accept payment. In addition, ACB now accepts card payments such as American Express, JCB... Card payment is the most important and most effective activity in providing card services of ACB. ACB is applying card payment according to business processes, guidelines issued internally and consistent with the uniform regulations of domestic and international card organizations. Specifically:

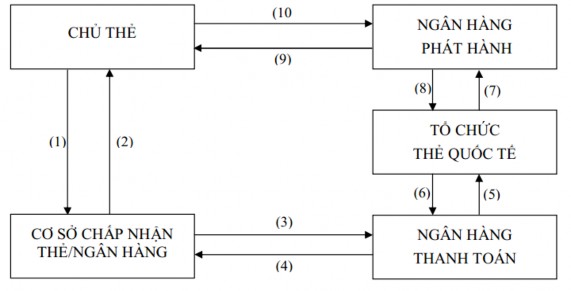

Figure 3.2 Card payment process at ACB

Source: Internal documents of Asia Commercial Joint Stock Bank - Decision No. 20/2007/QD-NHNN Regulations on issuance, payment, use and provision of supporting services for bank card operations, 2007

Step 1: Cardholder requests to pay for goods or services or withdraw cash by card

Step 2 : Merchants provide goods and services to customers. Merchants using POS provided by ACB when accepting card payments perform the following tasks:

Check card, card number, cardholder authentication, payment amount. In case the payment amount is larger than the limit, the merchant must obtain a payment approval order from the Payment Department at the Card Center.

Make 03 payment invoices, in which, one copy of the payment invoice will be returned to the cardholder, the merchant will keep one copy of the invoice to save as a document in case of dispute, the remaining copy shall be returned to the paying bank.

Prepare invoices and payment requests. After a certain time, merchants will make a list for each type of ACB transfer card to request payment.

Step 3: Merchant sends card payment invoice to ACB

Step 4: Upon receipt of the invoice and statement, the Payment Department and the Cardholder Processing Department will check the validity of the information, debit the account at the Card Center and credit the cardholder's account. merchants during the day.

Step 5: Cardholder Processing Department and ACB Card Center Accounting Department collect data, contact Information Technology Division to make payment with issuing banks and international organizations (in case the card is issued by another bank).

Step 6: Organize an international credit card for the paying bank (here, ACB)

Step 7: The international card organization reports the debt to the issuing bank

Step 8: The issuing bank pays the debt to the international card organization

Step 9: Every month, the ACB card center prints a statement and sends it to the ACB cardholder, requesting the cardholder to pay within a certain period of time in case the cardholder uses a credit card. If the cardholder fails to pay, a late fee will be charged.

Step 10: Pay the debt to the issuing bank

In case of domestic card payment, steps 05, 06, 08 will be passed through NAPAS because there is no role of international card organization.

The handling of transaction complaints ensures compliance with Mandate/Bulletin regulations of Visa/MasterCard/NAPAS organizations and the State Bank of Vietnam in terms of time, risk control mechanism and compensation limit.

3.2.4 Card products and services at Asia Commercial Joint Stock Bank

Cards issued by ACB meet diverse transaction needs and convenience for customers. As of December 31, 2015, ACB's current card products are divided into 3 types: debit card, prepaid card and credit card.

3.2.4.1 Debit card

Debit cards issued by ACB connect to accounts to help customers use and manage their accounts conveniently. Currently, ACB has domestic and international branded debit card products as follows:

- Domestic debit card 365 Styles/ACB2GO/ATM2+ Domestic debit card connected to VND payment deposit account branded Banknetvn, Smartlink issued by ACB with advantages: fast card issuance time (receiving card) within 15 minutes after completing the application form); withdraw money nationwide at extremely low cost; pay for goods and services at card-accepting points with Banknetvn, Smartlink and VNBC logos nationwide.

- International Debit Card Visa (Standard Class/Extra Debit/Platinum Debit), MasterCard (Standard Class /Extra Debit), JCB (Standard Class) International debit card connected to a branded VND current account Visa/MasterCard/JCB issued by ACB. The card is used for ATM transactions and easy payment at more than 30 million points in 220 countries worldwide and at 15,000 points in Vietnam with the Visa/MasterCard/JCB/Cirrus logo. An international debit card with the advantages of safer and more secure transactions (using EMV chip cards), the ability to authenticate online payment transactions, and enjoy promotional offers from card organizations.

