Finally, for customer satisfaction studies in the banking sector, Grönross’s model of technical quality and skill quality is more reasonable (Lassar et al, 1998). However, this study does not consider the corporate image factor, so this model is not used. Oliver’s Perception-Perception model was also rejected because this study did not measure customer expectations.

Conclusion Chapter 1

Chapter 1 presented the theoretical basis of banking services, services, service quality, banking service quality, customer satisfaction about banking service quality and the relationship between service quality and customer satisfaction. banking services and customer satisfaction. At the same time, the criteria for measuring the effectiveness of banking service quality are also outlined. In addition, service quality measurement models are also mentioned. The study chose the appropriate theoretical model, SERVPERF model.

CHAPTER 2: ASSESSMENT OF CUSTOMERS’ SATISFACTION WITH SERVICE QUALITY AT SCB Commercial Joint Stock Bank AFTER Merging

2.6. Overview of Saigon Commercial Joint Stock Bank after the consolidation

2.6.1. General introduction

Vietnamese name: Saigon Commercial Joint Stock Bank.

English name: Saigon Commercial Bank.

Maybe you are interested!

-

Evaluation of customer satisfaction for service quality at Saigon Commercial Joint Stock Bank after consolidation - 2

Evaluation of customer satisfaction for service quality at Saigon Commercial Joint Stock Bank after consolidation - 2 -

The Effectiveness Of Banking Service Quality

The Effectiveness Of Banking Service Quality -

The Role Of Customer Satisfaction In The Development Of The Bank

The Role Of Customer Satisfaction In The Development Of The Bank -

Assess The Current Status Of Customer Satisfaction About Products And Services Of Saigon Commercial Joint Stock Bank

Assess The Current Status Of Customer Satisfaction About Products And Services Of Saigon Commercial Joint Stock Bank -

Correction Of Research Models And Hypotheses

Correction Of Research Models And Hypotheses -

Evaluation Of Customer Satisfaction With Service Quality At Saigon Commercial Joint Stock Bank After Consolidation

Evaluation Of Customer Satisfaction With Service Quality At Saigon Commercial Joint Stock Bank After Consolidation

Brand Name: SCB.

Head office: 927 Tran Hung Dao, District 5, HCMC.

Charter capital: since January 1, 2012, SCB’s charter capital is VND 10,584 billion

2.6.2. The process of formation and development

Saigon Commercial Joint Stock Bank, formerly known as Que Do Commercial Joint Stock Bank, was established in 1992 under the operating license number 00018/NH-GP dated 06/06/1992 by the Governor of the State Bank of Vietnam and under the license of the State Bank of Vietnam. 308/GPUB dated June 26, 1992 of the People’s Committee of Ho Chi Minh City.

After a process of existence and development, Que Do Commercial Joint Stock Bank officially changed its name to Saigon Commercial Joint Stock Bank under Decision 336/QDNHNN dated April 8, 2003 by the Governor of the State Bank of Vietnam.

On December 26, 2011, the Governor of the State Bank of Vietnam officially granted License No. 238/GPNHNN on the establishment and operation of Saigon Commercial Bank (SCB) on the basis of voluntary consolidation of three banks: Saigon Commercial Joint Stock Bank. (SCB), De Nhat Commercial Joint Stock Bank (Ficombank), Vietnam Tin Nghia Commercial Joint Stock Bank (TinNghiaBank). Saigon Commercial Joint Stock Bank (Consolidated Bank) officially came into operation on January 1, 2012.

On the basis of inheriting the inherent strengths of the three banks, the Consolidated Bank immediately has a strong advantage in the banking sector and is among the top five largest joint stock banks in Vietnam. Specifically: Charter capital reached VND 10,584 billion, Total assets of the bank reached about VND 154,000 billion, Fund mobilized from credit institutions, economy and residents of the bank reached more than VND 110,000 billion. The accumulated pre-tax profit reached over 1,300 billion VND. Currently, the bank’s system based on the total number of head offices, transaction offices, branches, transaction offices, savings funds, and transaction points is estimated at 230 units across the country. most convenient and economical.

From the available strengths and the determination of the Board of Directors, the Board of Management and all employees, the support of the State Bank, Bank for Investment and Development (BIDV), especially With the trust and support of customers and shareholders, Saigon Commercial Joint Stock Bank (Consolidated Bank) will certainly promote its strengths in financial capacity, operational scale and management ability to quickly become one of the leading financial and banking groups in Vietnam and of international stature, strong enough to compete in domestic and foreign markets. Thereby, providing flexible and high-quality financial solutions to meet the needs of all customers as well as enhance the value and interests of shareholders.

2.6.3. Products and services being offered

Capital mobilization

– Individual customers: Demand deposits, regular term deposits in VND and foreign currencies; demand deposits, regular term deposits; online deposit.

