CHAPTER 2

OVERVIEW OF CARD SERVICE DEVELOPMENT AT COMMERCIAL BANK

In this chapter, the author presents theories related to the research topic and synthesizes previous research models. The author will present the concept and characteristics of banking services in general and card services in particular at commercial banks. In order to clarify the research topic, the author also presents the development of card services at banks, influencing factors and evaluation criteria for the development of bank card services.

To build a research model for the thesis, the author has researched and presented a summary of studies related to the development of bank card services by foreign and Vietnamese authors as a basis for model reference. research form for the thesis.

2.1 Overview of banking services

2.1.1 The concept of banking services

According to the General Agreement on Trade in Services (1997), “A financial service is any service of a financial nature performed by a financial service supplier of a Member. Financial services include all insurance and insurance-related services, and all banking and other financial services (except insurance)”.

According to David Cox (1997), "Banking service is the matching of all reasonable financial needs of all customers, it is a condition to ensure that banking business can be profitable. effective".

In summary, “Banking services are financial services associated with the bank's business activities, created by the bank in order to satisfy certain needs and desires of customers with the goal of seeking profit. , and only banks with its advantages can provide these services in the best way to customers”.

Maybe you are interested!

-

Developing card services at Asia Commercial Joint Stock Bank - 1

Developing card services at Asia Commercial Joint Stock Bank - 1 -

Developing card services at Asia Commercial Joint Stock Bank - 3

Developing card services at Asia Commercial Joint Stock Bank - 3 -

Developing card services at Asia Commercial Joint Stock Bank - 4

Developing card services at Asia Commercial Joint Stock Bank - 4 -

Developing card services at Asia Commercial Joint Stock Bank - 5

Developing card services at Asia Commercial Joint Stock Bank - 5

2.1.2 Characteristics of banking services

In a nutshell, DVNH has the following characteristics:

- Intangible banking services. However, not all of them are intangible as most of them are supported by tangible objects known as physical signs of the service.

- Banking services are seamless and inseparable. Inseparability arises from the service being processed or experienced and is an action that occurs at the same time as the cooperation between the customer and the bank.

- Banking services are heterogeneous and difficult to define. The quality of banking services is composed of many factors such as reputation, brand, technology, and staff qualifications. These factors affect quality but are often variable, making it difficult to determine precisely.

- Banking services carry two-way information flow. Banking is not simply a one-time purchase, but involves a frequent series of two-way transactions over a specific period of time.

- Diversified banking services, constantly developing. Banks try to develop in the direction of multi-purpose business, not simply providing traditional services as before.

2.1.3 Classification of banking services

2.1.3.1 Capital mobilization services

Capital mobilization service is a service that banks perform to attract temporarily idle capital from organizations and individuals in many forms with different interest rates and pay interest according to commitments to form a working capital of the bank.

2.1.3.2 Credit granting services

Credit extension service is a service in which a bank agrees to an individual or organization to use an amount of money or commits to allow the use of an amount of money according to the principle of repayment. Including the following services: Lending, financial leasing, discount, guarantee, factoring...etc.

2.1.3.3 Payment service

Payment service means a service where the bank will provide payment means, perform domestic and international payment transactions, collect and pay on behalf of the bank and other services prescribed by the State Bank. of service providers at the request of payment service users.

This service occupies an extremely important position in the operation of commercial banks, it minimizes cash payments and facilitates the development of other services of commercial banks.

2.1.3.4 Other services

In addition to the services presented, commercial banks also provide other services: import/export financing, issuance of guarantee certificates, verification of financial capacity, remittance, tax collection, services, insurance .

2.2 Card service overview

2.2.1 Bank Card

2.2.1.1 Concepts

The current monetary rationale does not have an exact definition of a card, but we can simply understand "A card is a payment instrument issued by a card-issuing bank to a customer to use to pay for goods and services. service or withdraw cash within your balance at your deposit account or credit line granted under the contract signed between the card issuer and the cardholder.”

2.2.1.2 Classification of bank cards

- According to the nature of card payment

- Credit card is a type of card where the cardholder is allowed to use a specified credit limit to buy goods, services, etc.

