Securities investment loans

Borrowers: For individual investors wishing to invest in securities. Securities are securities officially listed on the centralized stock market and auctioned through a Securities Company or a Finance Company that has signed a cooperation contract with Sacombank .

Product features: The maximum loan term is 12 months with the loan amount determined in proportion to the value of investment securities and the loan term for each type of securities. Lending interest rate according to regulations of Sacombank – Hanoi at the time of borrowing. Method of periodic interest payment, flexible principal payment.

Mortgage loans for valuable papers

The branch’s valuable papers mortgage loan product helps customers who are in need of capital to get the necessary capital when the savings book or valuable papers under the customer’s ownership has not yet expired. maturity period.

Product Features: The loan level is suitable for the type and nature of valuable papers and up to 90% of the assessed value. The loan period is consistent with the maturity of valuable papers but up to 12 months with flexible repayment methods. The time for appraisal and lending decision is no more than 2 hours.

Unsecured consumer loans : With unsecured loans, employees with stable incomes will not need special assets but can still access loans from Sacombank – Hanoi to meet their needs. consumption needs for themselves and their families.

Product features: Customers can borrow up to 200 million VND and not more than 10 times monthly net income depending on salary without collateral. The minimum installment loan term is 12 months, the maximum is up to 60 months. The easiest and most convenient repayment method, the principal and interest are paid in monthly installments. Solve the fastest loan application (02 working days from the date of receiving the full application). Very competitive loan interest rate on the initial loan balance. Borrowers are provided with Life Insurance by Sacombank – Hanoi for the duration of the loan.

Loans to Sacombank employees

Maybe you are interested!

-

Business Performance Of Saigon Thuong Tin Commercial Joint Stock Bank – Hanoi Branch

Business Performance Of Saigon Thuong Tin Commercial Joint Stock Bank – Hanoi Branch -

Activities Of Using Capital (Mainly Lending Activities)

Activities Of Using Capital (Mainly Lending Activities) -

General Regulations On Consumer Lending Activities At Saigon Thuong Tin Commercial Joint Stock Bank – Hanoi Branch

General Regulations On Consumer Lending Activities At Saigon Thuong Tin Commercial Joint Stock Bank – Hanoi Branch -

Solutions to promote the efficiency of consumer lending activities at Saigon Thuong Tin Commercial Joint Stock Bank - 9

Solutions to promote the efficiency of consumer lending activities at Saigon Thuong Tin Commercial Joint Stock Bank - 9 -

Evaluating The Efficiency Of Consumer Lending Activities At Saigon Thuong Tin Commercial Joint Stock Bank - Hanoi Branch

Evaluating The Efficiency Of Consumer Lending Activities At Saigon Thuong Tin Commercial Joint Stock Bank - Hanoi Branch -

Solutions to promote the efficiency of consumer lending activities at Saigon Thuong Tin Commercial Joint Stock Bank - 11

Solutions to promote the efficiency of consumer lending activities at Saigon Thuong Tin Commercial Joint Stock Bank - 11

Loan object: Employees who are working at Sacombank are entitled to borrow capital to serve personal or family consumption needs such as: home repair, medical examination and treatment expenses, home appliance purchases, travel expenses … and other consumer needs not contrary to the provisions of the Law and Sacombank.

Loan term: up to 48 months, but not exceeding the remaining working time according to the signed labor contract of Sacombank’s officers and employees.

Borrow to prove financial capacity

This product provides a solution for customers who need to prove their financial capacity to travel abroad or need to ensure their children’s financial ability to study abroad according to the requirements of the host country.

Product features: Quick procedure, no collateral required for the loan; Reasonable borrowing costs, customers only need to pay the difference between loan and deposit interest rates; Sacombank closely links study abroad companies across the country, promptly responding to customers’ needs; The loan level that best meets the needs of financial proof. Maximum loan term is 12 months. Disbursement in VND.

