CN4 | 9.5556 | 6.602 | ,493 | ,677 |

Maybe you are interested!

-

Developing card services at Asia Commercial Joint Stock Bank - 5

Developing card services at Asia Commercial Joint Stock Bank - 5 -

Developing card services at Asia Commercial Joint Stock Bank - 6

Developing card services at Asia Commercial Joint Stock Bank - 6 -

Developing card services at Asia Commercial Joint Stock Bank - 7

Developing card services at Asia Commercial Joint Stock Bank - 7

2.4. Analysis results of Cronbach's Alpha coefficient on brand scale (TH)

Reliability Statistics

Cronbach's Alpha | N of Items |

,728 | 4 |

Item-Total Statistics

Scale Mean if Item Deleted | Scale Variance if Item Deleted | Corrected Item- Total Correlation | Cronbach's Alpha if Item Deleted | |

TH1 | 10.7870 | 4,996 | ,593 | ,621 |

TH2 | 10.5694 | 5,260 | ,512 | ,671 |

TH3 | 10,8102 | 5.122 | ,558 | ,643 |

TH4 | 10,7500 | 5.919 | ,412 | ,725 |

2.5. Analysis results of Cronbach's Alpha coefficient on ATM/POS network scale (ML)

Reliability Statistics

Cronbach's Alpha | N of Items |

,783 | 4 |

Item-Total Statistics

Scale Mean if Item Deleted | Scale Variance if Item Deleted | Corrected Item- Total Correlation | Cronbach's Alpha if Item Deleted | |

ML1 | 10.9352 | 5.698 | ,606 | ,722 |

ML2 | 10.9676 | 5.566 | ,571 | ,740 |

ML3 | 10,8889 | 6.313 | ,542 | ,754 |

ML4 | 10.9167 | 5.258 | ,645 | ,700 |

2.6. Analysis results of Cronbach's Alpha coefficient on the Diversity Utility Scale (TI)

Reliability Statistics

Cronbach's Alpha | N of Items |

,776 | 5 |

Item-Total Statistics

Scale Mean if Item Deleted | Scale Variance if Item Deleted | Corrected Item- Total Correlation | Cronbach's Alpha if Item Deleted | |

TI1 | 13.9815 | 7,739 | ,546 | ,737 |

TI2 | 14.1389 | 7,916 | ,600 | ,719 |

TI3 | 14.1759 | 8,481 | ,459 | ,765 |

TI4 | 13.6991 | 7,979 | ,522 | ,745 |

TI5 | 13.8565 | 7,956 | ,633 | ,709 |

2.7. Analysis results of Cronbach's Alpha coefficient of card service development scale (PTDVT)

Reliability Statistics

Cronbach's Alpha | N of Items |

,774 | 3 |

Item-Total Statistics

Scale Mean if Item Deleted | Scale Variance if Item Deleted | Corrected Item- Total Correlation | Cronbach's Alpha if Item Deleted | |