- Debit card is a card directly related to the cardholder's deposit account. Payment transactions will be immediately deducted from the cardholder's account and immediately credited to the merchant's account. Debit cards can be classified into on-line or off-line based on the time the transaction value is deducted from the cardholder's account.

- Prepaid card is a type of card that allows the cardholder to make card transactions within the amount of money loaded into the card corresponding to the amount that the cardholder has prepaid to the card issuer. Prepaid cards are not necessarily connected to a checking account and can be divided into both identity and anonymous types.

- According to the specification

- Magnetic tape cards are manufactured with magnetic tape containing information on the back of the card.

Smart Card : A card with an electronic "chip" that contains information with a computer-like structure.

- According to the criteria of the issuer

- Bank-issued card is a card that customers use their account at the bank, or use the amount of credit granted by the bank.

Cards issued by non - banks: Travel and entertainment cards issued by large business groups such as Dinner Cub, Amex...etc.

- According to the scope of use:

- Domestic card: card limited to use within a country.

- International card: A payment card used globally and supported and managed by major companies such as Master Card, Visa...etc.

2.2.2 Card Service

2.2.2.1 Concepts

Card service is a type of service that belongs to the group of retail services, also known as personal services of banks. This is a service in which a bank will provide customers with payment tools (cards), so that customers can use the convenient features that the bank provides through payment tools. this.

Besides, according to the author, from the perspective of satisfying customer needs, card service can be defined as "a card service is a collection of features, features and utilities created by the card for customers. to satisfy certain needs and wants of customers in the financial market”

2.2.2.2 Card service classification

- Card issuance service

The process of issuing bank card service is overviewed through the following steps:

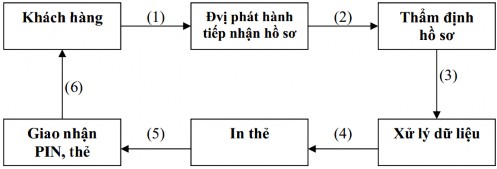

Figure 2.1. Card issuance process

Source: Dr. Le Thi Man, 2014

Step 1: Customers wishing to open a card and use card services go to the bank to request card issuance. At the issuing bank, the customer requests to open an account, issue a card, and here completes some necessary procedures with valid documents as required by the bank and the conditions for using the service.

Step 2: The card issuer (bank) receives the customer's profile. In this step, the bank's representative receives and preliminarily checks the customer's profile. If the customer's profile is complete, it will proceed to the application appraisal step.

Step 3: Verify the profile and classify customers. In this step, the bank will check, appraise and classify customers. In the case of a debit card, card issuance is simpler when the customer already has an account at the bank. The remaining case is to issue a credit card, the bank needs to check more closely and classify customers.

Step 4: Based on the appraisal results, the bank will decide to provide the appropriate service to the customer. The customer's data file is updated on the system and sent to the card printing processing place. Depending on the bank's regulations and card classification, card printing can be done at the customer's request-receiving unit or the bank's card-issuing center.

Step 5: Using the technology of the issuing bank, the card will be written with the cardholder's necessary information on the card's surface, and encrypt and assign a personal number (PIN) to the cardholder.

Step 6: Next, when the bank delivers the card to the customer, it will include a PIN code and the cardholder keeps it a secret for himself. And at this stage, it is considered the end of the card issuance task of the bank when the customer has received the card with the PIN.

- Card payment service

Card payment activities in each country and each bank are different in terms of procedures and conditions, due to many binding factors such as law, politics, level of intellectual development or economic conditions. socio-economic. In general, it includes the following basic contents:

(4)

(5)

Issuing bank

International card organization

Card holder (card holder)

(4)

(3)

Providing goods and services

Use card to pay for goods

service

(first)

(5)

(2)

(2) (4)

(5)

Bank payment

Card merchant or correspondent bank

(2) Licensing

(4) Request for payment

Figure 2.2. Card payment process

Source: Dr. Nguyen Minh Kieu, 2007

Step 1: When the cardholder uses the card to pay for goods and services or withdraw cash at the merchant, the agent will have to check the solvency of the card by asking for the payment bank's approval.

Step 2: If there is no problem with the card, the issuing bank will approve the payment and notify the merchant.

