under Decision No. 00374/GP-UB of Hanoi People's Committee, under Operation License No. 0054/NH-GP of Hanoi People's Committee. Governor of the State Bank of Vietnam (SBV).

Military Commercial Joint Stock Bank is a legal entity with independent economic accounting, financial autonomy and business initiative, and an account opened at the State Bank of Vietnam. The bank's head office is located at 21 Catinh, Dong Da, Hanoi.

Born from the idea of building a military financial institution, following the policy of the Central Military Party Committee and the leadership of the Ministry of National Defense, up to now, after 18 years of operation and development, MBBank has achieved many successes. effectively serving all economic sectors, affirming its position as the leading joint stock commercial bank in Vietnam. By the end of 2012, Military Commercial Joint Stock Bank had become the 4th largest joint stock bank and the 8th largest bank in the Vietnamese banking system with a total asset value of 175,610 billion.

With diversified services and products, MBBank has grown strongly and rapidly expanded its operations into new market segments besides the original traditional market, and at the same time expanded its network to cover the whole country. with Head Office in Hanoi, 1 Transaction Office, 1 branch in Laos, 1 branch in Cambodia, 182 branches and transaction points by the end of 2012.

In addition, Military Commercial Joint Stock Bank formed a series of member units in many fields such as securities (MB Securities Joint Stock Company - MBS), investment fund management (Fund Management Joint Stock Company - MBS). MB investment - MBCapital), real estate (MB Real Estate Joint Stock Company - MB Land), asset management (Debt Management and Asset Exploitation Co., Ltd. Military Commercial Joint Stock Bank - MBAMC) , office leasing business (Viet REMAX Joint Stock Company) has operated continuously for the past 18 years, with the vision of becoming a leading bank in Vietnam, MBBank is moving towards building a solid financial group strong.

During the last 5 years, the bank faced many difficulties when the economy went downhill, but with a separate market share (military industry) compared to other banks, the bank was able to grow its credit scale. use and mobilize capital without facing stiff competition obstacles. However, with its wise policies and efforts, MBBank not only affirms its position in the system but also helps maintain the trust of customers, which is a solid motivation for MBBank to overcome difficulties. , rapidly developing.

Along with continuous development efforts, MBBank has always been ranked A by the State Bank of Vietnam and continuously won major domestic and international awards such as Vietnam Strong Brand, Prestigious Vietnamese Brand, Top 100 Vietnamese Strong Brands. , Vietnam Gold Star Award...

The Bank has achieved the current development steps, first of all thanks to the right strategy and orientation in business activities, the high unity in management and administration between the Board of Directors (BOD). and the Bank's Board of Directors, the smooth coordination between the banking departments. The trust of domestic and foreign customers, the help of friends banks and relevant agencies is a great encouragement, contributing significantly to the success of Military Commercial Joint Stock Bank in recent years.

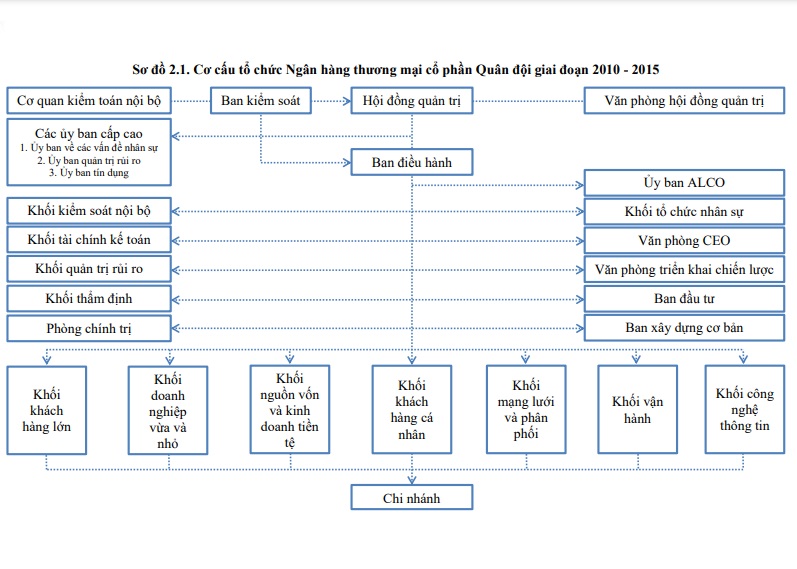

2.1.2. Organizational structure

The Bank's Board of Directors has a term of four years, from the Annual General Meeting of Shareholders on June 15, 2009, consisting of six members: the Chairman, two Vice Chairman, four other members, the Supervisory Board. consists of four members and the Executive Board consists of nine members. In addition, the bank holds controlling or controlling shares with five subsidiaries.

(Source: Military Commercial Joint Stock Bank Annual Report 2012)

Board of Directors: is the body that has the power to decide on issues related to the purposes and interests of MBBank.

Supervisory Board: is the shareholder representative agency, responsible for inspecting and supervising the activities of the Board of Directors, the Board of Management, and the financial activities of MBBank, supervising the observance of the accounting regime and safety. in MBBank's operations, conducting internal audit from time to time, etc.

High-level committees: include: Credit and Investment Committee, Human Resources Committee, Risk Management Committee. These committees assist the Board of Directors in each specific area of work to ensure that strategic decisions of the Board of Directors are effectively formulated and implemented in accordance with the law.

Internal audit agency: is the agency assisting the Supervisory Board, implementing supervisory activities of the Supervisory Board.

