including commercial banks will have greater income. Therefore, this is a criterion that reflects the development of card services of the bank.

- Income from card service provision

After all, banks provide card services with the purpose of increasing income, increasing the number of services to reduce risks and improve competitiveness for banks. Income from card business can be listed according to the following sources: fee for issuance, maintenance, collection of loan interest from consumer credit, fee from Interchange, issuance fee, annual fee,..., revenue from the point of sale on the payment sales, pay part of the international card organization, transaction fee on ATM

- Market share of bank cards

The indicator shows the development of card services that the bank provides to customers. The better the bank's card service meets the needs of customers, the positive effect will be to attract more customers to use the service, and the bank's market share will change markedly.

- Risks in payment and card use

Customer psychology is always wanting safety, afraid of the risk of loss. Therefore, if the card product brings safety in payment and use, it will be trusted by customers, thereby increasing the number of customers and the number of cards issued.

2.3.1.2 Qualitative indicators

Besides quantitative indicators, qualitative indicators are also used to measure the level of card service development:

- Diverse features of card services

One of the important criteria to evaluate the development of card services cannot fail to mention the conveniences brought by the bank's card services. From simple cards to withdraw money, today cards are also used for payments, transfers, online purchases, electricity and water bill payments, ... and many other utilities that make the card really a vehicle. modern and useful payment. So

If the bank's card service provides more utilities, it will clearly have the strength to attract customers and contribute to the overall development of this service.

- Convenience in payment and card use

Besides wanting safety, customers also want convenience. Card products must bring convenience to use, so that they can replace other means of payment. The convenience in payment and card use is reflected in the availability and availability of card-accepting devices such as ATM, EDC/POS... Stable operation will make it more convenient for customers to use the card and the bank will also get a bigger revenue from the fee for using its card-accepting devices. At the same time, convenience is also reflected in the acceptance of use and payment of cards by merchants, websites providing online shopping services, etc.

- Quality of customer care service

Customer Care is all that is necessary for a bank to do to satisfy the needs and expectations of its customers, that is, to serve customers the way they want to be served and to do what they want. necessary to keep the existing customers. This will help the bank build trust and credibility with customers, help retain existing customers and attract new customers. The quality of customer care service is reflected in the process by which the bank provides information and services related to card products to customers, which is a dedicated and thoughtful attitude when dealing with customers. Quickly and thoroughly handle customer problems and complaints, minimize errors and confusion in transactions with customers, etc.

2.4 Experience in developing card services of commercial banks and lessons for Asia Commercial Joint Stock Bank

2.4.1 Experience in developing card services of commercial banks

2.4.1.1 Joint Stock Commercial Bank for Foreign Trade of Vietnam

Joint Stock Commercial Bank for Foreign Trade of Vietnam (Vietcombank) has boldly invested heavily to develop card products and services such as: Deeply changing/adjusting public processes

In order to improve customer service time, invest in a modern card-issuing machine system, ATM/EDC system, etc.. The majority of ATMs are concentrated in big cities, tourist areas, resorts, etc. etc… attract a large number of domestic and foreign customers.

Vietcombank has developed a strategy to promote marketing activities to ensure it is well and clearly implemented. As of the end of 2015, the domestic card issuance market share accounted for about 20.5% and 39.1% for international cards; ranked first in card usage with more than 155,000 billion dong, accounting for nearly 30% of the market share; leading the market in terms of the number of EDCs (17,714 machines, accounting for 27.4% of the market share) and the second in terms of the number of ATMs (1,829 machines, accounting for 20.1% of the market share).

In addition, Vietcombank has diversified advertising methods, uniform logos, logos and images across the country, organized incentive programs for using cards for a number of subjects, sponsored programs for prizes and awards. position on television, especially contributing to the college student scholarship fund, etc.

Vietcombank focuses on developing card products and services as a bridge to develop individual customer base, creating conditions for the development of other service areas.

