REFERENCES

Vietnamese documents.

2017;

1. Annual Report, Financial Report of Commercial Banks for the period 2008-

2. Dang Van Dan (2015), Factors affecting liquidity risk

of commercial banks in Vietnam , Finance Magazine, issue 1, November 2015 - page 60;

3. Hoang Cong Gia Khanh (2016), Limits on using short-term capital for medium and long-term lending from the perspective of maturity mismatch risk management techniques;

4. State Bank of Vietnam (2009), Circular No. 15/2009/TT-NHNN “Regulations on the maximum ratio of short-term capital used for medium- and long-term lending to credit institutions” ;

5. State Bank of Vietnam (2014), Circular No. 36/2014/TT-NHNN "Regulating limits and safety ratios in the operations of credit institutions and foreign bank branches" ;

6. State Bank of Vietnam (2016), Circular No. 06/2016/TT-NHNN “Amending and supplementing a number of articles of Circular No. 36/2014/TT-NHNN dated November 20, 2014 of the Governor of the State Bank regulating limits and safety ratios in the operations of credit institutions and foreign bank branches” ;

7. State Bank of Vietnam (2018), Circular No. 16/2018/TT-NHNN “Amending and supplementing a number of articles of Circular No. 36/2014/TT-NHNN dated November 20, 2014 of the Governor of the State Bank regulating limits and safety ratios in the operations of credit institutions and foreign bank branches” ;

8. Nguyen Van Tien (2010), Risk management in banking;

9. Nguyen Xuan Thanh (2016), Vietnam's commercial banks: From changes in laws and policies in the period 2006-2010 to restructuring events in the period 2011-2015 ;

10. Rudolf Duttweiler (2010), Liquidity management in banking , Ho Chi Minh City General Publishing House & Tinh Van Media;

11. Truong Quang Thong (2012), Commercial Bank Management , Ho Chi Minh City Economic Publishing House;

12. Truong Quang Thong (2013), “Factors affecting liquidity risk of Vietnam's commercial banking system” ;

13. Viet Chung (2012), “ 8 years of ups and downs in interest rates ”, Vneconomy, accessed on December 11, 2018 at: http://vneconomy.vn/tai-chinh/8-nam-thang-tram-lai- suat-20120611030953573.htm ;

14. Vu Thanh Tu Anh, Tran Thi Que Giang, Dinh Cong Khai, Nguyen Duc Mau, Nguyen Xuan Thanh, Do Thien Anh Tuan (2013), “ Overlapping ownership between credit institutions and economic groups in Vietnam: assessment and institutional recommendations” ;

15. Vu Thi Hong, (2015), “ Factors affecting liquidity of Vietnamese commercial banks ;

16. Website of General Statistics Office of Vietnam: www.gso.gov.vn ;

English Documents

17. Arif A. & Anees AN, (2012), “Liquidity Risk and Performance of Banking System”, Journal of Financial Regulation and Compliance , Vol.20 Iss: 2 pp 182-19 5 ;

18. Aspachs, O., Nier, E., Tiesset, M. (2005), Liquydity, Banking Regulation and macroeconomics. Proof of shares, bank liquidity from a panel the bank's UK - resident , Bank of England working paper;

19. Bank for International Settlement (2009), International framework for liquidity risk measurement, standards and monitoring;

20. Bonfim, D., Kim, M. (2012), “Liquidity risk in banking: Is there herding?”, International Economic Journal, vol. 22, no. 3, pp. 361-386;

21. Berger, N.A., Bouwman, C. (2006), The Measurement of Bank Liquidity Creation and the Effect of Capital ;

22. Bunda, I., Desquylbet, JB., (2003), T he bank liquidity smile across exchange rate regimes;

23. Basel Committee on Banking Supervision, (1997), Core Principles for Effective Banking Supervision , Bank for International Settlements;

24. Bonin, J.P., Hasan, I., and Wachtel, P. (2008), Banking in Transition Countries , BOFIT discussion paper;

25. Chung-Hua Shen et al. (2009), Bank Liquidity Risk and Performance , working paper;

26. Deléchat, C. et al (2012), The Determinants of Banks'Liquidity Buffers in Central America , IMF WP/12/301. Dinger, Valeriya (2009), “Do Foreign-Owned Banks Affect Banking System Liquidity Risk?”, Journal of Comparative Economics , Vol. 37, pp.647-657;

27. Lucchetta, M. (2007), What Do Data Say About Monetary Policy, BankLiquidity and Bank Risk Taking? , Economic Notes by Banca Montedei Paschi di Siena SpA, vol. 36, no. 2, pp. 189-203;

28. Muhammad Farhan Malik and Amir Rafique (2013), Commercial Banks Liquidity in Pakistan: Firm Specific and Macroeconomic Factors , Romanian Economic Journal, 2013, vol. 16, issue 48, 139-154;

29. Perry, P. (1992), “Do Banks Gain or Lose from Inflations?,” Journal of Retails Banking , Vol.14, 25-30. Poorman Jr., F. & Blake, J. (2005), Measuring and Modeling Liquidity Risk: New Ideas and Metrics , Financial Managers Society Inc., white paper;

30. Rauch, C., Steffen, S., Hackethal, A.and Tyrell, M., (2009),

Determinants of Bank Liquidity Creation;

31. Saunders, A. & Cornett, M.M. (2006), Financial Institutions Management: A Risk Management Approach , Mc Graw-Hill, Boston;

32. Vodová, P., (2011), “Liquidity of Czech Commercial Banks and Their Determinants”, proceedings of the 30th International Journal of Mathematical Models and Methods in Apllied Sciences ;

33. Vodova. P., (2013a), Determinants of Commercial Banks' Liquidity in Hungary , working paper;

34. Vodova. P., (2013b), “Determinants of Commercial Banks' Liquidity in Poland”, proceedings of the 30 th International Conference Mathematical Methods in Economics .

