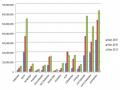

● Estimation results with REM model

Table 2.5. Estimation results with REM . model

Source: calculated by the author

Regression results when estimating with 2 models FEM and REM give the conclusion in Table

2.4 ![]() and

and ![]()

four![]() elements

elements

still ![]()

![]() This seems to be in agreement with the results obtained when estimated with the above Pooled model.

This seems to be in agreement with the results obtained when estimated with the above Pooled model.

Maybe you are interested!

-

Factors affecting liquidity risk of Vietnamese commercial banks - 1

Factors affecting liquidity risk of Vietnamese commercial banks - 1 -

Factors affecting liquidity risk of Vietnamese commercial banks - 2

Factors affecting liquidity risk of Vietnamese commercial banks - 2 -

Factors affecting liquidity risk of Vietnamese commercial banks - 3

Factors affecting liquidity risk of Vietnamese commercial banks - 3 -

Factors affecting liquidity risk of Vietnamese commercial banks - 5

Factors affecting liquidity risk of Vietnamese commercial banks - 5

![]()

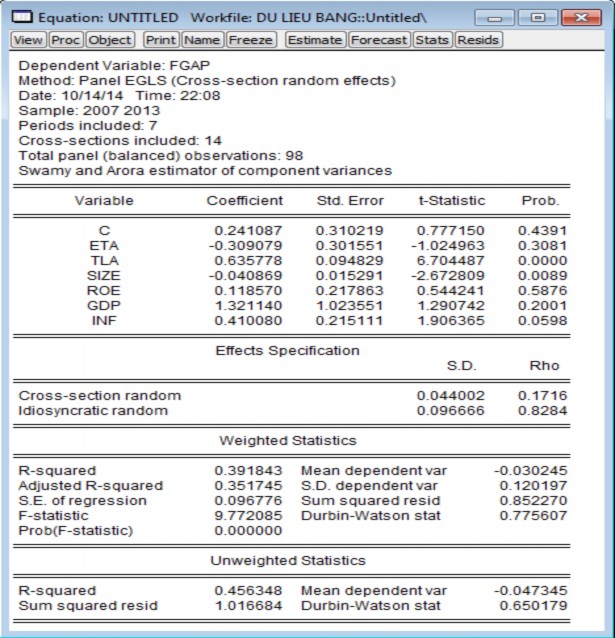

Before approaching FEM or REM, we consider Hausman test to determine whether FEM and REM are really different in the case of this study sample or not.

Hypothesis:

Ho: REM model is suitable H1: FEM model is suitable

Hausman test results are presented in Table 2.6.

![]()

Source: calculated by the author

Hausman test results give p-value equal to 0.1490 greater than 0.05, so we accept hypothesis H 0 and reject hypothesis H 1 . Therefore, the suitable model to study is the Random effect model.

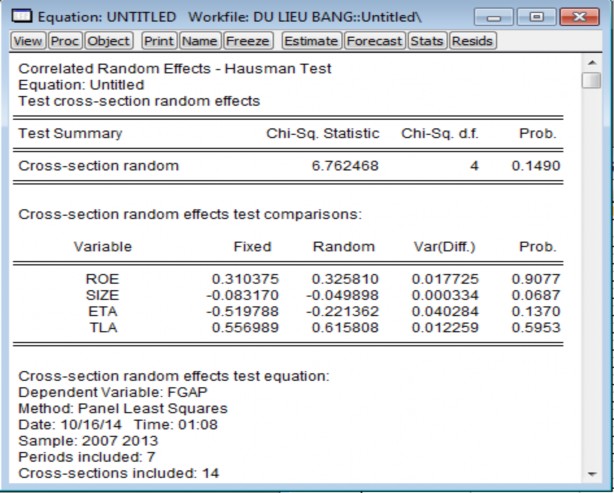

After selecting the Random effect model as the research model, the author removed the variables with p-value greater than 0.05 from the model. The results after removing redundant variables from the model, the author re-estimates the model with 2 variables, TLA and SIZE, the results are shown in Table 2.7 as follows:

![]()

estimated with the REM model after removing redundant variables

Source: calculated by the author

The regression equation has the form:

FGAP = 0.309326 – 0.037125*SIZE + 0.588163*TLA

At the 5% significance level, the coefficient R 2 is equal to 40.72%, showing that the two variables SIZE and TLA explain nearly 41% of the change in FGAP during the period 2007 - 2013.

