However, the use of quality and distance models as a basis for assessing service quality is also controversial (Carmen 1990, Cronin & Taylor 1992). From the experimental research results, Cronin & Taylor (1992) with the SERVPERF scale, said that the perceived level of customers towards the service performance of the enterprise best reflects the service quality. According to the SERVPERF scale:

Service quality = Perceived level

From the experimental research results, Cronin and Taylor (1992) concluded that the SERVPERF scale performed better than any other service quality measurement tool. The superiority of the SERVPERF scale compared to the SERVQUAL scale has been demonstrated in many studies by authors such as McAlexander et al., 1994; Hahm et al., 1997; Avkiran (‘BANKSERV’), 1999 and most recently Lee et al., 2000; Brady et al., 2002.

The SERVPERF scale also uses the same statements as the questions and feelings of customers in the SEVQUAL model, omitting the question about expectations.

The SERVPERF scale was introduced by the authors Cronin & Taylor (1992) based on overcoming the difficulties when using the SERVQUAL scale with 5 service quality components:

1. Tangible means

2. Trust

3. Respond

4. Service capacity

5. Sympathy

Since it comes from the SERVQUAL scale, the components and observed variables of this SERVPERF scale are kept as SERVQUAL. This measurement model is called the perceptual model.

1.5.2. Proposed research model

Accordingly, inheriting from the research related to service quality in the banking sector of the authors, the previous scientists, after analyzing the models related to SERVQUAL, SEVPERF model, I found that the SEVPERF model is quite suitable for the current situation and research scale of the topic, so I decided to choose the SEVPERF model as the research model in this topic.

| Vehicle material | |

| Reliability | |

| Ability to meet | ->Evaluate the quality of lending services for individual customers at National Commercial Joint Stock Bank, Hue branch |

| Service capabilities | |

| Level of sympathy |

Maybe you are interested!

-

Evaluation of loan service quality for individual customers at National Commercial Joint Stock Bank - 1

Evaluation of loan service quality for individual customers at National Commercial Joint Stock Bank - 1 -

Evaluation of loan service quality for individual customers at National Commercial Joint Stock Bank - 2

Evaluation of loan service quality for individual customers at National Commercial Joint Stock Bank - 2 -

Overview Of Services, Service Quality And Service Quality Of Banking

Overview Of Services, Service Quality And Service Quality Of Banking -

Situation Of Assets And Capital Of National Commercial Joint Stock Bank Hue Branch For The Period 2015-2017

Situation Of Assets And Capital Of National Commercial Joint Stock Bank Hue Branch For The Period 2015-2017 -

Evaluation Of The Quality Of Lending Services For Retail Customers At National Commercial Joint Stock Bank , Hue Branch

Evaluation Of The Quality Of Lending Services For Retail Customers At National Commercial Joint Stock Bank , Hue Branch -

Evaluation of loan service quality for individual customers at National Commercial Joint Stock Bank - 7

Evaluation of loan service quality for individual customers at National Commercial Joint Stock Bank - 7

Figure 1.3: Research model of the topic

The research hypothesis is stated as follows:

– Hypothesis H1: Tangibles factor has a positive influence on the quality of lending services for individual customers.

– Hypothesis H2: Reliability factor has a positive influence on service quality of personal loans

– Hypothesis H3: Responsiveness factor has a positive influence on service quality for individual customers.

– Hypothesis H4: The service capacity factor has a positive effect on the quality of lending services for individual customers.

– Hypothesis H5: Factor Level of sympathy has a positive influence on service quality of personal loans.

