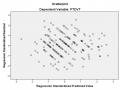

The results of the research model show that the adjusted R 2 is 0.639. Thus, 63.90% of ACB's card service development is explained by 6 factors: TI, PL, TH, TL, CN, ML.

4.3.6 Discussion of research results

The research model has 6 factors affecting the development of card services of ACB with different levels (from 0.097 to 0.309). The difference distance is relatively high. All these factors have greatly influenced the development of card services of ACB.

From the regression results, the author found that the factors: TL, PL, CN, TH, ML, TI have regression coefficients with positive sign (+), that is, the relationship has the same direction with the dependent variable PTDVT and has a positive sign. significance level < 0.05. Thus, we accept the hypothesis H1, H2, H3, H4, H5, H6.

Table 4.13 Results of hypothesis testing

Hypothesis | Content | Coefficient β | Result |

H1 | Customer psychology has a positive impact on the development of card services of ACB. | 0.132 | Accept Sig. = 0.004 |

H2 | Legislation has a positive impact on the development of card services of ACB. | 0.097 | Accept Sig. = 0.097 |

H3 | Technology infrastructure has a positive impact on the development of card services of ACB. | 0.278 | Accept Sig. = 0.004 |

H4 | Brand has a positive impact on the development of card services of ACB. | 0.309 | Accept Sig. = 0.000 |

H5 | ATM/POS network has a positive impact on the development of card services of ACB. | 0.238 | Accept Sig. = 0.000 |

H6 | Utilities have a positive impact on the development of ACB card services | 0.229 | Accept Sig. = 0.000 |

Maybe you are interested!

-

Developing card services at Asia Commercial Joint Stock Bank - 3

Developing card services at Asia Commercial Joint Stock Bank - 3 -

Developing card services at Asia Commercial Joint Stock Bank - 4

Developing card services at Asia Commercial Joint Stock Bank - 4 -

Developing card services at Asia Commercial Joint Stock Bank - 5

Developing card services at Asia Commercial Joint Stock Bank - 5 -

Developing card services at Asia Commercial Joint Stock Bank - 7

Developing card services at Asia Commercial Joint Stock Bank - 7 -

Developing card services at Asia Commercial Joint Stock Bank - 8

Developing card services at Asia Commercial Joint Stock Bank - 8

Source: Survey results, SPSS, 2015

The author found that:

- The brand factor has the most positive and positive impact on the development of card services at ACB. This factor plays a decisive role in the development of ACB. The fact shows that customers tend to continue to choose to use cards and card services of big-brand banks... the ones with big and long-standing brands will win, the ones with the best brands. low brand will lose. This is completely consistent with the perception that the brand factor greatly affects the development of card services of ACB.

- The technology infrastructure factor has the second strongest and positive impact on the development of card services at ACB. Technology plays an extremely important role in the banking sector because it affects the security, accuracy, speed…determining the existence and development of the bank. This is one of the decisive factors to the development of card services of ACB. As it relates to the development of ACB.

- The factor of ATM/POS network has the third strongest and positive impact on the development of card services at ACB. This factor is the customer base that uses the card when making payments or withdrawals. This greatly affects the development of card services of ACB. Therefore, ACB must pay attention to this factor when formulating its development strategy.

- The utility factor has the fourth strongest and positive impact on the development of card services at ACB. This factor is that the customer base has many choices when using ACB's card services. This greatly affects the development of card services of ACB. Therefore, ACB must pay attention to this factor when formulating its development strategy.

- Customer psychology has the fifth strongest and positive impact on the development of card services. Currently, the habit of non-stop cash payment is gradually being formed by young card users who like to apply modern and convenient technology. Therefore, ACB must pay attention to this factor when formulating its development strategy.

- Legal factors have the same impact and have the lowest influence on the development of card services at ACB. From the above results, the author found that there is a relationship

clearly correlated with previous domestic and foreign studies, and the research results are consistent with the proposed hypothesis.

There is a difference in the order of the strong and weak effects of other factors in the model because the products that each study author are different, hence the above difference.

Conclusion Chapter 4

The author has presented the research results in the chapter: the results of testing the scales, models and research hypotheses. The results of Cronbach's alpha reliability analysis and exploratory factor analysis show that there are 6 factors affecting the development of card services.

The results of the regression analysis show that six factors have a positive influence on the development of card services, the level of influence is in order from the strongest to the lowest of the following factors: brand, infrastructure technology, ATM/POS network, utilities, customer psychology, legal

The author will rely on this result as a basis for making recommendations and presented in the next chapter.