2.4.1.2 Bank for Agriculture and Rural Development of Vietnam

After 6 years of participating in the payment card market, by August 2015, Bank for Agriculture and Rural Development of Vietnam (Agribank) has developed more than 2,300 ATMs, accounting for 24% of the total number of banks participating in the payment card market. card market. Also in this year, by the end of August 2015, the bank has issued more than 12 million accumulated cards, most of which are cards of agencies and units registered to pay salaries via card accounts. ; including more than 15% Visa/Master Card international cards.

Agribank cherishes the ambition to "cover" ATMs nationwide with free tricks, even assigning card opening limits to each employee. Agribank has implemented a free and flexible policy in the marketing of some branches (in some places, each employee must invite 100 new cardholders) has brought more than 30,000 new customers to Agribank after one month. program implementation. The most important thing

The amount of money deposited through the accounts of ATM cardholders is continuously increasing. If before, the highest balance in the account was only 250 billion VND, now, there is a time when it has reached 400 billion VND.

Currently, Agribank provides Mobilebanking services via mobile phones for customers to look up account balances, short balance information, print statements, pay mobile phones, transfer funds, purchase goods and book air tickets. fly online without going directly to the bank. In addition, Agribank also has another outstanding utility that is an account overdraft service that allows customers to withdraw money or pay for goods and services when there is no balance in their account. The overdraft limit can be up to 30 million VND depending on the income of each customer.

2.4.2 Some lessons learned for Asia Commercial Joint Stock Bank

From the experience of other banks, the author draws some lessons for Asia Commercial Joint Stock Bank as follows:

- The first thing that needs to be done is to complete and adjust specific regulations and instructions for employees and customers in order to create convenience and openness for the process of using and developing card payments at ACB. On the market today, customers have a lot of card service options to use. Therefore, creating convenience and speed in service provision will be important for customers to recognize and choose to use the bank's services.

- Besides, the research, selection and development of modern technology applications is also a necessary experience to develop card services. In the context of rapidly developing information technology, ACB can choose for itself the most modern and effective technology solutions suitable for its bank, contributing to creating the best products with high quality. Bringing maximum convenience to customers and partners at home and abroad.

- In order to increase competitiveness in the market, it is necessary to diversify card products and card's utility functions at ACB. Currently, the bank's customers are increasingly diverse with their own transaction needs

In particular, understanding tastes and meeting customer needs through diversification of product portfolio and utilities is being actively implemented by the bank.

2.5 Review of research related to card service development

2.5.1 Domestic studies

- Luong Thi Ngoc Lan (2011), "Development of payment card services at Vietnam Joint Stock Commercial Bank for Industry and Trade, Luu Xa - Thai Nguyen branch."

The author has carried out quantitative research with a model of 05 good factors and obtained results that are reliable and have scientific value. Research results show that 05 factors included in the model are government policies and regulations, paperwork, promotion and promotion policies, technical facilities, and customer psychology. Sig is less than 0.05, so all variables are significant at 95% confidence level. So at the 95% confidence level, the independent variables all affect the dependent variable the number of payment cards and the slope coefficients (Beta) are: 0.152, 0.161, 0.235, 0.213, respectively.

Dependent variable

Number of payment cards

-

-

-

-

-

Independent variables

Government policies and regulations Customer psychology

Paperwork

Promotion and promotion policy Technical facilities

0.205 all have a positive sign, so the variables have the same effect as the number of payment cards. That is, if the independent variables increase, the dependent variable number of payment cards will also increase.

Information | |

interview | |

Year old | |

Sex | |

Job | |

Education | |

Income |

Maybe you are interested!

-

Developing card services at Asia Commercial Joint Stock Bank - 1

Developing card services at Asia Commercial Joint Stock Bank - 1 -

Developing card services at Asia Commercial Joint Stock Bank - 2

Developing card services at Asia Commercial Joint Stock Bank - 2 -

Developing card services at Asia Commercial Joint Stock Bank - 4

Developing card services at Asia Commercial Joint Stock Bank - 4 -

Developing card services at Asia Commercial Joint Stock Bank - 5

Developing card services at Asia Commercial Joint Stock Bank - 5 -

Developing card services at Asia Commercial Joint Stock Bank - 6

Developing card services at Asia Commercial Joint Stock Bank - 6

Figure 2.3 Factors affecting the development of payment card services

at Joint Stock Commercial Bank for Industry and Trade of Vietnam, Luu Xa - Thai Nguyen branch

Source: Luong Thi Ngoc Lan, 2011

The importance of the independent variables: government policies and regulations, paperwork, promotion policies, promotions, physical facilities, and customer sentiment are grounded and factored. beta. The larger any Beta value, the greater the importance of that variable for the number of payment cards.