PTDVT1 | 6.2917 | 3.063 | ,581 | ,744 |

PTDVT2 | 6.5463 | 1.868 | ,644 | ,696 |

PTDVT3 | 6.2731 | 2,534 | ,669 | ,635 |

3. EFA discovery factor analysis results.

3.1. EFA test results of factors affecting card service development

KMO and Bartlett's Test

Kaiser-Meyer-Olkin Measure of Sampling Adequacy. | ,698 | |

Approx. Chi-Square | 1396,072 | |

Bartlett's Test of Sphericity | DF | 276 |

Sig. | , 000 | |

Total Variance Explained

Components | Initial Eigenvalues | Extraction Sums of Squared Loadings | ||||

Total | % of Variance | Cumulative % | Total | % of Variance | Cumulative % | |

first | 3.257 | 13,570 | 13,570 | 3.257 | 13,570 | 13,570 |

2 | 2,691 | 11.214 | 24.783 | 2,691 | 11.214 | 24.783 |

3 | 2,321 | 9,670 | 34.454 | 2,321 | 9,670 | 34.454 |

4 | 2,281 | 9,502 | 43,956 | 2,281 | 9,502 | 43,956 |

5 | 1,935 | 8,065 | 52.020 | 1,935 | 8,065 | 52.020 |

6 | 1.489 | 6,205 | 58,225 | 1.489 | 6,205 | 58,225 |

7 | ,936 | 3,902 | 62,127 | |||

8 | ,830 | 3.458 | 65,585 | |||

9 | ,775 | 3.228 | 68,813 | |||

ten | ,742 | 3.092 | 71,905 | |||

11 | ,715 | 2,980 | 74.886 | |||

twelfth | ,709 | 2.955 | 77.840 | |||

13 | ,660 | 2.752 | 80.592 | |||

14 | ,607 | 2.531 | 83,123 | |||

15 | ,538 | 2.241 | 85,364 | |||

16 | ,514 | 2.141 | 87.505 | |||

17 | ,475 | 1,978 | 89,483 | |||

18 | ,436 | 1.818 | 91,302 | |||

19 | ,413 | 1,721 | 93,023 | |||

20 | ,396 | 1,650 | 94.673 | |||

21 | ,369 | 1.536 | 96,209 | |||

22 | ,332 | 1.384 | 97,593 | |||

23 | ,324 | 1.351 | 98,944 | |||

24 | ,253 | 1.056 | 100,000 yen | |||

Rotated Component Matrix a

Components | ||||||

first | 2 | 3 | 4 | 5 | 6 | |

TI5 | .782 | |||||

TI2 | .758 | |||||

TI1 | .712 | |||||

TI4 | .689 | |||||

TI3 | .661 | |||||

ML4 | .817 | |||||

ML1 | .782 | |||||

ML2 | .768 | |||||

ML3 | .702 | |||||

TL2 | .812 | |||||

TL4 | .780 | |||||

TL1 | .729 | |||||

TL3 | .620 | |||||

TH1 | .770 | |||||

TH3 | .766 | |||||

TH2 | .719 | |||||

TH4 | .639 | |||||

CN2 | .794 | |||||

CN1 | .747 | |||||

CN4 | .705 | |||||

CN3 | .679 | |||||

PL1 | .803 | |||||

PL2 | .778 | |||||

PL3 | .777 | |||||

Extraction Method: Principal Component Analysis. Rotation Method: Varimax with Kaiser Normalization.

3.2. Decomposition of Card Service Development

Total Variance Explained

Components | Initial Eigenvalues | Extraction Sums of Squared Loadings | ||||

Total | % of Variance | Cumu lative % | Total | % of Variance | Cumu lative % | |

first | 2.111 | 70,364 | 70,364 | 2.111 | 70,364 | 70,364 |

2 | .506 | 16.869 | 87.232 | |||

3 | .383 | 12.768 | 100,000 won | |||

Extraction Method: Principal Component Analysis. | ||||||

4. Correlation analysis results between independent and dependent variables

Correlations | ||||||||

TL | PL | CN | th | CN | TIEN | PTDVT | ||

TL | Pearson Correlation | first | ||||||

Sig. (2- tailed) | ||||||||

WOMEN | 216 | |||||||

PL | Pearson Correlation | .098 | first | |||||

Sig. (2- tailed) | .151 | |||||||

WOMEN | 216 | 216 | ||||||

CN | Pearson Correlation | .269 ** | .055 | first | ||||

Sig. (2- tailed) | .000 | .422 | ||||||

WOMEN | 216 | 216 | 216 | |||||

th | Pearson Correlation | .174 * | .046 | .387 ** | first | |||

Sig. (2- tailed) | .011 | .505 | .000 | |||||

WOMEN | 216 | 216 | 216 | 216 | 216 | |||

ML | Pearson Correlation | .294 ** | .120 | .234 ** | .350 ** | first | ||

Sig. (2- tailed) | .000 | .077 | .001 | .000 | ||||

WOMEN | 216 | 216 | 216 | 216 | 216 | |||

TIEN | Pearson Correlation | .363 ** | .090 | .266 ** | .214 ** | .326 ** | first | |

Sig. (2- tailed) | .000 | .186 | .000 | .002 | .000 | |||

WOMEN | 216 | 216 | 216 | 216 | 216 | 216 | ||

PTDVT | Pearson Correlation | .423 ** | .189 ** | .555 ** | .576 ** | .536 ** | .503 * * | first |

