On the other hand, the weakness in macroeconomic planning, unreasonable investment allocation has led to a crisis of overinvestment in some industries leading to the consequences of oversupply causing waste. That not only causes a loss of money for the State but also seriously affects the interests of investors along with the massive amount of capital pouring into the market.

The state of rampant project licensing has created abandoned urban areas, wasting money of people and society, and at the same time causing information chaos in the market because of the high virtual supply, while information on The market is still not transparent in many projects. the growth model is unreasonable and inefficient, especially when the economic environment is more difficult. The economic growth (GDP) is high and capital-based, while technology, and specifically management, has not kept pace, the more businesses borrow, the more difficult it is to effectively manage the currencies. that loan (or the business becomes more careless with easy capital).

In addition, Vietnam is a country with a very modest income, but the paradox is that in the cities, there are successive apartment buildings with high-class apartments, the prices are completely inconsistent with the income level. general integration of society. This inadvertently causes the supply and demand of this particular commodity to change, resulting in a large inventory. Although the demand for housing is still very much, especially in big cities, people with low incomes such as civil servants and laborers are allowed to own houses due to the high prices.

+ Due to ineffective legal environment

Concerning business loan mattersCommercial real estate has a lot of governing laws, a lot of sub-law documents guiding the implementation of the law. That shows the overlap in bank credit management in the field of real estate lending. In addition, the implementation of the law into banking activities is very slow, difficult and faces many shortcomings, the credit policy is not stable and there is no mechanism that can provide a full range of services. information related to the business, there is no agency responsible for rating the business credit independently, effectively and accurately, making it difficult to determine the exact source of information needed by customers. get a loan. Therefore, making it difficult for the entire banking system to control credit risks for a young economy like ours today.

– Subjective reasons

+ From the borrower’s side

Bad debt occurs when customers use capital for wrong purposes, do not have goodwill in repaying debts or due to inefficient business management, lack of competitiveness in the market, leading to a high risk of bankruptcy. Although most businesses when taking loans from banks have specific and feasible business plans, when they are put into practice, they face difficulties from many sides such as market prices, customer demand, and policies of customers. The state makes it difficult for businesses to borrow capital.

+ From the lending bank

Maybe you are interested!

-

Solutions to limit bad debt in real estate lending at Joint Stock Commercial Bank for Investment and Development - 1

Solutions to limit bad debt in real estate lending at Joint Stock Commercial Bank for Investment and Development - 1 -

Solutions to limit bad debt in real estate lending at Joint Stock Commercial Bank for Investment and Development - 2

Solutions to limit bad debt in real estate lending at Joint Stock Commercial Bank for Investment and Development - 2 -

The Need For Solutions To Limit Bad Debts In Real Estate Lending

The Need For Solutions To Limit Bad Debts In Real Estate Lending -

Organizational Structure, Management Apparatus Of Bidv Quang Trung Branch

Organizational Structure, Management Apparatus Of Bidv Quang Trung Branch -

Solutions to limit bad debt in real estate lending at Joint Stock Commercial Bank for Investment and Development - 6

Solutions to limit bad debt in real estate lending at Joint Stock Commercial Bank for Investment and Development - 6

Although the customer is the first to blame when bad debt occurs, it must also be recognized that the bank is too lenient in the process of project appraisal, and in the granting of credit. The “health” of the business is the “life” of the bank.

But in fact, the careful and careful consideration of the financial management capacity of the customer is not really effective, so when the business has an incident, the risk that the bank encounters is very great. When the economy declines (as was the case in Vietnam recently, inventories increased, unemployment increased, the number of businesses shutting down also increased), that difficulty also reflected in the assets of enterprises. It is inevitable that businesses, and enterprises’ bank loans are also unable to repay their debts, and bad debts increase.

The increased bad debt situation reflects that the SBV has been advocating for transparency in credit relations and financial information. From the point of view of prudent bank management, it is clear that bad debt should not be hidden. It is clear that publicizing which businesses have bad debt and good debt will help banks and the wider society to clearly distinguish “black and white” and thereby “choose the deposit side” (lending).