Promotion and promotion policy variable of 0.235 has the largest value compared to the remaining variables, so this variable has the most influence on the number of payment cards. Next is the technical infrastructure variable with beta coefficient of 0.213. The customer psychology variable has a beta coefficient of 0.205; the paperwork variable has a beta coefficient of 0.161. The variable of government policy and regulation is the variable with the smallest beta coefficient (0.152).

- Tran Thi Phuong Thao (2011), "Developing card services at Joint Stock Commercial Bank for Industry and Trade of Vietnam - Thua Thien Hue branch"

In his research, the author introduced an overview of the current situation of card service development at Joint Stock Commercial Bank for Industry and Trade of Vietnam - Thua Thien Hue branch in recent years. Based on the results of quantitative research, the author has proposed solutions to develop this service in the coming time.

To build a model of his influencing factors, the author synthesizes studies on payment card development solutions or factors affecting the decision to use payment cards of banks. Besides, the author also has subjective suggestions on factors affecting the development of card services at the research unit.

In his research model, the author has identified the factors that affect the development of card services at Vietnam Bank for Industry and Trade, Hue branch, which are: Staff, brand, company technology, fees, card issuance procedures, promotions, customer care policies, cards, ATMs, merchants, and finally card problems.

Research results have shown that according to customers' evaluation, the number one priority when choosing to use card services of Vietinbank - Hue is firstly because of its brand and reputation. The second priority that makes customers choose are many ATMs and merchants. The third priority is the enthusiasm of the staff. The fourth priority is fees. Quick problem resolution and customer care promotion are not factors that many customers care about, as evidenced by it ranked fifth and sixth after the factors above.

Cards, ATMs, Card Accepters

Development of bank card services

Promotions - customer care

Trademark

Staff

Fee

Card problem

Figure 2.4 Factors affecting the development of card services at Vietnam Bank for Industry and Trade, Hue Express

Source: Tran Thi Phuong Thao, 2011

However, the study has many limitations: The study did not investigate

factors affecting the development of bank cards such as customer loyalty, trust, legal factors... Convenient sampling method, random approach to individual customers who use the service card service of Vietinbank - Hue should not be generalizable of the sample. The research is only done for Vietinbank - Hue.

- Vu Van Thuc (2012), "Developing card services at Bank for Agriculture and Rural Development of Vietnam"

With many conveniences and high safety, after being applied and developed by commercial banks in Vietnam, card service has quickly been loved and used by many people. Compared to some other commercial banks, the Bank for Agriculture and Rural Development of Vietnam (Agribank) implemented this service relatively slowly, but has also quickly become one of the leading banks in this field.

In this article, the author introduces readers to an overview of the current situation of card service development at Agribank in recent years, and at the same time proposes solutions to develop card services.

develop this service in the near future. Solutions for: Card convenience, infrastructure, promotion - customer care, ATM network expansion - merchants, training to improve qualifications and have preferential policies for staff.

2.5.2 Foreign studies

- Narteh, Bedman (2013) "Research and development of ATM card services - Exploring success factors through empirical investigation"

The study aims to identify the factors affecting ATM card service and assess the customer's perception of the importance of these factors. The author collects data from 525 customers using services of 15 banks in Ghana. Descriptive statistics, exploratory factor analysis and confirmatory factor analysis, as well as regression were used to determine the impact level of factors. The research results identify five factors of the model according to their importance as follows: Reliability, convenience, responsiveness, ease of use and execution.

- Hanudin Amin (2013) “Factors influencing Malaysian customers to choose to use Islamic credit cards: Empirical evidence from the TRA model" Bank customers in general perceive the usefulness of credit cards. use

Islam but the factors that made them choose it are particularly unexplored. This study is aimed to explain the influence of attitudes, subjective norms and perceived financial costs on the behavioral intentions of Malaysian bank customers to choose an Islamic credit card.