- Business Card is a premium debit card designed luxuriously and delicately exclusively for Merchant Account holders with exclusive card privileges (insurance, fee waiver, priority service ...)

3.2.4.2 Prepaid card

Prepaid cards issued by ACB provide convenient and secure spending solutions anytime, anywhere, whether traveling, studying abroad or shopping online, including Visa prepaid cards (Standard Class – Citimart/Extra), MasterCard /JCB (Standard Class). prepaid cards issued by ACB have more safety and security advantages when transacting (using EMV chip cards), the ability to authenticate online payment transactions, enjoy promotional offers from organizations card function and no need to maintain a minimum balance

3.2.4.3 Credit cards

Credit card provided by ACB is an alternative to cash when customers have payment needs. In addition to the "spend first, pay later" feature and the interest-free period of up to 45 days, ACB's credit cards are especially safe and convenient in all payment transactions globally. Current credit card products include: Visa international credit cards (Standard/Business/Platinum), MasterCard (Standard/World), JCB (Standard)

3.2.5 Services attached to card products

In addition, ACB provides accompanying services to bring the most convenient and friendly banking experience to customers. The services accompanying the card currently provided by ACB include:

- Online card management/transactions: ACB's cardholders using the service will easily manage card information, manage card status, pay online, and useful accompanying services. other linked to the connection account.

- ACB2Pay payment gateway: With the ability to make payments on handheld devices such as computers, phones, tablets...; implementing and managing payment transactions, especially allowing businesses to provide installment purchase and recurring transactions, ACB2Pay payment gateway supports online card acceptance for all Vietnamese individuals and businesses Male or foreign have forms of e-commerce business, including: airlines, hotels, travel agencies, schools, telecommunications companies, electricity, water, online shopping websites...

- Receive transfer from abroad via card: Cardholder receives remittance from abroad through direct credit to the card account.

- Card insurance: ACB is the first bank in Vietnam to offer card insurance to customers in order to bring high reliability and safety to cardholders. Types of insurance currently provided by ACB include: ATM withdrawal insurance, fraudulent transaction insurance, trip delay insurance, travel insurance

- Card payment: ACB provides a modern, convenient and safe payment method, improving business efficiency through brand promotion programs.

- International online card transaction authentication service (with the common name for both Visa and MasterCard is 3D Secure service, the specific name for Visa is Verified by Visa and MasterCard is MasterCard SecureCode) is a feature to increase security. secure for cardholders when making online payment transactions at websites with Verified by Visa or MasterCard SecureCode logos through authenticating cardholders with a password. ACB is the first bank to deploy 3D Secure service in Vietnam to help international cardholders feel secure to buy goods online without having to worry about card account abuse.

- Smart spending management service (MasterCard inControl) is a smart spending management service that helps ACB MasterCard cardholders control spending for their main card as well as related supplementary card(s) (if applicable) yes) through online setting of card parameters such as: spending control, spending control by transaction type, territory spending control, spending control over time.

3.2.6 Card business results at Asia Commercial Joint Stock Bank

ACB's card business is constantly growing and developing, contributing to improving the bank's business performance.

Every year, the card business has brought in significant profits. The average profit from card business since 2000 until now accounts for 5-6% of ACB's total annual profit.

Table 3.2: Statistics of card business results at ACB in 2010 - 2015

2010 | 2011 | 2012 | two thousand and thirteen | 2014 | 2015 | |

Number of accumulated cards (thousands of cards) | 785 | 1152 | 1,508 | 1.832 | 2.130 | 2.449 |

Turnover (billion VND) | 14.692 | 21.561 | 30.507 | 36.755 | 41,670 | 47,087 |

Profit (billion VND) | 75 | 98 | 101 | 183 | 218 | 251 |

Maybe you are interested!