NPLs increased for a long time, of course, on the commercial side, it also reflected the banks’ weakness in risk management in general. Concealment of bad debt can be the cause of incentives to get high salary – bonus, dividend payment, keeping the bank stock price (for listed banks); Cross-ownership also exists and is being controlled more tightly which can also reveal problematic credits from this relationship…

The rapid increase in bad debt also reflects the policy of transparency in credit relations between banks and businesses: the increase in bad debt reflects one thing that the State Bank has been advocating for transparency in credit relations, through financial news.

From the point of view of prudent bank management, it is clear that bad debts should not be hidden. NPLs increase for a long time, of course, on the commercial side, it also reflects weak banks in risk management in general: the situation, hiding bad debts can be the cause of the incentive to get salary – bonus. high, paying dividends, keeping the bank’s stock price (for listed banks); Cross-ownership also exists and is being controlled more tightly which can also reveal problematic credits from this relationship…

Besides, domestic banks with weak management systems themselves face increased risk of bad debt because most customers with great financial potential will be attracted by foreign banks.

Credit risk can arise due to many subjective or objective reasons. Risk prevention measures may be within the reach of commercial banks, but there are also measures beyond the capacity of individual banks, related to existing problems of the economy.

Due to the special role of the real estate business in the economy, it has a profound impact on other business sectors. Therefore, banks need to identify and develop effective measures to limit credit risks in the real estate sector.

1.3.3 Impact of bad debt in real estate lending

Along with the development of the economy, the domestic real estate market is witnessing great development steps. Only in the past 10 years, real estate has become a familiar form of investment for both organizations and individuals and increasingly contributes greatly to the formation and development of the economy. Many people believe that the reason for the high bad debt ratio is the fault of the banks, and maybe that is part of the reason why bad debts tend to be hidden or less public.

However, the reality shows that bad debt is not new but it has been accumulated for a long time, and recently when the business situation worsened, the cause of bad debt became more and more obvious. . Especially with bad debt in real estate lending, when it happens, it will leave a lot of consequences. This is a very special commodity, with a very large asset value, which can easily affect the economy when risks occur. We can see some impacts when bad debt happens to banks, real estate market and the whole economy as follows: – For the national economy

+ The housing market holds an important position for social stability. The housing market of any society is also associated with the policies of a country, once the housing market develops healthily, it also means that housing policies develop appropriately and the society is stable.

The real estate market is the leading factor that has a decisive impact on the increase and decrease of the economy’s accumulation, contributing to improving people’s living standards, creating conditions for them to settle down and start a business, and at the same time create a material foundation for the economy. industrialization and modernization of the country.

When this market fluctuates, it will affect people’s lives, especially those with housing needs and many other areas in society such as finance – currency, machinery and equipment market. , construction materials, energy industries, water supply, telecommunications and furniture production, electrical appliances and expensive household electronics… + Real estate inventory entails input materials (labor, iron). Steel, cement and other building materials) also have a relatively large inventory, causing great difficulties for enterprises producing building materials, due to high input costs such as electricity, water, transportation, etc.

Goods cannot be sold, revenue declines, leading to regular workers’ salary debt, even mass layoffs. Currently, there is an imbalance between supply and supply because the production capacity of the material industry exceeds the market’s consumption demand by 20-30%. The reason is that for a long time, the real estate market froze, making the construction materials industry unable to sell. Inventories are most concentrated in iron and steel, cement, ceramics, construction bricks, sanitary ware… These are products closely related to the real estate sector.

+ In the real estate market, real estate traders and consumers make their purchases. As a special commodity, land and houses are transferred ownership and use rights from one person to another. Such buying and selling creates an inexhaustible volume of goods supplied to the market, making the real estate market always rich.

The market is the place where capital is transformed from in-kind form to value, which is a decisive factor in capital turnover, business growth and the existence of real estate businesses. Therefore, when the phenomenon of “stagnation” of real estate goods occurs, that is, the exchange rate of goods slows down or even stops, the number of exchanges decreases, the capital turnover rate decreases, the amount of money generated from The additional profit after each real estate exchange is also limited.