The results show that attitudes, subjective norms and perceived financial costs significantly influence the intention to choose an Islamic credit card. Among these, attitude is first ranked as a highly influential factor in explaining one's intention to choose an Islamic credit card.. The results have proven the validity of TRA. to study in the field of Islamic credit cards.

- Ali Kara, Erdener Kaynak, Orsay Kucukemiroglu (1994) “Strategies for developing credit card services for young markets: Using combined analytics"

The young market (young adults aged 18 to 25 years old) has great opportunities for companies and banks to develop credit card services. Sensory organizations

see the need to assess and understand the needs and wants of a customer's credit card.

The aim of this empirical study was to identify the important factors influencing credit card selection behavior of college students through association analysis. The results of this study provide important managerial implications for policy makers in service development at banks and financial institutions.

Conclusion of chapter 2

Banking services are financial services associated with the bank's business activities, created by the bank in order to satisfy certain needs and desires of customers with the goal of making profits, and only Only banks with its advantages can provide these services in the best way to customers.

Card service is a collection of features, features and utilities created by the card for customers to satisfy certain needs and desires of customers in the financial market.

Card service development is the bank's implementation of an increase in the number of card services provided, accompanying features, and additional utilities of card products; improve the quality of each type of service in order to best satisfy the needs of customers using the bank's card services.

There are many factors affecting the development of card services: brand, legal environment, intellectual level, science and technology, financial potential of the bank, human resources to provide card services. market, the direction of the bank and its marketing activities.

CHAPTER 3

THE SITUATION OF DEVELOPMENT OF CARD SERVICES AT ASIAN COMMERCIAL JOINT STOCK BANK

Chapter 3, the author will present an overview of Asia Commercial Joint Stock Bank; overview of ACB's operations and business results from 2010 to present in general; business situation and card service development at ACB, the evaluation criteria for card service development of ACB as a basis for the study in the next chapter and proposed solutions in the future.

3.1 Overview of Asia Commercial Joint Stock Bank

3.1.1 Overview of the history of formation

Asia Commercial Joint Stock Bank officially came into operation. from June 4, 1993; was established under License No. 0032/NH-GP issued by the State Bank of Vietnam (NHNN) on April 24, 1993, and License No. 533/GP-UB issued by the People's Committee of Ho Chi Minh City May 13, 1993. ACB is still one of the leading banks in the group of joint stock commercial banks with relatively high and stable growth after many events.

ACB's goal is to continue to maintain high growth by making a difference based on understanding customer needs and focusing on customers. Building a synchronous, effective and professional risk management system to ensure sustainable growth. Strive to maintain a high level of financial safety, optimize the use of shareholder capital to build ACB into a strong financial institution that is able to overcome challenges in the business environment. imperfection of Vietnam's banking industry.

Some memorable milestones of ACB can be reviewed as follows:

The period of ACB's establishment of ACB was from 1993 to 1995. During this period, starting from a competitive position, ACB focused on individual customers and businesses in the private sector, with a cautious view in granting credit. new products and services that are not available in the market (consumer loans, Western Union fast money transfer services, credit cards).

ACB officially operated the core banking technology system TCBS (The Complete Banking Solution) since 2005, allowing all branches and transaction offices to connect to each other and conduct instant transactions. , share a centralized database; building a quality management system according to ISO 9001:2000 standard and recognized as standard in many fields; implementing the second phase of the banking technology modernization program.

October 2006 was an important milestone in the development of ACB when it was officially listed at the Hanoi Stock Exchange. ACB continues its strategy of diversifying operations, strengthening cooperation with partners such as Open Solutions Company (OSI), Microsoft, and Standard Chartered Bank. In the period from 2006 to 2010, ACB accelerated the expansion of its network, established and put into operation 223 branches and transaction offices.

ACB's development strategy orientation for the period 2011-2015 and a vision to 2020 was issued in early 2011. In which, emphasis is placed on the program to transform the governance system in accordance with Vietnamese laws and regulations. and towards the application of international best practices. Recently, from January 5, 2015, ACB officially changed the new brand identity throughout the ACB system. This is the first rebranding after more than 20 years of establishment of ACB. With a stylized image showing the heart of a satisfied smile, a bonding bracelet, inspiring ACB's sustainable relationship with customers, employees, the community, management agencies as well as shareholders bronze.

