2.2.3 Operational situation.

2.2.3.1 Main activities of Vietcombank Vung Tau.

Banking services: The branch provides payment deposit accounts, securities trading deposits, term deposits, centralized capital management services, automatic investment services; issue a payment card linking Vietcombank and an enterprise providing services, such as airlines or telecommunications. Vietcombank Vung Tau issues and accepts all 6 popular cards in the world: Visa, Master Card, JCB, American Express, Diners Club and China Union Pay. Besides, customers can also use other cards such as Vietcombank Connect 24 (domestic debit card), Vietcombank Connect 24 Visa and Vietcombank Mastercard (international debit card).

Savings and Investments: The branch attracts savings from residents and businesses with many attractive programs.

Lending:

- Individuals: loans to employees; lending to executive managers; loans to buy project houses; car loans; personal account overdraft; fortune business products; credit security;

- Enterprises: lending working capital; investment project loans.

Guarantee: Vietcombank Vung Tau provides a variety of guarantee services such as loan guarantee, payment guarantee, bid guarantee, contract performance guarantee, advance payment guarantee (refundable guarantee). advance payment, deposit return guarantee or deposit guarantee), retention guarantee (work quality guarantee, warranty guarantee, maintenance guarantee), reciprocal guarantee, Confirmation of guarantee, guarantee for study abroad, other types of guarantee not prohibited by law and in accordance with international practices.

Payment services: Domestic and foreign money transfer and receipt, payment of domestic and foreign checks; import and export payment services; automatic payroll service; automatic payment for goods and services through banking payment channels (billing payment) such as automatic transaction system ATM, POS, Internet banking, payment at the counter.

Foreign currency trading: buying and selling foreign currencies in many forms such as Spot, Forward,... and performing transactions of valuable papers on the money market.

E-banking: this service at the Branch is very diverse, including many forms such as: VCB online banking - iBanking, VCB mobile messaging banking - SMS Banking, top-up service phone via mobile message VCB - eTopup, 24/7 e-banking service via phone VCB - Phone Banking, automatic bill payment service.

2.2.3.2 Business results of Vietcombank Vung Tau.

Table 2.1: Business results of Vietcombank Vung Tau in the period of 2009-2011

Unit: billion VND

Targets | 2009 | 2010 | 2011 | Compare 2010/2009 (%) | Compare 2011/2010 (%) |

Total source mobilized capital (in VND) | 17,598.37 | 5.469.77 | 4,660.40 | (68.92) | (14.8) |

Odd debt | 2.114.82 | 2,550.01 | 2,636.28 | 20.58 | 3.38 |

Income | 500.37 | 389.27 | 418.41 | (22.20) | 7.49 |

Expense | 319.87 | 204.07 | 207.90 | (36.20) | 1.88 |

Profit | 180.50 | 185.20 | 210.51 | 2.60 | 13.67 |

Maybe you are interested!

-

Solution to complete international payment activities by documentary credit method at Joint Stock Commercial Bank for Foreign Trade of Vietnam, Vung Tau branch - 1

Solution to complete international payment activities by documentary credit method at Joint Stock Commercial Bank for Foreign Trade of Vietnam, Vung Tau branch - 1 -

Solution to complete international payment activities by documentary credit method at Joint Stock Commercial Bank for Foreign Trade of Vietnam, Vung Tau branch - 2

Solution to complete international payment activities by documentary credit method at Joint Stock Commercial Bank for Foreign Trade of Vietnam, Vung Tau branch - 2 -

Solution to complete international payment activities by documentary credit method at Joint Stock Commercial Bank for Foreign Trade of Vietnam, Vung Tau branch - 3

Solution to complete international payment activities by documentary credit method at Joint Stock Commercial Bank for Foreign Trade of Vietnam, Vung Tau branch - 3 -

Solution to complete international payment activities by documentary credit method at Joint Stock Commercial Bank for Foreign Trade of Vietnam, Vung Tau branch - 5

Solution to complete international payment activities by documentary credit method at Joint Stock Commercial Bank for Foreign Trade of Vietnam, Vung Tau branch - 5 -

Solution to complete international payment activities by documentary credit method at Joint Stock Commercial Bank for Foreign Trade of Vietnam, Vung Tau branch - 6

Solution to complete international payment activities by documentary credit method at Joint Stock Commercial Bank for Foreign Trade of Vietnam, Vung Tau branch - 6 -

