When lending to individual customers to serve production and business needs, commercial banks have contributed to promoting economic development such as reducing unemployment rate, creating production capacity for household goods. The number of households is increasing, the household economy is growing day by day, creating jobs and improving people’s living standards.

1.3. Overview of services, service quality and service quality of Banking

1.3.1. Service concept

Philip Kotler defines a service as: “A service is any action and result that one party can provide to another that is essentially intangible and does not result in the ownership of anything. Its product may or may not be tied to a physical product”.

Assoc. Prof. Dr. Nguyen Van Thanh said that: “Service is a creative labor activity to add value to the material part and diversify, enrich, differentiate, excel… which is the highest. become brands, business cultures and high satisfaction for consumers so that they are willing to pay high, thus doing business more effectively”.

Thus, service is a creative activity of people, an activity with specific characteristics of people in a developed society, with high competition, a factor in technology, transparency in law. and government policy.

1.3.2. Basic features of the service

Customer involvement in the service process: The presence of the customer as a participant in the service process requires attention to the design, location, and facilities, and the customer can become an integral part of the service process. in the service process.

Intangibility or immateriality: For services, customers cannot see, taste, hear or smell them before consuming them.

Simultaneous production and consumption of services: The production process, associated with the consumption of services or products and services produced and consumed at the same time. The simultaneous production and consumption of services eliminates many opportunities for quality control.

Perishability: A service is difficult to stock, it is lost when not in use.

Heterogeneity: Non-standardized products and services, service delivery depends on technology, the ability of each performer and depends on customer perception.

1.3.3. The role of the service

Services play an important role in the social life and economic activities of people. Services are the bridge between “input” and “output” in the production process, promoting a dynamic and efficient economy. It is the birth and development of transport services such as road, air and sea transport that have contributed to overcoming geographical obstacles, speeding up the circulation of goods, and boosting the demand for trading. , the exchange of goods from one country to another. Banking services also enable the payment process to take place in an efficient manner, helping both exporters and importers to achieve the purpose of their trading relationship. Telecommunications and information services also play a supporting role for commercial activities in stimulating demand and shortening the time for consumers to make purchasing decisions. Services such as agency services, trading and retailing act as intermediaries between producers and consumers; at the same time, contributing to speeding up the process of goods consumption, shortening the time of goods in circulation.

Development services promote social division of labor, meeting the increasingly diverse needs of society. Through the purchase and sale of goods and services on the market, the consumption capacity, increasing consumption and enjoyment levels of individuals and businesses also increase, contributing to promoting production and expanding the labor market. Services also create many jobs, attract a large amount of labor force in society, thereby reducing the unemployment rate. Development services change the economic structure towards the optimal direction. Service development in the commercial sector has the role of stimulating demand and serving customers better.

1.3.4. The concept of service quality

According to the International Organization for Standardization ISO8402 (TCVN 5814-94) has defined: “Quality is the totality of characteristics of a product or service that have the ability to satisfy set requirements. or latent.” Or in the draft DIS 9000:2000 gave the following definition: “Quality is the ability of a set of characteristics of a product, system or process to satisfy requirements of customers and other interested parties. relate to.”

1.3.5. The concept of banking service quality

When society is increasingly developing, customers are not only interested in the price but also the service quality of that product. Banking service quality is an abstract concept, depending on each time and under certain conditions.

According to the NH Institute of Science (1999): “Banking service quality is the capacity of the Bank, provided by the Bank and expressed through the degree of satisfaction of the needs and desires of the target customers.”

Most customers coming to the Bank will have certain expectations. That expectation can be formed by word of mouth, from individuals and from the customer’s own experience. Banks cannot change customers’ expectations but can only find ways to satisfy customers. Service quality is perceived by the customer, not by the Bank. The quality of banking services reflects the ability to meet, or even exceed, customers’ expectations and should be maintained on a regular and consistent basis.

1.4. Factors affecting loan quality for individual customers at commercial banks

1.4.1. Subjective factors

From the customer side

– Professional nature of individual clients

Occupational nature and life stability of science and technology have a great influence on the quality of loans of science and technology. If the job is stable, there is little occupational risk or the possibility of unemployment is low, the quality of the loans will be high.

– Qualification of individual customers

The level of science and technology, especially the management level, will also affect the quality of loans used for production and business. Usually, lending science and technology to serve production and business, the level of risk is quite high because of poor management ability, low level and low production capacity, which can lead to bankruptcy. Therefore, the Bank is very afraid of this.