APPENDIX

Appendix 1: List of research banks

STT

Bank Name | Abbreviation | Symbol | |

1 | An Binh Commercial Joint Stock Bank | ABB | ABB |

2 | Asia Commercial Joint Stock Bank | ACB | ACB |

3 | Vietnam Bank for Agriculture and Rural Development | Agribank | AGR |

4 | Joint Stock Commercial Bank for Investment and Development of Vietnam | BIDV | BID |

5 | Vietnam Joint Stock Commercial Bank for Industry and Trade | Vietinbank | CTG |

6 | Vietnam Export Import Commercial Joint Stock Bank | Eximbank | EIB |

7 | Ho Chi Minh City Housing Development Joint Stock Commercial Bank | HDbank | HDB |

8 | Kien Long Commercial Joint Stock Bank | KLB | KLB |

9 | Lien Viet Post Joint Stock Commercial Bank | Lienvietpostbank | LPB |

10 | Military Commercial Joint Stock Bank | MBBank | MBB |

11 | Vietnam Maritime Commercial Joint Stock Bank | Maritime Bank | MSB |

12 | Nam A Commercial Joint Stock Bank | NAB | NAB |

13 | National Commercial Joint Stock Bank | NCB | NCB |

14 | Saigon Commercial Joint Stock Bank | SCB | SCB |

15 | Southeast Asia Commercial Joint Stock Bank | Seabank | SEA |

16 | Saigon Joint Stock Commercial Bank for Industry and Trade | SaigonBank | SGB |

17 | Saigon Hanoi Commercial Joint Stock Bank | SHB | SHB |

18 | Saigon Thuong Tin Commercial Joint Stock Bank | Sacombank | STB |

19 | Vietnam Technological and Commercial Joint Stock Bank | Techcombank | TCB |

20 | Tien Phong Commercial Joint Stock Bank | Tienphongbank | TPB |

21 | Viet A Commercial Joint Stock Bank | VAB | VAB |

22 | Joint Stock Commercial Bank for Foreign Trade of Vietnam | Vietcombank | VCB |

23 | International Commercial Joint Stock Bank | VIB | VIB |

24 | Viet Capital Commercial Joint Stock Bank | Vietcapitalbank | VCP |

25 | Vietnam Prosperity Joint Stock Commercial Bank | VPBank | VPB |

Maybe you are interested!

-

Factors affecting the liquidity of stocks listed on the Vietnamese stock market - 4

Factors affecting the liquidity of stocks listed on the Vietnamese stock market - 4 -

Factors affecting the liquidity of stocks listed on the Vietnamese stock market - 21

Factors affecting the liquidity of stocks listed on the Vietnamese stock market - 21 -

Factors affecting liquidity risk of Vietnamese state-owned commercial banks - 10

Factors affecting liquidity risk of Vietnamese state-owned commercial banks - 10 -

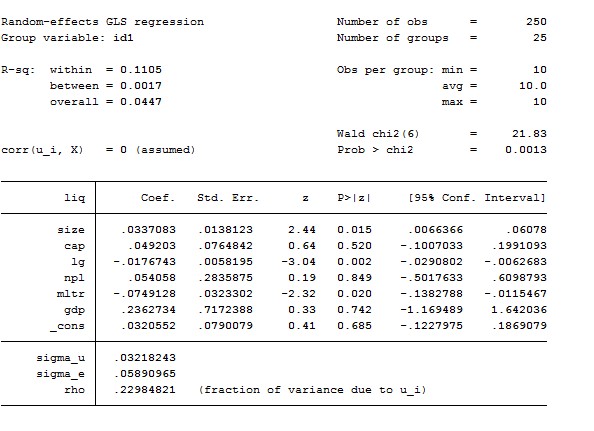

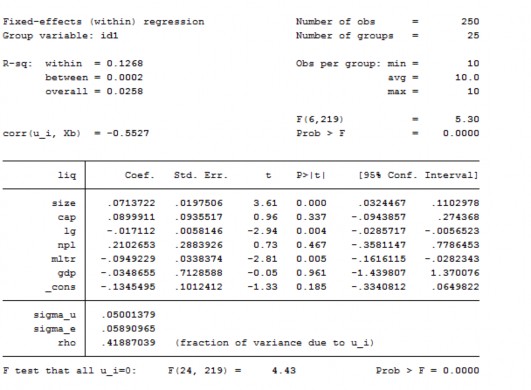

Factors affecting liquidity of Vietnamese joint stock commercial banks - 11

Factors affecting liquidity of Vietnamese joint stock commercial banks - 11 -

Factors affecting the liquidity of stocks listed on the Vietnamese stock market - 26

Factors affecting the liquidity of stocks listed on the Vietnamese stock market - 26

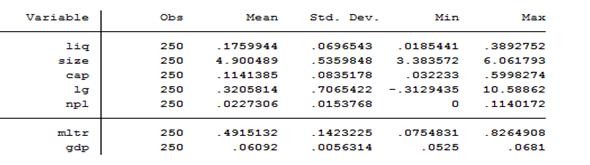

Appendix 2: Descriptive statistics

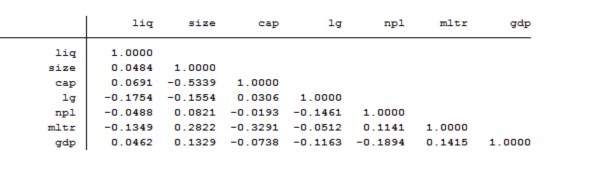

Appendix 3: Check the correlation matrix between variables in the model