Step 3: Merchant will then ask the cardholder to sign the invoice (make sure the signature on the invoice must be the same as the signature on the card) and provide goods, services or cash advance to the customer.

Step 4: Merchants request to receive payment from the paying bank after returning the invoice to the bank (if it is a card machine), or after summarizing it on the electronic card reader and a sum is deducted. Dealer discount. The paying bank will collect money from the issuing bank through an international card organization (in case the issuing bank and the paying bank are not in the same system), the of international card organizations is to debit the account of the issuing bank and credit to the paying bank. Every month on the date of the transaction notice, the issuing bank receives a detailed statement of the cardholder's activities during the period, then the bank makes a transaction notice and sends it to the cardholder to request payment. .

Step 5: Review the monthly transaction notice. The cardholder makes payment to the issuing bank to make the payment back to the international card organization and the bank.

2.2.3 Risks in card service business

2.2.3.1 Risks in the issuance stage

- Application for issuance with fake information: The bank may issue a card to a customer with fake information due to lack of due diligence, leading to credit risk when the cardholder using the card loses his/her ability to pay. pay their expenses, or commit fraud.

- Counterfeit cards: Cards forged by criminal organizations or individuals based on information obtained from card transaction documents or stolen or lost cards.

- Cardholder does not receive the card: This risk arises when the issuing bank sends the card to the cardholder by post but the card is stolen on the way. The card is used while the cardholder is unaware that the card has been sent to him.

- Cardholder's account is taken advantage of: This risk arises when the bank sends the card to a fake address that is not the request of the genuine cardholder. Cardholder's account is taken advantage of by others.

2.2.3.2 Risks in the payment stage

- Card stolen or lost: The card is stolen or lost and is used by another person before the cardholder can notify the issuing bank to take measures to limit the use or withdraw the card.

- Creating fake magnetic tape: This is a type of fake card transactions using high technology on the basis of collecting information on magnetic tapes of payment cardholders at card-accepting establishments.

- Moral risk: This risk arises when the merchant has intentionally printed out many sets of card payment invoices, but only delivered one set of invoices to the cardholder to sign for payment. After that, the overprinted invoice will be forged with the customer's signature to request the bank to pay.

- In addition to the above main risks, there are a number of other risks related to the management of the data processing system and the administration of the technical system. In short, the bank card business contains a lot of risks, so in order to reduce loss and maximize income, banks need to focus on risk prevention.

2.2.4 Benefits of card service

2.2.4.1 For the economy

Card service eliminates a very large amount of cash that should be circulated directly in circulation to pay for purchases and services in an increasingly vibrant and developing market mechanism in all areas. In all countries, this type of payment does not require a lot of paperwork. Therefore, it will save a significant amount of printing costs, costs of preservation, transportation... With pictures

This modern, fast, safe and effective payment method will promote the development of the economy and help the state manage the economy in terms of both micro and macro.

2.2.4.2 For cardholders

Cardholders can safely, securely and conveniently use their cards to pay for goods and services, to withdraw cash or to receive some banking services at establishments that accept card payments. ATMs, domestic and foreign card payment banks. When using a payment card, the cardholder can spend first, pay later (for credit cards), or can carry out shopping and selling services at home...

In addition, when using a credit card, it can help customers flexibly adjust their spending in a reasonable manner in a certain period of time with a credit limit, creating favorable conditions for consumption and daily life. as well as production.

2.2.4.3 For merchants accepting cards

Providing services that accept card payments helps agents sell more products, thereby increasing sales, reducing selling costs, and increasing profits. At the same time, accepting card payments contributes to making the place of sale civilized and modern, creating a comfortable feeling for customers when making transactions, attracting more customers to the store. Sales proceeds are transferred directly to a bank account, making it safer and more convenient in financial and accounting management.

2.2.4.4 For banks

By participating in card payments, the card issuer can diversify its services, attract new customers to the card service and other services provided by the bank, while keeping get old customers. On the other hand, through issuing activities, bank card payment can attract a large source of capital to supplement short-term capital from fee and interest collection activities brought by card issuance.