– Reputation of individual customers

If the Customer has a long-term and reputable relationship with the Bank, it is usually assessed by the Bank to be more secure in terms of principal and interest recovery and loan quality compared to other customers.

Ethics and reputation of customers always affect the authenticity of the information provided to the appraisal staff, affecting the Bank’s lending decisions. The honesty and ethics of customers greatly determine the quality of the Bank’s loans.

From the Bank’s side

– Interest rates

The bank’s lending interest rate determines the borrowing of science and technology. If the bank sets the interest rate for science and technology loans too high, it will reduce the demand for loans of individuals or households, they will not dare to borrow a large amount of money or customers do not want to prolong the loan period for too long. . Therefore, the Bank’s increase or adjustment of lending interest rates will more or less affect the demand for loans for individuals and households.

– Banking information system

The Banking Information System is a tool to assist the Bank in capturing customer information before and after borrowing, helping the Bank to recognize and prevent bad loans in the first place.

– Bank’s lending policies and regulations

In order to improve credit quality, the Bank needs to build for itself a reasonable, correct and fast lending process, ensuring the following criteria: compliance with the law, simple and complete procedures, effective application effectively with each customer group, easily solving problems when risks occur.

– Professional qualifications and responsibilities of credit officers

Credit officers need to accurately evaluate customers, make quick decisions and closely monitor the disbursement process, which will help the Bank improve loan quality and bring prestige to the Bank. In contrast, credit officers who are not qualified to evaluate customers, ignore potential customers, or deal with projects that do not meet quality standards will reduce credit quality, causing loss of revenue and revenue. damage the reputation of the Bank. Therefore, credit officers need to be trained to improve the bank’s lending quality.

1.4.2. Objective factors

– Legal environment

An appropriate and stable legal framework is a favorable environment for the Bank’s credit activities. Laws and regulations of the State are the basis to help the Bank and credit institutions handle and solve problems related to credit activities. Moreover, the law also creates a healthy legal environment for all production and business activities to achieve high efficiency.

– Socio-economic environment

The socio-economic situation also has an indirect impact on the credit quality of households and businesses. A stable socio-economy is the basis for households to have stable production and business conditions, and both efficiency and scale. This increases the credit quality of production households when households have a favorable business environment, increased income, more conditions for borrowing from banks, and assurance of timely and full repayment. .

– Natural environment

For households that produce and borrow capital to do business in the fields of agriculture, forestry and fishery, this factor has a great influence on business activities. If there is a natural disaster, storm, flood, drought, etc., causing damage to crops and livestock, causing economic decline of the households, which leads to the inability to repay the Bank’s debt on time and may also result in loss of income. lost white.

1.5. Service quality evaluation model

1.5.1. Service quality model and service quality scale

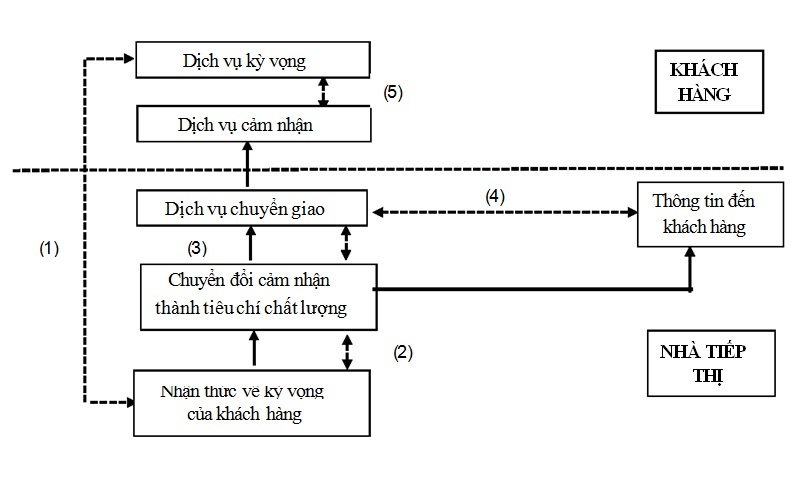

Parasuraman et al. (1985) introduced a five-gap and five-factor service quality model called SERVQUAL for short.

Figure 1.1: Quality Gap Five Model

(Source: Parasuraman et al. (1985, cited by Nguyen Dinh Tho et al., 2003))

Gap (1) is the difference between the customer’s expectation and the service provider’s perception of that expectation.

Gap (2) is created when a supplier encounters both objective and subjective difficulties and obstacles in translating perceived expectations into specific quality criteria and delivering them as expected.