3.1.2 Financial situation and business results

After more than 20 years of establishment, operation and development, although there were times when ACB experienced fluctuations in the system and customers' beliefs, up to now, ACB has had a firm foothold in the context of fierce competition among banks. banks and economic institutions. The diversified products and services provided by ACB meet the increasing demands of different customer groups.

Vietnam's economy in the years from 2010 to 2014 was generally better than at the time of the 2008 financial crisis, but there were still many difficulties.

Unsustainable growth, export growth rate tends to decrease. For the banking industry in general and ACB in particular, credit flows are still congested; the handling of collateral for bad debts has not made good progress. The big fluctuations in 2012 had a significant impact on ACB's business activities. ACB has gradually changed its strategy to overcome the consequences and develop sustainably. 2014 marks the second year ACB has implemented the strategic plan for the period 2013-2018, and also the second year that ACB has implemented the restructuring roadmap for the period 2013-2015 to solve outstanding problems.

Table 3.1 Summary of ACB's business situation 2010 - 2015

Unit: billion VND

Targets | 2010 | 2011 | 2012 | two thousand and thirteen | 2014 | 2015 |

total assets | 205.103 | 281.019 | 176,308 | 166.599 | 179,897 | 201,457 |

Equity | 11,377 | 11,959 | 12,624 | 12.504 | 12.128 | 12.787 |

Profit after tax | 2.335 | 3.208 | 784 | 826 | 922 | 1.028 |

ROA | 1.7% | 1.7% | 0.5% | 0.6% | 0.7% | 0.7% |

ROE | 28.9% | 36% | 8.5% | 8.2% | 7.6% | 8.2% |

EPS (thousand VND/share) | 2.86 | 3.28 | 0.67 | 0.87 | 1.02 | 1.14 |

Source: ACB Annual Report, 2010 – 2015

In order to avoid repeating the events that happened in the past, ACB works persistently and consistently in the goal of building a healthy and highly liquid asset balance sheet.

Summarizing 2015, ACB had a strong and strong balance sheet. ACB's total assets by the end of 2015 reached VND 201,457 billion, an increase of VND 21,560 billion (equivalent to 11.98%) compared to 2014 (VND 179,897 billion). Liquidity, especially VND liquidity, continued to be maintained at a very good level. Loan/deposit ratio is stable around 75%. Liquid assets account for a high proportion of total assets, of which government bonds alone account for about 15% of total assets

During the two years of 2013-2014, ACB actively implemented the restructuring roadmap, handled backlog issues, recovered as well as made provision for loans, bonds, and loans.

bills, receivables of group of 6 companies; loans and bonds of a state corporation; and deposits at a joint stock commercial bank.

In addition, ACB actively promotes debt settlement to minimize the impact of Circulars 02/2013 and Circular 09/2014 on asset quality as well as income. ACB also continuously reviewed bad debts, made provisions, and sold debts. By the end of 2014, ACB had sold more than VND 1,000 billion of bad debt to VAMC. The bad debt ratio stood below 2.2%, lower than the average level of the whole system.

ACB's pre-tax profit in 2015 reached VND 1,261 billion, an increase of 14% compared to 2014 (1,104 billion VND) and completed 102% of the profit target. Interest income and non-interest income segments, especially service income, all had higher growth rates compared to 2013.

In recent years, although interest rates have remained low, credit growth of banks in general and ACB in particular has been quite difficult. However, ACB has implemented many solutions to maintain stable credit growth along with safety assurance. Newly incurred bad debts in 2015 decreased significantly; bad debt ratio as of December 31, 2015 was at 2.09%, lower than 2.17% at the end of 2014.

After the big event, ACB's income structure has stabilized again. The income structure in 2015 was more stable than 2014. The ratio of non-interest income to total revenue reached over 21%, the highest level since 2011.