2.2.3. Discussing research results

![]() Test results

Test results ![]()

important as follows:

2.2.3.1. About the factors inside the bank a. Total Asset Size (SIZE)

The scale of the total wealth ![]() is poor in the bar

is poor in the bar ![]()

![]()

make bank liquidity better. This seems to be consistent with the theories of scale, as the larger the bank size, the more advantage the bank has in the market and the less liquidity risk . Once there are signs of liquidity risk, banks with a large scale can easily take advantage of their reputation to access the interbank market or get support from the lender of last resort. and quickly, thereby overcoming the risks in their infancy. Regression results show that when other factors are constant, a 1% increase in total asset size of the bank will help the bank reduce its liquidity risk by 0.04%.

A bank's core operations are on the assets side of its balance sheet. The size, structure and quality of assets determine the existence and development of the bank. Asset quality is a composite indicator that speaks to the quality of management, solvency, profitability and sustainable prospects of a bank. Most of the risks in banking are concentrated on the asset side

Therefore, along with ensuring sufficient capital, improving asset quality is an important factor to ensure safe operation of the bank.

The bank's assets include profitable assets and non-earning assets, in which profitable assets always account for the major part. Profitable assets are the assets that provide the main source of income for the bank and are also the assets that carry many risks. These assets include loans, finance leases, investments in securities, capital contribution to joint ventures, associates... in which loans account for the highest proportion. Talking about asset quality is referring to the quality of profitable assets, which is first and foremost reflected in the quality of credit activities. If a bank has high credit quality, as demonstrated by timely collection of principal and interest, preservation of loan capital, low rate of overdue debt, and rapid credit turnover, then that bank rated as essentially safe and effective. Usually, common, normal, The credit quality of the bank is assessed through the following indicators: Ratio of overdue debts to total outstanding loans; the ratio of net debt loss to total outstanding debt; ratio between provision for bad debts to total net loss and to total outstanding loans. Rate and nature of overdue debt, outstanding debt, level of loan loss as well as provision for loan loss are important indicators to assess credit quality. A bank with a bad credit rating and a high debt ratio will cause asset losses and reduce profitability, while an insufficient provision will lead to a decrease in equity and will eventually become insolvent. ratio between provision for bad debts to total net loss and to total outstanding loans. Rate and nature of overdue debt, outstanding debt, level of loan loss as well as provision for loan loss are important indicators to assess credit quality. A bank with a bad credit rating and a high debt ratio will cause asset losses and reduce profitability, while an insufficient provision will lead to a decrease in equity and will eventually become insolvent. ratio between provision for bad debts to total net loss and to total outstanding loans. Rate and nature of overdue debt, outstanding debt, level of loan loss as well as provision for loan loss are important indicators to assess credit quality. A bank with a bad credit rating and a high debt ratio will cause asset losses and reduce profitability, while an insufficient provision will lead to a decrease in equity and will eventually become insolvent.

Besides the quality of credit activities, the bank's asset quality is also reflected in other assets such as securities investment portfolio, assets in foreign currencies, gold, silver, and precious stones. The quality of these assets is often reflected in the foreign exchange structure and position, and the quality and status of the portfolio. These items also have a great influence on the profitability and liquidity of a bank. Therefore, in order to fully assess the bank's asset quality and operational level

and precisely, on the one hand, it is necessary to comprehensively consider the structure and properties of assets that the bank is holding, on the other hand, to study the relationship between the structure of assets and liabilities. This correlation helps to evaluate the optimality of the asset structure, the bank's ability to react to market fluctuations, the ability to withstand the unusual phenomena of the business environment and meet the requirements of the market. public withdrawal requests.