Building a scale

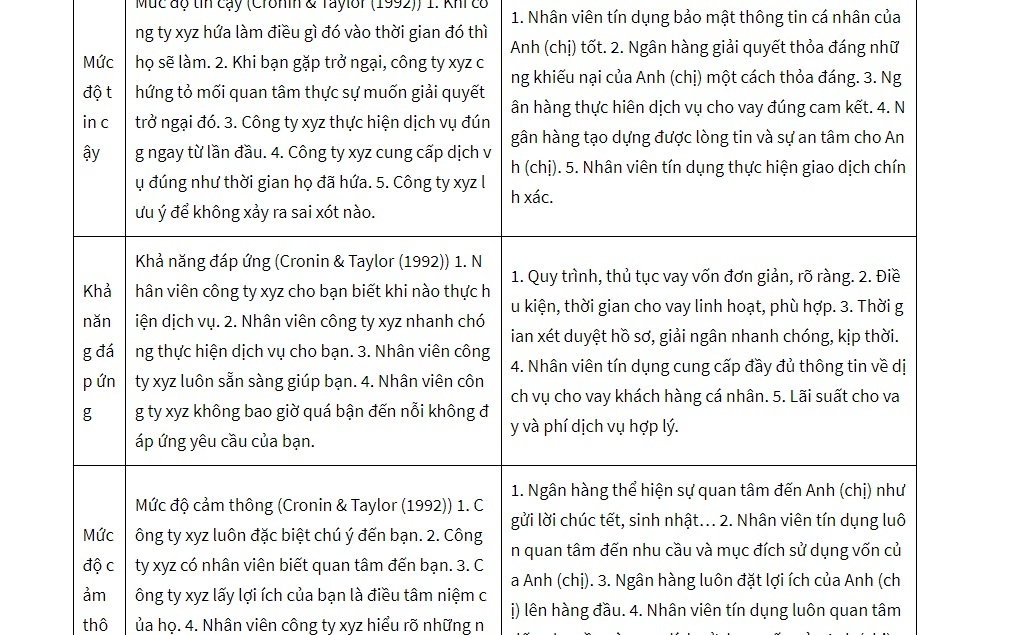

Table 1.1: Original scale and correction scale

| Ingredient | Original scale | Calibration scale |

| Vehicle material | Direction tangible convenience (Cronin & Taylor (1992)) first. Company xyz has a favorable location. 2. Company xyz has equipment machine Modern hook. 3. The facilities of company xyz look Stunning. 4. Books, introductory photos of labour ty xyz is related to translation service looks very nice. 5. Employees of company xyz dress up tidiness. | first. Bank with delivery location Translate convenient. 2. The bank has facilities, Page modern equipments. 3. Banks arrange delivery counters Translate, reasonable signs and favorable convenient. 4. Bank staff have a page compact neat and polite. |

| Service capabilities | Capacity serve (Cronin & Taylor (1992)) first. Employee behavior xyz cause fun believe for you. 2. You feel safe while transaction with company xyz. 3. Employee of company xyz always attentive with you. 4. Are employees of xyz company enough? understand know to answer your question. | first. The bank responded in a timely manner, full the amount borrowed from you. 2. The credit officer handled it in a timely manner time, the full amount of the British loan (older sister). 3. Credit officer answers all questions Brother’s (sister’s) problem. 4. Knowledgeable Credit Officer full about products and services service Bank. 5. Banks have hotlines serve |

| Trust level | Level reliable (Cronin & Taylor (1992)) 1. When What does xyz company promise to do? that in that time they will. 2. When you have a problem, company xyz evidence show genuine concern would like solve that obstacle. 3. Company xyz performs the service correct from the very first time. 4. Company xyz provides service correct as the time they promised. 5. Company xyz takes note not to happen out wrong what a pity. | first. Security Credit Officer pine your personal information (sister) good. 2. Satisfactory settlement bank worth British complaints (older sister) satisfactorily. 3. Bank performing the service give loan as promised. 4. Banks create hearts believe and peace of mind for you. 5. Credit officer performed transaction exactly. |

| Ability to meet | Possibility responsiveness (Cronin & Taylor (1992)) first. Company staff xyz for you know when to perform the service. 2. Fast xyz company employees quickly perform services for you. 3. Company employees xyz are always available ready help you. 4. Employees of company xyz do not when too busy to answer application your request. | 1. Rules simple loan process and procedures simple, clearly. 2. Article conditions, loan period sacred active, suitable. 3. Time application review time, solution echo Fast, timely. 4. Credit officer provided full service information for get a loan individual customers. 5. Interest loan rate and service fee fit physical. |

| Level of sympathy | Level sympathy (Cronin & Taylor (1992)) first. Company xyz always pay special attention to you. 2. Company xyz has employees who know Mandarin care about you. 3. Company xyz take your benefit is the thing their thoughts. 4. Employees of xyz company understand well NS Your Needs. 5. Company xyz works on hour convenient. | first. Banks show their importance care about You (sister) like to send a message Happy New Year, birthday… 2. Credit officers are always important care about needs and purposes capital use of brother (sister). 3. The bank always puts the interests of Brother (sister) to the top. 4. Credit officers are always important care about needs and purposes capital use of brother (sister). 5. Bank staff serving equal for all guests row when it comes to the transaction. |

Source: Author’s own compilation

CHAPTER II. THE SITUATION OF LIVING SERVICE QUALITY FOR PERSONAL CUSTOMERS AT NATIONAL COMMERCIAL BANK HUE BRANCH.

2.1. Introduction about National Commercial Joint Stock Bank

2.1.1. General introduction about National Commercial Joint Stock Bank

2.1.1.1. History of establishment and development of National Commercial Joint Stock Bank

The predecessor of National People’s Commercial Joint Stock Bank was named Nam Viet Commercial Joint Stock Bank (Navibank), established in 1995 under the certificate number 0005/NH_CP dated September 18, 1995 with the original name of Song Kien Commercial Joint Stock Bank in Kien Giang province. with charter capital of 3 billion VND. With the starting point of Rural Commercial Joint Stock Bank, the Bank’s main activities are mainly focused on agricultural credit for customers who are farmers throughout Kien Giang province.