Solution to complete international payment activities by documentary credit method at Joint Stock Commercial Bank for Foreign Trade of Vietnam, Vung Tau branch - 7

Solution to complete international payment activities by documentary credit method at Joint Stock Commercial Bank for Foreign Trade of Vietnam, Vung Tau branch - 7

(Source: Vietcombank Vung Tau's business results report 2009 - 2011)

From 2009 to the end of 2011, although the mobilized capital in VND at the branch increased, but the huge decrease in USD capital caused the total mobilized capital in VND to decrease to 68.92% (in 2010 compared to 2009). ). Since 2008, oil and gas businesses have moved to Ocean Commercial Joint Stock Bank to transact under pressure from the Oil and Gas Group, causing a sharp decrease in USD capital at the branch.

Credit balance at the branch has increased over the years. Taking up a large proportion of the credit portfolio are loans to oil and gas, steel, power generation, water, real estate, and construction material production. Despite increasing lending and bringing in higher profits, debt management has always been focused by Vietcombank Vung Tau, the branch's bad debt ratio is low, from 1.91% (in 2009) to 0.4% (in 2011). ) on the total outstanding balance.

Income and expenses in 2011 both decreased compared to 2009. In 2009, due to the high capital mobilized at the Branch, the deposit interest rate was high (231.42 billion VND). By 2010, the mobilized capital decreased sharply, reducing the cost of paying interest on deposits (VND 158.21 billion), the departure of some oil and gas enterprises reduced the branch's income. increased by 2.60% compared to 2009. However, in 2011, although the mobilized capital reached the lowest level in 3 years (2009 - 2011), down 14.8% compared to 2010, but Vietcombank Vung Tau still achieved high profit, an increase of 13.67% compared to 2010.

In general, the services Vietcombank Vung Tau provides to customers are very good, bringing high profits.

2.3 The situation of international payment activities at Vietcombank Vung Tau.

At Vietcombank Vung Tau, the international payment department performs money transfers, L/C payments, documents collection, in which, money transfer accounts for a high proportion of sales.

Table 2.2: Sales of import and export payments at Vietcombank Vung Tau in 2009-2011:

Unit: Million USD

Five | 2009 | 2010 | 2011 |

Export sales | 360 | 422 | 800 |

Import sales | 600 | 725 | 700 |

total | 960 | 1.147 | 1,500 yen |

(Source: Report on international communication activities of Vietcombank Vung Tau in 2009 - 2011)

In general, the import-export sales of Vietcombank Vung Tau have increased steadily over the years, especially in export payments due to efforts to attract customers as well as improve professional skills. The growth rate of export sales was higher than that of imports and in 2011 export turnover exceeded import turnover.

Revenue from import-export operations did not increase correspondingly, on the one hand due to the policy of the Head Office to exempt and reduce money transfer fees for exporting enterprises, on the one hand, because the branch supports service fees for import-export enterprises in the area where the business is located. high number are loyal customers of the branch.

2.3.1 Export payment.

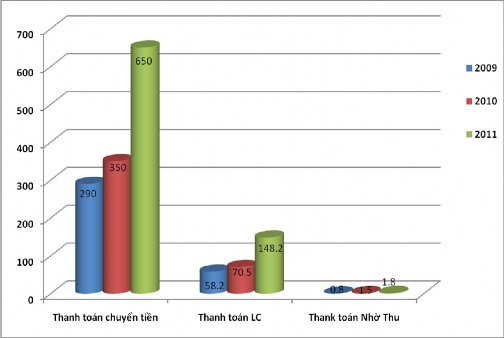

Table 2.3: Sales of export payments by payment method at Vietcombank Vung Tau in 2009-2011

Unit: Million USD

Method payment | 2009 | 2010 | 2011 | |||

Sales | Number of dishes | Sales | Number of dishes | Sales | Number of dishes | |

Transfer money | 290 | 4,000 won | 350 | 4,800 | 650 | 5,300 |

L/C | 58.2 | 380 | 70.5 | 390 | 148.2 | 410 |

Thanks to Thu | 0.8 | 9 | 1.5 | twelfth | 1.8 | 15 |

total | 360 | 4,389 | 422 | 5.202 | 800 | 5.725 |

(Source: Report on international communication activities of Vietcombank Vung Tau in 2009 - 2011)

Located in the key economic area of the Southeast with many large enterprises present in the fields of oil and gas, seaports, tourism, construction,..., Vietcombank Vung Tau was instructed by most businesses to receive payment. move back. Money transfer revenue accounts for a large proportion of the branch's export turnover because the money transfer method is free, the documentary credit method accounts for about 20% of the export turnover and the collection method has the lowest revenue due to the fact that the transaction is free of charge. export industry does not like. In 2011, the value and number of payment items increased significantly compared to previous years, especially noting the sudden increase in money transfer payment, the number of L/C payments also increased significantly with the value of each payment. Due to high volume, L/C payment volume doubled compared to 2010.