-

Developing card services at Asia Commercial Joint Stock Bank - 1

Developing card services at Asia Commercial Joint Stock Bank - 1 -

Developing card services at Asia Commercial Joint Stock Bank - 2

Developing card services at Asia Commercial Joint Stock Bank - 2 -

Developing card services at Asia Commercial Joint Stock Bank - 3

Developing card services at Asia Commercial Joint Stock Bank - 3 -

Developing card services at Asia Commercial Joint Stock Bank - 5

Developing card services at Asia Commercial Joint Stock Bank - 5 -

Developing card services at Asia Commercial Joint Stock Bank - 6

Developing card services at Asia Commercial Joint Stock Bank - 6 -

Developing card services at Asia Commercial Joint Stock Bank - 7

Developing card services at Asia Commercial Joint Stock Bank - 7

Source: ACB card business report, 2010 – 2015

Besides the profit of card business, the number of customers using ACB's cards has continuously increased over the years. Through the card business aggregate data from the years. The total number of cards issued by ACB as of December 2015 has reached 2.4 million cards. In addition, card agent development activities are always interested in promoting ACB.

In addition, ACB constantly increases utilities and incentives for customers in order to increase new customers registering to use card services and maintain the number of existing customers of the bank. Sales of use as well as sales of payment grew relatively steadily and always exceeded the set plan. ACB always promotes the increase of the number of card-accepting units nationwide and constantly increases the convenience of using cards for customers.

The convenient business of card services is explained by the fact that after a long time of applying card payment in Vietnam, the use of cards for payment in the Vietnamese market has become more and more popular. Goods and service providers have seen the convenience of accepting card payments. Part of the reason is that ACB has strengthened card marketing activities, actively sought customers, and expanded its network of merchants. In addition, more and more Vietnamese citizens are sending their children and relatives to study and travel abroad, which also makes the use and payment of cards increasing.

Some other reasons for the increase in card transaction sales over the years include the ATM and POS system ACB has a reasonable planning strategy, customers realize the many benefits that ACB cards bring such as: : pay for goods and services at merchants, pay for electricity, water, telephone, internet, cable TV, insurance premiums... so customers have access to these utilities to serve their payment needs. mine.

3.2.7 Evaluation of card service development at Asia Commercial Joint Stock Bank

Card service was deployed by ACB relatively slowly compared to some other commercial banks, specifically: from 1995 to 1998, ACB started to build

developed a business plan for card services, but it was not until the period from 1999 to 2002 that ACB purchased equipment and went into operation. Although the implementation is slower than other commercial banks, ACB's card service has made significant progress, so far ACB has quickly grown to become one of the competitive commercial banks.

Table 3.3. ACB's card service development targets

Targets | 2010 | 2011 | 2012 | two thousand and thirteen | 2014 | 2015 |

Total number of cards (thousands of cards) | 785 | 1.152 | 1,508 | 1.832 | 2.130 | 2.449 |

Number of domestic cards (thousands of cards) | 542 | 775 | 916 | 1.074 | 1.202 | 1.349 |

Number of international cards (thousands of cards) | 242 | 407 | 592 | 757 | 929 | 1,100 |

Rate of active cards | 73.6% | 75.1% | 70.0% | 71.4% | 74.0% | 72% |

Card account balance (Billion VND) | 776 | 1.137 | 1.489 | 1.808 | 2.174 | 2.565 |

Market share by number of cards | 2.06% | 2.2% | 3.0% | 3.1% | 3.3% | 3.3% |

Sales market share | 2.3% | 2.3% | 2.3% | 2.4% | 2.5% | 2.7% |

Market position | 7 | 7 | 6 | 7 | 6 | 6 |

Number of ATMs (Machine) | 405 | 491 | 559 | 557 | 542 | 560 |

Number of POS (Machine) | 2.170 | 2.364 | 2.413 | 2.519 | 2.615 | 2705 |

Source: ACB card business report, 2010 – 2015

- Diversity of cards issued

In recent years, commercial banks have begun to focus on the development of international cards because our country's economy is currently stable and high growth, the number of foreigners coming to Vietnam as well as Vietnamese people. Going abroad has increased rapidly, so the need to own an international card is a very necessary need of people.

On the basis of grasping the market trend in non-cash payment, besides developing domestic cards, ACB soon invested to become one of

pioneer banks in providing customers with a wide range of international branded cards with a variety of features and utilities.