+ The challenging macroeconomic situation has caused real home buyers to hesitate a lot in buying decisions, especially when they have to rely on bank loan interest rates that are often floating and extremely unpredictable. Future.

+ Fluctuating real estate market often affects gold prices. Real estate prices are unstable or have a downward trend, which makes investors tend to switch to gold. On the other hand, for a long time we have a habit of trading real estate in gold.

The continuous increase in the gold price will cause panic in the general market, information disturbance and can not be oriented, people have to wait and temporarily stop real estate transactions. This is one of the reasons why the real estate market is congested and settled because the two parties buying and selling houses conduct payment transactions in gold.

Some transactions have deposited gold to buy houses, but due to the high price of gold, these transactions fell into disrepair. Therefore, buyers are very reluctant to find out about houses for sale in gold because they are afraid that the price of gold will continue to increase. Although the home seller wants to choose a means of payment in gold to be able to enjoy the difference when the gold rises, the liquidity of that house will be very low. Therefore, real estate businesses experience a decrease in revenue, affecting the financial capacity of the business itself.

+ Not only affects the gold price, the correlation between real estate and securities is very clear. The effects are sometimes in the same direction, sometimes in the opposite direction due to the influence of many psychological factors. When the stock market fell into a state of deep decline, both the volume of transactions and the price level in the real estate market dropped sharply, which easily caused real estate businesses to fall into a serious financial crisis, which is also the reason for the possibility of a recession. limited ability to repay bank loans.

– For the real estate market

+ Lack of investors reduces market liquidity. The rapid increase in supply leads to fierce competition, which reduces the prices of many real estate.

+ Real estate businesses have increasingly large inventories, and competition in the future will be stronger when this inventory is released to the market. In the report of CBRE, Knight Frank or Savills, by the second quarter of 2012, the inventory of real estate in the market is very large and more than 60 listed companies related to real estate only contribute a very small part of it. In fact, state-owned or other private companies have also contributed to the large inventory. Great competition requires businesses to spend more money on advertising, selling less inventory.

+ Interest rates from the beginning of the year until now for real estate loans, especially real estate investment, are quite high (not less than 17%/year). Even most real estate companies still bear interest rates above 20%. This cuts the company’s profits significantly, especially when the project is completed and the company cannot sell goods and repay the loan, the level of interest expense increases. It is difficult for banks to collect debts on time, forcing companies to dumping to recover debts, creating negative vortex pressure between Banks – real estate companies – investors: difficult to sell – difficult to repay – selling at high prices. low – create new pricing ground – force to sell cheaply or add more collateral – increase competition – continue to decrease.

+ Along with the development of the economy, the domestic real estate market is witnessing great developments. Only in the past 10 years, real estate has become a familiar form of investment for both organizations and individuals and increasingly contributes greatly to the formation and development of the economy. Like some other economic sectors, greatly affected by the worldwide financial crisis starting in 2007, 2008, the country’s real estate market suffered a heavy decline.