In the context of current international economic integration, the quality of the bank's assets is also greatly influenced by external factors such as political fluctuations, changes in foreign policies and laws, volatility of national currencies. When assessing the bank's asset quality in this case, it is necessary to take into account the situation of using assets abroad, the correlation between foreign assets and foreign currency assets in total bank assets.

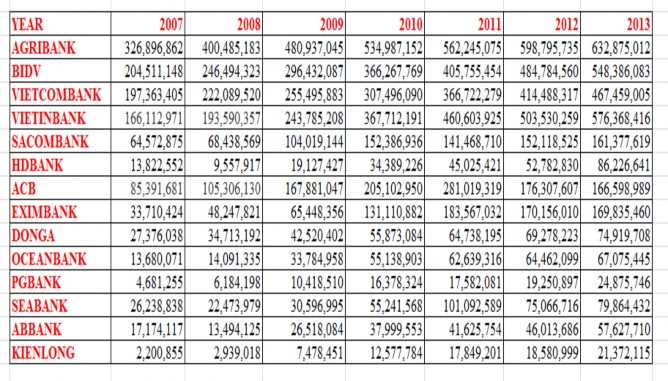

Through the table of total assets of 14 commercial banks in Vietnam in the period 2007-2013, we can see that the total assets of the banks collected by the end of 2013 was 3,992 trillion VND, an increase of 11.34%. compared to the end of 2012, When the banks with the largest equity capital are also the banks with the largest liabilities, of course they are also the banks with the largest total assets. According to the report of the National Financial Supervisory Commission in the assessment of the money market, the liquidity of the banking system in recent years has continued to be consolidated and is now quite abundant compared to the previous period due to the rapid growth of the banking system. deposit growth has always been much higher than the credit growth of the system. Thanks to abundant liquidity, lending interest rates in the interbank market remained stable and always remained low (3-4%). Though, According to the Supervisory Committee's assessment, there are some times when interest rates in this market have a sudden increase. In addition, the gradual decrease in the rate of loans mobilized in the residential market along with the decrease in the ratio of deposits from the interbank market to total assets of credit institutions also show positive signals when the risk level is low. in the activities of

the majority of credit institutions and the whole system has decreased significantly. Banks with abundant liquidity are concentrated in groups with high asset size.

Table 2.8. Scale of total assets of commercial banks in the period 2007-2013

Source: Compiled from financial statements of banks b. Loan-to-total assets (TLA) ratio

![]() at

at![]() the rate for

the rate for

loans on total ![]() assets

assets![]()

![]()

On the other hand, when the ratio of loans to total assets decreases by 1%, the bank will reduce its liquidity risk by 0.59%. This is explained that when banks face difficulties, banks often focus on credit growth to seek profits and tend to lend to higher risk subjects with high interest rates.

than. The ratio of outstanding loans to total assets helps to assess liquidity and helps determine the trend and liquidity status of the bank during the operating period.

In general, the main activities of Vietnamese commercial banks are still credit activities. Due to the influence of the economic and financial crisis and the global recession from 2008 to now, our economy has been negatively affected and the macro-economy has many unfavorable factors. The production and business activities of enterprises faced many difficulties. One of the risks banks are currently facing is liquidity problems as the mobilized capital is mainly short-term and must be compensated for in medium and long-term loans while the outstanding loans are not easy to collect. recovery and potentially losing debt is increasing rapidly.

Contrary to the term structure of deposits, the bank's loan term structure is not disproportionate, focusing entirely on one side. The proportion of outstanding loans for medium and long-term loans generally ranges from 35% - 47% of the total outstanding loans. The reason comes from the very high demand for investment capital and expansion of production scale of enterprises in Vietnam due to their establishment and operation in a developing country. In addition, the capital market is still in its infancy, so the State-owned commercial banks (including shares) must actively support in providing medium and long-term loans to businesses in the economy, leading to a surplus. medium and long-term loans at banks maintained a fairly high ratio over the years. However, from 2009 to now, this rate has tended to decrease in line with the impact of the financial crisis and the world economic recession from 2007 to 2009. Therefore, Vietnamese enterprises have little courage in long-term projects because they are afraid of fluctuations in the economy and often do business in a rolling business, rather than afraid to take risks, and lack confidence in the demand of the market. . In addition, when dealing with bad debts is one of the central tasks of banks, banks are more and more cautious in the loan appraisal stage, no longer racing massively like in the previous stages. Although there is a decreasing trend, the rate for no longer racing massively like the previous stages. Although there is a decreasing trend, the rate for no longer racing massively like the previous stages. Although there is a decreasing trend, the rate for