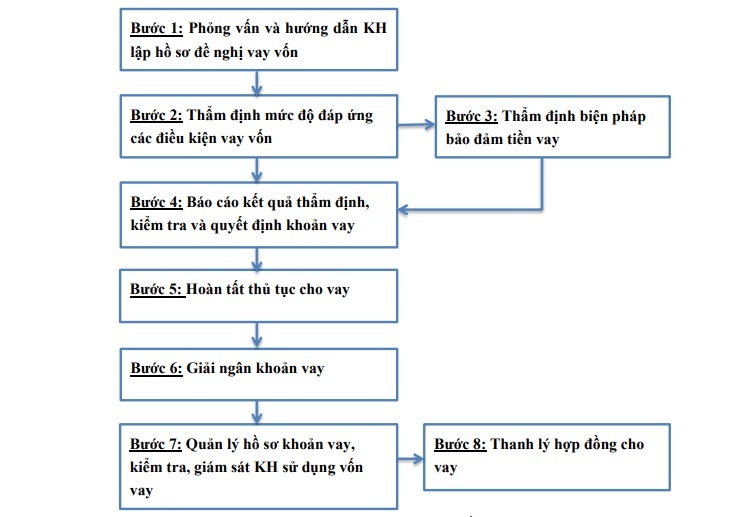

2.3.5. Consumer loan process

Step 1: Interview and guide customers to make loan application documents

In step 1, there are two specific job contents: interviewing, discussing with customers and guiding customers to make, receive and compare loan application documents.

Interview and exchange with customers

The purpose of customer interviews is to: Observe the customer’s attitudes, methods and responses, detect conflicts and inconsistencies, or dishonesty between loan documents and content. content of interviews; comments on the borrower’s qualifications, capacity, qualities, ethics, experience and reputation; explain unclear or contradictory points in the loan application.

Based on the purpose of the above interview, the CBTD must ask questions for specific interviews. After the interview and exchange, the CBTD carefully keeps a record of the content of the interviews in case there is a lawsuit. When asking customer interview questions, credit bureaus need to pay special attention to a number of contents that are often not fully explained or contradicted in customer loan documents.

During the interview, the credit officer should ask questions mainly about the following: Personal identity (name, age, address, occupation) of the client and related persons (household member, guarantor) consular, international students); the purpose of borrowing capital, the demand for capital use; properties of which the client is the owner or co-owner, the property of the household; expected income and sources of debt repayment, expected repayment period; alternative sources of money can be mobilized to repay the Bank in case the loan application is at risk of being unable to repay the loan ; current financial obligations, credit relationship of customers with Sacombank’s banking system and other organizations and individuals…

Credit officers provide specific and complete instructions to customers on: principles of borrowing capital; loan conditions; Lending rates; interest rates; loan maturity date; loan security measures; inspect and supervise the use of loan capital and handle collateral for debt recovery, procedures and documents in accordance with current regulations of the State Bank and Sacombank.

Diagram 2.2. Process of consumer lending activities of Saigon Thuong Tin Commercial Joint Stock Bank – Hanoi Branch

(Source: Personal Customer Room )

Guide customers to make, receive and compare loan application documents

After exchanging information with the customer, if the customer approves, the bank will guide the customer to receive, check and request additional loan documents to ensure the completeness, legality and validity. and unify.

A loan application file includes: Loan application form, identity card, passport, personal papers to determine identity, household registration (if any), documents proving the source of income used for financing. loans, documents related to credit, documents related to loan security… (usually banks specify each specific type of document for each type of loan with specific purposes).

Credit officers collect other information related to borrowers through direct interviews with customers, through customer transactions at Sacombank and through credit centers of the State Bank of Vietnam. South and channels can be collected.

Step 2: Assess the level of meeting loan conditions

The basic content of this step focuses on three main issues: appraisal of customers, appraisal of financial situation and feasibility of the loan – repayment plan.

Customer evaluation

The branch checks and evaluates the legal capacity and civil act capacity of the client, including: Full name, age, gender, nationality, place of residence for individual customers and their representatives according to the law for customers who are households, cooperative groups and individual business households; contents related to civil act capacity for individual clients and legal representatives for clients being households, cooperative groups and individual business households.

Check, determine and evaluate the capability and reputation of the Customer in the socio-economic life, including: The situation of facilities such as houses, equipment serving consumer needs; moral rights attached to property; ownership, inheritance and other rights to property; ethics and lifestyle in community relations for individual clients and legal representatives for clients being households, cooperative groups and individual business households.

Assess financial situation

The branch accurately assesses the financial capacity of the customer to determine the financial strength; independence, financial autonomy in daily life, business activities, solvency and debt repayment ability of borrowers. The branch also needs to assess the income of customers and related people: salary, income from deposits, securities, rental properties and other lawful incomes in money and other assets… based on the documents. provided by the customer and the actual investigation.