JCB card is issued by Japan Credit Bureau which is an organization based in Tokyo Japan. This is also a popular card in the world. But in Vietnam, there are many places where they are still more used to using Visa and MasterCard. However, if you use this card in Japan or Japanese shops in Vietnam, most of them are accepted. JCB is also very useful today because Japanese brands are increasingly blooming in Vietnam and often have promotions applied to customers using cards. In 2015, ACB issued credit cards and prepaid cards of JCB international card organization and was the only bank in the market to provide all three types of debit, credit and prepaid cards of international organizations. International card organization Visa, MasterCard and JCB according to both magnetic card and EMV card standards. Now, Besides ACB, there are only 05 issuing banks in the market, namely Joint Stock Commercial Bank for Foreign Trade of Vietnam (Vietcombank), Joint Stock Commercial Bank for Industry and Trade of Vietnam (Vietinbank), Saigon Commercial Joint Stock Bank. Thuong Tin Commercial Joint Stock Bank (Sacombank), Vietnam Technological and Commercial Joint Stock Bank (Techcombank), and Vietnam Export-Import Commercial Joint Stock Bank (Eximbank) issue JCB cards but only focus on credit cards. ACB's orientation to diversifying card portfolio shows its efforts to improve services to meet customers' needs for quick, safe and convenient payment, and gradually integrate with the world market. . Vietnam Technological and Commercial Joint Stock Bank (Techcombank) and Vietnam Export Import Commercial Joint Stock Bank (Eximbank) issue JCB cards but only focus on credit cards. ACB's orientation to diversifying card portfolio shows its efforts to improve services to meet customers' needs for quick, safe and convenient payment, and gradually integrate with the world market. . Vietnam Technological and Commercial Joint Stock Bank (Techcombank) and Vietnam Export Import Commercial Joint Stock Bank (Eximbank) issue JCB cards but only focus on credit cards. ACB's orientation to diversifying card portfolio shows its efforts to improve services to meet customers' needs for quick, safe and convenient payment, and gradually integrate with the world market. .

- Number of cards issued and customers using cards

The number of cards issued over the years has increased. Specifically, the growth rate of the number of cards in 2011 was 147%, in 2012 it was 131%, in 2013 it was 121%, in 2014 it was 116% and in 2015 it was 115%. The average growth rate of the number of cards from 2010 to 2014 was 126%. In which, the proportion of international cards is always increasing gradually, accounting for about 31% in 2010, about 35% in 2011, accounting for about 35% in 2012.

39%, about 41% in 2013, 44% in 2014 and 45% in 2015 of the total number of cards issued. International cards still account for a high proportion because of many conveniences

More useful than domestic cards, can be used domestically and abroad and pay for online purchases. Along with the development of e-commerce, international payment cards are an indispensable means for people who want to use this type of shopping.

Compared to the two leading banks in the market in terms of the number of cards in general, and Vietcombank in particular, Agribank has a growth rate of 15~ 25% in the number of cards, the development of ACB is positive. The increase in the number of cards comes from ACB's focus on expanding the source of individual customers as well as corporate customers through combining with well-known partners and diversifying attached services to maximize satisfaction. customer needs.. In particular, ACB organizes staff to deliver cards to their homes outside of business hours for VIP customers or customers who are busy at work and cannot come to receive cards. ACB also increases the convenience and incentives for customers to register for a card, regularly offers promotions and incentives for cardholders and promotes the dissemination of knowledge about cards among students.

- Rate of active cards

With the diversity of card types and stability in service quality, ACB's card services have attracted many customers to use. With the advantage of being a pioneer bank in the issuance of international cards, many young customers with the need to experience technology, regularly make online transactions, shop on foreign websites have come and use card service of ACB. On the other hand, good customer positioning in the strategy also helps to guide the expansion of the number of customers for card merchants effectively. The number of customers using ACB's cards out of the total number of cards issued over the years is relatively stable (over 70%).

- Deposit balance on customer's card account

Along with the increase in the number of cards, the deposit balance on the customer's card account over the years has increased. Deposit balance on customer's account has a growth rate of over 120%. Specifically, the growth rate in 2011 was 146%, in 2012 it was 130%, 121% in 2013 and 120% in 2014-2015. ACB

can take advantage of this capital to supplement and support other service business plans.

- Card payment sales

Along with the increase in investment in machinery and equipment, sales of card use and payment at ACB have seen good growth.

Total card transaction turnover over the years has increased. Revenue from card activities has brought a significant source of revenue for ACB, contributing to increasing profits, as well as enhancing ACB's position in domestic and foreign markets.