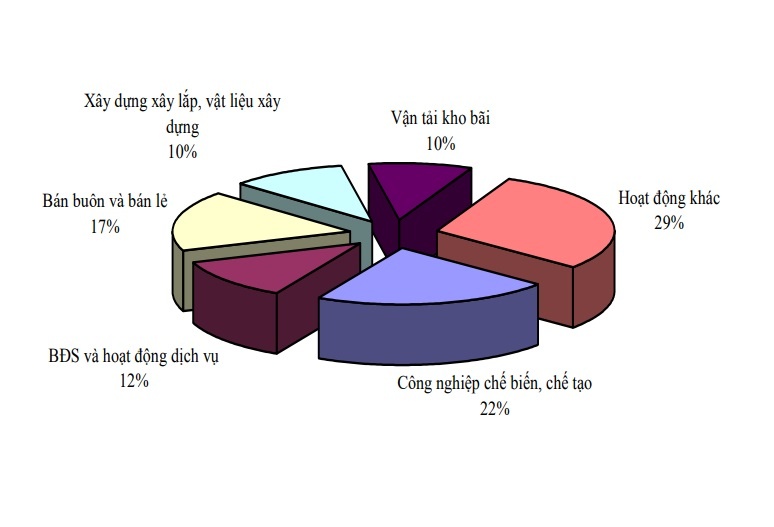

According to the latest data on the bad debt structure announced by the State Bank in the first quarter of 2013, the manufacturing and processing industry accounted for the highest proportion of all sectors (with 21.67%); followed by wholesale and retail (17.34%), ranked third was real estate and service activities (11.65%)… However, the resolution of bad debts in the real estate sector is still a matter of concern. most interested, because credit outstanding loans related to real estate account for a large proportion of the total outstanding loans.

Moreover, real estate bad debt led to the stagnation of two important industries related to employment and social security: construction (created jobs for about 3.3 million workers – equivalent to 6.4% of the total). economy) and construction material production (about more than 500,000 employees, equivalent to more than 1% of the total labor of the economy). According to statistics, the number of finished apartments is not much in stock (the whole country has 26,444 apartment buildings and 15,786 low-rise houses in stock). But the number of apartments still lying on paper, new projects only compensation for site clearance, may have detailed planning, project design … are many.

The number of apartments and low-rise houses in the projects is dozens of times larger than the number of finished built apartments and this is the real concern of the real estate market. The Macroeconomic Bulletin of the National Assembly said that the scale of bad debt of the real estate sector is significant, but even larger, when analyzing the fluctuations of this debt block.

With an economy in the process of adjusting towards debt divestment after a period of hot growth based on high credit growth, the hottest sectors using the most debt, especially the Real estate will have to make the strongest adjustments to bring the economy back to a balanced and sustainable trajectory. Both assessments of the Economic Committee of the National Assembly and the Ministry of Construction agree on the possibility that bad debt in the real estate sector will continue to increase in the medium term.

Figure 1.1. Structure of bad debt in the first quarter of 2013

(Source: SBV)

According to recent statistics, in the first quarter of 2013, the housing market in Hanoi witnessed the largest decrease in price adjustment since 2008. Statistics show that 53% of new apartments for sale are priced below 1,000 USD/ m2 , a rare phenomenon since the real estate “fever” in 2007. In the second quarter, the selling price continued to be low with 100% of the new apartments offered for sale under 30 million VND/m2 and half in the second quarter. This number is priced at less than 20 million VND/m2. Attractive locations such as My Dinh, Dinh Cong and Cau Giay have quite reasonable asking prices around 1,000 USD/m2. Many investors are seriously considering reducing the size and finishing of the apartment to reduce the overall price of the apartment.

The office leasing market, under pressure of increased supply, also dropped sharply in the second quarter of 2012, especially in the western area of the capital. The average rent of Grade A office space is only about 34 USD/m2, while Grade B office is about 20 USD/m2.

Due to a strong increase in western supply in Q2 due to Keangnam’s completion, the market vacancy rate was 22.5%. Demand in the hotel market is also relatively modest due to the combined effect of many factors. Since 2009, tourists’ room rental budget has been on a downward trend, while the average room rate has also witnessed a similar trend.

The supply of 3-5 star hotels continues to increase in both the central and western areas. All these factors are contributing to the decrease in the value of hotels now and in the future. The decision to delay or suspend construction at some shopping centers may be a misguided strategy when for the first time since 2008, the year Vietnam ranked first in ATKearney’s ranking of the World Development Index. Global Retail Development (GRDI), Vietnam has left the Top 30 of this ranking.

Some retailers have had to downsize operations. While 41 medium-sized booths (area 21-100 m²) were closed, the number of small (1-20 m²) and large (251-500 m²) stalls increased. This partly shows a decrease in the attractiveness of Vietnam’s retail market.

– For commercial banks