– Corporate customers: online investment; day term investment; ordinary term deposits; flexible investment; online deposit.

– Promissory note, certificate of deposit…

Loan

– Individual customers: lending to small businesses; loans to prove financial capacity; mortgage loans of savings books, valuable papers and deposit account balances; trust lending; travel loans for the elderly; car loans; loans to buy houses, land and construction, home repair, interior decoration; study aid loans.

– Corporate customers: entrusting loans; short-term loans, medium and long-term loans; VND loans to finance exports with USD interest rates; co-sponsor.

Payment Service

– Domestic and international money transfer.

– Pay salaries of enterprises via accounts, ATM cards.

– Payment of remittances, Western Union.

– Pay phone, water and electricity bills.

– Phone recharge service.

Card service

– ATM card

Electronic banking services

– SMS Banking, Internet Banking.

Treasury Services

– Counting.

– Currency exchange.

– Exchange for other face value.

– Paying on the spot.

– On-site collection.

Other services

– Escrow service to establish a business and maintain business operations.

– Balance confirmation service to prove financial capacity.

– Service of supply and payment of domestic registration checks.

– Consulting service and making export documents.

– Domestic check collection service.

– Guarantee.

– Factoring.

– Trading in foreign currency – gold.

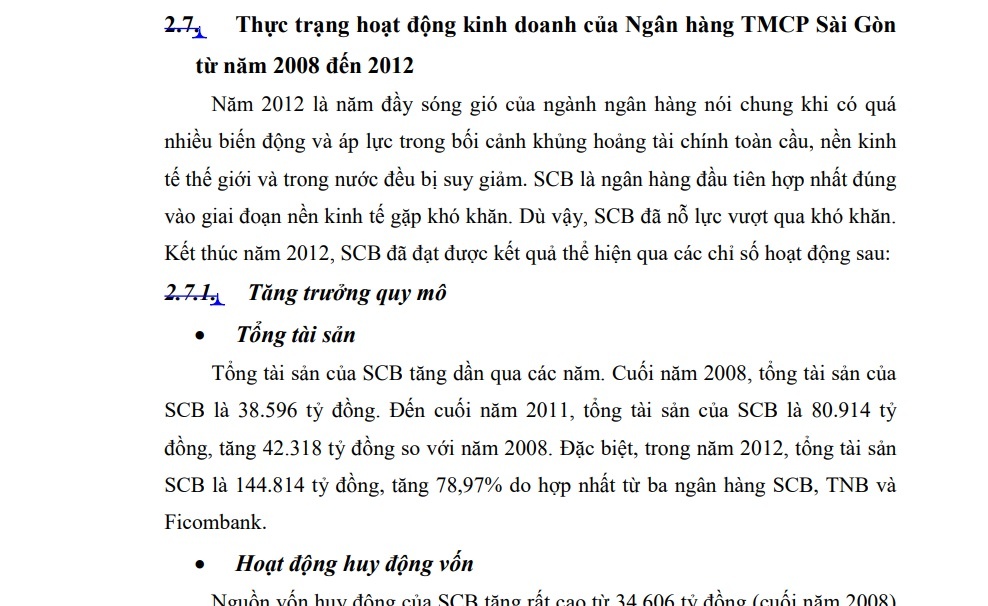

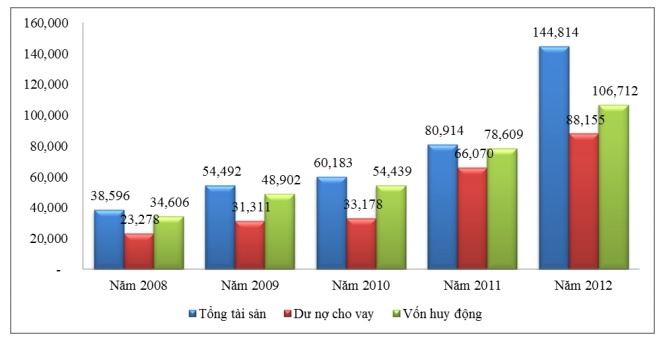

2.7. Situation of business activities of Saigon Commercial Joint Stock Bank from 2008 to 2012

2012 was a turbulent year for the banking industry in general when there were too many fluctuations and pressures in the context of the global financial crisis, the world and domestic economies were in decline. SCB was the first bank to consolidate in a time of economic difficulties. However, SCB has made efforts to overcome difficulties. At the end of 2012, SCB achieved the following performance indicators:

2.7.1. Scale growth

• Total assets

Total assets of SCB increased gradually over the years. At the end of 2008, SCB’s total assets were VND 38,596 billion. By the end of 2011, total assets of SCB were VND 80,914 billion, an increase of VND 42,318 billion compared to 2008. In particular, in 2012, total assets of SCB were VND 144,814 billion, an increase of 78.97% due to consolidation from three banks SCB, TNB and Ficombank.