By 2004, the Bank’s charter capital was only 1.5 billion dong, overdue debts were increasing, leading to the Bank’s risk of bankruptcy and having to be under special control. After that, large enterprises such as Vietnam Textile and Garment Group, Gemadept Shipping Union Joint Stock Company, Tan Tao Industrial Park Joint Stock Company, Kinh Bac Development Joint Stock Company, etc., participated in investing in the Bank. .

In 2006, with the approval of the State Bank of Vietnam, the Bank transformed its operating model from Rural Commercial Joint Stock Bank to Urban Commercial Joint Stock Bank operating in the financial-monetary sector, from then on. The Bank’s activities had a breakthrough, reflected in the rapid and stable growth in terms of total assets, network and operating area, charter capital and business performance. In 2006, Navibank’s charter capital was 3,000 billion VND.

However, Nam Viet Bank had major problems in risk management, the management and administration system was not synchronized, and the allocation of resources was inefficient. Therefore, when the Vietnamese economy was in crisis, Nam Viet Bank fell into a difficult situation and only restructuring could help the Bank to really change and develop. Faced with that situation, Nam Viet Commercial Joint Stock Bank proposed to the State Bank to allow self-restructuring based on available resources. In early 2014, the beginning of a new development phase. Nam Viet was changed to a new shirt with the name of National Citizen Commercial Joint Stock Bank (NCB). Over 20 years of operation, National People’s Commercial Joint Stock Bank has affirmed its position in the financial-currency market.

Figure 2.1: Logo of National Commercial Joint Stock Bank

Source: Customer Relations Department of NCB-Hue Bank

– Full name: National Commercial Joint Stock Bank

– International name: National Citizen Bank

– Short name: NCB

– Head office: No. 28C-28D Ba Trieu street – Hang Bai ward – Hoang Kiem district, Hanoi.

– Phone: (84.24) 62693535

– Email: ncb@ncb-bank.vn

– Website: http://www.ncb-bank.vn

2.1.1.2. The process of formation and development of National Commercial Joint Stock Bank Hue branch

On August 10, 2009, National People’s Commercial Joint Stock Bank (NCB) officially opened Thua Thien Hue branch at 44 Dong Da, Hue city, Thua Thien Hue province. Licensed for establishment under Decision No. 1700169765 issued by Business Registration Office – Department of Planning and Investment of Thua Thien Hue on 22/07/2009. Phone: (0234) 3840999, Fax: (0234) 3840999. With the goal of becoming a financial fulcrum for customers, NCB Thua Thien Hue branch provides a full range of deposit and lending services (production) business, consumption), domestic and foreign payments… with the highest accuracy, safety and security. Especially, with the support of the information technology system, NCB Bank – Thua Thien Hue branch is connected online with all the different transaction points in the system to track customers can transact at at any NCB transaction point nationwide. Currently, NCB – Thua Thien Hue has opened 2 more transaction offices:

– Tay Loc Transaction Office, No. 116 Nguyen Trai, Tay Loc Ward, Hue City.

– Dong Ba Transaction Office, No. 271 Tran Hung Dao, Hue City.

In the new period of operation, NCB Hue Branch encountered many difficulties and challenges: as the Bank opened a branch in Hue later than some other joint-stock commercial banks, it was not known by many Hue people. In addition, the fear of reputation and trust in a new bank is also a difficulty that the branch needs to face, finding the market is also under competitive pressure from other banks. . However, with its efforts and customer policies, NCP-Hue Bank has removed the initial difficulties, gradually created a good image and consolidated trust and prestige in the hearts of people. people.

With a team of young, dynamic, professional financial resources, interested in more subjects of science and technology, dedicated to serving customers, businesses have brought to customers financial solutions with good costs.

2.1.2. Organizational structure and functions

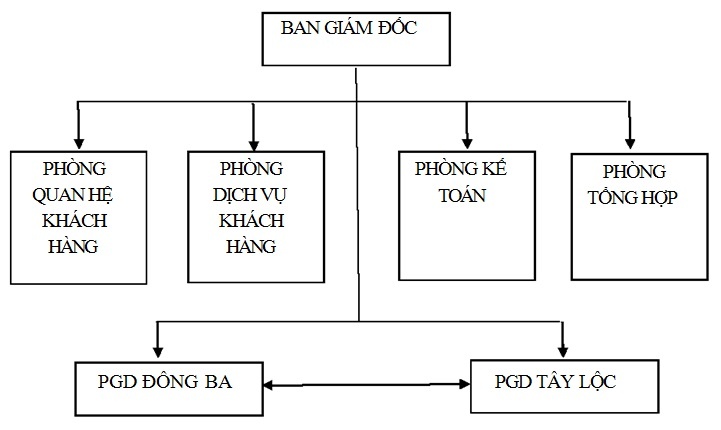

Figure 2.2: The management apparatus of National Commercial Joint Stock Bank – Hue branch

Source: Customer Relations Department of NCB-Hue Bank

Functions and duties of departments:

– The Board of Directors: is the highest leadership department and has the right to decide on all matters in the Bank, to take control and take all responsibility for the Bank’s operations in accordance with the Bank’s plans and targets.