Sig. (2- tailed) | .000 | .005 | .000 | .000 | .000 | .000 | ||

WOMEN | 216 | 216 | 216 | 216 | 216 | 216 | 216 | |

**. Correlation is significant at the 0.01 level (2-tailed). | ||||||||

*. Correlation is significant at the 0.05 level (2-tailed). | ||||||||

5. Linear regression analysis results

Model Summary b

Model | CHEAP | R Square | Adjusted R Square | Std. Error of the Estimate | Durbin-Watson |

first | .806 a | .650 | .639 | .17778 | 1,913 |

a. Predictors: (Constant), TL, PL, CN, TH, ML, TI | |||||

b. Dependent Variable: PTDVT | |||||

ANOVA ah | ||||||

Model | Sum of Squares | DF | Mean Square | F | sig, | |

first | Regression | 12,242 | 6 | 2.040 | 64,556 | 000 b |

Surplus | 6.606 | 209 | .032 | |||

Total | 18,848 | 215 | ||||

a. Dependent Variable: PTDVT | ||||||

b. Predictors: (Constant), TI, PL, TH, TL, CN, ML | ||||||

Coefficients a | ||||||||

Model | Unstandardized Coefficients | Standardized Coefficients | t | Sig. | Collinearity Statistics | |||

REMOVE | Std. Error | Beta | Tolerance | VIF | ||||

first | (Constant) | -.308 | .213 | -1.446 | .150 | |||

TL | .125 | .043 | .132 | 2,907 | .004 | .809 | 1.236 | |

PL | .062 | .026 | .097 | 2.355 | .019 | .980 | 1.021 | |

CN | .246 | .041 | .278 | 6.038 | .000 | .791 | 1.264 | |

th | .279 | .042 | .309 | 6.653 | .000 | .777 | 1.287 | |

ML | .193 | .038 | .238 | 5.133 | .000 | .780 | 1.282 | |

TIEN | .187 | .038 | .229 | 4,972 | .000 | .794 | 1.260 | |

a. Dependent Variable: PTDVT | ||||||||

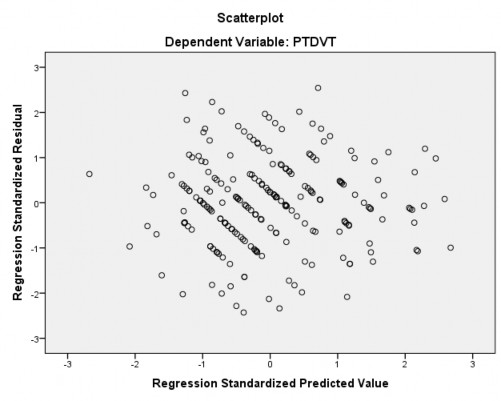

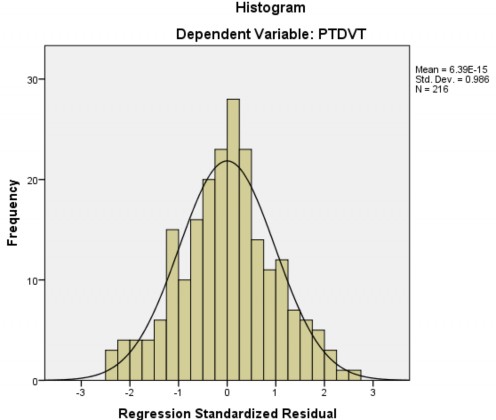

6. Testing of regression assumptions

Ex 9eeted Cu m P r•b

Normal PP Plot of Regression Standardized Residual Dependent Variable: PTDVT

Observed Cum Prob

APPENDIX 4:

INTERVIEWER QUESTIONS

This survey aims to understand the factors affecting the development of card services at Asia Commercial Joint Stock Bank . Your objective answers contribute to the success of this study. All your information will be used for research purposes only. We will keep your answers private and only publish aggregated results.

Thank you for your cooperation.

A. Prologue

(You answer by ticking or X in the corresponding box )

A 1 . First, please indicate:

Have you/are you using ACB card service? (If you choose Yes , continue to question A2 , if you answer No , end the interview .)

