Open deposit and loan accounts for customers, be responsible for handling customer requests for current and new accounts; perform transactions of receiving deposits and withdrawing money in domestic – foreign currencies of customers; make loans, issue guarantees within the scope of authorization of the director; collect debts according to regulations; handling debt extension, urging customers to pay debts (principal and interest) on time, transferring overdue debts, implementing debt collection measures…

Accounting – treasury department

The branch’s accounting – treasury department is responsible for performing tasks such as: Managing and performing detailed accounting and general accounting; carry out post-audit work for the branch’s accounting activities; performing financial management and supervision tasks: Coordinating with departments to develop and submit financial plans; monitoring and managing assets, labor tools, stationery, printing expenses.. In addition, the department is also responsible for the correctness, accuracy, timeliness, reasonableness and truthfulness of accounting data. , financial statements, accounting reports; safe management of treasury money in accordance with regulations of the State Bank and Sacombank; make advances and collect money for transaction offices inside and outside the ATM counters as authorized in a timely, accurate and correct manner; collecting and spending cash with large transaction value, administrative organizations conduct money transfer between the branch’s professional fund and the State Bank and Sacombank’s affiliated banks in the area,…

Organization and Administration

As the administrative office and business service office at the Branch, performing security and safety work at the Branch. The administrative division has the following main tasks: To comply with regulations of the State and Sacombank related to staff policies on salary and social insurance¼; perform labor management, recruit labor, mobilize and arrange staff in accordance with the capacity, qualifications and requirements of business tasks according to the Bank’s competence; carry out training and planning for leaders of the Branch and develop plans and organize training to improve the qualifications of all staffs of the Branch; regularly check compliance with regulations and internal regulations of Sacombank.

Internal control inspection room

The Internal Control Department is responsible for: Inspecting the operation of the Branch and its affiliated units in accordance with the resolution and direction of Sacombank; inspect and supervise the observance of business regulations in accordance with the law and the State Bank, ensuring safety in monetary, credit and service activities of the Branch; checking the accuracy of financial statements, balance sheet reports and settling complaints and denunciations related to the branch’s operations.

2.1.3. Products and services

With the goal of striving to become a modern, versatile retail bank and with the motto “bringing the highest value to customers”, Sacombank – Hanoi constantly adds and develops a system of products and services. of the bank richer than ever.

Capital mobilization activities: Sacombank – Hanoi receives demand deposits, term deposits in VND and foreign currencies from economic organizations and residents; receive savings deposits with many rich and attractive forms: Savings with demand and term in VND and foreign currencies, bonus savings, cumulative savings, ladder savings…

Lending and investment activities: Sacombank – Hanoi provides diversified products including short-term, medium-term and long-term loans in VND and foreign currencies; export – import financing, discount of export documents; co-financing and syndicating loans for large projects with long payback period; overdraft, consumer loans; investment in capital markets, domestic and international money markets. In addition, the Branch also provides services related to guarantee activities: Guarantee, re-guarantee (domestic and international); bid guarantee; contract performance guarantee; payment guarantee.

International payment and trade finance activities: Currently, Sacombank – Hanoi provides services to customers such as: Issuance and payment of imported letters of credit; notification, confirmation, payment of the import letter of credit; thanks to import – export revenue; domestic and international money transfer; Western Union fast money transfer; payment of collection orders, payment orders, checks; pay salaries to businesses via account…

Treasury activities: Buying and selling foreign currencies, buying and selling valuable documents (government bonds, treasury bills, commercial papers), collecting and paying cash in VND and foreign currencies.

Card and e-banking activities: Issuing and paying for domestic credit cards, international credit cards (Visa, mastercard¼), payment cards (Passport Plus, Visa Debit Classic, Visa debit Gold, Visa debit Platinum Imperial) , UnionPay), prepaid cards (Visa Lucky Gift, Visa All for you, UnionPay, Parkson gift cards, Citimart gift cards), ATM card services, cash cards, Internet Banking, Phone Banking, SMS Banking…

2.2. Business performance of Saigon Thuong Tin Commercial Joint Stock Bank – Hanoi Branch

2.2.1. Fundraising activities

Capital mobilization is the most basic activity and sets the stage for other activities of the bank. The period 2010-2012 was a difficult period for banks in general and Sacombank – Hanoi in particular when the macro economy was full of instability, inflation increased along with fierce competition between banks. . Facing that situation, Sacombank – Hanoi has determined the importance of capital in business and identified the goal of promoting capital mobilization as the top goal, and made efforts to implement policies to increase capital mobilization. attract capital mobilized from customers.