Table 3.4. Target sales of card use and card payment

Unit: billion

Targets | 2010 | 2011 | 2012 | two thousand and thirteen | 2014 | 2015 |

Card sales | 14.692 | 21.561 | 30.507 | 36.755 | 41,670 | 47,087 |

Card payment sales | 698 | 1.025 | 3,978 | 4.486 | 5,341 | 6.482 |

Source: ACB card business report, 2010 – 2015

In 2014, the total sales of card payments at ACB reached VND 5,341 billion, an increase of VND 6,683 billion compared to 2010; VND 4,316 billion compared to 2011; increase compared to 2012

VND 1,363 billion, an increase of 134%; an increase of VND 885 billion compared to 2013 (19.06%); ACB's market share of payment for services at the point of acceptance of card transactions ranks 8th with nearly 3% market share, still quite low compared to leading banks such as Vietcombank with 22.06% market share. Agribank is 19.56% market share, Vietinbank is 18.90% market share.

- Income from card service provision

Card business brings the bank income from many sources such as revenue from issuance fee, card maintenance fee, annual fee, fee for collection of points of sale, collection of online payment... Annually, operations Card business has brought in significant profits. The average profit from card business accounts for 5-6% of ACB's total annual profit. Revenue from card activities of ACB increased approximately 3.5 times, specifically from VND 75 billion in 2010 to VND 251 billion in 2015 (table 3.2).

- Market share of bank cards

In the 5 years from 2010 to 2014, ACB's card market share fluctuated around 2

- 3% market share. This is also the same level of market share at positions from 6 to 7 in the market, ACB is classified in another group of private joint stock commercial banks such as Vietnam Technological and Commercial Joint Stock Commercial Bank (market share is about 2 – 7). 4%), Saigon Thuong Tin Commercial Joint Stock Bank (market share is about 3-7%), Dong A Commercial Joint Stock Bank (market share is about 5-11%) competes for the top positions (accounting for 4 percent of the total market share). (approximately 75% market share) belongs to the group of 04 banks with more than 50% state capital, namely Bank for Agriculture and Rural Development of Vietnam, Joint Stock Commercial Bank for Foreign Trade of Vietnam, Joint Stock Commercial Bank Investment and Development in Vietnam, Joint Stock Commercial Bank for Industry and Trade of Vietnam with a large existing customer base and long operating experience. The author finds that ACB's card market share is still too low compared to the market.

- Diverse features of card services

In parallel with the development of the number of cards, ACB also constantly increases the utility of card products, not only to attract customers to find the product but also to retain customers. ACB has really cared about the utility of the card and is striving to bring customers the highest satisfaction when using ACB's card products.

The card's features can meet the needs of consumers such as: transactions at more than 11,000 ATMs, payment for goods and services at card-accepting units with the NAPAS logo nationwide, payment electricity/water/telephone bills, recharge prepaid mobile subscribers and pay postpaid mobile subscription charges. online payment at websites of card-accepting units connected to online payment system of ACB and/or ACB's partners, card balance viewing service via mobile phone banking, health insurance service global economy ...v/v. However, at present, Vietcombank, Vietinabank, Sacombank, Techcombank are the banks that have excelled thanks to the implementation of utilities.

application of modern technology: bill payment, deposit at ATM, fingerprint recognition at ATM,...

- Risks in payment and card use

Recently, the situation of bank card crime has been very complicated. In some areas such as Hanoi, Ho Chi Minh City... there have been a number of cases where foreigners use devices to steal information from bank cards, make fake cards, withdraw money at ATMs, and this has already happened. affecting the safety of assets of banks and customers, causing negative sentiment in the card market in Vietnam. In order to minimize the possibility of risks for customers and give customers peace of mind when using the service, from June 29, 2010, ACB officially issued EMV cards and converted card products from current to the EMV card. Besides, ACB's ATM system also accepts EMV card transactions. This is an outstanding factor of ACB card products compared to banks in the market, ensuring minimal risk for customers when paying and using cards.