Figure 2.2: Sales of export payments by payment method at Vietcombank Vung Tau in 2009-2011

Due to the specificity of the area of operation and the motive for establishment, the main export payment revenue of Vietcombank Vung Tau is petroleum, petroleum services, transportation, seafood, etc.

Table 2.4: Export payment data at Vietcombank Vung Tau in 2009- 2011 by commodity group

Unit: Million USD

Items | 2009 | 2010 | 2011 |

Petroleum | 92 | 105 | 190 |

Seafood | 30 | 35 | 44 |

Carriage | 45 | 55 | 250 |

Other | 193 | 227 | 316 |

total | 360 | 422 | 800 |

(Source: Report on international communication activities of Vietcombank Vung Tau in 2009 - 2011)

Since 2007, according to the centralized money transfer mechanism of Vietcombank's Head Office, most of the crude oil export money entrusted by Petechim Company (located in Ho Chi Minh City) to the Vietsovpetro Vietsovpetro Joint Venture is received. Moving to Vietcombank Ho Chi Minh City, the proportion of crude oil exports decreased gradually, instead of seafood, transportation, etc., there were negligible fluctuations year by year, because the business had a stable plan. with partners. As for other products, sales increased gradually, reflecting the growth and diversity of economic activities in the province.

2.3.2 Import payment.

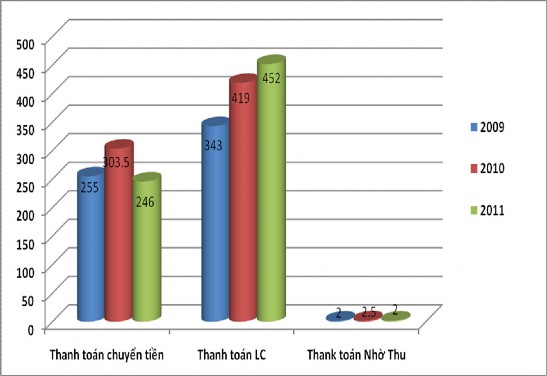

Table 2.5: Sales of import payments by payment method at Vietcombank Vung Tau in 2009-2011

Unit: Million USD

Payment methods | 2009 | 2010 | 2011 | |||

Sales | Number of dishes | Sales | Number of dishes | Sales | Number of dishes | |

Transfer money | 255 | 4,500 | 303.5 | 5,100 | 246 | 3,800 |

L/C | 343 | 388 | 419 | 403 | 452 | 420 |

Thanks to Thu | 2 | 11 | 2.5 | 8 | 2 | 8 |

total | 600 | 4.899 | 725 | 5.511 | 700 | 4.228 |

(Source: Report on international communication activities of Vietcombank Vung Tau in 2009 - 2011)

In 2011, the number of imported payment items at Vietcombank Vung Tau decreased significantly, mainly due to the decrease in the number of remittances. The value of L/C payment has increased due to the increased demand for imported machinery and equipment by the Vietnam-Russia Joint Venture - Vietsovpetro and the Gas Products Trading Company.

Figure 2.3: Sales of import payments by payment method at Vietcombank Vung Tau in 2009-2011

In contrast to export payment, importers often use L/C method. L/C payment volume always accounts for the highest proportion of import turnover and is 35% or more higher than money transfer revenue, especially in 2011 it is 84% higher, showing that enterprises are increasingly prioritizing the use of L/C due to its outstanding advantages.

Table 2.6: Import payment data at Vietcombank Vung Tau in 2009- 2011 by commodity group

Unit: million USD

Items | 2009 | 2010 | 2011 |

Petroleum | 336 | 395 | 284 |

Devices | 201 | 262 | 315 |

Iron and Steel | 32 | 41 | forty six |

Chemistry | 26 | 24 | 51 |

Other | 5 | 4 | 4 |

total | 600 | 725 | 700 |

(Source: Report on international communication activities of Vietcombank Vung Tau in 2009 - 2011)

With the goal of serving oil and gas exploration and production in the southern continental shelf, most of Vietcombank Vung Tau's import L/Cs are machinery, equipment, and chemicals, 90% of which are by sight payment method. importing petroleum for gas product processing and trading companies and petroleum companies. Because the value of petroleum import L/Cs is usually quite large, the import turnover of this item is always the highest, followed by the import turnover of petroleum machinery and equipment. The remaining commodities such as iron and steel, chemicals... have increased steadily over the years. However, since the end of 2011, the largest petroleum importer at Vietcombank Vung Tau has transferred most of its transactions to Vietcombank Ky Dong branch, causing a significant decrease in sales of this product.