In terms of scale

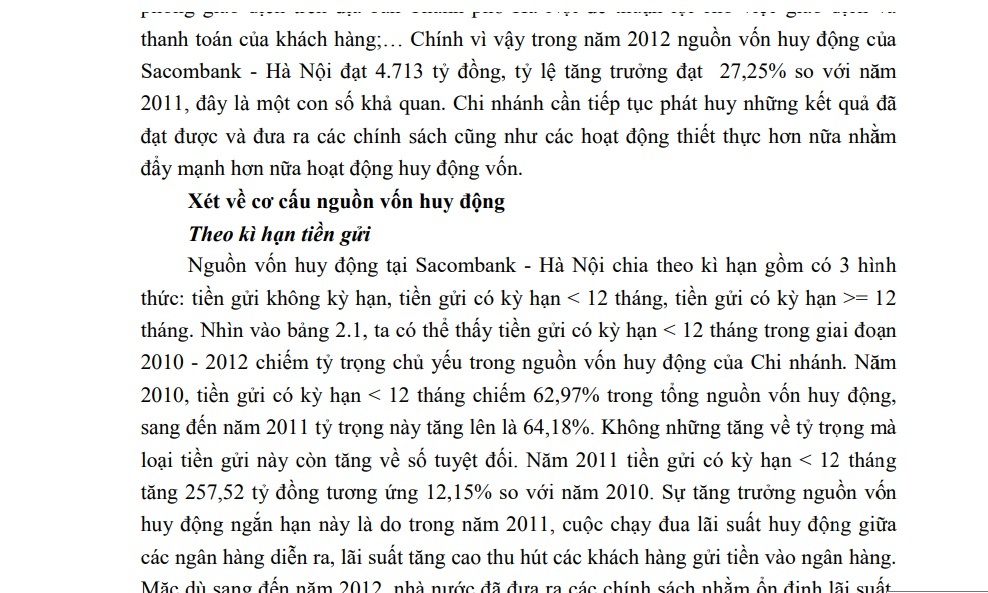

The capital mobilization situation of Sacombank – Hanoi has continuously grown over the years 2010, 2011, 2012. According to Table 2.1, in 2010, the total mobilized capital of the Branch reached VND 3,366.42 billion. By 2011, this figure was 3,703.86 billion VND, an increase of more than 10% compared to 2010. This is a relatively low growth rate because in 2011, the domestic macroeconomy was full of instability due to the turbulence. The impact of the crisis, the inflation rate was up to 18.6% (according to bbc.co.uk), the VND was continuously depreciated, the world gold market continuously increased in price, greatly affecting the mobilization of money. capital mobilization of most banks, the branch’s capital mobilization is also affected.

However, the Branch promptly issued appropriate policies, adjusted interest rates, closely followed the socio-economic development goals in the area, did a good job of serving customers as well as strengthening advertising activities. promote the brand to customers. Moreover, the Branch also tries its best, thoroughly exploiting different capital sources, from savings deposits to payment deposits of customers; from improving service quality to expanding locations and transaction offices in Hanoi city to facilitate customer transactions and payments;¼ Therefore in 2012 the capital source Sacombank – Hanoi’s deposits reached VND 4,713 billion, a growth rate of 27.25% compared to 2011, which is a positive figure. The branch needs to continue to promote the achieved results and come up with more practical policies and activities to further promote capital mobilization.

In terms of capital structure mobilized

According to the deposit term

Funds mobilized at Sacombank – Hanoi are divided by term into 3 forms: demand deposit, term deposit < 12 months, term deposit >= 12 months. Looking at Table 2.1, we can see that deposits with a term of < 12 months in the period 2010 – 2012 accounted for the main proportion of the branch’s mobilized capital. In 2010, deposits with term < 12 months accounted for 62.97% of total mobilized capital, in 2011 this proportion increased to 64.18%. Not only increased in percentage but this type of deposit also increased in absolute number. In 2011, deposits with term < 12 months increased by 257.52 billion VND, equivalent to 12.15% compared to 2010. This growth in short-term deposits was due to the race in interest rates in 2011. occurred between banks, high interest rates attracted customers to deposit money in banks. Although by 2012, the State had introduced policies to stabilize interest rates, but short-term capital still increased by VND 912.85 billion, equivalent to an increase of 38.40% compared to 2011 and accounted for the largest proportion. 69.81%. The above positive results are an effort of the Branch for constantly innovating short-term savings deposit products with more favorable interest rates and offering more attractive services. On the other hand, it is also because businesses switch from demand deposit to term with short term to enjoy higher interest rate. The increase in short-term capital helps the Branch’s short-term solvency to be more secure, and proves that its prestige is increasingly enhanced, customers know the Branch more.