CHAPTER 5

CARDS SERVICE DEVELOPMENT SOLUTIONS AT A EUROPEAN COMMERCIAL JOINT STOCK BANK

In the last chapter, the author will present solutions to develop card services at Asia Commercial Joint Stock Bank (ACB). To have a comprehensive view, the author presents the future development orientation and strategy of ACB to develop development solutions for card services.

To summarize, the author presents solutions to develop card services at ACB and recommendations to ACB and the State Bank to promote the development of card services.

5.1 Business development orientation at Asia Commercial Joint Stock Bank to 2020

5.1.1 Orientation of vision and mission of Asia Commercial Joint Stock Bank.

ACB sets out a development orientation based on taking advantage of opportunities in Vietnam's new development phase to continue to strengthen and enhance its position and build ACB to become a leading financial and banking institution. In Vietnam, successfully implementing the mission of "every home's bank".

5.1.2 Ambition and development goals of Asia Commercial Joint Stock Bank to 2020

ACB is determined and strives to become one of the three banks with the largest scale, safe and effective operation in Vietnam by 2020.

To realize its ambitions, ACB builds a suitable strategy for each period, with a long-term orientation with a competitive strategy towards markets and customers. ACB has outlined a three-phase roadmap to create favorable conditions to become a leading bank in Vietnam and implement it for a period of 5 years from 2014 to 2018.

Phase 1 of the development started in 2014. This is the stage of perfecting the platforms, taking drastic steps to keep ACB competitive in the market.

Phase 2 will be implemented in 2015 and 2016. This is the period when the bank is strongly implementing capacity building. Build or enhance critical capabilities to move to the top of the market, such as the ability to segment customers to deliver the right product to customers to dominate the target customer segment.

Phase 3 is implemented in 2017 and 2018. This is the “Top Positioning” phase in which the policy is to build more sophisticated sophisticated capabilities to analyze and understand customers more deeply, conduct sales. cross products and services to target customers.

Based on the forecast of the business environment, assessment of opportunities and challenges for ACB's business activities, the financial targets of the Group in 2016 are set as follows:

- | Total assets growth | 18% |

- | Deposits from customers grow | 18% |

- | Credit growth | 18% |

- | Bad debt ratio does not exceed | 3% |

- | The Group's pre-tax profit is about | 1,503 billion VND |

Source: ACB Annual Report 2015

ACB prioritizes developing business activities in urban areas, first of all in big cities like Ho Chi Minh City. At the same time, ACB will gradually continue to increase its presence in provinces and cities throughout the country, in the direction of expanding operations in urban areas of provinces and cities located along the Northern transport axis. – South (National Highway 1 and Ho Chi Minh road through the Central Highlands) and a number of large urban areas in the East and Southwest regions.

In addition to developing operations in the domestic market, with the strong rise of countries in the region and the increasing economic and trade relations of these countries with Vietnam, in the future ACB may consider the possibility of expanding operations to a number of countries in the region.

With the goal of becoming one of the leading banks in Vietnam, in addition to continuing to prioritize traditional market segments, ACB needs to improve its capacity to become a multi-functional bank. in broader market segments, more fully meeting the needs of banking products and services of more diverse customers.

Along with expanding target customer segments, ACB needs to focus on building increasingly deep and sustainable customer relationships, on the basis of high service quality, diversified products on the basis of technology. modernize, perfect the organizational structure to improve risk management capacity, increase operational productivity, on that basis, improve the bank's business efficiency

ACB continues to focus on its core business, which is commercial banking in urban areas, and intends to review the Bank's annual growth targets from now to 2015 in line with new context of the economy, in the direction of appropriate, safe and effective growth. In addition, the bank also prioritizes focusing on developing the retail banking business, with segments of small and medium-sized businesses and individual customers.

In addition, ACB continues to maintain and develop operations with large corporate customers and financial institutions selectively. In addition to the credit relationship, ACB needs to focus on developing transactional banking products, improving professionalism and service quality to effectively promote diverse relationships with this customer group. Adhering to strategic directions is a necessary factor to ensure the Bank's ability to develop sustainably, safely and effectively in the coming period.

5.1.3 Development strategy of Asia Commercial Joint Stock Bank

In addition to the successes, recently ACB has begun to reveal its weaknesses and inadequacies, requiring ACB to innovate strongly, extensively and comprehensively to meet the requirements of the development stage. next. The Board of Directors of ACB in its meeting on January 24, 2011 approved ACB's Strategic Development Orientation for the period 2011-2015 and a vision to 2020, fulfilling the mission of being a bank for everyone, with the motto: action is “Growth”

Fast- Good Management - High Efficiency", aiming to put ACB in the group of 4 largest and effective banks in Vietnam in 2015.