Medium and long-term loans in the total structure still remained at a relatively high level (from 35 to 40%), requiring a large amount of capital with corresponding financing terms. However, as mentioned, medium and long-term deposits of customers - the main source of funds to finance medium and long-term lending activities of the bank could not be met, leading to the situation that the bank had to use Using short-term capital for financing, as a result, the proportion of short-term capital used for medium and long-term loans at banks is maintained at a relatively high level.

The loan ratio accounts for a large proportion of the asset structure of Vietnamese commercial banks, plus the term imbalance between deposits and credits, besides the increasing bad debt ratio. are the main causes of liquidity risk for Vietnamese commercial banks.

![]() Contrary to expectations , the

Contrary to expectations , the![]() economic growth rate (GDP) and the inflation rate in

economic growth rate (GDP) and the inflation rate in ![]() Vietnam

Vietnam ![]() .

.

CONCLUSION OF CHAPTER II

![]()

In Chapter II, the author presented a regression model of factors affecting liquidity risk of Vietnamese commercial banks. Through analyzing panel data from data collected in Annual Reports of 14 Vietnamese commercial banks from 2007 to 2013, the author has drawn some valuable conclusions. Among the factors affecting liquidity risk of Vietnamese commercial banks as the author's model builds, the factor of Total Bank's Assets (SIZE) has a negative relationship with liquidity risk (FGAP). is an increase in total bank assets that will reduce liquidity risk or in other words increase liquidity for the bank. In addition, the factor TLA (loan ratio to total assets) is positively correlated with liquidity risk, that is, an increase in the ratio of loans to total assets will increase liquidity risk, In other words, it will reduce the bank's liquidity. Contrary to initial expectations, in his research paper, the author did not detect the factors ETA (Equal capital to total capital), ROE (Return on equity), GDP (Rate of equity). Economic Growth), INF (Rate ![]() incubate

incubate

CHAPTER 3: SOLUTIONS IMPACT FACTORS POSITIVE AFFECTING FACILITIES OF VIETNAM'S COMMERCIAL BANKERS

In the current period, the activities of Vietnamese commercial banks have made strong progress, contributing positively to promoting the national economy. However, reality also proves that the business activities of commercial banks today still have many potential risks, in which liquidity risk is one of the most dangerous risks. Through the regression results of the model, the author draws some conclusions in identifying the factors affecting liquidity risk of Vietnamese commercial banks. Thereby, the author also makes some recommendations to contribute to the orientation in liquidity risk management at Vietnamese commercial banks in the coming time.

3.1. For Vietnamese commercial banks

3.1.1. Regarding the policy of increasing capital, increasing assets, asset management - bank capital in recent times.

The requirement to increase charter capital under Decree 141/2006/ND-CP has created favorable conditions for small Vietnamese banks to have a development opportunity that is not easy to obtain, with the advantages of the stock market.period 2006-2007, supporting the increase of charter capital of these banks. After seven years (as of 2013), these banks are still small banks, most of which have poor financial size, lack of liquidity, lack of capacity and experience in banking at a low level. Bigger, more risk. The issue of increasing capital and increasing the size of assets of the Vietnamese banking system, through Decree 141/ND-2006, has shown an example of banking management policies. The situation of excess liquidity, followed by a continuous liquidity deficit, requires policies to increase charter capital and increase assets, both at macro and micro levels, to take into account specific characteristics and situations. specific banks and groups of banks. The increase in assets must also be associated with a reasonable and safe allocation of assets

Therefore, attention must be paid to the list of liquid reserve assets, ensuring a safe buffer for liquidity. Finally, banks also need to maintain a more reasonable capital structure, by increasing the proportion of deposits from the public and enterprises-institutions, limiting a capital structure that is too skewed towards the ratio. borrowing in the interbank market.