As for banks that accept cards, card services will help attract more customers to their bank and use the products provided by the bank. Thereby increasing revenue and profit through collection of agency discount fees from agent payment activities.

2.3 Development of card services at commercial banks

2.3.1 Concepts

According to the materialist conception in Marxist-Leninist philosophy: "Development is the movement in the upward direction, from low to high, from simple to complex, from incomplete to perfect of things. Besides, according to Development Economics: "Development represents quantitative change and qualitative change".

Thus, the development of banking services refers to the change in both quantity and quality. From the concept of "banking services are financial services created by banks to satisfy certain needs and desires of customers with the goal of seeking profit, and only banks with the advantage of only it can provide these services in the best way to customers”, the author introduces the concept of developing banking services as follows:

“Development of banking services is an increase in the number of services provided by the bank, the network of operations and the utility of the product; improve the quality of each type of service to best satisfy the needs of customers”

Card service is a type of service that belongs to the group of retail services (personal services) of a modern bank. The development of card services is associated with the development of banking services.

Therefore, according to the author, “Development of card services is an increase in the number of card products offered by the bank, its accompanying features, and additional utilities of the card product; improve the quality of card services in order to best satisfy the needs of customers using the bank's card services”

Contents of card service development at commercial banks include:

- Expanding the scale of card services by expanding the audience of customers according to any age, gender, level, income, aiming and expanding the scope of implementation not only to the people of the city but also to the people of the city. districts, towns...

- Developing card categories in the direction of diversifying card products to suit customers' needs, adding more conveniences to ATM cards and issuing more payment cards other than existing ones.

- Improve the quality of card services by investing in more facilities and information technology to provide fast services; reduce the complexity of card issuance and payment processes; improve the ability to meet customer needs; increase the reliability or satisfaction of customers about card services; Risk management in card issuance and payment operations.

2.3.2 Factors affecting card service development

2.3.2.1 The group of factors belonging to the economic environment

- People's level of education and habit of using cash of the people

People's cash habits have a great influence on the development of cards, especially in the card payment process. A market where people still only have the habit of spending in cash will not be a good environment to develop the card market. Only when the payment is made mainly through the banking system will the payment card really promote its full effectiveness.

- Personal income

High income means higher purchasing power. At that time, people's needs are not merely the purchase of essential goods, but they must achieve maximum material and spiritual utility. The payment card will be a convenient and safe means of payment to meet their needs.

- Legal environment

Card service business in any country is conducted within a certain legal framework. The card regulation creates a common legal environment for specific operations in the card service business to suit the market situation and the conditions of each bank.

- Science and technology level

The scientific and technological development of a country will have a great influence and determine the quality of payment services and card issuance. The higher the technology level, the better the service quality, the higher the security, thus attracting a large number of card users.

- Competitiveness of the market

This is a decisive factor to the expansion and contraction of a bank's market share when participating in the card market. If there is only one bank in the market providing card services, that bank will have a monopoly advantage, but the fees can be very high and the interests of cardholders are difficult to be guaranteed. But when more banks join the market, competition becomes more and more fierce, it will contribute to the development of service diversification, reduction of card issuance and payment fees, and therefore also guaranteed cardholder's interests. .

2.3.2.2 Group of factors belonging to the bank

- Card's utility

The use of cards as a payment tool makes it easier and more convenient for consumers to make purchases. Today, the needs of customers are increasingly diverse, requiring a card with many necessary utilities will affect customers' decision to choose to use the service. This has a significant impact on the development or decline of the market share of banks providing card services.

- Brand of the bank

Issuing bank must have a large scale of operation and high reputation not only in the domestic market but also in the international market, having a relationship as an official member of international card organizations. In the world, there is a system of fast, modern and safe updating facilities. Only then will the bank's card services be able to compete strongly in the market.

- Technological infrastructure of the Bank

Card payment is associated with high-tech equipment, including: highly secured internal computer network, Telex machine, telephone, ATM, receipt machine, EDC licensing machine... If there is any malfunction in this mechanical system, it will cause unpredictable consequences, causing great damage not only to the system of facilities and equipment but also to the reputation of the bank. Therefore, the application of new and most advanced technologies in card business is essential for banks.