To accomplish this goal, ACB chose the development strategy as a multi-functional bank, exploiting more deeply and diversifying the operating market.

In terms of geography, ACB continues to adhere to the principle of development in traditional urban areas, first of all in big cities such as Ho Chi Minh City. At the same time, ACB will gradually continue to increase its presence in provinces and cities throughout the country, in urban areas of provinces along the North-South transport axis and some urban areas. major cities in the East and Southwest regions. In the future, ACB may consider expanding its operations to some countries in the region.

Regarding customers, in addition to continuing to maintain priority for traditional customer segments, ACB will improve its capacity to operate with broader customer segments, both corporate and individual.

Regarding products, in addition to traditional products, ACB will gradually research and apply new products and package products to more fully meet the needs of banking products and services of diverse customers. than.

To implement this business strategy, ACB will transform the current distribution system into a modern system model in line with international standards and practices. Transforming the distribution channel system is a multi-step program, researched and implemented from now to 2015. ACB will study and identify appropriate models of branches and transaction offices, planned according to needs. market and customer demand. Distribution channel system transformation is carried out in conjunction with operational system transformation plans towards further centralization to improve productivity and quality. Programs should also be linked to medium-term programs on technology development, especially information technology, development of risk management systems etc. In 2016,

a step to review and reallocate customer service centers in order to improve service quality and better meet customer needs

Capacity building in information technology, human resources, operation and control, and risk management are important areas that ACB plans to develop in the 2016-2020 period to ensure implementation. strategic goals.

ACB will transform the banking governance system, in line with the requirements of Vietnamese law, the reality of ACB, towards international standards and best practices, in order to ensure stable development. steady and sustainable.

5.2 Solutions to develop card services at ACB.

The card market is forecasted to grow at an average revenue growth rate of 10.79% with 100 million cards in 2018. In the current context, credit institutions can completely be optimistic about the growth of the card market. development of the card market.

In order for ACB's card service to develop quickly, sustainably, and be more suitable in the coming time and meet the objectives of the project to promote non-cash payment of the State Bank, on the basis of theory and practice. In the current situation, the author proposes some solutions as follows:

5.2.1 Brand solutions.

From the research results, this brand factor plays a decisive role in the development of ACB. The fact shows that customers tend to continue to choose to use cards and card services of big-brand banks... the ones with big and long-standing brands will win, the ones with the best brands. low brand will lose. This is completely consistent with the perception that the brand factor greatly affects the development of card services of ACB.

After the incident of August 2012, the ACB brand was greatly affected. Therefore, ACB needs to focus on implementing synchronous solutions to ensure and increase brand value. Specifically:

- The bank needs to implement many marketing programs to develop the ACB brand to a wide range of customers: Increase advertising activities in prestigious newspapers and have a large readership (Tuoi Tre, Thanh Nien, Times of Business

Te, ...), city and local television stations at time frames with a large number of young viewers (HTV, VTV, Vinh Long, ...), as well as outdoor advertising panels at the area attracts a lot of people's attention (Pedestrian Street, Airport Road, Le Duan,...) so it is easy to penetrate the market and easily influence consumers; Participating in organizing conferences, seminars, economic events to be able to reach out to customers (Introducing card products, promoting business, starting a business,...). Through these meetings, ACB introduces to customers the card services that ACB is providing, provides customers with card useful information when customers use the service, thereby raising the awareness of customers. customers gradually change their habit of using cash to use card services, participate in cultural and sports programs,

- Besides, ACB must focus on properly implementing commitments to customers from the very beginning. ACB needs to develop a service commitment, which specifies the time and attitude to serve customers and shows it in writing so that customers can recognize it. Bank staff need to record what they promise to customers, such as advising on promotions, time to distribute promotional gifts, time and place to send credit cards according to customers' requirements... Avoid this situation. lost credit card because this greatly affects the bank's interests and security terms for customers. Absolutely do not promise customers about the credit limit when issuing a credit card

- In addition, ACB needs to ensure its credibility by investing in technology software to process accurately, quickly, safely, and keep customer information and customer transaction information confidential. In addition, ACB needs to strictly control collaborators who sell cards to ACB (Outsource) such as consulting information, product training and issues related to banking law and anti-fraud certificates (FRAUD) in the field. banking sector for partners to minimize the advice of false information or falsifying records for personal gain. Sanctions should be introduced to manage this situation.