– Customer Relations Department: has the function and task of researching and building credit customer strategies, appraising and proposing loans to borrowers, regularly monitoring, checking and controlling the use of credit. loans, recover loans, analyze business activities of the borrowers, select the safest and most effective lending measures.

– Accounting Department: directly accounting operations, accounting reports of branches, treasury, performing revenue and expenditure operations according to the decision of the leader or authorized person.

– Customer service department: disbursing loans and providing loans to customers based on approved documents, and at the same time opening deposit accounts for customers. Perform transactions such as deposit, withdrawal, payment, foreign currency transaction… and be responsible for handling customer needs.

– Transaction offices: operate like fast payment but with small scale, under the management and administration of the branch.

2.1.3. Main credit products and services

2.1.3.1. Credit products for individual and household customers

– Loans to buy business cars.

– Additional loans for working capital for production and business.

– Loans to purchase machinery and equipment, invest in factories.

– Loans to supplement working capital with medium and long-term installments.

2.1.3.2. Credit products for corporate customers

– Loans to finance import-export enterprises.

– Financing the production and processing of export goods.

– Loans to construction enterprises.

– Loans for implementation of housing projects and residential land. – Credit product package for car businesses.

– Loans to invest in cars with transport businesses.

2.1.4. Overview of the operation of National Commercial Joint Stock Bank Hue branch

2.1.4.1. Labor force situation of National Commercial Joint Stock Bank Hue branch in 2015-2017

Table 2.1: Labor situation of National Bank Hue branch

| Targets | 2015 | 2016 | 2017 | 2016/2015 | 2017/2016 | |||||

| SL | % | SL | % | SL | % | +/- | % | +/- | % | |

| total number of employees | 51 | 100 | 65 | 100 | 68 | 100 | 14 | 27.45 | 3 | 4.62 |

| 1. Segmentation by gender count | ||||||||||

| male | 24 | 47.06 | 30 | 46.15 | 28 | 41.18 | 6 | 25.00 | -2 | -6.67 |

| Female | 27 | 52.94 | 35 | 53.85 | 40 | 58.82 | 8 | 29.63 | 5 | 14.29 |

| 2. By level specialize | ||||||||||

| On the big learn | 6 | 11.76 | 7 | 10.77 | 8 | 11.76 | first | 16.67 | first | 14.29 |

| Grand school and college | 37 | 72.55 | 48 | 73.85 | 50 | 73.53 | 11 | 29.73 | 2 | 4.17 |

| Intermediate | 4 | 7.84 | 5 | 7.69 | 5 | 7.35 | first | 25.00 | 0 | 0 |

| Labor Common | 4 | 7.84 | 5 | 7.69 | 5 | 7.35 | first | 25.00 | 0 | 0 |

| 3. By nature Work | ||||||||||

| Labor live | 41 | 80.39 | 58 | 89.23 | 60 | 88.24 | 17 | 41.46 | 2 | 3.45 |

| Labor Indirect | ten | 19.61 | 8 | 12.31 | 8 | 11.76 | -2 | -20 | 0 | 0 |

| 4. Sort by degrees the age | ||||||||||

| Are from 18 to 30 years old | 28 | 54.90 | 35 | 53.85 | 38 | 55.88 | 7 | 25.00 | 3 | 8.57 |

| Are from 31 to 50 years old | 21 | 41.18 | 28 | 43.08 | 28 | 41.18 | 7 | 33.33 | 0 | 0 |

| From 50 age or older | 2 | 3.92 | 2 | 3.08 | 2 | 2.94 | 0 | 0 | 0 | 0 |

Source: Customer Relations Department of NCB-Hue Bank

From Table 2.1, we can see that the Bank’s labor situation has changed over the years. Specifically, in 2015 there were 51 people. In 2016 increased to 65 people and in 2017 increased by 3 people to 68 people.

In terms of gender

The number of male employees in 2016 was 30 people, an increase compared to 2015 of 6 people, equivalent to 25%. By 2017, the number of male workers decreased by 2 people to 28 people, equivalent to 6.67% compared to 2016.

The number of female employees has steadily increased year by year. Specifically, in 2015 there were 27 people, equivalent to 52.94%, in 2016 there was an increase of 8 people, corresponding to 53.85%. In 2017, it increased by 5 people, equivalent to 58.82%.