• Fundraising activities

SCB’s mobilized capital increased very high from 34,606 billion VND (at the end of 2008) to 106,712 billion VND at the end of 2012. With the policy of ceiling deposit interest rate reduced from 14%/year from the beginning of the year to 8%/year. At the end of the year, together with the general difficulties of the economy and the banking industry, as well as being the first bank to consolidate in Vietnam are challenges that SCB must overcome. With many drastic and positive solutions, increasing capital through mobilization channels, ensuring liquidity safety and complying with regulations of the State Bank, by December 31, 2012, the deposit balance reached 106,712 thousand billion, up 35.75% compared to 2011.

• Lending activities

SCB’s lending also increased from VND 23,278 billion (end of 2008) to VND 88,155 billion (end of 2012). In 2012, the credit activity of the banking industry was strongly affected by the general difficulties of the economy (negative growth in the first 6 months of 2012). In the third quarter of 2012, the macro economy improved.

Total outstanding loans to customers as of December 31, 2012 of SCB reached VND 88 trillion, an increase of 33.43% compared to 2011.

Figure 2.1: Scale growth (Unit: Billion VND)

(Source: SCB Annual Report 2012)

2.7.2. Profit before tax

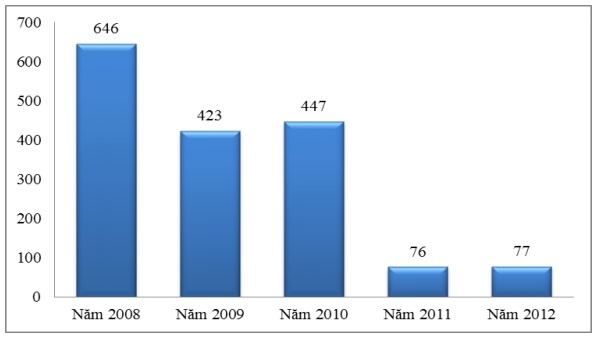

Despite the difficult business environment in 2012, complicated changes in interest rates and exchange rates and the first year of consolidation, SCB managed to achieve a pre-tax profit of VND77 billion.

Figure 2.2: Profit before tax (Unit: Billion VND)

(Source: SCB Annual Report 2012)

2.7.3. Current status of products and services of Saigon Commercial Joint Stock Bank

2.7.3.1. About fundraising activities

For the whole year of 2012, SCB’s total mobilized capital from economic organizations and residents reached VND 106,712 billion, an increase of VND 28,103 billion, an increase of 35.75% compared to 2011, the growth rate average over 2,300 billion VND/month (see chart 2.1). In 2012, SCB has continuously implemented many attractive deposit mobilization products and policies with an appropriate and highly competitive interest rate mechanism. for customers by flexible and comprehensive deposit mobilization products and policies. Some of the deposit products for individual customers can be mentioned such as: “Consolidate millions of springs”, “Enjoy the summer with SCB”, “Billionaire’s fortune”, “Sparkling Christmas – Win gifts” level”…; deposit products for corporate customers such as: “Multi-benefit payment”, “Flexible investment”, “SCB 100+” with VIP customer policies, preferential policies for middle-aged customers , elderly. Through that, SCB has attracted the attention and support of customers across the country; building a loyal customer base, and helping SCB approach and attract new customers.

2.7.3.2. About credit activities

As of December 31, 2012, total outstanding loans of SCB reached VND 88,155 billion, an increase of VND 22,085 billion, an increase of 33.4% compared to 2011. In which, overdue debt of SCB decreased by 8.4 % compared to 2011, mainly because credit activities in 2012 focused on debt restructuring and collection activities to improve the quality of the loan portfolio (see chart 2.1).

Besides, with the policy of accompanying and sharing difficulties for customers, especially corporate customers, SCB advocates selective credit growth, focusing on businesses in priority areas. , with typical loan products such as: “Lending for agricultural and rural development”, “Lending for rice purchase”, “Lending for farming and seafood processing”. In addition, SCB continues to apply preferential policies for customers such as preferential interest rate policy for customers who transfer revenue to SCB. Especially, in 2012, following the policy of the State Bank, SCB continuously reduced lending interest rates to support businesses facing difficulties in production and business activities.

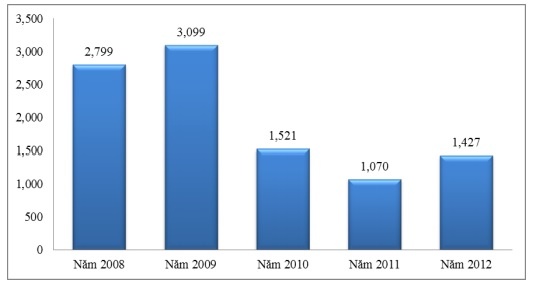

2.7.3.3. About Forex trading

Always ensure that the amount of gold and foreign currency meets the needs of customers with an appropriate and competitive exchange rate from time to time. As of December 31, 2012, the total sales of USD and other foreign currencies of SCB reached more than USD 1,426.8 million.