Have | No | |

Encode | 1 _ | 0 _ |

A 2 . Please indicate if you have been working at ACB and have used ACB's card services for a period of time (If you choose Over 06 months, continue to move to Part B, if you answer Under 06 months, then continue to Part B. end of interview)

Over 06 months | Less than 6 months | |

Encode | 1 _ | 0 _ |

B. Access to Information

(You answer by ticking or X in the corresponding box ) Please indicate which card type of ACB you are using mainly

Type of card in use | ACB credit card - World MasterCard - Visa Platinum - Visa Business - JCB/Visa/MasterCard | ACB Debit Card - JCB Debit - Visa/MasterCard debit - ACB2Go - Business card | Drop prepaid ACB - Visa/JCB Prepaid - Master card Dynamic - JCB Prepaid |

Encode | 1 _ | 2 _ | 3 _ |

C. Intensive section

The following are statements about ACB's card products and services. Please indicate your level of agreement with the following statements by ticking ( or

X) in the most appropriate box (in each line)

These numbers represent the extent to which you agree or disagree with the following conventional statements:

Totally disagree | Disagree | Neutral | Agree | Totally agree |

first | 2 | 3 | 4 | 5 |

Customer psychology | |||||||

01 | When using card services, customers feel afraid of revealing personal information | first | 2 | 3 | 4 | 5 | |

02 | Customers feel comfortable, happy and accept the use of card services | first | 2 | 3 | 4 | 5 | |

03 | Customers complain, disagree about the procedure in the process of using card service | first | 2 | 3 | 4 | 5 | |

04 | Customers are afraid and difficult to understand when they have to make card transactions | first | 2 | 3 | 4 | 5 | |

Juridical | |||||||

05 | The guiding policy on implementing the use of payment card services is complete and clear | first | 2 | 3 | 4 | 5 | |

06 | The State applies supportive policies in the use of card services | first | 2 | 3 | 4 | 5 | |

07 | The Bank issues its own policies and regulations when using card services | first | 2 | 3 | 4 | 5 | |

Technology infrastructure | |||||||

08 | The bank has adequate and modern technical facilities for payment card services. | first | 2 | 3 | 4 | 5 | |

09 | Technical facilities for card services are many, convenient for users | first | 2 | 3 | 4 | 5 | |

ten | Technology used in payment card services is safe and secures customer information | first | 2 | 3 | 4 | 5 | |

11 | Customers can easily use technologies, technical facilities in the process of using payment card services | first | 2 | 3 | 4 | 5 | |

Trademark | |||||||

twelfth | ACB has a wide brand name | first | 2 | 3 | 4 | 5 | |

13 | ACB always keeps its reputation | first | 2 | 3 | 4 | 5 | |

14 | ACB is always at the forefront of social activities | first | 2 | 3 | 4 | 5 | |

15 | ACB always keeps good information about transactions | first | 2 | 3 | 4 | 5 | |

ATM/POS network | |||||||

16 | Wide network of ATM and POS ACB | first | 2 | 3 | 4 | 5 | |

17 | ACB has a convenient transaction location | first | 2 | 3 | 4 | 5 | |

18 | ACB's cards and ATMs are easy to use | first | 2 | 3 | 4 | 5 | |

19 | ACB's ATMs operate 24/24 | first | 2 | 3 | 4 | 5 | |

Convenience – Diversity | |||||||

20 | ACB's card service portfolio is diverse and rich | first | 2 | 3 | 4 | 5 | |

21 | ACB card service has many utilities | first | 2 | 3 | 4 | 5 | |

22 | ACB card service meets transaction needs | first | 2 | 3 | 4 | 5 |

23 | ACB card service saves time | first | 2 | 3 | 4 | 5 |

24 | ACB card service with high security | first | 2 | 3 | 4 | 5 |

Card service development | ||||||

25 | ACB card service is well-reviewed, more and more people are recommending to use it | first | 2 | 3 | 4 | 5 |

26 | ACB card service brings continuous and long-term value | first | 2 | 3 | 4 | 5 |

27 | ACB card service brings love and pride when using | first | 2 | 3 | 4 | 5 |

D. Demographics section

Could you please provide some details about your personal information?

D1. Sex

Sex | male | Female |

Encode | 1 _ | 2 _ |

D2. Age

Year old | 18 - 30 | 31 - 40 | 41 – 45 | 46 – 50 | >50 |

Encode | 1 _ | 2 _ | 3 _ | 4 _ | 5 _ |

D3. Working years

Seniority | Less than 1 year | From 01 year to less than 03 years | From 3 years to less than 5 years | Over 05 years |

Encode | 1 _ | 2 _ | 3 _ | 4 _ |

D4. Working department

Part | Card business | Customer Service – Transaction Counter | Standard spending/cardholder operations | Other |

Encode | 1 _ | 2 _ | 3 _ | 4 _ |

Thank you very much sir/madam!