Gap (3) forms when employees deliver services to customers that do not meet the set criteria.

Gap (4) is the difference between the delivered service and the information that

Customer received. This information can increase expectations but can reduce the perceived service quality when the customer does not receive what was promised.

Gap (5) forms from the difference between perceived quality and expected quality when customers consume services.

However, many times the service provided meets specific standards and the customer’s perception of service quality is acceptable, but the customer still feels unsatisfied. According to Parasuraman el al. (1985) suggested that service quality is perceived by customers as distance (5). This distance depends on the variation of the previous distances 1, 2, 3, 4. In order to improve service quality, it is necessary to shorten the gap (5), which means it is necessary to shorten the remaining distance. Service quality is considered to be the best when the gap (5) is zero.

The service quality model according to these researchers can be represented by the following function:

CLDV= F ((KC_5 = f (KC_1, KC_2, KC_3, KC_4))

Inside:

CLDV: is service quality

KC_1, KC_2, KC_3, KC_4, KC_5: are service quality distances 1, 2, 3, 4, 5.

The five quality gap model is a general, theoretical model of service quality. In order to be more realistic and practical, Parasuraman et al. (1985) built a scale used to assess quality in the service sector, according to him, for any service, quality is also perceived by customers. based on 10 components: (a) reliability (b) responsiveness, (c) service capacity, (d) accessibility, (e) courtesy, (f) information, (g) credibility, ( h) safety, (i) customer knowledge, (j) tangibles.

The advantage of the ten-factor model of service quality over it covers almost every aspect of service. However, the disadvantage of this model is that it is complicated to measure, evaluate and analyze. Therefore, Parasuraman et, al (1988) re-calibrated and introduced the SERVQUAL scale to measure the perception of service quality through 5 components including:

| -> Expected service | ||

| – Tangibles – Reliability – Responsiveness – Service capacity – Empathy | -> Service quality perceived service quality) | |

| -> Feeling Service (perceived) |

Maybe you are interested!

-

Evaluation of loan service quality for individual customers at National Commercial Joint Stock Bank - 1

Evaluation of loan service quality for individual customers at National Commercial Joint Stock Bank - 1 -

Evaluation of loan service quality for individual customers at National Commercial Joint Stock Bank - 2

Evaluation of loan service quality for individual customers at National Commercial Joint Stock Bank - 2 -

General Introduction About National Commercial Joint Stock Bank

General Introduction About National Commercial Joint Stock Bank -

Situation Of Assets And Capital Of National Commercial Joint Stock Bank Hue Branch For The Period 2015-2017

Situation Of Assets And Capital Of National Commercial Joint Stock Bank Hue Branch For The Period 2015-2017 -

Evaluation Of The Quality Of Lending Services For Retail Customers At National Commercial Joint Stock Bank , Hue Branch

Evaluation Of The Quality Of Lending Services For Retail Customers At National Commercial Joint Stock Bank , Hue Branch

Figure 1.2: SERVQUAL model (Parasuraman, Zeithaml & Berry (1988))

1. Tangibles: shown through appearance, service staff’s clothing, and equipment to perform services. 2. Reliability: represents the ability to perform services appropriately and on time the first time.

3. Responsiveness: showing the willingness of service staff to provide timely service to customers.

4. Service capacity (assurance): showing professional qualifications and polite and welcoming service to customers.

5. Empathy: showing care for each individual customer.

The scale set consists of 2 parts, each part has 22 statements. The first part aims to determine the customer’s expectations for the service type of the business in general, that is, regardless of a particular business, the interviewees indicate their level of desire for the service. there. The second part is to determine the customer’s perception of the service performance of the surveyed enterprise, that is, based on the specific service of the surveyed enterprise for evaluation. The research results aim to recognize the gap between customers’ perception of service quality performed by enterprises and customers’ expectations for that service quality.

Specifically, according to the SERVQUAL model, service quality is determined as follows:

Service quality = Perceived level – Expected value.

Parasuraman et al. confirmed that SERVQUAL is an accurate and reliable service quality measurement tool and that this scale has been widely used (Buttle 1996, Robinson 1999).

Currently, many researchers in Vietnam have used the SERVQUAL model of Parasuraman et al. (1988) such as Nguyen Dinh Tho & ctg (2003) have applied measurement and developed this scale set for the field of entertainment services. City entertainment. Ho Chi Minh; Nguyen Thi Mai Trang (2006) research on service quality, satisfaction, loyalty of hotel customers in Ho Chi Minh City; Nguyen Thi Phuong Tram (2008) research on the quality of e-banking services.