Figure 2.3: Revenue from foreign exchange business (Unit: Million USD)

(Source: SCB Annual Report 2008, 2009, 2010, 2012)

Developing many derivative products such as futures, swaps, etc. to help customers be proactive in hedging against exchange rate risk. Sales in 2012 of these products reached more than 188 million USD.

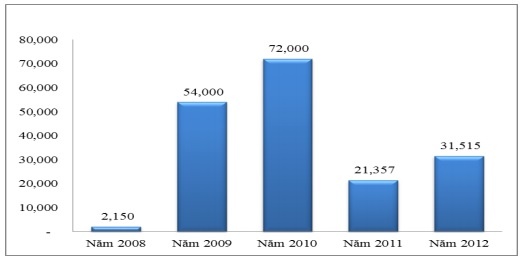

2.7.3.4. ATM card

By the end of 2012, SCB had 138 ATMs operating nationwide and issued more than 31,515 domestic debit cards, including co-branded cards, Rose cards and Tai – Loc – Phu – Quy cards with different colors. Feng shui colors and outstanding transaction limits to meet the different needs of many customers. In addition, in order to encourage customers to use ATM cards, SCB does not collect fees for basic transactions of cardholders at ATMs such as withdrawing money, looking up balances, transferring funds, printing transaction statements, etc.

By the end of 2012, SCB had installed 133 POS machines at hotels, restaurants, commercial centers, supermarkets, and retail stores with a payment turnover of VND 188 billion. In addition, SCB has implemented salary payment service via card for 51 businesses with a total salary of 524 billion dong. At the same time, completing the implementation of the international MasterCard credit card project.

SCB has successfully connected to Banknetvn and VNBC systems. SCB has been a pioneer in joining the Smartlink card alliance, and at the same time, SCB is also one of the first four banks of this alliance to successfully connect to the Banknetvn system. On June 10, 2010, SCB successfully connected with the ATM system of Dong A Commercial Joint Stock Bank under VNBC alliance, bringing the total number of allied banks that SCB card can transact with up to 30 banks with thousands of transactions. ATMs nationwide.

Figure 2.4: Number of ATM cards (cards)

(Source: SCB Annual Report 2008, 2009, 2010, 2012)

2.7.3.5. About e-banking

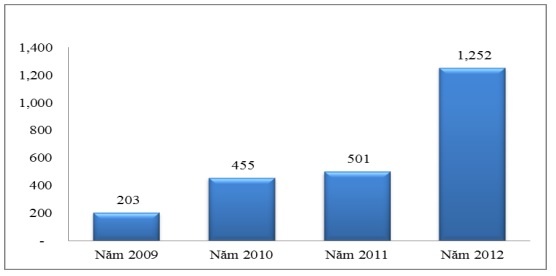

As of the end of 2012, the transaction turnover through the ebanking channel reached more than 1,252 billion VND, an increase of 751 billion VND compared to 2011. Customers can use the utilities provided by the ebanking service such as: online money transfer within and outside the system, deposit / finalize / renew savings accounts, look up account information, topup, pay bills for electricity, water, telephone, ADSL, pay for online shopping such as airline tickets , games, movie tickets… and other operations without fear of risk, without fear of being stolen or copied. This is a fast, time-saving transaction method, anytime, anywhere, customers can make transactions 24/7 without having to go to the bank.

SCB has received Verisign’s certificate of authenticity in transmission encryption. At the same time, SCB has also developed a variety of authentication methods via SMS and Entrust token. Customers’ financial transactions are checked and authenticated through two rounds with passwords and randomly generated security chains from the system to ensure that transactions are processed accurately, safely and securely.

Figure 2.5: Sales of e-banking transactions (Unit: Billion VND)

(Source: SCB Annual Report 2009, 2010, 2012)

2.7.3.6. About international payment activities

Sales of international payments in 2009 increased sharply compared to 2008 (up 70.8%). This is the period when SCB’s international payment activities have developed strongly. However, in 2010-2011, international payment sales decreased because the production and business situation of enterprises faced many difficulties, leading to a decrease in import and export activities. The root cause is that the world economy was in a severe crisis, which had a profound effect on the Vietnamese economy. Entering 2012, the total revenue of international payment activities in 2012 reached nearly 200 million USD (up 11.73% compared to 2011). In which, export payment sales in 2012 increased by 61% over the same period last year, making an important contribution to increasing foreign currency supply for SCB.