In fact, at Vietcombank Vung Tau, customers mainly use the money transfer method, followed by the documentary credit method with sales increasing steadily over the years, the collection method is the least used.

Assessing the position of Vietcombank Vung Tau in import and export payment activities in Ba Ria-Vung Tau province:

According to statistics, in the period from 2009 to 2011, the import-export payment turnover of Vietcombank Vung Tau accounted for about 50% of the market share of import-export payment of commercial banks in the province.

Table 2.7: Market share of import and export payments of Vietcombank Vung Tau in Ba Ria - Vung Tau province in 2009-2011

Unit: %

BANK | EXPORT (%) | IMPORT ( %) | ||||

2009 | 2010 | 2011 | 2009 | 2010 | 2011 | |

Joint Stock Commercial Bank for Foreign Trade | 40 | 42 | 45 | 58 | 57 | 55 |

Joint Stock Commercial Bank for Industry and Trade | 18 | 16 | 15 | 14 | 14 | 11 |

Bank for Investment and Development | 15 | 15 | 14 | 13 | twelfth | ten |

Agricultural Bank | 0 | first | first | first | first | 2 |

Ocean NH | first | 6 | 7 | 3 | 8 | 9 |

Military Bank | 2 | 2 | 2 | 3 | 2 | 4 |

Maritime Commercial Joint Stock Bank | 8 | 7 | 6 | first | first | 2 |

Asia Commercial Joint Stock Bank | 4 | 3 | 3 | 2 | first | 2 |

Bank Sacombank | 5 | 3 | 3 | 2 | 2 | 2 |

Other NH | 7 | 5 | 4 | 3 | 2 | 3 |

total | 100 | 100 | 100 | 100 | 100 | 100 |

(Source: General report of the State Bank of Ba Ria-Vung Tau Province 2009-2011 )

With its strength in international payment, a wide network of agents around the world, a policy of maximum support for exporters to make documents, and a low preferential payment fee, Vietcombank Vung Tau always attracts many foreigners. currency from export enterprises. Therefore, Vietcombank Vung Tau holds a large market share in the area in terms of export sales through itself and gradually increased over the years, from 40% in 2009 to 45% in 2011.

As a bank with many years of experience in international payment trusted by customers, L/Cs with complex payment conditions and large values are often presented through Vietcombank Vung Tau for checking and payment. The branch has flexible policies on fees and export financing credits to encourage customers. The transparency of the SWIFT system helps to facilitate the international payment operations of the branch, the units easily choose a reputable bank, convenient to act as an advising bank, a bank

payment in export, bank confirmation ...., import L/Cs opened at Vietcombank Vung Tau or confirmed by Vietcombank Vung Tau are trusted by foreign partners thanks to the system's reputation. Export payment sales mainly focus on state-owned enterprises, joint stock companies, limited liability companies, private companies... many units have enough assets to guarantee export financing or discounts. document.

2.4 The situation of international payment by documentary credit method at Vietcombank Vung Tau.

2.4.1 Import and export letter of credit business process at Vietcombank Vung Tau.

2.4.1.1 Export letter of credit business process.

Step 1: Get L/C and amend L/C.

Step 2: Notify or refuse to notify L/C, amend L/C Step 3: Negotiate and send documents to claim money

In case the customer wishes to discount the set of documents, the discount request form enclosed with a copy of the L/C will be sent to the Customer department, the Customer department will issue a discount limit on the system and submit it to the Board of Directors for signature. approve the discount and then transfer it to the International Payments Department (International Payments Department) to make a discount on the Trade Finance program.

Step 4: Track and check the payment of export documents Step 5: Payment/acceptance of export L/C payment

Step 6: Close the export documents file

Step 7: Store export L/C documents

2.4.1.2 Import letter of credit business process.

Step 1: Receive and check the application. The customer presents the documents to the Customer Department for appraisal and approval by the director, then moves to the International Relations Department to open the import L/C.