Table 3.5: Fraud statistics of cards issued by ACB from 2010 - 2015

Unit: Billion VND

2010 | 2011 | 2012 | two thousand and thirteen | 2014 | 2015 | |

Local card | ||||||

Number of cases | 75 | 77 | 71 | 38 | 24 | 22 |

Amount of money | 0.79 | 0.84 | 0.89 | 0.45 | 0.34 | 0.41 |

sales | 4.407 | 6.253 | 10,678 | 8.822 | 10,418 | 12,051 |

Ratio (%) | 0.017 | 0.013 | 0.008 | 0.005 | 0.003 | 0.003 |

International card | ||||||

Number of cases | 524 | 611 | 619 | 457 | 428 | 431 |

Amount of money | 4.95 | 6.67 | 6.30 | 4.35 | 4.02 | 4.21 |

sales | 10.285 | 15.308 | 19,829 | 27,933 | 31.252 | 35,036 |

Ratio (%) | 0.048 | 0.044 | 0.032 | 0.015 | 0.012 | 0.012 |

Source: Report of the General Department of personal service business activities 2010 - 2015

- Convenience in payment and card use

The convenience in payment and card use is reflected in the range of ACB card products that are accepted for use and payment. Currently, ACB cardholders can make transactions at more than 11,000 ATMs, pay for goods and services at card-accepting units with the NAPAS logo across the country. The growth rate of ACB's ATM machines increased steadily every year from 405 machines in 2010 to 542 machines in 2014. However, ACB's ATM market share is only 8th and still small compared to the leading group of Agribank (2300 machines), Vietinbank (2125 machines), Vietcombank (1829 machines). As of December 31, 2014, ACB has installed 2,615 POS machines, accounting for 2.8% of the total number of installed machines by commercial banks, led by Bank for Foreign Trade of Vietnam, with 21,977 equipped machines. , accounting for 28.4%, followed by Industry and Trade Bank of Vietnam with 19,875 machines, accounting for 25.7%. The number of ATM/POS is not high because ACB is restructuring card operations,

- Quality of customer care service

The quality of customer care service is an important factor in building trust and reputation with customers, contributing to retaining existing customers and attracting new customers. A pays great attention to this issue, which is reflected in the development of a set of quality standards for providing information and services related to card products to customers, adjusting the regulations on customer complaints, and reducing customer complaints. minimize errors, confusion in transactions with customers, etc.

ACB, Vietnam Technological and Commercial Joint Stock Bank and Saigon Thuong Tin Commercial Joint Stock Bank are evaluated more positively in terms of service quality than state-owned joint stock commercial banks as well as service attitude. The service is very high, in which many customers say that they are satisfied with the card service, the staff is dedicated and gentle, the procedures are quick and simple, the payment is fast, and they promptly support customers when in need.

- Overall rating

The above analysis shows that ACB's card service has gained significant momentum in recent years:

- The advantage of card diversity comes from a fairly reasonable strategic orientation;

- Ensure risk control is concerned and focused;

- Card utility has partly met the transaction needs of customers;

- Maintain commitment to quality service to customers. However, there are still certain limitations, such as:

- The utility of using cards has not been superior in the market;

- Distribution channels are limited, not really convenient to serve customers;

- Technical facilities for card business are still limited, business application programs are still in the transition phase.

- Card staff have not met the actual requirements... The above existence is due to a number of main reasons as follows:

- The legal corridor for card operations is still lacking, there are not many solutions to encourage commercial banks to develop this service;

- Technical facilities are still limited, as well as the utility of card use of ACB is somewhat still not keeping up with that of some other commercial banks.

- Searching, customer care and propaganda, advertising and marketing are subject to stiff competition from commercial banks with state capital.

- The policy of training to improve professional qualifications and encourage working performance for card staff and card sales staff is incomplete and attractive.

Conclusion of chapter 3.

Thus, after understanding and analyzing the general operation and business results of ACB in the period 2010 - 2014, we can see that ACB is a private bank with strong competitiveness in the market. Despite going through ups and downs, ACB is still able to overcome it.

The development of card services at ACB can be summarized as follows:

- ACB's card portfolio is diversified, meeting the needs of customers in many segments;

- ACB's position in the card market is quite good (ranked 6-7). However, ACB's card market share is still quite small (approximately 3%).

- ATM/POS network is still small, there is a long distance from leading banks in the market.

- ACB's card service has made significant progress, but besides that, there are still certain limitations, such as: card usage has not yet met the requirements of users; distribution channels are not really convenient to serve customers; Technical facilities for service are still limited…