3.1.2. Implement good futures risk management

The maturity mismatch between the bank's liabilities and assets is an important reason for banks' liquidity difficulties in recent years. The issue of using short-term capital for medium and long-term loans with a large proportion or the same short-term, medium-term, long-term but different specific terms (for example, medium and long-term mobilization of two years but lending three-year medium term) also makes it difficult for banks to control their cash inflows and outflows.

3.1.3. Ensure a balance ratio between Assets and Liabilities

In essence, this is the application of a balance strategy between TSC and TSN or combined liquidity risk management. Any imbalance between mobilized capital and capital use can lead to credit risk. In fact, Vietnamese commercial banks seem to rely heavily on borrowing to meet liquidity needs. In recent years, some commercial banks have had a very large borrowing rate in the interbank market, accounting for 50% or more of the loan balance. Therefore, not only the liquidity is threatened but also affect the profit result. Not only that, some banks have relatively available capital, especially newly established banks, the capital contributed by shareholders is temporarily unused for other borrowing purposes, instead of for ordinary customers. loans, have lent in the interbank market in search of a higher interest rate differential. So,

the bank itself. Another issue that commercial banks need to pay attention to is maintaining the ratio of using short-term capital to finance medium and long-term at a reasonable and statutory level.

3.1.4. Strengthen forecasting of macroeconomic conditions

Changes in macroeconomic conditions may affect the business results of commercial banks. When the State Bank of Vietnam implemented a tight monetary policy by successively issuing a series of strong solutions such as increasing the reserve reserve ratio, increasing the basic interest rate, imposing a ceiling on deposit interest rates, etc., the liquidity of banks Commercial banks in Vietnam have difficulties. Because before that, there was a time when there was an excess of available capital in some banks. These banks have reduced deposit deposit rates. But as macroeconomic conditions changed, these banks became flustered. This proves that it is necessary to strengthen and improve the efficiency of economic forecasting in banks

3.1.5. Promote capital mobilization and diversify mobilized capital sources

Commercial banks should increase the proportion of residential deposits with promotional measures for customers, as long as it complies with the regulations on deposit interest rates set by the State Bank and can ensure that the bank does not fall into the state of credit risk. Banks need to reasonably calculate between interest rates and terms and maintain reasonable liquidity reserves to best ensure solvency when needed. In addition, to enhance capital mobilization and TSN management, commercial banks should focus on the retail banking market. This is a very potential capital mobilization channel and can bring many benefits to banks and customers. In addition, commercial banks can diversify forms of capital mobilization such as: Issuing bonds and stocks, using promotional measures to attract customers, flexibly applying interest rates, etc. to increase capital from economic organizations and residents to contribute to the growth of mobilized capital. Commercial banks should also simplify loan procedures, cut cumbersome processes and redundant information.

3.1.6. Strengthening customer due diligence and accounting work

Credit is the most profitable activity but the highest risk for commercial banks. This risk has many causes, all of which can cause losses and reduce the bank's income. There are many financings where the loss can take up most of the equity, pushing the bank to bankruptcy. To ensure that the bank can recover the loan, the loan documents of the customer must meet the conditions according to the regulations and the appraisal process of the bank. Therefore, credit appraisal is a very complicated and necessary issue before banks provide loans to customers. Currently, Vietnamese commercial banks have high rates of bad debt and overdue debt. This affects the bank's income and ability to operate safely. That is why credit assessment is very important.

3.1.7. Building a team of qualified, capable and ethical employees

Human resource development is always the top goal of every organization and enterprise. The development of management staff in general and credit risk management in particular is necessary for any commercial bank. It is this department that will effectively advise the bank's leadership in making the right decisions in a timely manner to prevent and overcome arising risks and direct business activities to new successes.

Therefore, commercial banks need to have a plan to recruit, train and employ employees in a scientific, transparent and equal manner. Placing employees in positions that match their abilities is an important step in staffing, to ensure that it is these staff who will contribute to the overall success of the bank. An experienced leader always understands that, knowing the suitability of each