Office of the Board of Directors: is a specialized agency to assist the Board of Directors and Standing Board of Directors in performing their functions and duties in accordance with the provisions of law and MBBank's Charter, advising and supporting the Board of Directors in matters strategic direction. At the same time, support the proposal, implementation and evaluation of development programs for MBBank and other member companies upon request.

Board of Management: is the body that manages MBBank's daily activities, organizes the implementation of business and operational strategies to achieve the goals and plans approved by the Board of Directors.

Assets - Assets Management Committee (ALCO): is a committee directly under the Executive Board to perform the tasks and powers of the Executive Board in asset management activities - capital sources of Military Commercial Joint Stock Bank.

System administrators:

Risk Management Division: is the agency that helps the General Director control all risks arising in banking business.

Internal inspection and control division: is the body that helps the General Director establish, maintain and develop a reasonable and effective internal inspection and control system, assess and manage risks. risk, to ensure the effective operation of the bank.

Appraisal Division: Appraisal credit options for all customers throughout the system; System administration on organization, implementation of appraisal and supervision of the organization and implementation of credit granting plans to customers.

Handling and recovering overdue debts throughout the system to ensure the achievement of overdue debt and bad debt plans assigned by the Board of Directors from time to time.

Finance and accounting division: Building, organizing and implementing financial and accounting activities, financial statements, management reports, and accounting regimes throughout the MBBank system to ensure efficiency and compliance with regulations of the Bank. law.

Organization and personnel division: Building organizational models, deploying and monitoring the functions and tasks of the units. Managing human resources of the whole system.

Political Department: Building, organizing and implementing Party and political work throughout the MBBank system.

Basic Construction Department: Managing and implementing capital construction investment projects, repairing infrastructure works. Carrying out the activities of purchasing and liquidating equipment.

Strategy Implementation Office: Directs and supervises MBBank's strategic projects.

CEO's Office: Develop and monitor business plans, develop strategies. Marketing, performing external affairs, emulation and commendation work, MBBank's initiatives.

Business support agencies:

Operations: Building, implementing and managing all operational and support operations at MBBank.

Network and distribution division: Planning, building, monitoring and evaluating the effectiveness of the entire MBBank network.

Information technology block: Research, build, manage and operate the entire information technology system to ensure good service for business activities.

Business blocks:

Capital resources and currency trading: Trading capital, foreign currencies and services, derivative products on the money market, capital market, commodity market. Centrally operate and manage capital sources and develop capital mobilization policies for the whole system, manage foreign currency positions throughout the system to focus on managing interest rate and exchange rate risks, in order to diversify products and services. services and increase profits for MBBank. Establishing transactional relations, linking translation products with domestic and foreign credit institutions and financial institutions.

Large enterprises: Providing a full package of financial solutions for large enterprises.

Block medium enterprises and small : Providing products and specialized banking services to individual customers and small all over the place recently nationwide.

Individual customer segment: is MBBank's specialized business unit, specializing in loan, savings and development needs, providing full service for science and technology.

Investment Division: Managing investment capital and investment activities of MBBank, carrying out long-term investment activities for business development, investment activities for infrastructure development, coordinating in providing financial services. investment banking services, financial consulting services package for customers and partners of MBBank.

Branches and transaction offices, transaction points: is the focal point to provide a full package of solutions and products and services to customers, according to each location on the basis of MBBank's policies and strategies.

Table 2.1. List of subsidiaries of Military Commercial Joint Stock Bank

| S TT | Company name | License to operate | Business areas | Charter capital (T VND) | Ownership rate of MBBANK |

| first | MB Securities Joint Stock Company (MBS) | 005/GPHD D issued by the State Securities Commission on 11/05/2000 | Investment brokerage and securities trading | 1,200,00 | 61.85% |

| 2 | MB Investment Fund Management Joint Stock Company (MB Capital) | 07/UBCK- GPHDQ Q issued by the State Securities Commission on September 29, 2006 | Investment fund management | 100.00 | 61.78% |

| 3 | Military Commercial Bank Asset Exploitation and Debt Management Company Limited (MBACM) | 0104000066 dated 09.11.2002 and by the Department of millet or Hanoi Investment grade | Debt management and asset exploitation | 822.69 | 100% |

| 4 | MB Real Estate Joint Stock Company (MB Land) | 0103022148 dated 25/01/2008 and by the Department of millet or Hanoi Investment grade | Real estate investment and business | 653.73 | 65.95% |

| 5 | Viet REMAX Joint Stock Company (Viet REMAX) | 4102082055 issued by the Department of Planning and Investment of Ho Chi Minh City on 02/02/2010 | Investment and development of office rental business | 100.00 | 80% |

Maybe you are interested!

-

Solutions to promote the efficiency of lending activities for individual customers at Military Commercial Joint Stock Bank - 2

Solutions to promote the efficiency of lending activities for individual customers at Military Commercial Joint Stock Bank - 2 -

Lending Activities For Individual Customers

Lending Activities For Individual Customers -

The Necessity Of Promoting The Efficiency Of Lending Activities For Individual Customers

The Necessity Of Promoting The Efficiency Of Lending Activities For Individual Customers -

Business Performance Of Military Commercial Joint Stock Bank

Business Performance Of Military Commercial Joint Stock Bank -

Solutions to promote the efficiency of lending activities for individual customers at Military Commercial Joint Stock Bank - 7

Solutions to promote the efficiency of lending activities for individual customers at Military Commercial Joint Stock Bank - 7 -

General Provisions On Lending To Individual Customers In The Military Commercial Joint Stock Bank

General Provisions On Lending To Individual Customers In The Military Commercial Joint Stock Bank

(Source: Military Commercial Joint Stock Bank prospectus September 2013)