5.2.2 Solutions for technology infrastructure

Besides branding solutions, ACB needs to well implement solutions related to technology infrastructure. Specifically:

- Firstly, the bank strengthens and promotes marketing, reduces costs and provides card payment machines (using EMV and Wireless card-accepting machines) to points of supply of goods and services. to encourage them to accept card payments.

- Second, ACB applies computer programs suitable to the CORE DNA system, which has been in operation since 2015 in the reconciliation and transaction processing to shorten the time to settle complaints and avoid mistakes. due to manual handling.

- Third, ACB needs to focus on investing and upgrading the DNA software system for Internet banking and mobile banking services. Diversify applications for the above software so that they are not only used for information retrieval, or online payments, but also for other applications.

- Fourth, the system between machines and equipment used in payment card services such as readers, POS machines, ATMs needs to be synchronized, and ensure instant online communication to push Faster payment process for customers.

- Fifthly, Regularly upgrade the information system to ensure card transactions for other banks in the card alliance, creating a good payment relationship between the two systems of ACB and NAPAS, Visa, MasterCard

- Sixth, In parallel with the investment in the ATM system, the management software must regularly check and maintain the equipment system, as well as update and upgrade the management software to ensure , improving security and safety for users as well as the whole system. Specifically, Invest in upgrading camera equipment to monitor and check the operating status of ATMs daily through text messages to the phone of the officer in charge and report the status and errors.

technical issues, problems that customers encounter when transacting and customer complaints with technical staff to immediately handle customers.

5.2.3 ATM/POS network solutions

The expansion and development of the network of ATMs and merchants will make important contributions to the development of card services. Therefore, ACB needs to invest heavily in implementing solutions related to this problem. Specifically:

- ACB should develop a strategy to develop more ATM systems for monthly payroll services to serve customers at large companies with long-standing relationships with ACB (Nestlé, Duy Tan Plastics... ) If you want to develop payroll service, it must be accompanied by synchronous development of ATMs. Because most of the beneficiaries of salaries from the state budget have unequal incomes, but most of the time when they receive their salaries, they have a need to withdraw money from the card for consumption purposes, they often do not have savings, thus developing their income. Synchronous development of these two services can satisfy the needs of customers

- In addition to maintaining current agents, ACB needs to have a specific strategy for agent expansion. Depending on each region, each location with its own characteristics of business activities and shopping habits, ACB needs to have an appropriate strategy. For example, in potential tourist areas such as Nha Trang, Ha Long, and Hoi An, there will be large spending needs, requiring a wider network of agents than suburban areas with little traffic.

- ACB needs to improve the system of ATMs, considering them as card service centers by diversifying services performed on ATMs: Deposit, withdraw money, transfer money, check account balance and pay bills related to life such as phone bills, electricity bills, water bills. The ATM system is always maintained and operated 24 hours a day to create trust for customers at these retail locations. Conduct a review of the current ATM system and network in the area. Expand, install new ATM network in densely populated areas, universities, colleges, industrial parks in the area managed by the Branch.

- Have a special treatment policy to keep customers who are reputable merchants, high and stable card payment sales.

- To be more effective, ACB needs to develop more POSs at restaurants, hotels, and consumer shopping shops to improve the efficiency of ATM card usage.

- Focus on developing more transaction offices and transaction locations in major city centers.

5.2.4 Utility solutions

From simple cards to withdraw money, now there are many other utilities that make the card really a modern means of payment, so if the bank's card service provides more and more obvious benefits, it's possible. strong in attracting customers, contributing to the overall development of this service. ACB needs to do:

- Firstly, Expand the accompanying utilities for customers when using ATM cards such as overdraft limit service, transfer, payment of electricity bills, water bills, insurance premiums, savings deposits through via the bank.

- Second, the staff needs to advise and introduce about the features and utilities when using ACB's ATM card in order to increase the number of customers and generate service revenue from the card daily.

- Third, Increase the utility of the card: Currently, the payment card only stops at a few basic functions such as withdrawing money, transferring money to an internal payment deposit account at the counter - ATM and paying for goods. Therefore, the increase in the utility of the card will contribute to an increase in the number of cards. Utilities that can be used such as credit card loans, savings accounts... Develop a variety of card products and services suitable for a wide range of customers, such as business cards, teacher cards, and credit cards. associated with corporations, co-branded cards...increasing the utility of card services such as: paying bills via ATM, depositing savings at ATMs, paying via the internet... Besides, it is necessary to upgrade improve the quality of existing card products and services such as: replacing magnetic cards with chip cards, simplifying card issuance procedures, shortening card issuance time,

Fourth, Improve the security of card services at ACB by consolidating the network system and establishing a stable transmission line to ensure smooth operation .

throughout the system 24 hours a day in order to create trust in customers when using ACB's ATM cards.