Step 2: Register and issue import L/C. Step 3: Modify L/C:

+ Amendment, extension of validity and/or increase in value: Receive and check dossiers. The customer presents the documents to the Customer Department for appraisal and approval by the director, then moves to the International Relations Department to amend the L/C.

+ Other amendments: International Affairs Department amends L/C without approval.

Step 4: Receive, check and process documents, pay/accept payment

maths

Step 5: Endorse the bill of lading/guarantee to receive goods/authorization to receive goods/

deliver documents to customers.

Step 6: Track import L/C documents Step 7: Close import L/C documents Step 8: Save documents

2.4.2 Status of payment by documentary credit method at Vietcombank Vung Tau

2.4.2.1 Payment of export L/C.

To serve exporters in the area, Vietcombank Vung Tau can act as the advising bank, confirming bank or discounting bank. For the benefit of customers and their own safety, Vietcombank Vung Tau absolutely adheres to the steps in the business process. With an automatic, fast, accurate and secure information processing system, a worldwide network with flexible and preferential fees, and a team of skilled professionals, customers can completely trust the services they provide. services provided by Vietcombank, moreover, Vietcombank Vung Tau also advises on the most favorable payment terms in accordance with current international practices.

Through the effective support of Vietcombank, the exporter also creates a reputation for its customers. However, the branch's export L/C payment turnover is still limited because there are few state-owned export enterprises, many joint stock companies, limited liability companies, private companies, joint venture companies, etc. . does not meet the conditions on collateral for export financing or document discount.

Table 2.8: Export L/C data of Vietcombank Vung Tau in 2009-2011

Unit: Million USD

Five | Notice of L/C | LC payment | L/C discount | |||

Value | Quantity | Value | Number of dishes | Value | Number of dishes | |

2009 | 65.90 | 244 | 58.20 | 380 | 1.90 | 45 |

2010 | 73.20 | 290 | 70.50 | 390 | 2.10 | 48 |

2011 | 150.90 | 361 | 148.20 | 410 | 2.90 | 52 |

(Source: Report on international communication activities of Vietcombank Vung Tau in 2009 - 2011)

The above table shows that, with the extensive SWIFT network, more and more customers informing L/C through branches, the total value and number of L/C export notices has increased rapidly over the years. In 2011, the value of petroleum export L/Cs of the Gas Products Trading Company was often very large, leading to a sudden increase in the total value of L/C notices, up 129% compared to 2009 and 106% compared to 2009. 2010 while the amount of L/C increased by 18.85% and 47.95% respectively. Most of the export L/Cs announced through Vietcombank Vung Tau are presented at the branch, only a few customers bring the L/C presented at another bank to enjoy a higher negotiable rate. Sales of export payments by L/C have increased unevenly over the years due to price fluctuations on the world market, as well as great impacts from the world economy. Sales of export L/C payments in 2011 increased quite high - up 154.

profile appraisal. The exporter is almost never refused payment when presenting the set of documents through Vietcombank Vung Tau. Although sales and discounts increased, the ratio of discounts to payments decreased, showing that the discounting business needs to be reconsidered because it cannot generate a reasonable revenue while Vietcombank's strengths Vung Tau is an export payment business. The main reason is that the branch is too careful in discounting, many customers want to discount vouchers but have not met the conditions on documents and collateral. In fact, many customers with discount needs have transferred documents to present and discount at other banks, reducing sales of export L/C payments, leading to the gradual loss of Vietcombank Vung Tau's position in the world. locality.

Table 2.9: Sales and export L/C market share of commercial banks in Ba Ria - Vung Tau province in 2009 - 2011

Unit: million USD

BANK NAME | 2009 | 2010 | 2011 | |||

Market part | Business number | Market part | Business number | Market part | Business number | |

Joint Stock Commercial Bank for Foreign Trade | 14 | 58.20 | 18 | 70.50 | 22.8 | 148.20 |