- Marketing orientation and policies of the bank

Each payment card business bank must build its own appropriate card product marketing plan and strategy. That strategy is built on the basis of investigation and survey of target customers; technological environment; competitive environment; the bank's own resources. Each bank's strategy in turn affects the development and level of competition of the card market itself.

Through marketing policies, the bank will introduce its card products, from which more people will know about the bank's card products, stimulate customers to use the card, and attract customers. In particular, increasing the bank's prestige and image in the market.

- Quality of human resources

Card-related service is a new and modern service with many benefits but also many risks, so the card service staff needs to be dynamic and creative. Capable, dynamic and experienced staff is one of the important factors for the development of card services. Cards cannot develop on their own if only based on technology and utilities, which is a very important factor that is human. Any bank that has a reasonable human resource training policy will have the opportunity to accelerate the development of the card business in the future.

- Network of ATMs and card payment merchants

The more ATMs are installed, the wider the merchant network is, the more favorable conditions are created for customers, and the convenience of card products also increases. From there, the bank will attract more customers to use the card.

The number of merchants plays an important role in card payment operations, acting as a bridge between payment activities between banks and cardholders. If in an environment that does not exist a diverse and quality merchant network, it will not be possible to guarantee the "supply" to stimulate people at home and abroad to use the card.

- Risk management in card payment

Along with the strong development of card business, criminal activities related to this field are increasing, sophisticated and difficult to detect. Therefore, risk management activities of banks in the field of international payment card payment are very important. Good card risk management not only limits financial losses, but also protects the interests of customers and enhances the reputation of the bank.

2.3.3 Evaluation criteria for card service development

2.3.1.1 Quantitative indicators

- Diversity of cards issued

Currently, the needs of customers are very diverse and rich, so banks are making efforts to launch many new card products with many utilities, diverse features, beautiful and unique forms. The more diversified card products are, which better meet the needs of customers, the more and more cards are issued, which increases the bank's market share. Thus, it can be said that increasing the diversity of card products will directly affect the number of cards issued by the bank, thereby helping the bank's card services to develop more and more.

- Number of cards issued and customers using cards

The number of customers using the card and the number of cards issued are not the same. In the current trend, a customer can use many types of cards at the same time, some of which are used with more frequency (can be considered as "main" card), with these cards, Banks will have more income. Thus, the bank's goal is not only to increase the number of customers using the card and paying by card, but also to let the cards issued by the bank be used as the "main" cards. of cutomer. The number of customers constantly increasing along with the number of cards issued is also the goal of any bank, it is one of the criteria to evaluate the development of card services of the bank.

As the financial market in general and the bank card market in particular grow, the competition between banks is increasingly fierce. Main

Therefore, to attract customers, banks often have advertising policies so that the number of cards of the bank is held as much as possible. The higher the number of cards issued, the more proof that the bank's card services can meet the needs of customers. At the same time, the more cards are issued, the higher the bank's income and vice versa. Therefore, the increase in the number of cards, the increase of customers, the loyalty of customers in using the bank's cards is one of the important criteria that every bank is aiming for.

- Rate of active cards

In card business, the statistics of the number of cards issued do not mean the number of cards in circulation and in actual use. It can be understood that an inactive card or a "non-active" card is a card that has been issued but has no withdrawal and top-up transactions for a long time after opening an account or in the account with only sufficient balance at Minimum to maintain the card. Cards that do not work cause waste of resources of the bank, cost of marketing, issuance and management costs of card business for the bank. Therefore, the ratio of active cards is one of the criteria to evaluate the performance of banks' card business.

- Deposit balance on customer's card account

Deposit balance on the card account is the amount that the cardholder deposits at the bank to ensure the payment of goods and services. The bank can use it for business activities and guarantee payment for this amount.

Cardholders with large deposit balances are also financially capable cardholders, reaching these customers is the success of the bank. Therefore, the deposit balance on the card account (absolute or average number per card) is also one of the criteria showing the development of the bank's card service.

- Card payment sales

Card payment turnover is the total value of transactions paid by card at merchants and cash advance at cash withdrawal points. The higher this sales, the more customers put their trust in the card service and its convenience and safety. Through which the entities providing this service