- Fifth, perfecting and improving existing card products and services in the direction of applying information technology to increase accuracy, safety, speed and maximum convenience for users. Besides investing in upgrading electronic banking services such as Homebanking, PhoneBanking, Internetbanking...

5.2.5 Customer psychology solutions.

Currently, people still have some reservations about using card services. Therefore, in order to enhance accessibility and create a comfortable shopping psychology, ACB should implement:

- ACB needs to ensure the confidentiality of customers' personal information, and at the same time create the comfort and ease of use of ACB's card services and products by guiding and answering all questions and complaints from customers. card services of ACB. Instruct customers to contact the hotline 1900 54 54 86 for questions and answers.

- In addition, banks need to study and simplify administrative procedures related to card issuance by minimizing journey procedures for card users. Simplify administrative procedures for cardholders and card acceptors;

- In addition, ACB develops and provides detailed instructions on how to use the card, how to open the card, how to redo the card... for customers who need to use the card.

5.2.6 Solutions on card development strategy

ACB needs to develop and complete strategies and activities to promote card business in order to develop card services in the right direction and meet customers' needs with the following solutions:

- Changing the order of priority for the development of cards: In the short term, we can focus on developing both the quantity and quality of domestic debit cards and international credit cards because in the short term these two cards are very important. potential in Vietnam market. Meanwhile, domestic credit cards and international debit cards can be identified as the long-term business strategy of the bank. Banks need to determine that the development of domestic credit cards will bring them large, safe and effective revenues compared to the current form of simple cash loans.

- Accelerating the development of ATM cards by approaching potential customers who are low-income and no accumulated customers as analyzed in the customer management policy.

- Continue to implement the program of free access to card services, free card delivery... for one year for customers to register to use.

- Regularly have gift programs for regular customers, VIP customers on birthdays and holidays to create long-term relationships with these customers.

- Implement preferential fees and interest rates and associated services for customers using card services, thereby being able to compete with other banks, retain old customers and develop customers. new.

5.2.7 Human resource solutions

The human factor plays an equally important role in the development of banking services in general and card services in particular. Therefore, ACB needs to focus on implementing:

- The Bank needs to implement the policy, all officers and employees, regardless of position, must receive professional training, advanced training in expertise in that department. Open training courses on communication skills, customer persuasion skills, negotiation skills, negotiation for staffs, especially consultants and tellers.

- Strengthen the training and retraining of card marketing staff so that they are professional in marketing, research and market development, ensuring full and accurate transmission of information related to card services. attracting more and more people interested in and using the bank's card. Improve the quality of card service management and development

- Improve professional qualifications and sales consulting skills of card staff: For new employees, ACB needs to conduct training on card process, techniques and operations. For employees who are working, conduct advanced professional training. The Board of Directors should regularly check, inspect and urge the development of card service business as well as regularly check the status of card service development of ACB.

- Regularly check the machine system, ATM system, management software to ensure stability, continuity, and safety for card users

5.2.8 Solutions on risk management activities

In order to prevent and avoid risks and risks for customers, as well as damage to ACB in investing, using ACB cards can apply the following measures:

- The Bank regularly checks its machinery and equipment system to ensure its continuity and stability. Organize and monitor the operation of the card payment system 24/24h to promptly handle any problems. Strengthening control over the professional steps of staff working directly, ensuring strict compliance with prescribed processes.

- Banks need to comply with general regulations on confidentiality. Comply with security requirements. ACB needs to inform customers about the importance of card security. In addition, in order to enhance security, as well as reduce risks, ACB needs to properly implement business processes, step up inspection and supervision in professional activities, strengthen security systems, and surveillance cameras. …

- Banks need to regularly promote the dissemination of information, benefits and effects of cards, but also disseminate to them about ways to prevent and recognize fake cards, limit card loss and how to deal with them. card stolen...

5.3 Limitations and directions for further research

Due to the limitations of time, knowledge and experience, the research paper has limitations related to sample selection, the sample size is not much, the survey subjects are only related employees who are using the service. card at ACB, the author has not reached the perception level of other potential audiences.

The survey has not been carried out in many areas and localities, so the proposed solutions are not completely appropriate.

The topic still lacks more extensive qualitative research to continue to perfect the research model and scale such as solving multivariable relationships by SEM method.