Public Commercial Joint Stock Bank Love | 15 | 62.36 | 13 | 50.92 | 15 | 97.50 |

Investment Bank and PT | 14 | 58.20 | 11 | 43.08 | 11 | 71.50 |

Agricultural Bank | 2 | 8.31 | 2 | 7.83 | first | 6.50 |

Ocean NH | 0 | 0.00 | 0.5 | 1.96 | 0.2 | 1.30 |

Military Bank | 2 | 8.31 | 3 | 11.75 | 2 | 13.00 |

Maritime Commercial Joint Stock Bank | 23 | 95.61 | 22.5 | 88.13 | 20 | 130.00 |

Asia Commercial Joint Stock Bank | 11 | 45.73 | ten | 39.17 | ten | 65.00 |

Bank Sacombank | twelfth | 49.89 | 11 | 43.08 | ten | 65.00 |

Other NH | 7 | 29.10 | 9 | 35.25 | 8 | 52.00 |

total | 100 | 415.71 | 100 | 391.67 | 100 | 650.00 |

Source: General report of the State Bank of Ba Ria-Vung Tau Province 2009-2011

Vietcombank Vung Tau's export L/C payment turnover accounted for about 19% of the export L/C payment market share in the province in 2009-2011. Recently, Vietcombank Vung Tau has made efforts to retain traditional customers and attract more customers with large sales in the area.

Maritime Commercial Joint Stock Bank accounted for the highest market share with 23% in 2009, 22.5% in 2010 and 20% in 2011, followed by Vietcombank Vung Tau which kept the ratio stable and increased steadily over the years, the highest was in 2018. 2011 with sales of 148.2 million USD, accounting for 22.8% market share of the whole area. State-owned commercial banks such as Joint Stock Commercial Bank for Industry and Trade, Bank for Investment and Development are also banks with stable transaction volume with a market share of 11% to 15%, Ocean Bank alone has just come into operation. Since 2009, export L/C sales are very low.

2.4.2.2 Payment of import L/C.

At Vietcombank Vung Tau, international payment activities always strictly follow the business process, helping customers avoid risks arising in the implementation process, ensuring 100% capital safety. Therefore, the sales and number of import L/C payment transactions at Vietcombank Vung Tau have increased steadily over the years..

Table 2.10: Sales of NK L/C payments of Vietcombank Vung Tau in 2009-2011

Unit: Million USD

Targets | 2009 | 2010 | 2011 |

Sales of payment L/C import | 343 | 419 | 452 |

Business No | 388 | 403 | 420 |

(Source: Report on international communication activities of Vietcombank Vung Tau in 2009 - 2011)

Sales of import L/C payments in 2010 increased by 31.78% compared to 2009, in 2011 increased by 7.87% compared to 2010 and the number of payment transactions

also increase accordingly. In 2011, the number of import L/C payment transactions at Vietcombank Vung Tau increased by 32 items compared to 2009 but the sales increased by 109 million USD compared to 2009, mainly from Vietsovpetro - Vietsovpetro and Trading Company. sales of gas products. This is a traditional customer of the branch, with a high credit limit and 100% deposit exemption when opening L/C. Some companies with good business performance are also considered and approved by the branch to open L/C without deposit and commit to provide foreign currency when due for payment at the listed exchange rate, creating favorable conditions for businesses in transactions. transactions with foreign countries as well as enhancing Vietcombank's reputation in the international market.

Table 2.11: Sales and market share of import L/C payments of commercial banks in Ba Ria - Vung Tau province in 2009 - 2011

Unit: million USD

BANK NAME | 2009 | 2010 | 2011 | |||

Market share (%) | Sales | Market share (%) | Sales | Market share (%) | Sales | |

Joint Stock Commercial Bank Foreign Trade | 40 | 343.00 | 38 | 419.00 | 35 | 452.00 |

Joint Stock Commercial Bank for Industry and Trade | 17 | 145.78 | 15 | 187.45 | 14 | 219.54 |

Bank for Investment and Development | 7 | 60.03 | 7 | 77.18 | 8 | 90.40 |

Agricultural Bank | 0 | 0.00 | first | 0.00 | first | 0.00 |

Ocean NH | 16 | 137.20 | 20 | 176.42 | 22 | 206.63 |

Commodity Commercial Joint Stock Bank | 2 | 17.15 | first | 22.05 | 3 | 25.83 |

Military Bank | 4 | 16.63 | 5 | 19.58 | 5 | 32.50 |

Asia Commercial Joint Stock Bank | first | 8.58 | first | 11.03 | 2 | 12.91 |

Bank Sacombank | first | 8.58 | first | 11.03 | 2 | 12.91 |

Other NH | twelfth | 102.90 | 11 | 132.32 | 8 | 154.97 |

total | 100 | 857.50 | 100 | 1102.63 | 100 | 1,291.43 |

(Source: General report of the State Bank of Ba Ria-Vung Tau Province 2009-2011 )