Assess the feasibility of the loan – repayment plan

The branch assesses the legitimacy of the loan purpose according to Sacombank’s current lending regulations; examine, evaluate, and determine: necessity, consumption level compared to income, ability to develop household business/cooperative group/individual household business according to the methods mentioned in loan plan and debt repayment ability of borrowers; determine the effectiveness of the customer’s loan repayment plan with Sacombank when lending, and at the same time calculate and re-evaluate the customer’s income, sources of debt repayment for the loan at Sacombank and the financial obligations of the customer. customers during the loan period; determining Sacombank’s management measures for customers’ cash repayment; forecasting risks and taking measures to deal with them. In addition, the Branch needs to determine the loan amount, loan currency, loan interest rate, loan fee,loan maturity date; principal and interest repayment plan; grace period, form of security, value of loan security assets according to current lending regulations and regulations on loan security of Sacombank.

Step 3: Appraise loan security measures

In order to decide whether to lend or not, it is necessary to appraise customers, plan to use loan capital, etc. Loan collateral is a backup source of debt collection in case the customer’s debt repayment plan cannot be implemented, and at the same time, collateral also increases the borrower’s debt repayment responsibility and limits fraud and avoids debt repayment obligations. borrower. Therefore, the purpose of appraisal of collateral is to determine whether the property has the right owner? Is there a dispute? Is it easy to sell when selling? Does the actual obtained value fully cover the loan principal, interest and taxes and fees as prescribed?

Contents of appraisal of loan security measures include: Loan security measures, legality and validity of security measures; Quantity, quality, marking, condition, location of the property; the client’s rights to the property; the valuation value of the loan security property, the loan amount compared to the value of the collateral; loan guarantee procedures; ability and measures to manage assets to secure loans of Sacombank – Hanoi; other loan security issues.

In addition to the inspection on paper, it is necessary to conduct an actual inspection at the scene to determine the location, location, quality, actual value, and form of artifacts. The credit officer and the appraisal team must make a record of the inspection of the mortgaged property according to the prescribed regime. In case the mortgaged, pledged or guaranteed property exceeds the appraisal capacity of the bank staff, it is necessary to hire competent agencies or experts with knowledge in that field to appraise. Procedures for mortgage and pledge of assets must be completed before disbursement.

Step 4: Report appraisal results and check loan decision

Credit officers appraise customers’ situation, loan repayment plans, guarantee loans of customers, forecast potential risks, and conform to Sacombank’s credit policy. From there determine the loan amount, method, interest rate, loan term; debt maturity and payment terms.

Credit officer prepares “personal credit report” according to the form issued by Sacombank: Assessing the quality of data provided by customers, rating customers, proposing lending or not lending. Time limit for completing “Personal credit report”: no more than 02 working days for customers who have regular credit relations or the last loan at Sacombank’s business units is not more than 06 months; no more than 3 working days for remaining customers.

The individual customer department’s leader re-checks the “Personal Credit Statement”, requests the Credit Officer to additionally appraise or explain the contents that need to be clarified related to the loan; compare with Sacombank’s lending policies and regulations; propose ideas for lending or not lending, additional conditions to submit to leaders of Sacombank – Hanoi for approval and lending decision. After the loan decision is made, the leader of the individual customer department transfers the loan application to the credit bureau to notify the results of the approval process to the customer. When proposing not to lend CB credit, the basis must be clearly stated to the customer.

Step 5: Complete the loan procedure

After having a loan decision or loan approval, the credit bureau completes the lending procedures in accordance with Sacombank’s regulations. Credit control and credit support for individual customers to receive and check the originals and documents proving ownership of the loan security assets, the originals of other papers on loan security; Drafting Loan Security Contract and submitting it to the competent authority for signing with the Client; Notarized loan security contract as prescribed. After signing the credit contract and loan security contract, the customer credit control and support officer shall register the secured transaction according to regulations. Credit control and support officers hand over and enter the loan collateral fund.

Step 6: Disburse the loan

Disbursement requirements must be managed so that customers use loans for the right purposes, effectively and minimize all risks that occur in the process of using loans of customers.