Table 2.1. Capital mobilization activities at Saigon Thuong Tin Commercial Joint Stock Bank – Hanoi Branch

Unit: billion

| Targets | Year 2010 | Year 2011 | Year 2012 | difference deviated | ||||||

| 2011/2010 | 2012/2011 | |||||||||

| Amount of money | Proportion (%) | Amount of money | Proportion (%) | Amount of money | Proportion (%) | Amount increased (+) decreased (-) | Gain the ratio (%) | Amount increased (+) decreased (-) | Gain the ratio (%) | |

| Tdriveengagementng | 3,366.42 | 100 | 3,703.86 | 100 | 4.713 | 100 | 337.44 | 10.02 | 1,009.14 | 27.25 |

| I. TG by term | ||||||||||

| 1. No term | 908.93 | 27.01 | 933 | 25.19 | 947.63 | 20.11 | 24.07 | 2.65 | 14.63 | 1.57 |

| 2. TG < 12 months | 2.119.85 | 62.97 | 2.377.37 | 64.18 | 3.290.22 | 69.81 | 257.52 | 12.15 | 912.85 | 38.40 |

| 3. TG >= 12 months | 337.64 | 10.02 | 393.49 | 10.63 | 475.15 | 10.08 | 55.58 | 16.54 | 81.66 | 20.75 |

| II. TG by composition KT | ||||||||||

| 1. TG of nest position economy | 1,851.53 | 55 | 2.104.83 | 56.83 | 2,856.6 | 60.6 | 253.30 | 13.68 | 751.77 | 35.72 |

| 2. Personal TG | 1,514.89 | 45 | 1599.03 | 43.17 | 1,856.4 | 39.4 | 84.14 | 5.55 | 257.37 | 16.10 |

| III. By deposit type | ||||||||||

| 1. VND | 2,827.84 | 84 | 3.152.67 | 85.11 | 4.147.44 | 88 | 324.83 | 11.49 | 994.77 | 31.55 |

| 2. Foreign currency (conversion) | 538.58 | 16 | 551.19 | 14.89 | 565.56 | twelfth | 12.61 | 2.34 | 14.37 | 2.61 |

Maybe you are interested!

-

Solutions to promote the efficiency of consumer lending activities at Saigon Thuong Tin Commercial Joint Stock Bank - 2

Solutions to promote the efficiency of consumer lending activities at Saigon Thuong Tin Commercial Joint Stock Bank - 2 -

Factors Affecting The Improvement Of The Efficiency Of Consumer Lending Activities

Factors Affecting The Improvement Of The Efficiency Of Consumer Lending Activities -

Overview Of Saigon Thuong Tin Commercial Joint Stock Bank – Hanoi Branch

Overview Of Saigon Thuong Tin Commercial Joint Stock Bank – Hanoi Branch -

Activities Of Using Capital (Mainly Lending Activities)

Activities Of Using Capital (Mainly Lending Activities) -

General Regulations On Consumer Lending Activities At Saigon Thuong Tin Commercial Joint Stock Bank – Hanoi Branch

General Regulations On Consumer Lending Activities At Saigon Thuong Tin Commercial Joint Stock Bank – Hanoi Branch -

Current Status Of Consumer Lending Activities At Saigon Thuong Tin Commercial Joint Stock Bank – Hanoi Branch In The Period 2010-2012

Current Status Of Consumer Lending Activities At Saigon Thuong Tin Commercial Joint Stock Bank – Hanoi Branch In The Period 2010-2012

(Source: Financial Newspaper of Saigon Thuong Tin Commercial Joint Stock Bank – Hanoi Branch for the period 2010-2012)

However, this is also a concern for the Branch because the medium and long-term capital with a low proportion will be difficult to secure financing for medium and long-term loans, so the Branch will have to use short-term sources to finance medium and long-term loans, making the Branch’s liquidity difficult. Therefore, the Branch needs to take measures to shift the proportion of short-term and long-term capital in a reasonable manner.

Holding the second highest proportion after deposits with terms of less than 12 months are payment deposits with the proportion ranging from 20% to nearly 30%, the proportion decreasing over the years. The proportion of demand capital is too high, which may cause the Branch to fall into a passive state in business activities (this is a low stable and high-risk mobilization source) when the cash source fluctuates in the direction of the bank. negative direction. Therefore, the Branch has put in place reasonable measures to control and maintain this proportion of funds, so there has been a slight decrease in the proportion of demand deposits year by year. Although the proportion decreased, the demand capital still grew slightly in the period 2010-2012. In 2011 the demand deposit increased by 2.65% compared to 2010 and in 2012 this capital increased by 1.57% compared to 2011. The branch has been active in finding new customers. , especially businesses, organizations and individuals that have a need to deposit money into banks for the purpose of payment transactions to pay for the purchase and sale of goods and services with preferential costs and quick services. . This has helped the bank’s demand for deposits increase year by year. However, the decrease in growth rate over the years is due to low interest rates on demand deposits, businesses want to earn more, so they switch to term deposits with short durations with higher interest rates.