The profitability ratios of profit before tax on total assets and average equity in 2015 were 0.7% and 8.2%, respectively, higher than those in 2014 and 2013, showing the stability and becoming more stable. of ACB since the 2012 incident.

3.2 Current status of card service development at Asia Commercial Joint Stock Bank

3.2.1 Legal framework for card business

All card issuance and payment activities at ACB comply with legal regulations of the State, ACB and regulations of card organizations: Decision No. 20/2007/QD-NHNN Regulations on issuance and payment , use and provide the service

supporting bank card operations, Circular 35/2012/TT-NHNN “regulations on domestic debit card service fees”, Circular 47/2014/TT-NHNN “technical requirements for website safety and security”. bank card payment equipment”, Visa/MasterCard Mandate/Bulletin…. Not only fully meeting the above regulations, ACB also issued its own regulations approved by the Board of Directors to ensure the suitability and limit the risks of card operations: Official Letter 283/NVQD-KCN.09 " Regulations on issuance, payment, use and provision of supporting services for card operations of Asia Commercial Joint Stock Bank” and ACB also regularly review current regulations and make adjustments in accordance with reality. Some details in the legal framework of ACB's card business are as follows:

Regulation on card issuance ensures that all card products at ACB are issued in compliance with: name, product description, purpose of use, target audience, card opening conditions, card features, usability…).

Regulations on making domestic/international payments to ensure compliance with regulations of payment organizations and switching organizations (limit, processing time, transaction fee,...). In addition, the foreign currency payment limit complies with the foreign exchange policy and foreign exchange management of the State Bank.

ACB issues regulations related to card security and use: Regulations on opening and using Accounts, Cards and Account Services (A1.66 KHCN-03.16), Card/PIN handover procedures at the request of customers customers (QP-7.166), Handling suspicious transactions of card-accepting units managed by branches/transactions, etc. In which specific instructions are provided (preservation of card blanks, card transfer, etc.) , transfer of personal passwords to customers, confidentiality of customer information ...), specific regulations on the responsibilities of related parties and forms of handling violations...

3.2.2 Card issuance activities at Asia Commercial Joint Stock Bank

Card issuance activities at ACB comply with the provisions of Vietnamese law, international card organizations of which ACB is a member and internal regulations of ACB.

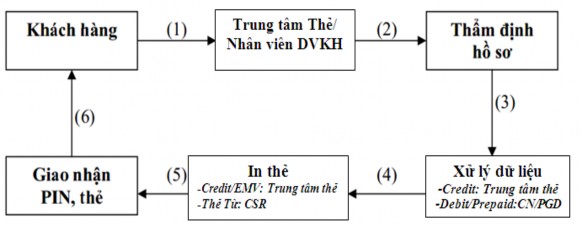

The order of card issuance at ACB is similar to the process shown in Figure 2.1 with the following overview: Individual/business customers wishing to use the service

Card service will fill in the Card Issuance Request Form (according to the form) and send it to the Customer Service Officer/ACB Card Center along with the card issuance file. Based on and received documents, Customer Service Staff/ACB Card Center conducts the appraisal and approval for card issuance to card customers. If the bank agrees to issue the card, ACB and the customer shall make additional necessary documents at ACB's request, complete the procedures (mortgage, blockade) on the collateral (In case of using credit card), sign a contract to use the card. After that, ACB will deliver the card and PIN to the customer, open a card account for the customer and manage the customer's card account. The procedure for issuing the supplementary card is similar to the procedure for issuing the primary card and the primary cardholder must be the person requesting the issuance of the card to the supplementary cardholder(s).

Issuing and delivering cards to customers directly at ACB Card Center or through issuing branches must ensure confidentiality and safety for customers, as well as avoid damage to ACB.

Figure 3.1 Card issuance process at ACB

Source: Internal documents of Asia Commercial Joint Stock Bank - Decision No. 20/2007/QD-NHNN Regulations on issuance, payment, use and provision of supporting services for bank card operations, 2007

3.2.3 Card payment activities at Asia Commercial Joint Stock Bank

Currently, in addition to cards issued by ACB, the bank accepts two types of international cards, MasterCard and Visa. This means that any card issued by any bank bearing the Visa or Mastercard brand is approved by ACB .