Consumer credit control and support officers are responsible for: Guiding customers in making and signing debt receipts; compare the loan use purpose on the customer’s profile, credit contract, debt receipt and submit it to the Head of Department/

Credit Team Leader for approval; enter data and loan information into the Credit Module according to regulations; transfer the approved credit contract, debt receipt and payment documents to the customer service department for disbursement to the customer; coordinate with individual customer department, accounting – treasury department to collect fees related to loans; establish a monitoring book for the loan and record any arising in the course of loan management.

Step 7: Manage loan records, check and monitor customers using capital

Manage loan records

The consumer credit control and support officer is responsible for: Coordinating with the Customer Service Department, the accounting – treasury department to supervise the process of storing, preserving, importing and exporting legal documents. loan management, legal documents of special assets; updating loan records on problems arising after disbursement; Manage loan documents in writing at the customer loan department.

Check and supervise customers in the use of loans

The inspection and supervision of loan use is carried out concurrently with the process of disbursement, debt collection, and debt repayment term rescheduling. Request supervision and follow-up to check the reality of the debt repayment plan and the ability to implement, detect and forecast risks that may arise; detect problem loans early before they become serious; to propose solutions in a timely manner. The results of inspection and control must be recorded in writing.

The contents of inspection and supervision include: The situation of loan use, collection and examination of documents proving the use of capital, especially in the case of cash disbursement; the implementation of the contents of the credit contract and the loan security contract; business development situation of households/ cooperative groups/ individual business households; the client’s income situation; revenue sources and debt repayment ability; the situation of loan security assets; other problems (if any).

Step 8: Liquidation of the loan contract

Loans when due or when customers violate the contract, the Branch will proceed to liquidate the loan contract. This step includes: debt collection and debt reconciliation, contract liquidation, debt rescheduling, and special asset handling.

Debt collection and debt reconciliation

Credit officers are responsible for: Monitoring and urging the repayment of customers’ debts; collect principal, calculate and collect interest, forecast loan interest collection and make accounting according to Sacombank’s regulations; update in the professional file the arising in the collection of principal, interest and fees; notify Credit Officers, Divisional leaders and business unit directors of unusual credit signs (delayed payment of principal, interest, fees, etc.) for timely handling and urging measures. All revenues generated from bank loans and other financial sources agreed upon by the customer in the debt repayment plan must be repaid to the bank; When there is a source of revenue, the bank must immediately recover the debt. Customers are not allowed to use the capital sources used to repay the bank’s debt to turn around or use it for other purposes. To track debt collection,CBTD must open a monitoring book in combination with a management program on a computer system to monitor daily for each customer: due debts, overdue principal/interest debt, overdue debt by overdue time, debt extension, debt rescheduling, debt rescheduling, interest collection of debts, debt classification according to prescribed debt groups.

Liquidation

If the term of the contract expires and the customer has fulfilled the obligation to repay both principal and interest, the bank and the customer will carry out procedures for liquidating the loan contract, disposing of assets, and keeping loan documents and warehouses. storage.

Restructuring the repayment term

In case the customer fails to pay the principal or interest by the due date and the customer submits an application for debt rescheduling, the credit officer is responsible for: Receiving the application for rescheduling of the debt repayment term. client; examine the actual situation, make a record of checking the use of loan capital; compare the reality with the proposal for debt rescheduling and Sacombank’s regulations on conditions and procedures for debt rescheduling. Then, the credit officers make a proposal to restructure the repayment term, assess the satisfaction of the conditions for debt rescheduling in accordance with Sacombank’s regulations, and write suggestions. If a debt rescheduling is proposed, it must be clearly stated: the amount requested for rescheduling the repayment term, and the time for rescheduling the repayment term. If the proposal does not restructure the repayment term, the reason must be clearly stated.

The credit officer shall draft a contract to amend and supplement the credit contract and the mortgage contract in accordance with the appraisal results, propose the rescheduling of his loan repayment period or modify it according to the approval of the competent person/level (if the content is approved). approval different from the proposed content); instruct customers to sign. Submit the loan rescheduling file to the Head of the Personal Customer Department and enter the file into the computer program. After having the decision of the authorized person/level, the credit officer shall notify the results of submission to the customer for approval.

Disposal of solid assets

In case the customer is unable to repay the loan principal or interest by the due date and is not approved by the bank to restructure the repayment term, the Branch will handle collateral to recover the loan.

2.4. Current status of consumer lending activities at Saigon Thuong Tin Commercial Joint Stock Bank – Hanoi Branch in the period 2010-2012

2.4.1. Consumer loan sales situation