If the proportion of short-term capital accounts for the majority of total capital, long-term capital accounts for only a small proportion (in 2010 accounted for 10.02% of total mobilized capital) and in 2011 this proportion increased. accounted for 10.63%. In parallel with the increase in proportion, long-term capital in 2011 increased by 55.58 billion dong, equivalent to 16.54% compared to 2010. In 2011, the economic situation had many fluctuations in interest rates, but the amount attracting bank capital still increased in both short term and long term, which is a good sign in attracting capital. However, by 2012, the state introduced economic policies to restore the real estate market, stabilize the gold market, and people had more confidence when investing in these markets. Meanwhile, banks are limited in interest rates by the State Bank, facing many difficulties in mobilizing capital because the interest rate is not enough to attract long-term money. In addition, partly because people’s psychology is still afraid to deposit long-term capital at banks, when interest rates change constantly, short-term deposits will help customers change investment channels easily. than. Therefore, the proportion of medium and long-term capital decreased to 10.08% of the total capital. Although the proportion decreased, the long-term capital in 2012 still increased by 81.66 billion VND, equivalent to 20.75% compared to 2011. It is because the Branch has found all measures to overcome difficulties and since then stabilize the structure, increase the proportion of medium and long-term capital to meet the demand for medium and long-term loans and ensure a more stable liquidity demand at the Branch.

By economic composition

Funds mobilized are mainly from two economic sectors, namely economic organizations and individuals. Looking at Table 2.1, we can see that capital from economic organizations always accounts for the main proportion of total capital (2010: 55%; 2011: 56.83%, 2012: 60.6%). . The reason is that the Branch has always focused on strengthening relationships with economic organizations, maintaining old partners and seeking and developing new relationships with businesses and organizations in the locality. table. Funds mobilized from economic organizations have increased sharply over the years. In 2011, mobilized capital reached 2,104.83 billion VND, an increase of 13.68% compared to 2010; in 2012 reached 2,856.6 billion VND, up 35.72% compared to 2011. The above satisfactory results were achieved because the Branch tried to diversify deposit mobilization methods such as: ladder savings, savings, and savings. bonus savings, prepayment of interest, application of many interest periods for term deposits of economic organizations… with attractive interest rates in line with market changes to attract money . In addition, the Branch has always cared about customers, focusing on improving service quality and improving reputation. In 2012, Sacombank – Hanoi increased advertising activities, organized seminars to introduce its products and services to businesses and organizations in the area, in order to find and attract customers. add new customers. Since then, more economic organizations have come to the branch, and the mobilization of capital from economic organizations of Sacombank – Hanoi has grown quite well in the period 2010 – 2012.

Besides capital mobilized from economic organizations, capital mobilized from individuals also accounts for a relatively high proportion, ranging from 39% to 43% and accounts for a large part of the role of stabilizing capital flows for businesses. branch’s production and business activities. However, the proportion has decreased over the years, due to the fact that the capital mobilized from economic organizations has a higher growth rate than the growth rate of capital mobilized from deposits of the population. mobilized still increase in absolute value. As the competition for capital mobilization from businesses is getting fiercer, banks are increasingly focusing on mobilizing capital from deposits of individuals, with a large population and abundant money in the area. , the development potential is huge. In 2011, the Branch has focused on doing well the brand promotion activities, improving the reputation and quality of activities in order to increase and develop capital mobilization from the population, making not only economic organizations that individuals also know more about the bank. Therefore, the capital mobilized from individuals of the Branch in 2011 increased by VND 84.14 billion compared to 2010 respectively, an increase of 5.55%. In 2012, a series of deposit products were offered by the Branch with attractive interest rates, and service improvement activities were promoted not only at the Branch but also at transaction offices. , in order to create a better impression in the eyes of customers. From those efforts, by 2012, the amount of capital mobilized was VND 1,856.4 billion, an increase of VND 257.37 billion compared to 2011, corresponding to a growth rate of 16.10%.

By deposit type

Banks often divide capital into VND capital and foreign currency capital. VND capital always accounts for a large proportion in the capital structure, with the proportion of 84% in 2010, 85.11% in 2011 and 4,147.44 billion dong in 2012, accounting for 88%. The amount of deposits in VND grew continuously for 3 years from 2010 to 2012. In 2011 the amount of capital mobilized from VND was 3,152.67 billion VND, an increase of 11.49% compared to 2010. In 2012 the capital source. VND deposits increased sharply to VND 4,147.44 billion, equivalent to an increase of 31.55% compared to 2011.